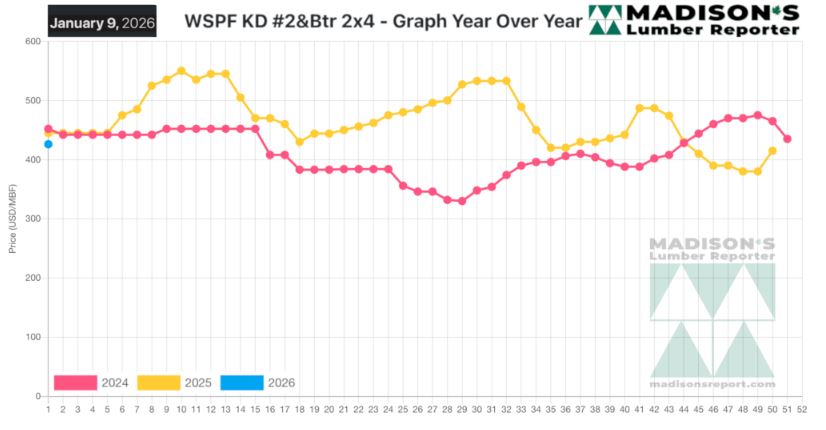

This New Year Started With Lumber Prices Very Close To Levels For The Same

Week Last Year And In 2024.

The annual seasonal price trend lines have returned to similar range of 2019

and prior; in 2025 the spread between high and low was US$170 mfbm. Now that

the extreme volatility of 2020 to 2022 is truly in the past, industry

players can have a better view of what prices might do as the spring

building season comes on this year. The final half of 2025 had a lot of

disruptions for both the lumber industry, the housing market, and for

macroeconomic conditions generally.

As such the sawmills and the home builders responded by being very cautious

with their business decisions. This means last year ended quite muted; with

potential home

buyers still skeptical of what would happen in real estate and the lumber

manufacturers keeping their production volumes low. Currently all eyes are

on the looming spring building season.

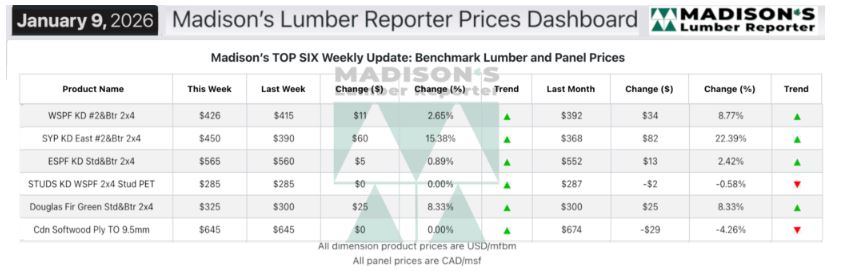

In the week ending January 09, 2026 the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$426 mfbm, which was up +$11, or +3%, from the previous

week when it was $415, said weekly forest products industry price guide

newsletter Madison’s Lumber Reporter

That week’s price was up +$34, or +9%, from one month ago when it was $392.

Compared To The Same Week Last Year, When It Was Us$445 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending January 09,

2026 Was Up +$20, Or +5%.

Compared To Two Years Ago When It Was $470, That Week’S Price Was Down -$20,

Or -4%.

Lumber sales for the first week of this year showed signs of sneaky

strength even while overall sentiment remained subdued coming out of the

Holidays.

KEY TAKE-AWAYS:

Overall supply of Western-SPF in the US was widely described as tight, with

prices inching higher on many key items.

Purchasers were reluctant to jump on shipments that often didn’t arrive on

time and as quoted.

There was a feeling that supplies were thin, based on limited supply with

little to no slack in the system.

Prices of Western-SPF in Canada also increased due Holiday downtime taken by

sawmills.

Downstream, secondary suppliers reported delayed shipments.

Eastern-SPF players reported that sales were seasonally slow, but underlying

sentiment appeared to be strong.

As Southern Yellow Pine sawmills returned to full production schedules,

players expected supply to catch up with seasonally weak demand.

There were notable price spreads based on region.

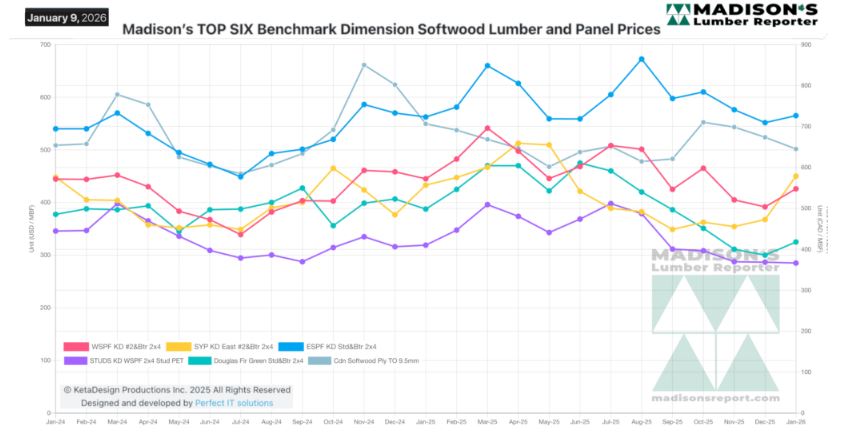

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source: madisonsreport.com

More Reports: