Two Major Wood Industry Conventions At The Beginning Of November Took Many

Lumber Sellers Away From Their Desks.

While sawmill folks and wholesalers alike mingled at annual association

meetings, demand continued very soft. Even with the latest round of

curtailments, inventories throughout the supply chain were enough to serve

the small orders that did finally get booked. As the first blasts of winter

weather started to arrive across the continent, all eyes turned to making

plans for year-end. It is likely that this year will have a similar total

shutdown for the Holidays as it did last year.

Meanwhile, questions about the coming construction season next year abound;

without the government data of housing starts for September and October, no

one can really be sure yet how this year is going to end.

With so much lumber manufacturing capacity offline for the past couple of

years, one thing is certain: when demand does return to historical levels

there is a lot of room for existing sawmills to increase their production

volumes.

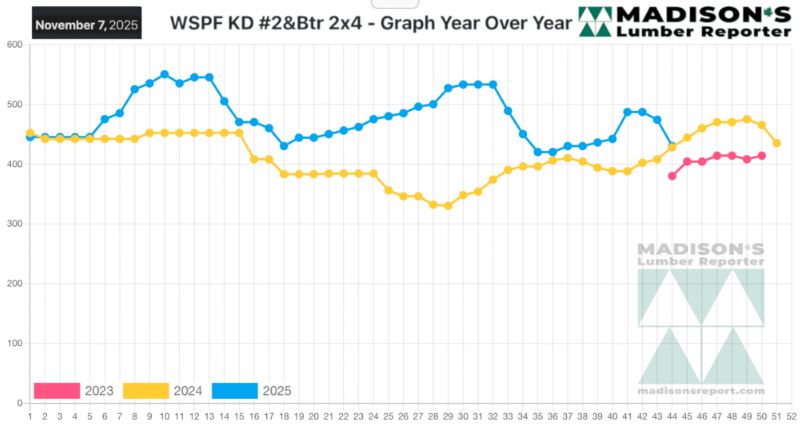

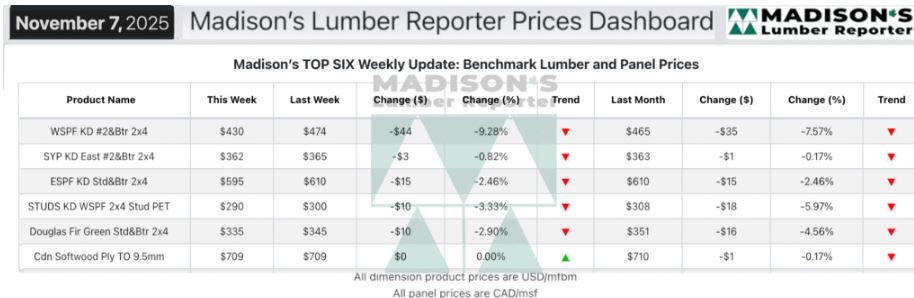

In the week ending November 07, 2025, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$430 mfbm. This was

down -$44, or -9%, from the previous week when it was $474, said weekly

forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price was down -$35, or -8%, from one month ago when it was

$465.

Compared To The Same Week Last Year, When It Was Us$444 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending November 07,

2025 Was Down -$14, Or -3%.

Compared To Two Years Ago When It Was $404, That Week’S Price Was Up +$26,

Or +6%.

...

KEY TAKE-AWAYS:

Western-SPF traders in the US felt as if everyone was waiting for everyone

else to make a move first.

Canadian suppliers of Western-SPF were unimpressed with a disinterested

market.

Supply was ample among both the sawmills and the distribution network.

Weak downstream demand further widened the price gap between primary and

secondary suppliers.

Competition among sellers for limited orders intensified as overall trading

volumes were light.

Sawmills resisted discounting as best they could.

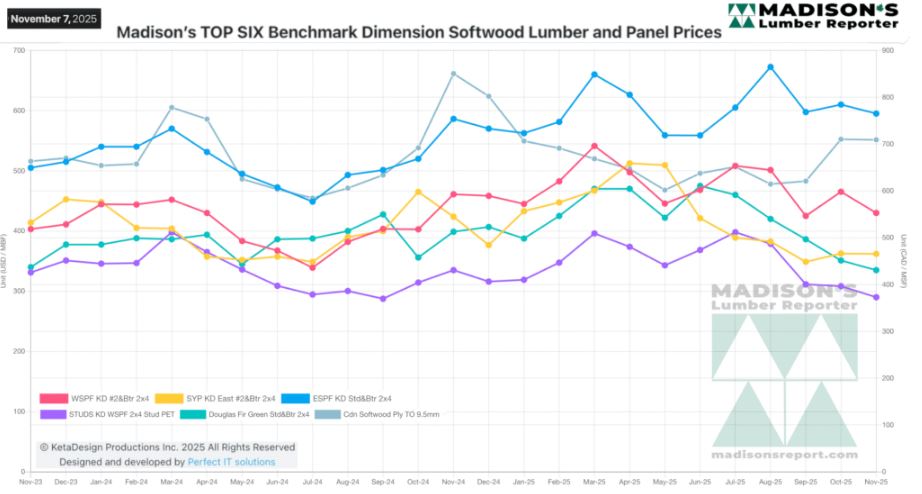

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: