October 2025 Drew To A Close With The Usual Seasonal Slowdown In Lumber

Buying Thus Some Price Softness. However, Current Levels Are Somewhat Higher

Than The Same Week Last Year And In 2023.

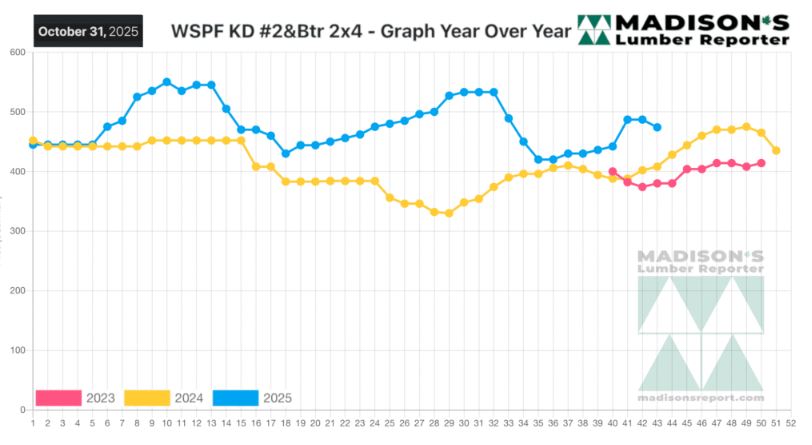

Indeed, for benchmark softwood lumber commodity item Western SPF 2×4 this

price was up +16% compared to the end of October 2024 and up +25% compared

to the previous year. This confirms what Madison’s explained earlier this

year; that the price trendlines over the past three years are showing a good

stability.

For this year the seasonal price cycle up-and-down has been a high of US$550

mfbm in March and a low of US$420 in September. A range of $130 throughout a

year, as construction activity ramps up then wanes into winter, is a return

to the usual historical amount prior to all the volatility of 2020 to 2022.

This bodes well for next year new home building, as players are now able to

recognize where prices might be in the coming spring.

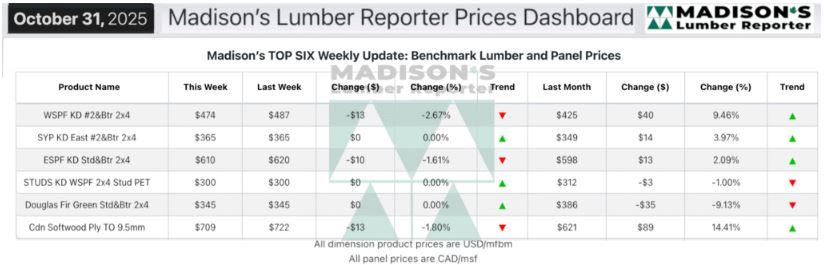

In the week ending October 31, 2025 the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$474 mfbm, which was down -$13, or -3%, from the

previous week when it was $487, said weekly forest products industry price

guide newsletter Madison’s Lumber Reporter.

That week’s price was up +$49, or +12%, from one month ago when it was $425.

Compared To The Same Week Last Year, When It Was Us$408 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending October 31,

2025 Was Up +$66, Or +16%.

Compared To Two Years Ago When It Was $380, That Week’S Price Was Up +$94,

Or +25%.

...

KEY TAKE-AWAYS:

Demand and resultant takeaway for Western-SPF in the US was distinctly down.

Sawmills were clearly starting to look for business to offload their

accumulated material.

Prices of several bread-and-butter Canadian Western-SPF dimension items fell

a few points.

Thin field inventories were sufficient to furnish meagre demand levels.

Eastern-SPF buyers were uneasy about the direction of business.

It was clear most purchasers were hoping to squeak through 2026 on the

minimal stocks they have maintained.

Southern Yellow Pine purchasers had most of their needs already covered.

Multiple reports indicated a fickle truck market in the US South.

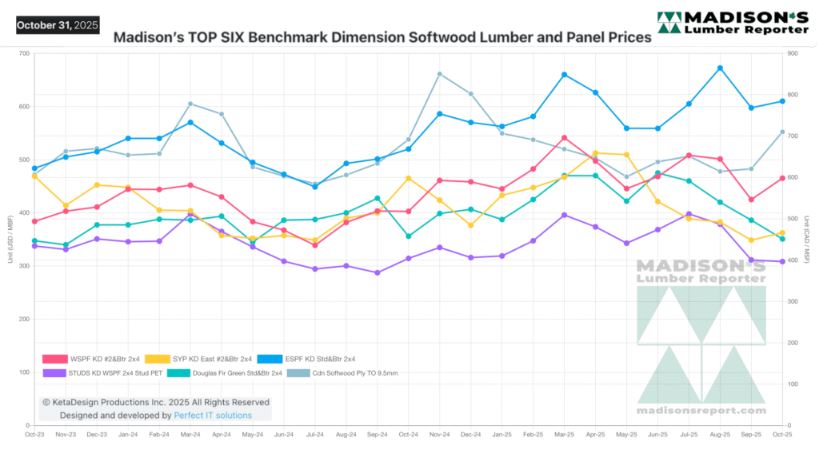

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: