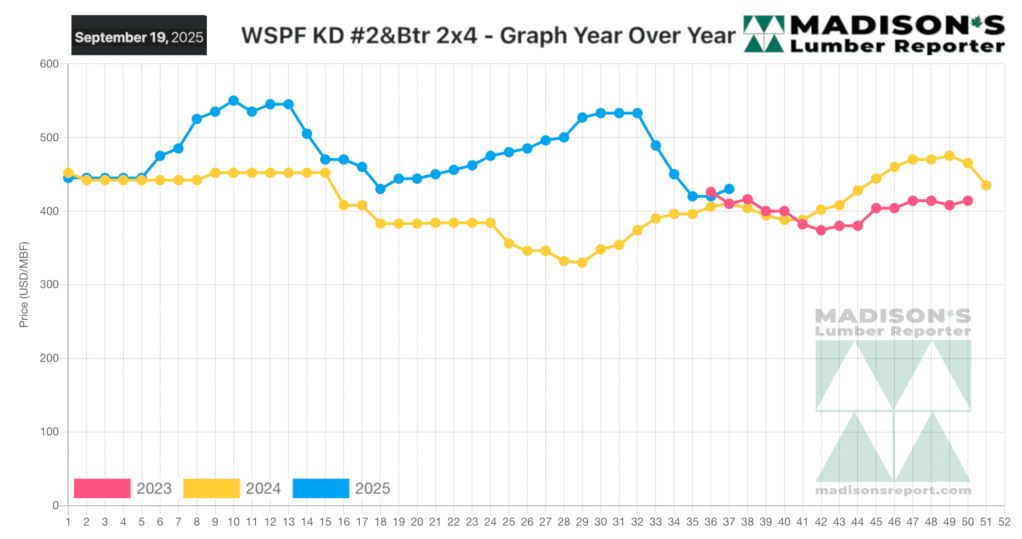

It Was This Very Week, In Mid-September Last Year, That Madison’S Pointed

Out The Price Of Benchmark Softwood Lumber Commodity Item Western S-P-F Kd

2×4 #2&Btr Crested The Same Week In 2023.

The data shows this week again, price levels intersect exactly. As Madison’s

has noted in recent weeks; a return to normal annual up and down of lumber

prices seasonally throughout the year has returned to trend lines of years

past. Which provides good insight and information for sawmill operators to

make their plans for future production volumes, in view of the building

season next year.

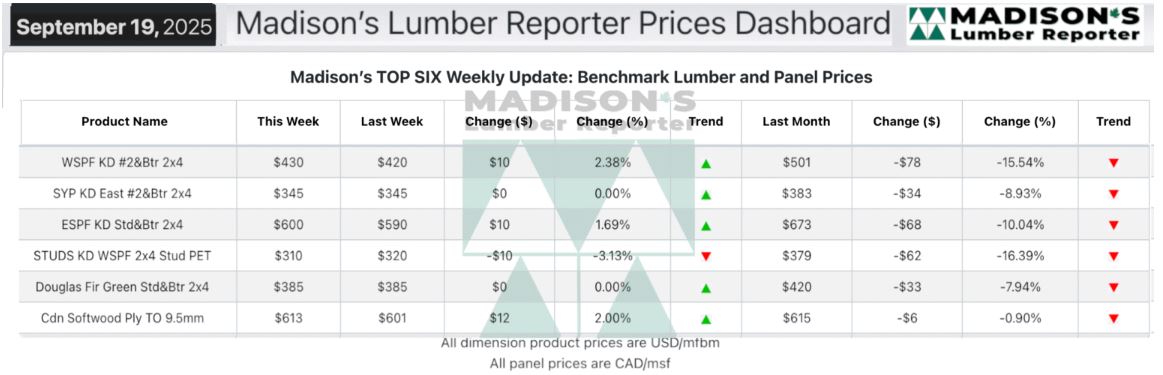

In the week ending September 19, 2025 the price of Western Spruce-Pine-Fir

2×4 #2&Btr KD (RL) was US$430 mfbm, which was up +$10, or +2%, from the

previous week when it was $420, said weekly forest products industry price

guide newsletter Madison’s Lumber Reporter.

That week’s price was down -$71, or -14%, from one month ago when it was

$501.

Compared To The Same Week Last Year, When It Was Us$410 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending September 19,

2025 Was Up +$20, Or +5%.

Compared To Two Years Ago When It Was $410, That Week’S Price Was Up +$20,

Or +5%.

.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Western-SPF suppliers in the US reported slightly better sales, but blunted

by waffling commodity prices and poor follow-through from buyers.

Sawmills trimmed production schedules and cleaned up much of their on-ground

inventories thus avoided entertaining the steep counteroffers of yesterweek.

In Canada Western-SPF prices were mostly flat, although bread-and-butter

widths hovered on either side of the previous week’s numbers.

Ongoing production curtailments did nothing to prompt customers to take

longer positions with their inventories.

Reports from Eastern-SPF sellers varied considerably, but field inventories

remained sparse by all accounts.

A troubling lack of urgency persisted among buyers of Southern Yellow Pine.

Weak prices and plentiful supply gave customers ample opportunity to pick

off what they needed.

Eastern stocking wholesalers reported lumber consumption was well-below

seasonal norms.

Inventory holders at the ports in New Jersey sold under replacement levels

and struggled to court business.

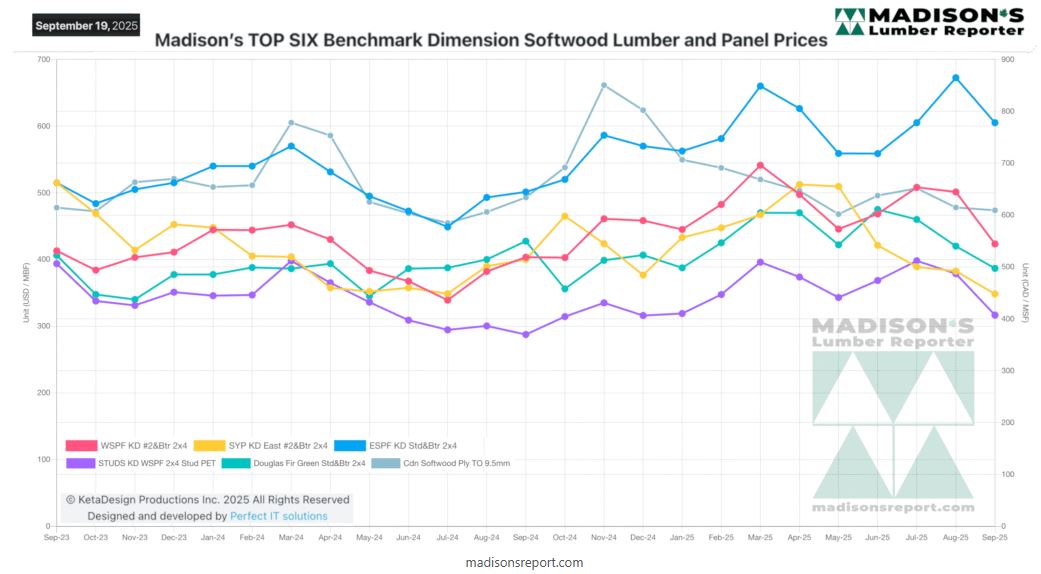

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: