The Historical Seasonal Cycle Of Lumber Price Increases And Drops Has

Returned, After The Time Of Great Volatility And Many Changes In 2020 To

2022.

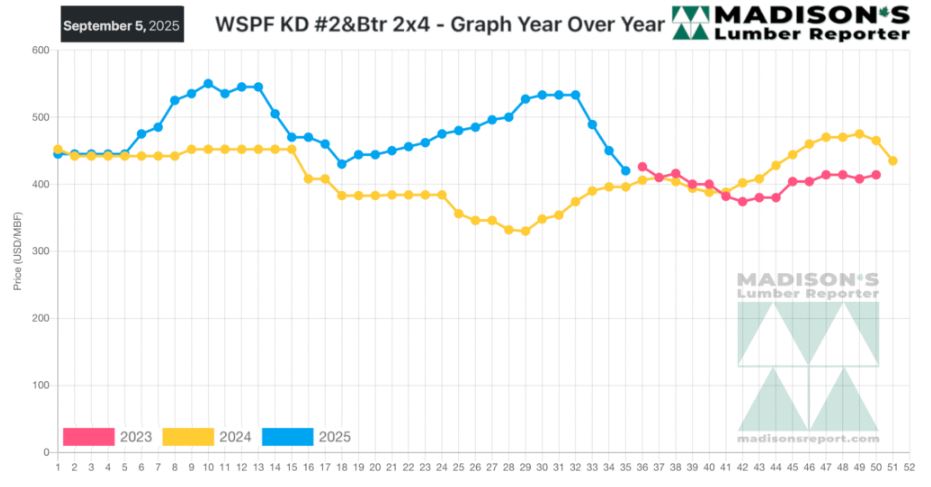

For the past two years, the annual price highs and lows are similar to how

they were in 2019 and prior. This gives operators a better understanding of

market conditions, thus provides greater ability to make plans.

Currently, in early September, the usual seasonal drop in lumber prices has

begun as housing construction activity starts to slow down into winter.

For the northern species, coming out of Canada, incremental price increases

through the summer to take into account the big spike in the softwood lumber

Duty were soundly rejected

by customers. Those prices dropped back down to levels of late spring.

For their part, Southern Yellow Pine East Side prices fell far below where

they had been in early spring this year.

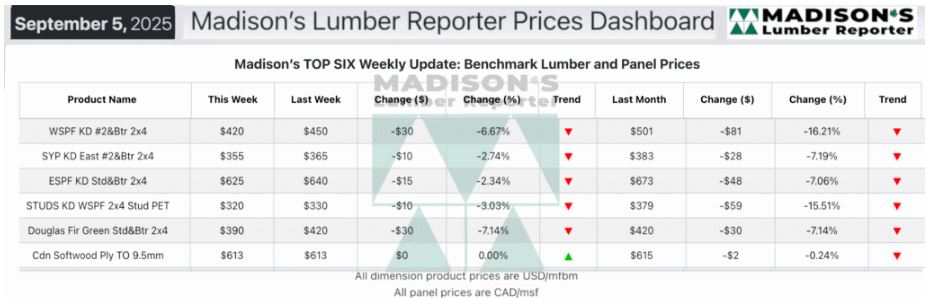

In the week ending September 05, 2025 the price of Western Spruce-Pine-Fir

2×4 #2&Btr KD (RL) was US$420 mfbm, which was flat from the previous week

when it was $420, said weekly forest products industry price guide

newsletter Madison’s Lumber Reporter.

That week’s price was down -$81, or -16%, from one month ago when it was

$501.

Compared To The Same Week Last Year, When It Was Us$395 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending September 05,

2025 Was Up +$30, Or +7%.

Compared To Two Years Ago When It Was $410, That Week’S Price Was Up +$10,

Or +19%.

.

..

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Experienced traders described a glut of Canadian, US, and Euro framing

lumber hiding among vendors to create the illusion of thin field

inventories.

For Western-SPF suppliers in the US, market weakness again manifested as

prices of bread-and-butter dimensions and key stud trims tumbled.

Sloppy demand persisted and promptly available wood accumulated, according

to Western-SPF suppliers in Canada.

As such, WSPF sellers in Canada got more aggressive with their pricing.

Overall, slim field inventories prevailed across the Northwest and West.

Supply of Eastern-SPF remained well ahead of demand; buyers did not secure

longer term coverage while prices were still vulnerable.

Sellers of Southern Yellow Pine were alarmed as their prices crashed and

burned to eye-popping lows.

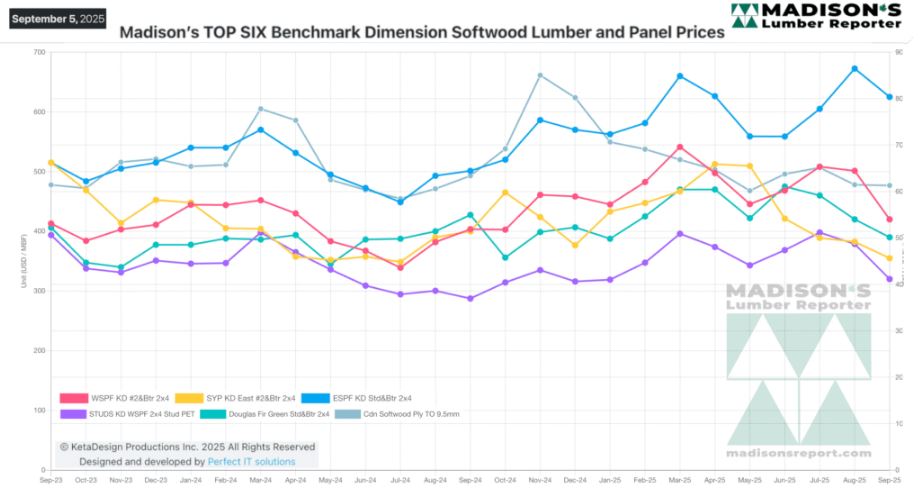

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: