One Of The Most Interesting Things To Watch With The North American Softwood

Lumber Market Is The Dynamic Between The Prices Of The Main Construction

Framing Commodities: 2×4 #2&Btr.

Wood products of this grading standard come in a variety of species, the

main ones of which are Western and Eastern Spruce-Pine-Fir and Southern

Yellow Pine.

These are the lumber commodity items sold at the highest volumes across

North America.

Since they all meet the building code, they are interchangeable in terms of

application, so end-users (home builders) are able to choose which to

purchase according to preference and to which is available at the best

deal/price at any given time. As previously mentioned often by Madison’s,

historically it is the Labour Day long weekend which

signals the usual seasonal slow-down of new housing construction as autumn

looms. Generally at this time lumber sales begin to slow down for the winter

season.

Given the huge swings and volatility of lumber prices from 2020 to 2022,

the past couple of years have been a waiting game to see what will be the

“new normal” for the lumber market.

This week Madison’s takes a hard look at the current data compared to the

previous two years and compared to the last “normal” year, of 2019:

.

..

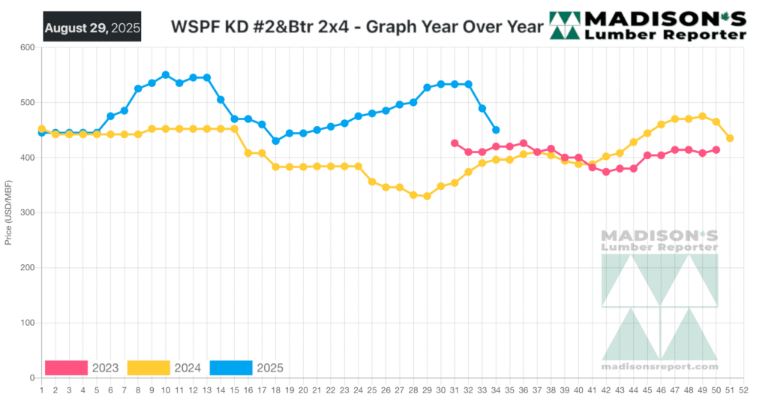

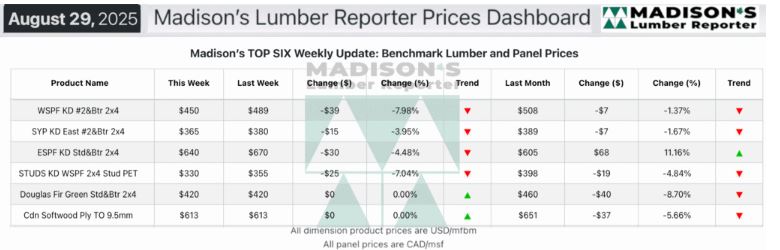

In the week ending August 29, 2025, the price of benchmark softwood lumber

item

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$450 mfbm.

This was down -$39, or -8%, from the previous week when it was $489, said

weekly forest products industry price guide newsletter Madison’s Lumber

Reporter.

That week’s price was down -$51, or -10%, from one month ago when it was

$501.

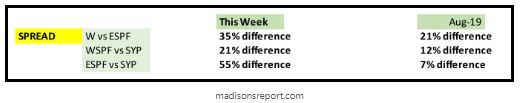

The correlation between current prices compared to last year and the year

before, and compared to the last “normal” year

(2019), could start to provide some insight into what the new price bottom

and price top will be for each of these items.

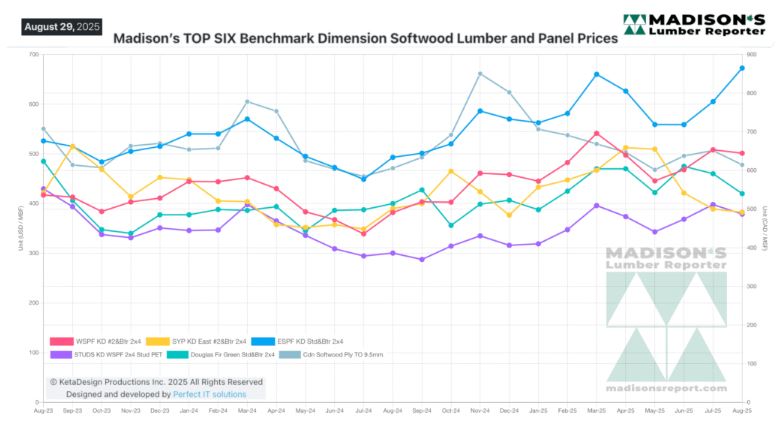

For that same week in 2019 this price was US$349 mfbm, so the spread

between then and the current price is a 25% difference. That same item

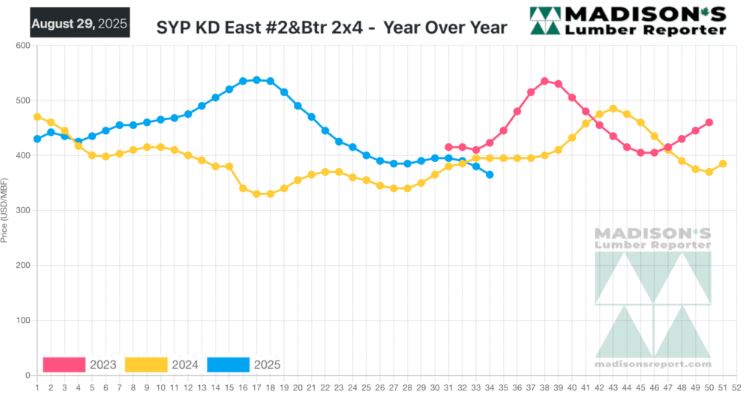

in Eastern S-P-F for the last week of August 2025 was US$640, compared to

US$432 in 2019, which is a spread of 39% difference. As for Southern Yellow

Pine 2×4 on the East Side, at the end of August this year that price was

US$364, compared to US$393 for the same week of 2019. This is a spread of 7%

difference.

KEY TAKE-AWAYS:

The upcoming Labour Day weekend holiday in both Canada and the US dominated

lumber sales.

Western-SPF sawmills in the United States quietly discussed reducing lumber

production volumes.

In Canada there was widespread perception that Western-SPF producers were on

a knife’s edge regarding curtailments.

Eastern-SPF manufacturers tried to balance short sawmill order files and

vulnerable numbers with significantly increased duties.

Traders in the East noted a potential two-tier market developing.

At the ports in New Jersey, Eastern Stocking Wholesalers reported the market

felt oversupplied with demand underwhelming.

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Compared To The Same Week Last Year, When It Was Us$374 Mfbm, The Price

Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending

August 29, 2025 Was Up +$159, Or +43%.

Compared To Two Years Ago When It Was $410, That Week’S Price Was Up +$123,

Or +30%.

Source:

madisonsreport.com

More Reports: