Hot Weather Across Many Parts Of The Continent Brought The Usual Slow-Down

In Construction Activity, As Well As At Manufacturing Facilities.

Workers fled both offices and industrial sites to enjoy some time off. Due

to continuing weak inventories and generally diminished supply, lumber

prices were mostly firm or slightly up. Sales volumes, however, were

uninspiring.

There was, of course, much talk about the big spike in lumber duties which

had been announced at the beginning of this year and have now come into

effect.

The response by Canadian suppliers of lumber to the US will be to diversify

and start shipping even more wood offshore. At this point, with the duty

constraint at the border so high, the

previous disadvantage of high shipping costs to other continents is

eliminated. Indeed, with the lumber duty THIS high, it is actually less

expensive for Canadians to send wood into alternative markets.

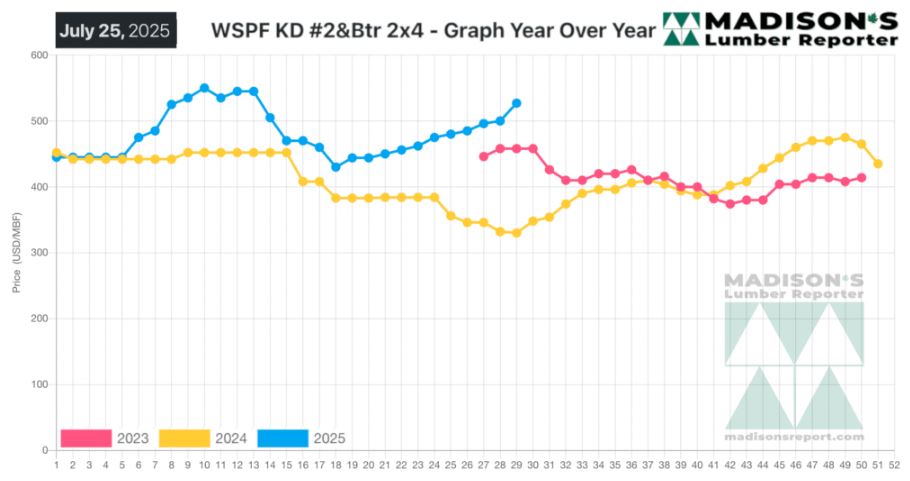

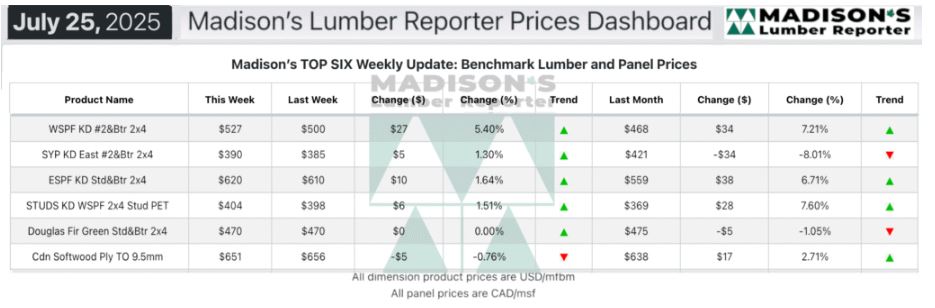

In the week ending July 25, 2025 the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$527 mfbm, which is up +$27, or +5%, from the previous

week when it was $500, said weekly Madison’s Lumber Reporter.

That week’s price is up +$59, or +13%, from one month ago when it was $468.

Compared To The Same Week Last Year, When It Was Us$330 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending July 25, 2025

Was Up +$197, Or +60%.

Compared To Two Years Ago When It Was $458, That Week’S Price Was Up +$69,

Or +15%.

..

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Sales of Western-SPF lumber and studs in the United States were limited as

buyers confined their forays to immediate needs.

Speculative purchasing remained elusive.

Canadian Western-SPF sawmills reported solid order files into August, this

augmented by tightening log supply.

Sales of Eastern-SPF slowed down in Quebec for the typical two-week summer

downtime taken by multiple mills.

Even so, demand for bread-and-butter ESPF dimension showing strength on both

sides of the border.

In Southern Yellow Pine, many players stepped away for their summer

vacations while scorching temperatures limit jobsite activity.

Inventory holders at the ports in New Jersey and eastern stocking

wholesalers noted flat pricing, quiet buying, and a general sense of

seasonal lethargy.

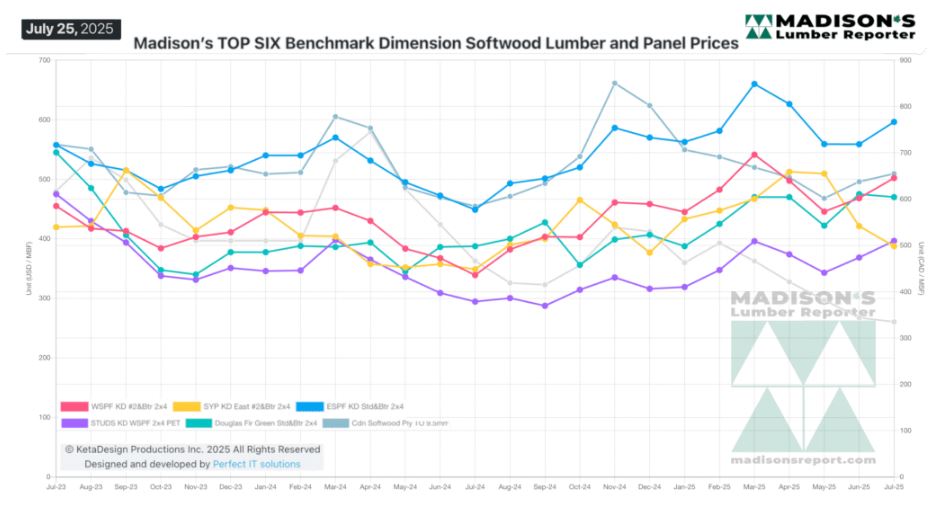

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: