Into Mid-July, Softwood Lumber Buyers Across The Us And Canada Had To Cast A

Wide Search To Find Wood.

Only those with immediate needs made purchases, looking mostly at smaller

producers and secondary suppliers. Discounts on Western-SPF low grade and

industrial stock, which were slow to move, suddenly appeared on sawmill

price lists.

Sparse on-ground material to cover unexpected interruptions caused concern

with purchasers about delayed shipments.

Supply of Southern Yellow Pine was hit-or-miss, with a heavy dependence on

regionality.

The latest US housing starts data showed a slight increase over the previous

month and flat compared to June of 2024.

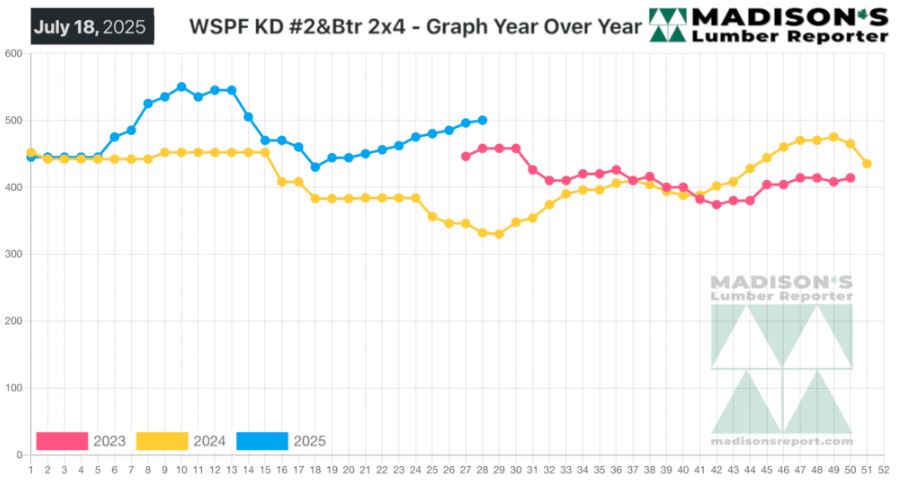

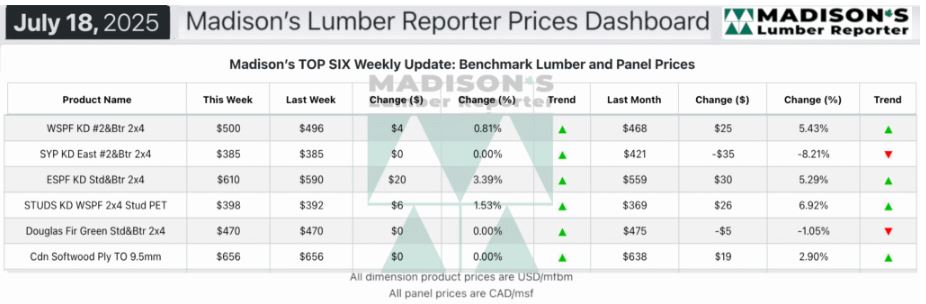

In the week ending July 18, 2025, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$500 mfbm. This is up

+$4, or +1%, from the previous week when it was $496, said weekly forest

products industry price guide newsletter Madison’s Lumber Reporter. That

week’s price is up +$32, or +1%, from one month ago when it was $468.

Compared To The Same Week Last Year, When It Was Us$332 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending July 18, 2025

Was Up +$168, Or +51%.

Compared To Two Years Ago When It Was $458, That Week’S Price Was Up +$42,

Or +9%..

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Buyers of Western-SPF lumber and studs in the United States looked to

smaller domestic producers and secondary suppliers to cover their short-term

needs.

Canadian Western-SPF sawmills already started quoting with the anticipated

duty increase added to their numbers.

Several mills quietly discounted low grade and industrial stock which were

slow to move.

Any whiff of delayed shipments sent purchasers into apoplexy as they had

sparse on-ground material to cover unexpected interruptions.

Demand Eastern-SPF was solid, as overall supply levels remained

questionable.

Southern Yellow Pine players noted that the supply landscape was

hit-or-miss, with a heavy dependence on regionality.

In the US south, lead times varied from prompt to September with very little

in-between.

Jobsites in the tri-state area were quieter as crews worked limited hours to

beat the heat.

Vendors there held on to decent inventories with flat commodity prices.

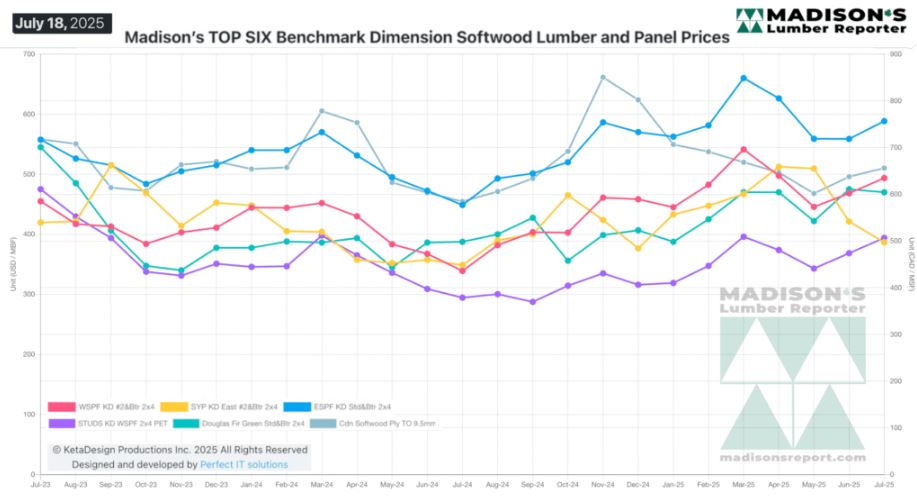

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: