Following The Dual National Holiday Long Weekends For Canada And The Us,

Sales Of Softwood Lumber Reached Their Usual Mid-Summer Torpor.

Most conversations were about the previously-announced sizeable increase in

lumber duties on Canadian wood entering the US, expected to come in August.

As true summer heat arrived in the east, Quebec entered its annual two-week

holiday, and jobsite activity in the US eastern seaboard also slowed down.

Supply remained quite tight.

The now long-term ongoing practice of not stocking inventory continued as

larger questions remained unanswered about

macroeconomic conditions. Such uncertainty only kept players cautious.

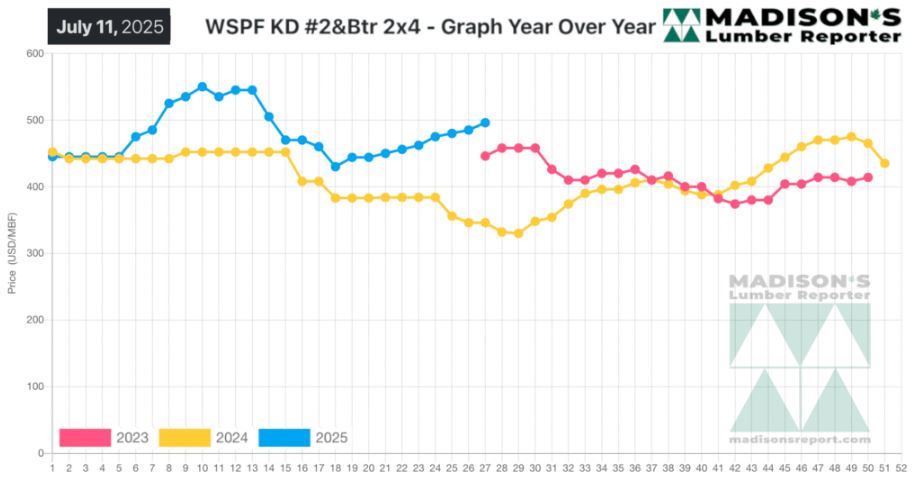

In the week ending July 11, 2025 the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$496 mfbm, which is up +$11, or +2%, from the previous

week when it was $485, said weekly forest products industry price guide

newsletter Madison’s Lumber Reporter.

That week’s price is up +$28, or +6%, from one month ago when it was $468.

Compared To The Same Week Last Year, When It Was Us$346 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending July 11, 2025

Was Up +$150, Or +43%.

Compared To Two Years Ago When It Was $446, That Week’S Price Was Up +$50,

Or +11%.

.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Sales of Western-SPF lumber and studs in the United States didn’t improve

much from the previous week’s holiday-induced torpor.

Supply in the West has been drawn down gradually for the past several

months.

Field inventories remained extremely scanty.

Demand for Western-SPF lumber in Canada remained muted ahead of the

imposition of higher anti-dumping duties on Canadian softwood lumber.

As availability continued to tighten, traders of Eastern-SPF commodities

reported a steady week of business.

Many sawmills were off-the-market on several items.

Later in the week buyers grew less reactive and balked at current numbers,

thus inquiry and follow-through tapered off.

A few Southern Yellow Pine sawmills scheduled curtailments, giving players

another reason to think the market bottom had been reached.

Eastern stocking wholesalers in the US Northeast offered their wares in a

wide range of prices, mostly below print levels.

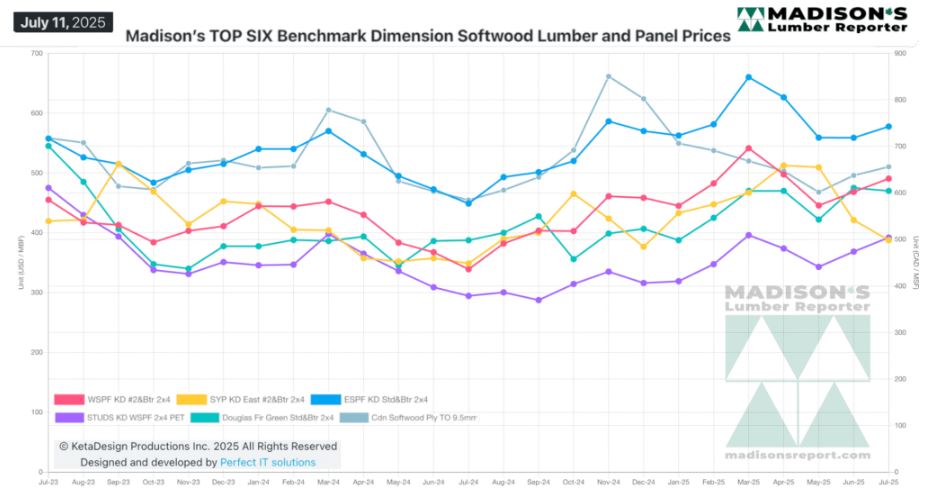

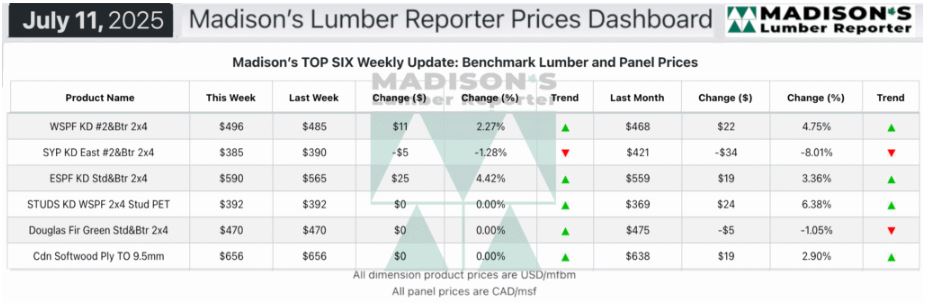

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: