Lumber Producers Kept Manufacturing Volumes Lower To Keep Supply In Line

With Still-Muted Demand.

Capacity utilization rates at North America sawmills have been well below

optimal levels for approximately 2 years, since rising interest rates

brought slower home sales thus reduced new housing starts.

Solid wood manufacturers prefer to keep production volumes higher, due to

the very complex process of securing log supply over a longer term.

As such, maintaining balance between amount of sales and prices can get

tricky. As true summer months this year arrive, it seems this balance has

been achieved;

as lumber prices reversed recent drops and started climbing.

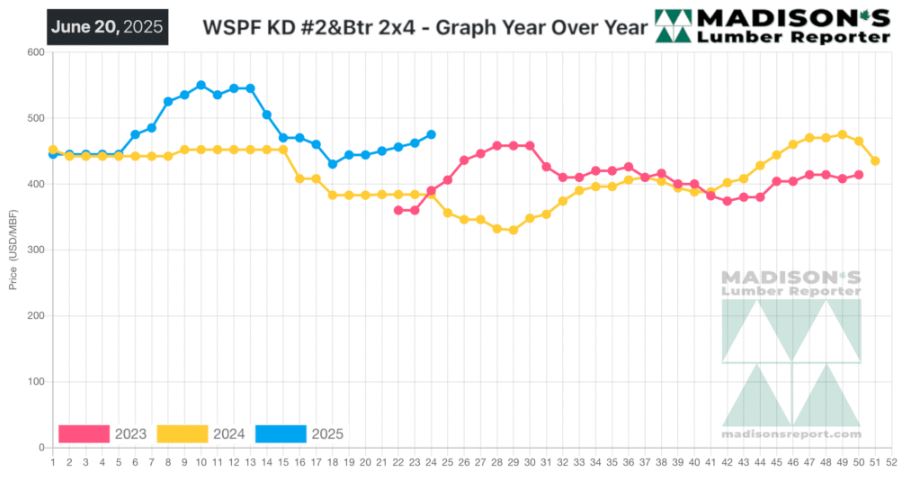

In the week ending June 20, 2025, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$475 mfbm. This is up

+$13, or +3%, from the previous week when it was $462, said weekly forest

products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up +$29, or +7%, from one month ago when it was $446.

Compared To The Same Week Last Year, When It Was Us$384 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending June 20, 2025

Was Up +$91, Or +24%.

Compared To Two Years Ago When It Was $390, That Week’S Price Was Up +$85,

Or +22%.

.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Western S-P-F players in the United States reported good daily trading

volumes, although as a barrage of smaller transactions.

Ongoing tweaks on the supply side seemed to balance overall availability

with suboptimal demand.

There was a prevailing sense that lumber was in a state of oversupply

heading into summer.

Sawmill order files were slowly inching beyond the two- to three-week range.

For Eastern S-P-F, gone were the $30-$50 counter offers that were easy to

find in May.

There was still liquidity in Southern Yellow Pine as suppliers navigated the

bumpy ride of pricing and availability.

Eastern stocking wholesalers reported many buyers had covered their

near-term needs and gone back to just-in-time purchasing.

Transportation issues abounded, especially in trucks, delaying orders;

players lamented nearly every load arrived late.

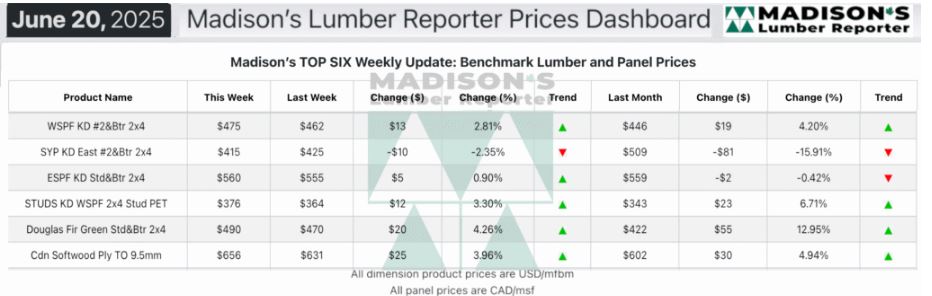

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: