As The Month Of June Came On The Seemingly Entrenched Habit Of Not Stocking

Inventory Caught Up With Lumber Buyers.

More purchases were booked at sawmills, sending prices slightly higher. The

lack of supply throughout the market shifted sentiment from a “wait-and-see”

approach to more active purchases.

As customers had trouble sourcing the material they needed for ongoing

construction projects, they insisted less on making counter-offers and more

on taking actual delivery. Highly populated areas like the US northeast

started to see an increase in home building activity as true summer weather

finally arrived.

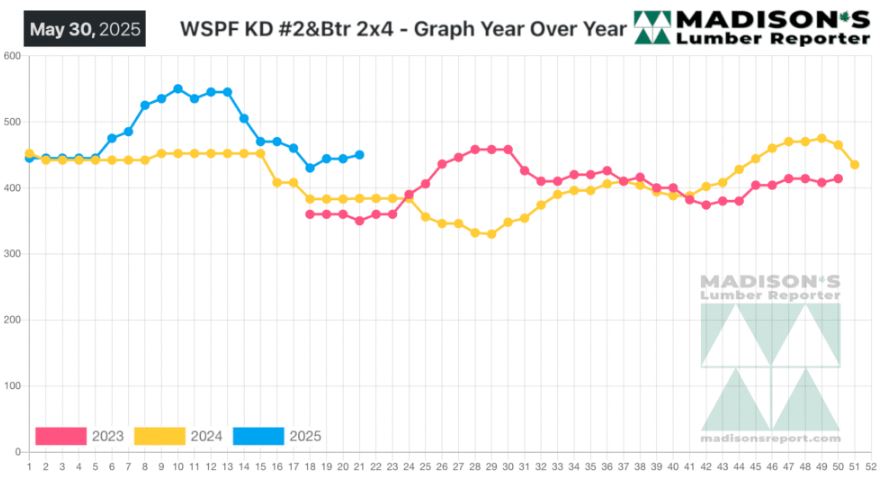

In the week ending May 30, 2025, the price of benchmark softwood lumber item

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$450 mfbm.

This is up +$6, or +1%, from the previous week when it was $444, said weekly

forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up +$4, or +1%, from one month ago when it was $446.

Compared To The Same Week Last Year, When It Was Us$383 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending May 30, 2025

Was Up +$61, Or +16%.

Compared To Two Years Ago When It Was $360, That Week’S Price Was Up +$84,

Or +23%.

KEY TAKE-AWAYS:

Western-SPF buyers in the US continued to keep their inventories

conspicuously lean.

There was a palpable absence of pressure from end-users downstream.

Secondary suppliers maintained thin on-ground stocks as they avoided

accumulating too much of any one commodity item.

There was noticeably less material available on Canadian Western-SPF sawmill

sales lists.

Eastern-SPF buyers were cautious with their forays, shopping around

extensively.

Southern Yellow Pine suppliers worked to track down business, while buyers

twiddled their thumbs.

Business in the busy US Northeast was still confined to short-covering.

Purchasers on the US eastern seaboard had let their inventories run so low

they had to step in with new purchases.

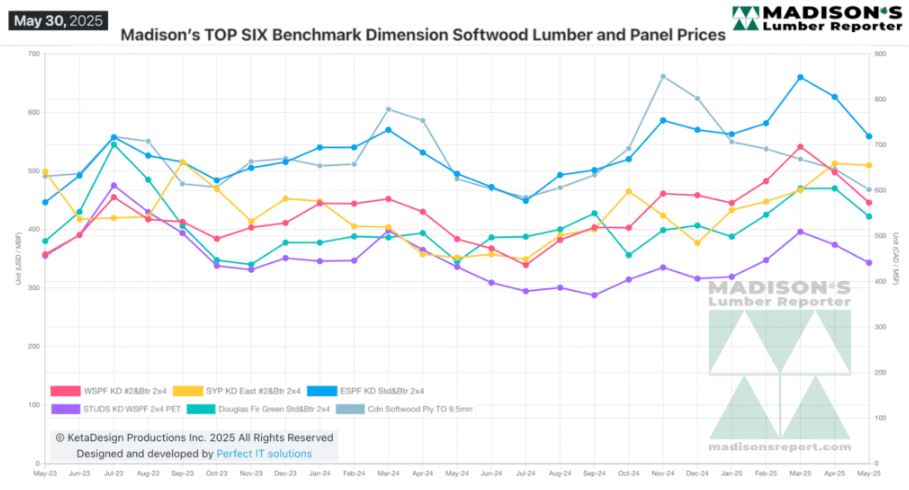

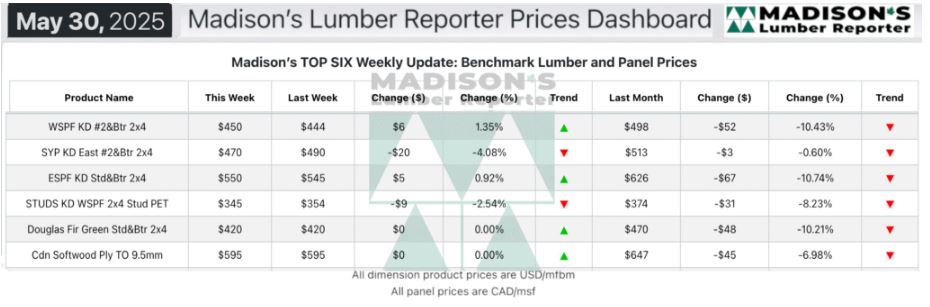

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: