In The Week Between The Canadian Victoria Day Long Weekend And The Us

Memorial Day Holiday, Construction Framing Dimension Softwood Lumber Prices

Stayed Mostly Flat.

Lumber inventories in the field remained low enough that customers agreed to

seller list prices for most of their purchases. Counter-offers were few as

buyers often searched with multiple sources to find the wood they needed.

Many felt that the price bottom had been reached, thus sentiment improved

and more sales were made.

At sawmills the order files stretched to about two weeks. Where in recent

weeks lumber suppliers had been calling customers to book orders, the

situation was

reversed so eager buyers were reaching out to make contact for their

purchases.

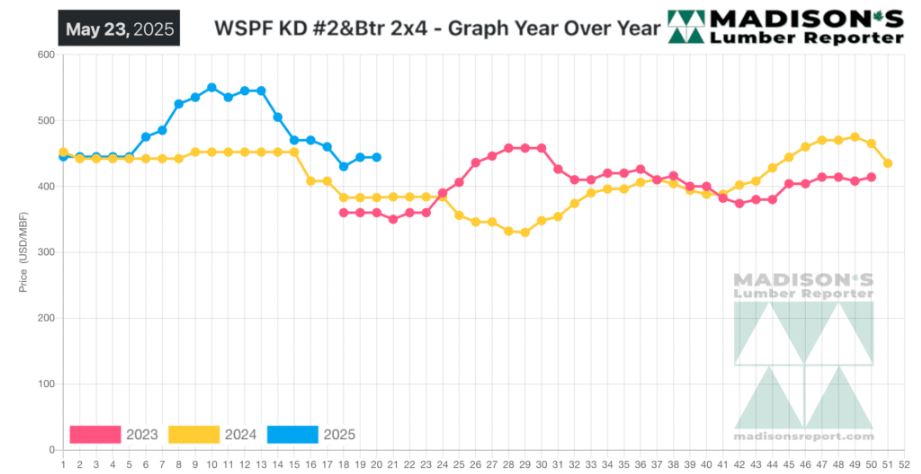

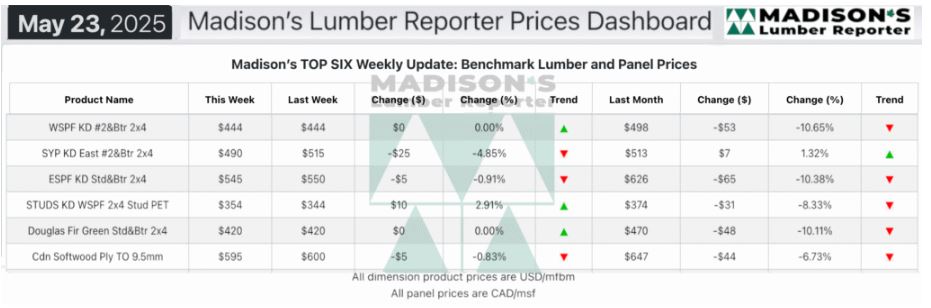

In the week ending May 23, 2025 the price of Western Spruce-Pine-Fir 2×4 #2&Btr

KD (RL) was US$444 mfbm, which is flat from the previous week, said weekly

forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down -$54, or -11%, from one month ago when it was

$498.

Compared To The Same Week Last Year, When It Was Us$383 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending May 23, 2025

Was Up +$61, Or +16%.

Compared To Two Years Ago When It Was $360, That Week’S Price Was Up +$84,

Or +23%.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Suppliers of Western S-P-F no longer had to search for orders.

Following the Victoria Day long weekend, prices of Western S-P-F in Canada

were a bit of a mixed bag.

The downward slide in Eastern S-P-F commodity prices seemed to all but over

according to suppliers.

Availability at the Eastern S-P-F sawmills was much tighter than buyers had

gotten used to in recent weeks.

It looked like the market was building something of a base to trade from.

Southern Yellow Pine sawmills saw an accumulation of higher grade material.

Treaters, typically a major source of Southern Pine takeaway at this time of

year, stepped away from the market.

Sawmill order files were prompt to two weeks out, depending on the tally.

Stocking wholesalers reported inventory levels in the tri-state area were

tightening up noticeably as no one wanted to hold excess material.

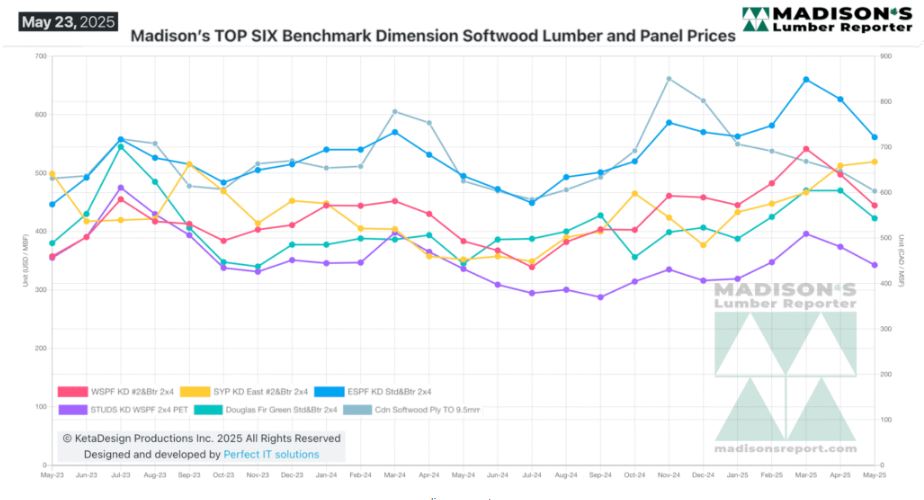

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: