In Mid-May, Some Benchmark Construction Framing Dimension Softwood Lumber

Prices Bounced Slightly As Players Recognized A Bottom Had Been Reached.

The sentiment among players remained cautious due to ongoing uncertainty in

the greater economic landscape, however there was a move to replenish

severely depleted inventories. The usual seasonal supply-chain issues

resurfaced, with operators in the US south especially finding it difficult

to source trucks to move their wares.

Indications from the housing market suggested there might be an increase in

activity as this building season truly came on. Meanwhile, several wildfires

broke out in central Canada and in the northeast US. At time of writing the

rebuilding and reconstruction from both

Hurricane Helene and the Los Angeles fires had not even begun in earnest;

expectations are that both of these activities will drive up demand for

lumber over the next few months.

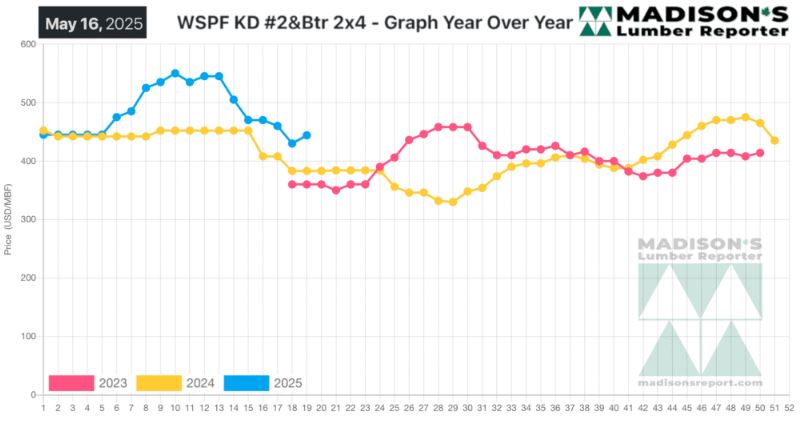

In the week ending May 16, 2025, the price of benchmark softwood lumber item

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$444 mfbm.

This is up +$14, or +3%, from the previous week when it was $430, said

weekly forest products industry price guide newsletter Madison’s Lumber

Reporter.

That week’s price is up +$14, or +3%, from one month ago when it was $498.

Compared To The Same Week Last Year, When It Was Us$383 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending May 16, 2025

Was Up +$61, Or +16%.

Compared To Two Years Ago When It Was $360, That Week’S Price Was Up +$84,

Or +23%.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Players thought several factors pointed to a recrudescent market.

Traders reported a good mixture of rail and truck business, though total

sales volumes remained underwhelming for the spring season.

Demand for Western S-P-F in Canada shifted palpably.

Buyers were markedly busier; most suppliers reported a tangible boost in

inquiries.

Transactions were signified by a lack of follow-through from buyers, as well

as ongoing trend of steep counteroffers.

Buyers still had plenty of options between sawmills and secondaries to cover

their close-term needs in a timely manner.

Eastern S-P-F commodity prices continued to vary considerably between mills

and at the distribution level.

Recent sharp price drops seemed to be over; many purchasers stepped in to

replenish their nearly depleted inventories.

Heavy spring rain in several key Southern Yellow Pine sourcing regions

restricted access to large-diameter logs.

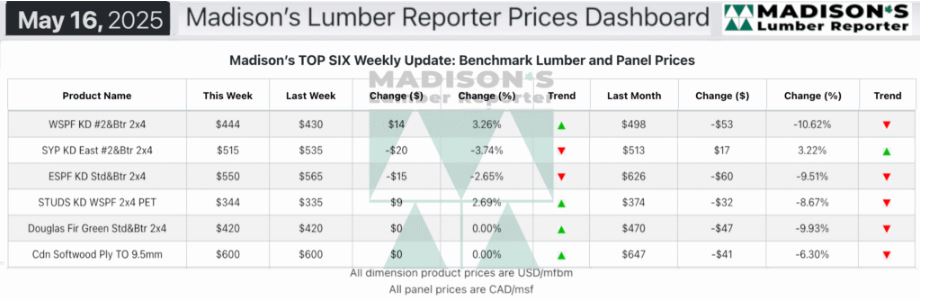

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: