Due To Ongoing Soft Demand, North American Lumber Suppliers Cut Prices

Further To Spur Sales.

Customers responded by placing some orders, suggesting they agreed that

current price levels were likely the bottom. The collision of ongoing weak

demand and arrival of spring building season did little to prompt any real

increase in sales volumes.

It seemed like everyone was waiting for someone else to make a move.

Continued lack of clarity from political leaders and many unknowns in

macroeconomic conditions made for still more feeling of uncertainty.

Sawmills looked forward to an increase in demand now that price levels

dropped steadily over the past few weeks.

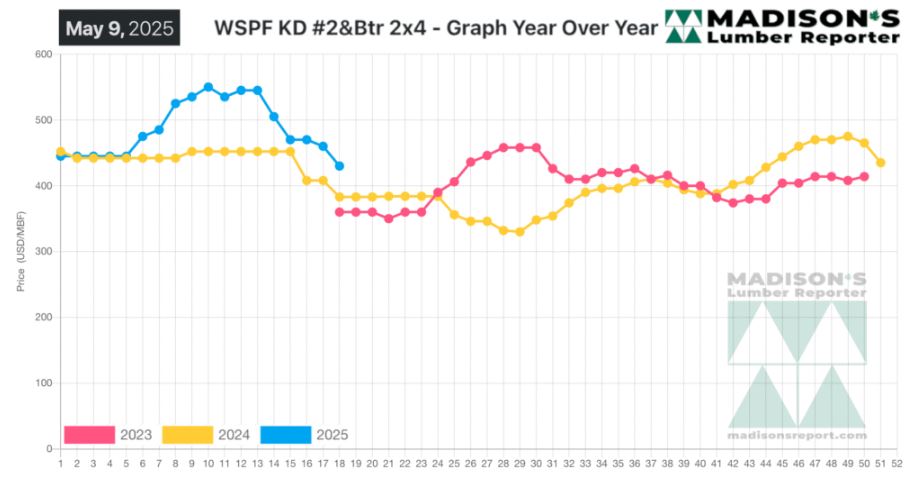

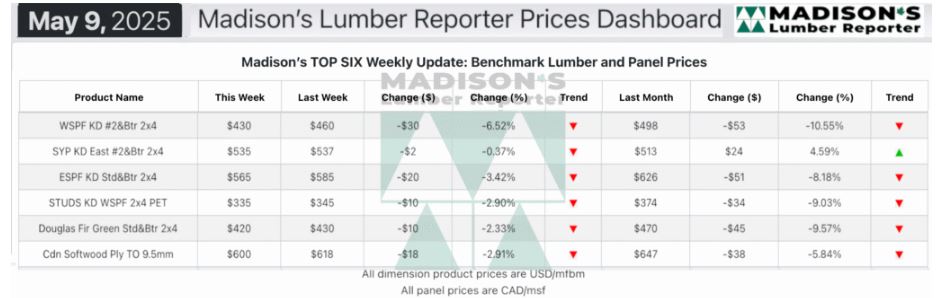

In the week ending May 9, 2025 the price of Western Spruce-Pine-Fir 2×4 #2&Btr

KD (RL) was US$430 mfbm, which is down -$30, or -7%, from the previous week

when it was $460, said weekly forest products industry price guide

newsletter Madison’s Lumber Reporter.

That week’s price is down -$68, or -14%, from one month ago when it was

$498.

Compared To The Same Week Last Year, When It Was Us$383 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending May 9, 2025

Was Up +$47, Or +12%.

Compared To Two Years Ago When It Was $360, That Week’S Price Was Up +$70,

Or +19%.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Builder sentiment remained negative amid ongoing turbulence in the broader

economy.

Oversupply reduced the pressure on buyers to take long positions and kept

the flow of wood to end users inconsistent.

Wide disparity between suppliers’ quoted prices persisted, contributing to

buyer apathy.

In the highly-populated areas of US Northeast construction activity was a

step behind typical spring levels.

Vendors in the tri-state area had begun selling product at below replacement

cost.

In the US south, freight was an ongoing sore point, with players advising to

book early and budget accordingly.

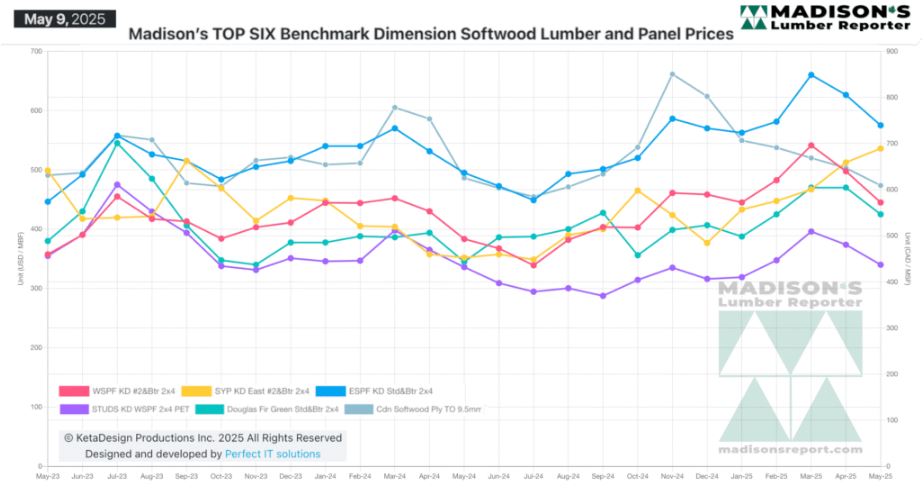

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: