|

1.

CENTRAL/ WEST AFRICA

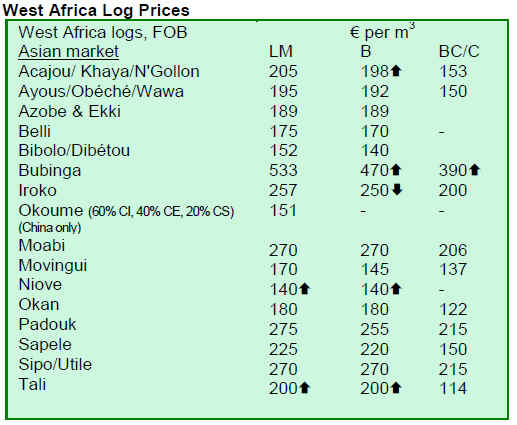

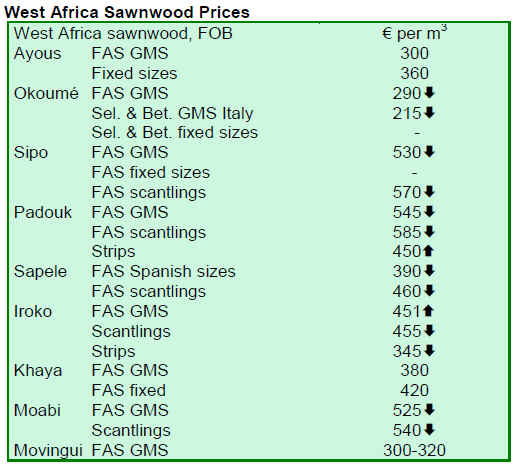

Marginal price changes in West Africa amid dull market

In the West African region, there were some minor

upward price adjustments for logs, while most prices

remained unchanged. European log purchases were very

small in volume as the majority of the log trade was to

Asian destinations. China, the largest buyer along with

India, was still quite active in the market. The European

sawn lumber market was also quiet although some

European traders reported that stocks of some species

were becoming very low leaving merchants with

fragmented specifications and limited ability to fulfill even

quite run-of-the-mill user orders. Even sapele was

mentioned in this context, although prices for exporters

were very low and had not yet shown any strengthening;

there were also very few enquiries for new contracts.

In continental Europe, some government financial

measures had started to make an impression on the level of

business in the building and construction industries. This

was expected to trickle down to help the timber trade,

though there were still reports of business closures in light

of the economic downturn. The situation in the UK had

not improved, as government announced initiatives had

not yet impacted on the construction industries even

though the housing market had reported more activity and

a larger number of housing sales than in the third and

fourth quarters of 2008.

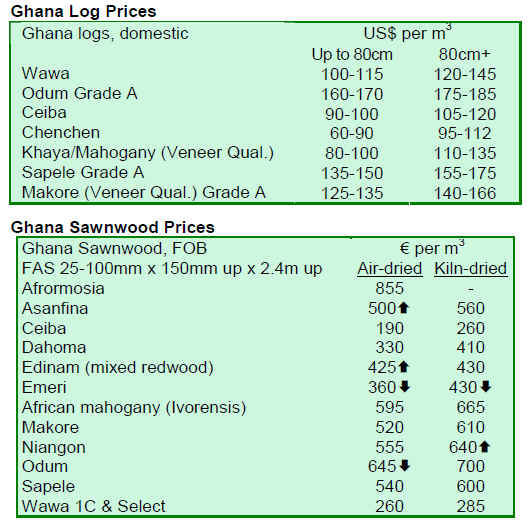

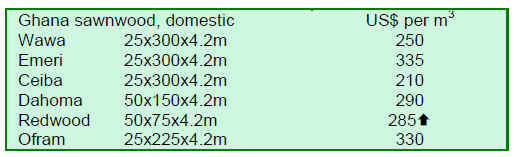

2. GHANA

Export applications drop 21% in fourth quarter 2008

One thousand, seven hundred and thirty three (1,733)

export permits were vetted, processed, approved and

issued to exporters during the fourth quarter of 2008

covering shipments of various timber and wood products

through the ports of Takoradi and Tema as well as through

overland exports to neighboring ECOWAS countries,

according to the permit section of Timber Industry

Development Division (TIDD).

These export permits were issued by offices in Sunyani

(55 permits), Kumasi (117 permits), Tema (197 permits)

and Takoradi (1,364 permits) as well as the head office of

TIDD, representing 3.17%, 6.75%, 11.37% and 78.71% of

the total export permits, respectively. The corresponding

total export permits issued for the third quarter of 2008

was 2,196. This was a substantial decrease of 21% in the

number of permits issued for the exports of timber and

wood products compared to the fourth quarter of 2008.

The decline was largely attributed to the global economic

slowdown.

Lumber, both kiln-dried (KD) and air-dried (AD),

continued to register the highest number (792) of export

permit applications, representing nearly 46% of the total

number of export permits issued during the period under

review. This was followed by plywood, mouldings and

sliced veneer. There were substantial reductions in the

number of permits issued in the fourth quarter for the

export of lumber, block boards, floorings, teak

billets/poles/logs, plywood, curl veneer, sliced veneer and

rotary veneer. However, demand for the exports of lumber

(both KD and AD) was still higher than tertiary wood

products such as furniture parts, mouldings, floorings,

dowels, broomsticks and profile boards.

For free and special permits, four (4) free export permits

were issued solely in Takoradi to Mondial Veneer (Ghana)

Ltd. and Peewood Craft & Art Cottage for the shipment of

wooden carvings, lazy chairs, wood craft boxes, wooden

drums, bar stools, bar chairs, cane chairs and cane centre

table. These products were shipped to clients in the EU.

Five special export permits were issued solely in Takoradi

to Machined Wood Company Ltd. for the shipment of

okoume laminated strips/mouldings to Italy. These were

200.633 m³ by volume and EUR113,780 by value. These

laminated mouldings were made from okoume sawn

timber, which were imported from Gabon. In contrast,

only one special export permit was issued to Machined

Wood Company Ltd. in the previous quarter for the

shipment of sapele laminated strips to the UK.

With respect to overland exports, 295 export permits were

granted to a number of timber companies to export lumber

and plywood by road to Burkina Faso, Nigeria, Niger,

Benin and Togo. The total volume and value of permits

issued for overland exports during the fourth quarter of

last year were 31,801m³ and EUR10.16 million,

respectively. The total number of permits issued for

overland exports during the previous quarter was 338 and

these export permits were 32,937 m³ by volume and

EUR10.30 million by value. These figures represent

reductions of 12.72%, 3.45% and 1.27%, respectively in

the number, volume and value of permits issued for

overland exports in the fourth quarter of 2008 compared to

the previous quarter.

The drop in the number, volume and value of overland

exports, in comparison with global trends, indicates that

the global economic slowdown has not severely affected

trade amongst the ECOWAS member countries. This is

further indication of the importance of the ECOWAS subregional

market and reinforces the need for Ghana to

diversify its export markets.

3.

MALAYSIA

Dompok appointed new Minister of Plantation Industries

and Commodities

The Star reported Mr. Bernard Dompok had been

appointed the new Minister of Plantation Industries and

Commodities as of 10 April 2009. Mr. Dompok was born

and brought up in the timber resource rich state of Sabah,

and is familiar with many of the issues and challenges

affecting the local timber industry

Furniture manufacturers face threat of closure

Some furniture manufacturers could be forced to close

within six months as a result of the 50% increase of the

levy for foreign workers, indicated The Star. Mr. Desmond

Tan, president of the Malaysia Furniture Entrepreneurs

Association (MFEA), commented that the federal

government needed to address the problem quickly as it

would have an adverse effect on the operational costs of

furniture manufacturers. With declining orders, he added

that it could lead to further layoffs at the management and

executive levels. Furniture exports posted a 14.2% drop in

January 2009, to RM621.3 million, from RM724.2 million

compared to the same month in year 2008. Malaysia¡¯s

furniture exports registered 2% growth in year 2008 from

year 2007, and were worth RM8.7 billion. This translates

to only 2.6% of the world¡¯s market for furniture.

MTC to represent timber sector at MICCOS event in August 2009

The Malaysian agricultural commodity industry will be

holding a major exhibition for international buyers at the

Malaysia International Commodity Conference &

Showcase (MICCOS), which will be convened at the

Malaysia Agro Exposition Park Serdang (MAEPS) from

13 to 16 August 2009. The Malaysian timber sector will be

represented by the Malaysian Timber Council and the

Malaysian Timber Industry Board. For more information,

see: http://www.miccos.com.my/?page=welcome

Properties facing foreclosure on the rise in Malaysia

The number of properties facing foreclosure or

receivership had increased from between 10% to 20% as

more property owners fell victim to the recession in

Malaysia. Personal and business bankruptcy in Malaysia is

expected to increase significantly as well, reported The

Star.

Withdrawal of investment could impact timber sector

Many banks are reportedly to have started withdrawing

trade credit facilities from a wide range of exporters,

including those with low credit risk exposure in the timber

sector. Most Malaysian banks traditionally favor the

construction sector over the manufacturing and trading

sectors. This has contributed to the large number of

abandoned construction projects in Malaysia during a

recession, which in turn drives down prices of building

materials and timber products.

4.

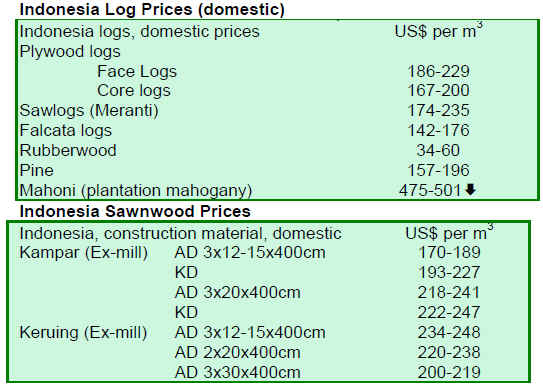

INDONESIA

Pulp and paper market turns focus to Asia

The decline in the demand of paper and pulp in

Indonesia¡¯s traditional markets has shifted attention to

major consuming countries in Asia such as China, India

and South Korea, according to Mr. Muhammad Mansur,

chairman of the Indonesian Pulp and Paper Association

(APKI). This new focus is a result of new forest

concessions of 7 million ha and the issuance of new

permits to allow the collection of timber waste to be used

as raw material, reported The Jakarta Globe. APKI¡¯s

forecast stated that China¡¯s demand for pulp will reach 25

million per year eventually, from 2007 to 2010, and

India¡¯s demand will reach 14 million tons for the period.

Indonesia faces critical shortage of rattan

Indonesia, the world¡¯s largest exporter of rattan and rattan

products, is facing a critical shortage of the material.

Prices for rattan climbed from Rp. 4,000 per kg. in the

1990¡¯s to Rp. 28,000 per kg. at present. This is due largely

to producers¡¯ preference to export unprocessed rattan in

bulk than to sell to local craftsmen. Bulk export prices for

rattan range from a low of Rp 9,344 to a high of Rp 16,150

per kg. In addition, local buyers have to pay a 10% levy on

all local inter-island shipments. Kalimantan is the main

source for most of Indonesia¡¯s rattan.

5.

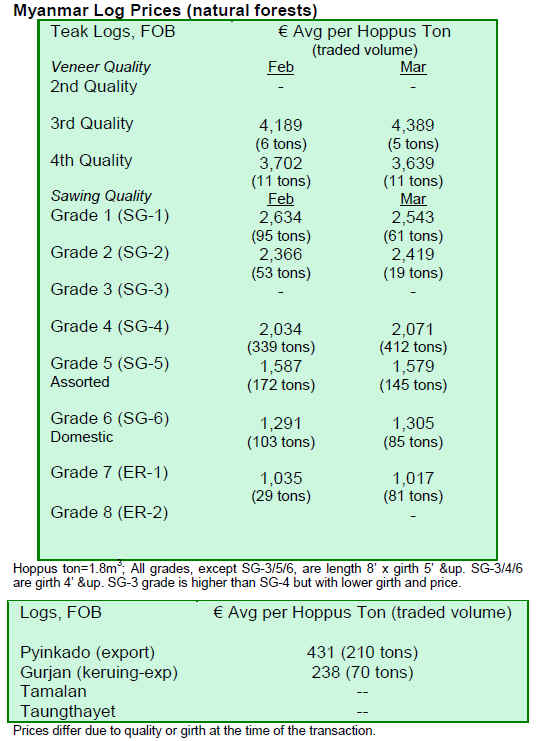

MYANMAR

Low trade seen during holiday period

Local experts in Myanmar observed low trading activity

during the Myanmar New Year holiday, which occurred

during 11-21 April. The next tender results will be

published during in the TTMR 14:9.

6. BRAZIL

State inspection results in sawmill closures and seized

illegal timber

According to Ascom MMA/Ascom IBAMA, the National

Military Force, the Brazilian Patrol Police, the

Environmental Military Police, the Brazilian Institute of

Environment and Renewable Natural Resources (IBAMA)

and the National Indian Foundation (FUNAI) have

recently started a mega-inspection operation to control

illegal forest activities in the Amazon region. Of particular

interest is the municipality of Nova Esperança do Piri¨¢, in

the Northern state of Par¨¢, which has a population of

32,000 and is reported as being a hot spot for

environmental crimes. To date, a total of thirteen sawmills

in the municipality have cleared 80,000 of 250,000

hectares of an indigenous reserve and held employees

captive as slave labor.

The recent inspection was led by the Minister of

Environment. Sawmill and/or forest land owners were not

detained, but computers and documents were seized

during the field inspection. The seized materials could

result in the indictment of at least ten people found

responsible for illegal operations and for acting as buyers

of illegal timber.

Seven sawmills were embargoed, which produce about

2,000 m³ of roundwood and 200 m³ of sawn wood, and

their materials were seized. In the coming weeks, other

sawmills will be closed. According to the Minister of

Environment, none of them had forest management plans,

a pre-requisite for obtaining environmental permits for

legal forest harvesting.

Part of the seized timber, including high value species

such as maçaranduba, will be sold in auctions, and the

remaining part will be donated to the municipality for

public use, such as construction of bridges, low-income

housing and schools. The money from the auction will be

used for environmental preservation projects of the federal

and state governments.

Par¨¢ faces further closure of solidwood companies

The export-oriented timber industry is the basis of the

economy of the Novo Progresso region, one of the highest

revenue generating municipalities in the state of Par¨¢.

However, such revenue has declined mostly due to the

difficulty for companies to obtain new permits for Forest

Products Transportation (ATPFs), since the federal

government¡¯s Curupira inspection operation started in

2008.

As a result, production of manufactured wood products

has fallen 50% and layoffs, collective holidays and even

closure of mills has already started throughout the state,

reported the Jornal Folha do Progresso/Madiera Total.

Over 10,000 people have lost their jobs in rural areas and

in timber-processing mills in West and Southwest regions

of Par¨¢.

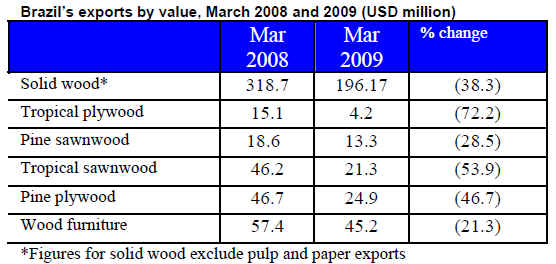

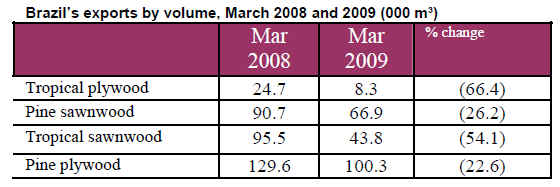

Brazil¡¯s March 2009 exports continue downward trend

Brazil¡¯s wood products exports (except pulp and paper)

dropped 38% by value compared to the same period in

2008. The charts below show the volume and value of

Brazil¡¯s exports for March 2009 compared to the same

month a year earlier:

Brazil searching for ways to boost forest sector

According to Centro de Inteligencias em Florestas, Brazil

is seeking ways to overcome the effects of the financial

crisis. At the beginning of the financial crisis, the Brazilian

forest sector did not expect to be as affected as other

sectors. However, in the first two months of 2009, exports

declined and many investments and contracts were

reduced or cancelled.

As for the solidwood industry, the segments affected were

sawnwood, doors, plywood and high value-added products

that are export-oriented, mainly to the North American

market. For instance, from July 2008 to January 2009,

sawnwood and plywood exports plunged 20% and 48%

respectively.

To mitigate the effects of the crisis, Brazil has attempted

to diversify exports to foreign markets, expanding

participation in the domestic market and diversifying

products, as well as increasing manufacturing of valueadded

products. In addition, ABIMCI (National

Association of Mechanically-Processed Timber Products)

has requested the government to adopt economic measures

to benefit the sector, such as cost and tax reductions.

The charcoal market has also been affected by the crisis,

mainly due to the significant decrease in market demand

for pig-iron, which has affected the iron and steel industry

in Brazil. According to the Brazilian Institute of the Iron

and Steel Industry (IBS), in the first half of both January

and February 2009, the decrease in production exceeded

40% compared to the same period of 2008. Other

charcoal-related segments have reduced their consumption

and charcoal prices have continued to fall, negatively

impacting the sector.

7.

PERU

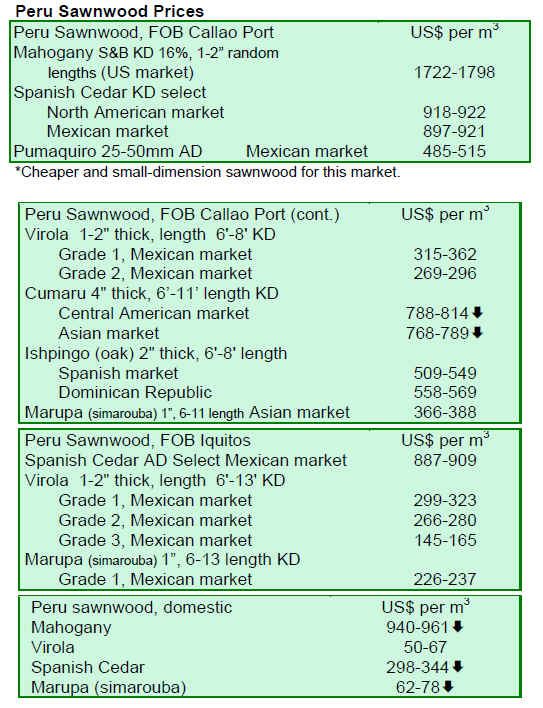

Exporters redirect trade to local markets

Wood exporters have been rerouting exports to the

national market as well as to non-traditional market

destinations overseas, as the international economic

downturn has negatively affected demand from traditional

market destinations for Peruvian exports. Currently the

countries importing most of Peru¡¯s wood products are

Mexico, China and the US, according to the Peruvian

Exporters Association (ADEX). ADEX Forestal

Committee President Santiago Echecopar explained that of

the USD222 million of 2008 Peruvian exports, three

countries accounted for 84% of Peru¡¯s total exports worth

USD185.9 million.

Mexican elections delay Peru¡¯s signature to NAFTA

Peru¡¯s signature of the North American Free Trade

Agreement (NAFTA) has been delayed due to political

uncertainties in Mexico. With upcoming elections in

Mexico on 5 July 2009, Peru cannot sign the Agreement

until there is a clearer political view in the country,

according to the Ministry of International Commerce and

Tourism. This delay could stall exports from several

productive sectors, as NAFTA is designed to facilitate

exports such as value-added wood products to signatories

to NAFTA. Mexico is currently the main buyer of Peru¡¯s

wood products.

Environment Ministry recommends revised export

quotas for mahogany

On 16 April 2009, the Environment Ministry issued a

recommendation to set limits on exports of mahogany,

with the Ministry allowing only 562 to 851 trees to be

harvested for export. The recommendation was drafted by

the Environment Ministry (as the authority on CITES),

with the support of the National Agricultural University of

La Molina. The new recommendation would also allow

the Agricultural Ministry to be a CITES administrative

authority in Peru. As part of the recommendation, the

Ministry can also approve tariffs on mahogany exports in

2009. Mahogany has high commercial value and is a

highly demanded commercial species in the international

market.

8. BOLIVIA

Preliminary estimates show 10% decline in forest

exports in 2008

Preliminary statistical reports indicate that forest products

exports from Bolivia during January to November 2008

dropped 10% compared with the same period in 2007. The

value of forest products exports fell from USD197.7

million to USD177.6 million, breaking the positive trend

in Bolivia¡¯s forest exports since 2002.

Exports of manufactured products accounted for 80.2% in

January to November 2008. Doors, plates, fiberboard,

boards, parquet, decking, furniture, shelled chestnut, and

palmito accounted for this total. The remaining 19.7%

consisted of semi-finished products, which include: sawn

timber; poles; tables; and cocoa beans. The cause of the

decline in export value was the international economic

downturn and other political events affecting the forest

sector.

Exports of wood products over the same period in 2008

represented 48.7% of the total or USD85.1 million. Nonwood

products were up 51.3% or equivalent to USD91.1

million, with shelled chestnuts representing the entire

value.

9. Mexico

US and Mexico sign historic agreement on climate

change

Xinhua news service reported on the historic agreement

signed by Mexican President Felipe Calderon and US

President Barack Obama on 16 April 2009, which will

provide a framework for bilateral work on energy and

climate change and allow for information exchange and

other technical cooperation. During a joint press

conference in Mexico City, President Obama explained

the agreement would focus on renewable energy, energy

efficiency, sustainable use of forests and carbon reduction

technology.

Both countries will work to reduce greenhouse gas

emissions, promote climate change adaptation measures

and fortify the sharing of energy resources between the

two nations. Other bilateral work will include the

establishment of organizations and information exchange

to maintain and establish greenhouse gas inventories and

design strategies for greenhouse gas reduction. It will also

promote development of renewable energy by undertaking

technical and economic viability studies and development

of projects in the border region between the two countries.

10.

Guyana

Prices surge over previous fortnight

Compared to the first half of March 2009, log and

sawnwood prices in April 2009 showed gains by value.

Plywood prices remained fairly stable compared to the

same period in 2008. Splitwood prices were more

favorable in 2008 compared to 2009 prices.

Value-added products such as indoor furniture have shown

significant export value earnings compared to the first half

of April 2008. The Caribbean market remains the main

destination for this product. High export value earnings

were also recorded for outdoor garden furniture over the

same period, with the UK being the main export

destination.

Guyana¡¯s local forest-based communities benefit from

training in forest management

Forest-based communities in Guyana have traditionally

received forest management training through initiatives of

the Guyana Forestry Commission (GFC) and the World

Wildlife Fund. However, the emergence of the Forestry

Training Centre Incorporated (FTCI), established with

support from ITTO, has served as the catalyst to provide

forest management training to a large number of

communities. FTCI¡¯s forest management training has been

designed to be applicable to community forest

management and community forestry needs.

Communities benefit from forest management training in

three main ways. Firstly, forest management training

enables communities to manage their forest resources with

basic knowledge of forestry and other basic management

tools (e.g. maps). Secondly, it allows communities to

develop a shared understanding of their situation, which in

turn enables communities to better source and utilize

technical assistance in forestry provided by donors;

further, communities become more active during

consultations because they have more information on

which to take decisions. Thirdly, trained members of the

communities are able to take up job opportunities with

logging enterprises and at the GFC¡¯s forest stations near

their communities, leading to cash inflows for the

development of schools, medical centers and community

businesses.

Since FTCI started its forest management training in 2007

through ITTO Project PD 333/05 Rev.2 (I), many younger

community members have been seeking support to

participate in the one-year forestry certificate course at the

Guyana School of Agriculture. The GFC itself offers full

scholarships for up to five persons per year.

|