|

Report

from

Europe, the UK

and

Russia

EU import statistics show dramatic fall in tropical hardwoods during 2008

Newly released Eurostat data provides official

confirmation of anecdotal reports of a dramatic EU-wide

fall in imports of tropical hardwood products during 2008.

The downturn was felt in all corners of the EU and

affected just about the entire range of wood products

imported from tropical countries. In 2008, the volume of

EU-25 imports of hardwood logs, sawn, veneer, and

plywood from countries in the tropical forest zone was

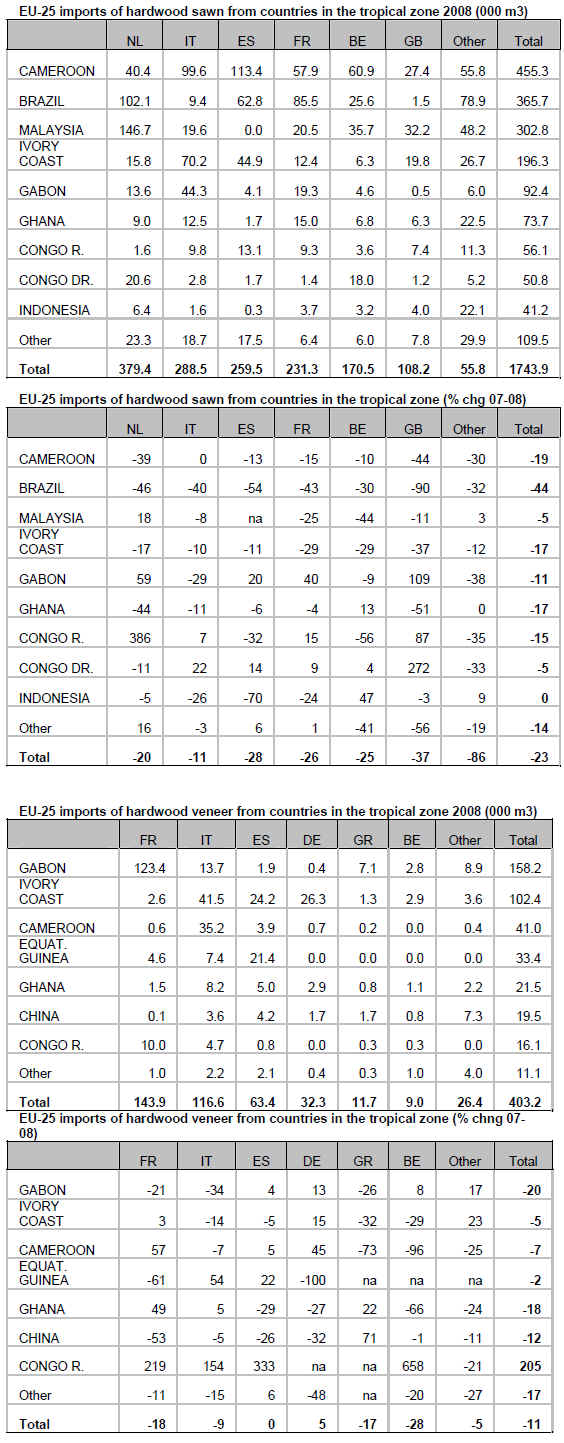

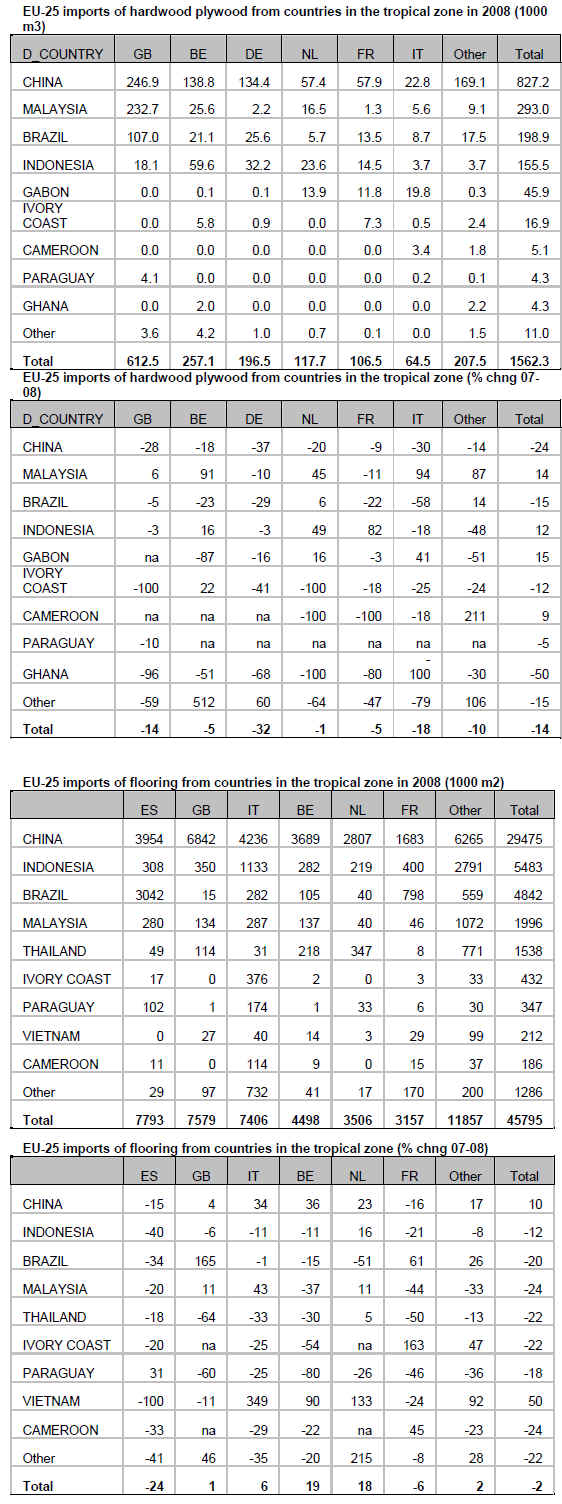

down 27%, 23%, 11% and 14%, respectively.

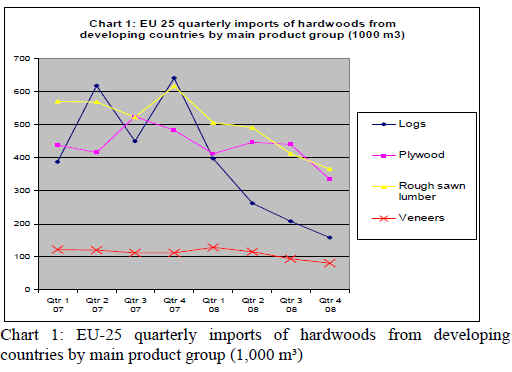

Closer analysis of quarterly data indicates that the timing

of the downward trend varied by product group (Chart 1).

The decline in EU-25 imports of hardwood logs and sawn

from tropical countries set in at the start of 2008, falling

dramatically between the last quarter of 2007 and the first

quarter of 2008. The downturn in veneer imports began in

the second quarter of 2008, following a gentler but

nevertheless relentless slide. Hardwood plywood imports

held up well until the end of the third quarter of 2008 but

then tumbled dramatically in the last three months of the

year. The late response of the European plywood sector to

the changing demand situation seems now to be reflected

in particularly dire market conditions for this commodity

in the EU, with importers now desperate to offload

excessive stocks in the face of very slow consumption.

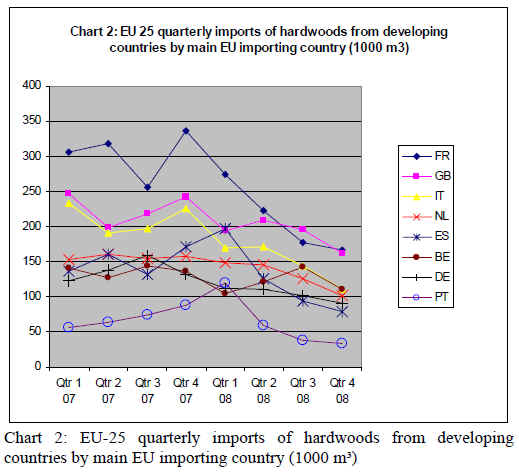

No European country has escaped the impact of the market

downturn, although there is some variation in the depth of

the recession in timber imports (Chart 2). The volume of

hardwood imports from tropical countries into France,

Italy, Spain, and Portugal fell particularly steeply during

the course of 2008. Imports into the UK fell more slowly,

although this may be due more to the delayed reaction of

the UK plywood sector than to any strength in underlying

consumption. Germany¡¯s decline was more moderate,

partly because this market is already now less dependent

on tropical wood than other European countries and partly

due to more stable (but still unexciting) demand in

Germany¡¯s joinery sector.

Imports of hardwoods from tropical countries into

Belgium and to a lesser extent, the Netherlands, held up

better than most other countries in 2008. Since both

countries are very significant as staging posts in the supply

of other European countries, the relative stability of their

imports during 2008 is just as likely to reflect changes in

purchasing practices in the wider European hardwood

market in the face of the recession as it is underlying

domestic consumption in the Benelux region. One impact

of the recession may have been to intensify the trend

towards increased reliance on little-and-often purchases

from the large concentration yards in the Benelux

countries and to reduce the numbers of European

companies engaged in direct imports of tropical wood.

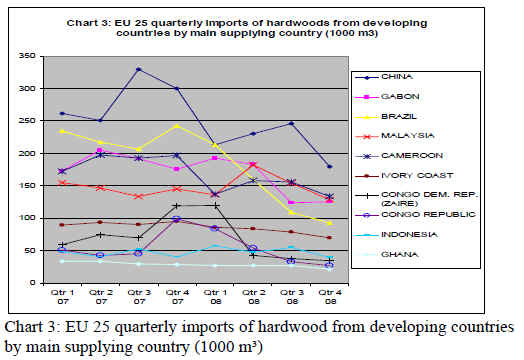

The fortunes of key tropical hardwood supplying countries

to the EU have also varied widely, although none could

claim to have had a particularly ¡®good year¡¯ in Europe

during 2008 (Chart 3). The volume of EU-25 imports of

hardwood products from China (mainly plywood) fell

from a peak of around 330,000 m³ in the third quarter of

2007 to less than 180,000 m³ in the last quarter of 2008.

Rising costs of labor and raw material combined with

quality and environmental concerns were undermining the

competitiveness of Chinese plywood products in the EU

market from the middle of 2007 onwards. The economic

downturn only added to these problems ¨C although it is

worth noting that in pure volume terms, China remains a

very significant supplier of hardwood-based products to

the EU.

The decline in EU-25 imports of hardwood products from

Brazil (mainly plywood and sawn lumber) also fell very

dramatically from close to 250,000 m³ in the fourth quarter

of 2007 to less than 100,000 m³ in the last quarter of 2008.

During the whole of 2008, the volume of EU-25 imports

of hardwood plywood and sawn lumber from Brazil were

down respectively 44% and 15%. This reflects both

difficult supply conditions in the Brazilian hardwood

sector as well as slowing European consumption.

EU-25 imports from African countries during 2008 saw

some significant declines, although less dramatic than

those experienced from Brazil and China. European log

and sawn imports from Gabon were down 19% and 11%

respectively on the previous year, although these declines

were partly offset by a 15% rise in EU imports of plywood

from Gabon, an effect of the new inward investment in

processing capacity in the country in recent times. EU-25

imports from Cameroon followed a similar path, with

significant declines in volumes of logs (-45%) and sawn (-

19%), but a rise in volumes of plywood (+9%). EU-25

hardwood imports from the Congo Democratic Republic

(logs and rough sawn), having risen dramatically at the

end of 2007, fell to much lower levels from the end of

March 2008 onwards. EU-25 imports of logs and rough

sawn from the Republic of Congo fell consistently

throughout 2008, partly offset by a rise in imports of

veneer from the country. EU-25 imports of hardwood

(mainly sawn lumber) from Côte d¡¯Ivoire and Ghana fell

consistently during the course of 2008, ending the year

around 17% down on 2007.

Malaysian hardwood suppliers performed better than most

of their competitors in the European market in 2008. EU-

25 imports of Malaysian sawn lumber in 2008 were down

only 5% on the previous year while imports of Malaysian

plywood were actually up 14%, with large increases in

sales to Belgium, Netherlands, and Italy. This reflects both

the mounting problems in Chinese plywood supply and the

development of new FSC-certified combi-plywood

products in Malaysia combining tropical hardwood face

with a New Zealand radiata pine core.

Meanwhile EU-25 hardwood imports from Indonesia

(mainly plywood and mouldings) remained relatively

stable throughout the course of 2008, although a shadow

of their former self at well below 200,000 m³ for the whole

year.

During 2008, EU-25 imports of hardwood flooring

products from developing economies reached 45.8 million

m², a 2% decline on the previous year. China consolidated

its position of dominance in the sector, contributing 29.5

million m³ of European imports, up 10% on the previous

year. EU-25 imports of hardwood flooring from most

other developing countries declined, including from

Indonesia (-12%), Brazil (-20%), Malaysia (-24%),

Thailand (-22%) and Côte d¡¯Ivoire (-22%).

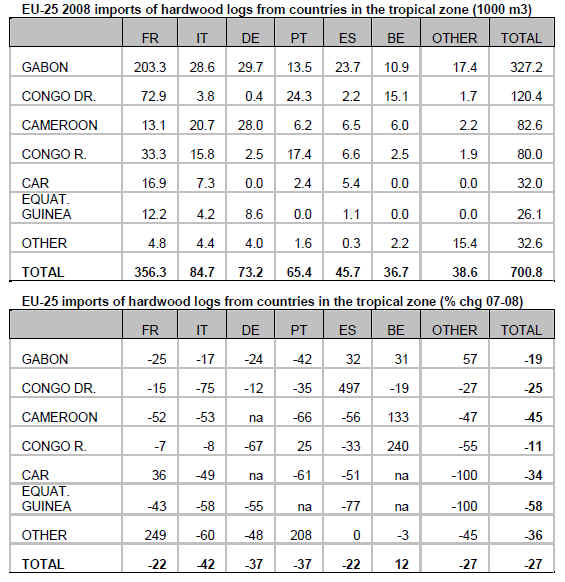

A comprehensive breakdown of EU-25 imports of

hardwood products from countries in the tropical zone

during 2008 by leading supply country and European

Member State is shown in the following tables. European

imports of all hardwood from countries that are fully or

partially in the tropical zone are included. In some cases a

significant proportion of these hardwoods may be of

temperate origin, particularly in the case of China. The

EU-25 group of countries includes all members of the EU

with the exception of Romania and Bulgaria (which only

joined the EU on 1 January 2007). Data is compiled from

Eurostat data supplied by Business Trade and Statistics

Ltd. Forest Industries Intelligence Limited analyzed the

data to remove inconsistencies.

¡¡

|