|

1.

CENTRAL/ WEST AFRICA

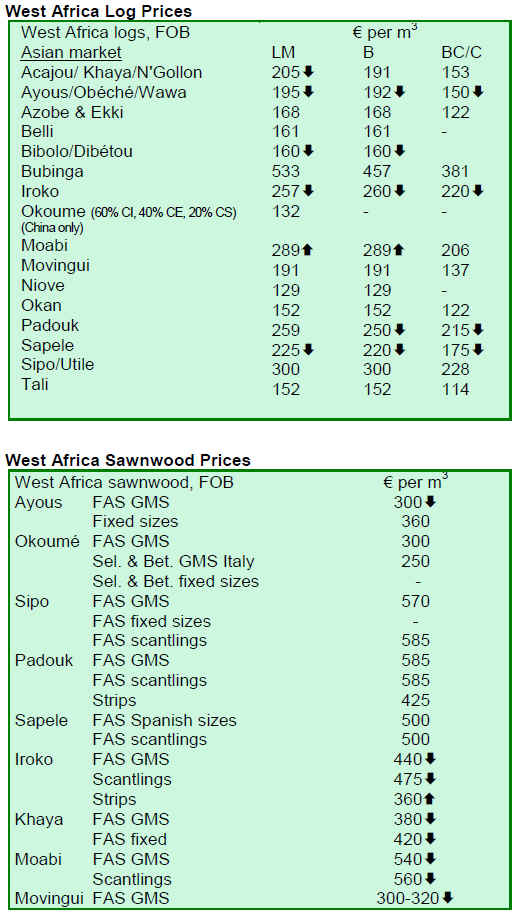

Prices fluctuate as low trade hits producers

The downturn in trade has now started to impact West

African prices, with some significant price decreases

occurring even for the more popular species. Gabon¡¯s

harvesting ban on four timber species (douka/makore,

moabi, ozigo and afo) has not had any notable effect due

to the large overstock of moabi and douka/makore in

major markets and low demand from the construction

industry. Prices were up about EUR30 m³ for both logs

and lumber, with the expectation buyers will want to take

advantage of log stocks being disposed by producers until

the end of March. The forestry department in Gabon is on

strike, with the expected cause being over certain elements

of the pay package for staff. In the region many forest

operators and sawmills are closed, and some closures

continue to be made.

It is a buyer¡¯s market and companies in operation are

facing very tough negotiations on price. India and China

are still buying and Vietnam is also still very active and

steadily increasing import volumes. Log production in

Congo Brazzaville is low. Trade with South Africa has

slowed after a very long period of regular, high volume

intake of West African sawnwood species. Buyers in

possession of contracts are asking exporters to hold

shipments for unspecified later dates.

Exporters and traders report that pricing has become very

difficult and finding a base price level has not been easy to

determine. Sapele sawn stocks are now much depleted and

prices for remaining stock depend very largely on what the

buyer will offer, new production is low and prices tend to

be firm for buyers¡¯ specifications. Sipo has firmed up

again because of limited production.

Price negotiations for okoume logs are affected by the low

plywood consumption in European markets. In particular,

the slow down in imports and the reduced prices of

plywood from China reflect back to plywood

manufacturing in other countries, squeezing margins and

resulting in lower offer prices for the raw materials.

DRC cancels nearly 60% of timber contracts

After a review of 156 logging deals in the Democratic

Republic of Congo (DRC), the government has cancelled

nearly 60% of timber contracts in the country¡¯s rainforests,

reported the BBC. The investigations, backed by the

World Bank, were conducted with the view to exposing

corruption and enforcing environmental standards. The

investigations concluded that only 65 of the existing deals

were viable. The government notified the relevant

companies of the cancelled contracts and indicated new

contracts would be issued for 90,000 square kilometers of

forest area.

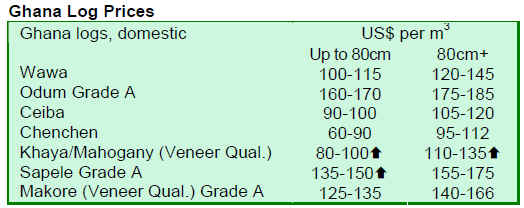

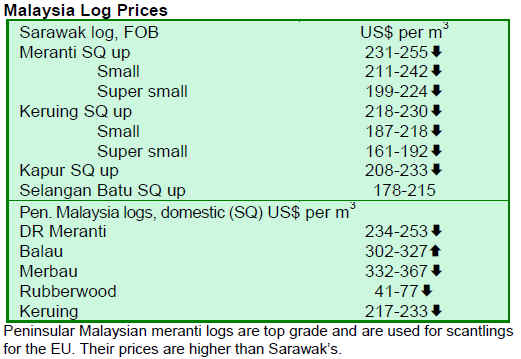

2. GHANA

Export contracts drop in third quarter 2008

A total export contract volume of 169,481 m³ was

processed and approved during the third quarter of 2008,

according to Ghana¡¯s Timber Industry Development

Division (TIDD). This represents a decrease of 13.6%

compared to the figure for the second quarter of 2008. In

a similar development, furniture parts processed and

approved during the quarter under review were 15,379

pieces, an increase of 28.7% compared to the figure for the

second quarter of the same year.

With the exception of lumber and logs/billets/poles, which

increased 2.5% and 16.7% by volume to register 54,326

m³ and 47,274 m³, respectively, almost all exportable

products decreased by volume during the third quarter

2008.

While plywood contracts decreased 32.6%, amounting to

45,083 m³, sliced veneer, rotary veneer,

moldings/processed lumber and finger jointed lumber

decreased by 36.3%, 20.9%, 37.7% and 57.7%,

respectively, to register volumes of 8,690 m³, 5,189 m³,

4,180 m³ and 2,340 m³.

Lumber regained its position as the leading exported

product, contributing 32% of the total volume achieved

during the quarter under review.

John Bitar Company Ltd (JCM), A. G. Timbers Ltd. and

Rimmens Company Ltd. secured three free permits, issued

in Takoradi, for the shipment of 312 pieces of wood

carvings and various wooden musical instruments.

Compared with the previous quarter, only one (1) free

permit was issued for the shipment of wood carvings to

Italy.

One special permit was issued in Takoradi to Machined

Wood Company Ltd. for the shipment of sapele laminated

strips to the UK. This shipment involved a total volume of

11,367 m³ and a total value of EUR13,072. These

laminated strips were made from sapele sawn timber,

which were imported from Gabon. However, no special

permit was issued during the second quarter of 2008.

In another development, 53 export permits were issued in

Takoradi to several companies for the shipment of teak

billets, poles and logs to India and Hong Kong, while 157

export permits were issued in Tema for the shipment of

teak billets, poles and logs to India and Vietnam. These

shipments involved a total volume of 29,011 m³ and a

corresponding total value of EUR5.88 million. From these

shipments, an amount of EUR587,679 was the export levy

on unprocessed timber, as stipulated under the Trees and

Timber (Amendment) Act, 1994 (Act 493).

Other export permits issued in Takoradi during the quarter

were 12 export permits for the shipment of gmelina billets

and poles to India. These involved a total volume of 2,298

m³ and a corresponding total value of EUR215,867. Two

export permits to Best Glow Wood Ltd. were issued for

the shipment of rubberwood lumber to Malaysia, for a

total volume of 125 m³ with a corresponding value of

EUR14,618. Eight export permits were also issued to John

Bitar Company Ltd. (JCM) for the export of blockboard

and plywood by road to Nigeria, in the amount of 185 m³

(EUR59,559).

Five (5) export permits were issued in Tema to Messrs.

Danteng Wood Processing Company Ltd. and Geavag

Company Ltd. for the shipment of rosewood (Pterocarpus

erinaceus) lumber to China, India and Thailand. These

shipments involved a total volume of 166 m³ and valued at

EUR44,699.

3.

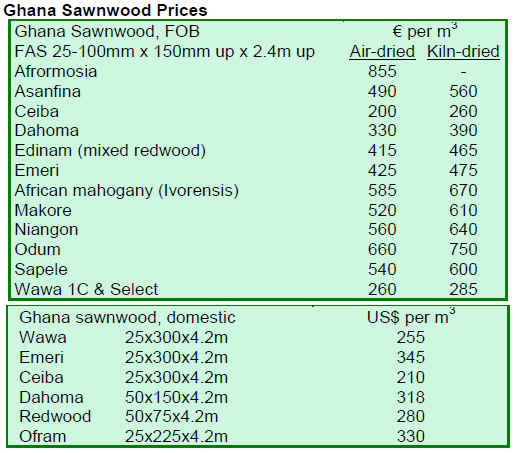

MALAYSIA

Decline in timber business expected after Chinese New Year

Malaysian prices continued to decline as the global

economic slowdown continued. BTimes indicated that the

price decline was further aggravated by the worst slump in

US lumber prices in almost 18 years and shares of

Malaysian timber companies were equally negatively

affected. However, the full impact of the drop in prices

was paused due to the closure of businesses during the

annual Chinese Lunar New Year celebrations.

Nevertheless, the decline in prices is expected to persist

after the New Year festivities.

Low growth of GDP anticipated in 2009

Analysts expected Malaysia¡¯s GDP growth to be between

1.1% and 2.2% in 2009 as the national economy contracts,

reported Bernama News. Unemployment is expected to hit

4.7% and market conditions continue to be bleak. The

Malaysian Ringitt fell for the third week in the wake of

speculations that the central bank will cut interest rates to

stimulate economic growth and aid local exporters.

DRC cancelled contracts could provide Malaysia with opportunity

The Independent reported on traders¡¯ hopes that Malaysian

sawnwood suppliers can fill the void created by the

cancelled contracts in the Democratic Republic of Congo

(see West/Central Africa section). However, the EU, one

of the major destinations for timber from the DRC may

prove to be elusive for Malaysian timber suppliers as EU

shares fell to a six-year low, according to The Guardian.

Economic data indicated the UK economy went into

recession at the end of 2008 and contracted 1.5% in the

fourth quarter of 2008.

Government decides to reduce export of natural rubber

Btimes reported on Malaysia¡¯s decision to reduce the

export of natural rubber by 5% to 57,050 tons in year

2009. As a result of this measure, more rubber plantations

can be replanted or converted into alternative commercial

projects. This would mean that more rubberwood would

be available as raw material, thus reducing pressure on

rubberwood prices.

4.

INDONESIA

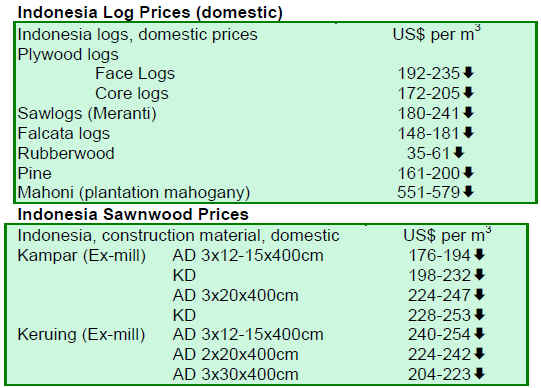

Domestic prices of Indonesian wood products plunge

The current economic climate in Indonesia is pushing

domestic prices of Indonesian wood products near the

verge of collapse. With the country grappling with

unemployment, there is a fear that more natural forests

will be cleared for agricultural purposes as the country

struggles to contain rising poverty. Some Indonesian

plywood manufacturers have been unable to fulfill their

order books beyond April 2009. Orders from the U.S. have

stalled while Japanese buyers are making some of the

smallest orders ever witnessed by Indonesian plywood

manufacturers in 20 years. Buyers from the Middle East

are seeking discounts for purchases to complete ongoing

projects. Some manufacturers are considering the

possibility of cutting production by reducing the number

of working days between three to four days per week in

order to stay afloat.

Forestry Minister optimistic about plans to eradicate illegal logging

Indonesian Forestry Minister M.S. Kaban¡¯s recently stated

his optimism on Indonesia¡¯s five programmes to eradicate

illegal logging and trading in state forests, revitalize

forestry, conserve and rehabilitate forest resources,

employ people living inside and around forest areas, and

consolidate forests, reported Antara News. He added that

Indonesia faced a two-pronged problem with

deforestation, due to the high and irreversible rates of

deforestation experienced by Indonesia from 1997 until

2000 and the current state of degraded forests, estimated at

59 million hectares.

5.

MYANMAR

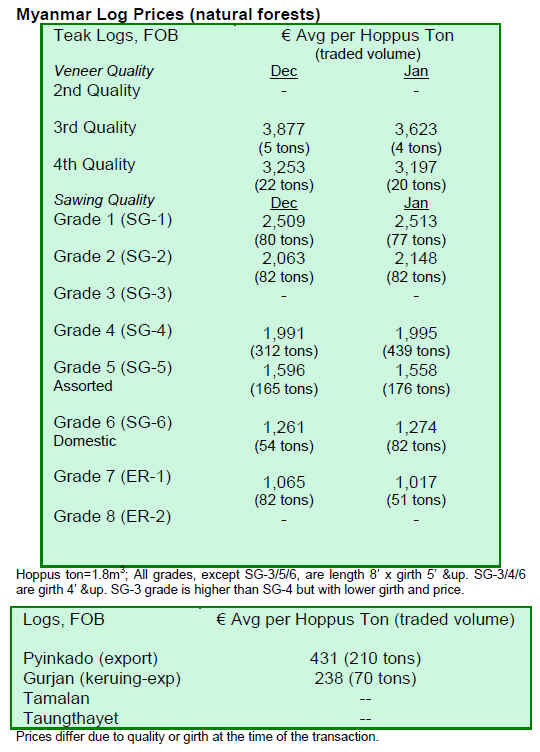

Bleak outlook for Myanmar timber

Bids from major buyers have propped up prices of teak at

last week¡¯s tender, although average monthly prices

steadied. The quantity of teak was also adequate for the

amount of bids made. Most analysts say the market is

moving very slowly and outlook is a bit bleak for 2009.

The upcoming week¡¯s business will be less active due to

the Chinese New Year Lunar holiday.

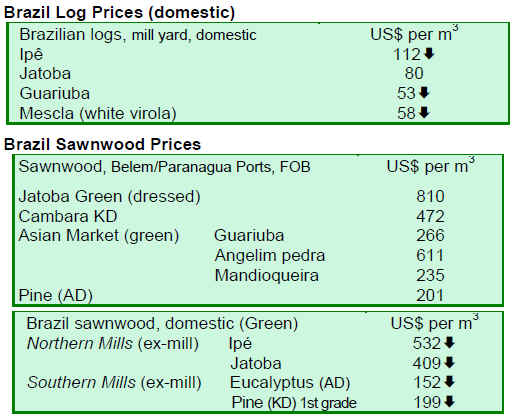

6. BRAZIL

Brazilian Amazon timber sector contributes 3.5% to

GDP

Ag¨ºncia Amazônia reported on how the timber industry in

the Amazon was the largest industrial employer. Although

the Amazon timber industry was the largest industrial

employer and collected the highest amount of taxes, it was

said to be responsible for a deforested area of 11,986 km²

in 2007. Nevertheless, the sustained performance of the

sector made Brazil one of the world¡¯s top producers of

tropical timber.

In 2004, the timber sector generated 124,000 direct and

108,000 indirect jobs, with over 147,000 jobs located

outside the region. Timber activities also provided a gross

income of USD2.3 billion, involving 3,132 companies

distributed in 82 timber clusters. The export value of

products from the industry also jumped between 1998 and

2004, from USD381 million to USD943 million,

according to the results of the Sustainable Action Plan

(PAS).

The parts of the production chain directly dependent on

timber accounted for 3.5% of Brazil¡¯s GDP and 6% of

exports in 2006. In the same year, the industry collected

more than BRL4.2 billion in taxes and generated 6 million

direct and indirect jobs in the country. The activity is

spurred by complementary activities in other industrial

sectors of the economy: the steel industry; the pulp and

paper industry and the civil construction industry.

Timber sales, price and stock of timber drops in Northern Mato Grosso

The municipality of Sinop has seen slowing business for

timber companies in 2009. Demand has been low since

mid-December and the majority of companies have also

held a low volume of timber stocks. The timber industry is

the economic base for the many cities in the Northern

region of the country. In Sinop alone, there are over 150

timber-related companies.

According to the Union of Timber Industries of Northern

Mato Grosso (SINDUSMAD), many companies are short

of timber for sale due to delays associated with the State¡¯s

approval of forest management plans for selective logging.

Another factor is that few companies are able to harvest in

the rainy season. However, since sales are currently low,

no shortages of timber in the market are anticipated.

SINDUSMAD noted a drop in timber prices between 10

and 15% during the last quarter of 2008, depending on the

species. However, sales are expected to grow from

February 2009 and the current state of the market seems

suitable for exports. Currently, with a more favorable

exchange rate, exports of timber products are expected to

grow, although accurate forecasts have not been made.

Another positive expectation relates to the validity of

forest management plans, for a period of five years,

instead of being reviewed annually.

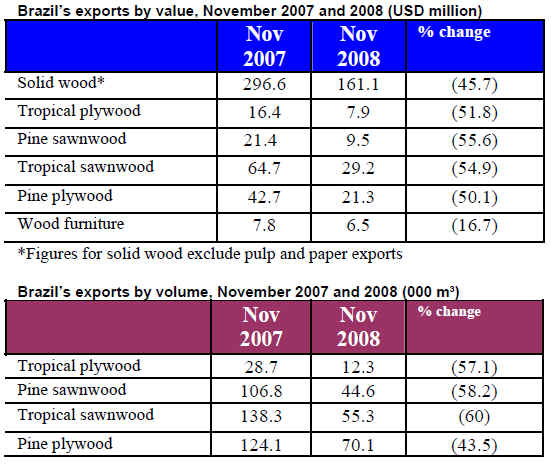

Brazil¡¯s November and December 2008 exports fall from October levels

Brazil¡¯s wood products exports (except pulp and paper) in

the month of November 2008 slipped from November

2007 levels, decreasing in value by 45.7%. The largest

year-on-year fall in exports by value was in pine

sawnwood products. The charts below show the volume

and value of Brazil¡¯s exports for November 2008

compared to the same month a year earlier:

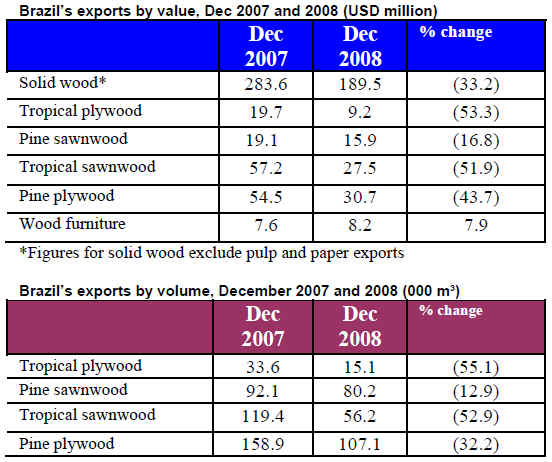

In December 2008, solidwood exports dropped 33.2%

compared to the previous year¡¯s levels. The value of all

other wood exports, with the exception of wood furniture,

fell by value during the month of December 2008. The

charts below show the volume and value of Brazil¡¯s

exports for December 2008 compared to the same month a

year earlier:

US furniture imports from Brazil tumble 35%

Gazeta de Bento Goncalves reported on the recent drop in

US furniture imports from Brazil. Despite a drop of 30%,

the US, which imports 16% of Brazil¡¯s furniture, is still

the largest importer. The US is followed by Argentina,

France and the UK as the main markets for Brazilian

furniture. France imported 12% more furniture from

January to November 2008 compared to the same period

in 2007. In contrast, the UK imported 7% less in 2008. A

notable trend was a growth in Africa¡¯s imports of

Brazilian furniture, which grew 64% in 2008. Angola is

one of the largest importers of Brazilian furniture,

matching the UK¡¯s import share of 7%. At the intraregional

level, Argentina accounted for 13% of total

exports, raising imports by 46% from January to

November 2008.

The furniture industry of Rio Grande do Sul announced

domestic sales of 29% during the first 11 months of 2008

and a growth of 1.9% in exports. The state remains behind

Santa Catarina as the largest exporting state in Brazil, with

Santa Catarina accounted for 32% of exports in 2008. Sao

Paulo saw a 28.5% growth in its exports compared to 2007

levels.

Export situation worsens in Par¨¢

The global financial crisis is affecting exports from the

Brazilian Amazon state of Par¨¢, reported Folha da Mata

Online (No 71). Exports of manufactured and

industrialized wood products from Par¨¢ dropped 19% by

value and 35% by volume from January to November

2008 compared to the same period in 2007. The largest

drops in exports were recorded in painting and photo

frames, particleboard, plywood and veneer. According to

the Timber Exporting Companies Association of Par¨¢

(AIMEX), the forest sector was beginning to feel the

effects of the crisis, which were exacerbated by factors

such as a reduction in raw material supply and the falling

value of the US dollar in the second half of 2008. Since

August 2008, the situation has become worse. Despite the

appreciation of the US dollar against the Brazilian real,

demand for wood products from Par¨¢ by importing

countries has dropped, including in US and EU countries,

the main importers of Brazilian wood products.

7.

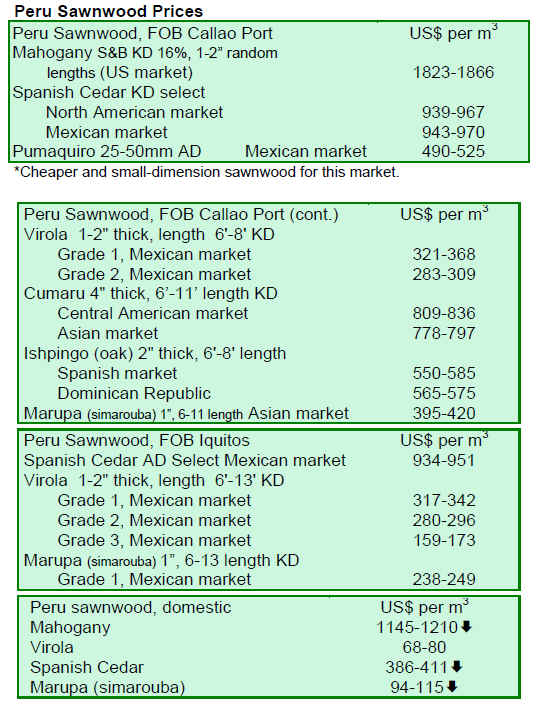

PERU

Peru ¨C US sign FTA

On 16 January 2009, Peru signed a Free Trade Agreement

(FTA) with the US, reported various news sources. The

agreement, which will take effect from 1 February 2009,

opened possibilities for Peru¡¯s intellectual property

arrangements, said Peru¡¯s Minister of Tourism and

Foreign Commerce, Mercedes Araoz. Some also expected

the agreement to reflect improved environmental

standards. However, the BBC reported that the agreement

had been criticized for putting the Amazon rainforest at

risk and had not strengthened labor rights.

Sales of Peruvian wood products fall in China

Mauro Rios Torres, a forest expert in Peru, warned that

China¡¯s wood intermediaries were being increasingly

indecisive about buying more wood from Peru. There was

significant overstocking in the Asian market, since wood

products from China¡¯s markets were being redirected for

internal consumption instead of being sold to key

exporters, the US and EU. He said Chinese buyers were

not purchasing hardwoods or flooring from Pucallpa and

Puerto Maldonado producers, with as many as twenty

producers in these areas losing sales to China. Producers

from the regions were mainly shipping small volumes of

products to the Chinese market. Since last September,

wood prices had fallen, with China reducing its demand by

more than 50% for wood flooring. The US had stopped

importing sawnwood made from mahogany and Spanish

cedar, as well as other furniture and manufactured

products. The effects were particularly being felt in Lima

and Pucallpa.

U

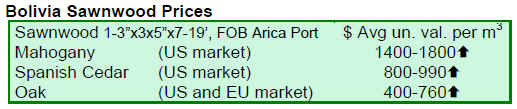

8. BOLIVIA

Forest products exports from Santa Cruz and La Paz

drop

Exports from Santa Cruz showed an approximate 15%

drop in exports from January to December 2008,

compared to the same period in 2007, falling in value from

USD63 million to USD53.4 million. Similar trends were

seen in La Paz, where forest products exports contracted

nearly 10% in value, from USD51.6 million to USD46.4

million, bucking a positive trend since 2002. The reasons

for the falling trends were political uncertainty in the

country, lack of adequate fuel distribution, the devaluation

of the dollar, and the financial crisis, particularly affecting

the US and parts of Europe.

Exports of wooden manufactured products were valued at

USD66.1 million in 2008, consisting mainly of three-ply

panels, doors, fiberboard, furniture and parts and chestnut

without shells. The remaining USD33.8 million of

Bolivian wood exports from the two regions were from

semi-processed products, including sawnwood, wooden

sticks, and poles. Exports of wooden products accounted

for 85% of total Bolivian exports, while non-wood

products made up about 15% of exports.

Caviuna, alemdrillo, oak, ipe and curupau were in the

highest demand in foreign markets, generating USD11.3,

USD9.3, USD7.8 and USD7 million, respectively. As with

the previous year, 61 species were represented in the wood

exports of Bolivia. The US, even in the financial crisis,

remained the main buyer of Bolivian wood products worth

USD29.8 million. China imported USD9.4 million,

Argentina USD6.9 million and the UK and France USD6

million each. A total of 53 countries purchased products

from Bolivia, three less than 2007.

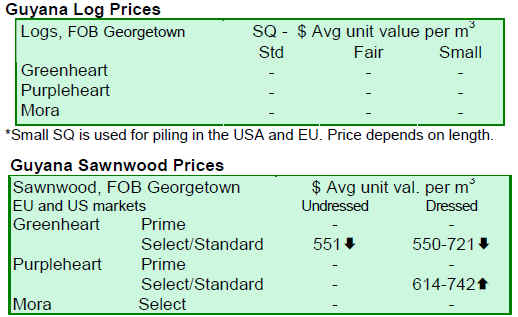

9.

Guyana

Early 2009 brings strong results for Guyana

Export market prices showed strong results at the start of

2009 with recorded increases in average prices for

sawnwood, roundwood, splitwood and plywood compared

to 2008 prices for same period. Improvements in average

prices were greatest for splitwood, with prices rising by

30%. This was closely followed by gains for sawnwood

and plywood, with increases in average prices reaching

29% and 28%, respectively. Other improvements were

recorded in average prices of roundwood, which showed a

13% rise compared to the same period of 2008.

In terms of destination, Guyana¡¯s forest products were

exported mainly to Latin American/Caribbean markets.

Favored products for these markets included sawnwood

roundwood, splitwood, plywood and other value added

products such as crabwood doors and spindles made from

greenheart, purpleheart, kabukalli and wamara. Other

markets for Guyana¡¯s forest products were in North

America, Asia Pacific and South America, with the latter

two¡¯s interests being only in shingles and plywood

respectively, while North American market interests were

in sawnwood, splitwood and wooden utensils and

ornaments.

In other news, no logs were exported for the first fortnight

of 2009, largely due to the new log export policy that took

effect on 1 January 2009, which imposes a higher export

commission on certain species of logs, and to a lesser

extent, to the early closure of operations by many

concessionaires as a consequence of rainy weather at the

end of 2008. In the corresponding period for 2008,

Guyana¡¯s log export volume total was 4,989 m³. On the

production side, reports from one large concessionaire also

indicate that 2009 promises to be more rewarding, with

hopes pinned on earlier starts in operations and plans

being made for greater efficiency in their production

processes.

Guyana unanimously passes new Forestry Bill passes with unanimous support

Guyana¡¯s Forest Bill 2007 (Bill No. 21 of 2007), which

seeks to consolidate and amend the law relating to forests,

was unanimously passed by Parliament on 22 January

2009, with strong support from both government and

opposition members of Parliament. The Forest Bill 2007

provides an important and timely piece of legislation

necessary to ensure that Guyana¡¯s forest sector continues

to contribute to the country¡¯s sustainable development.

The Bill was the product of a lengthy public consultation

with various stakeholder groups including Amerindian

NGOs, the Forest Products Association, Guyana

Manufacturing Association, civil society groups, and even

a number of international organizations. The Bill was

introduced in the National Assembly and read for the first

time on 2 August 2007. Following its first reading, the Bill

was committed by the National Assembly for

consideration by a Special Select Committee, with the

Committee meeting on fifteen (15) occasions during the

period 15 January 2008 to 13 January 2009. On 22 January

2009, members of Parliament supported and unanimously

accepted the passage of the Bill.

The Bill takes into account the important contribution and

role played by Guyana¡¯s forest resources in climate

change mitigation and the provision of environmental

services. It also seeks to update existing legislation under

which forests are managed with keen regard to

international best practices for sustainable forest

management and legality. The Forest Bill also recognizes

forests¡¯ vital role in poverty alleviation especially in

relation to forest dependent communities.

The Bill sets a regime for the sustainable management of

the state forests. The second part of the Bill provides for

the issuance of five types of state forest authorizations:

concessions, exploratory permits, use permits, community

forest management agreements and afforestation

agreements. This section also addresses compliance with

occupational health. The Bill prohibits acts that could

cause forest fires in State Forest areas and allows the GFC

to declare certain areas to be fire protection areas. The

Bill places emphasis on value added activities by

addressing issues of quality control through legally

binding codes of practice which can be subject to

amendments from time to time. Issues of under-pricing,

unlawful exportation of forest produce, trade of timber in

contravention to the GFC¡¯s guidelines, and procedures for

ownership of concession areas and change thereof, are also

outlined in the Bill.

This Bill will serve to significantly enhance the quality of

environmental management, the contribution of the forest

sector to Guyana, and the benefits derived for forest-based

communities and surrounding areas.

Growing interest in RIL and SFM stimulates demand for training

The Guyana Forestry Commission and the Forestry

Training Centre Incorporated (FTCI) planned a one-day

course in Georgetown on 31 January 2009 for decision

makers of forest enterprises and public agencies. Given the

high level of interest, another course will be held on 7

February 2009 with similar courses being planned for the

country¡¯s regions 2 and 6 in February 2009.

FTCI normally offers a three-day ¡®Decision Makers¡¯

Course¡¯ at its field centre, where senior staff of forest

enterprises, public agencies, environmental NGOs and

communities have a chance to observe a model logging

operation, review RIL practices, and discuss the skills sets

required for a well planned logging operation. A quick

look at the profile of persons registering for the course

reveal interest by senior staff of GFC, chairpersons of

communities, senior staff of forest enterprises and

environmental NGOs and lecturers in forestry.

The course will include a review of emerging

developments in the forestry sector, the legislative

framework for forestry practices, forest management

planning, RIL concepts and practices, occupational health

and safety, considerations on the use of machines and

forest roads, management of timber quality and

management of costs.

uyana

|