Japan Wood Products

Prices

Dollar Exchange Rates of 30th

Oct. 2006

Japan Yen 117.47

Reports From Japan

Japan log intake snapped declining import trend

Import of tropical logs by Japan surged 27% to 130,938 m3 in July. However, total Japanese

imports of tropical logs amounted to 721,377 m3 in the year to July, 16% below last

year’s import volume (see chart). Japan’s total supply of Southeast logs fell 16.5%

to 742,900 m3 up to

July while inventories declined 17.3% to 278,800 m3, equivalent to 2.7 month supply.

Accumulated log imports in 2006 have come from Malaysia (75%, two-thirds of which from

Sarawak), PNG (15%), Salomon Isl (9%) and Africa (1%).

July-arrivals of Southeast Asian logs in Japan had not been cleared through the customs

by mid-October due to delays in weighing operations in Tokyo Port. The office was short of

workers. In Sarawak, logging operations were facilitated by increased river volume due to

rains in

September. In contrast, logging operations were affected by the rains in Sabah.

Log prices stay firm amid some market resistance

Log prices in Japan continued to firm due to high FOB prices and a weakening yen.

However, plywood manufacturers were resisting higher log prices because price increases of

tropical plywood were slowing down and imports of these products were recovering, reducing

speculative movements in the market.

China becomes Japan’s second largest lumber supplier

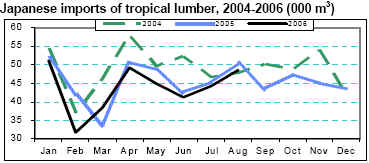

Japan’s imports of Southeast lumber amounted to 46,600 m3 in August (see chart).

Accumulate lumber imports through August fell 4.6% to 347,400 m3, compared with the same

period last year. Imports from Malaysia surged 4.7% to 132,950 m3 while those from

Indonesia plunged

29% to 87,100 m3. Imports from China rose 8.3% to 107,500 m3, surpassing those from

Indonesia and making China the second largest lumber supplier to Japan.

Japan enforces legal documents on timber imports

The presentation of “legality documents”, proving that the origin of timber for

lumber and construction material used in public construction work is legal, came into

effect on 1 October in Japan. Export permits from PNG and Malaysia (Sabah and Sarawak),

Japan’s main log and lumber suppliers, would be recognized in Japan as documents

proving timber legality, according to the Tokyo Chapter of the Japan Southeast Lumber

Conference. Japan was also studying legality requirement for Brazilian timber products

such as ipe for exterior use.

Concerning imports from China, which have rapidly grown in recent years, some said that

proving legality of timber products was rather difficult. This was due to the fact that

Russian oak, ash and other species were used for flooring, plywood and lumber products and

tracing the

origin of the logs used by each Chinese manufacturer would be very complicated.

Increased imports drive plywood supply up in Japan

Total volume of plywood supply rose to 714,000 m3 in August, up 5.5% from July, helped by

a rise in plywood imports. Domestic plywood supply fell 11.7% to 255,213 m3 while imports

rose 18.2% to 459,496 m3. By import source, 220,000 m3 came from Malaysia (up 4.1%) and

167,000 m3 from Indonesia, which exceeded the 160,000 m3 level for the first time in over

a year. Plywood imports recovered in August due to greater diversion of logs for plywood

production in Southeast Asia lured by attractive prices in Japan. However, plywood supply

from Southeast Asia was expected to decline in September-October due to Ramadan and

associated festivities.

In spite of the larger supply, Japanese prices for structural, concrete forming and thick

plywood remained bullish due to a sizeable backlog of unfilled orders. Prices for medium

and thin panels were stabilizing as inquiries were getting back to normal.

New housing starts regain upward trend

Total housing starts resumed their upward trend, rebounding 4.3% to 106,649 units in

August, up 1.8% from a year ago (see chart). The growth was supported by gains in

built-for-sale and owner-occupied houses.

Wood-based units accounted for 45% of the total housing starts, down from 46% last month.

However, wood structured houses increased for the eleventh consecutive month compared with

one year earlier. Seasonally adjusted annual starts reached 1.296 million units, the

fourth consecutive month over the 1.2 million level. In Jan-Aug 2006, total housing starts

were 4.1% above the pace in 2005.

FA releases forecast of timber supply and demand

Japan’s Forestry Agency (FA) released its forecast of timber supply and demand for

the second half of 2006 and first quarter of 2007. According to the FA, the recovery of

new housing starts in the second half of 2006 would drive demand for wood products and

building materials up. However, imports of tropical logs and lumber from Southeast Asia

are projected to decline due to continuing shortages in major production regions. Plywood

imports in 2006 are expected to exceed those in 2005, but will still be lower than in

2004.

“Eco-value Wood” to compete with tropical boards

Sekisui Chemical’s Environment and Life Company will start making new wood materials

with waste wood and thinning. The ‘Eco-value Wood’ involves basically the same

manufacturing method as wood chip based board. The production technique allows arranging

variable shaped wood chips into one direction and heating time can be ten times faster

than normal press. By changing pressure, strength and hardness can be adjusted for the use

of the material. The maximum board size would be 150 mm thick, 720 mm wide and 4,300 mm

long.

The hardest and strongest board materials can be used for truck flooring, flooring and

interior decorative wall. According to Sekisui, the material is about 1.5 times as hard

and as strong as keruing, the hardest Southeast Asian

species used for truck floor. The board is expected to compete with Southeast Asian board

products at a target price of 150,000 yen per m3 (around $1,270 per m3). Sekisui will

construct a plant in Ohta, Gunma prefecture, with a total investment of one billion yen.

It expects to have a monthly production of about 1,500 m3 and reach sales of about five

billion yen a year by 2010.

|