|

Rebuilding Summit showcases uses of timber

A Gulf Coast Rebuilding Summit to showcase the use of wood products and systems for rebuilding coastal areas hit by Katrina and Rita Hurricanes will be held on 3-4 August in New Orleans. The Summit is organized by the Southern Forest Products Association

(SFPA) and Engineered Wood Association (APA), sponsored by the Wood Products Council. The meeting will cover

rebuilding issues from policy and regulatory perspectives and discussions on market opportunities and threats,promotional needs and opportunities for cooperation. A summary action plan will be elaborated at the end of the Summit.

US new housing sector continues to cool down

Total housing starts dropped 5.3% in June to a seasonally adjusted annual rate of 1.85 million units, according to the US Commerce Department. This was 11% below the pace of a year ago. The decline was due to a reduction in single-family sector, which accounts for over 80% of the houses built. The National Association of Home Builders¡¯ (NAHB) surveys of single-family builders have been showing a steady decline in confidence since the middle of last year, with builders acting accordingly.

According to NAHB, the June decline clearly showed that the housing downswing was still underway. Builders were reporting not only systematic declines in home sales, but also increases in sales cancellations and inventories, due to eroding affordability conditions as well as a withdrawal of investors/speculators from the market.

IWPA launches Task Force on lesser known species

The International Wood Products Association (IWPA) has launched a Lesser Known Species (LKS) Task Force to coordinate a process to identify and promote marketable LKS in the USA. The task force began work in May on developing the framework to begin the project. IWPA has sent questionnaires to its members in the USA and nearly 40 overseas producer associations

soliciting viable LKS candidates.

US plywood imports ¨C Part III

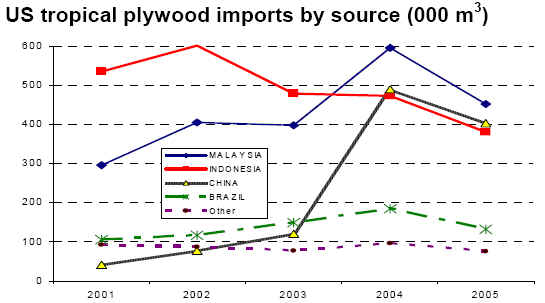

This is the third and final part of an analysis of US plywood imports, focusing on source countries. The USA imported 5.33 million m3 of plywood ($1.79 billion), of which 1.45 million m3 ($519.57 million) was tropical plywood. The four most important suppliers of tropical plywood to the USA are Malaysia, Indonesia, China and Brazil, accounting together for 95% of the import volume and 93% of the value. With the exception of Indonesia, all have consolidated their dominating position since 2001.

Malaysia is the largest supplier in volume terms

Malaysia is the leading volume supplier of tropical plywood to the USA with 453,359 m3 as of 2005 (31% of total US tropical plywood imports), up 53% from 2001. Malaysian tropical plywood is relatively inexpensive on average ($320 per m3 in 2005 compared to an average $360 per m3). Therefore, Malaysia ($145.29 million) was second after Indonesia ($158.63 million) in import value terms. Malaysian meranti plywood exports to the USA are very small and declining. Last year¡¯s shipments

amounted to only 1,738 m3 down from 3,152 m3 in 2001. US tropical plywood imports by source (000 m3)

Indonesia is the largest supplier in value terms

Prior to 2003, Indonesia was the largest supplier of tropical plywood to the USA, both in terms of value and volume. In 2005, Indonesia ranked third, after Malaysia and China, with 380,616 m3 (26.3% of the US tropical plywood market), down 29% from the 2001. With an average of $416 per m3, Indonesian tropical plywood is relatively expensive. Indonesia prices rose at an above average rate of 40% between 2001 and 2005. Thus,Indonesia remained the US largest supplier of tropical

plywood in value terms ($158.47 million). However, the value of Indonesian plywood shipments to the USA has been declining in 2006.

In earlier years, Indonesia was an important source of meranti et.al. plywood to the USA. In 2001, it held a market share of 44% of all US meranti et.al plywood imports. In 2005, Indonesia¡¯s share plunged to only 4% due to growing dominance by China.

China edged Indonesia as second largest ply supplier

China was US second largest supplier of tropical plywood in volume terms in 2005 (404,141 m3), after Malaysia and the third (after Malaysia and Indonesia) in value terms ($127.48 million). The average price of Chinese tropical plywood of $315.4 per m3 is below the overall average. Chinese shipments of tropical plywood to the USA grew 653.8% in volume and 1,000% in value

from 2001, well above the overall growth of US tropical plywood imports of 34.8% in volume and 70% in value. As a result, China¡¯s share increased from 4% in 2001 to over one-quarter in 2005.

China is the USA¡¯s most important supplier of merantiet.al plywood with 29,782 m3 (market share of 62%).However, its average price of $288 per m3 is below the overall average price of $311.8 per m3.

Nevertheless, Chinese meranti et.al exports of $6.94 million in 2005 accounted for a value-share of 41.3%. The volume and value of Chinese meranti et.al plywood shipments to the USA climbed by 7,800% and 3,818%, respectively, between 2001 and 2005, well above the overall increase of 136% and 228%. China is also an important supplier of mahogany plywood to the USA, ranking third after

Canada and Brazil. China¡¯s share of just above 10% in 2005 continues to grow in 2006.

Brazil is the USA¡¯s fourth largest supplier of tropical plywood. Its volume and value share is slightly below 10% and virtually unchanged since 2001. The export volume was 131,260 m3, valued at $50.58 million in 2005. Brazilian tropical plywood for the US market is priced at $385.4 per m3, above the overall average but below the $416 per m3 for Indonesian plywood. In spite of CITES and Brazil¡¯s export restraints, Brazil remains the most important supplier of mahogany plywood to the USA, with a volume of 5,711 m3 in 2005 (53.4% as all mahogany plywood imports). However, Brazilian mahogany plywood import value is only $2.19 million or only 39.5% value-share, due to below average prices. Canada exports higher added-value mahogany plywood with an export value of $2.48 million in 2005.¡¡ Other suppliers of tropical plywood to the USA include Canada, the Philippines, Ecuador, Taiwan

and Guatemala. However, the share of each of these on total US imports of tropical plywood is less than 2%.

|