US Dollar Exchange Rates of

10th

December

2025

China Yuan 7.06

Report from China

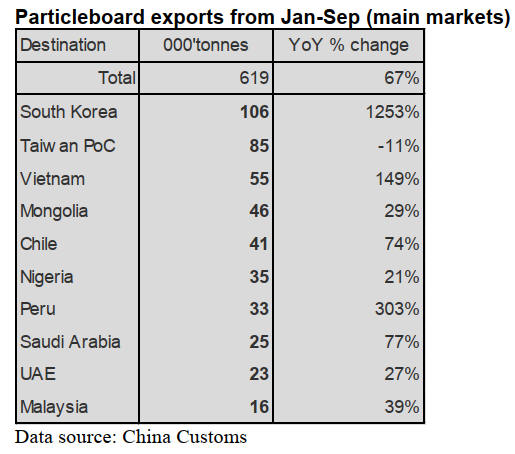

Significant growth in particleboard exports

According to China Customs, from January to September

2025 China’s particleboard exports totalled 619,000

tonnes valued at US$267 million, up 67% in volume and

28% in value over the same period of 2024.Only exports

to Taiwan P.o.C fell while other top destinations posted

increase.

South Korea became the largest destination for

particleboard exports with volumes surging to 106,000

tonnes from January to September 2025. Particleboard

exports to Vietnam and Peru surged 149% and 303%

respectively from January to September 2025.

China has exported particleboard to Asia, Africa and Latin

America markets aided by the development of the Belt and

Road initiative. The demand for lower cost particleboard

in Asia, Africa and Latin America has increased which

drove China's export of particleboard to these countries in

recent years.

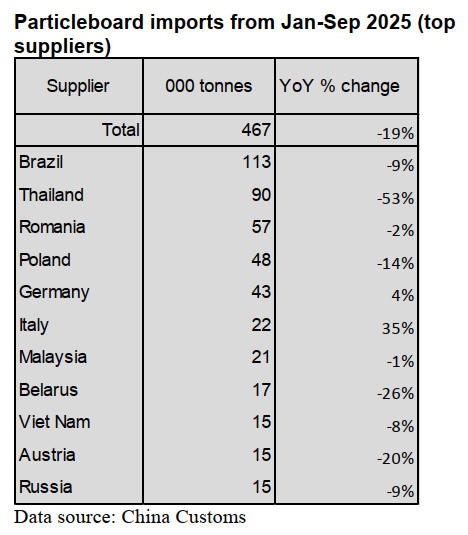

Decline in particleboard imports

According to China Customs, from January to September

2025 particleboard imports totalled 467,000 tonnes valued

at US$224 million, down 19% in volume and 12% in

value over the same period of 2024.

Brazil was the largest supplier of China’s particleboard

imports from January to September 2025.

China’s particleboard imports from Brazil rose 9% to

113,000 tonnes, accounting for 24% of the national total

for the period. In addition, China’s particleboard imports

from Germany and Italy grew 4% and 35% respectively

from January to September 2025.

It has been reported that China-Europe freight train route

has become a strong bond for China-Europe trade

cooperation. Germany and Italy are the beneficiaries in

particleboard trade by the China-Europe Railway Express

opening.

In contrast, China’s particleboard imports from Thailand,

Poland, Belarus and Austria have decreased 53%, 14%,

26% and 20% respectively significantly from January to

September 2025.

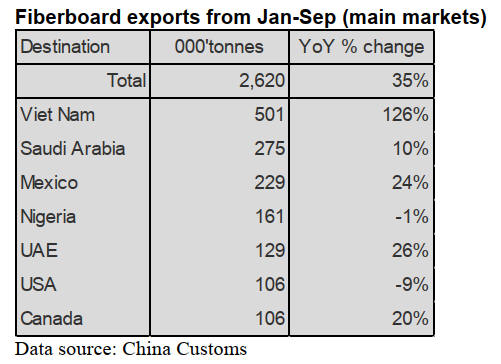

Surge in fibreboard exports to Vietnam

China’s fibreboard exports to Vietnam, the largest

destination, surged over 120% to 501,000 tonnes from

January to September 2025. China’s fibreboard exports to

Saudi Arabia, Mexico, UAE and Canada rose 10%, 24%,

26% and 20% respectively from January to September

2025. In contrast, China’s fibreboard exports to Nigeria

and USA fell 1% and 9% respectively from January to

September 2025

China’s fibreboard exports to the vast majority of the top 7

markets rose at different rates resulting in an increase in

the total national fiberboard exports.

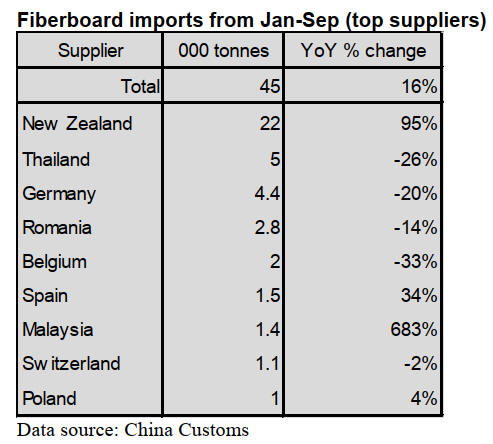

Rise in fiberboard imports

From January to September 2025 China’s fibreboard

imports were 45,000 tonnes valued at US$33 million, up

16% in volume but down 4% in value over the same

period of 2024.

New Zealand was the largest supplier of fibreboard

imports from January to September 2025. China’s

fibreboard imports from New Zealand rose 95% to 22,000

tonnes over the same period of 2024.

It is worth noting that China’s fibreboard imports from

Malaysia surged over 680%, from Spain and Poland they

grew 34% and 4% respectively from January to September

2025.

In contrast, China’s fiberboard imports from Thailand,

Germany, Romania, Belgium and Switzerland fell 26%,

20%, 14%, 33% and 2% respectively over the same period

of 2024.

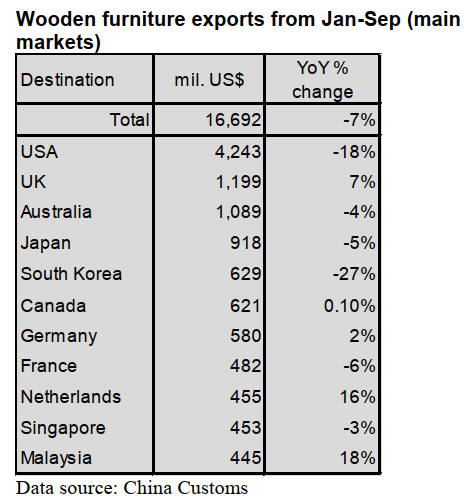

Decline in wooden furniture exports

According to Customs data, from January to September

2025 wooden furniture exports fell 7% to US$16.69

billion over the same period of 2024.

The US was the largest market for China’s wooden

furniture exports. 25% of China’s wooden furniture was

exported to US from January to September 2025, down

18% over the same period of 2024.

Due to the impact of the tariffs in the US the total export

value of China’s wooden furniture and the value of

wooden furniture exported to the US fell significantly

from January to September 2025. China’s wooden

furniture is exported to more than 200 countries and

furniture destination are scattered. The value of China’s

wooden furniture exports to the top 3 countries, theUS,

UK and Australia at more than US$1 billion accounted for

less than 40% of the national total in the first three

quarters of 2025.

China’s wooden furniture exports to Australia, Japan,

South Korea, France and Singapore dropped 4%, 5%,

27%, 6% and 3% respectively from January to September

2025. In contrast, China’s wooden furniture exports to

UK, Canada, Germany, Netherlands and Malaysia grew

7%, 0.1%, 2%, 16% and 18% from January to September

2025.

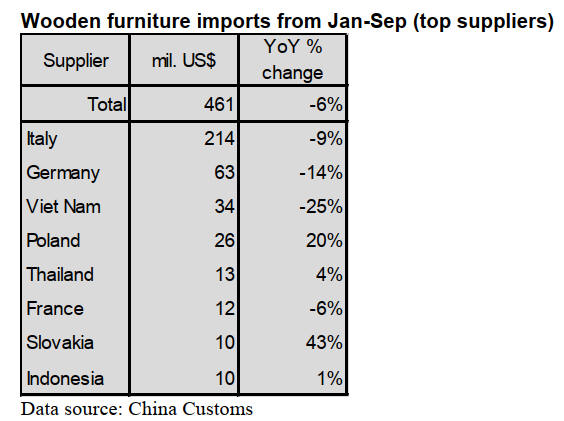

Decline in wooden furniture imports

According to China Customs, from January to September

2025 China’s wooden furniture imports dropped 6% to

US$461 million over the same period of 2024.

Italy was the largest suppliers for China’s wooden

furniture imports. 46% of China’s wooden furniture were

imported from Italy but compard to a year earlier they fell

9% to US$214 million from January to September 2025.

This was the main reason for the decline in China’s

wooden furniture imports in the first three quarters of

2025.

In addition to being affected by the tariffs in the US the

total import value of China’s wooden furniture imports

and the value of wooden furniture imported from the top

suppliers significantly declined.

The main reason for the large decline was that domestic

demand for furniture has fallen sharply.

China’s wooden furniture imports from Germany, Viet

Nam and France fell 14%, 25% and 6% respectively from

January to September 2025. In contrast, China’s wooden

furniture imports from Poland, Thailand, Slovakia and

Indonesia grew 20%, 4%, 43% and 1% respectively from

January to September 2025.

|