Japan

Wood Products Prices

Dollar Exchange Rates of 10th

December

2025

Japan Yen 155.58

Reports From Japan

Press release - “Comprehensive Economic

Measures

to Build a Strong Japanese Economy”

This includes a statement of intent on harnessing regional

growth potential and stabilising everyday life which will

be achieved through support for and the revitalisation of

key industries that sustain local living environments,

including medical and nursing care, local transportation

and logistics, retail and services and tourism.

Support will be provided to mid-sized enterprises for

fostering industrial clusters to create world-leading

technologies and businesses originating in local regions.

The government will work to realise a community-based,

inclusive society by strengthening support systems for

people facing economic hardship and enhance safety and

security measures.

In addition, the government will reinforce responses to

issues related to foreign nationals in Japan and pursue

the revitalisation of public education and measures to

advance toward making education effectively free.

A further aim is creating an environment that enables

wage increases, particularly for small- and medium-sized

enterprises and micro-businesses.

To achieve this the press release says the government will

expand provision of the Priority Support Local Allocation

Grant and create an environment that enables wage

increases at companies, including SMEs and small-scale

businesses, that are unable to make use of the tax

incentives that have been introduced to promote wage

hikes.

The government will also ensure thorough price pass-

through and fair business practices and will intensify

support for capital investment aimed at enhancing the

earning power of mid-sized and small and medium sized

enterprises and bolster our support to facilitate business

succession and mergers and acquisitions while also

strengthening hands-on, ongoing support structures.

The government is aware local governments are now

implementing measures to address rising prices in a

manner in line with local needs. To support these

measures the government will expand provision of the

Priority Support Local Allocation Grant. While

maintaining existing initiatives supporting households and

business operators, the government will also

advance additional measures to address the sharp rise in

food prices.

To reduce the burden imposed by energy costs and related

expenses the government will provide assistance to

reduce electricity and natural gas bills during the winter

months having the most severe cold (for usage between

January and March).

For the full statement see:

https://japan.kantei.go.jp/ongoingtopics/sogokeizaitaisaku2025/i

ndex.html

Hint of a rate increase from Bank of Japan

Bank of Japan (BoJ) Govenor, Kazuo Ueda, delivered

hawkish remarks early this month saying “the Bank of

Japan sees the probability that the baseline outlook for the

economy and prices will be realised” which has been

widely interpreted as a rate hike signal. Despite wanting to

normalise interest rates the BoJ has been holding off since

rates rose to 0.5% in January.

At its upcoming Policy Board meeting later this month a

rate increase is anticipated and the longer term policy may

include as many as four rate increases by 2027 according

to Hideo Hayakawa a former executive director of the

Bank of Japan. If the rate increase is implemented

it would be the first since January 2025 and will lead to a

level (anticipated to be 0.75%) not seen since 1995.

With the Bank set to debate raising its policy rate to 0.75%

later this month Prime Minister Sanae Takaichi's

government is showing little opposition to an increase in

borrowing costs.

See:https://www.japantimes.co.jp/business/2025/12/11/economy/

boj-ex-director-multiple-rate-hike-projection/

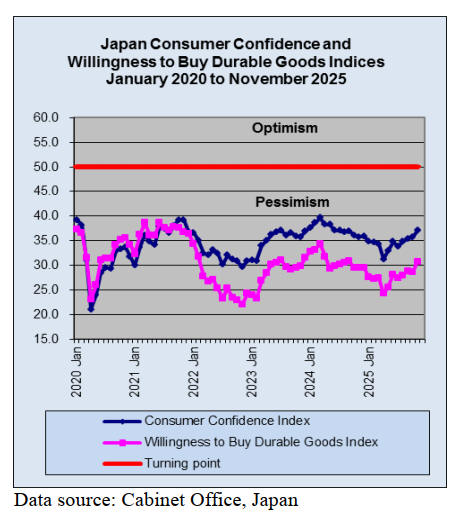

Gradual recovery in household spending

In December 2025 prospects for Japan's household

spending point to a continued gradual recovery supported

by declining inflation and improving income conditions.

However, consumer caution remains a limiting factor with

a sharp recent contraction highlighting underlying

fragility.

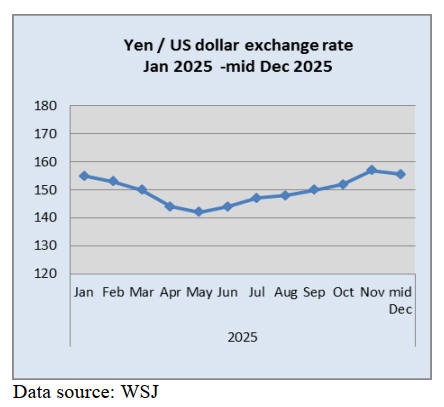

Yen/US dollar exchange rate influenced by

interest rate

differentials

As interest rates rise there could an increase in prices.

With the yen per dollar remaining in the 154-158 range

import prices stay high stimulating overall price rises.

However, the Bank of Japan anticipates a certain brake on

the weakening yen if the interest rate gap between the US

and Japan narrows. The Japanese yen/US dollar exchange

rate is influenced by interest rate differentials between

the US Federal Reserve (Fed) and the Bank of

Japan (BoJ). With the BoJ signalling steady rate increases

against a dovish Fed factors such as US payrolls, BoJ

policy shifts and global risk sentiment (yen as safe haven)

will be key drivers of exchange rate movements in the

coming months.

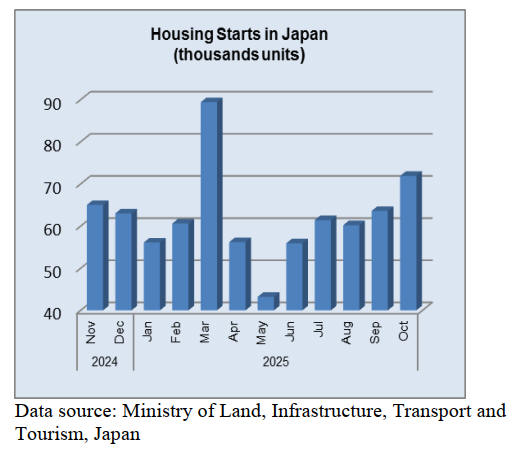

Growing interest in quality pre-owned properties

Japan's long-term housing starts have been declining due

to population decline and are projected to fall from

around 800,000 units in the early 2020s to 600,000-

700,000 by the 2030s-2040s with 2025 projections around

785,000, supported by stable interest rates but challenged

by high vacancy rates and shifts towards existing homes.

Key issues are the shrinking working-age population,

increasing vacant homes and a growing preference for

quality pre-owned properties, alongside government

pushes for energy-efficient Net Zero Energy Houses

(ZEH).

A ZEH dwelling is one that that contributes to realisation

of carbon neutrality by introducing renewable energy such

as photovoltaics thereby to make the annual energy

income and outgo to zero after achieving energy efficiency

through improved thermal insulation performance.

20% of materials from World Expo to be re-used

The Japan Association for the 2025 World Exposition

aims to reuse over 20% of the total materials in the

pavilion structures. While non-reusable items, including

exhibits, will become waste, which will be recycled.

Timber from the external walls of the Japan Pavilion will

be reused by municipal governments and educational

facilities.

See: https://japannews.yomiuri.co.jp/editorial/political-

pulse/20251206-296710/

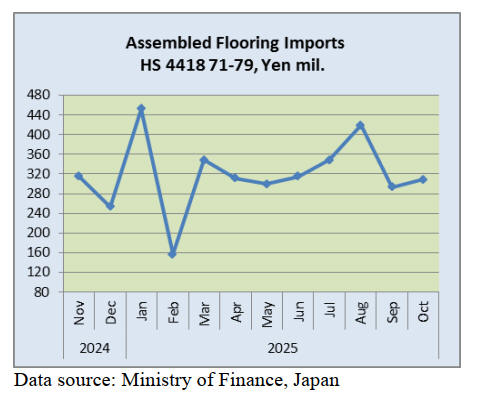

Import update

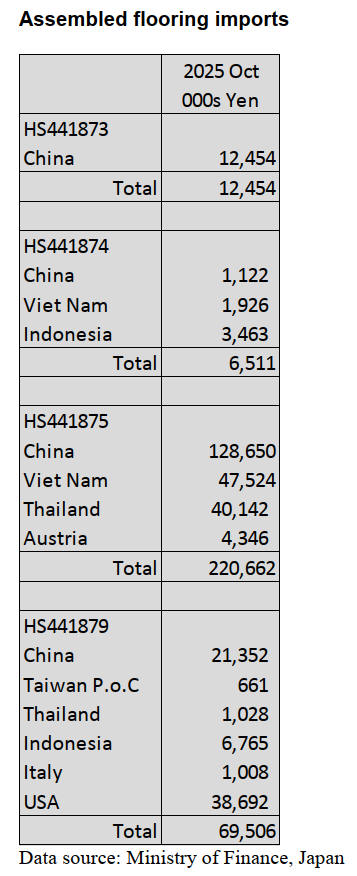

Assembled wooden flooring imports

The 3 months of steady increases in the value of imports

of assembled wooden flooring (HS441871-79) ended in

September but the value of imports reversed again rising

in October. Year on year the value of October 2025

imports was at around the same level as in October 2024

and month on month there was a modest 5% increase in

October.

Of the various categories of assembled flooring imports in

October 72% was of HS 4418-75 with China and Vietnam

being the top shippers. For the other categories HS4418-79

accounted for 22% in October (13% in September)

followed by HS4418-73 4% (11% in September) and

HS4418-74 2% (5% in September).

For HS4418-73 imports all originated in China. Shippers

in China and Indonesia were the main shippers of

HS4418-79 arrivals in October with the others suppliers

being Viet Nam, Thailand and Austria.

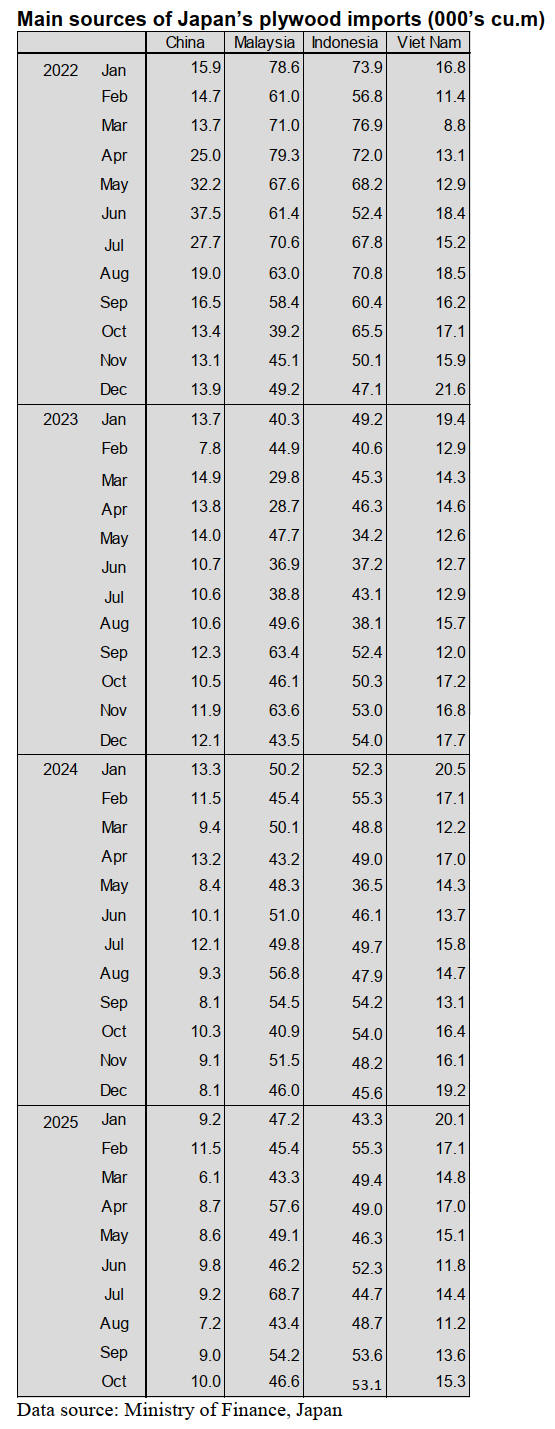

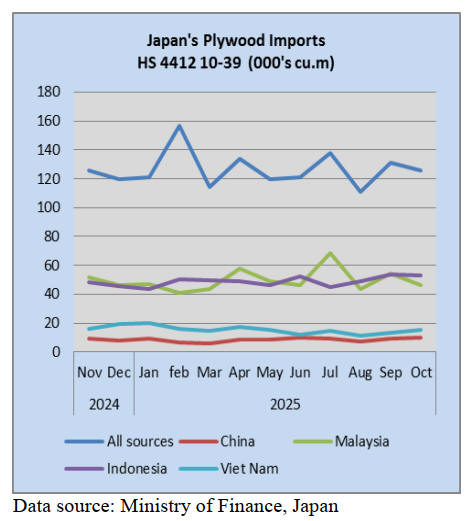

Indonesia and Malaysia were the top suppliers of plywood

to Japan in October and the combined volume of

shipments accounted for 79% of Japan’s plywood imports,

the other top shipper being Viet Nam and China.

October 2025 plywood arrivals were slightly down

compared to the volume of September with Shippers in

Malaysia posting the largest deline.

In October 2025 arrivals of HS441210-39 were reported at

215.755 (131,017 cu.m in September). As in previous

months of the various categories of plywood imported in

October 2025 HS441231 accounted for most followed by

HS441233 and HS441234 with the balance being

HS441239.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR. For the JLR report

please see: https://jfpj.jp/japan_lumber_reports/

Orders for house builders

In October 2025, the order amounts of major housing

manufacturers and builders varied widely. Despite

achieving year-on-year gains, housing firms have yet to

feel a clear recovery in the market. October 2024 was

marked by order amounts that stood out for surpassing or

nearing 100% compared with the same month a year

earlier.

Relative to that time, October 2025 is expected to see few

firms achieving substantial growth in the number of units

ordered, though the average sales price per unit has

increased. Higher sales prices contributed to October 2025

figures surpassing the level of the previous year’s month.

For certain housing firms, performance fluctuates from

month to month, preventing a steady flow of orders.

According to some housing firms, October’s performance

faltered as a rebound effect from the relatively favorable

results in September. In November, certain housing firms,

in contrast, were able to sustain a stable order flow.

Although custom housing orders have been hard to obtain,

certain firms have expanded sales of subdivision homes.

In the case of subdivision housing, higher sales prices

were one background factor, yet regional strategies and

unique product development also played a role in driving

performance.

Cedar KD foundation lumber hits market

Xyence Corporation will begin full-scale sales of

domestically sourced preservative-treated cedar KD

foundation materials to meet low-cost demand.

Traditionally, domestic demand has been met with

Japanese cypress, while low-cost needs have been

addressed with U.S. hemlock. However, both are currently

being overshadowed by untreated cypress foundation

materials, which offer stronger price competitiveness. By

Promoting cedar KD preservative-treated foundation

materials made from domestic timber as the most

affordable option, Xyence aims to stimulate growth in the

preservative-treated foundation market.

This foundation is manufactured by deeply impregnating

incised cedar KD lumber with the oil-based preservative

“Sunpreser OP Ace.” The product has obtained AQ2

certification (equivalent to JAS K3) from the Japan

Housing and Wood Technology Center.

The embedding strength is 6.0 N/mm≤, which is

comparable to that of American hemlock. The company is

also promoting the expansion of preservation treatment

demand for components other than the foundations such as

columns, studs, window frames, panels, and secondary

members—particularly around the first-floor structure.

Last year, all manufacturing sites obtained AQ2

certification for laminated cedar posts

Adapting to larger non-residential wooden projects

West Forest Products has added new 150 mm and 180 mm

widths to its lineup of high-strength Douglas fir lamina for

the Japanese market. Amid the increase in large non-

residential wooden construction projects, the company

responded to the demand for wider lamina.

Two years ago, the company began supplying high-

strength Douglas fir lamina, anticipating that the increase

in medium-and large-scale wooden construction would

require stronger laminated timber. The company handles

lamina for lintels in widths of 105 mm and 120 mm,

selling them to domestic laminated timber manufacturers.

Although the company initially conducted trial sales, it

now operates under quarterly contracts, with monthly sales

volumes reaching the level of 1,700 to 1,800 cbms. As

projects grew larger in scale, laminated timber

manufacturers had been voicing demand for lamina wider

than 120 mm.

Until now, laminated timber manufacturers had been

cutting 2x8 and 2x10 lamina to meet demand, but this led

to rising production costs and poorer yield.

With the addition of these new variations, further

expansion in the use of high-strength lamina is expected.

Plywood

Domestic softwood structural plywood shipments have

remained steady since September, though market prices

continue to move weakly.

Domestic softwood structural plywood (12 mm, 3◊6) is

quoted at •1,080–1,100/sheet (wholesaler delivery) in the

Tokyo area, reflecting broader downside. Major producers,

however, seek to lift prices to •1,200/sheet

(ť60,000/cu.m) for margin recovery and will continue

pressing for hikes in December.

Imported South Sea plywood, including 12 mm Malaysian

products and ordinary Indonesian plywood, is generally

firm in domestic prices. Painted formwork plywood (12

mm thick, 3◊6 size) is priced at •1,800– 1,900 per sheet

(delivered to wholesalers), with some variation among

manufacturers.

In November, prices were observed to be •20–30 higher

than the previous month. Formwork plywood is quoted at

around •1,550/sheet (wholesaler delivery), with structural

plywood at similar levels. Indonesian ordinary plywood is

firm at approximately •780 (2.5 mm), •930 (4 mm), and

•1,100 (5.5 mm), all showing a strengthening tone.

Origin prices, especially for Indonesian ordinary plywood,

have strengthened, reflecting higher log costs and related

factors. Prices are quoted at about USD 970/cu.m (C&F)

for 2.4 mm, USD 880 for 3.7 mm, and USD 850 for 5.2

mm, all in 3◊6 size. Malaysian plywood prices remain

steady: painted formwork (12 mm, 3◊6) at USD 600–

610/cu.m (C&F), formwork at USD 500–510, and

structural at USD 510–520, flat from the prior month.

Domestic lumber and logs

The market for domestic wood products has stayed flat,

reflecting the continued high cost of logs. During October

and November, with large precut plants at the center of

activity, sawmills serving direct demand have continued to

operate at full stretch.

Cedar studs are seeing stronger demand, with procurement

costs for competing whitewood studs rising.

Prices for 3-meter ◊ 105-millimeter premium KD cedar

lumber are steady at •62,000–65,000 per cbm, market

basis. Hinoki foundation timber, KD special grade, 4

meters ◊ 105 mm square, has been hovering around

•75,000 per cbm.

Cedar log prices, rising in eastern Japan, remain buoyant

in Tohoku but have leveled off in northern Kanto. With

product markets depressed, hinoki logs of standard

dimensions have kept falling in northern Kanto and

Kyushu and weakened further in the Chugoku region.

Cedar medium-diameter logs in Akita are priced at

•16,500–17,000/cu.m, •1,000 higher than last month.

In Tochigi, post-sized logs are •16,500/cu.m (market

delivered), •500 lower than last month. In Kyushu, post-

sized logs stay at •16,000/cu.m, with medium-diameter

logs flat at •14,500/cu.m. Hinoki foundation logs in

Tochigi are priced at •19,000/cu.m, •3,000–4,000 lower

than before. In Kyushu, foundation logs stand at

•21,500/cu.m and post-sized logs at •20,500/cu.m, each

down •1,000. In Chugoku, post-sized logs are steady at

•24,500/cu.m, while foundation logs eased to

•23,500/cu.m, •500 lower.

Output varies by region, some showing increases, others

not—but unlike last year, no log shortages have been

reported so far.

|