US Dollar Exchange Rates of

10th

November

2025

China Yuan 7.12

Report from China

Retail sales of consumer goods

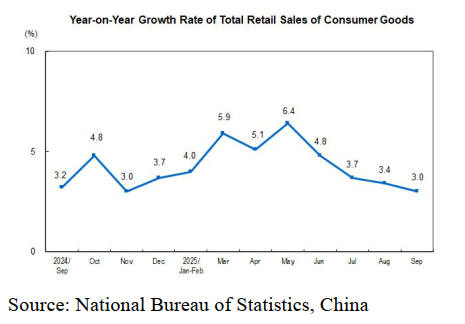

In a press release the National Bureau of Statistics

reported total retail sales of consumer goods in September

2025 rose by 3.0% year on year. Specifically, retail sales

of consumer goods excluding automobiles rose 3.2%.

Between January and September total retail sales of

consumer goods rose by 4.5%. In the same period China’s

online retail sales were up by 9.8% year on year.

It was reported that furniture sales in September rose

21.5% and sale of builders’ material and interior trim rose

just 1.6%

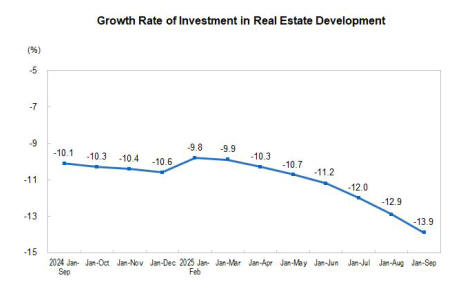

In another press release the National Bureau of Statistics

says in the first nine months of 2025 investment in real

estate development fell almost 14% year on year, of which

investment in residential buildings was down 12.9%.

Sales of newly built commercial buildings

Similarly, the floor space of newly built commercial

buildings in the first nine months of 2025 was down 5.5%

year on year and sales of newly built commercial buildings

were down 7.9%.

See:

https://www.stats.gov.cn/english/PressRelease/202510/t2025102

2_1961654.html

Decline in log imports

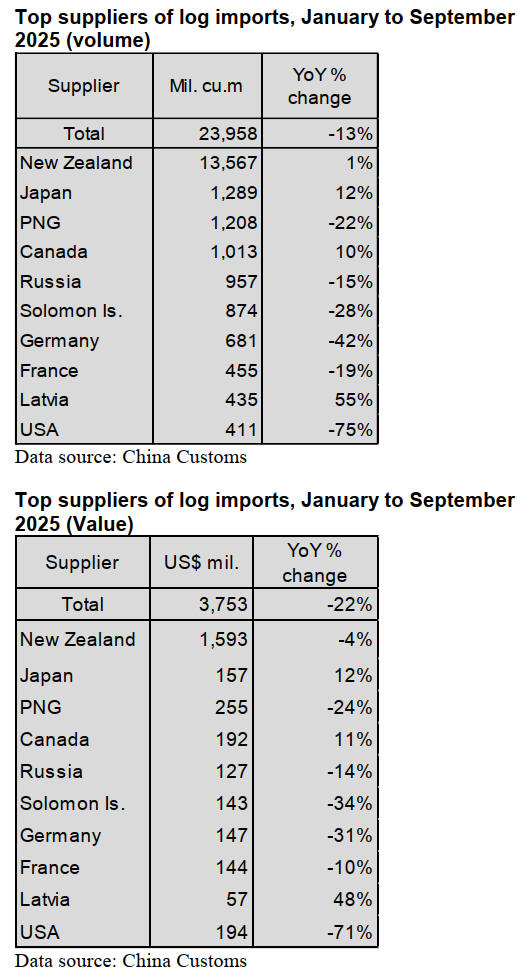

According to China Customs, from January to September

China’s log imports dropped 13% to 23.96 million cubic

metres valued at US$3.753 billion, down 22% over the

same period of 2024.

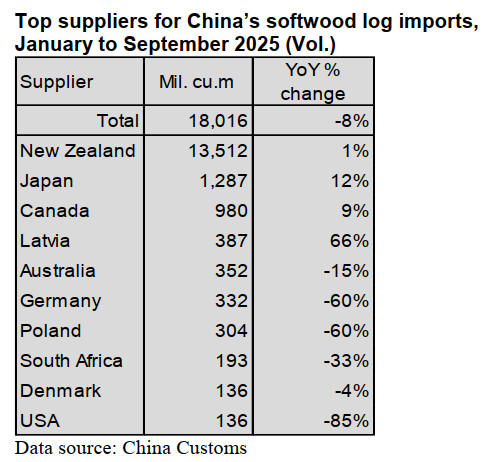

Of the total, China’s softwood log imports amounted to

18.02 million cubic metres, down 8%. Hardwood log

imports came to 5.94 million cubic metres, dropping 25%

over the same period of 2024.

New Zealand was the largest supplier of logs and. China’s

imports from New Zealand rose 1% to 13.567 million

cubic metres between January to September 2025,

accounting for 57% of the national total.

China’s log imports from Japan grew 12% to 1.289

million cubic metres, in addition, imports from Canada

and Latvia rose 10% and 55% respectively between

January and September 2025. In contrast, China’s log

imports from the US fell 75%. Log imports from PNG,

Russia, Solomon Isands, Germany and France declined

(see table).

Due to quarantine issues with logs from the US, on 4

March 2025 the General Administration of China Customs

issued an announcement stating that it would immediately

suspend the import of wood from the United States. This

not only had a profound impact on the wood trade pattern

between China and the United States but also brought an

extremely obvious shock to the domestic wood industry in

the US.

It has been reported that many sawmills in the southern

United States have had to reduce production due to

changes in demand, uncertainties in trade policies and

various regulatory barriers.

See:

https://www.chinatimber.org/index.php/price/detail.html?id=857

30

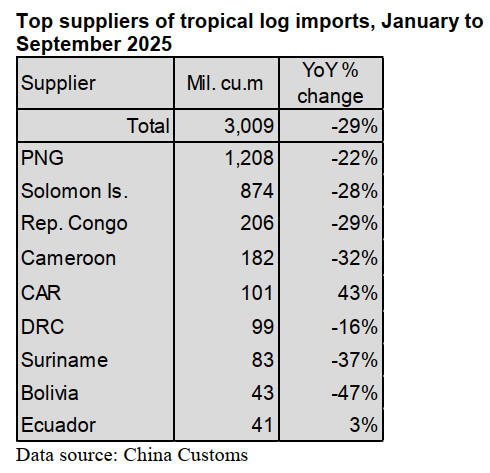

Further decline in tropical log imports

China’s tropical log imports fell 29% to 3.009 million

cubic metres valued at US$743 million from January to

September 2025.

Tropical log imports from PNG, the largest supplier, fell

22% to 1,208 million cubic metres over the same period.

In the meantime, China’s tropical log imports from

Solomon Is, the Republic of Congo, Cameroon, DRC,

Suriname and Bolivia dropped 28%, 29%, 32%, 16%,

37% and 47% respectively year on year. In contrast,

China’s tropical log imports from Central African

Republic and Ecuador rose 43% and 3% over the same

period of 2024.

The main reasons for the significant reduction in China's

tropical log imports were the sluggish real estate sector

leading as well as the cautious purchasing strategies

adopted by importers due to economic environment and

trade uncertainties.

The real estate sector in China remains sluggish. In the

first half of 2025 the reduction in new housing starts and

the decline in the level of second-hand housing

transactions directly led to a cooling in the demand for

wood from developers, decoration companies and

furniture factories. This trend was particularly evident in

July 2025 when both the import volume of logs and

sawnwood each decreased by 14% over the same period of

2024.

When China and the US failed to reach a consensus on

trade it intensified the cautious purchasing attitude of

importers. Coupled with the pressure in the domestic

economic environment importers reduced their

inventories. Export volume from most major tropical log

suppliers such as Papua New Guinea to China has

decreased directly leading to a significant drop in China's

total tropical log imports.

Surge in sawnwood imports from Viet Nam

The US decision to impose additional tariffs on wood

products, furniture etc. exported to the US has brought

about a challenging situation for Viet Nam.

Some American timber is being transported to China via

Viet Nam. China Customs data shows that from January to

September 2025 China's sawnwood imports from Viet

Nam reached 246,400 cubic metres valued at US$144

million, up 91% and 148% respectively over the same

period of 2024.

Reshaping of the wood trade pattern between China and

the United States, Viet Nam is not only a transit station for

China's wood imports but also a affected party of US trade

protectionism. Future competitiveness not only depends on

the ability to diversify external markets but also relies on

policy initiatives, the improvement of supply chain

transparency and the upgrading of processing technology.

|