Japan

Wood Products Prices

Dollar Exchange Rates of 10th

November

2025

Japan Yen 154.14

Reports From Japan

New economic package planned

The government has drafted an economic package to

support the Prime Minister’s "responsible and active fiscal

policy." The plan is expected to be adopted by the end of

November. It is reported the package will include

expanding subsidies for local governments to distribute

rice and shopping vouchers to households amid the rising

cost of living. The subsidies will also be used to help small

businesses raise wages.

The government will also raise the ceiling on long-term,

fixed-rate housing loans. Some private-sector members of

the Council on Economic and Fiscal Policy said that the

size of a supplementary budget to finance the economic

package could exceed the fiscal 2024 level of 13.9 trillion

yen.

See: https://www.nippon.com/en/news/yjj2025111300563/

Rise in Japanese manufacturer confidence

Business sentiment in Japan is mixed but showing signs of

improvement with large manufacturing firms expressing a

rise in confidence due to a strong export performance,

small and medium sized businesses are also seeing some

positive shifts. Recent data indicates large manufacturers'

sentiment is at a three-quarter high and forecasts for the

final quarter remain optimistic, although there are

headwinds as a result of sluggish domestic consumption

and concerns over US tariffs.

The Business Survey Index (BSI) for large manufacturing

firms rose to a three-quarter high in the third quarter of

2025 returning to positive territory and beating market

expectations.

The business sentiment index for medium size companies

improved in the July-September 2025 period and

surprisingly sentiment for small businesses also improved

but only to minus 9.6 in the third quarter of 2025, an

improvement from minus 12.3 in the previous quarter.

Manufacturers are projecting further improvement into the

fourth quarter of 2025 though a slight decline is expected

in the first quarter of 2026.

Japanese manufacturing confidence surged to its highest

level in nearly four years in November, led by the

electronics and auto sectors which have been buoyed by

softness in the yen and solid orders according to the

Reuters Tankan survey. In other news, Japanese listed

companies saw April-September net profits rise 7% year

on year, a record high despite US tariffs.

See:

https://www.japantimes.co.jp/business/2025/09/11/economy/japa

n-big-firm-sentiment/

Inflation above Bank of Japan target

Headline inflation and core inflation, which excludes fresh

food, are firmly above the central bank’s 2% target which

is complicating the Banks options for additional interest

rate increases.

The issue is that the durability of inflation remains

questionable. Headline inflation is moving due to factors

unrelated to domestic demand. For example, energy and

government subsidies for education were the main

contributors to the recent drop in headline inflation. At the

same time, food prices are pushing inflation in the other

direction. Food items are currently the principal drivers of

current inflation.

See:

https://www.deloitte.com/us/en/insights/topics/economy/asia-

pacific/japan-economic-outlook.html

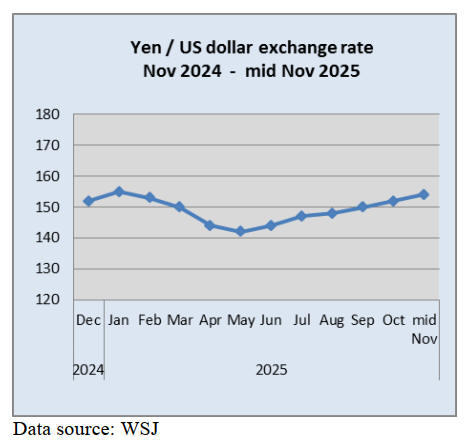

Weak yen - direct intervention may not deliver this time

The yen fell to a new low in mid-November reaching a

level when, in the past, the government intervened in the

currency market. This time currency traders are not

optimistic that the new government will be able to shore

up the yen by direct intervention.

Analysts point out that, unlike last year when intervention

took place in the run-up to higher interest rates by the

Bank of Japan, this time Japan would be buying yen just

as Prime Minister Sanae Takaichi signals her desire for a

slowdown in rate hikes.

The yen has fallen about 4.5% against the dollar so far this

quarterand was trading at 154 to the US dollar in mid-

November

See:

https://www.japantimes.co.jp/business/2025/11/13/economy/yen-

dollar-intervention-debate/

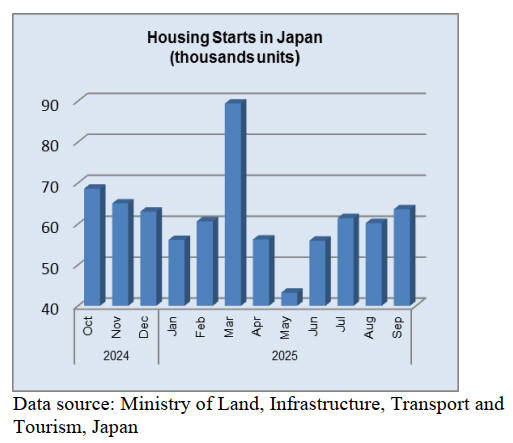

Families priced out of Tokyo's real estate market

The Japanese capital is taking action to provide lower-cost

housing for the growing number of families that have been

priced out of Tokyo's skyrocketing real estate market.

Starting in fiscal 2026, public-private funds totalling more

than 20 billion yen (US$130 million) will provide housing

with rents around 20% below market rates.

Tokyo is launching an affordable housing initiative to

begin in April 2026 using a combination of public and

private funds to provide family-sized units at rents about

20% below market rates. This programme comes as rental

prices have soared and the supply of new condominiums

has hit a 30-year low.

The Tokyo Metropolitan Government will invest 10

billion yen, with the private sector raising more than 10

billion yen and the funds will be used for both new and

existing properties.

See: https://asia.nikkei.com/business/markets/property/tokyo-to-

roll-out-affordable-housing-for-families-as-rents-soar

Positive growth forecast for construction market

Mordor Intelligence has published a new report on the

Japan Construction Market offering an analysis of trends,

growth drivers and future projections.

The Japan construction market size is forecast to be

around US$528 billion in 2025 and is likely to reach

US$621 billion by 2030, translating into a 3.3% CAGR,

says the report. This growth is driven by steady demand in

residential, commercial and infrastructure projects.

Analysts note that the Japan construction sector is

increasingly influenced by both domestic and international

players who contribute to the modernisation of urban

spaces and the expansion of transport and industrial

facilities.

See: https://www.openpr.com/news/4252818/japan-construction-

market-forecast-to-reach-621-83-bn-by-2030

Import update

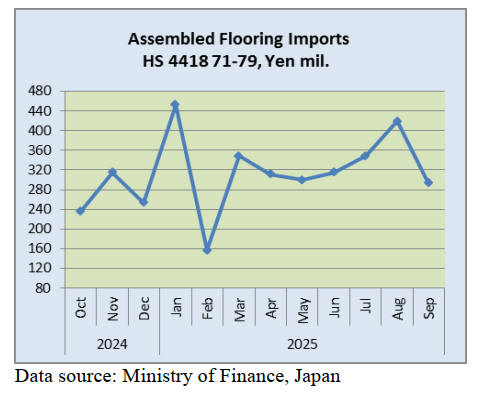

Assembled wooden flooring imports

After 3 months of steady increases in the value of imports

of assembled wooden flooring (HS44187179) there was a

sharp correction in September as the value of imports

dropped 30% from August. Year on year the value of

September 2025 imports was at around the same level as

in September 2024.

Of the various categories of assembled flooring imports

report 71% was of HS 441875 with China and Vietnam

being the top shippers. For the other categories HS441879

accounted for 13% of September imports followed by

HS441873 (11%) and HS441874 (5%).

Of HS441873 imports all originated in China and shippers

in China accounted for over 60% of HS441874 arrivals in

September with the others suppliers being Viet Nam,

Indonesia and Thailand.

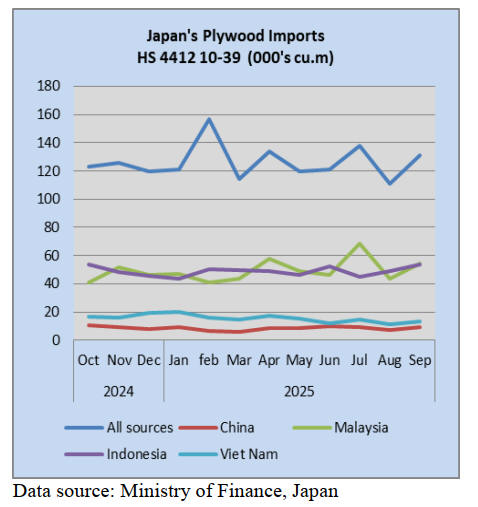

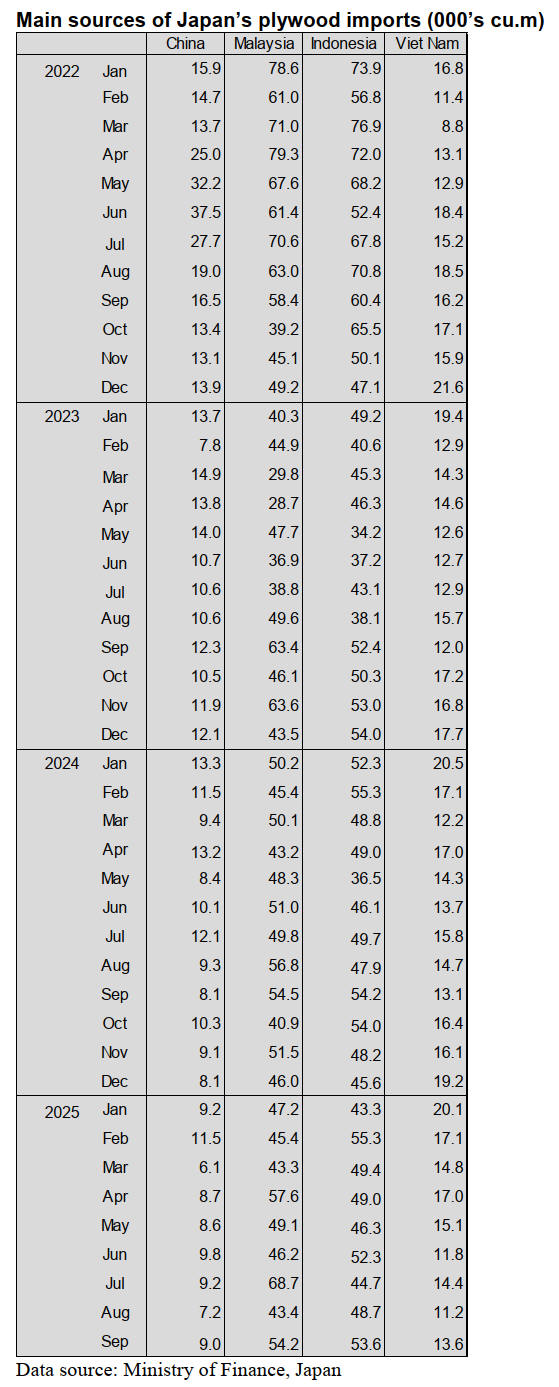

Plywood imports

As in previous months Indonesia and Malaysia were the

top suppliers of plywood to Japan in September and the

combined volume of shipments accounted for over 80% of

Japan’s plywood imports, the other top shippers being Viet

Nam and China. September 2025 import volumes were

18% higher than in August 2024 but came in at around the

same level as in September 2024.

The volume of September 2025 imports from Malaysia

and Indonesia rose as they did from the other main

shippers, Vietnam and China.

In September 2025 arrivals of HS441210-39 were reported

at 131,017 cu.m (110,998 cu.m in August). As in previous

months of the various categories of plywood imported in

September HS441231 accounted for most followed by

HS441233 and HS441234 with the balance being

HS441239.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR. For the JLR report

please see: https://jfpj.jp/japan_lumber_reports/

First 2x4 lumber exports to the U.S.

Sumitomo Forestry Co., Ltd. announced that it had

exported Japanese cedar 2x4 lumber to the United States,

where the shipment was graded by a local inspection

agency. The export volume was equivalent to one

container load, totaling 45 cbms.

Nearly the entire shipment met local standards and was

stamped with the appropriate grade mark. While Japanese

cedar fence materials have previously been exported to the

United States, this marks the first time that 2x4 structural

lumber has been shipped to the country, adding a new

chapter to the history of Japan’s timber industry.

As part of efforts to expand demand for wood products,

Sumitomo Forestry has been working closely with its

partner companies to promote the export of domestically

produced structural lumber, recognizing its importance in

this context. The company loaded 2x4 lumber produced at

the Chugoku Mokuzai Noshiro Plant into a container and

exported it from Akita Port to Seattle in early August.

The shipment consisted of roughly equal portions of JAS-

certified and non-JAS lumber. Sumitomo Forestry

requested grading from Fritch Mill, a member company of

a grading agency based in Washington State. On

September 25, nearly the entire volume was found to meet

local standards and was stamped with the appropriate

grade mark.

Sumitomo Forestry views this as a first step toward

exporting structural lumber to the United States. However,

several challenges remain, including the compatibility of

Japanese cedar structural lumber with the U.S. market, the

added costs associated with import tariffs, and supply

issues, particularly the difficulty of securing logs in Japan

that meet the length requirements for 2x4 lumber

production.

However, the company plans to promote Japanese cedar

lumber in the U.S. market by leveraging its expertise in

architecture-related fields to explore prototype

applications using the imported 2x4 structural lumber.

Through these efforts, it aims to expand demand for

domestically produced wood products within the United

States.

Monthly volume falls below 100,000 m³ for first time in

2025

In August, Japan’s log exports to China fell below 100,000

cubic meters for the first time in 2025. The August total

was 85,227 cbms, marking the first time monthly volume

has fallen below 100,000 cubic meters since January 2024.

The impact of the Trump tariffs had already begun to

surface in the first half of the year, but with the added

slowdown in China’s domestic economy in the second

half, the downward trend has become more pronounced.

At the end of September, U.S. President Donald Trump

signed a proclamation to impose phased tariffs of 10% to

50% on imports of lumber and processed wood products

bound for the United States, effective from October 14,

2025 through January 1, 2026 of the following year.

Since spring, demand for Japanese cedar logs has declined

among local manufacturers in China who produce cedar

fencing and decking materials for export to the United

States, due to the impact of the Trump tariffs. In the

second half of the year, demand also stagnated among

local manufacturers shipping cedar lumber for

construction and civil engineering use within China, due to

the slowdown in the Chinese economy.

The export price of Japanese cedar logs stood at just over

USD 100 per cbm (C&F), down roughly 10% from the

beginning of the year, with a continued weakening trend.

From January to August 2025, total log exports reached

1.162 million cbms, representing a 90% increase

compared to the same period last year and maintaining a

high overall level. However, with roughly 90% of this

volume bound for China, the recent slowdown in Chinese

demand is having a significant impact on the overall

market.

Total log exports in August also fell below the 100,000

cbms mark, coming in at 99,235 cbms. If this pace

continues, the final export volume for 2025 may fall short

of the 1.819 million cbms recorded in 2024.

South Sea logs and lumber

Domestic distribution of hardwood products continues to

show signs of stagnation. Among imported products,

production and shipments of South Sea timber items such

as Merkus pine laminated free boards and decking

materials appear to be delayed due to adverse weather

conditions in Indonesia.

Prices of Indonesian products are rising or showing signs

of an upward trend, primarily due to reduced log supply

caused by adverse weather conditions. While the impact

on the domestic market remains limited, some distributors

have begun actively procuring due to inventory shortages.

The supply-demand balance for South Sea hardwood logs

remains stable.

Although log consumption by domestic South Sea timber

manufacturers has slowed compared to the same period

last year due to deteriorating market sentiment, they

continue to secure supply as usual for bulk shipments,

which are said to occur two to three times a year.

Trilateral plywood conference

The Trilateral Plywood Conference, bringing together

plywood-related organizations from Indonesia, Malaysia,

and Japan, was held on September 18 in Miri, Sarawak,

Malaysia, where participants exchanged views on the

current situation in their respective countries.

No urgent issues emerged regarding log supply or

domestic and international plywood conditions, resulting

in a calm and steady conference throughout. The next

meeting is scheduled to be held in Indonesia. Participants

included the Indonesian Plywood Association from

Indonesia; the Sarawak Timber Association and the Sabah

Timber Industries Association from Malaysia; and the

Japan Plywood Manufacturers' Association and the Japan

Lumber Importers' Association from Japan, with a total of

30 attendees.

The conference began with presentations on the economic

conditions and plywood-related circumstances in each

country, followed by an open discussion. The Japanese

delegation reported on the state of the domestic market,

with representatives assigned to specific sectors such as

flooring base panels, thin plywood and general-purpose

panels (GP), and formwork.

The Indonesian delegation reported that five companies

are expected to face anti-dumping duties of up to 300% in

the U.S., and that no resolution is currently in sight. The

Malaysian delegation raised a question regarding the

increasing exports of Japanese sugi logs.

|