|

1.

CENTRAL AND WEST AFRICA

Overall market situation

Trading activity continues at a slow pace with stable to

weak demand across most regions and limited movement

in prices. European market remains dull as ever, overall

sentiment remains cautious and prices are unchanged. In

the Middle East markets there has been a slight recovery

in Okoume demand as enquiries are arriving from

traditional buyers. Red species continue to perform well

maintaining stable volumes and steady interest.

In China market conditions remain unchanged with buyer

interest confined to Belli, Ovangkol and Okan. In recent

weeks orders from buyers for the Philippine market have

been slowing. The recent severe typhoons have ravaged

many Philippine islands and this may trigger higher timber

imports for reconstruction.

Market activity remains stable in Viet Nam with consistent

orders and no major fluctuations in volumes or price.

Regional round up

Gabon

Gabon’s forestry sector is facing a very difficult period

due to the ongoing activities of the government Task Force

investigating companies’ financial and social obligations.

This has disrupted operations across the supply chain

affecting operators, subcontractors, financial institutions,

Customs and shipping companies alike.

It is reported that a major company remains fully blocked

as it discusses a 40% payment of its sizeable assessment as

demanded by the Task Force. Other companies which

underwent investigation have resumed operations but the

weather is slowing forest and transport operations.

Opertators say the Task Force’s actions, while intended to

restore fiscal discipline, are crippling short-term

production and undermining investor confidence and have

also resulted in a drop in Customs revenue.

In November a vessel arrived at Libreville expecting a

cargo of logs but departed without loading, an unusual

event since the vessel typically carries around 2,500 cu.m

per voyage. One shipment was missed entirely because the

log supplier remained under Task Force sanctions, which

includes blocking movement of products. The GSEZ log

park in Nkok is nearly depleted of Okoume, with only

about 1,500 cu.m of mixed species remaining (mainly

Bosse, Sapelli, Padouk, Azobe and Okan).

November marks the mid-rain period; rains continue up-

country and are expected to continue until late December.

Transport conditions are improving as key sections of the

national road network undergo repair.

A government-financed 3,000 km rehabilitation

programme supported by the Islamic Bank and African

Development Bank is under way.

A new cross-country route is planned to connect to the

future Mayumba Port Project. Chinese funding

commitments for infrastructure have reportedly fallen

short of earlier promises.

Cameroon

Production and trade remains quiet at present, a reflection

of the ongoing rainy season. Harvesting conditions are

expected to improve in the coming months as the dry

season begins allowing production and transport to

recover. While the presidential election is over business

sentiment remains reserved. Before the elections several

Chinese operators suspended activities but now these firms

are resuming production

Harvesting is now limited due to the ongoing rainy season.

In several regions, particularly the Littoral (Douala) West

and North Cameroon, log transport has been delayed.

Sawmills report that bad weather continues to limit log

inflows forcing production slowdowns. Laterite roads are

under rain-barrier control, meaning no truck movement

during heavy rain. Rail transport remains functional with

no major disruptions reported.

Container availability remains sufficient across major

ports. Shipping and dispatch operations continue without

major interruptions though volumes are reduced due to

lower production.

Most operators anticipate some recovery production as the

dry season arrives, however, without firm demand in

international markets or improved domestic confidence the

short-term outlook remains uncertain and cautious.

Republic of the Congo

Operations in Congo continue to move slowly influenced

by both the upcoming elections and a difficult financial

environment. Investor confidence is said to be low and

most operators are cautious on investment and production.

Delays in exports are causing cash flow problems for

companies and missed shipping schedules and log

shortages are an issue for European Azobe importers

which have contract obligations. Overall, no operator is

satisfied with the current situation.

The country’s timber sector continues to operate at a

moderate pace affected by weak international demand,

particularly in China and ongoing political and financial

uncertainty ahead of next year’s elections. While

production remains steady, export activity is constrained

by limited orders and long stock rotations. The main

commercial species remain Sapelli, Ayous, Iroko, Padouk,

Azobe and Okoume (in the northern regions). Operators

are maintaining log stocks for 2–3 months of sawmill

activity.

Timber from northern Congo continues to move to Douala

Port over long distances. Rail and road infrastructure from

central Congo to Pointe-Noire remains operational with no

new fee or toll adjustments reported.

Port activity in Pointe-Noire is described as steady, though

there are minor vessel congestion delays reflecting overall

tight port capacity rather than timber volume surges.

European demand remains subdued with limited activity in

traditional hardwood markets. China continues to reduce

log orders, focusing instead on existing stocks and

alternative suppliers.

Domestic operators remain focused on maintaining

production levels while hoping for firmer demand in early

2026. The overall sentiment in Congo’s timber market

remains cautious but stable, characterised by adequate

operational capacity yet limited export opportunities.

2.

GHANA

New law to stop mining in forest reserves

The Minister of Lands and Natural Resources, Emmanuel

Armah Kofi-Buah, has presented a new Legislative

Instrument (L.I. 2505) in Parliament that seeks to prevent

mining in the country’s forest reserves.

The new Instrument, also known as the Environmental

Protection (Mining in Forest Reserves Revocation

Instrument, 2025) will revoke L.I. 2462 which was

enacted in 2022 to ensure that environmental management

principles are legally enforced in mining operations in

forest reserves.

Speaking to the press the Minister said the enormous

public outcry on illegal mining led to an amendment of L.I

2462, to delete Regulation item 3.2 to effectively limit the

powers of the President to allow mining forest reserves.

The Minister said in light of this and after consultations

with experts it had become clear that “we could

completely revoke that L.I. 2462 and to use the guideline

that was enacted in 2020.

The legislation, when approved, will permanently strip the

presidency of powers to issue mining permits in protected

forest areas. The Instrument will form part of

government’s broader reforms aimed at curbing illegal

small-scale mining (galamsey) and strengthen the

protection of the environment by reinforcing Ghana’s

commitment to sustainable resource management and

environmental conservation.

Mr. Kofi-Buah said the current administration is

committed to demonstrating to Ghanaians that government

is ready to protect the environment, forests and water

bodies.

Meanwhile, trade bodies and environmentalist including

the Ghana Federation of Labour (GFL), have applauded

government’s decision to revoke Legislative Instrument

L.I. 2462 describing it as a bold and commendable step in

the ongoing national fight against illegal mining.

The Ghana Institute of Foresters said they will fight

against any government policy that is contrary to their

mandates in safeguarding the country’s forests if

government fails to hold proper consultative dialogues for

a robust law that protects the environment.

See:https://www.graphic.com.gh/news/general-news/new-l-i-to-

stop-mining-in-forest-reserves-laid-in-parliament.html

and

https://www.myjoyonline.com/foresters-to-resist-l-i-2501-if-

proper-consultations-arent-made-to-safeguard-forests-reserves/

Sliced veneer exports record year-on-year growth

The Timber Industry Development Division (TIDD) of the

Forestry Commission has reported that Ghana’s wood

product exports for the period from January to September

2025 plunged to 160,974cu.m at a value of Eur74.08

million. Compared to the same period last year this

showed decreases of 23% and 20% in volume and value

respectively.

The data revealed that of the seventeen wood products

exported during the period teak, wawa, ceiba, denya,

dahoma, ofram, asanfina, chenchen and makore featured

prominently in the exports of sawnwood. Air and kiln dry

sawnwood, billets and plywood (including overland

exports) contributed 93,180 cu.m, 23,450cu.m, 13,605

cu.m and 10,908 cu.m respectively to the total volume of

timber exports for the first nine months of the year.

Compared to the same period in 2024 the volume and

value of wood product exports declined, however, sliced

veneer exports for both international and regional market

rose 16% in volume and 27% in value.

Sliced veneer (including overland exports) accounted for

3% and 9% of the overall total export volume and value

respectively for the period. Italy was the main sliced

veneer importer registering about 35% of the total export

volume. This was followed by China with 10% and

Denmark 8%.

Of regional markets the lead importers of sliced veneers

included Togo, Burkina Faso and Cote D’Ivoire. The

overall average unit price of the product within the sub-

region surged from Eur820/cu.m in 2024 to Eur916/cu.m

in the first nine months of this year.

The major species for sliced veneer exports included

asanfina (32%), chenchen (20%), koto (14%) and sapele(

8%) with twenty-three other species accounting for the

balance.

In the first nine months of this year tertiary wood products

accounted for 5% (Eur3.77 million) of total revenue

against 5% (Eur4.52 million) for January to September

2024. Secondary wood products also recorded an 11%

higher in value over 2024 reaching Eur30.06 million.

Ghana to host 2025 renewable energy forum

The Association of Ghana Industries (AGI), in

collaboration with the Africa Solar Industry Association

(AFSIA), has announced its partnership to host the 2025

edition of the Renewable Energy Forum Africa (REFA) in

Accra from 3-4 December 2025.

Speaking at a press briefing in Accra, Mr.

Kwame Jantuah, Chairman of AGI’s Energy Sector,

underscored the importance of renewable energy in

Ghana’s economic transformation. He noted that AGI

would leverage its extensive industrial network to promote

REFA 2025, facilitate connections between investors and

local businesses and advocate for policies that support

renewable energy adoption.

The event will bring together key stakeholders from across

Africa and beyond, including investors, developers,

policymakers and technology providers. It is expected to

catalyse investment, foster partnerships and accelerate

Ghana’s transition to a sustainable energy future.

See: https://gna.org.gh/2025/11/ghana-to-host-refa-2025-in-

accra-agi-and-afsia-join-forces-for-a-greener-future/

Ghana’s reports 8% inflation in October 2025

According to data from the Ghana Statistical Service

(GSS) inflation dropped further to 8.0% in October 2025

marking the 10th consecutive monthly decline and the

lowest rate since June 2021.

The latest figure represents a continued easing from 9.4%

recorded in September 2025.

The sustained downward trend is attributed to the impact

of a stable currency, easing fuel prices and improved

macroeconomics.

But these have not yet reflected deeply in the prices of

general goods and services which are still on the high side.

Speaking at the 2025 PwC Cyber Forum, the Country

Senior Partner of PwC Ghana, Vish Ashiagbor, expressed

optimism that Ghana’s inflation will continue on its

downward trend in the coming months citing growing

economic stability and improved coordination between

fiscal and monetary policies.

See: https://www.myjoyonline.com/october-inflation-slows-to-

four-year-low-of-8/

and

https://www.myjoyonline.com/pwc-ghana-predicts-a-further-fall-

in-inflation/

3. MALAYSIA

United States and Malaysia – tarff Fact Sheet

In a Fact Sheet the US Trade Representative reports that

the United States and Malaysia reached an Agreement on

Reciprocal Trade, a legally binding agreement that will

provide American exporters with access to Malaysia’s

market while bolstering U.S. national and economic

security.

On tariffs, Malaysia has committed to provide significant

preferential market access for US products exported to

Malaysia across many sectors, including chemicals,

machinery and electrical equipment, metals, passenger

vehicles, dairy, horticultural products, poultry, pork, rice

and fuel ethanol which will create commercially

meaningful market access opportunities for a significant

range of U.S. exports.

The United States will maintain a 19% reciprocal tariff

rate for imports from Malaysia except for identified

products from the list set out in Annex III to Executive

Order 14,346 of 5 September 2025, Potential Tariff

Adjustments for Aligned Partners, which will receive a

zero percent reciprocal tariff rate. Malaysia has

committed to address a range of non-tariff barriers.

Malaysia’s trade with the United States surged 15.4% to

RM 270.88 bil between January and September this year,

up from RM 234.68 bil in the same period last year.

See: https://ustr.gov/about/policy-offices/press-office/fact-

sheets/2025/october/fact-sheet-united-states-and-malaysia-reach-

agreement-reciprocal-

trade#:~:text=The%20United%20States%20will%20maintain,zer

o%20percent%20reciprocal%20tariff%20rate.

and

https://www.whitehouse.gov/briefings-

statements/2025/10/agreement-between-the-united-states-of-

america-and-malaysia-on-reciprocal-trade/

and

https://theedgemalaysia.com/node/775418

Financing forest conservation and environmental

protection initiatives

The Malaysian government intends to expand the Forest

Conservation Certificate (FCC) instrument to encourage

broader participation and contributions toward forest

conservation and protection efforts.

Deputy Prime Minister, Fadillah Yusof, said the FCC is a

non-market-based green financing instrument introduced

by the government to address climate change and

safeguard the nation’s strategic natural assets.

Launched in May last year, the FCC, developed by the

Malaysian Forest Fund (MFF) since 2022, serves as a

mechanism to finance sustainable forest conservation and

environmental protection initiatives.

See:

http://theborneopost.pressreader.com/article/281629606512584

Guidance document for Sarawak forestry projects

A guidance document on ‘Interpreting Environmental

Impact Assessment (EIA) Terms and Conditions for

Forestry Sector Projects in Sarawak’ was officially

launched to support the State’s sustainable development

agenda. Premier Abang Johari Tun Openg launched the

document during the recent state-level National

Environment Day 2025 celebration.

Jointly developed by the Natural Resources and

Environment Board (NREB) and the Sarawak Timber

Association’s Environmental Compliance Audit (ECA)

Working Group with technical input from the Forest

Department Sarawak (FDS), the guidance document

serves as an important reference to help the forestry sector

better interpret and compile EIA reports.

By clarifying these terms and conditions, the document

directly supports the implementation of the ECA, a key

regulatory mechanism under the Natural Resources and

Environment (Audit) Rules, 2008, said NREB and STA in

a joint statement.

The document also helps bridge the gap between

regulatory requirements and on-ground practices, ensuring

that environmental safeguards are translated into

measurable actions. The guidance document complements

the existing Guidelines for Natural Resources and

Environment (Audit) Rules, 2008 by providing sector

specific interpretations and reference tables for two key

forestry activities in hill forests in Sarawak, namely timber

harvesting and industrial forest plantation development.

See: https://sta.org.my/index.php/2-website/66-publication

and

http://theborneopost.pressreader.com/article/281552297103323

Mersk distribution centre

The logistics group AP Moller–Maersk A/S has launched

its largest contract logistics facility in the Asia-Pacific

region, the Maersk Mega Distribution Centre in Shah

Alam, Malaysia.

Maersk said the 180,000 sq.m. facility expands its

warehousing in Malaysia by more than 30% and is

designed to handle a range of commodities including fast-

moving consumer goods. The facility is about 340km from

the Port of Tanjung Pelepas in Johor, which serves as

Maersk’s largest transshipment hub in Asia.

“Malaysia’s strategic location between the Indian Ocean

and the South China Sea means it is at the crossroads of

major maritime trade routes, putting the country in an

ideal position to act as a hub for shipping and logistics,”

said Maersk Contract Logistics head of Malaysia P’ng

Tean Hau.

See: https://theedgemalaysia.com/node/777648

4.

INDONESIA

Export Benchmark Price (HPE) for November

2025

The following is a list of Wood HPE from November 1 to

November 30, 2025. Note there are no changes compared

to October.

Veneers

Natural Forest Veneer US$613/cu.m

Plantation Forest veneer US$754/cu.m

Wooden Sheet for Packaging Box US$1,041/cu.m

Wood Chips

Woodchips in chips or particles US$90/tonne

WoodChips US$97/tonne

Processed Wood

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1000 mm2 to

4000 mm2 (ex 4407.11.00 to ex 4407.99.90)

Meranti (Shorea sp) US$1,016/cu.m

Merbau (Intsia sp) US$869/cu.m

Rimba Campuran (Mix Tropical hardwood) US$688/cu.m

Eboni US$1,711/cu.m

Teak US$3,243/cu.m

Pinue and Gmelina US$717cu.m

Acacia US$638/cu.m

Sengon (Paraserienthes falcataria) US$1,327/cu.m

Rubber US$321/cu m

Balsa (Ochroma sp), Eucalyptus. US$544/cu.m

ungkai (Peronema canescens) US$1,298s/cu.m

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth of

Merbau wood with the provisions of a cross-sectional area

of 4000 mm2 to 10000 mm2 (ex 4407.11.00 to ex

407.99.90) = US$1,500/cu.m

See: https://jdih.kemendag.go.id/peraturan/keputusan-menteri-

perdagangan-republik-indonesia-nomor-2139-tahun-2025-

tentang-harga-patokan-ekspor-dan-harga-referensi-atas-produk-

pertanian-dan-kehutanan-yang-dikenakan-bea-keluar-dan-tarif-

layanan-badan-layanan-umum

SVLK ensures legality

The Indonesian Ministry of Forestry has reaffirmed that all

timber exported from Indonesia is verified as legal and

sustainable through the Timber Legality and Sustainability

Assurance Programme (SVLK). According to Erwan

Sudaryanto, Director of Forest Product Processing and

Marketing Development, the SVLK demonstrates

Indonesia’s commitment to ensuring that exported forest

products are both legally sourced and produced through

responsible and socially equitable practices.

The system is supported by the National Forest

Monitoring System (SIMONTANA) and involves

independent third-party verification under the supervision

of Conformity Assessment Bodies and a consortium of

NGOs to maintain its credibility.

Erwan also addressed recent concerns raised by nonprofit

organisations claiming that Indonesian timber sold in

European markets may still come from deforested areas.

He clarified that under Indonesian law, deforestation refers

specifically to the permanent conversion of forested land

into non-forest uses and not all forest clearing constitutes

illegal activity.

The government distinguishes between unauthorised

deforestation and officially permitted land use changes

which may occur for forest plantations, infrastructure

projects or other national development purposes. This

differentiation, Erwan emphasised, ensures that

Indonesia’s forest management practices remain

transparent, lawful and aligned with national and

international sustainability standards.

In related news, the Director General of Sustainable Forest

Management, Laksmi Wijayanti, said the harvesting of

timber is strictly regulated through various permits

including Forest Utilization Business Permits (PBPH),

Social Forestry and Timber Utilisation Permits for Non-

Forestry Activities (PKKNK) in other land use areas.

These licensing frameworks require that all forest-related

activities such as land preparation, plantation development

and infrastructure projects be conducted with official

authorisation.

The Director of Forest Product Processing and Marketing

Development, Erwan Sudaryanto, said the SVLK

continues to be enhanced to meet global standards,

particularly those related to deforestation-free trade, while

ensuring fairness for domestic businesses and

communities.

The Ministry encourages public participation in

monitoring and improving transparency through upgraded

information systems, aiming to strengthen confidence

among both local and international stakeholders in the

legality and sustainability of Indonesian timber.

See: https://www.antaranews.com/berita/5196609/kemenhut-

pastikan-legalitas-ekspor-kayu-indonesia-lewat-verifikasi-svlk

Green energy from legally and sustainably managed

forests

The Government reaffirmed its strong commitment to

preserving forests while ensuring that the biomass industry

especially wood pellet production operates legally and

sustainably. All forest-based products in Indonesia comply

with the Timber Legality and Sustainability Assurance

Program (SVLK), which guarantees the legal and

sustainable origin of raw materials and is recognised by

global markets.

Indonesia’s wood pellet production reached 333,971 cubic

metres in 2024 tripling since 2020 while exports soared to

US$40 million. The leaders of the Indonesian Biomass

Energy Producers Association (APREBI) and the

Indonesian Biomass Energy Society (MEBI) stressed the

importance of collaboration to grow the biomass sector

responsibly. They argued that negative campaigns linking

wood pellets to deforestation are misleading and could

harm communities and green energy goals.

With over 10 million hectares of land suitable for

industrial and energy forests, Indonesia has vast potential

for biomass development. However, stakeholders urged

the government to review biomass pricing policies to

attract more investment and position biomass as a key

component of the nation’s renewable energy future.

See: https://wartaekonomi.co.id/amp/read589106/biomassa-

indonesia-energi-hijau-dari-hutan-yang-dikelola-secara-legal-

dan-lestari

and

https://swa.co.id/read/465809/aprebi-dorong-ekspor-energi-hijau-

pacu-ekspor-biomassa-yang-legal-dan-berkelanjutan

Furniture Industry concerned on tariffs and regulations

Indonesia’s furniture and wooden handicraft industry is

beginning to recover after facing global economic

pressures though the rebound remains uneven. Positive

momentum has been seen in several subsectors such as

wood, rattan and bamboo products driven by increased

export orders from Japan and Europe as well as domestic

initiatives like the Proudly Made in Indonesia (BBI)

programme.

This government-backed initiative, along with the e-

catalog procurement system, has helped boost local

demand and support industry growth. According to the

Ministry of Industry, these trends have contributed to an

increase in the Industrial Confidence Index (IKI) for the

furniture sector.

However, significant challenges persist due to volatility in

international trade. The fluctuating US tariff policy

continues to disrupt export orders, particularly for wood

and upholstered furniture, prompting manufacturers to

diversify their markets toward Europe, Japan and the

Middle East.

The recently concluded Indonesia–EU Comprehensive

Economic Partnership Agreement (IEU-CEPA) offers

optimism, potentially granting zero tariffs to most

furniture exports once ratified.

Meanwhile, the upcoming implementation of the EUDR

poses compliance challenges, though proposed

simplifications and transition periods for small and

medium enterprises provides temporary relief. The

government and industry players are now working on

strategies to adapt while maintaining competitiveness in

both export and domestic markets.

See: https://www.kompas.id/artikel/industri-mebel-mulai-pulih-

kebijakan-tarif-hingga-regulasi-masih-membayangi

Elevating creative capacity to achieve global presence

The Indonesian Furniture Industry and Craft Association

(HIMKI) aims to transform the country’s creative industry

so it is recognised not just as a low-cost supplier in the

global market but as a producer of high-quality, luxury

products. HIMKI Chairman, Abdul Sobur, emphasised

that brand endurance depends more on mindset than on

capital, urging Indonesian creators to focus on developing

strong brands rooted in cultural identity and emotional

value.

See: https://www.antaranews.com/berita/5206829/himki-

upayakan-industri-kreatif-ri-naik-kelas-tak-hanya-jadi-pemasok

and

https://www.tribunnews.com/bisnis/7747988/himki-industri-

kreatif-perlu-naik-kelas-tak-sekadar-pemasok-produk-murah

Early warning system to curb deforestation

Indonesia’s Ministry of Forestry has implemented an early

warning system to detect deforestation in unlicensed forest

areas as part of its strategy to combat illegal logging and

timber production.

According to Agus Budi Santosa, Director of Forest

Resources Inventory and Monitoring, the system tracks

forest clearing activities and provides updates every two

weeks. The ministry coordinates with various directorates

to monitor areas managed under Forest Utilization

Business Permits (PBPH), particularly those involving

timber and its derivative products.

See: https://en.antaranews.com/news/387881/indonesia-uses-

early-warning-system-to-curb-deforestation

Indonesia to invest in Brazil-led Forestry Fund

Indonesia has pledged to invest in Brazil’s US$125 billion

Tropical Forest Forever Facility (TFFF), a global forestry

fund designed to provide financial incentives for tropical

countries to halt deforestation. President Prabowo

Subianto announced this commitment during a joint press

conference with Brazilian President stating that Indonesia

would match Brazil’s investment in the initiative.

The fund aims to generate permanent income for forest-

rich nations in exchange for protecting their forests,

combining US$25 billion in sovereign investments with

US$100 billion from private capital. The move according

to the media underscores Indonesia’s commitment to

global forest conservation and sustainable finance

cooperation with other tropical nations.

See: https://jakartaglobe.id/news/indonesia-vows-to-invest-in-

brazilled-125-billion-forestry-fund

Indonesia/ ICVCM partnership to build high-integrity

carbon market

Indonesia’s Ministry of Forestry and the Integrity Council

for the Voluntary Carbon Market (ICVCM) have signed a

memorandum of understanding (MoU) to develop a high-

integrity voluntary carbon market in the country. The

Minister of Forestry, Raja Juli Antoni, stated that the

collaboration underscores Indonesia’s commitment to

building a carbon market rooted in trust, integrity and

national sovereignty. By aligning with international

integrity standards, Indonesia aims to establish a

transparent and science-based carbon market that also

delivers tangible benefits to local communities and

Indigenous Peoples.

Under the MoU, the ICVCM will provide support through

capacity building, knowledge sharing and technical

assistance in integrity criteria, assurance mechanisms and

measurement reporting and verification (MRV) systems

for the forestry and land-use sectors.

The agreement also includes plans to strengthen the

capabilities of civil servants and project developers,

promote public awareness and create collaborative

platforms to prepare Indonesia for a credible and

sustainable carbon market framework.

See: https://en.antaranews.com/news/390769/indonesia-icvcm-

partner-to-build-high-integrity-carbon-market

Indonesia and UK Strengthen forestry cooperation

Indonesia and the United Kingdom are deepening their

forestry partnership through two new strategic

programmes: the Multistakeholder Forestry Program

(MFP-5) and the Land Facility–Indonesia Country Support

Project.

Both initiatives aim to accelerate Indonesia’s Forestry and

Other Land Use (FOLU) Net Sink 2030 target. MFP-5,

building on the success of previous MFP phases from

2000 to 2023, focuses on strengthening forest governance,

implementing the Timber Legality Verification System

(SVLK) and promoting sustainable forest management

and timber trade.

The Land Facility project, ‘Land to Livelihoods’ seeks to

recognise customary forests and enhance indigenous food

resilience through sustainable land-use practices,

particularly in Papua, West Papua and Southwest Papua.

The Land Facility’s first phase (November 2025–March

2026) will focus on case studies, institutional capacity

building and developing a roadmap for customary forest

recognition through 2029.

See: https://rri.co.id/en/national/1940579/indonesia-and-uk-

strengthen-forestry-cooperation

and

https://mediaindonesia.com/humaniora/825927/indonesia-dan-

inggris-perkuat-kerja-sama-kehutanan-untuk-capai-folu-net-sink-

2030

Smallholder tree farmers’ role in sustainable wood

supply

At the 31st Session of the Asia-Pacific Forestry

Commission (APFC31) and the 5th Asia-Pacific Forestry

Week (APFW2025) in Chiang Mai, Thailand, Indonesia

highlighted the pivotal role of smallholder tree farmers in

ensuring a sustainable wood supply and supporting rural

livelihoods.

Agus Justianto, Senior Policy Analyst at Indonesia’s

Ministry of Forestry, emphasised that smallholders

produce around 80% of the teak used by small and

medium-scale furniture industries making them key

players in the national timber supply chain. He also noted

that Indonesia is expanding its social forestry and

community forestry programmes with 8.32 million

hectares already allocated and a goal of reaching 12.7

million hectares benefiting approximately 1.42 million

households.

Agus further stressed that community-managed forests

contribute significantly to environmental sustainability and

Indonesia’s FOLU Net Sink 2030 target. Forests under

secure community tenure tend to experience lower

deforestation rates and higher regeneration levels,

supporting carbon sequestration and land restoration

efforts.

By empowering local communities through secure rights

and sustainable management practices, Indonesia aims to

balance economic development with long-term ecological

benefits, positioning smallholder tree farmers as central

actors in both national and regional sustainable forestry

strategies.

See: https://forestinsights.id/indonesia-highlights-smallholder-

tree-farmers-role-in-sustainable-wood-supply-across-asia-pacific/

https://www.antaranews.com/berita/5224733/di-forum-asia-

pasifik-ri-tegaskan-perkuat-kehutanan-berbasis-rakyat

5.

MYANMAR

Timber sector experiencing a marked

slowdown

As Myanmar approaches a General Election on 28

December 2025 the economic landscape is becoming

increasingly complex. Escalating armed conflict,

tightening economic sanctions and surging commodity

prices are adding significant pressure to an already

unstable business environment.

Within this broader climate of uncertainty the timber

sector is experiencing a marked slowdown. Export

activities have declined sharply and the Myanma Timber

Enterprise (MTE) is struggling to market logs and

sawnwood, both teak and other hardwoods, on the

international market.

MTE has increasingly shifted to domestic sales conducted

in MMK due to restricted access to foreign currency

inflows.

At the same time several sawmills have suspended export-

oriented production and turned toward local markets.

These converging pressures underscore the vulnerability

of Myanmar’s timber supply chain at a time when broader

political and economic uncertainties are deepening.

New oil and gas production projects

Myanma Oil and Gas Enterprise (MOGE), the largest

source of foreign currency is moving ahead with new oil

and gas production projects through partnerships with Thai

companies. Agreements have recently been signed for

projects including Aung Sinkha, Pyay Thar Ya and Min

Ye Thu which when completed are expected to boost

output and revenues.

The earning of MOGE is variable from the different

sources but the most reliable estimation is US$1.5–2.2

billion annually, representing up to 80 percent of

Myanmar’s foreign-exchange income.

See - https://burmese.dvb.no/archives/732720

6.

INDIA

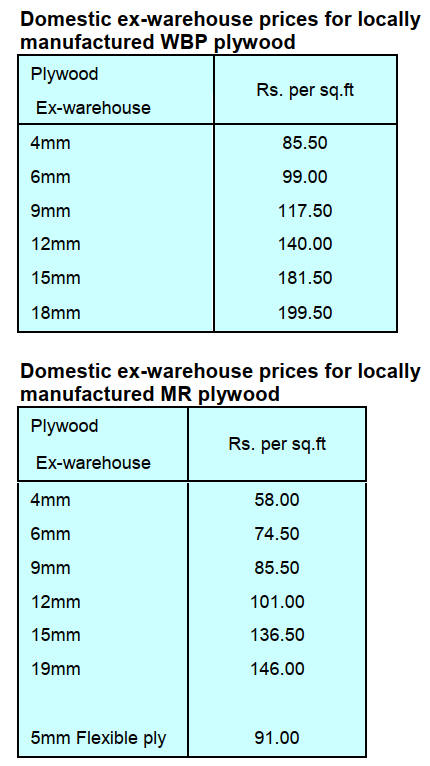

Demand for shuttering ply sustained

throughout

monsoon season – a surprise

Over the past few months construction activity was

disrupted in many regions across the country due to

torrential rain. Plywood traders and manufacturers

anticipated a sharp decline in demand for shuttering

plywood. To everyones‘surprise, demand for shuttering

ply was sustained throughout the monsoon season.

In some places the rain was devestating such as Punjab,

Haryana, Himachal and Tamil Nadu and building work

stopped. As reconstruction work began the demand for

shuttering ply ireturned.

Ply Reporter says the demand for shuttering ply in the

major cities was sustained due to scores of new

commercial projects, real estate developments and many

government funded infrastructure projects.

The real estate sector witnessed a few challenges owing to

labour shortage in May and June as workers left for their

home towns to help with harvesting. When they returned

construction sites were seen in full swing further boosting

the shuttering ply demand.

Demand for shuttering ply in South Indian States such as

Andhra Pradesh, Telangana, Karnataka has also been

promising except in some parts of Tamil Nadu and nearby

areas which were affected by storms.

Analysts suggest that the launching of new real estate

projects targetted to be completed within contract

timelines under the Real Estate (Regulation and

Development) Act 2016 has supported construction

demand. Tier 2 and Tier 3 cities have witnessed good

demand for shuttering plywood.

See: https://www.plyreporter.com/article/154255/current-issue

A good monsoon boosts consumer spending

The 2025 India monsoon season experienced prolonged

and above-average rainfall continuing into October,

beyond its usual duration. The India Meteorological

Department (IMD) recorded 8% more rainfall than

average for the core June-September season.

India's monsoon rains significantly influence domestic

consumption, primarily by impacting the agricultural

sector, rural incomes and food price stability. A good

monsoon boosts consumer spending while a weak one can

dampen demand across the economy.

A good monsoon leads to higher agricultural production

and increased farm incomes. Since a large portion of the

Indian population (around 60%) depends on agriculture

and over half of the net sown area is rain-fed, the

purchasing power of millions of rural households increases

with good rains.

The monsoon drives consumer spending as higher rural

incomes directly translate into increased demand for goods

and services. This surge in spending benefits many

sectors.

Booming construction and furniture industries rely on

imported timber

A 2024 GAIN report says India’s annual import of logs,

sawnwood and wood products increased from US$630

million to US$2.3 billion over the past two decades with

US capturing a significant share. Limited domestic

supplies coupled with booming retail furniture, handicraft

and hospitality sectors are driving demand for newer

species. Exporters are also increasingly sourcing imported

species to meet certification requirements in export

markets.

India’s booming construction, housing, furniture and

handicrafts industries are increasingly relying on imported

forest products to expand output. The government

estimates 51% of India’s population will be living in urban

areas by 2047 leading to a demand surge for furniture

products.

India’s furniture market was valued at US$24 billion in

2023 making it the fifth largest producer and fourth largest

consumer globally with an expected annualised growth

rate of 11% from 2023-28. Wooden furniture is expected

to remain at the core of home furnishing demand as rising

incomes and demand for high quality and distinctive

designs are forecast to grow.

Dual income earning households, larger disposable

incomes and changing lifestyle trends among these

consumers is driving growth for luxury and imported

goods including luxury furniture. Wealthy urban

consumers are increasingly shopping for goods online

through various e-commerce sites.

See:

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadRepor

tByFileName?fileName=Wood%20and%20Wood%20Products

%20Update%202024_Mumbai_India_IN2024-0026.pdf

Indian economy forecast to grow at 6.6% in 2025-26

The IMF released its revised projections following the

effects of US tariffs across various economies and the

subsequent deals made between countries amid growing

uncertainty. With the effects of tariffs lower than

expected, the IMF projects global growth at 3.2% in 2025,

while slowing to 3.1% the following year.

The International Monetary Fund (IMF) has predicted that

India will continue to be one of the fastest-growing

‘emerging market and developing economies‘ in 2025-26,

growing at a rate of 6.6% according to the World

Economic Outlook (WEO) report. This upward revision is

attributed to strong economic performance in the first

quarter, which has more than offset the effects of

increased US tariffs on Indian goods.

See: https://www.business-standard.com/economy/news/imf-

projects-indian-economy-to-grow-at-6-6-in-2025-26-outpacing-

china-125102500042_1.html

7.

VIETNAM

Wood and Wood Product (W&P) trade

highlights

Vietnam’s W&WP exports in October 2025 reached

US$1.55 billion, the same as in October 2024 of which

WP exports contributed US$1.07 billion, up 14%

compared to October 2024. In the first 10 months of 2025

W&WP exports earned US$14 billion, up 6% over the

same period in 2024 of which WP exports accounted for

US$9.6 billion, up 5% over the same period in 2024.

Vietnam's oak imports in October 2025 were 54,300 cu.m,

worth US$28.8 million, up 4% in volume and 5% in value

compared to September 2025. Compared to October 2024

the imports increased of 79% in volume and 57% in value.

In the first 10 months of 2025 oak imports totalled to

463,500 cu.m, worth US$254.7 million, up 49% in volume

and 41% in value over the same period in 2024.

Vietnam's NTFP exports in September 2025 earned

US$66.4 million, a slight increase compared to August

2025 and 31% over the same period in 2024. In the first 9

months of 2025 NTFP exports earned US$640 million, up

8% over the same period in 2024.

Vietnam W&WP exports to Africa in October 2025 were

valued at US$9 million, up 15% compared to October

2024. In the first 10 months of 2025 W&WP exports to

African markets amounted to US$68.7 million, up 17%

over the same period in 2024.

Vietnam’s office furniture exports in October 2025

amounted to US$35 million, down 2% compared to

October 2024. In the first 10 months of 2025 exports of

office furniture generated US$314 million, up 22% over

the same period in 2024.

Vietnam’s imports of raw wood in October 2025 are

estimated at 530,600 cu.m, worth US$164.5 million, down

5% in volume and 5% in value compared to September

2025 but compared to October 2024, they were up 4% in

volume and 5% in value. In the first 10 months of 2025

imports of raw wood stood at 5.67 million cu.m, worth

US$1.79 billion, up 23% in volume and 20% in value over

the same period in 2024.

Vietnam’s W&WP exports to the EU in October 2025

reached US$56 million, down 2% compared to October

2024. In the first 10 months of 2025 W&WP exports to the

EU brought in about US$504 million, up 15% over the

same period in 2024.

Vietnam’s kitchen furniture exports in October 2025

earned US$120 million, down 5% compared to October

2024. In the first 10 months of 2025 kitchen furniture

exports totalled US$1.18 billion, up 2% over the same

period in 2024.

Vietnam’s imports of raw wood from China in September

2025 amounted to 107,070 cu.m, with a value of

US$30.29 million, up 6% in volume, but down 7% in

value compared to August 2025. In the first 9 months of

2025 imports of raw wood from China reached 1.05

million cu.m, with a value of US$320 million, up 65% in

volume and 26.7% in value over the same period

in 2024.

VIFOREST – 25 Years of growth, vision and a green

future

This year VIFOREST is celebrating its 25th anniversary.

A quarter of a century is more than just a measure of time

it is a story of persistence, transformationandvision.

For VIFOREST, those 25 years mark a remarkable

journey from humble beginnings to becoming the

“conductor” of one of Vietnam’s most dynamic,

sustainable and globally integrated industries.

The seeds of that journey were sown by the late Deputy

Prime Minister Nguyễn Công Tạn, whose foresight gave

birth to VIFOREST with a bold mission: “to revitalise the

wood industry and turn it into a billion-dollar sector.”

At that time, few could have imagined how far the

Vietnamese timber industry would go. Yet, from the first

sawmill hum to today’s modern factories producing world-

class designs, the industry has grown into a global force.

This year exports are expected to reach over US$17

billion, securing Vietnam’s place among the top five wood

and wood product exporters worldwide and second place

wooden furniture and interior manufacturers, just after

China.

Behind those impressive numbers are millions of

hardworking forest growers, thousands of resilient

businesses and countless silent contributions to the

nation’s green growth. Each log, each crafted piece of

furniture carries within it the ingenuity, dedication and

unity of a community that has weathered challenges and

embraced change.

Through global turbulence, from the pandemic and trade

disruptions to the growing urgency of climate change,

Vietnam’s timber industry has shown remarkable

resilience. Exports, once just over US$1 billion in the

early 2000s, soared to US$17.1 billion in 2022. These

milestones are more than economic success stories they

are testaments to the Vietnamese spirit of innovation,

adaptability and perseverance.

But as the world turns its focus toward the green economy,

circular economy and responsible supply chains, new

horizons appear, both challenging and full of promise.

Global standards on traceability, emission

reductionandforest certification are no longer distant

concepts; they are today’s imperatives. For Vietnam, they

signal an opportunity to redefine its wood industry one

that is modern, transparentandvalue-driven.

The 5th Congress of VIFOREST, held in November 2025,

marked a defining moment. Looking toward 2030

VIFOREST sets forth an ambitious vision: to elevate

Vietnam’s wood and forest product exports to US$25

billionandto make the “Wood from Vietnam” brand a

global emblem of quality, responsibility and creativity.

This is not merely about economic targets, it is about

sustaining forests, nurturing livelihoods and contributing

to Vietnam’s Net Zero commitment by 2050.

As it steps into its next chapter VIFOREST remains a

beacon of knowledge, connection and leadership guiding

the industry toward a greener more inclusive future.

From the resilience built over the past 25 years rises a

renewed ambition to see Vietnamese wood not only reach

every corner of the world but also stand as a proud symbol

of sustainability, innovation and national identity.

Source: Ngo Sy Hoai, Vice President and Secretary General of

VIFOREST

VIBE 2025: Celebrating unique designs

The Vietnam Interior & Build Expo (VIBE 2025) held at

the Saigon Exhibition and Convention Center (SECC)

from October 1–4, 2025 brought together 150 enterprises

and 550 booths affirming the strong growth of Vietnam’s

domestic architectural, interior design and construction

sectors. According to Mr. Nguyễn Chánh Phương, Vice

Chairman of the Handicraft and Wood Industry

Association of Ho Chi Minh City (HAWA), this year’s

theme “Next in Space: The Future of Living” offered

Vietnamese businesses in architecture, interior design and

construction an opportunity to redefine living spaces, seize

new opportunities and reshape their development models.

To realise this vision, the organisation of VIBE 2025

centered on four core principles: sustainability,

technology, creativity and locality. As a result, the

exhibition introduced visitors to an innovative and

inspiring display space featuring high-quality products

from unique design styles to next-generation materials

including wood-based products, all reflecting current

domestic and global market trends.

This year, VIBE 2025 introduced a comprehensive

renewal of its event series, with a focus on in-depth

professional seminars to foster knowledge exchange and

inspire creativity. Highlights included:

The V-Talk Forum, where leading experts discussed key

industry challenges and external influences shaping the

future of Vietnam’s architecture and wood industries.

The Continuing Professional Development (CPD)

Workshop, co-hosted by HAWA and the Ho Chi Minh

City Association of Architects, with the theme “Culture –

Material – Technology in Sustainable Architecture 2050.”

Source: Vietnam Architecture & Interior Magazine, Issue

No. 179 – October 2025

Strong Growth in wood pellet exports

In the first eight months of 2025, Vietnam’s wood pellet

exports recorded significant growth, reaching a total value

of US$796 million, an increase of 57% compared with the

same period in 2024. The export volume was estimated at

over 5.46 million tonnes, up 43% year-on-year.

Top export markets

Japan remained Vietnam’s largest export destination,

accounting for 74.6% of total export volume (over 4

million tonnes), equivalent to US$604 million. South

Korea ranked second, accounting for 19% of the total

volume (1.05 million tonnes), valued at US$138 million.

The European Union and other markets accounted for the

remaining sales.

The average export price of Vietnamese wood pellets

during the period reached US$146 per tonne, up 9% from

the same period last year. The continued expansion in both

export volume and value demonstrates the resilience and

competitiveness of Vietnam’s wood pellet industry.

The sector has effectively maintained a stable biomass

energy supply for major Asian markets, particularly Japan

and South Korea, while enhancing its readiness to expand

into the EU and other emerging markets amid the ongoing

global energy transition.

See: /https://mkresourcesgovernance.org/wp-

content/uploads/2025/08/20250607_Vietnam-wood-pellet-

production-and-trade-2024-EN.pdf

8. BRAZIL

Green economy and sustainable development

During the “Agenda SP+Verde Summit” held in São Paulo

the governors of Mato Grosso do Sul and São Paulo

participated in the panel “A New Vision for the Green

Economy” which addressed key topics related to

sustainability, energy transition, infrastructure, production

and logistics.

The event brought together around 10,000 participants

over two days and was structured around four thematic

axes: Green Finance; Resilience and the Future of Cities;

Climate Justice and Sociobio-diversity and Energy

Transition and Decarbonisation.

The forestry sector of Mato Grosso do Sul State was

highlighted as one of the world’s leading forest industry

hubs driven by an unprecedented expansion cycle.

Between 2023 and 2025 private investments have

exceeded R$89 billion focusing on the production of

paper, pulp and MDF, consolidating the state’s position as

a benchmark in the forest-based bio-industry.

The industrial transformation is being led by major global

corporations such as Suzano, Eldorado Brasil, Arauco and

Bracell which have made the State one of the world’s

largest forestry hubs.

The main projects include Suzano’s plant in Ribas do Rio

Pardo (R$23 billion), Eldorado Brasil’s new facility in

Três Lagoas municipality (R$25 billion), Arauco’s

Sucuriú Project in Inocência municipality (R$25.1 billion),

Bracell’s plant in Bataguassu municipality (R$16 billion),

and the expansion of Greenplac in Água Clara

municipality (R$120 million).

Collectively, these investments reinforce Mato Grosso do

Sul’s role as a national reference point in sustainable

development, the bio-economy and forestry innovation.

See: https://www.maisfloresta.com.br/governadores-de-ms-e-sp-

discutem-economia-verde-e-desenvolvimento-sustentavel/

Forestry drives innovation and growth in Brazilian

agribusiness

Brazilian forestry is undergoing a transformation. With

approximately 10 million hectares of planted forests and

the daily planting of around 1.2 million new trees, Brazil

has established itself as a world leader in pulp productivity

and exports which reached US$12.7 billion in 2024

according to the Brazilian Tree Industry (IBÁ).

The sector continues to grow driven by technological

innovation, advances in forest management, favorable soil

and climate conditions and growing domestic and

international demand.

By 2030, five new pulp mills are expected to be

established reinforcing the strategic role of planted forests

in the green economy. The energy transition is also

boosting the sector: corn ethanol plants are increasingly

using forest biomass for power generation.

Corn ethanol production reached 8 billion litres in 2024

(+37% yoy) and is projected to climb to 15 billion litre by

2032.

Currently, corn accounts for 25% of national ethanol

production, a share expected to rise to 40% by 2035 and

this will require tripling the supply of wood chips to meet

the growing energy needs of ethanol plants set to increase

from 24 to 56 facilities over the next decade.

To meet this new demand the forestry sector is adopting

precision technologies and mechanisation, including

remote monitoring, digital mapping and integrated forest

operations management.

Continued progress depends on the training of skilled

professionals and partnerships among government, private

sector and research institutions. More than just exporting

timber and pulp,

See: https://www.maisfloresta.com.br/silvicultura-como-

propulsora-de-desenvolvimento-do-agronegocio/

Contributions to Tropical Forests Forever Fund

The Tropical Forests Forever Fund (TFFF) was launched

by the government of Brazil during the UNFCCC COP30

Leaders’ Summit in Belém on 10 November 2025 as a

global financial instrument aimed at the preservation of

tropical forests.

The fund´s goal is to raise US$125 billion based on an

operational model that combines financial returns with

environmental benefits. Profits will be directed to tropical

forest countries that can demonstrate measurable

reductions in deforestation.

The TFFF´s structure is hybrid, blending public and

philanthropic contributions referred to as “sponsoring

investors”, who assume higher risks to attract estimated

additional US$100 billion in private capital.

The initial fundraising target is US$25 billion from these

‘sponsoring investors’. Among the confirmed

contributions, Norway has pledged up to US$3 billion

over ten years and France has committed US$580 million.

Indonesia and Brazil will each invest US$1 billion,

positioning themselves as the main beneficiaries of the

fund. Other commitments include Portugal, with €1

million and a possible contribution from Germany.

China, the Netherlands and the United Arab Emirates have

expressed their intention to provide financial support,

though specific amounts have yet been disclosed. Despite

the broad international engagement, the United Kingdom,

previously seen by the Brazilian government as a likely

partner, has opted not to contribute at this time.

See: https://capitalreset.uol.com.br/clima/cop/noruega-promete-

us-3-bi-para-fundo-de-florestas-reino-unido-e-alemanha-ficam-

de-fora/?utm_medium=email&utm_campaign=061125_-

_bn_noruega_no_tfff_banner_cop&utm_source=RD+Station

Brazilian forest production reaches record high

In 2024, Brazil’s forest production reached a historic

record of R$44.3 billion, representing a 17% increase

compared to 2023 according to the Brazilian Institute of

Geography and Statistics (IBGE). In addition to the strong

performance of the pulp sector there was notable growth in

production from native forests and of wood products.

Non-timber forest product extraction from native forests

generated R$3.8 billion (+4% yoy) driven by products

such as açaí, Brazil nuts, yerba mate, piassava and latex,

which strengthen the bio-economy and income generation

in the North and Central-West regions.

The states of Pará, Amazonas and Acre led this segment

highlighting the potential of sustainable forest

management as a driver of environmental conservation.

In foreign trade exports of forest-based products including

processed wood, MDF, plywood, reconstituted panels and

pulp totalled US$18.2 billion (+18% yoy). China remained

the main destination followed by the United States and the

European Union.

The sector’s strong performance was supported by the

appreciation of pulp prices in the international market,

high demand for engineered wood and MDF products and

the expansion of sustainability certification which has

improved access to higher value-added markets.

With growing global demand for sustainable practices the

Brazil´s forestry sector has distinguished itself through the

adoption of low-carbon technologies, large-scale

reforestation and digital resource management. The

Brazilian Tree Industry (Ibá) projects R$60 billion in new

investments by 2030, focused on expanding planted forest

areas and innovation in bio-economy.

Despite challenges such as water scarcity, species

diversification and combating informality in logging

Brazil continues its position as a global leader in

sustainable forest economy successfully aligning

economic growth, environmental conservation,

competitive exports, valuation of native forests and

innovation in the timber industry.

See: https://www.maisfloresta.com.br/producao-florestal-

brasileira-atinge-r-443-bilhoes-e-bate-recorde-historico/

9. PERU

SERFOR recognised for promoting new Standard

The National Forest and Wildlife Service (SERFOR)

received recognition for its key role in the development

and approval of the Peruvian Technical Standard NTP-ISO

38200:2023, "Chain of Custody of Timber and Wood

Products," officially adopted by the National Institute of

Quality (INACAL).

These standard guarantee traceability, legality and

sustainability throughout the timber production chain

enabling Peruvian forest products to meet international

certification and responsible trade standards.

NTP-ISO 38200:2023 aligns with the international

standard ISO 38200:2018 facilitating the tracing of timber

origin from harvesting to final sale, thus strengthening the

sector's transparency and credibility.

See: https://www.gob.pe/institucion/serfor/noticias/1277995-

reconocen-al-serfor-por-impulsar-norma-que-asegura-el-origen-

legal-y-sostenible-de-la-madera

Financing opportunities to strengthen forestry and

wildlife sectors

With the aim of publicising the programme, funds and

financing mechanisms available at the national and

international levels and promoting sustainable investments

that drive the development of the forestry and wildlife

sector in Peru, the National Forestry and Wildlife Service

(SERFOR) organised the event “Financing Opportunities

for the Forestry and Wildlife Sector.”

The event showcased proposals, experiences, and success

stories that demonstrated how access to responsible

financing and collaborative work can generate economic

development and environmental sustainability.

See: https://www.gob.pe/institucion/serfor/noticias/1275918-

serfor-presento-oportunidades-de-financiamiento-para-fortalecer-

el-sector-forestal-y-de-fauna-silvestre

ADEX's contribution to sustainability of Peruvian

forest resources

The Wood and Wood Industries Committee of the

Extractive Industries and Services Management Division

of the Association of Exporters (ADEX) has on its agenda

improving the sector's competitiveness, prioritising the

legality and traceability of added value timber products.

Thanks to coordinated efforts with ADEX's Institutional

Relations and Agreements Management, a problem

preventing many companies in the sector from accessing

Drawback (a Peruvian Customs regime that reimburses

exporters for the amount of tariffs paid on imported inputs

used in the production of goods) was resolved.

|