|

Report from

Europe

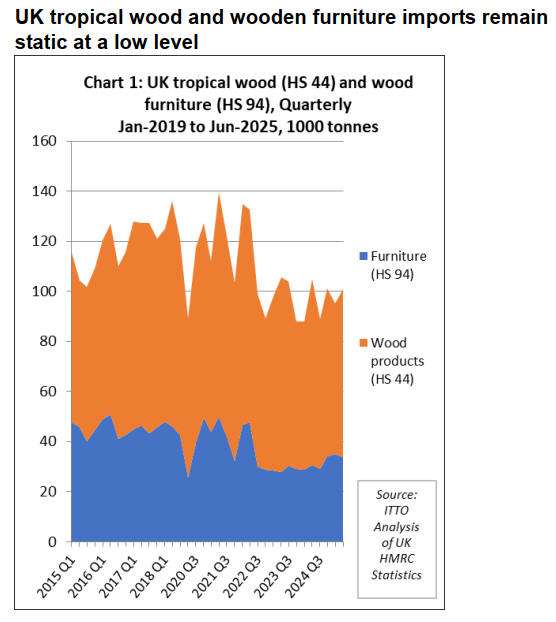

In the first eight months of this year, the UK imported

255,700 tonnes of tropical wood and wooden furniture

products, 1% more than same period in 2024. Import value

in the first eight months this year was US$686 million, 5%

more in nominal terms but only 2% more in real terms (i.e.

taking account of inflation) than the same period in 2024.

Imports were slow in the first quarter this year, down 6%

in quantity terms compared to the final quarter of 2024 but

rebounded by 6% in the second quarter (Chart 1).

UK imports of tropical wood products this year have

essentially continued at the low level maintained since the

end of the COVID pandemic in 2022 and remain around

15% below the pre-pandemic level. While the quantity of

tropical wooden furniture imported into the UK has

increased 13% this year, plywood is down 12% and

joinery, sawnwood and mouldings/decking products have

made only marginal gains of less than 3% against

historically low levels last year.

Tropical products underperformed in UK market this

year

The UK market for tropical wood and wooden furniture

this year has been slower than the wider UK market for

these products. UK import value of wood and wooden

furniture from all supply regions was US$7.56 billion

between January and August this year, 6% more in real

terms compared to the same period in 2024.

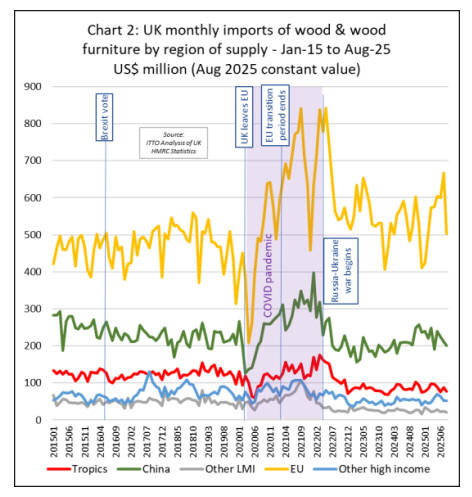

The share of tropical wood and wooden furniture products

in total UK imports declined slightly from 9.4% in the first

eight months of 2024 to 9.1% during the same period this

year. This share is now well down on the 11.4% share

achieved in 2022 and the close to 14% share typical before

the COVID pandemic.

Considering the value of UK imports of all wood and

wooden furniture products in the first eight months of this

year, imports from China were, at US$1.77 billion, 10%

more than the same period in 2024. China’s share of total

UK import value was 24% in the first eight months this

year, up from 23% in the same period last year.

Nevertheless, wood and wooden furniture imports from

the EU continue to dominate in the UK market, rising 5%

in the first eight months of this year to US$4.46 billion.

Imports from the EU accounted for 59% of all UK import

value of wood and wooden furniture in the first eight

months of 2025, marginally down on the 59% share in the

same period last year.

The most notable recent trend in the UK market for wood

and wooden furniture was a step change during the

COVID pandemic as the country became generally more

reliant on regional suppliers inside the EU. Following the

UK’s departure from the EU in 2020, this trend ran

contrary to expectations.

UK imports from China are only now just beginning to

recover from a downturn in the immediate aftermath of the

pandemic and to once again eat away at the dominant EU

market position.

However, imports from the tropics have remained broadly

flat at a lower level during the last three years (Chart 2).

Some small positive signs in gloomy UK economy

The economic picture in the UK remains very patchy.

Statistics for the third quarter of the year were quite

gloomy, notably so in construction, a key driver of UK

timber demand, but some forward looking business

indicators showed signs of improvement in October as

some positive news on inflation raised expectations of an

interest rate cut before the end of the year.

Official figures revealed that the UK economy grew by

0.1% in August 2025, up marginally from a revised

contraction of -0.1% in July. Manufacturing was the main

driver of economic growth, which grew by 0.7%. In

contrast, the services sector saw no growth in August,

amid weaker transport and storage activity and retail

output. Construction output fell by 0.3%, partly reflecting

lower repairs and maintenance activity.

The UK Institute of Chartered Accountant’s Business

Confidence Monitor for Q3 2025 stood at -7.3 on the

index, down from -4.2 in the previous quarter. On this

measure, confidence is now at its weakest level since Q4

2022, having fallen for five consecutive quarters. Record-

high tax concerns are the likely cause, squeezing profit

growth, recruitment and investment activity. Muted

domestic sales growth also weighed on sentiment, as firms

were lowering their expectations for the year ahead.

Particularly worrying for the timber sector, sentiment was

most negative among property businesses (-23.2), amid a

challenging housing market and weak commercial

demand.

Data from CoStar, a firm that monitors Real Estate data in

the UK, shows that construction of offices, shops and

warehouses in the country has now fallen to the lowest

level in more than a decade amid rising build costs and

general uncertainty. All commercial sectors have been hit,

with construction across office, retail and industrial sectors

down by 21% to 5.85m sq metres (63m sq ft) in the third

quarter compared with a year earlier.

This data is particularly concerning at a time UK

housebuilding is also slowing. This year is on course to be

the weakest for construction starts so far this century.

Somewhat more positive is data from the UK Office of

National Statistics which shows that total construction

output increased by 0.3% in the three months to August

2025. While new work fell by 0.4% in the three month

period, repair and maintenance grew by 1.3%. The closely

watched purchasing managers’ index (PMI) for the

construction sector gave a reading of 46.2 for September,

still below the 50-mark separating growth from

contraction, but up from 45.5 in August.

In October, the UK’s overall PMI - published by S&P

Global Market Intelligence - also rose unexpectedly to

51.1, up from 50.1 in September, raising hopes that the

economy may have reached a turning point, particularly as

inflation seems on track to hit the Bank of England’s 2 per

cent target. Manufacturing PMI climbed to 49.6 in

October from 46.2 in September, the highest level in a

year. The services PMI, which measures output in a sector

that generates about 80 per cent of UK GDP, rose to 51.1

from 50.8 over the same period.

According to Chris Williamson, chief business economist

at S&P Global Market Intelligence, the rise in the overall

PMI in October implies that “September was a low point

for the economy from which business conditions are

starting to improve”.

Sharp rise in UK imports of tropical wooden furniture

from Viet Nam this year

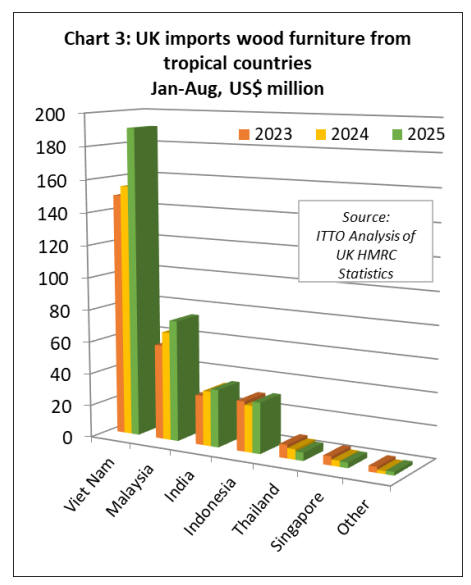

In the first eight months of this year UK imports of

wooden furniture from tropical countries increased 16% to

US$343 million while import quantity increased 13% to

89,800 tonnes.

Wooden furniture imports in the eight-month period

increased particularly sharply from Viet Nam (+23% to

US$191 million) and Malaysia (+12% to US$75 million),

building on the momentum that built up in the second half

of last year.

Imports increased at a slightly slower pace from India

(+5% to US$36 million), and Indonesia (+9% to US$32

million). However, imports declined from Thailand (-20%

to US$5.1 million), and Singapore (-7% to US$3.3

million). UK wooden furniture imports were negligible

from all other tropical countries during the first eight

months of this year (Chart 3).

UK imports of wood joinery products from the EU and

Indonesia fell this year

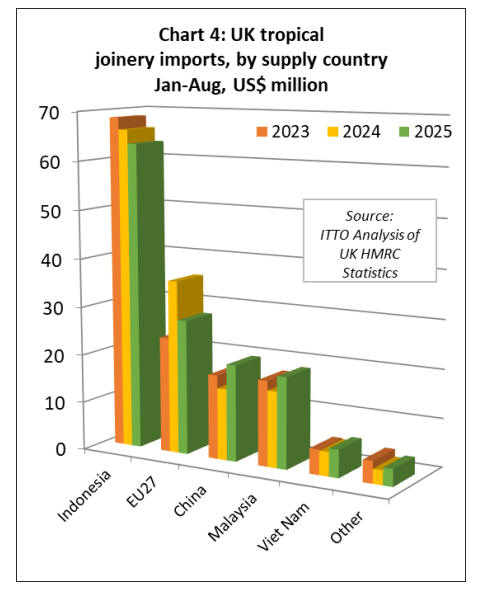

Total UK import value of tropical joinery products

decreased 1% to US$139 million in the first eight months

of 2025, although import quantity increased 3% to 49,100

tonnes. Following a big increase in 2024, imports of these

products from the EU fell 22% to US$28 million in the

first eight months of this year. Imports from Indonesia,

mainly comprising doors, were US$63 million during the

eight-month period, 4% less than the same period last

year.

These declines were partly offset by rising imports of

tropical hardwood joinery products from China (+35% to

US$20 million), Malaysia (+20% to US$19 million), and

Viet Nam (+15% to US$5.7 million) (Chart 4).

UK imports of plywood shifted from China to Malaysia

this year

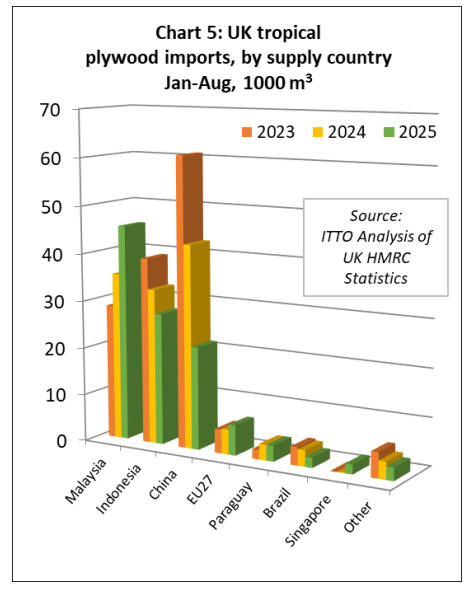

In the first eight months of this year, the UK imported

111,500 cu.m of tropical hardwood plywood, 12% less

than the same period last year. Import value fell more

sharply, by 14% to US$67 million.

However, this was mainly due to a decline in imports from

China. Direct UK imports of hardwood plywood from

tropical countries increased 6% to 83,500 cu.m in the

eight-month period. Imports were up 29% to 45,600 cu.m

from Malaysia and increased from zero to 2,000 cu.m

from Singapore. These gains offset declines of 15% to

27,700 cu.m from Indonesia and of 39% to 2,100 cu.m

from Brazil.

Imports from Paraguay were unchanged from last year at

3,300 cu.m. The UK imported 21,700 cu.m of plywood

with an outer layer of tropical hardwood from China in the

first eight months of this year, 49% less than in the same

period last year. However, UK imports of tropical

hardwood plywood from EU countries increased, by 21%

to 6,400 cu.m during this period. (Chart 5).

Republic of Congo expands share of UK tropical

sawnwood market

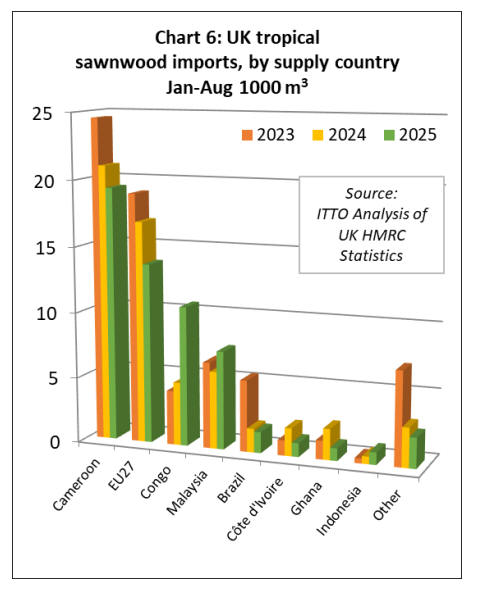

UK imports of tropical sawnwood were 58,000 cu.m in the

first eight months of this year, marginally less than the

58,400 cu.m imported in the same period last year. Import

value was also very close to the same level as last year, at

US$71.2 million, a gain of just 0.2%.

The most notable trend this year has been a sharp rise in

imports from the Republic of Congo which increased

121% to 10,600 cu.m in the first eight months of this year.

A significant increase was also recorded in UK imports

from Malaysia (+27% to 7,500 cu.m).

These gains offset declining imports from Cameroon (-8%

to 19,300 cu.m), Brazil (-11% to 1,600 cu.m), Côte

d'Ivoire (-50% to 1,000 cu.m), and Ghana (-60% to 900

cu.m). Indirect imports from the EU also fell, by 19% to

13,700 cu.m. (Chart 5 above).

The introduction of the log export ban and shift towards

more kiln dried production by some leading exporters in

the Republic of Congo has been particularly critical to

expansion of the UK market which has no hardwood

processing capacity of its own.

This trend also partly explains the decline in UK imports

of tropical sawnwood from the EU this year as more kiln

dried product is being imported direct from the Republic

of Congo instead of being shipped first to the EU for

drying.

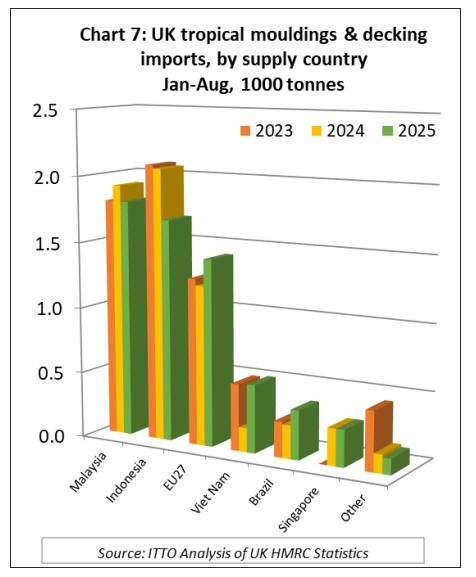

UK imports of tropical hardwood mouldings/decking

increased 2% to 6,200 tonnes in the first eight months of

this year. However, import value fell 0.5% to US$16.7

million.

Import quantity declined from the two largest suppliers,

Malaysia (-6% to 1,800 tonnes) and Indonesia (-18% to

1,700 tonnes). However, imports increased from Viet Nam

(+180% to 500 tonnes) and Brazil (+48% to 400 tonnes).

Imports of tropical mouldings/decking imports from the

EU also increased, by 17% to 1,400 tonnes (Chart 7).

Postponement of EUDR implementation unlikely - EC

publishes proposal to amend regulation

On 21 October, the European Commission (EC) published

its proposal to amend the EU Deforestation Regulation

(COM(2025)652). The EC is no longer proposing a delay

to EUDR and the implementation date remains 30

December 2025.

However, some other specific adjustments to the timeline

for application of the law are proposed, alongside several

“targeted simplifications” designed to reduce obligations

on certain categories of EU operator. The proposal still

needs to be approved by both the European Parliament and

the Council before it can enter into force. The relevant

documents may be accessed here:

See:

https://ec.europa.eu/commission/presscorner/detail/en/ip_25_2464

Two specific adjustments to the timeline are proposed by

the EC:

“Micro and small” EU operators would have until

30 December 2026 to comply. This concession

would apply only to EU operators with net

turnover of up to EUR 10 million and average 50

employees. It would not apply to medium or large

sized operators above these thresholds.

EU Member States will only begin checks on

operators and applying enforcement measures

after 30 June 2026. In the interim, regulators may

issue warnings to operators, accompanied by

recommendations to achieve compliance, where

they “become or are made aware of non-

compliance”, but they wouldn’t apply sanctions.

Overall, the changes now proposed by the EC, even if

passed, fall short of expectations raised in some quarters

following the EC’s suggestion in September that EUDR

would have to be delayed for another year and that the law

may be amended.

The proposed 12 month delay for “micro and small” EU

operators is probably only of limited relevance to

exporters of tropical hardwood products since most

importing companies in the EU are above the size

threshold. Therefore, even with the change they would still

be obliged to collect and enter their due diligence data

onto the EU Information System from 30 December this

year.

The six month delay to enforcement is probably more

significant for the tropical wood industry as it gives more

time for EU importers and their suppliers to finalise and

refine their own data management systems and procedures

without risk of falling foul of the regulation in the first six

months of application.

Other changes proposed to the legislation are designed

almost exclusively to simplify application inside the EU.

The EC is proposing to remove the requirement for so-

called “micro and small primary operators” to submit a

due diligence statement in the information system with

each harvest and instead to submit a “one-time simplified

declaration”. This one-off document would include the

“geolocation or the postal address of all plots of land

where the relevant commodities are produced”.

The EC press statement accompanying the EC proposal

suggests that this “simplification” applies to “micro and

small primary operators in low risk countries worldwide”.

However, its relevance to producers outside the EU is

greatly constrained by the fact that it would only apply to

products which “they (i.e. the forest owners) themselves

produce”. Therefore, logs exported directly by small forest

operators in a “low risk” country might conceivably meet

the requirement, but no product that is processed,

manufactured, or traded by any intermediary outside the

EU.

The change in requirement would therefore, almost

exclusively, be of benefit only to small forest operators

and farmers inside the EU. In fact, EC press release states

that this new category of operator covers “close to 100%

of farmers and foresters in the EU”.

The other major “simplification” proposed, this being

entirely restricted to the internal EU market, is the

introduction of a new sub-category of operator called a

"downstream operator".

Downstream operators would no longer need to undertake

any due diligence or, if a SME, to enter any data on the

EUDR Information System. Their obligation would extend

only to passing on the reference numbers of due diligence

statements or declarations received from their suppliers on

to their customers.

The new “downstream operator” category would capture a

large proportion of existing EU operators under EUDR,

being defined as those which “place on the market or

export relevant products made using relevant products, all

of which are covered by a due diligence statement or by a

simplified declaration".

Instead of requiring due diligence statements to be

prepared at every point of transformation inside the EU

(that is by mills/manufacturers of all types of lumber, pulp,

paper, joinery, furniture etc), as previously required, this

proposed change would reduce the burden on the EU

wood product manufacturing sector.

The EU’s existing non-legally binding guidance was

already heading in this direction, but the introduction of a

new category of ‘downstream operator’ would make

explicit the shift away from requiring transfer of

geolocation data and mandatory due diligence throughout

the supply chain for EU-produced and traded goods.

The next plenary of the European Parliament is 12–13

November 2025 in Brussels and it is likely that the

proposal will be voted on then.

|