US Dollar Exchange Rates of

25th

October

2025

China Yuan 7.12

Report from China

Wood-based panel Industry during "15th Five-Year

Plan"

The output of wood-based panels in China was 349

million cubic metres representing a year-on-year growth of

4% in 2024. The consumption of wood-based panel

products was approximately 330 million cubic metres,

increasing by 3.5% year-on-year.

The output value of China's wood-based panel products

has generally shown an increasing trend over the past 10

years with an average annual growth rate of 3%. China has

become one of the world's largest producers, consumers

and traders of wood and bamboo processing products.

The period of the 15th Five-Year Plan is a crucial time for

laying a solid foundation and making all-out efforts to

basically achieve modernisation. It is also an important

window for the wood-based panel industry to shape new

drivers of development and form new competitive

advantages.

The development of China's wood-based panel industry is

confronted with both opportunities and challenges but the

favorable conditions outweigh the unfavorable ones. The

general trend of high-quality development in wood-based

panel industry has not changed and the "timing" and

"trend" of development still creates an advantage.

Focusing on the ecological board industry, promoting the

optimisation of varieties, consolidating the foundation of

quality, enhancing brand influence and driving the

transformation and upgrading of wood-based panel

industry towards high-value, intelligent, green and

functional directions are key in achieving high-quality

development.

At present, the output of wood-based panel products in

China generally shows a phenomenon of oversupply.

Especially in the particleboard industry there is a situation

of overheated investment.

The extremely rapid growth of particleboard production

capacity has led to an overcapacity in a short period of

time. Resolving the temporary imbalance between supply

and demand in production capacity is the top priority. It is

suggested that more attention should be paid to green and

low-carbon development of wood-based panel industry

and it is believed that this will be a new track for the

transformation and upgrading of panel enterprises.

Experts suggest that wood-based panel production should

be determined by sales to bring prices back to rationality.

The importance of product quality and development of

high-value products along with serious analysis of markets

could lead to expanded applications of wood-based panel.

Through the dual efforts of policy innovation and resource

integration enterprises could promote the transformation

of industries to the advanced form of processing and

diversified integration.

See:

https://www.forestry.gov.cn/lyj/1/lcdt/20251022/646008.html

Large timber market planned for Qiandongnan

Prefecture

The administration in Qiandongnan Prefecture plans to

invest RMB1 billion to launch the Qiandongnan Timber

Market Construction Project further promoting the

transformation of the prefecture's forest resource

advantages into industrial advantages through extending

the industrial chain and increasing the added value of

products.

It has been reported that the project covers an area of more

than 33 hectares and is planned to build three core

sections: a wood processing zone, a trade logistics centre,

and a science and technology innovation centre. The

facility will create a modern wood industry cluster

integrating production, processing, sales and research &

development and help Qiandongnan Prefecture become an

important wood industry cluster in the southwest region of

China.

Data shows that the total volume of timber harvested in

the entire Prefecture reached 3.51 million cubic metres and

wood processing enterprises consumed 1.39 million cubic

metres of logs in 2024.

By the end of 2024 there were a total of 333 wood

processing enterprises in normal production and operation

throughout the prefecture.

The industrial output value of large-scale wood processing

enterprises in the entire Prefecture reached RMB1.685

billion in 2024, becoming an important support for local

economic development.

After the completion of the Qiandongnan Timber Market

Construction Project it is expected that the annual wood

processing capacity will reach 1 million cubic metres, the

annual transaction value will exceed RMB5 billion and it

will directly create more than 3,000 jobs.

Through the development of enterprises in the upstream

and downstream secors an integrated pattern of raw

material supply, production and processing, trade

circulation, scientific research & development and display

and sales will be formed promoting the transformation of

Qiandongnan Prefecture from a "major timber resource

prefecture" to a "strong timber industry prefecture".

The project will also drive the development of supporting

service industries such as logistics, finance, e-commerce

and packaging in the surrounding areas becoming a new

engine for regional economic growth and an important

support for rural revitalisation.

Qiandongnan Miao and Dong Autonomous Prefecture

(referred to as Qiandongnan Prefecture) is an autonomous

prefecture under the jurisdiction of Guizhou Province. It is

located in the southeast of Guizhou Province. It has a total

area of 30,282 square kilometres and governs 1 county-

level city and 15 counties. By the end of 2023, its

permanent resident population was 3.76 million, with

ethnic minorities accounting for 82%, mainly the Miao

and Dong ethnic groups.

In 2024, the regional GDP reached RMB143 billion,

growing by 6%. It is a national-level ethnic cultural and

ecological reserve, renowned as the "Prefecture of Songs

and Dances" and the "Hometown of a Hundred Festivals"

and boasts abundant natural and cultural landscapes.

Home furnishing industry still has structural growth

opportunities

Regarding the future development prospects of the home

furnishing industry the market for home furnishs is huge

but the contribution of leading brands is not high. There

are still structural growth opportunities and enterprises are

full of confidence in the development prospects of the

furniture industry and are optimistic about the long-term

development opportunities of the industry.

In terms of overseas market development, the US tariff

policy will have a negative impact on the foreign trade in

the short term. However, companies are increasing

efficiency and capacity expansion of its bases in Vietnam,

Mexico and also in the United States.

The impact of the national subsidy policy on boosting

consumption has also drawn much attention.

Since the implementation of the national subsidy policy in

2024 it has played a significant role in stimulating home

furnishing consumption. However, since the second

quarter of 2025 the impact of the national subsidy has

slowed.

The main drivers of profit growth in the sector will depend

on enterprises actively promoting internal ‘lean’

production and cost-effectiveness to enhance internal

operational efficiency. On the other hand, efforts will be

made to intensify technological innovation.

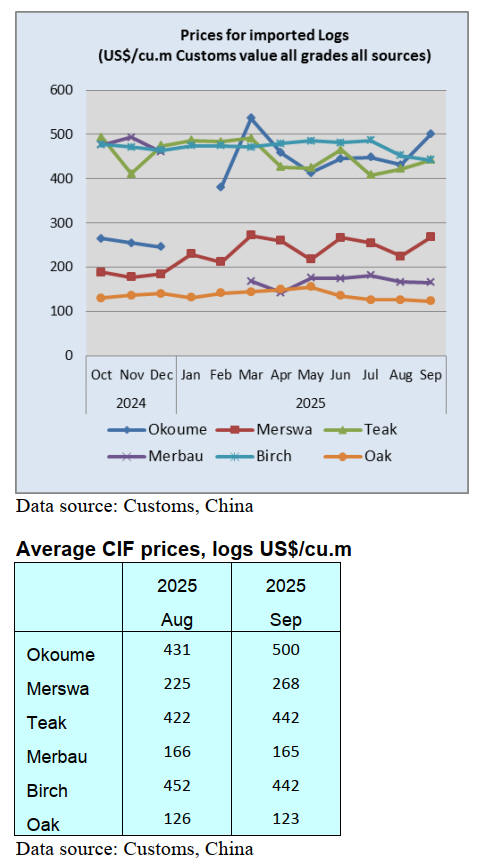

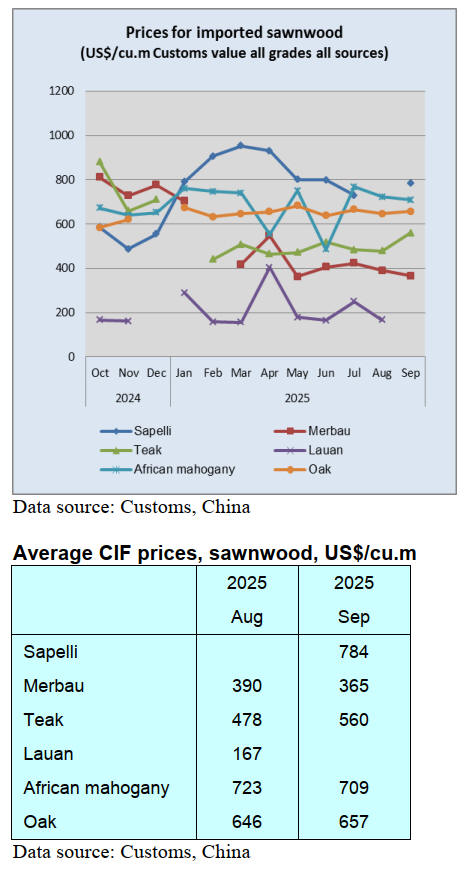

China - September Global Timber Index

Data from China's General Administration of Customs

showed that China's cumulative imports of logs and

sawnwood between January to August 2025 reached 37.50

million cubic metres, representing a year-on-year decrease

of 13%. The total import value amounted to 54.54 billion

yuan, down 16%.

In September six authorities, including China's Ministry of

Industry and Information Technology jointly issued the

"Work Plan for Stabilising Growth in the Building

Materials Industry (2025-2026)", which proposes demand-

side measures such as promoting the use of green building

materials in rural areas and matching the "Good Housing"

initiative to stimulate the domestic market.

The Plan seeks to integrate the building materials industry

into green building development and the national dual-

carbon goals and sets a target to generate over 300 billion

yuan in revenue from green building materials by 2026.

In other news, a report on the economic performance of

China's furniture industry in the first eight months released

by the China National Furniture Association showed that,

driven by a series of government policies, the domestic

consumer market remained active with positive growth.

While the furniture exports continued to decline year-on-

year, the overall performance still remained higher than

the level seen during the same period in 2023.

In September 2025 the GTI-China index registered 51.7%,

an increase of 0.9 percentage point from the previous

month and was above the critical value (50%) for 2

consecutive months indicating that the business prosperity

of the timber enterprises represented by the GTI-China

index expanded from the previous month.

In September both production volume and new orders

(domestic and international) in China's timber sector

showed slight growth compared to the previous month.

As for the twelve sub-indexes, eight indices (production,

new orders, export orders, purchase quantity, purchase

price, import, employees and market expectation) were

above the critical value of 50%, while the remaining four

indices (existing orders, inventory of finished products,

inventory of main raw materials and delivery time) were

below the critical value.

Compared to the previous month the indices for new

orders, export orders, purchase quantity, purchase price,

import, employees and market expectation increased by

0.8-5.9 percentage point(s) and the indices for production,

existing orders, inventory of finished products, inventory

of raw materials and delivery time declined.

See: https://www.itto-

ggsc.org/static/upload/file/20251022/1761099830162631.pdf

|