Japan

Wood Products Prices

Dollar Exchange Rates of 25th

October

2025

Japan Yen 152.87

Reports From Japan

Fight against inflation the top priority

Prime Minister Sanae Takaichi devoted her first policy

speech on her suggestions for boosting Japan’s economy

and tackling inflation along with her plans to make Japan

more assertive on security. More than half of the 20-page

speech was dedicated to economic policies. Takaichi made

the case for fiscal expansion to create a strong economy,

describing the fight against inflation as the top priority of

her administration. “In order to build a strong economy,

we will implement strategic fiscal spending under the

approach of responsible and proactive fiscal policy,”

Takaichi said in parliament.

See:

https://www.japantimes.co.jp/news/2025/10/24/japan/politics/tak

aichi-first-policy-speech/

Bank of Japan - interest rate unchanged

The Bank of Japan (BoJ) Policy Board met in late October

at a time when consumer prices, excluding fresh food, rose

2.9% from a year earlier in September, up from 2.7% in

August and accelerating for the first time in four months,

according to the Ministry of Internal Affairs. Despite this

the BoJ left its benchmark interest rate unchanged.

The pace of inflation would appear to have support an

interest rate increase by the BoJ. The Consumer Price

Index, the main inflation related data, has hovered around

the BoJ’s 2% target for three and a half years.

However, Taro Saito, Head of Economic Research at NLI

Research Institute, suggested that the main driver of core

inflation was the impact from last year’s bigger energy

subsidies and this was not enough justification for a BoJ

rate increase.

Utility subsidies have been implemented to help

households cope with the hottest summer on record from

July to September. But its impact on inflation figures

generally has a lag of a month and the scale of this year’s

electricity subsidies was about 40% smaller than last

year’s.

BoJ Govenor, Kazuo Ueda, highlighted food inflation as

one of three factors to watch in deciding the timing of the

bank’s next rate increase along with the US economy and

the impact of US tariffs.

Signs of recovery in private consumption

Japanese household spending rose at a faster pace than

expected in August government data showed, with

consumers feeling relatively optimistic, a promising sign

for the recovery in private consumption. Consumer

spending rose 2.3% from a year earlier, up for the fourth

consecutive month.

An increase in travel and transportation expenditure, partly

a reflection of pent-up demand from the same month last

year, contributed to the rise in spending.

Consumption and wage trends are also among key factors

the BoJ is monitoring to determine the timing of the next

rate hike.

See: https://www.reuters.com/world/asia-pacific/japan-august-

household-spending-rises-23-yearyear-2025-10-06/

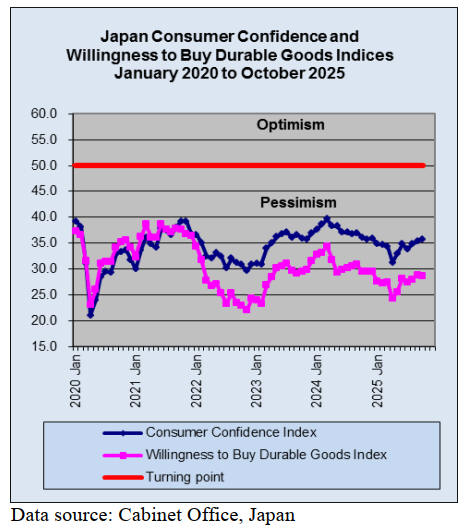

Consumer confidence indices all positive

Japan’s consumer confidence index rose to 35.8 in

October 2025 from 35.3 in September, surpassing market

forecasts. All components improved: overall livelihood

(34.3 vs 33.2 in September), income growth (40.0 vs

39.4), employment outlook (40.1 vs 39.9) and willingness

to buy durable goods (28.9 vs 28.8)

See: https://tradingeconomics.com/japan/consumer-

confidence/news/496964

Union to demand minimum 5% wage increase

The Japan Trade Union Confederation, also known as

Rengo, has announced its decision to demand a wage

increase of at least 5% in the 2026 spring annual labour-

management negotiations, maintaining the same target as

this year to sustain momentum amid persistent inflation.

In its basic policy for the 2026 "shunto" wage talks Rengo

said it aims for a real wage increase of 1%. Rengo also

said it will seek a minimum hourly wage of 1,300 yen or

higher, up from this year's negotiations.

In the 2025 negotiations, Japanese firms agreed to raise

wages by an average of 5.25% marking the second

consecutive year that exceeded 5%.

See:

https://mainichi.jp/english/articles/20251024/p2g/00m/0bu/0140

00c

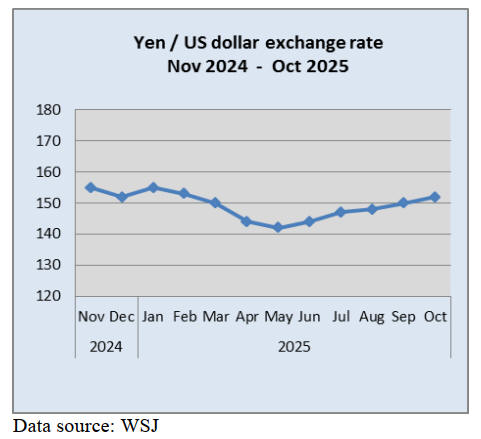

Weak yen a headache for policymakers

Japan's new Economic Revitalisation Minister, Minoru

Kiuchi, said a weak yen benefits the economy and its

demerits could be addressed by swiftly compiling a

package of steps to ease the pain from rising living costs.

He also said the new administration's priority would be to

accelerate economic growth so that the benefits of

recovery can be delivered to the broader population. These

remarks highlight the focus of the new administration on

reflating the economy through expansionary fiscal

policies.

The weak yen has become a political headache for

policymakers in Japan as it pushes up import costs and

broader inflation. The BoJ's exit from a decade-long,

massive stimulus in 2024 and two interest rate hikes came

amid political calls for action to combat sharp exchange

rate declines.

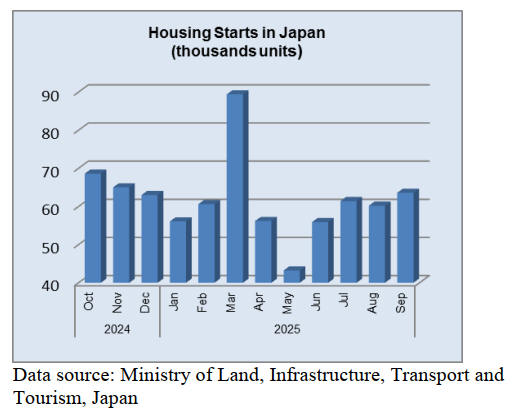

Rural and urban house price disconnect

Key issues in Japan's housing sector include a shrinking

and aging population leading to a rise in the number of

vacant homes, particularly in rural areas. At the same time

there is currently a boom in prices in urban centres due to

limited supply and investment from wealthy individuals

and foreign buyers.

Other major challenges are the increasing cost of

construction due to material and labour price hikes and

potential government intervention to control the market.

Housing complex for foreign workers in Niseko

Hokkaido authorities have approved converting farmland

in Kutchan Town to construct a large shared housing

complex for around 1,200 foreign workers in

the Niseko resort area. Niseko is one of the world's top ski

destinations.

The prefectural government said the developer's plan met

legal and environmental standards, with minimal impact

on nearby farmland. The town expects the complex to

accommodate up to 1,200 foreign workers employed at

local resorts during the winter season. That number is

equivalent to nearly 10% of Kutchan's population of about

14,000 as of August.

https://japan-forward.com/hokkaido-approves-massive-foreign-

worker-housing-project-despite-concerns/

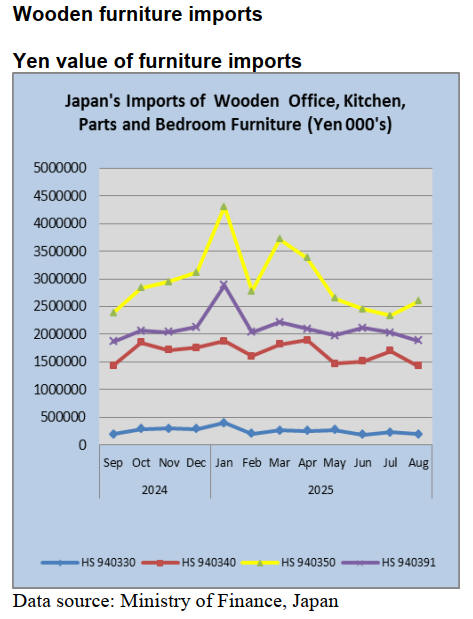

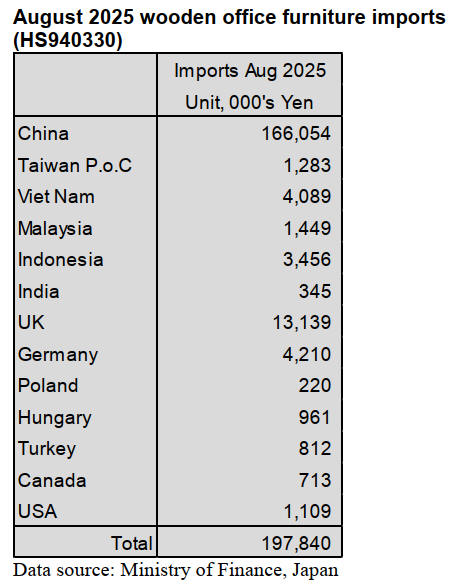

Wooden office furniture imports (HS940330)

In August two shippers, China and the UK accounted for

91% of Japan’s imports of wooden office furniture

(HS940330). August marked the first time the UK

appeared in Customs data as a major shipper. The other

main shipper in August was Germany. In August, shippers

in China accounted for 84% (79% in July) of Japan’s

imports of wooden office furniture. Year on year, the

value of Japan’s imports of wooden office furniture in

August declined as it did month on month.

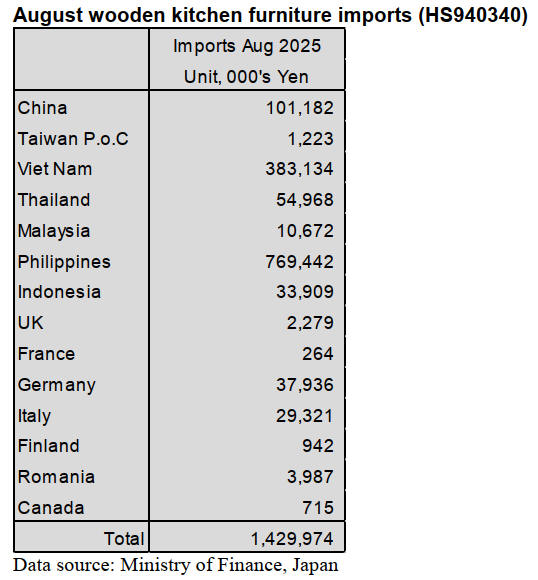

Wooden kitchen furniture imports (HS940340)

Year on year the value of wooden kitchen furniture

imports was at around the same level as in August 2024

but compared to a month earlier the value of imports

declined after two months of increase.

As in previous months August imports of wooden kitchen

furniture (HS940340) were dominated by shippers in the

Philippines (54% of HS940340 imports) and Viet Nam

(27% of HS940340 imports). August arrivals from both

the Philippines and Viet Nam declined compared to a

month earlier. The value of August arrivals from China

(7% of the total) was below that reported in July.

In August there were significant shipments originating in

Thailand, Germany, Indonesia and Italy.

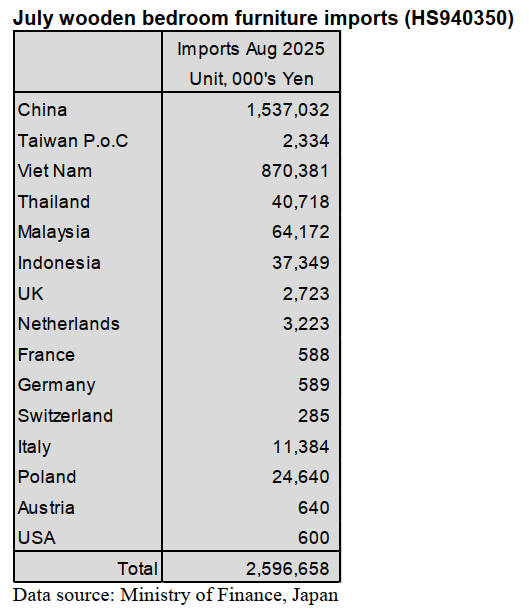

Wooden bedroom furniture imports (HS940350)

After the four consecutive months of decline the value of

wooden kitchen furniture imports rose 11% in August

back to the same level as seen in the first quarter of the

year but still well below the average for the past eight

months.

The top two shippers of HS940350 to Japan in August

were China, 59% (64% in July) and Viet Nam 29% (29%

in July). Shippers in Malaysia improved their market share

to 4% of imports compared to 2.5% in July. The other top

sources of August imports were Thailand, Indonesia,

Poland and Italy.

Year on year there was an 7% increase in the value of

August imports and an 11% increase compared to a month

earlier.

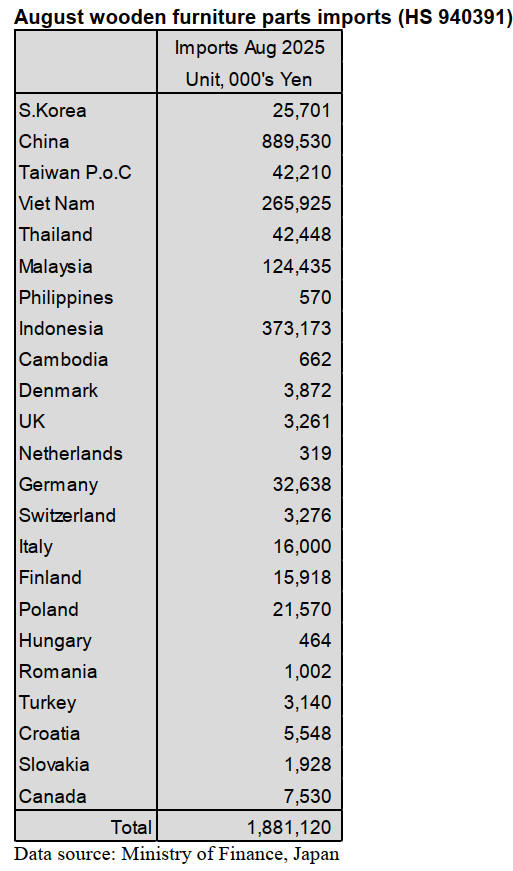

Wooden furniture parts imports (HS940391)

Apart from the spike in the value of wooden furniture

parts (HS940391) imports in January the monthly value of

imports of wooden furniture parts remained steady up to

June but thereafter there has been a slight decline.

The value of August 2025 imports was slightly lower (7%)

than reported in July but compared to August 2024 there

little change.

Shippers in China and Viet Nam accounted for most

(61%) HS940391 imports in August 2025. The value of

imports from China dropped compared to July while the

value of imports values from Viet Nam remained at

around the same level as in July.

Of the total value of HS940391 imports, 47% was

delivered from China (46% in July), 20% from Indonesia

(18% in July), 14% from Viet Nam (12% in July).

Malaysia, which secured an 7% share of July imports, was

the fourth ranked source in terms of value. Imports of

HS940391 from Germany Italy and Hungary declined in

August mainly because of EU factory closures for

holidays.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR. For the JLR report

please see: https://jfpj.jp/japan_lumber_reports/

Japan’s forestry budget targets timber growth

The Forestry Agency has requested ¥345.762 billion for

fiscal 2026, a 12.7% increase from the previous year’s

initial budget.

The proposal emphasizes achieving net-zero

emissions by

2050, addressing pollen-related health concerns, and

advancing the “Forest Nation, Wood City” vision. The

allocations include ¥231.7 billion for public works such as

forest maintenance and erosion control, and ¥114.012

billion for non-public projects, maintaining a 2:1 funding

ratio.

The budget highlights four priority areas: green growth in

forestry and wood industries, forest conservation, erosion

control, and rural revitalization. Notable increases include

¥18.2 billion for green growth initiatives and ¥148.5

billion for carbon sink enhancement and wildfire

prevention.

It also includes ¥1.1 billion for pollen-related measures

and requests tax revisions to support forest management

and fuel cost relief.

Acquisition of shares in French plywood manufacturer

Nankai Plywood Co., Ltd. in Kagawa Prefecture

announced its full acquisition of shares in a French

company engaged in plywood manufacturing. As part of

the deal, the company and its four subsidiaries will

become consolidated subsidiaries, while one equity-

method affiliate will be added to Nankai’s equity-method

affiliates.

The Joubert Group, whose shares are being acquired in

this transaction, is the second-largest plywood

manufacturing group in France. The group includes two

subsidiaries engaged in plywood manufacturing and sales,

one subsidiary involved in veneer production, one equity-

method affiliate, and one subsidiary dedicated to

afforestation.

The company's strength lies in the high quality of its

manufactured plywood, which is primarily made from

okoume and poplar wood species. For the fiscal year

ending December 2024, consolidated net sales amounted

to ¥12.708 billion, based on an exchange rate of ¥170 per

euro. The company also aims to utilize the acquisition as a

sales channel for construction materials such as LVL,

which are scheduled to be produced by its Indonesian

subsidiary, thereby enhancing profitability.

Plywood

Since September, domestic softwood plywood has seen

some improvement in distribution activity, but real

demand remains sluggish due to stagnation in new housing

starts.

Major plywood manufacturers continued to strengthen

their intention to raise prices in September for

domestically produced structural softwood plywood (12

mm thick, 3×6 size). However, amid weak demand, some

plywood manufacturers have taken a cautious stance,

resulting in a lack of alignment across the industry.

In the Tokyo metropolitan area, the prevailing price is

around ¥1,100 per sheet (delivered to wholesalers), up

approximately ¥10 from the previous month.

Shipments of imported South Sea plywood have also

generally been sluggish. Due to weak demand, price

increases have not been progressing.

Domestic prices are as follows: painted formwork

plywood (12 mm thick, 3×6 size) is ¥1,800–1,850 per

sheet (delivered to wholesalers); standard formwork

plywood is around ¥1,550 per sheet; and structural

plywood is also approximately ¥1,550 per sheet.

Standard plywood is priced approximately as follows:

¥780 per sheet for 2.5 mm thickness, ¥930 for 4 mm, and

¥1,100 for 5.5 mm (all delivered to wholesalers).

Major plywood manufacturers in Sarawak, Malaysia

appear to have reached a plateau in their price hikes

around September.

Meanwhile, standard plywood, all-natural varieties,

producers have increasingly firm in their stance. The

original prices remain flat compared to the previous

month: painted formwork plywood (12 mm thick, 3×6

size) is priced at US$600–610 per cbm (C&F), standard

formwork plywood at US$500–510, and structural

US$510–520. In contrast, standard plywood showing an

upward trend, with 2.4 mm thick (3×6 size) at around

US$970, 3.7 mm at approximately US$880, and 5.2 mm at

about US$850 (all C&F).

|