|

1.

CENTRAL AND WEST AFRICA

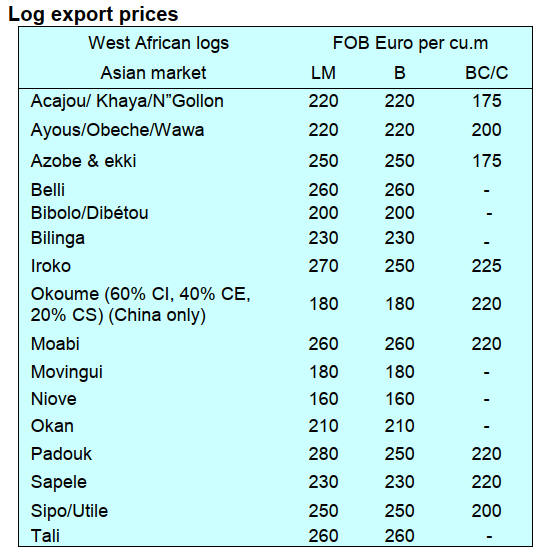

Production levels generally remain low

The African timber sector enters the final months of 2025

under heavy pressure from both domestic financial

challenges and weak international demand. Across the

region production levels remain low while prices are

largely flat due to sluggish export orders.

Global demand remains muted, China’s continued

slowdown, competition from Brazilian softwoods and a

flat European market are collectively restricting export

growth for African producers.

Producer perceptions of international demand

China remains the most critical weak link in global

tropical timber demand. The Chinese government has not

announced any new stimulus measures for the housing and

construction sectors leaving the market flat. Import

volumes of Okoume and Okan remain sharply reduced as

the volume of landed stocks is said to be high.

Demand in India is seen as stable with steady imports of

peeled veneer and Padouk sawnwood. While demand is

consistent prices are under pressure due to competition

from lower-cost Southeast Asian suppliers.

Phillipine imports from African suppliers have slowed

considerably. It has been suggested that buyers are seeing

competitive pressure from Indonesian suppliers offering

product at attractive prices.

Middle East markets are under increasing competitive

strain from Brazilian kiln-dried sawn pine effectively

displacing several West African hardwood species.

The European market remains unchanged and subdued.

Demand is limited to niche certified species, with little

sign of recovery in the short term. Buyers are operating

mainly on replacement-level purchasing, avoiding

speculative contracts.

Gabon

Analysts report the situation in Gabon has become

increasingly tense and financially strained. The Forestry

Ministry and the Presidency are actively addressing unpaid

taxes in the forestry sector. Some major operators are

reportedly unable to pay the 40% settlement demanded on

outstanding arrears of over 5 billion FCFA. This has led to

suspension of operations and to layoffs. There is a mood

of uncertainty in the timber industry.

Adding to the strain the 2026 Finance Law is expected to

introduce further tax increases. These will come at a time

when the sector needs relief and liquidity support.

Producers are calling the situation a “disaster,” and

investment confidence is fading rapidly.

A Presidential Task Force has been established to audit

and enforce financial compliance across the forestry

sector. It has been reported that the first round of

inspections revealed large-scale arrears on land taxes,

transfer charges and social welfare contributions. Reports

indicate that some companies have negotiated releases

from shutdowns after partial payments while others are

resorting to temporary layoffs, paying only 30% of salaries

during suspension periods.

With ongoing rains, forest accessibility remains limited.

Harvesting continues at low levels and electricity

disruptions persist affecting commercial operations.

Export activity is slow and Okoume stocks at Nkok remain

high.

The government continues to promote 3rd and 4th level

transformation targeting plywood and furniture production

initially for domestic consumption. However, operators

say it will be difficult to be competitive in furniture

manufacturing due to very low priced imports.

Cameroon

October saw heavy rainfall in Cameroon which slowed

operational activity as roads become increasingly

impassable, however, mill stocks are said to be sufficient.

Flooding in northern Cameroon and along the Chad border

has caused severe damage to housing and transport

infrastructure.

Transport on laterite roads is controlled when the rain pose

a risk, traffic is prohibited during rainfall to prevent

further deterioration. This continues to delay timber

transport from the interior regions. Rail transport remains

operational and stable with no major disruptions reported.

Sawmills continue to operate but at reduced levels due to

lower demand and challenging logistics. Many operators

are limiting milling to satisfy only existing contracts.

Operations in Douala and Kribi Ports are functioning

normally, though vessel congestion occasionally delays

berthing. Container availability is reported as satisfactory

and there are no major logistical issues at the ports.

No major regulatory changes were introduced in October

but operators report delays in permit renewals, inspection

processing and processing of customs documentation.

CITES compliance checks and EUTR-related

documentation requests remain strict.

Overall, export prices in Cameroon remain stable but

export volumes have declined as buyers avoid long-term

contracts.

The recent re-election of President Paul Biya has not yet

translated into market confidence with operators and

investors largely holding back on new commitments

pending clearer signals from the government.

Republic of the Congo

The Congo has for months been preparing for presidential

elections in 2026 and the business climate is said to be

cautious with operators are holding back on capital

investments and expansion plans until after the election.

Unlike Gabon and Cameroon, harvesting in the Congo

continues despite seasonal rains. Export volumes are

moderate, with operators increasingly focusing on

European species as Chinese demand remains weak.

Rail operations are said to be stable but the overall

logistics network is under stress due to heavy port

congestion.

The Port of Pointe-Noire, Congo’s main timber export

hub, is experiencing a severe backlog of vessels. Shipping

delays are increasing costs significantly. Authorities have

acknowledged that port expansion is urgently required and

discussions are ongoing with Chinese partners to finance

an extension project. Despite congestion, container

availability remains sufficient and exports continue, albeit

at slower turnover rates.

Congo’s forestry sector remains one of the most structured

and controlled in the region and government agencies are

strictly enforcing compliance with CITES and EU

regulations.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

See: https://www.itto-

ggsc.org/static/upload/file/20251022/1761099830162631.pdf

2.

GHANA

Small-scale mining licenses revoked

The Minister for Lands and Natural Resources (MLNR),

Emmanuel Armah-Kofi Buah, has revoked 278 small-

scale mining licenses across the country over regulatory

breaches and the expiration of operating permits.

According to Paa Kwesi Schandorf, the Media Relations

Officer at the Ministry, the decision forms part of the

Ministry’s ongoing efforts to enforce regulations in

Ghana’s small-scale mining sector.

The revoked licenses include those belonging to operators

who failed to comply with key environmental and safety

standards or who continued operations after their permits

had expired.

The move underscores the Minister’s commitment to

enforcing discipline and accountability in the small-scale

mining industry which has been plagued by illegal

operations and environmental degradation in recent years.

Since assuming office the Minister has initiated a

coordinated multi-pronged approach including the setting

up of the Blue Water Guards and National Anti illegal

Mining Operations Secretariat (NAIMOS) to combat

illegal mining and environmental destruction. He has

called for a concerted and shared effort from civil society,

the private sector and all Ghanaians to help protect the

country’s remaining forest resources and water bodies

from further depletion.

Meanwhile, the office of the Attorney-General is currently

prosecuting over 1,500 cases of illegal mining, commonly

known as galamsey and to expedite these legal processes,.

See: https://www.myjoyonline.com/lands-minister-revokes-278-

small-scale-mining-licenses-over-regulatory-breaches/

Strengthen collaboration - advisory board observes

operations of the Commission

The Ministerial Advisory Board to the Ministry of Lands

and Natural Resources (MLNR) paid a working visit to the

Forestry Commission (FC) to familiarise itself with the

operations of the Commission and strengthen

collaboration between the Ministry and its key

implementing agency.

The visiting team comprised members of the Board, the

Secretary and support staff. They were received by the

Chairman of the FC Board, Professor Martin Oteng-

Ababio, along with the Acting Chief Executive, Dr. Hugh

C. A. Brown, his deputies and members of the Executive

Management Team.

In his welcoming address, Professor Oteng-Ababio

appealed to the Advisory Board for logistical support to

help the Commission effectively address its operational

challenges to deliver on its mandate. These included

security threats posed by heavily armed illegal miners,

insufficient funding for reclamation and reforestation and

the lengthy judicial processes for prosecuting forest

offenders.

Dr. Brown highlighted some key achievements of the

Commission in 2025. This included efforts to restore

degraded landscapes, of which 9,707 hectares of

plantations had been established so far. The reclamation of

nine forest reserves from illegal miners resulted in the

seizure of 190 excavators, 16 vehicles and the arrest of

345 suspects.

Responding on behalf of the visiting delegation, Mr. Israel

Ackah, Co-Chair of the Advisory Board, explained that

the purpose of the visit was to foster meaningful

engagement between the Ministry and the agencies under

its supervision. He emphasised the Board’s commitment to

learning about the Commission’s work and offering its full

cooperation to support the government’s broader

environmental vision.

See: https://fcghana.org/ministerial-advisory-board-pays-

familiarisation-visit-to-fc/

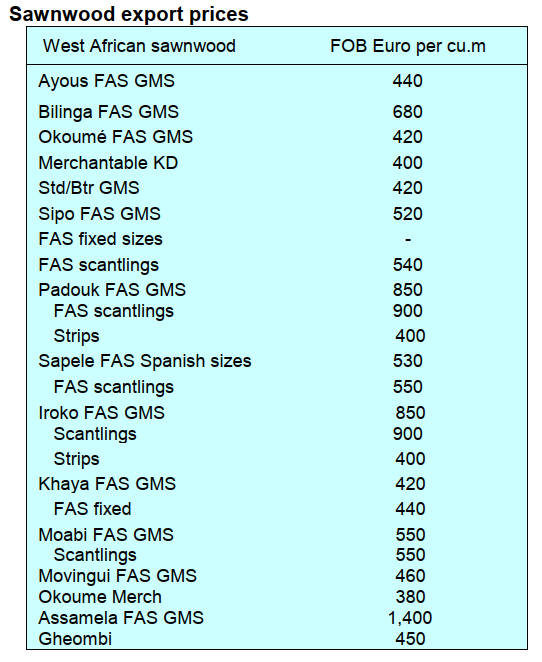

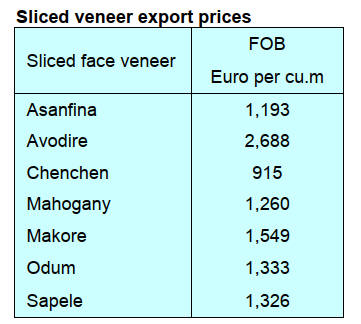

Ghana’s wood product market performance – Asia

tops

Asia continent continued to maintain its dominance as

Ghana’s largest market for wood products for the period

January to August 2025. Total exports to Asian markets

for the 8 month period accounted 66% (95,075 cu.m)

valued at Eur36.05 million according to Timber Industry

Development Board (TIDD) data source. However, this

represented a decrease of 24,131 cu.m in volume and

Eur10.08 million in value when compared to the same

period in 2024.

Aside from the shipments of wood products to Asia the

share of Ghana’s remaining wood product exports for the

first eight months of this year went to Europe (16%),

Africa (10%), America (5%) and Middle East (3%).

Ghana’s main importing countries in Europe were Italy,

France, Germany, the UK, Belgium, Spain, Ireland and the

Netherlands while African market destinations included

Egypt, Morocco, and South Africa and the ECOWAS sub-

region.

Wood products export to Asian markets included air and

kiln dried sawnwood, billets, sliced veneer and

mouldings. The species exported included Teak, Denya,

Wawa, Koto / Kyere, Papao / Apa, Cedrela, Kaku / Ekki /

Azobe, Asanfina / Anigre, Gmelina and Ananta.

Local currency erases losses recorded in Q3 2025

Available data from Commercial Banks showed that the

Ghana Cedi depreciated by about 14% in the third quarter

of 2025. But the currency sustained a “good run” against

the US dollar in the first half of October 2025, which

helped erase the local currency’s losses posted in the third

quarter of the year. The Cedi had earlier recorded

appreciation by more than 40% at the end of July 2025 to

about 21% by the end of September.

Bank analysts have attributed the recent performance of

the Cedi to the Bank of Ghana’s new forex market

interventions and monetary policy measures that have

improved dollar supply and strengthened enforcement of

foreign exchange regulations. The CEO of Ghana

Association of Banks has described the currency’s

performance as a policy shift that has enhanced market

efficiency.

The stability of the local currency is also a welcome

development to local industries, which will now require

fewer Cedis to purchase the same amount of foreign

currency to secure raw materials and machinery parts for

their production.

See: https://www.myjoyonline.com/cedi-erases-q3-losses-

recorded-in-2025-posts-37-year-to-date-appreciation-against-

dollar/

Informal cross-border trade at GH¢7.4 biln in the final

quarter of 2024

According to the Ghana Statistical Service (GSS) survey

informal cross-border trade between Ghana and its three

neighbouring countries reached GH¢7 bil. in the fourth

quarter of 2024 (Q4 2024), representing 4% of the

country’s total trade for the period.

The report revealed that informal trade continues to

dominate the country’s commerce with its immediate

neighbours, Togo, Burkina Faso and Côte d’Ivoire. The

volume of informal trade during the period accounted for

61% of total trade with Togo, 56% with Côte d’Ivoire and

37% with Burkina Faso.

The formal trade still dwarfs informal trade overall with

formal trade valued at GH¢165.3 bil. compared to GH¢7.4

bil. in informal trade during the quarter.

See:

https://www.statsghana.gov.gh/headlines.php?slidelocks=ODA0

OTM4MzIxNC44MzI1/headlines/05r1nrn496

and

https://thebftonline.com/2025/10/23/informal-cross-border-trade-

hits-gh%C2%A27-4bn-in-q4-2024/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Ghana.

See: https://www.itto-

ggsc.org/static/upload/file/20251022/1761099830162631.pdf

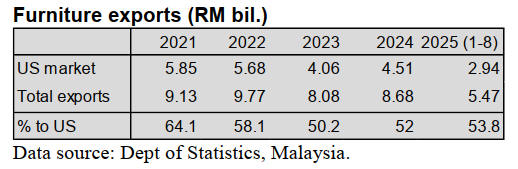

3. MALAYSIA

Difficult to find alternative markets in the short term

Malaysia’s furniture industry cannot easily cushion the

impact of the latest US tariffs by selling more to other

markets, at least not in the short term, say manufacturers.

Muar Furniture Association (MFA) president, Steve Ong,

said no other export market comes close to the United

States in terms of market size and demand for Malaysian

wooden furniture. (see table) Johor, particularly Muar,

produces the bulk of Malaysian wooden furniture. Trying

to reduce reliance on the US by growing sales in other

countries or finding new markets would need time, along

with government support and assistance, he added.

The United States remains the largest market. Singapore,

the United Kingdom and Japan are also Malaysia’s key

export markets but none come close to the scale and

consistency of demand seen from the United States, said

Ong. From January to August wooden furniture exports

dropped by around 3% year on year but shipments to the

United States moved in the opposite direction, rising 2%

reflecting front loading of exports in the early part of the

period.

According to data from the US Census Bureau Malaysia

was the fifth largest supplier of wooden furniture to the

United States last year behind Vietnam (US$6.27 bil),

China (US$1.88 bil), Canada (US$1.5 bil) and Mexico

(US$1.06 bil).

The MFA president said the new tariffs were expected to

dampen demand with local furniture manufacturers likely

to face pressure to absorb part of the cost to maintain

competitiveness. “Besides tariffs, we are also dealing with

rising domestic costs such as higher Sales and Service Tax

(SST), foreign labour EPF (Malaysian provident fund for

retirement) contributions and electricity rates, all of which

could further weaken our international competitiveness, he

added.

Malaysian Furniture Council (MFC) president, Desmond

Tan, said he was disappointed with the tariffs as Malaysia

and the United States shared a mutually dependent

economic relationship. He said investment, Trade and

Industry Ministry officials were currently in talks with the

United States to seek tariff exemptions for several

products, including furniture.

See:https://www.thestar.com.my/news/nation/2025/10/18/interac

tive-heres-why-us-tariffs-are-hitting-malaysias-furniture-makers-

hard

Aiming to achieve EUDR ‘low risk’ country ranking

A special committee on Implementation of the European

Union Deforestation Regulation (EUDR) has studied

strategies and measures that need to be implemented

across ministries to try and achieve recognition of

Malaysia as a low-risk country under the EUDR

framework.

Minister of Plantation and Commodities, Johari Abdul

Ghani, said the review covers the assessment of country

benchmarking criteria that fall under the responsibilities of

various ministries.

“Among the steps are the coordination of forest data

reporting and enforcement of forestry-related laws by the

Ministry of Natural Resources and Environmental

Sustainability, compliance and enforcement of laws

protecting human rights, including the rights of indigenous

communities, by the Ministry of Rural and Regional

Development and the inclusion of sustainability elements

in free trade agreement negotiations by the Ministry of

Investment, Trade and Industry (MITI)” he reported to

parliament.

Johari said the government has established a national

traceability system for the palm oil sector as part of

compliance with the Malaysian Sustainable Palm Oil

(MSPO) certification to ensure that palm oil exports are

not limited to large companies only. “Through this system,

all geomaps and geo-locations of each smallholder will be

recorded.

Meanwhile, more than 1.6 million hectares of forest areas

in Sarawak have been certified under the internationally

recognised Malaysian Timber Certification Scheme

(MTCS), reaffirming the State’s strong commitment to

sustainable forest management and environmental

stewardship.

See:

https://theborneopost.pressreader.com/article/282170772377557

and

https://dayakdaily.com/sarawak-reaffirms-sustainability-drive-

with-over-1-6-mln-hectares-of-forest-certified-under-mtcs/

Carbon market policy and climate change Bill coming

Malaysia will be introducing a carbon tax next year

starting with the iron, steel and energy sectors, said Prime

Minister Anwar Ibrahim.

Anwar said the implementation of the Carbon Tax will be

aligned with the forthcoming National Carbon Market

Policy and the Climate Change Bill to ensure effective

execution.

He also said the Green Technology Financing Scheme,

with a total financing value of RM1 billion, will remain

available until December 2026 offering government

guaranteed incentives of up to 80% for green technology

projects in the waste sector and up to 60 per cent for other

sectors such as energy, water, transport and

manufacturing.

See:

https://theborneopost.pressreader.com/article/281548002093566

In related news, Malaysia has the opportunity to shape the

regional carbon economy with the ability to grow, be

inclusive and be result-based said Plantation and

Commodities Minister, Johari Abdul Ghani,

He said from 2025 to 2050, ASEAN’s carbon market

could generate US$946 bil to US$3 trillion in cumulative

value, while by 2030, mitigation potential is estimated at

220 million tonnes of carbon equivalent. With that, he said

regional cooperation must now move from principle to

practicality. A memorandum of collaboration (MoC) has

been signed between the Malaysia Forest Fund (MFF) and

Malaysia Exchange to advance carbon market

development and foster synergies.

See: https://www.thestar.com.my/business/business-

news/2025/10/16/strengthening-countrys-carbon-economy

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

See: https://www.itto-

ggsc.org/static/upload/file/20251022/1761099830162631.pdf

4.

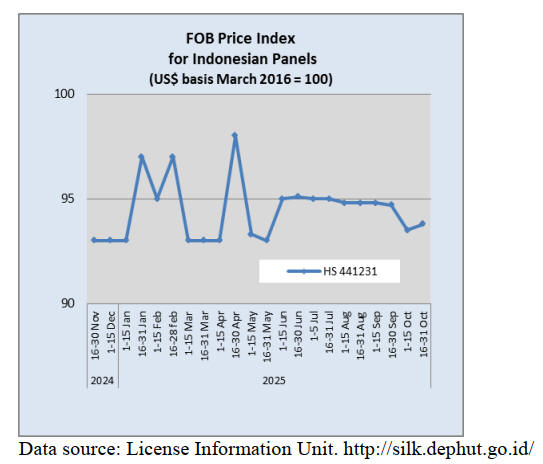

INDONESIA

Indonesia manufacturers secure

half million dollar

deals at Paris show

Indonesia's eco-friendly furniture and design products

secured potential deals worth approximately US$575,000

at the 2025 Maison & Objet (M&O) exhibition in Paris.

According to Indonesian Trade Attaché, Harry Putranto,

the transactions included furniture orders, decorative

accessory distribution contracts and plans to enter Europe's

high-end souvenir and museum markets. The strong

interest from European buyers highlights Indonesia’s

growing reputation in the eco-friendly design industry.

The event also opened new opportunities for expanding

business networks and promoting premium Indonesian

products.

See: https://en.antaranews.com/news/385589/indonesias-eco-

friendly-furniture-secures-575000-deals-in-paris

HIMKI launches digital marketplace

The Indonesian Furniture and Handicraft Industry

Association (HIMKI) has launched Mosaik Nusantara

(www.mosaiknusantara.com), a digital marketplace aimed

at boosting the global presence of Indonesian furniture and

handicraft products.

This platform serves as a direct gateway for local

entrepreneurs from regions such as Jepara, Cirebon and

Pasuruan to reach international buyers in markets like the

United States, Europe and the Middle East. Unlike

traditional trade exhibitions which are costly and time-

consuming, Mosaik Nusantara simplifies access with a

one-click solution. All participating vendors are verified

HIMKI members with globally curated products.

By connecting producers directly with international buyers

through a B2B model, HIMKI seeks to cut out complex

distribution chains, resulting in more competitive pricing

and higher returns for local manufacturers. Over 70

HIMKI merchants have already joined the platform,

offering more than 160 products, with numbers growing

daily.

See:

https://money.kompas.com/read/2025/10/17/144000926/himki-

luncurkan-marketplace-bawa-produk-mebel-dan-kerajinan-ri-

tembus-pasar.

and

https://www.antaranews.com/berita/5180065/himki-luncurkan-

lokapasar-perkuat-ekspor-industri-kerajinan-ri

Indonesia poised to be major global Carbon Credit

exporter

According to the Indonesian Chamber of Commerce and

Industry (Kadin), Indonesia is positioned to become the

world’s largest exporter of forestry-based carbon credit

with projections indicating up to 13 billion carbon credit

units could be generated from 2024 to 2050. This potential

is driven by the country’s vast tropical forests covering

over 90 million hectares and their significant carbon

absorption capacity.

Speaking at the 2025 Indonesia Sustainability Forum,

Kadin Chairman Anindya Novyan Bakrie emphasised that

with proper governance, Indonesia could lead the global

carbon credit market while advancing a green economic

future. Kadin is also developing the Regenerative Forest

Business Hub to ensure transparency and sustainability in

forestry-based carbon projects. Anindya noted that

building strong national and regional carbon markets will

be essential to supporting this green transition.

See:

https://economy.okezone.com/read/2025/10/10/320/3175861/ri-

berpotensi-jadi-eksportir-kredit-karbon-terbesar-dunia

Reforesting 10 million hectares to boost carbon market

Indonesia is taking major steps to establish a strong carbon

market by focusing on reforesting 10 million hectares of

degraded land, according to Minister Raja Juli Antoni. He

highlighted the importance of aligning Indonesia's carbon

market with international systems and securing

institutional investors for nature-based climate solutions.

The country is strengthening governance and regulatory

frameworks to increase the economic value of forests as

carbon assets. Indonesia supports nature-based solutions

not only for reducing emissions but also for removing

carbon through afforestation, reforestation and

revegetation. The government plans to achieve this

through social forestry, conservation and sustainable forest

management.

See: https://en.antaranews.com/news/385401/indonesia-aims-to-

reforest-10-million-hectares-to-boost-carbon-market

Speeding up approvals of customary forest status

The Ministry of Forestry is increasing the capacity of

verifiers responsible for approving customary forest

designations in order to accelerate progress toward its

five-year target of 1.4 million hectares.

Recent training sessions were held in Lombok, West Nusa

Tenggara as part of a broader effort to prepare local

governments and ensure they meet technical requirements

for customary forest designation.

The ministry plans to hold four rounds of similar training

across Indonesia to create a sufficient pool of qualified

verifiers. Earlier this year, Forestry Minister Raja Juli

Antoni established a Task Force for Accelerating

Customary Forest Determination, aiming to finalise

70,688 hectares of customary forest by the end of the year.

See: https://en.antaranews.com/news/385201/govt-boosts-

verifier-capacity-to-speed-up-customary-forest-status

Multi-enterprise model to boost forest potential

The Indonesian government, through the Ministry of

Forestry, is promoting a multi-enterprise forestry business

model to better utilise the forest potential and support

sustainable development.

This model emphasises diversifying forest-based

businesses, including the use of non-timber forest

products, environmental services, ecotourism, carbon

trading and agroforestry to enhance food, energy and

water security. The government is supporting this

transition with incentives such as applying carbon

economic value, encouraging investment and developing

infrastructure.

This multi-enterprise approach is part of a broader

sustainable forest management policy built on three

pillars: business model optimisation, forest landscape

enhancement and the strengthening of Forest Management

Units (FMUs).

Strategies include spatial consolidation to resolve land use

overlaps and ensure community access as well as

landscape reconfiguration through integrated planning and

infrastructure development. The policy also prioritises

ecosystem restoration, preservation and long-term forest

management, with FMUs playing a key role in managing

forests effectively at the local level.

See:https://rri.co.id/en/business/1902222/indonesia-promotes-a-

multi-business-forestry-model

Restructuring forest utilisation permits

The Ministry of Forestry, through the Directorate General

of Sustainable Forest Management (PHL), has declared

that the restructuring of forest utilisation business permits

(PBPH) is a strategic priority for improving national forest

management.

According to Director General, Laksmi Wijayanti, this

initiative aims to enhance the effectiveness and quality of

state forest governance while addressing long-standing

challenges including land conflicts and community rights

issues.

The restructuring process focuses on reducing conflict

risks, clarifying land status and promoting more efficient

and sustainable use of forest areas. This policy reflects the

ministry’s broader commitment to achieving social,

environmental and economic balance in forest

management across Indonesia.

See: https://mediaindonesia.com/humaniora/821625/kemenhut-

tegaskan-penataan-pbph-prioritas-strategis-untuk-pengelolaan-

hutan

Rattan downstreaming to strengthen industry

The Indonesian government, through the Ministry of

Forestry, is actively promoting the downstream processing

of rattan to strengthen the national industry and boost the

economic impact on forest-based communities. Indra

Explotasia, Head of the Forestry Extension and Human

Resources Development Agency, highlighted that many

Forest Farmer Groups (KTH) remain stuck in early stages

of development due to the lack of value-added processing.

Currently, rattan is sold mainly in raw form. Indra

emphasised that collaboration between the government,

private sector and financial institutions is essential to

unlock the full value of forest products, particularly rattan,

a key national commodity.

The Ministry is encouraging a shift in forestry extension

from a conservation only approach to one that also

supports local economic development. By increasing

budget allocations and promoting rattan downstreaming

the government aims to enhance the global

competitiveness of Indonesia’s forest product industry.

This strategy is expected to strengthen the national supply

chain and create new job opportunities, especially in rural

areas, thereby ensuring that local communities can benefit

more directly from the country's natural resources.

See: https://minews.id/news/pemerintah-dorong-hilirisasi-rotan-

untuk-perkuat-industri-nasional

Sharp drop in forest, land fires

Indonesia has reported a sharp decline in forest and land

fires in the first half of 2025, with burned areas dropping

by 43% compared to the previous year. According to The

Minister of Forestry a total of 213,984 hectares were

affected this year, down from 376,805 hectares in 2024

and significantly lower than the 1.6 million hectares

burned in 2019. Satellite data from NASA also showed a

24% decrease in fire hotspots from January to late

September.

The success in reducing wildfires is credited to strong

collaboration between government agencies including the

Forestry Ministry, Armed Forces (TNI), National Police

(Polri), and the Meteorology, Climatology and Geophysics

Agency (BMKG).

Support from the National Disaster Mitigation Agency

(BNPB), local governments and the public also played a

key role.

See: https://rri.co.id/en/national/1898542/indonesia-achieves-

major-reduction-in-forest-fire-areas

Green investment pledges

During the 2025 Indonesia International Sustainability

Forum (ISF) Indonesia’s Investment and Downstreaming

Ministry announced that the country secured green

investment commitments worth Rp278 trillion (US$17.47

bil.)

Deputy for Investment Promotion, Nurul Ichwan,

emphasised that the deals reflected strong business interest

in supporting Indonesia’s sustainable development goals.

Similarly, Kadin’s Coordinating Deputy Chair, Shinta

Kamdani, highlighted the crucial role of the private sector

in leading the green transition.

She noted that green investments not only promote

economic growth but also provide new opportunities for

micro, small and medium enterprises (MSMEs), generate

employment and accelerate industrial transformation

toward a more resilient and sustainable economy.

See:https://en.antaranews.com/amp/news/385717/rp278-trillion-

green-investment-pledges-signed-at-2025-isf

and

https://rri.co.id/bisnis/1896389/isf-2025-hasilkan-komitmen-

investasi-berkelanjutan-rp278-triliun

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Indonesia.

See: https://www.itto-

ggsc.org/static/upload/file/20251022/1761099830162631.pdf

5.

MYANMAR

Central Bank moves to curb inflation

Myanmar’s Central Bank has announced new measures to

withdraw excess liquidity from the banking system in an

effort to control inflation and stabilise the kyat.

In a statement the Central Bank of Myanmar (CBM) said

it will tighten liquidity through two mechanisms. The first

involves increasing the Average Excess Reserve, the funds

commercial banks hold at the central bank beyond

mandatory reserves. The second is interest paid on these

excess reserves will now be adjusted in line with the one-

month average market rate, though the exact rate was not

disclosed.

The central bank attributed the surge in excess liquidity to

the growing use of digital payment systems which has led

to higher bank deposits. However, some economists argue

that expanded money printing by the regime has also

fueled liquidity growth and inflation.

See: https://uniteddaily.my/en/dac7d511-3fc8-413c-9def-

12e62bb5d712

Preparation for ASEAN Economic Community

Myanmar has reviewed its progress in implementing

the ASEAN Economic Community (AEC) Blueprint 2025,

assessing achievements, remaining challenges and

preparations for the next phase of regional economic

integration under ASEAN Vision 2045.

As the AEC 2025 Blueprint enters its final year

discussions focused on Myanmar’s overall implementation

status, future priorities and the transition toward the AEC

Strategic Plan (2026–2030).

The review highlighted that more than 75% of AEC action

lines have been completed with the goal of reaching 90%

by the end of 2025.

Participants discussed how geopolitical and geoeconomic

shifts are shaping ASEAN’s economic landscape. To

strengthen collective resilience, ASEAN has established

the ASEAN Geoeconomics Task Force (AGTF) to provide

policy recommendations and reinforce rules-based,

multilateral cooperation among member states.

The review also emphasised the importance of ASEAN

Vision 2045, which will guide regional cooperation

through four strategic pillars, Political-Security,

Economic, Socio-Cultural, and Connectivity. Within this

framework, the AEC Strategic Plan (2026–2030),

endorsed at the 46th ASEAN Summit will serve as the

first of four consecutive five-year plans driving economic

integration beyond 2025.

Myanmar has kept pace with ASEAN’s evolving

economic goals by established 22 sectoral committees to

oversee AEC implementation each responsible for

advancing commitments across trade, investment, industry

and other key sectors.

See: https://www.gnlm.com.mm/asean-economic-community-

aec-2025-implementation-committees-meeting-held/

ASEAN Summit: Myanmar crisis

Following the recent 47th ASEAN Summit in Malaysia

the regional bloc delivered a decisive but familiar message

on the Myanmar crisis: The Five-Point Consensus (5PC)

remains the only path forward and the planned December

2025 election lacks regional legitimacy. ASEAN leaders

adopted a joint decision reaffirming the Five-Point

Consensus (5PC) as the "main reference" for resolving the

Myanmar crisis.

The ASEAN leaders reiterated their "deep concerns" over

the "lack of substantial progress" in the 5PC's

implementation by the Myanmar authorities nearly four

years after its adoption. ASEAN issued a clear demand:

the "cessation of violence and inclusive political dialogue

must precede elections." In a bid to maintain engagement

the summit reinforced existing diplomatic mechanisms:

ASEAN leaders pledged continued support for the Troika

mechanism (comprising current, past and incoming

ASEAN chairs) and are deliberating a proposal for

a longer-term Special Envoy to ensure sustained

diplomatic engagement.

The leaders reaffirmed the importance of delivering safe

and effective humanitarian assistance without

discrimination, including through cross-border efforts

where necessary, channeled via the ASEAN Coordinating

Centre for Humanitarian Assistance (AHA Centre).

See: https://thediplomat.com/2025/10/asean-foreign-ministers-

voice-concern-about-ongoing-myanmar-conflict/,

and

https://themalaysianreserve.com/2025/10/28/anwar-aseans-

priority-is-to-stop-violence-in-myanmar/#google_vignette

6.

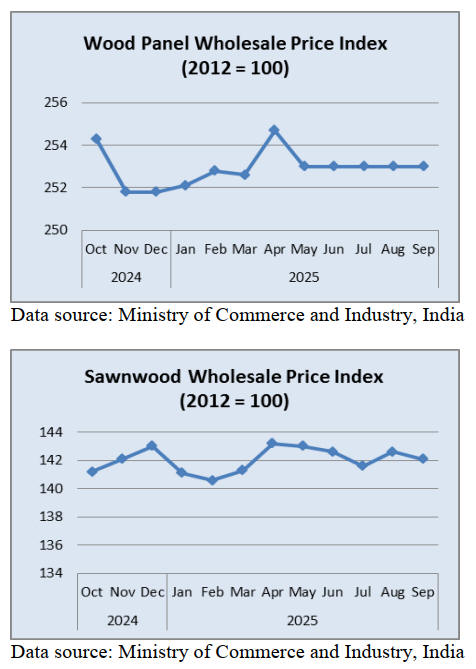

INDIA

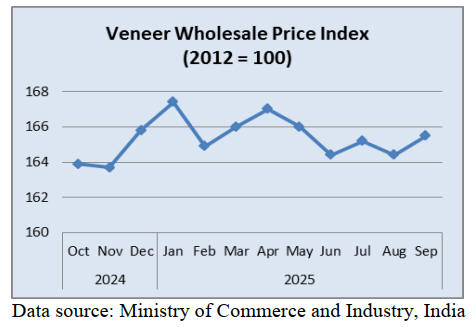

Inflation stable

The annual rate of inflation based on the all India

Wholesale Price Index (WPI) was 0.13 in September

(0.52% in August). The positive rate of inflation in

September was primarily due to increase in prices of

manufacture of food products, other manufacturing, non-

food articles, other transport equipment and textiles.

The index for manufacturing increased from 144.9 for

August 2025 to 145.2 in September 2025. Out of the 22

NIC two-digit groups for manufactured products, 10

groups witnessed an increase in prices, 6 groups a

decrease and 6 groups saw no change.

Some of the groups that showed month on month

increased in prices in September were; other

manufacturing, food products, electrical equipment,

textiles and other non-metallic mineral products. Some of

the groups that witnessed a decrease in prices were

manufacture of rubber and plastics products, motor

vehicles, trailers and semi-trailers, pharmaceuticals,

medicinal chemical and botanical products, leather and

related products and printing and reproduction of recorded

media.

The price index for wood panels in September was

unchanged from August. The sawnwood price index tilted

lower while the index for veneers trended higher.

See: https://eaindustry.nic.in/

Tariff reduction – a competitive edge in the US

Indian wood product and furniture exporters will become

more competitive in the US market as tariffs on these

products will be reduced from 50% to 10-25% according

to the policy think tank GTRI (Global Trade Research

Initiative, India ).

“For India, the change is a major relief” Ajay Srivastva of

GTRI said, adding that lower tariffs may make India a

cost-effective alternative for US buyers potentially

boosting Indian exports.

The GTRI added that the reduction will significantly

provide respite as India’s exports of affected products

totalled US$654.8 million last year, including US$568.3

million in kitchen cabinets, US$83.3 million in

upholstered furniture and US$3.2 million in softwood

lumber. India’s softwood lumber exports worth US$ 3.2

million will now face a reduced tariff of 10% down from

50%.

See: https://gtri.co.in/gtriFlagshipReportsd.asp?ID=110

and

https://economictimes.indiatimes.com/news/economy/foreign-

trade/indian-wood-and-furniture-exporters-to-gain-competitive-

edge-in-us-after-trumps-10-global-tariff-

gtri/articleshow/124247519.cms?from=mdr

New era of BIS compliancein for woodbased panel

sector

It has been almost six months since the implementation of

new Bureau of Indian Standards (BIS) Standards for the

plywood industry. Plywood manufaturers across the

country are scrambling to obtain a BIS licence but is has

been reported that only 1,000 companies have registered

under new BIS Rules. From 28th August all plywood mills

came under mandatory BIS compliance rules.

In the situation where industry is transitioning to a new set

of regulations there will be major challenges for those

companies that do not fully understand what is involved.

The BIS and industry associations are keen on spreading

awareness about revision to the Standards, particularly the

inclusion of BWP grade in IS:303. The compliance issue

poses a paricular challenge for small size manufactures

and traders.

After initial resistance the plywood and MDF board

industry is now slowly but surely embracing mandatory

quality control norms as they have recognised the long

term benefits of adhering to high quality standards.

See: https://www.plyreporter.com/article/154244/september-

onwards-plywood-panel-industry-is-set-to-witness-new-era-of-

bis-compliance

7.

VIETNAM

Wood and Wood Product (W&P) trade

highlights

According to the data from the Viet Nam Customs Office,

W&WP exports to Canada in September 2025 reached

US$24 million, up 14% compared to September 2024. In

the first 9 months of 2025 W&WP exports to the Canadian

market were valued at US$209 million, up 19% over the

same period in 2024.

Viet Nam’s wood pellet exports in September 2025 earned

US$117 million, up 166% compared to September 2024.

In the first 9 months of 2025 the wood pellet exports

earned US$903 million, up 66% over the same period in

2024. This is an impressive growth rate, showing that

demand from traditional markets continues to be stable

and provides an important contribution to Viet Nam’s

W&WP exports.

W&WP imports in September 2025 were at valued

US$260 million, down 10% compared to August 2025.

However, compared to September 2024, imports increased

by 11%. In the first 9 months of 2025, W&WP imports

totalled US$2.37 billion, up 16% in value over the same

period in 2024.

Viet Nam's tali wood imports in September 2025

amounted to US$40,600 cu.m, worth US$16.0 million, up

4% in volume and 5% in value compared to August 2025.

However, compared to September 2024, imports increased

by 54% in volume and 52% in value. In the first 9 months

of 2025, imports of tali were 284,700 cu.m, worth

US$106.4 million, up 24% in volume and 22% in value

compared to 2024.

Viet Nam’s wood industry seeks ways to cope with

tariff challenges

The Vietnamese wood industry is facing significant

challenges in terms of expenses, earnings and the capacity

to sustain exports to important markets as a result of new

US import levies.

The US has imposed high taxes on a variety of imported

wood and furniture products and is anticipated to rise

further in early 2026. In particular, kitchen cabinets,

bathroom cabinets and associated goods will be subject to

tariffs of up to 50% starting in early 2026 - a significant

rise from the initial 25% rate.

A 25% tariff on upholstered furniture (sofas, upholstered

chairs, etc.) went into effect in October and might rise to

roughly 30% by the start of 2026.

Vietnamese wood prices are less competitive than those of

local products in the US and other tax-exempt nations

which has a direct impact on the country's wood industry.

Billions of dollars worth of exports to subject to hefty

taxes

Following the announcement of the increased tax US

clients immediately reduced or canceled orders which had

a direct impact on many export enterprises, particularly

upholstered furniture producers.

FDI companies with factories in Việt Nam are also

concerned about shrinking profit margins as they will have

to reduce prices to preserve market share and split tax

expenses with partners. Businesses were advised to

diversify export markets and cut manufacturing costs

while State assistance such as exemptions and reductions

in land rent, social insurance and logistical costs are of

utmost importance, according to experts.

In the long term, Vietnamese wood product manufactures

should consider shifting to new markets, particularly

Europe and the Middle East with the latter seeing high

demand for furniture products for hotels, resorts and high-

end apartments.

Vũ Quang Huy, Director of the Tekcom Joint Stock

Company, said substantial duties are currently being

applied to various wood products.

Although plywood is not currently subject to the import

tariffs, it is still under an ongoing anti-dumping

investigation. If duties are imposed, the total rate could

reach around 20%. The investigation’s results are expected

to be announced by the end of 2025.

Meanwhile, Nguyễn Ngọc Thanh, General Director of the

Thiên Phát Company, a company that exports kitchen and

bathroom cabinets to the US, predicts that the Vietnamese

wooden furniture industry will encounter numerous

challenges in the future because of the high risk of

additional US investigations.

See: https://wtocenter.vn/su-kien/28873-viet-nams-wood-

industry-seeks-ways-to-cope-with-tariff-

challenges?utm_source=chatgpt.com

HCM City set to become global hub for

wooden furniture production and export

HCM City is poised to become one of the world’s leading

hubs for wood product and furniture production and export

as the global market enters a recovery cycle and demand

for green, sustainable products continues to rise, according

to speakers at a seminar in the city.

The event, titled “HCM City’s Wood and Furniture Export

Industry – A Global Manufacturing and Export Hub,” was

jointly organised by the Handicraft and Wood Industry

Association of HCM City (HAWA), the Viet Nam Timber

and Forest Product Association (Viforest) and the Bình

Dương Furniture Association (BIFA).

Speaking at the event, Phùng Quốc Mẫn, Chairman of

HAWA, said Viet Nam’s wood industry has achieved

remarkable progress over the past two decades, growing

from less than US$200 million in export value in 1999 to

an expected $20 billion by 2025. Viet Nam is now the

world’s second-largest exporter of wooden furniture, just

behind China.

“The industry has built a relatively complete supply chain,

from raw materials and production to distribution, creating

a strong global competitive advantage,” he said.

Following the recent administrative merger of HAWA and

BIFA, HCM City now accounts for nearly half of the

country’s total wood export revenue and has developed an

integrated supply chain covering production, processing,

logistics and seaports. This forms a solid foundation for

the city to position itself as a regional manufacturing hub,

Mẫn added.

HAWA and BIFA are merging, expanding HAWA’s

membership to nearly 1,000 enterprises, about 70%t of

which are producers and exporters.

The new HAWA will work closely with both government

and industry to ensure stable production, sustainable

growth, and global market expansion, aiming to make

HCM City a hub of the world’s wood and furniture

industry.

Nguyễn Quốc Khanh, Chairman of AA Corporation and

Senior Advisor to HAWA, said: "The industry’s goal is

not merely to export but to export profitably and

sustainably."

The wood industry must move beyond subcontracting and

focus on developing value-added products. To achieve

this, businesses need to invest in design, brand

development, marketing and sales channels to enhance

value,” he noted.

He urged local firms to embrace a’ go-global strategy’ by

building their own brands, developing a high-quality

workforce, and adopting ESG-based management models.

“With the right direction, by 2035, HCM City could

achieve US$15 billion in exports, with 80% of products

meeting green standards and forming a smart ecosystem

that integrates industrial, trade promotion, and logistic

hubs across the southern key economic region,” he said.

Nguyễn Liêm, Vice Chairman of Viforest and Chairman

of BIFA, emphasised that the wood industry must pursue

dual transformation - green and digital.

“The green transition helps save energy, reduce emissions

and encourage the use of legal, eco-friendly materials that

meet international standards.

Digital transformation, meanwhile, ensures transparent

management, enables production data measurement,

optimises supply chains and improves demand forecasting.

The two processes are closely linked and go hand in

hand,” he said.

He proposed establishing a Green and Digital

Transformation Support Centre for the wood sector in

HCM city, piloting low-emission factories and green

industrial clusters with shared infrastructure to help small

businesses ‘go green’ at affordable costs.

Lê Đức Nghĩa, Chairman of An Cường Wood Working

JSC, said the company has implemented SAP S/4HANA,

a comprehensive digital management platform, which

integrates production, finance and supply chain data,

boosting productivity by over 20%.

When digital transformation goes hand in hand with green

transition, companies not only save costs but also meet

international standards for transparency, governance and

ESG, all essential for expanding into global markets, he

explained.

He also recommended that the government priorities

digitalising the national wood industry database, build an

open data system, expand access to green finance and

energy-efficient technologies and develop training

programmes to help enterprises comply with international

standards.

Vũ Quang Huy, Chairman of Tekcom, said the industry is

facing trade barriers such as countervailing duty

investigations, traceability requirements and

environmental certification. But these challenges present

an opportunity for businesses with strong capacity and

high compliance standards.

He suggested that HCM city should take a more proactive

role in standardising digital traceability records,

establishing a dedicated centre for HS codes and rules of

origin and developing an early-warning system to prevent

trade fraud.

Thomas Luk, Director of Starwood Furniture of VN Corp,

said many Vietnamese exporters face high US tariffs but

there are ways to mitigate them.

He called for policies to support the renovation of ageing

factories and minimise account receivable risk.

Enterprises at the event further proposed streamlining

administrative procedures and developing a large-scale

trade fair and exhibition centre in HCM City to strengthen

international trade promotion.

In his closing remarks, HCM City People’s Committee

Chairman, Nguyễn Văn Được, praised the achievements of

Viet Nam’s wood and furniture industry, noting that

enterprises are the driving force of economic development.

The city government is committed to listening to and

acting on business feedback. It will turn these ideas into

practical and feasible policies to create a competitive,

transparent and sustainable business environment, he said.

He added that the city would review tax refund

procedures, address overlapping regulations affecting both

domestic and foreign enterprises and continue investing in

road and rail infrastructure to reduce logistics costs.

“With its tradition of dynamism, creativity and pioneering

spirit, I believe HCM City’s wood and furniture business

community will continue to lead the way in realising the

vision of making the city a regional manufacturing and

export hub,” he affirmed.

See: https://vietnamnews.vn/economy/1727961/hcm-city-set-to-

become-global-hub-for-wood-furniture-production-and-

export.html?utm_source=chatgpt.com

Wood industries under growing strain as US tariffs

reshape export dynamics

Ngo Si Hoai, Vice Chairman and Secretary General of the

Viet Nam Timber and Forest Products Association, says

the US decision on tariffs will significantly affect

Vietnamese wood product exports, leaving companies

little room to adjust in the short term.

He notes that, with the US accounting for more than half

of Viet Nam’s total wood product export value, many

enterprises may have to reconsider their strategies if tariffs

rise further.

Nguyen Phuong, Vice Chairman of the Dong Nai Wood

and Handicrafts Association, warns that export

performance may decline in the final months of 2025

depending on tariff developments. He calls for greater

government support through market intelligence, risk

assessment and more proactive trade policy responses to

help firms adapt to external shocks.

In addition, Nguyen Chanh Phuong, Vice Chairman of the

Handicraft and Wood Industry Association of Ho Chi

Minh City (HAWA), said that the sector’s long-term

sustainability depends on improving production autonomy,

developing skilled labour and ensuring legal raw material

sources.

He stressed that Vietnamese businesses should move

beyond contract manufacturing and focus on brand

building and professional design to strengthen their global

position.

See: https://the-shiv.com/wood-industry-in-vietnam-under-

growing-strain-as-new-us-tariffs-reshape-export-

dynamics/#utm_source=chatgpt.com

8. BRAZIL

BNDES initiative on native timber species

The Brazilian Development Bank (BNDES) has launched

the BNDES Forest Innovation Programme (Floresta

Inovação programs) aiming to position Brazil as a leader

in the international tropical timber market. The

programme was launched with an investment of R$24.9

million in a project focused on innovation in the

silviculture of planted native timber species

The project, approved by BNDES, was proposed by the

Steering Committee of the Research and Development

Program on the Silviculture of Native Species

(PPD&SEN, created by the Brazilian Coalition on

Climate, Forests and Agriculture in 2021. Its goal is to

develop and disseminate technological innovations to

expand the silviculture of native species following the

successful example of eucalyptus cultivation.

According to BNDES, tropical timber production in Brazil

currently comes mainly from natural forests and

expanding native species silviculture could complement

sustainable management in forest concessions.

The innovative project in silviculture covers five research

areas, seed and seedlings, genetic improvement, vegetative

propagation, forest management and wood technology

encompassing 30 native species from the Amazon and

Atlantic Forest biomes. It includes 20 research sites,

totalling around 160 hectares of new plantations along

with six existing areas that will serve as reference hubs.

With five-year duration, the project marks the first phase

of the programme that could extend to up to 30 years

aiming to develop improved clones, germination

protocols, optimised regional production systems and new

technological applications.

The Federal University of São Carlos (UFSCar) will

coordinate activities in the Atlantic Forest, while Embrapa

Amazônia Oriental and Embrapa Forestry will lead efforts

in the Amazon. The initiative is part of the BNDES

Florestas program which supports bioeconomy and

productive ecological restoration with the goal of restoring

6 million hectares by 2030 and 24 million hectares by

2050 transforming the current “Deforestation Arc” into a

corridor for restoration and sustainable forest production.

See:

https://agenciadenoticias.bndes.gov.br/socioambiental/BNDES-

lanca-iniciativa-para-impulsionar-mercado-de-floresta-tropical-

com-apoio-a-silvicultura-de-especies-nativas

Innovation and development in the Amazon

A feasibility study for the implementation of Innovation

Hubs in the Pan-Amazon Region, coordinated by the

Amazonia 4.0 Institute, identified significant economic

and socio-environmental potential in the Amazon region

with the capacity to generate up to R$8.3 billion per year

in added value and around 620,000 ‘green’ jobs by 2035.

The initiative aims to make the Amazon bioeconomy into

a strategic driver of sustainable development, adding value

to biodiversity products and promoting the inclusion of

local communities.

The study proposes solutions such as an Intelligent River

Logistics Platform, expected to cut logistics costs by up to

40%, reduced post-harvest losses by 25%, and

decarbonising 1.8 million tonnes of CO2 annually through

sustainable transport modes.

It also highlights structural bottlenecks in the states of

Amazonas, Pará and Amapá, including low value addition

to natural products, limited R&D infrastructure,

concentration of innovation in capitals and lack of

integrated governance among government, academia and

industry.

The proposed model envisions innovation hubs organised

into three integrated centres: (i) technological, focused on

research, development and prototyping; (ii)

entrepreneurial, with incubators, accelerators and

coworking spaces; and (iii) community-based, for training

and social integration of riverside, Indigenous and

extractivist communities.

The priority locations include Macapá, Santana, Santarém,

Marajó, Manacapuru, Tefé, Marabá, and Xinguara in the

Amazon region.

The initiative aligns with the National Bioeconomy Plan

and World Bank targets to triple Amazon’s GDP by 2035

to around R$700 billion per year. It establishes a strategic

framework for strengthening the Amazon bioeconomy,

combining technological innovation, environmental

sustainability and inclusive territorial development, while

paving the way for new energy and biomass studies as

levers for sustainable growth in the region.

See: https://www.maisfloresta.com.br/hubs-de-inovacao-na-

amazonia-podem-gerar-mais-de-r-8-bi-por-ano/

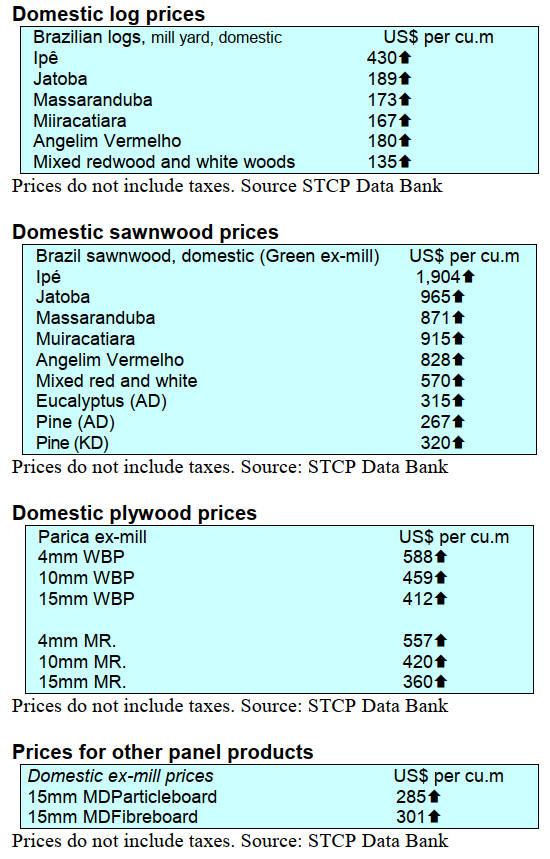

Export update

In September 2025, Brazilian exports of wood-based

products (except pulp and paper) decreased 31% in value

compared to September 2024, from US$313.7 million to

US$217.8 million.

Pine sawnwood exports increased 0.2% in value between

September 2024 (US$45.3 million) and September 2025

(US$45.4 million). In volume, exports increased 9% over

the same period, from 191,000 cu.m to 207,700 cu.m.

Tropical sawnwood exports increased 11% in volume,

from 25,700 cu.m in September 2024 to 28,600 cu.m in

September 2025. In value, exports increased 21% from

US$10.0 million to US$12.1 million, over the same

period.

Pine plywood exports decreased 40% in value in

September 2025 compared to September 2024, from

US$68.2 million to US$41.0 million. In volume, exports

decreased 36% over the same period, from 202,900 cu.m

to 130,700 cu.m.

As for tropical plywood, exports increased in volume (4%)

and in value (6%) from 2,700 cu.m and US$1.6 million in

September 2024 to 1,700 cu.m and US$2.8 million in

September 2025, respectively.

The value of wooden furniture exports decreased from

US$51.0 million in September 2024 to US$47.1 million in

September 2025, a decrease of 8%%.

State of Pará registers highest annual timber exports

The timber sector of the State of Pará recorded its best

export performance of the year in September 2025

reaching US$28.9 million and 25,000 tonnes of wood

products and by-products according to the Association of

Wood Exporting Industries of the State of Pará (Aimex).

Compared to August, exports grew 98% in value and 44%

in volume, with the highest average price of the year (US$

1,125.44/tonne).

Between January to September 2025 exports totalled

US$163.9 million and 203,600 tonnes, up 0.43% in value

and 7% in volume compared to the same period in 2024.

The main exported products, flooring, decking, parquet,

moldings and sawnwood, accounted for 82% of total

exports keeping Pará as Brazil´s fourth-largest wood

exporter in Brazil, behind only Santa Catarina, Paraná, and

Rio Grande do Sul.

The United States remained the top destination, importing

US$67 million driven by the housing market following the

recent interest rate cut in the US.

Despite the positive results, Aimex pointed out operational

bottlenecks, notably the lack of integration between Pará’s

control system and IBAMA´s National System for the

Control of the Origin of Forest Products (Sinaflor).

The association Aimex emphasised the sector´s resilience

amid bureaucratic barriers, exchange rate volatility and

growing international demand, highlighting the need to

improve environmental control and export clearance

mechanisms to balance sustainability and competitiveness.

See: https://www.diarioro.com.br/2025/10/20/exportacoes-de-

madeira-do-para-crescem-em-setembro-e-alcancam-melhor-

desempenho-do-ano-aponta-aimex

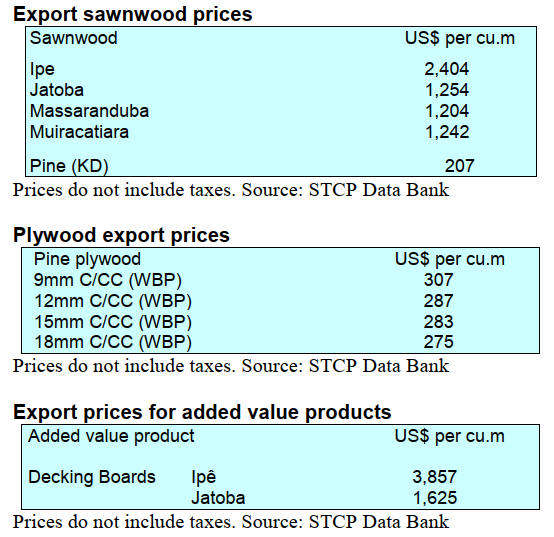

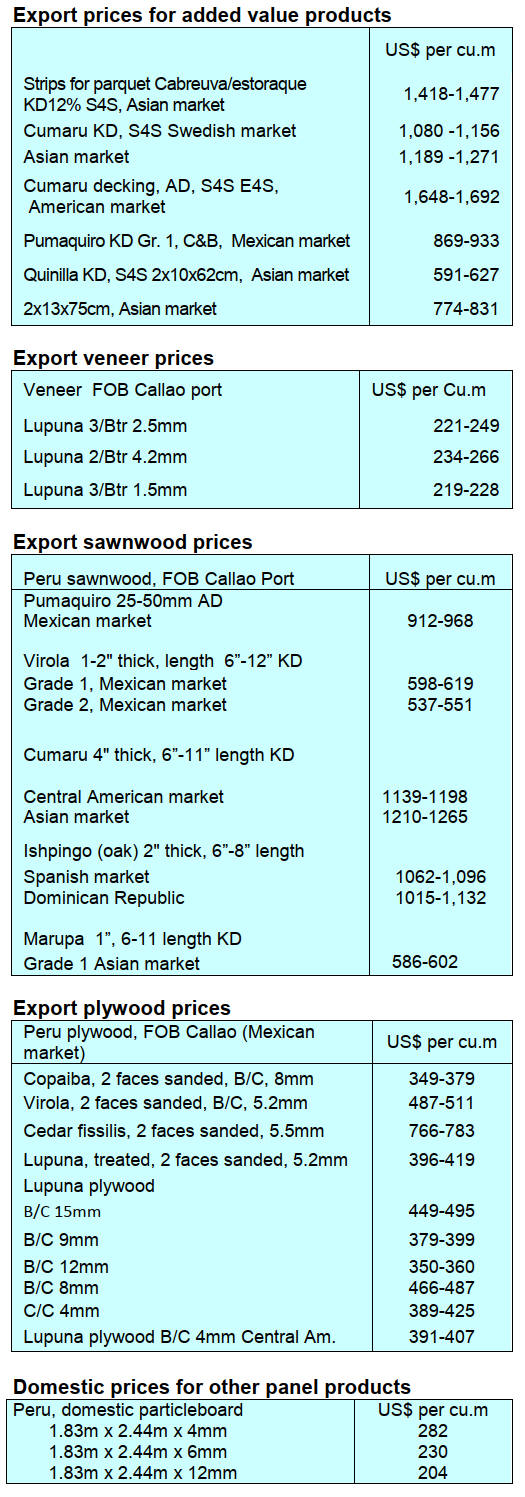

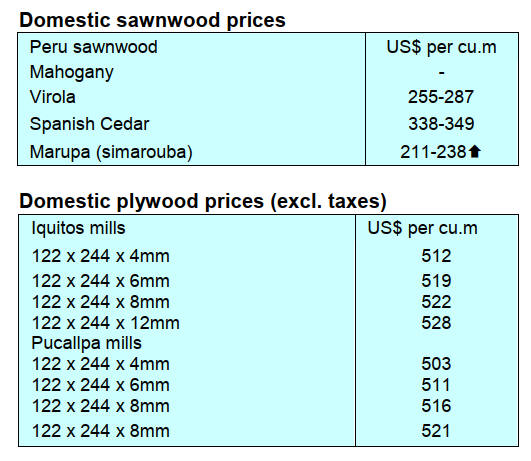

Export prices

Average FOB prices Belém/PA, Paranaguá/PR,

Navegantes/SC and Itajaí/SC Ports.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See: https://www.itto-

ggsc.org/static/upload/file/20251022/1761099830162631.pdf

9. PERU

A disappointing first 8 months, exports down more

than 20%

Shipments of wood products totalled US$42.7 million

during the first eight months of 2025, a decrease of over

20% compared to the same month in 2024 according to the

Center for Global Economy and Business Research of the

CIEN-ADEX Exporters Association.

According to figures from the ADEX Data Trade

Intelligence System, exports included sawnwood

(US$16.2 million), semi-manufactured products (US$14.2

million), firewood and charcoal (US$4.1 million),

furniture and parts (US$2.8 million) and construction

products (US$2.6 million).

The leading destination was the Dominican Republic, with

shipments totalling US$7.8 million, an increase of about

8% compared to the previous year. The United States

followed with US$6.2 million, (-28% compared to the

same period in 2024), France (US$6.1 million a drop of

34%), China (US$4.5 million, a decrease of 38%) and

rounding out the Top 5 destinations was Mexico with sales

of US$4.1 million, a decrease of 34% year on year.

Veneer and plywood exports declined January to

August 2025

According to information provided by the Services and

Extractive Industries Department of the Association of

Exporters (ADEX), veneer and plywood shipments during

the January-August 2025 period reached an FOB export

value of US$1.7 million, down around 7% year on year.

The main export market for these products was Mexico

which accounted for a 43% share but over the period in

question there was a 52% decline compared to the same

period in 2024. Ecuador followed with a 32% share and in

third place was Colombia with 12% share followed by the

Dominican Republic 9% and Costa Rica 4%.

International consults to assess prospects for

commercial forest plantations

The National Forest and Wildlife Service (SERFOR)

received representative of the consulting firm UNIQUE

Land Use GmbH to exchange information and deepen

technical and financial analysis related to the development

of commercial forest plantations.

The meeting provided an opportunity to exchange of

knowledge, the presentation of international experiences

and the development of a framework for a roadmap aimed

at more efficient and sustainable management of the

country's forest resources.

Leif Nutto, senior consultant at UNIQUE, highlighted the

need to work together to ensure that producers, investors

and public sector representatives can exchange ideas,

needs and opportunities to strengthen the forest value

chain.

See: https://www.gob.pe/institucion/serfor/noticias/1271155-

midagri-serfor-recibio-a-consultora-internacional-del-banco-

mundial-para-promover-plantaciones-forestales-comerciales

Training on investment mechanisms available for the

forestry sector

More than 200 authorities and public officials were trained

in collaborative investment mechanisms so they can access

the more than US$12 billion in competitive funds offered

by the Peruvian government for the forestry sector and

other development projects.

The event was organised by the National Forestry and

Wildlife Service (SEFOR) under its Sustainable

Productive Forests Programme (BPS). "Sustainable forest

development begins in the regions. That's why we

strengthen the capacities of regional and local

governments," said the BPS executive coordinator.

See: https://www.gob.pe/institucion/serfor/noticias/1264796-

serfor-capacita-a-mas-de-200-autoridades-en-mecanismos-de-

inversion-disponibles-en-el-sector-forestal

|