Japan

Wood Products Prices

Dollar Exchange Rates of 10th

October

2025

Japan Yen 152.29

Reports From Japan

GDP growth supported by exports

In the latest Dai-Ichi Life research Institute’s ‘Japan

Economic Outlook’ analyst Yoshiki Shinke reports Japan's

real GDP growth rate for the April-June quarter of 2025

posted a strong annualised gain of +2.2% from the

previous quarter supported by resilient exports and

business investment which had been considered vulnerable

to the adverse effects of the US tariffs. However, the

negative effects of the tariff hikes are highly likely to

emerge going forward.

Yoshiki suggests personal consumption in Japan is

expected to remain broadly stagnant. Although personal

consumption grew relatively strongly in the April-June

quarter with a quarter-on-quarter increase of +0.4%, the

sustainability of this momentum is questionable given the

persistent high level of prices.

Against this backdrop, as the negative effects of tariff

increases gradually materialise, the business sector is

forecast to slow down, resulting in the Japanese economy

in the latter half of 2025 remaining in a state of stagnation

with intermittent progress and setbacks.

See:https://www.dlri.co.jp/english/report_en/202509YS.html

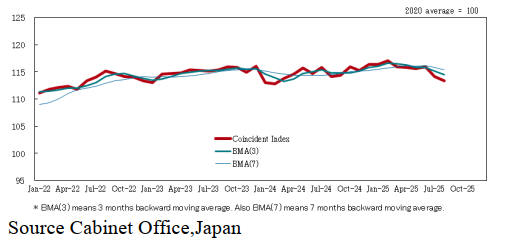

Business sentiment slides

Business conditions fell to a new low in August according

to the preliminary coincident index which tracks economic

conditions including factory output, employment and retail

sales. The index is compiled and published by the Cabinet

Office.

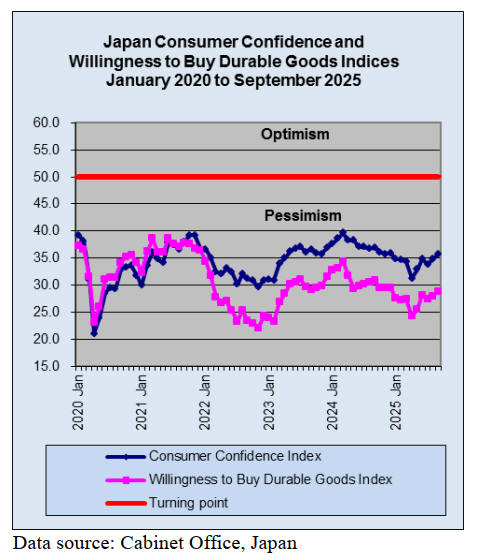

Uptick in consumer confidence in September

Japan's seasonally adjusted Consumer Confidence Index

increased by 0.4 points in September when compared to

the previous month, coming in at 35.3, according to

Thursday's report by the country's Cabinet Office.

The overall livelihood index went up by 0.5 points from

the previous month to reach 33.2, while the employment

index marked a 0.6 point increase, ending up at 39.9. The

income growth indicator remained unchanged at 39.4, with

the willingness to buy durable goods up by 0.8 points to

28.8.

The percent of respondents who expect prices to increase

over the next year was 93%, unchanged from the previous

month, while 2% of those surveyed see them unchanged

and 2% expect prices to fall.

Turmoil in domestic politics as coalition crumbles

The political fortunes of Sanae Takaichi, the newly elected

president of the Liberal Democratic Party (LDP), dimmed

dramatically after the LDP’s coalition partner declared it is

withdrawing from the coalition which put her path to

becoming Japan’s first woman prime minister in jeopardy.

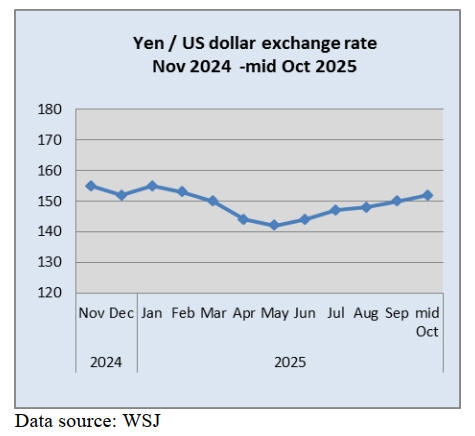

Just before the election the Japanese currency was trading

around yen 147 to the dollar. After the victory of Takaichi

and the departure of the coalition partner it quickly lost

value dropping to yen153-155.

The outlook for the yen is far from certain. Its weakness is

a function of a number of factors. The interest rate

differential between Japan and the United States is widely

seen as the primary reason for the weakening of the yen.

Analysts suggest other factors such as domestic political

instability and expectations for continued monetary

stimulus are also having an impact. A weak yen increases

import costs which eventually leads to price increases.

Atsushi Takeuchi, a former Bank of Japan official,

suggested Japanese authorities may tolerate moderate yen

decline but could intervene if the currency depreciates

towards 160 to the dollar.

Many observers see 160 yen per dollar as the limit after

which there would be a greater chance of currency

intervention. Finance Minister, Katsunobu Kato, said on

Friday the authorities were monitoring excessive,

disorderly exchange-rate moves.

BOJ rate hike still a possibility

Inflation, fueled by currency depreciation, remains risk to

Japan's economy. The current political turmoil has led

most analysts to rule out an interest rate hike when the

Bank of Japan next meets in late October but an increase

at one of the BOJ's winter meetings could be possible

depending on the movement of the yen.

See:

https://www.japantimes.co.jp/business/2025/10/10/markets/takai

chi-yen-plunge/

and

See: https://www.reuters.com/world/asia-pacific/japan-may-

intervene-if-yen-dives-toward-160-per-dollar-ex-boj-official-

says-2025-10-10/

Osaka Expo a resounding success

As the 2025 Osaka Expo ends after six months, despite a

host of problems, it has been deemed a resounding success

in terms of attendance and finances. Debate is now

focused on what to do with the Grand Ring.

The Grand Ring is a building designed by Sou

Fujimoto built using traditional wooden joinery

techniques. The Grand Ring covers an area of over 61,000

square metres, making it the largest wooden architectural

structure on earth according to the Guinness Book of

World Records.

While calls to “save the ring” have intensified in recent

days, officials have so far not shown signs of reviewing

the decision that only a 200-metre portion of the entire

ring will be preserved. Apart from some timber earmarked

for reuse in public housing being built in earthquake-hit

Suzu, Ishikawa Prefecture, most of the components could

be turned into wood chips.

The Expo is forecast to have generated a profit of up to

yen28 billion according to the organisers. Robust sales of

admission tickets and goods related to the Expo's official

mascot have pushed up expo revenue. A total of 22 million

admission tickets were sold surpassing the break-even

level of 18 million.

See:

https://www.japantimes.co.jp/news/2025/10/10/japan/society/call

s-for-full-preservation-of-osaka-expo-grand-ring/

Import update

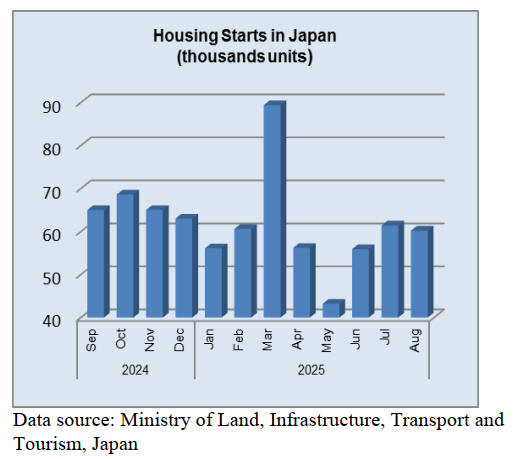

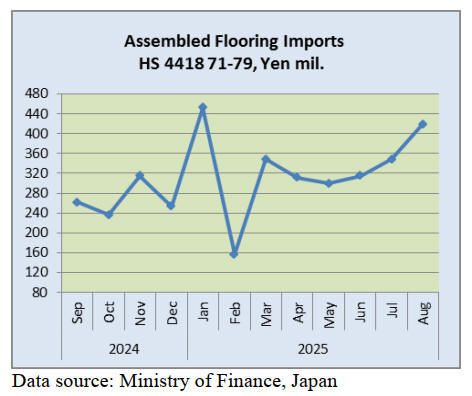

Assembled wooden flooring imports

The value of imports of assembled wooden flooring

continued its upward trend in August rising 83% year on

year and by 20% compared to a month earlier. After an

erratic few months in the second half of the year

residential housing starts settled into a more normal trend

with no significant increase in monthly starts.

Over the past few months the yen has weakened slightly

but not by enough to have pushed up import cost by so

much to explain the rise in flooring imports. This leaves to

possibility that it is demand in the non-residential sectors,

commercial and hospitality. That is driving flooring

demand.

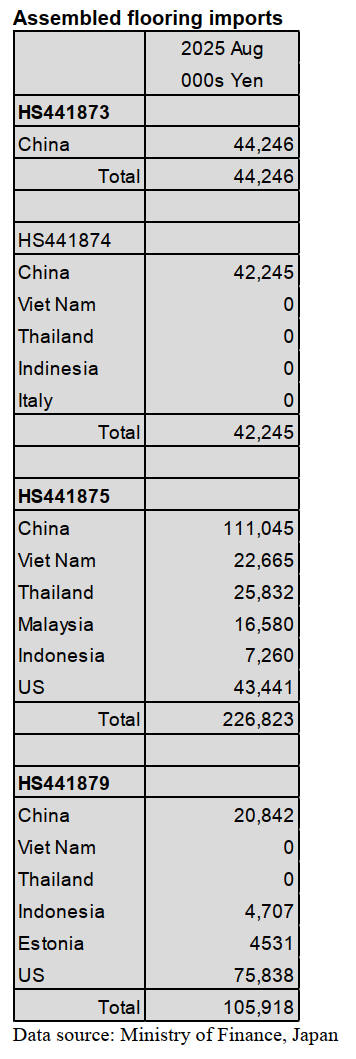

The main category of assembled flooring imports in

August 2025 was HS441875, accounting for 60% (62% in

July) of the total value of assembled flooring imports. Of

HS441875 imports, 80% was provided by shippers in

China, the US, Thailand and Viet Nam. The second

largest category in terms of value in July 2025 was

HS441879, 72% of which was shipped from the US, a

marked change, with a further 20% being shipped from

China.

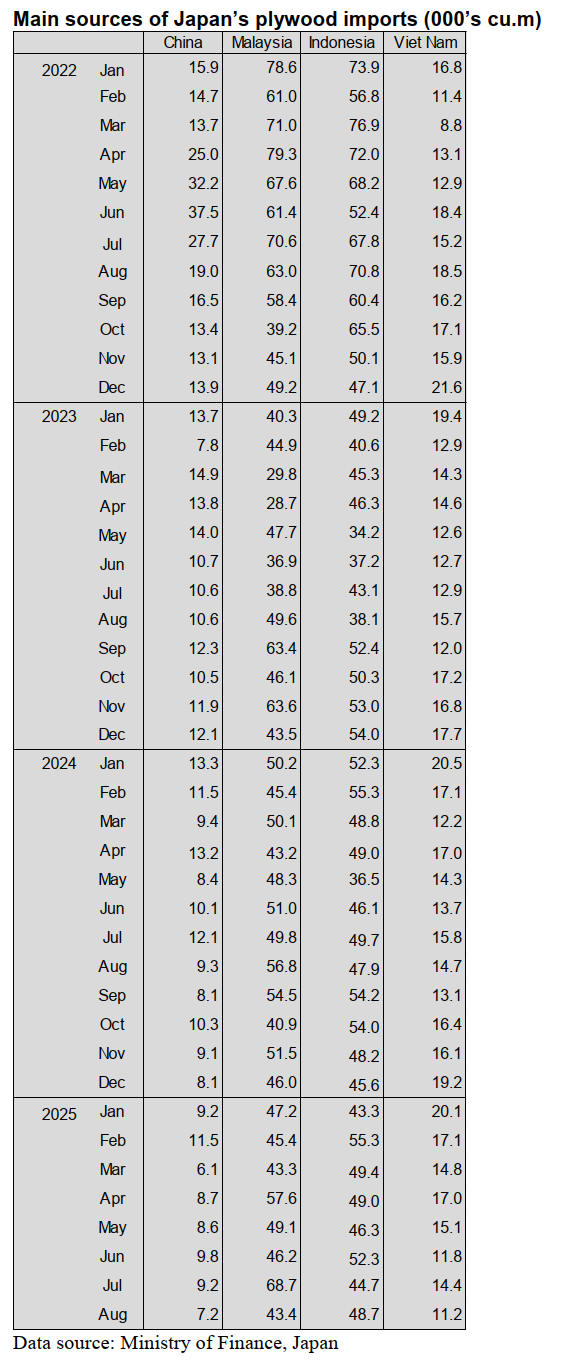

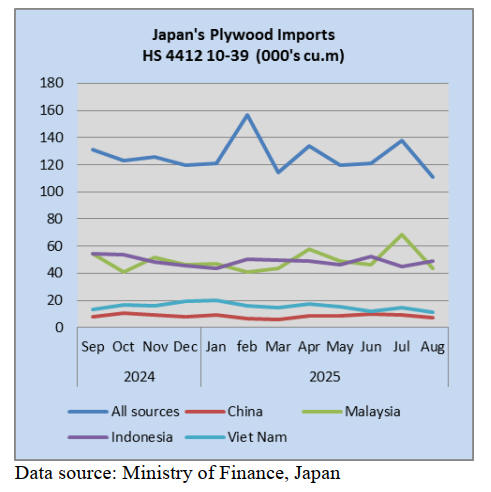

Plywood imports

In August, Malaysia and Indonesia were the top suppliers

of plywood to Japan, as in previous months providing over

80% of plywood imports. August 2025 import volumes

were 15% below those in August 2024 and 15% below the

volume of shipments in July 2025.

The volume of August 2025 imports from Malaysia fell

sharply, dropping almost 40% compared to a month earlier

but Indonesia saw a modest rise in the volume of

shipments in August. The volume of plywood arrivals

from both Viet Nam and China were down month on

month.

In August 2025 arrivals of HS441210-39 were reported at

110,998 cu.m (137,732 cu.m in July). As in previous

months, of the various categories of plywood imported in

August 2025 HS441231 (80% plus) followed by

HS441233 and HS441234 and the balance was of

HS441239.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal

published every two weeks in English, is generously allowing the

ITTO Tropical Timber Market Report to reproduce news on the

Japanese market precisely as it appears in the JLR. For the

JLR report please see: https://jfpj.jp/japan_lumber_reports/

Wood-based building material made from cedar

Haseko Corporation has begun construction of its own

factory in Gojō City, Nara Prefecture, to manufacture a

new wood-based building material called "HS Wood"

made from cedar. The total investment, including the

building and production equipment, amounts to

approximately 5 billion yen. The factory is scheduled for

completion in February 2027, with full-scale production

set to begin in April 2028. The annual production capacity

is expected to reach up to 15,000 cbms.

HS Wood is an engineered wood product made by

layering and pressure-bonding strands, wood pieces cut

from cedar logs, with their grain aligned lengthwise. A

patent application is currently pending. Because it is

unaffected by knots and can utilize small-diameter and

curved logs, HS Wood is expected to promote greater use

of cedar.

The HS Wood factory site covers 41,670 square meters,

with the main plant building occupying 8,236 square

meters and the administrative building 333 square meters.

The factory building will be a single-story steel structure,

while the administrative building will be a two-story

wooden structure.

HS Wood was developed through joint research with the

Advanced Wood Processing Institute at Akita Prefectural

University and the University of Kitakyushu. The cedar

used as raw material is planned to be sourced primarily

from areas surrounding the factory, with a focus on Nara

and Wakayama Prefectures.

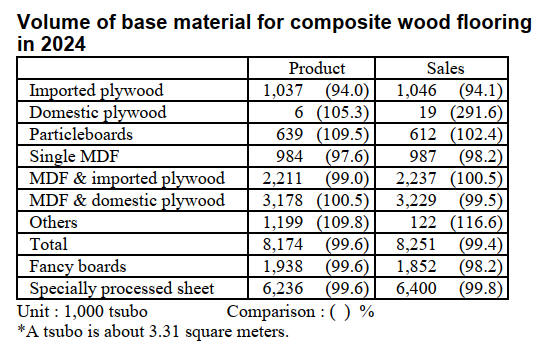

Volume of composite wood flooring in 1st half of 2025

Production and sales volume of composite wood flooring

from January to June, 2025 remain roughly at the same

level as last year.

New starts in the first half of 2025 are 7.5 % less than the

same period last year but production of composite flooring

declined by 0.4%, and sales volume decreased by 0.6%,

remaining roughly in line with the previous year.

Production volume of direct-install soundproof flooring

reached 47,000 tsubo for LL40, a 14.5% increase, and

928,300 tsubo for LL45, a 1.8% decrease. Sales volume of

LL40 reached 49,300 tsubo, an increase of 8.8%, while

LL45 recorded 911,700 tsubo, a decrease of 4.1%. Some

have pointed out that the increase in demand for direct-

install flooring, driven by efforts to reduce apartment floor

heights amid rising construction costs, contributed to the

growth of LL40.

By surface finish type, specially processed decorative

surfaces accounted for 78%, up 1 percentage point, while

natural wood finishes made up 22%, down 1 point. By

base material type, MDF combined with domestic

plywood accounted for 39%, while MDF combined with

imported plywood made up 27%.

Import of European lumber

Arrival volume of European softwood lumber in January

to June, 2025 is 1,037,000 cbms, 5.7 % more than January

to June, 2024. For the first time in three years since 2022,

the volume has reached the one-million-cubic-meter range.

The increase was driven by a rise in non-planed and non-

sanded materials, mainly laminates, which grew to

682,000 cbms, an 11.0% increase.

Imports of non-planed and non-sanded materials, mainly

used for studs and similar applications, increased from

Northern Europe but declined significantly from Central

Europe, resulting in a total decrease to 350,000 cbms—

down 3.2%.

In 2025, although the import volume in March dropped

significantly to the 110,000-cubic-meter range, monthly

volumes for the rest of the year remained steady between

170,000 and 200,000 cbms.

In the first half of 2025, housing starts declined by 7.5%

year-on-year, indicating a sluggish market. In contrast,

imports of laminated wood products increased by 11.0%.

However, unlike in the previous year or in 2022 following

the wood shock, there have been no reports of excessive

inventory accumulation.

Imports of structural laminated timber declined by 18.0%,

a sharper drop than housing starts, prompting increased

inquiries to domestic laminated timber manufacturers for

replenishment purchases.

Volume of pine products, including redwood laminates,

increased to 473,000 cbms—up 15.7%. Spruce, fir, and

other species including whitewood also increased to

209,000 cbms—up 1.7%—but the growth in pine was

more pronounced.

North American logs

Domestic demand for logs in Japan remains sluggish and

incoming volumes have also declined. There are reports

that major sawmill manufacturers are adjusting

theirproduction accordingly.

The price of Douglas fir logs for lumber use bound for

Japan remained flat at around US$1,020, FAS,MBM

,Scribner scale for IS-grade logs in September shipments

to major buyers. However, overall prices reportedly

declined by $10 to $20 due to falling market prices in the

U.S.

The price of Canadian Douglas fir log for plywood is $220

– 221, CIF per cbm and the priced is unchanged from July.

The import cost would be around 34,100 yen, FOB per

cbm if the yen were 147 yen against the US dollar.

The price of 105 x 150 – 270 mm KD Douglas fir beam is

68,000 – 71,000 yen, delivered per cbm.

The KD Douglas fir square is around 80,000 yen,

delivered per cbm. 60 x 45 mm KD Douglas fir lumber is

85,000 – 88,000 yen, delivered per cbm.

South Sea logs and products

Among South Sea and Chinese wood products, there is a

growing sense of shortage for Indonesian merkus pine

laminated free boards.

Typically, July and August mark the peak of the dry

season in the region, a time when harvesting of merkus

pine progress actively. However, this year has seen

irregular weather continued, hindering logging operations.

As a result, delivery delays of one to two months have

occurred.

Domestic distributors remain focused on securing supplies

tailored to immediate operational needs. Such delivery

delays are the first of their kind since the COVID-19

pandemic. As shipments have generally arrived without

notable delays until now, distribution inventories remain

low.At present, the supply of South Sea logs has not been

affected.

Weather conditions in Borneo, where Malaysia’s Sabah

and Sarawak states are located, remain stable and no

significant factors have emerged to reduce log output.

Papua New Guinea is showing a similar trend, with a

stable outlook for securing the necessary volume of South

Sea logs. Amid weak domestic demand, distributors are

narrowing their procurement. However, with weather

conditions deviating from past norms, they are now facing

unexpected shortages.

Russian lumber imports in the first half of 2025

Imported Russian lumber in January to June, 2025 is

299,669 cbms, 13.4 % more than January to June, 2024.

Although it has increased for two consecutive years, it has

yet to return to pre-2022 levels. Planed finished products

such as imported red pine rafters totaled 178,374 cbms, up

10.6%, while rough sawn boards and lamina reached

118,249 cbms, up 19.5%—both showing increases of over

10%.

Since late February this year, shipments have generally

arrived as scheduled. Domestic distributors have shown

little appetite for procurement, limiting purchases to the

bare minimum.

However, due to stagnant domestic demand, inventories of

Russian lumber have been increasing at major ports in the

Kanto region, leading to signs of oversupply in items such

as 30×40 mm red pine rafters and battens.

In the Tokyo metropolitan area, wholesale prices for

premium-grade Russian red pine rafters remained flat in

the first half of the year, trading at around ¥104,000 to

¥105,000 per cbm.

|