|

1.

CENTRAL AND WEST AFRICA

Weather drives down production - balances with

weaker demand

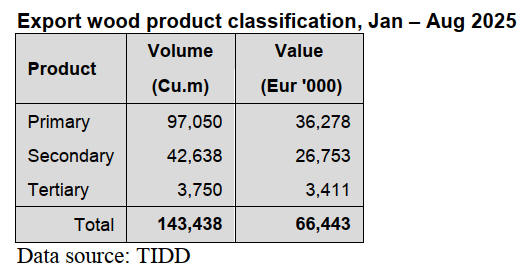

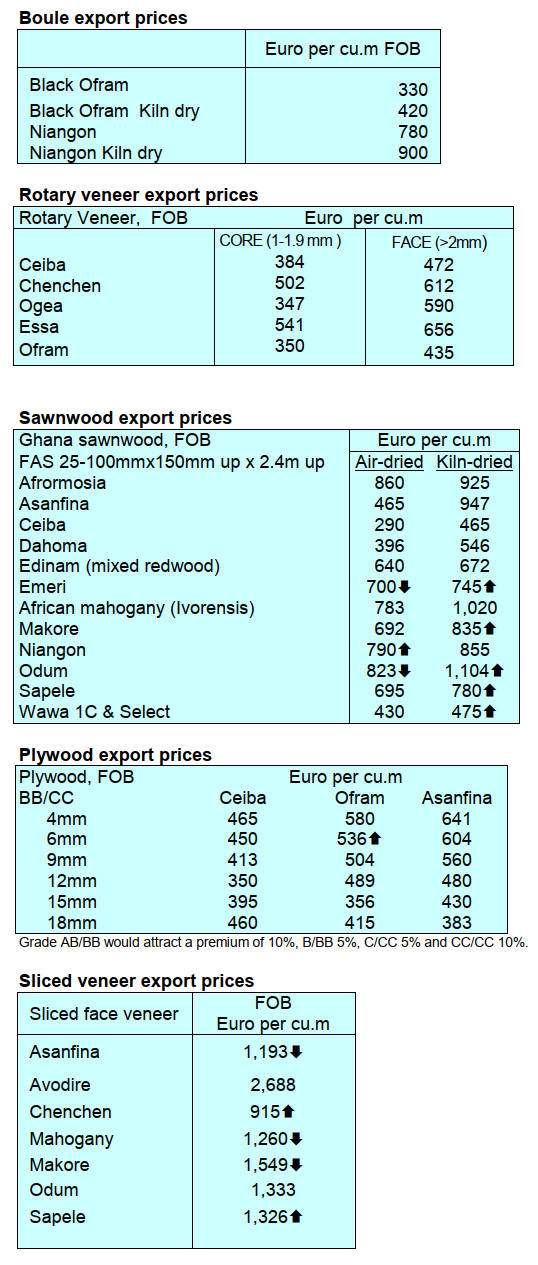

Producers report demand remained quiet in early October

with production activity overshadowed by political events

and seasonal weather patterns. Elections dominate the

agenda in Gabon and Cameroon while Congo looks ahead

to its presidential elections scheduled for March 2026.

The rain season is now in full swing across the region. In

Gabon and Congo heavy rains are expected to continue

until December followed by a two-month dry period. In

Cameroon rains should persist until the end of December

before the onset of a six-month dry season.

Production continues to be affected by difficult weather

conditions resulting in slower harvesting and supply

disruptions but these are largely balanced by the currently

weak international demand keeping stock levels low.

Prices remain generally stable across key markets.

Tropical Timber Trade Facility support from Germany

In other regional news the Central African Forest

Commission (COMIFAC) recently signed a grant

agreement under the Tropical Timber Trade Facility

project with the German Federal Ministry for Economic

Cooperation and Development to be implemented by GIZ

in partnership with COMIFAC and its member States

(Cameroon, Central African Republic, Equatorial Guinea,

Gabon, Democratic Republic of the Congo and Republic

of the Congo).

The main objective is to reduce illegal deforestation in the

Congo Basin by promoting a legal and sustainable trade in

tropical timber and wood products.

The Tropical Timber Trade Facility (TTT) is a project of

the German Federal Ministry for Economic Cooperation

and Development (BMZ) and began in 2023. The project

tackles the illegal timber trade in the Congo Basin.

See: https://www.businessincameroon.com/economy/2309-

12764-comifac-cracks-down-on-illegal-wood-trafficking-in-

central-africa

Country round-up

Gabon

October has brought the expected onset of the rain season

across Gabon with daily rainfall in the interior regions and

persistent wet conditions throughout the country. The end

of the dry period has led to slower harvesting activities

and overall production remains low. International buyers

continue to hold off from placing significant new orders

contributing to subdued operational levels.

Transport is becoming increasingly affected as road repair

projects proceed on major routes such as the Okonja–

Makoukou–Lastourville–Ovang–Lopé–Ndjolé to Bifoun

route. Road works are critical for maintaining delivery

flows to Libreville but are currently causing delays.

Log Stocks

It has been reported that the GSEZ log park in the Nkok

Special Zone currently holds approximately 35,000 cu.m.,

mainly Okoume, alongside red species such as Bosse,

Sapelli, Padouk and a small volume of Azobé and Okan.

The focus remains on Okoume, with stocks estimated at

around 30,000 cu.m.

In China, Zhangjiagang Port is reported to have

approximately two years of log stock in reserve, double

the usual consumption cycle. This significant surplus is

suppressing import demand in China and putting further

pressure on Gabonese producers.

Transport and Logistics

A serious incident occurred at SETRAG’s log stock yard

in Lastourville. It is reported timber residues caught fire

and spread destroying part of the log stocks, mainly

Okoume. Negotiations over compensation are ongoing.

Container availability remains adequate with no reported

shortages. Port operations are generally stable though

dredging work took place over a five-day period this

month, temporarily preventing large container vessels

from berthing.

Additionally, a French naval vessel is scheduled to visit

Libreville for seven days at the end of the month, likely

causing further temporary port congestion.

Electricity and Milling Operations

Electricity disruptions continue to affect operations in

Libreville. There are currently two daily power cuts,

typically lasting two to three hours, including frequent

night-time outages.

Although the government has ordered SEEG to stabilise

the power distribution and is preparing to add a third

Turkish power ship to boost capacity to 228,000 kW, the

new ship is not yet connected due to delays in laying the 9

km cable. These interruptions, combined with

administrative delays, are constraining milling activities.

Market demand

The Chinese market remains extremely weak which has

resulted in some Chinese operated mills closing. Some

mills maintain limited regular shipments but overall

demand from China is very low.

The Philippines has also reduced its Okoume purchases. In

contrast, Viet Nam continues to display solid demand for

Tali and increasingly Padouk sawn timber.

The Middle East market is slowing with Okoume facing

strong price competition from Brazilian softwood which is

reportedly being sold at half the price of Okoume.

European demand remains low, characterised by short-

term, supply-on-demand orders. The Netherlands

continues to receive regular monthly Azobé volumes of

around 2,500–3,000 cu.m but there is no significant pick-

up elsewhere.

Several companies have not yet fully paid their land taxes

which were due at the end of March. Furthermore, the

social tax of 800 FCFA/cu.m., owed to local communities,

remains largely unpaid prompting the government to

initiate checks across the country. Presidential directives

have emphasised recovery of outstanding amounts.

All timber bundles must now be marked with GPS details

on four sides. A new weighbridge is set to become

operational at the end of October approximately 150 km

from Libreville with a maximum tonnage of 32 tonnes.

However, there are already concerns about inadequate

parking capacity for trucks near the site.

Demand sentiment

Overall sentiment remains subdued. The collapse of the

Okan market in China and the Netherlands, coupled with

large inventories and competition from Brazilian pine, is

exerting significant downward pressure on Gabonese

exports. Forestry authorities are simultaneously tightening

regulatory enforcement and tax collection, creating

additional compliance and cost burdens for operators.

Cameroon

Heavy rains have returned and are expected to persist until

the end of December. Conditions are wet nationwide and

both harvesting and forest‐to-mill transport have slowed.

Worker availability is said to be adequate, including

technicians, so the primary constraint remains access

rather than labour.

Sawmills are operating but at reduced throughput. New

contracts are slow to arrive and several operators are

deliberately limiting commitments until the political

calendar clears.

No shortage of containers has been mentioned. The

principal logistical challenges stem from weather-related

slowdowns rather than equipment or spares which are not

flagged as an acute issue at this time.

Enquiry levels are subdued. Operators are maintaining

essential production but deferring investment and

expansion decisions. Overall market tone is cautious with

buyers slow to confirm orders and suppliers prioritising

continuity over growth.

Steep log taxes driving shift to processing

Cameroon’s fiscal regime has undergone a major

transformation. Between 2017 and 2024 the export duty on

logs rose from 17.5% to 75% of the FOB value. This

steep tax hike has significantly reduced log exports which

represented just 1% of total wood export earnings in the

first quarter of 2025.

Exporters are increasingly shifting to processing as duties

on sawnwood, although rising (165% between 2016 and

2023), remain less prohibitive. To support this strategy the

government has implemented customs duty exemptions on

wood-processing equipment, encouraging value-added

transformation over raw log exports.

This policy is reshaping Cameroon’s timber sector

structure and is expected to deepen the focus on sawn

wood and other processed products in the coming years.

See: https://www.businessincameroon.com/public-

management/0210-15127-steep-log-taxes-drive-cameroon-s-

timber-sector-toward-processed-wood

Regulatory and compliance environment

Preparations for the EUDR are intensifying. European

importers have been dispatching auditors to suppliers with

specific due-diligence instructions in preparation for the

tougher import rules.

While there is discussion of a potential 12-month delay in

EUDR enforcement operators remain on alert, particularly

given Cameroon’s exposure in commodities developed on

formerly forested land (notably palm oil and bananas in

areas such as Edéa to Kribi and in West Cameroon, Tiko

and Buea).

Assuming a calm post-election period and continued

container availability activity could stabilise modestly into

November, though any recovery will depend on weather

conditions and buyer confidence.

Republic of Congo

The rain season has advanced from north to south but

harvesting activities remain at a normal level, albeit

reduced compared to earlier in the year due to weaker

demand from Asia and Europe.

The main species harvested include Sapelli, Ayous, Iroko,

Padouk and Azobe. Reduced Chinese orders are forcing

mills to pivot toward European markets which carry the

risk of overproduction, particularly for Padouk. Demand

from the Philippines for Okoume has slowed while Viet

Nam remains active for Tali and Padouk. Middle Eastern

demand for Okoume sawnwood is also low.

Transport and logistics

Transport challenges persist, particularly for operators in

the northern regions and the Central African Republic who

rely on difficult road networks to reach Douala Port.

The Likouala region has seen some improvement in

transport conditions though heavy rains continue to

complicate logistics. Increasing volumes are being

diverted toward Kribi Port in Cameroon for export.

Regulatory environment

The government is maintaining a stable policy

environment but is pressuring companies toward third-

level transformations (veneer and plywood) to stimulate

domestic value addition.

Operators continue to pay land taxes (Assiette de Coupe)

on their active concession areas. No major fiscal measures

have been announced since the Bassin Congo meeting for

which no further official information has been released.

However, the government is monitoring company finances

more closely, especially for tax and duty arrears.

The Republic of the Congo remains more export-oriented

than its neighbour, the DRC. Timber accounts for roughly

3% of national exports compared to oil at 89%.

Historically, China has absorbed over 90% of Congolese

wood exports, primarily in raw log form. While export

quotas technically limit logs to 15% of annual production

for selected species. With limited processing capacity the

emphasis remains on logs.

In the Democratic Republic of the Congo it has been

reported that governance, widespread artisanal logging and

rebel group control over key forested areas continue to

destabilise regional timber markets. Illegal extraction is

said to be accelerating in areas such as Kahuzi-Biega

National Park.

Market demand and outlook

Demand in Asia, particularly China, remains muted

creating downward pressure on harvest volumes. European

demand for certified products continues but is highly

selective and compliance with CITES and EUTR/EUDR

regulations is tightening. The third transformation push by

the government, combined with lower log demand, is

likely to nudge operators gradually toward more

processing, though infrastructure constraints remain

significant.

Dependency on the Chinese market continues to be a

strategic vulnerability exposing Congo to external shocks

in demand and regulation. International scrutiny of Congo

Basin logging is expected to intensify into late 2025 and

2026 increasing compliance costs and pressure for better

governance.

The Congolese timber sector in mid-October 2025 is

weathering seasonal rains with steady operations but under

softer market demand. Government pressure for increased

processing is mounting while Chinese market weakness

and logistical challenges continue to shape export

strategies. The sector remains stable but exposed, with

medium-term prospects hinging on infrastructure

improvements, policy clarity and diversification of export

destinations.

2.

GHANA

Forestry Commission appoints Acting Deputy Chief

Executive

The Forestry Commission has engaged the services of Mr.

Timothy Ataboadey Awotiiri as Acting Deputy Chief

Executive to the Commission.At a brief meeting at the

Commission’s Head Office the Chief Executive of

Forestry Commission Dr. Hugh C.A Brown and members

of the executive management team welcomed Mr.

Timothy Awotiiri. Mr. Awotiiri, was a former member of

parliament for Builsa North.

See: https://fcghana.org/ag-ce-welcomes-new-ag-deputy-ce/

IMF fifth staff-level agreement

Ghana and the International Monetary Fund (IMF) have

reached a staff-level agreement on the fifth review of the

country’s economic programme under the Extended Credit

Facility (ECF) arrangement. This staff-level agreement is

subject to IMF Management’s review and approval

process executed by its Executive Board. After

consideration by the Executive Board, Ghana would have

access to additional US$385 million bringing the total

IMF financial support to about US$ 2.8 billion.

The team’s engagement established that Ghana’s

macroeconomic stabilisation is taking root with growth in

2025 the first half stronger than anticipated. The external

sector has also improved noticeably with the country’s

exports which include wood products.

The positive momentum is expected to continue into 2026

with growth projected at 4.8%. Inflation is forecasted to

remain within the Bank of Ghana’s (BoG) target band of

8±2 percent, allowing for gradual monetary policy

normalisation.

See: https://thebftonline.com/2025/10/10/imf-reaches-staff-level-

agreement-on-fifth-review-of-extended-credit-facility-with-

ghana/

and

https://www.imf.org/en/News/Articles/2025/10/09/pr-25338-

ghana-imf-reaches-agreement-on-the-5th-review-of-the-ecf

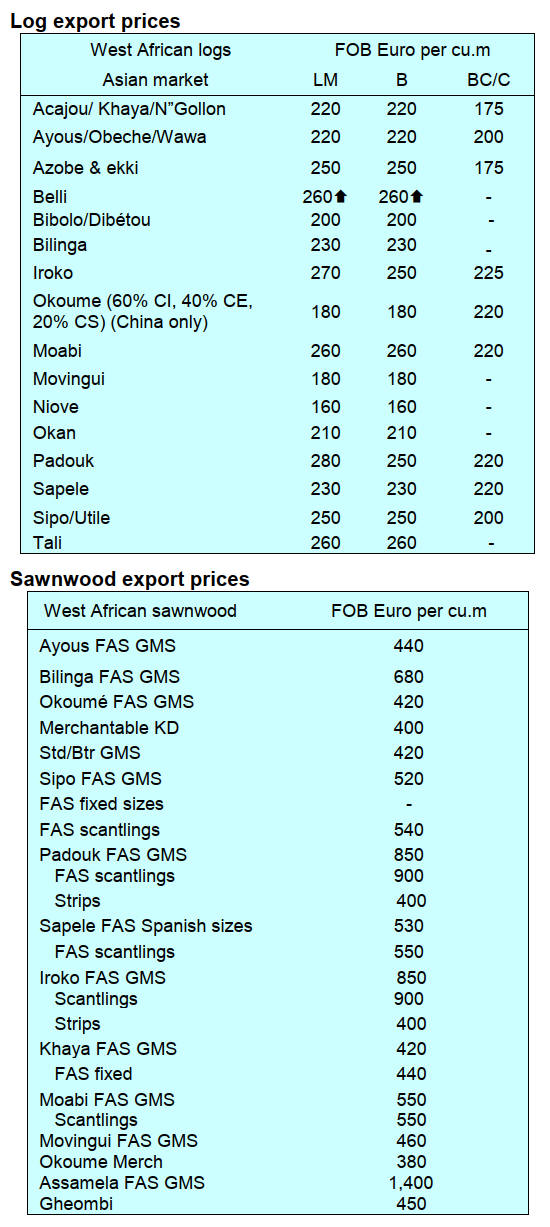

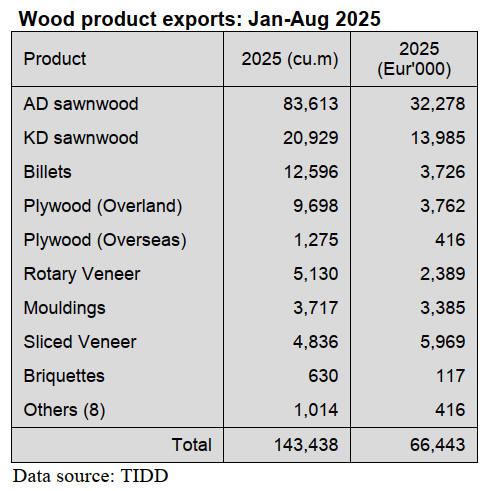

Export receipts fall 19% year-on-year

Ghana’s wood product export earnings in the first eight

months of 2025 fell 19% year-on-year according to the

Timber Industry Development Division (TIDD) August

2025 report.

The report revealed that a total of Eur66.44 million was

earned from the export of 143,438 cu.m for the period

under review compared with Eur82.46 million recorded in

the same period of 2024 from 182,542 cu.m. The drop in

exports could be attributed to the dwindling supply of raw

materials faced by local millers as well as macro-

economic constraints.

With a total of 17 products exported during the period,

primary product exports which included air-dried

sawnwood, billets, air-dried boules and poles earned

Eur36.28 million from 97,050 cu.m of the total export

value and volume respectively.

Tertiary wood products accounted for 5% of export

volumes while exports of secondary wood products

accounted for the balance. Concerns have been raised that

further progress in production of added value products is

hindered by outdated machinery and low-level production

techniques.

The Asian and European markets remain the stronghold

for Ghana’s wood product exports accounting for an

average of 66% and 16% respectively of the total export

volumes.

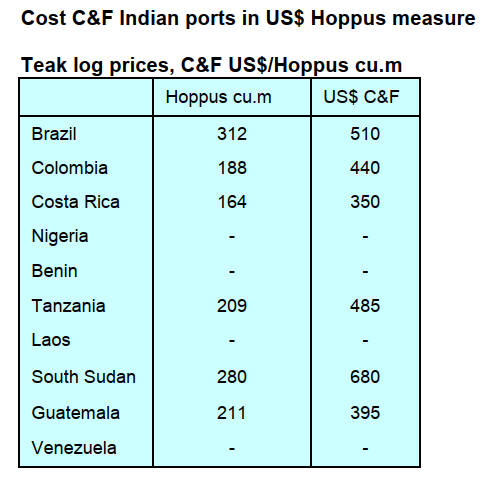

In August 2025 India was the single largest importer of

Ghana’s wood products, accounting for 50% of the total

export volume. India imported 7,408 cu.m of air-dried teak

sawnwood valued at Eur2.59 million. Teak products,

especially air-dried sawnwood, was the main species

exported. Italy and Spain imported sliced veneer but there

was a decline in rotary veneer exports to the US.

Bank of Ghana cuts policy rate

At its Monetary Policy Committee meeting the Bank of

Ghana lowered the policy rate by 350 basis points to

21.5%, the lowest level since 2019. This has signaled

confidence to the business community that the country’s

inflationary pressures will continue to ease while

economic growth remains robust.

The Bank has reinforced its determination to sustain the

disinflation process that has brought headline inflation to

its lowest level in four years. In July the Bank announced

a rate cut by 300 points that already brought reduced

borrowing costs in the money market and helped banks to

pass on lower rates to businesses and households.

According to the Ghana Statistical Service, Ghana's year

on year Inflation for September dropped significantly to

9.4% from 11.5% in August 2025. This is the lowest since

August 2021 and the ninth consecutive decline.

High cost of electricity taking a toll on businesses

The high cost of electricity is placing a heavy burden on

businesses and Ghanaians at large. Business associations

have urged the government to implement urgent reforms at

the Electricity Company of Ghana while some tax analysts

are proposing broader stakeholder engagement to reform

the ECG and boost its operational efficiency.

See: https://www.myjoyonline.com/bogs-historic-big-cut-faces-

tariffs-external-shocks-and-bank-risks/

3. MALAYSIA

Half of Malaysia’s furniture exports go to the US

In 2024 Malaysia exported RM9.89 bil worth of furniture

which represented 43% of all wood product exports. This

year, between January and July, RM5.46 bil. of furniture

was exported out of a total of RM12.64 bil wood product

exports.

With more than half of Malaysia’s furniture exports going

to the US the 25% tariffs on imported kitchen cabinets,

bathroom vanities and upholstered furniture is likely to hit

the industry hard. The local furniture industry is now

looking to the government to provide support.

Malaysian Furniture Council (MFC) CEO, Desmond Tan,

said implementing measures such as short-term financing,

tax relief, equipment upgrades and export market

incentives could help manufacturers navigate these

challenge.

According to the Malaysian Timber Council wooden

furniture exports to the US reached RM5.71bil last year,

accounting for 58% of Malaysia’s total wooden furniture

exports. US orders typically consist of bedroom furniture,

dining sets and upholstered items.

Philip Fong, a Director at Mi Kuang Furniture Centre in

Johor, said that if raw material costs were to rise due to

global factors local furniture prices could also go up.

However, he said, there could be a silver lining in the US

stance “If exporters see reduced orders from the US some

of their production capacity may be redirected to the

domestic market” .

Muar Furniture Association (MFA) president, Steve Ong,

said that, while the US stance may unsettle the market

initially, orders from the US will continue as American

consumers still rely on imports to meet their needs.

Investment, Trade and Industry Minister, Zafrul Abdul

Aziz, has said that Malaysia was actively engaging with

the US on tariff-related issues, particularly tariffs on

furniture products. Malaysia and the US are expected to

sign the Reciprocal Trade Agreement during Malaysia’s

chairmanship of the upcoming 47th ASEAN Summit

which takes place in Kuala Lumpur from 26-28 October.

Recently, the Deputy-Secretary General of the Ministry of

Investment, Trade and Industry, Mastura Ahmad Mustafa,

who also serves as the chief negotiator on US tariffs,

stated that the ministry is actively engaging with the US to

seek tariff exemptions for various products including

furniture.

“We remain hopeful for a positive outcome but we are not

sure of this,” said Desmond Tan, president of the

Malaysian Furniture Council. Tan added that both

countries share a mutually dependent economic

relationship.

The tariffs come at a time when the US economy is

showing signs of slowing and the US dollar weakening, all

of which is a negative for Malaysian furniture exporters.

Tan urged the government to provide support to the

furniture industry which has been severely affected by

these tariffs.

See: https://www.thestar.com.my/business/business-

news/2025/10/01/hoping-for-tariff-relief

Growth becoming more dependant on domestic

private consumption

According to the World Bank Malaysia’s economic

growth is expected to remain at 4.1% in 2026, unchanged

from its 2025 forecast. Its Lead Economist for Malaysia,

Dr. Apurva Sanghi, said the growth momentum is slowing

and 2026 would be rather restrained as external and

domestic factors are likely to cap growth. “Global and

regional forecasts are not that rosy. Specifically, we find

Malaysia’s economy highly sensitive to changes in the US

and China,” he said.

Apurva said Malaysia’s economic growth would mainly

be driven by private consumption, buoyed by wage

increases, government transfers and accommodative

monetary policy. In terms of the sensitivity changes of the

US and China, he explained that a 1% point reduction in

US growth reduces estimated growth in Malaysia by 0.8

percentage points. Additionally, a one percentage point

decline in growth in China reduces growth in Malaysia by

about 0.45 percentage points. “The next phase of

Malaysia’s economic story hinges on productivity,

innovation and deeper integration,” said Apurva.

See:

http://theborneopost.pressreader.com/article/282239491821434

40 years of Forest Research

Four decades since its establishment, the Forest Research

Institute of Malaysia (FRIM) is poised to elevate its

national contributions through high-impact research, green

innovation and biodiversity conservation research.

FRIM Director-General, Datuk Dr. Ismail Parlan, is

confident that with the continued support from all parties

the institute will remain relevant and authoritative as the

leading research institution for the well-being of the

people and future generations. “FRIM will continue to

play a key role in the fields of tropical forestry research,

biodiversity, climate change, biotechnology, forest

products and development based on natural resources,” he

was reported as saying.

See:

https://www.thestar.com.my/news/nation/2025/10/06/research-

and-passion-the-root-of-frims-success

4.

INDONESIA

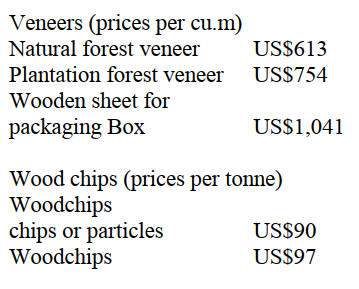

Export Benchmark Price (HPE) for

wood products

October 2025

The following is a list of Wood HPE from 1-31 October

2025.

Processed wood (prices per cu.m)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are levelled on all four

sides so that the surface becomes even and smooth of

Merbau wood with the provisions of a cross-sectional area

of 4,000 sq.mm to 10,000 sq.mm (ex 4407.11.00 to ex

4407.99.90) = US$1,500/cu.m

See: https://jdih.kemendag.go.id/peraturan/keputusan-menteri-

perdagangan-republik-indonesia-nomor-1990-tahun-2025-

tentang-harga-patokan-ekspor-dan-harga-referensi-atas-produk-

pertanian-dan-kehutanan-yang-dikenakan-bea-keluar

Plywood exports recorded growth in the first half of

year

The Indonesia Eximbank (LPEI), through its Indonesia

Exim Bank Institute, projects positive growth for

Indonesia's plywood exports in 2025 and 2026 despite

global economic uncertainties and challenges in raw

material supply.

According to Rini Satriani, Chief Specialist of Market

Intelligence and Leads Management, the value of plywood

exports is expected to grow by 8% year-on-year in 2025

driven by steady demand from key markets like the US,

China and Malaysia.

This upward trend is forecast to continue into 2026 with

an estimated 4% growth. Demand in the US is particularly

significant due to the expanding recreational vehicle (RV)

industry which relies heavily on plywood for interiors.

In the first half of 2025 Indonesia’s plywood exports

recorded positive growth with an almost 4% rise in value

and a 3% increase in volume compared to the previous

period.

Indonesia remains a strong global competitor in plywood

exports ranking second worldwide and exporting to over

85 countries with the support of more than 400 active

exporters.

Its competitive pricing, abundant timber resources and the

internationally recognised SVLK certification contribute

to its market strength. However, the industry faces

growing competition from emerging exporters and the

limited supply of certified wood due to high compliance

costs. To sustain long-term growth Rini highlighted the

need for improved access to wood certification, cost

efficiency in production and expanded market reach

through international trade agreements.

See: https://koran-jakarta.com/2025-10-05/ekspor-kayu-lapis-

diprediksi-moncer-lpei-sebut-momentum-20252026-jadi-titik-

kuat-industri-kehutanan?page=1

and

https://www.merdeka.com/uang/indonesia-eksportir-kayu-lapis-

terbesar-kedua-dunia-proyeksi-lpei-ekspor-plywood-tumbuh-

positif-hingga-2026-477134-mvk.html?page=4

US tariffs to heavily impact Indonesian furniture

exporters

The recent announcement by the US to impose higher

tariffs on imported furniture, 50% on kitchen cabinets and

bathroom vanities, and 30% on upholstered products has

raised concerns in Indonesia. The new policy, effective 1

October 2025, is expected to heavily impact Indonesian

furniture exporters who rely significantly on the US

market.

Economist Wijayanto Samirin from Paramadina

University has urged the Indonesian government to swiftly

engage in negotiations with the US to seek exemptions for

key export commodities, including furniture.

He points out that while some countries are already in

talks for exclusions, Indonesia must advocate strongly for

its core industries such as textiles, footwear, palm oil and

furniture to be protected from the new tariffs. Without

such measures, Indonesia's furniture sector could suffer

long-term setbacks in one of its most crucial export

markets.

Beginning 14 October 2025 the US will enforce a 25%

tariff on kitchen cabinets, bathroom vanities and

upholstered furniture under Section 232 of the US Trade

Act.

These tariffs are set to increase in 2026 with rates

potentially reaching 30% for upholstered products and

50% for certain items from countries that fail to strike

trade deals with the US.

Indonesian exporters are already feeling the impact, with

US buyers delaying or renegotiating upholstery orders and

becoming more cautious overall. While there was a short-

term surge in shipments to beat tariff deadlines, future

orders are expected to decline, especially in the upholstery

segment.

The combined effect of the new and existing tariffs could

lead to a total duty of 29% on lumber and 44% on

upholstered furniture from Indonesia. This is projected to

cause a 20–35% drop in upholstered furniture orders over

the next three to six months, particularly impacting OEM

manufacturers working with tight margins.

Wood case goods are also at risk with expected order

declines of 10–15% due to higher costs and a possible

shift by US buyers to alternative suppliers.

See: https://finance.detik.com/berita-ekonomi-bisnis/d-

8134725/ekspor-furnitur-ri-terancam-merosot-imbas-tarif-trump.

and

https://www.thejakartapost.com/business/2025/10/05/furniture-

makers-expect-decline-in-orders-under-new-us-tariffs.html.

In related news, the Indonesian furniture and handicraft

industry is facing severe challenges due to a combination

of the rupiah’s depreciation and new US tariffs. While the

weakened rupiah boosts export revenue in local currency

most input costs are dollar-based leading to higher

production expenses.

The crisis deepened when the United States, Indonesia’s

main export market, imposed steep tariffs on kitchen

cabinets and vanities and 30% on upholstered furniture.

This is especially damaging given that the US accounts for

over half of Indonesia’s furniture exports. Industry data

shows Indonesia already trails far behind global

competitors like Viet Nam and China in market share,

making the new trade barriers even more critical.

Abdul Sobur, Chairman of HIMKI, has called for urgent

and strategic government intervention. To stabilise the

industry HIMKI is pushing for financial relief, including

tax allowance or tax holidays for two to three years and

increased export loan interest subsidies. Without such

support the industry risks further decline amid intensifying

global competition and restricted access to its largest

export destination say HIMKI.

See:

https://money.kompas.com/read/2025/10/01/162221626/industri-

mebel-dihantam-pelemahan-rupiah-dan-tarif-impor?

and

https://kumparan.com/kumparanbisnis/industri-mebel-tertekan-

rupiah-tarif-trump-minta-tambah-insentif-pajak-25xfYTK6AgD

and

https://www.kompas.id/artikel/surplus-perdagangan-terjaga-

ekspor-furnitur-hadapi-tekanan-tarif-as?loc=hard_paywall

A challenge for industry: scarcity of high-quality raw

materials

Indonesia's wood industry is currently grappling with

significant challenges primarily due to the scarcity of

high-quality raw materials and rising global demand for

eco-friendly products. According to the Indonesian

Sawmill and Woodworking Association (ISWA), the

future of the sector depends heavily on technological

innovations that enhance product lifespan, durability and

environmental sustainability.

These innovations are not limited to furniture or

woodworking but extend to architecture, construction and

property development, underlining the need for cross-

sector collaboration.

ISWA leaders argue that innovative treatments such as

eco-friendly chemicals and high-temperature processes

can significantly improve the quality of fast-growing or

plantation wood making it more stable and less prone to

manufacturing defects. This not only adds value for

farmers and the industry but also helps extend the wood’s

lifespan from a few years to decades. Ultimately,

innovation in the wood industry is being positioned not

just as a business solution but as a broader environmental

and social strategy for sustainable development.

See: https://www.antaranews.com/berita/5137917/iswa-dorong-

inovasi-kayu-rekayasa-pacu-kontribusi-industri-pengolahan

Indonesia - global hub in furniture innovation

Indonesia is aiming to become a global hub for furniture

innovation driven by steady growth in its furniture,

handicraft and interior design sectors. According to the

Ministry of Creative Economy, these industries play a

significant role in job creation and export performance.

In 2025 furniture exports accounted for approximately

12% of the handicraft subsector ranking second and

surpassing other categories such as musical instruments

and children's toys.

At the IFMAC and WoodMac 2025 exhibition in Jakarta,

Deputy Minister Yuke Sri Rahayu highlighted the

importance of international collaboration particularly in

wood processing and hardware to boost the country’s

position in the global market.

To support this goal, the government is promoting a

hexahelix model of collaboration, engaging stakeholders

from government, business, academia, communities,

media and investors.

See: https://investor.id/business/411003/indonesia-sebagai-pusat-

industri-furnitur-dan-woodworking

Indonesia welcomes the Tropical Forest Financing

Facility initiative

Indonesia has expressed strong support for the

establishment of the Tropical Forest Financing Facility

(TFFF), with Coordinating Minister for Food Affairs,

Zulkifli Hasan, reaffirming the nation's commitment to

preserving tropical forests.

Minister Hasan highlighted that the responsibility for

protecting these forests is not only for the countries that

host them but is a global moral obligation. He noted that

one of the key challenges to forest conservation is the lack

of sufficient and stable funding which is why the TFFF

initiative is seen as a crucial step to fill the financial gaps

in conservation efforts, ecosystem restoration, and the

empowerment of local and indigenous communities.

See: https://www.msn.com/id-id/ekonomi/ekonomi/indonesia-

menyambut-baik-pembentukan-tropical-forest-financing-

facility/ar-AA1NfLew?ocid=BingNewsVerp

Strengthening social forestry to drive green economy

Indonesia is strengthening its social forestry, natural

resource conservation and forestry development

programmes to accelerate the transition toward a green

economy.

Deputy Minister of Forestry, Rohmat Marzuki,

emphasised that social forestry is a key national strategy to

create jobs, enhance welfare and preserve forests. The

programme has around 8.3 million hectares benefiting

over 1.4 million households nationwide. In Maluku

province, 171 social forestry permits have been issued,

covering 240,000 hectares and involving over 33,000

households.

These efforts have led to the creation of 533 Social

Forestry Business Groups (KUPS) which have generated

approximately Rp3.85 billion in economic transactions

this year.

Additionally, Maluku has launched its first exports of non-

timber forest products, sending 30 tonnes of damar resin

worth Rp570 million to India and 15 tonnes of nutmeg

worth Rp1.5 billion to China. Marzuki highlighted that

these developments demonstrate the potential for

economic, ecological and social benefits to align in

support of Indonesia's green economy goals.

See: https://en.antaranews.com/news/382244/indonesia-

strengthens-social-forestry-to-drive-green-economy

Human resources development in forestry sector

The Indonesian Ministry of Forestry, through its Agency

for Forestry Extension and Human Resources

Development (BP2SDM) is strengthening the

development of human resources in the forestry sector to

create a more advanced and adaptive workforce.

BP2SDM has launched a strategic transformation initiative

built around four key pillars aimed at enhancing

effectiveness, adaptability and impact. These include

improving internal and external communication strategies,

promoting a work culture focused on collaboration and

innovation, fostering regional creativity through the "One

Regional Office, One Innovation" programme and

implementing a Corporate University model to establish a

continuous learning ecosystem.

The Head of BP2SDM, Indra Eksploitasia, emphasised

that the agency must become the driving force behind

forestry development aligned with the vision of "Forestry

Human Excellence." The transformation efforts involve

cross-agency collaboration with regional offices, forestry

centres and educational institutions.

Indra called on pillar leaders and team members to carry

out their responsibilities with commitment, ensuring that

the outcomes of the initiative are practical and have a

tangible impact, particularly at the field level.

See: https://en.antaranews.com/news/382108/ministry-

strengthens-human-resources-development-in-forestry-sector

APHI - Strengthen integrity of Indonesia’s carbon

market

The Association of Indonesian Forest Concession Holders

(APHI) has expressed its full support for the government’s

efforts to enhance the integrity and credibility of

Indonesia's carbon market.

APHI Chairman, Soewarso, emphasised that this initiative

is a key opportunity to integrate environmental policies,

green investments and sustainable forest governance into a

fair and measurable framework.

He highlighted the critical role of the forestry sector in

carbon emission absorption, particularly through industrial

plantations, ecosystem restoration and land rehabilitation,

asserting that forest entrepreneurs must be seen as active

contributors to climate solutions, not just wood suppliers.

Soewarso further stressed the importance of collaboration

among various stakeholders, including the government,

businesses, international organisations and local

communities, to ensure the effectiveness and credibility of

carbon trading. This collaboration would help strengthen

verification systems, enhance technical capacity and

ensure that carbon trading benefits local communities. He

also emphasised the need to align carbon trading policies

with landuse and licensing regulations to ensure a

cohesive and sustainable system.

See: https://koran-jakarta.com/2025-10-07/aphi-dorong-

penguatan-integritas-pasar-karbon-indonesia

3.7 million hectares of peatland restored

Indonesia has successfully restored 3.7 million hectares of

peatland within concession areas, along with 52,000

hectares on community lands through the Independent

Peatland Care Villages (DMPG) programme. Agus

Justianto, Senior Policy Analyst at the Ministry of Forestry

presented these achievements during the Peatland

Breakthrough forum at the UN in New York, part of the

New York Climate Week.

He highlighted that Indonesia holds the world’s largest

tropical peatland, covering 24.67 million hectares, with a

carbon reserve of approximately 46 gigatons, which

constitutes 8–14% of the global peat carbon stock.

Additionally, Indonesia launched the International

Tropical Peatlands Center (ITPC) to foster scientific

collaboration and share best practices with countries in

Southeast Asia, the Congo and Peru.

In related news, Indonesia's Environment Minister has

called on companies to increase their support for peatland

restoration efforts, particularly by empowering local

communities near concession areas.

Speaking at the Peat Ecosystem Restoration Collaboration

Forum, Hanif Faisol Nurofiq emphasised the

government’s goal of managing 2,354 Peat-Caring

Independent Villages with 1,450 of these villages

requiring direct assistance from businesses due to their

location in concession buffer zones. He urged businesses

to help provide training to local workers to equip them

with the skills necessary for effective peatland restoration.

See: https://forestinsights.id/indonesia-pulihkan-37-juta-hektare-

lahan-gambut/

and

https://forestinsights.id/klh-gandeng-stakeholders-untuk-

restorasi-ekosistem-gambut-dan-mangrove/

CEPA with Canada and EU strengthens trade

opportunities

Trade Minister Budi Santoso announced that the signing

of the Comprehensive Economic Partnership Agreements

(CEPA) with Canada and the European Union marked the

beginning of efforts to strengthen Indonesia's position in

global trade.

He emphasised that these agreements, namely the ICA-

CEPA with Canada and IEU-CEPA with the European

Union are crucial for boosting Indonesian exports amid the

current global trade and geopolitical challenges. In 2024,

Indonesia’s exports to Canada were valued at US$3.5

billion, while exports to the EU stood at US$30 billion,

and both agreements are expected to further increase these

figures.

The ICA-CEPA, signed in Ottawa in September provides

preferential treatment for over 90% of Indonesian tariff

lines, potentially boosting the competitiveness of products

like textiles, footwear, furniture and electronics in Canada.

Similarly, the IEU-CEPA, signed in September focuses on

reducing tariffs on over 98% of goods traded between

Indonesia and the EU. This agreement aims to increase

Indonesian exports to the EU by 2.5 times within the next

five years with a focus on labour-intensive sectors such as

palm oil, coffee, textiles and furniture.

See: https://en.antaranews.com/news/383129/cepa-with-canada-

eu-strengthens-indonesias-global-trade-minister

5.

MYANMAR

Conflict, Crackdowns and Shifting Trade

Myanmar's forestry and timber trade in 2025 remains a

complex issue marked by ongoing efforts to curb illegal

logging, a slight decrease in the overall deforestation rate

and limited international market access due to

sanctions. Recent months have seen a wave of illegal

timber seizures and a renewed governmental push towards

forest conservation. The sector continues to be a source of

revenue and at the same time a focal point of conflict.

Recent reports indicate that authorities are actively

cracking down on the illicit timber trade. These seizures

are part of a broader government initiative to intensify its

campaign against illegal trade in various sectors, including

forestry. Despite these efforts, political and social

instability in many parts of the country continues to fuel

unregulated logging activities.

The ongoing conflict creates a challenging environment

for effective forest governance and enforcement with

reports suggesting that both state-affiliated actors and non-

state groups are involved in the illicit timber trade.

In a move to bolster forest protection, the government

announced in August 2025 the establishment of numerous

reserved and protected forests, now covering nearly 26%

of the country's land area. This initiative, based on the

2018 Forest Law, aims to mitigate climate change,

conserve biodiversity and ensure the sustainable extraction

of forest products. Furthermore, the Chairman of the State

Administration Council has issued a directive to increase

the nation's forest coverage to 50%, signaling a high-level

commitment to reforestation and conservation.

The international timber trade from Myanmar remains

heavily shaped by sanctions. However, the trade has not

ceased instead, it has largely redirected towards Asian

markets. Also, Myanmar's timber finds its way to various

international markets, often through complex and opaque

supply chains.

The international market has been significantly altered by

sanctions but the trade continues through alternative

channels, highlighting the persistent global demand for

Myanmar's valuable timber resources.

See: https://sacoffice.gov.mm/en/senior-general-min-aung-

hlaing-state-security-and-peace-commission-chairman-republic-

union-0?utm_source=chatgpt.com,

and

https://news.mongabay.com/2025/10/protected-areas-hit-hard-as-

mekong-countries-forest-cover-shrank-in-

2024/?utm_source=chatgpt.com

and

https://www.globalforestwatch.org/dashboards/country/MMR/?ut

m_source=chatgpt.com

Jobs - strong hiring in banking and trading

Myanmar’s job market continues to show resilience and

diversification, with the banking and trading

sectors leading employment demand according to the

latest “Navigating Talent Trends in Myanmar” report

released by JobNet.com.mm for September 2025.

The banking, insurance and microfinance industry retained

its top position for job postings, signaling continued

expansion in financial services and credit access across the

country. It was followed by Fast-Moving Consumer

Goods (FMCG) and trading/distribution and import-export

underscoring steady consumer demand and cross-border

trade activities despite economic challenges.

JobNet’s report serves as a benchmark for professionals,

employers and jobseekers navigating Myanmar’s shifting

labour landscape. The company noted that the steady

demand in finance, trade and IT-related fields points to a

gradual digital and economic reorientation in Myanmar’s

post-pandemic workforce.

See: https://banking.einnews.com/pr_news/856315844/2025-

september-navigating-talent-trends-in-myanmar

Central Bank tightens monetary policy

The Central Bank of Myanmar (CBM) has announced new

measures to absorb excess liquidity in the financial system

in an effort to curb inflation and stabilise the kyat.

According to the CBM’s statement, banks will be required

to increase their Average Excess Reserve funds held

beyond the mandatory 28-day reserve in kyat at the

Central Bank.

The Central Bank said the policy aims to restrain

inflation, support the kyat’s value and enhance interest

income for banks which could strengthen both banking

sector stability and overall monetary stability in Myanmar.

See: https://burmese.dvb.no/post/727300

6.

INDIA

India’s growing economic resilience

Speaking at the Kautilya Economic Conclave, the Minister

of Finance, Nirmala Sitharaman, highlighted India’s

growing economic resilience and said that the nation is

well-equipped to absorb external shocks amid ongoing

external trade tensions.

“Our capacity to absorb shocks is strong, while our

economic leverage is evolving. Our choices will determine

whether resilience becomes a foundation for leadership or

merely a buffer against uncertainty. So in conclusion,

history teaches us that crises often precede renewal”, said

Sitharaman

She added “Geopolitical conflicts are intensifying.

Sanctions, tariffs and decoupling strategies are reshaping

global supply chains and that these dynamics highlight

both India’s vulnerability and resilience

Becoming ‘Viksit Bharat’ (more economically

independent) by 2047 does not imply that India wants to

be a closed economy the Minister said adding, “we have to

reach 8% GDP growth to get to the goal for a developed

nation.”

See: https://timesofindia.indiatimes.com/business/india-

business/indian-economy-resilient-can-absorb-shocks-fm-

sitharaman-says-amid-50-us-tariffs-targets-8-gdp-

growth/articleshow/124283495.cms

Households beginning to feel relief from rising prices

According to the Reserve Bank of India’s latest Inflation

Expectations Survey, Indian households are beginning to

feel some relief from rising prices. The September 2025

survey showed that while households’ perception of

current inflation rose slightly, expected price increases

across major product categories including food, non-food

items, housing and services, have eased, signalling a

possible slowdown in the country’s cost-of-living

pressures.

Conducted between 28 August and 6 September across 19

major cities the survey found that median current inflation

perception rose marginally by 20 basis points to 7.4%

compared with the previous round. However, households

expect prices to rise less in the near future. Three-month

inflation expectations dropped to 8.1%, down 20 basis

points, while one-year expectations fell.

See: https://timesofindia.indiatimes.com/business/india-

business/inflation-outlook-indian-households-expect-price-

pressure-to-cool-heres-what-rbi-survey-

says/articleshow/124282015.cms

An assessment of India’s office market

In a press release the Confederation of Real Estate

Developers' Associations of India (CREDAI) reports that,

in collaboration with real estate data intelligence company,

CRE Matrix, an assessment of India’s Office Market has

been prepared revealing sustained momentum across

India’s commercial real estate landscape.

The report highlights the market’s structural strength with

vacancy rates declining between 2024 and 2025

underpinned by robust demand of 34.5 million square feet

in the first half of 2025 and consistent absorption across

major business hubs.

The Indian office market’s resilience is anchored by a

balanced demand-supply ratio of 1.3 times over the last six

quarters reflecting the continued confidence of occupiers

and the expansion of Global Capability Centres (GCCs).

The ongoing shift towards flexible work models and

strong domestic demand are also driving robust absorption

rates across Bengaluru, Mumbai Metropolitan Region,

Delhi and Hyderabad.

See: https://credai.org/media/view-details/?file_no=94

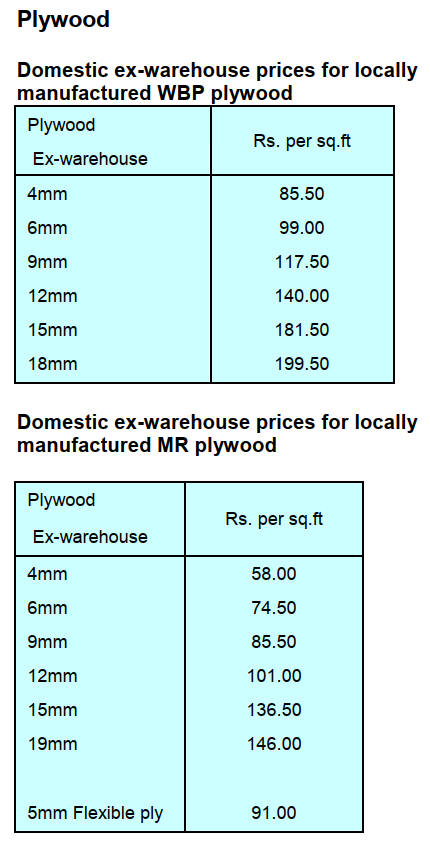

Changes to tax - wood based panel sector has not

benefitted

Recently Central government announced the GST (Goods

& Services Tax) reforms which eliminated the 28% and

12% tax on multiple consumer goods, however, the wood

based panel sector has not benefitted from the recent

changes despite a flurry of letters from various industry

associations seeking to bring the GST on agro-forestry

sourced plywood product from the current 18% to 5%.

Following the recent GST revisions the tax rates on

bagasse based particleboard and cement bonded

particleboard have been brought down from 12% to 5%

whereas the rate on craft paper and print base paper used

in high preasure laminate manufacturing has been

increased from 12% to 18%.

Plywood associations across the country such as the

Federation of Indian Plywood and Panel Industry, the

Haryana Plywood Manufacturers Association, the Punjab

Plywood Manufacturers Association, theUP-PWMA Utter

Pradesh Plywood Manufacturers Association, the All

Bharat Plywood & Laminate Trade Association and many

others have requested the finance ministry to reduce the

18% rate on agro-forestry based plywood products.

The plea had been made in the interest of farmers, engaged

in agro-forestry which is a significant source of their

income. In this context the Himachal Pradesh Plywood

Manufacturers Association wrote to the Chief Minister

seeking his intervention.

In its appeal the Association wrote “Plywood is directly

connected with thousands of farmers irrespective of their

states. 60% of our raw material is farm grown timber.

Because of plywood factories, vast number of trees

continues to exist on the farmland which improves the

environment and fixes the carbon”.

Haryana State has been a major plywood manufacturing

hub for the last 30 years and a GST reduction on plywood

will boost the economy and create employment in the state

the letter mentioned.

The Plywood industry in Punjab, with over 90% of its raw

material is sourced from farm grown timber, says that the

tax rate should be iniform to level the playing field.

The All Bharat Plywood & Laminates Trade Association

(ABPLTA) also requested the Finance Minister to review

the GST on panel products saying that now 100% of the

raw material comes from agro-based plantations and a

lower GST will directly benefit farmers. FIPPI also joined

conglomeration of associations making an appeal to the

Minister.

From an environmental point of view, AIPLI also

highlighted that promoting the wood panel sector through

a lower GST rate would incentivse the use of sustainable

material and align tax policy with the country’s

environmental commitments adding that lowering the GST

on agroforestry sourced wood and wood panels made from

such material would support the government’s affordable

housing goals, enhance farmer incomes by encouraging

agroforestry and improve tax compliance by reducing

inventive for tax evasion.

See: https://www.plyreporter.com/current-issue

and

https://www.plyreporter.com/article/154199/reduction-of-gst-on-

wood-panel-needs-priority-fippi

and

https://plyinsight.com/gst-on-plywood-should-be-5-employment-

will-rise-farmers-income-will-increase/

7.

VIETNAM

Wood and Wood Product (W&WP) trade highlights

Customs Department data shows W&WP exports to the

UK in August 2025 reached US$20.6 million, down 1%

compared to August 2024. In the first 8 months of 2025,

the exports of wood and wood products to the UK market

earned US$159.6 million, up 9% over the same period in

2024.

Viet Nam's W&WP exports to South Korea in August

2025 earned US$60.6 million, down 13% compared to

August 2024. In the first 8 months of 2025 W&WP

exports to this market were valued at US$493.2 million,

down 6% over the same period in 2024.

Viet Nam’s pine timber imports in August 2025 were

102,100 cu.m worth US$19.9 million, down 7% in volume

and 7% in value compared to July 2025. Compared to

August 2024, pine imports were down 9% in volume and

24% in value. In the first 8 months of 2025 pine imports

totalled 690,000 cu.m, worth US$139.5 million, up 15% in

volume and 5% in value over the same period in 2024.

This increase followed the demand for raw materials for

the wood processing industry as furniture exports continue

maintaining an upward trend.

In July 2025 imports of wood and raw materials from the

EU increased for the fourth consecutive month and

reached the highest level ever at 115,450 cu.m with a

value of US$34.73 million, up 6% in volume, but down

2% in value compared to June 2025 and an increase of 8%

in volume and 5% in value over the same period in 2024.

In the first 7 months of 2025 imports of raw wood from

the EU reached 575,860 cu.m with a value of US$183.68

million, up 24% in both volume and value over the same

period in 2024.

It is estimated that the exports of wood and wood products

in September 2025 will reach US$1.3 billion, up 4%

compared to September 2024. Of the total exports of wood

products are estimated at US$864 million, down 6%

compared to September 2024. In the first 9 months of

2025 exports of wood and wood products are estimated at

US$12.4 billion, up 6% over the same period in 2024 of

which exports of wood products are estimated at US$8.5

billion, up 5% over the same period in 2024.

In the first 9 months of 2025, the W&WP exports, in

general, maintained positive growth. However, from

August, a slowdown trend has been observed reflecting

weakness from overseas markets. This development shows

that global consumer demand is slowing down, especially

in key import markets, thereby putting pressure on the

export target of US$18 billion for the whole year 2025.

The imports of raw wood (logs and sawnwood) in

September 2025 are estimated at 684,000 cu.m, worth

US$218.9 million, up 9% in volume and 10% in value

compared to August 2025. Compared to September 2024

imports were up 39% in volume and 39% in value. In the

first 9 months of 2025 imports of raw wood are estimated

at 5.27 million cu.m, worth US$1.67 billion, up 28% in

volume and 25% in value over the same period in 2024.

In 2025 it is expected that raw wood imports to Viet Nam

will total 7 million cu.m, worth around US$2.3 billion

showing a growth momentum in the wood industry and the

trend of expanding supply from many sources to ensure

the legality and sustainability of the supply chain.

Viet Nam’s NRFP exports in August 2025 increased

slightly reaching US$66.26 million, up 0.4% compared to

July 2025 but down 1% over the same period in 2024. In

the first 8 months of 2025 NTFP exports fetched

US$574.20 million, up 5% over the same period in 2024.

Additional tariff came as a shock

From 14 October 2025 wooden furniture exported to the

US will be subject to an additional import tariff of up to

25%. This came as a shock at a time when enterprises are

accelerating production raising concerns over the

feasibility of maintaining Viet Nam’s 2025 wood export

targets.

In the long term, aside from adapting to frequently

changing tariff policies, enterprises in the wood industry

are working to improve product quality. Expanding

markets and building the Viet Namese wood brand are

considered key solutions for the sector’s sustainable

development.

The tariff rate may increase to 50% for dressing tables and

kitchen cabinets and 30% for upholstered products early

next year.

The US cited Section 232 of the 1974 Trade Act arguing

that wood and furniture imports are undermining national

security, weakening the domestic timber industry and

threatening supply chains linked to infrastructure and

defence. This decision will impact countries that export

significant volumes of wood products to the US including

Canada, Mexico and Viet Nam.

For Viet Nam the US remains the largest market for wood

products. In 2024, exports to the US were estimated at

around US$9 billion accounting for over 50% of the

industry’s total exports.

According to Ngo Si Hoai, Vice Chairman and Secretary

General of the Viet Nam Timber and Forest Products

Association, Viet Nam’s wood product exports will

certainly be affected by the decision announced by the US.

In the immediate term Viet Namese wooden furniture will

fall into the 25% tariff category. If the rate rises to 30–

50% in early 2026 many enterprises will reconsider their

strategies. Adjusting in the short term will be difficult as

the US market accounts for a significant share of Viet

Nam’s wood exports.

In fact, the US decision not only creates disadvantages for

exporting countries but has also triggerd mixed reactions

within the US itself. The higher tariffs are expected to

push up construction and production costs domestically,

while reducing the international competitiveness of the US

paper and pulp industries. Meanwhile, Viet Nam has been

a stable and reliable supplier of wood products for many

years. The new tariffs will not only affect Viet Namese

manufacturers but also have a direct impact on the entire

supply chain and American consumers.

To cope with these challenges Viet Namese wood

enterprises are strengthening supply chain cooperation,

expanding e-commerce operations, accessing new markets

and enhancing their competitiveness within global value

chains.

According to wood businesses, to respond effectively to

such tax policy fluctuations the Government should

provide greater support in terms of market information and

intelligence. It is also essential to consider tariff risk

assessment as a key tool to help enterprises develop

suitable solutions for each supply chain and product

category.

Nguyen Phuong, Vice Chairman of the Dong Nai Wood

and Handicrafts Association (Dowa), noted that in the

final months of 2025, market performance may decline

depending on the extent of tariff changes, especially since

exports to the US account for more than half of Viet

Nam’s total wood export value. Therefore, enterprises

must closely monitor market developments and trade

policies from importing countries to ensure that they have

flexible and adaptive strategies.

Another issue for the industry is fostering innovation and

breakthrough efforts in building brands in the international

market. Despite considerable improvement in recent years

Viet Nam’s furniture industry still lacks a breakthroughs

and remains largely dependent on contract manufacturing.

Businesses should vigorously pursue the goal of

establishing professional design and marketing teams to

trade under their own brands.

Sharing the same view, Nguyen Chanh Phuong, Vice

Chairman of the Handicraft and Wood Industry

Association of Ho Chi Minh City (HAWA), emphasised

the importance of production autonomy for businesses.

For sustainable development the sector requires a skilled

workforce and a legally certified source of raw materials.

At the same time the Government needs to issue

supportive policies for industry development and assist

enterprises in addressing issues arising from participation

in the global goods market.

Although market fluctuations are unavoidable they also

present opportunities for Viet Nam’s wood industry to

restructure. In recent years, thanks to its flexible market

approach, the sector has experienced strong growth. Its

annual exports reached US$16–17 billion and further

development remains within reach, particularly if brand

building continues to be prioritised.

See: https://baodongnai.com.vn/english/202510/wood-industry-

faces-new-challenges-da62da2/

Navigating tariff pressures through market

diversification

The US’s decision to impose high tariffs on a range of

Viet Namese exports, including wood products and

furniture, is pushing the country’s timber industry to

swiftly recalibrate its strategies to sustain growth.

Canada has emerged as a promising market with Viet Nam

ranking among its top three wood product suppliers.

According to the Viet Nam Timber and Forest Products

Association, Canadian buyers show strong demand for

Viet Namese products, particularly bedroom furniture,

which accounts for over 35% of the sector market share.

Analysts attribute this success to both quality and the

industry’s responsiveness to consumer preferences for

sustainable, minimalist and eco-friendly designs.

The Ministry of Industry and Trade (MoIT) has advised

businesses to prioritise Forest Stewardship Council (FSC)

certified products to meet Canadian sustainability

requirements alongside strict standards on safety,

durability and fire resistance.

The Comprehensive and Progressive Agreement for

Trans-Pacific Partnership (CPTPP) also offers tariff

advantages enhancing the competitiveness of Viet Namese

products.

Canada itself is a major timber producer with annual

output of around 600 million cubic metres, yet its furniture

industry meets only half of domestic demand. This

reliance on imports, particularly competitively priced

items, positions Viet Nam as a key supplier to bridge the

gap.

HAWA Chairman Phung Quoc Man noted that, unlike the

US, other markets have yet to impose tariffs on Viet

Namese wood. He urged enterprises to make full use of

free trade agreements, enhance design capacity and

expand online sales channels.

Nguyen Cam Trang, Deputy Director of the MoIT’s

Import-Export Department, said the ministry continues

technical talks with the US on trans-shipment issues where

clear definitions and guidelines are still lacking. In the

meantime, Viet Namese businesses are encouraged to

leverage free trade agreements and broaden export outlets

to maintain growth momentum.

See: https://Viet Namnet.vn/en/Viet Nam-s-wood-sector-

navigates-tariff-pressures-with-market-diversification-

2448006.html

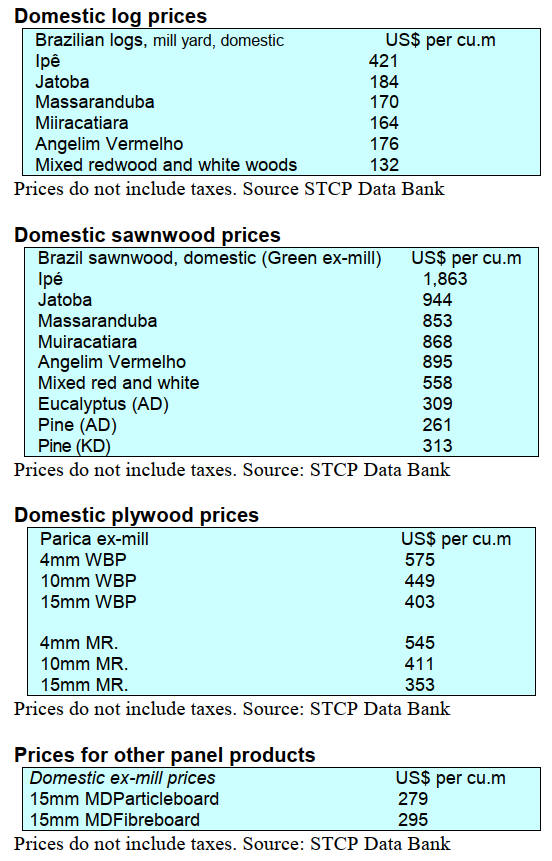

8. BRAZIL

Paraná - Brazil’s second largest forestry

producer in

2024

The State of Paraná became Brazil’s second largest

forestry producer in 2024 with a record production value

of R$6.9 billion, a 27% increase compared to 2023,

according to the Brazilian Institute of Geography and

Statistics (IBGE). Paraná accounts for 16% of the national

forest production after Minas Gerais (19%) and ahead of

São Paulo (13%), together these three states account for

nearly half of the country’s total forestry output.

In 2024 platations accounted for 92% of Paraná's forest

production (R$6.34 billion), representing a 24% growth

over the previous year according to IBGE. The State is

Brazil´s the largest producer of roundwood for industrial

purposes (32%) and of fuelwood from planted forests (14

million cu.m, 26% of the national total).

Forestry production in Paraná spans 391 of the State´s 399

municipalities. The municipality of General Carneiro

ranks first nationally in plantations, with R$637.2 million

followed by Sengés, Cruz Machado, Telêmaco Borba and

Bituruna municipalities. National forest extraction

represents 8% of the state's forestry production (R$577

million), with São Mateus do Sul municipality standing

out as a key contributor. Paraná also maintains leadership

in the production of yerba mate (leaves of the plant can be

used to make a beverage known as mate) with 86% of

Brazil´s total (R$117 million) and is the largest producer

of pine nuts.

In 2024 the value of yerba mate extraction in the southern

region reached R$522.8 million, an 11% decrease

compared to 2023.

With 1.2 million hectares of planted forests Paraná ranks

as the third largest State in cultivated forest area with Pine

plantations (670,700 ha.) and maintaining a significant

share in Eucalyptus (464,440 ha.) and other species

(22,600 ha.). Timber production primarily supplies the

pulp and paper industries.

See: https://apreflorestas.com.br/noticias/com-alta-de-207-

parana-consolida-vice-lideranca-no-valor-da-producao-florestal/

Forest restoration drives investment and innovation

Forest restoration in Brazil has become a pillar of the low-

carbon economy attracting investments in projects that

combine ecological recovery, sustainable forest production

and carbon credit generation. Since 2024 companies such

as Re.green, Mombak, Symbiosis Florestal and Biomas

Carbon2Nature have joined the Brazilian Tree Industry

(Ibá) strengthening the expansion of Brazil´s forest

restoration and environmental conservation sector.

Re.green has expanded its restoration activities to over

30,000 hectares in the Amazon and Atlantic Forest biomes

with 12,000 hectares currently under active restoration in

partnership with Microsoft and Nestlé. The company

promotes the planting of millions of trees and the

generation of certified carbon credits.

Since 2021, it has cultivated 6 million seedlings in the

states of Bahia, Pará, Maranhão and Mato Grosso in

collaboration with 29 local nurseries. Mombak received

R$160 million from the Climate Fund of the Brazilian

Development Bank (BNDES) and announced an

international investment round of US$30 million,

consolidating its position as a leading company in

degraded land restoration and carbon removal through

native species reforestation in the Amazon region.

Symbiosis Florestal received R$77.6 million from the

BNDES Climate Fund in the first financing initiative

dedicated to native species silviculture in Brazil.

Supported by Apple’s Restore Fund, the project plans to

plant 3,000 hectares, with 12 native species of the Atlantic

Forest, integrating sustainable tropical wood production,

conservation and local job creation.

The Muçununga Project, a partnership between Biomes,

Carbon2Nature and Veracel Celulose, aims to restore

1,200 hectares in southern Bahia with 2 million native

timber species seedlings by 2027 removing approximately

500,000 tonmes of CO₂ over 40 years. The initiative

exemplifies a new forest business model that combines

ecological restoration, sustainable management, carbon

credit generation and biodiversity valuation marking a

significant step forward in integrating silviculture,

technological innovation and green finance in Brazil.

See: https://www.maisfloresta.com.br/restauracao-florestal-

avanca-no-brasil-e-atrai-novos-investimentos/

Brazil announces initial investment in the Tropical

Forest Fund

The Brazilian government has announced a US$1 billion

investment in the Tropical Forest Forever Facility (TFFF),

an international financial mechanism aimed at

economically valuing tropical forest conservation.

The initiative, led by Brazil with support from the World

Bank, will be officially launched during the United

Nations Climate Change Conference (COP30) in Belém,

Pará. Its initial target is to mobilise US$25 billion by

November 2025 aiming to leverage up to US$125 billion

through private sector participation.

Other potential investors include Germany, the United

Arab Emirates, France, Norway and the United Kingdom.

The TFFF proposes an annual payment model per hectare

of preserved forest, encouraging tropical countries such as

Brazil, Colombia, Ghana, Congo, Indonesia and Malaysia

to keep their forest areas standing.

In the Amazon alone investments could reach US$2

billion per year helping to reduce the current US$7 billion

annual funding gap in the region. These amounts could

triple investments in forest conservation and help to curb

the expansion of predatory development models.

See: https://agenciabrasil.ebc.com.br/meio-

ambiente/noticia/2025-09/brasil-anuncia-us-1-bilhao-para-fundo-

de-florestas-tropicais

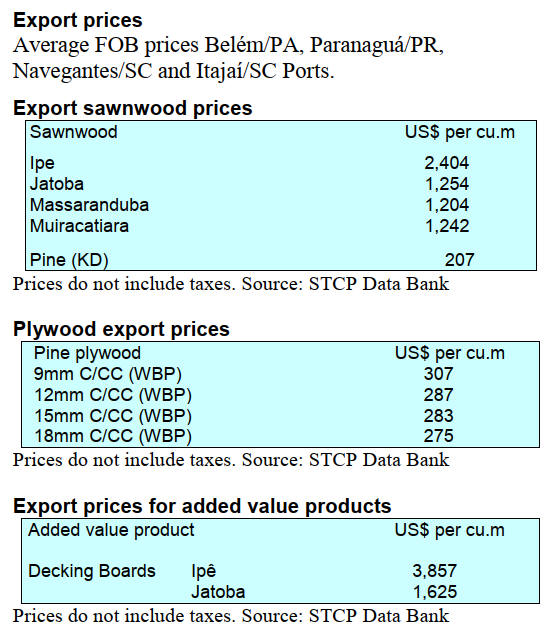

Impact of US tariffs on the timber sector

At a public hearing at the Legislative Assembly of Paraná

the Brazilian Association of the Mechanically Processed

Wood Industry (Abimci) presented its analysis of the

“Effects and Consequences of Lack of Negotiation with

the US Government Regarding Tariffs”.

Abimci shared data and information on the impacts of US

tariff measures on the timber sector, reporting over than

4,000 layoffs have already occoured while approximately

5,500 workers are currently on forced vacation and about

1,100 on temporary layoff.

If the tariffs remain in place for another two months,

projections indicate an additional 5,000 job losses, further

increasing the economic vulnerability of the producing

regions.

Abimci emphasised that unfair competition from other

countries with lower tariffs, such as Indonesia (19%), Viet

Nam (20%) and China (35%) threatens the maintenance of

access to the US market and the client base built over the

past three decades.

This situation jeopardises the competitiveness of Brazilian

industries and may result in a permanent loss of market

share.

The Federation of Industries of Paraná (Fiep) proposed the

creation of a crisis committee to monitor the effects of the

tariffs and to develop mitigation strategies. Among the

emergency measures announced by the State government

are direct credits purchase, ICMS (Tax on the Circulation

of Merchandise and Services) relief for affected

companies, expedited credit approvals and studies on new

forms of tax reduction as well as facilitated financing

through the Southern Regional Development Bank

(BRDE).

The meeting reinforced the need for swift and coordinated

responses between the productive sector and the

government to minimise social and economic impacts,

preserve jobs and prevent factory closures, especially in

regions with a high concentration of wood industries. The

mobilisation also seeks to pressure the federal government

to resume negotiations with the US to reduce or eliminate

tariffs on Brazilian processed wood.

See: https://abimci.com.br/abimci-apresenta-impactos-da-

taxacao-dos-eua-em-audiencia-publica-na-assembleia-legislativa-

do-parana/

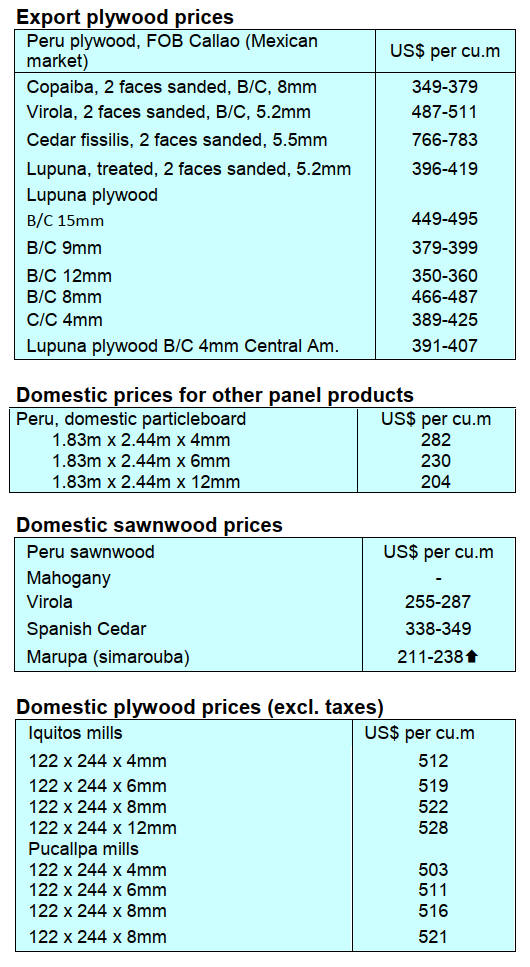

9. PERU

Pucallpa hosts business to business event

Pucallpa City was the location for the Ucayali 2025

Timber Business Roundtable, an event organised by the

Peruvian Export and Tourism Promotion Commission

(PROMPERÚ) in conjunction with the Regional

Government of Ucayali (GOREU) and the Provincial

Municipality of Coronel Portillo.

This initiative provided an opportunity for entrepreneurs in

the region's timber sector to establish direct contact with

international buyers opening new doors to the global

market and strengthening Ucayali's position as one of the

country's leading suppliers of forest products.

The event attracted the interest of foreign buyers in a

diverse variety of high-quality timber products, including

sawnwood, flooring, moldings, panels, beams, doors and

finger-jointed panels, products that represent the

productive potential of the Ucayali forestry industry.

This selection of products reflected the local timber

industry's ability to offer raw materials and value-added

products increasing the possibilities for forging

sustainable, long-term trade agreements. Representatives

of foreign companies from Chile, Colombia, Mexico,

Panama, Canada and Germany were present. For local

entrepreneurs, this business roundtable represented an

invaluable platform to showcase the quality of their

products, to establish direct business contacts and to learn

firsthand about the demands and trends in the international

market.

See:

https://eventospromperu.org.pe/event/iiiruedadenegociosdemader

a2025

Pioneering effort on Amazon forest regeneration

The Ucayali Region is advancing strategies for forest

regeneration through a study "A Look at Conservation:

Potential of Seed Trees in Native Communities and Forest

Concessions in the Ucayali Region." This research is

being conducted in the Yamino native community of the

Kakataibo people.

The project is being implemented jointly by the Forest and

Wildlife Resources Oversight Agency (OSINFOR), the

National Agrarian University of the Selva (UNAS) and the

Association for Comprehensive Research and

Development (AIDER). The institutional alliance

strengthens Amazonian forest research by examining

under-researched species and natural regeneration.

The data collected will determine the forest's natural

regeneration capacity and identify the productive potential

of seeds thus providing key information for promoting

reforestation programmes, restoring degraded areas and

developing sustainable marketing alternatives that

strengthen community economies. The species studied are

ana caspi, mashonaste, copaiba and cachimbo.

See: https://www.gob.pe/institucion/osinfor/noticias/1244472-

ucayali-impulsa-estudio-de-arboles-semilleros-para-fortalecer-la-

regeneracion-y-conservacion-de-los-bosques

CITEforestal chainsaw operator training

CITEforestal Pucallpa evaluated and certified the job

competencies of more than a dozen chainsaw operators

working for forestry companies.

The evaluation team conducted a total of 26 knowledge

tests on the job competency standards for "Cutting

Operations" and "Commercial Trunk and Log Cutting"

and the operators successfully passed both processes. The

trainees were from the companies Consorcio Maderero

S.A.C and Wood Baruch located in the Districts of

Contamana and Padre Márquez, Ucayali Province.

The role of chainsaw operators is key in the forestry