|

Report from

Europe

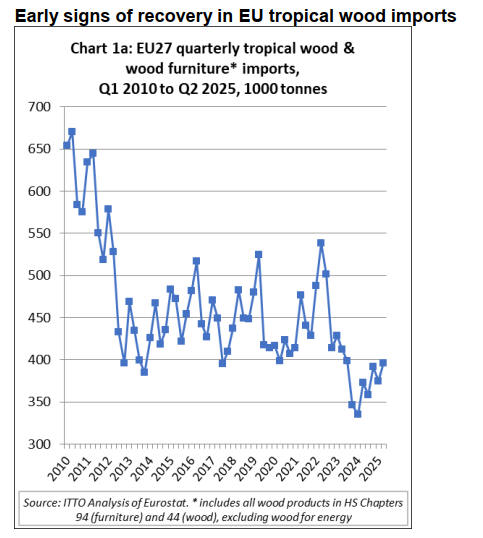

The EU27 imported 770,800 tonnes of tropical wood and

wooden furniturein the first six months of 2025, 9% more

than the same period in 2024 when imports were at an all-

time low. Imports in the second quarter of this year were

396,000 tonnes, 6% more than the previous quarter and

6% more than the same quarter the previous year.

Import tonnage during the second quarter of this year was

still well below the long-term quarterly average of around

450,000 tonnes in the last decade (Chart 1a above).

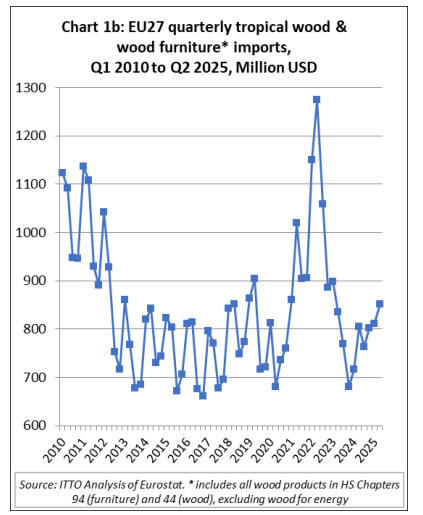

EU27 import value of tropical wood and wooden

furniturein the first six months of 2025 was US$1663

million, 9% more than the same period in 2024. Import

value in the second quarter this year was US$852 million,

5% more than the previous quarter and 6% more than in

the same quarter in 2024.

In nominal US$ value terms (i.e. not accounting for

inflation), import value during the second quarter of 2025

was well above the pre-pandemic 2013-2019 quarterly

average of around US$750 million (Chart 1b).

Fragile recovery in EU economy despite political

volatility in France

The faint signs of recovery in EU imports of tropical wood

products align closely with trends in the wider EU

economy.

The economy of the eurozone is growing but, according to

the IMF, only at a forecast 1.0% for 2025 and 1.2% for

2026. The forecast average rate of growth in the zone’s

three largest economies – Germany, France, and Italy – is

just 0.4%.

The economic recovery is fragile and there are continuing

political challenges.

A recent article in the Economist, the UK-based journal,

notes that “on September 8th the French government fell,

owing to disputes about how to close the country’s outsize

budget deficit, prompting its benchmark bond yields to

rise to the level of Italy’s for the first time since the

creation of the euro in 1999.

But there are also positive signals and underlying strengths

to the EU economy. The Economist observes that “the

purchasing managers’ index for European manufacturing,

a widely watched measure, reached a multi-year high in

August. Similarly, Germany’s main sentiment indicator,

the Ifo index, showed business expectations at their

highest since the start of the war in Ukraine.

For its part, Spain’s economy is going from strength to

strength, growing in both manufacturing and services,

according to surveys, helped by high immigration from

Latin America”.

A key reason for the recovery, however fragile, is that

inflation has been almost beaten, at 2.1% in the year to

August, which have allowed interest rates to be reduced.

Consumers have yet to respond with a significant increase

in consumption, but their savings have improved, holding

out the prospect of better times ahead.

The EU private sector is now faring much better than a

decade ago when the bloc was in the throes of the euro

area crisis. Outside of France, private sector debt has

fallen from a peak of 110% of GDP to 95%, the lowest

level in 17 years. Households and corporations are flush

with cash, and debt servicing ratios are healthy across

Europe except in France.

Similarly, European banks have now greatly rebuilt their

balance sheets. Non-performing loans are no longer a

threat, capital and liquidity ratios are robust and

profitability has improved. Germany’s new government

under Chancellor Friedrich Merz has lifted the country’s

debt brake and is embarking on a $1.2 trillion spending

spree focused on defence and infrastructure that is

expected to boost the broader EU economy.

It would be wrong to suggest that these positive trends for

the EU economy yet outweigh the negative impulses.

France’s political crisis may worsen. Export markets are

becoming more challenging in the face of increased tariffs,

slower global economic growth and vigorous competitors.

Structural reforms to the EU economy, seen by policy

makers and economists as essential to boost productivity

growth and the EU’s international competitiveness, are

being rolled only very slowly.

Mario Draghi, the Former Italian PM frustrated with

‘inaction’ a year after preparing an in-depth report for the

European Commission on how to improve Europe’s

competitiveness, told a news conference in September that

“one year on, Europe is ... in a harder place”. Ursula von

der Leyen, the Commission’s president, who asked Draghi

to write the report, admitted that the EU lacked “urgency”

in advancing the competitiveness agenda.

That may be about to change. In addition to measures

designed to improve the functioning of the EU’s single

market, “simplification” has become a watchword of

Ursula von der Leyen’s second term as European

Commission president.

Laws on the environment, agriculture, defence, financial

services, chemicals, artificial intelligence and transport are

all up for “simplification”. Much of it will be done through

so-called omnibus legislation that opens existing EU laws

and strips out anything deemed overly burdensome.

An omnibus bill, first unveiled in February, is now passing

through the EU’s legislative procedures. Right now, the

“simplification” agenda seems to have the upper hand in

the EU, but it is controversial, and the outcome remains

uncertain.

US-EU framework trade agreement promises to diffuse

trade tensions

Another boost to the EU economy may come from the

announcement on 21 August 2025 of the “Joint Statement

on a United States-European Union framework on an

agreement on reciprocal, fair and balanced trade” which

seems, for the time-being, to have diffused trade tensions.

The US agreed to cap the blanket “reciprocal” tariffs on

most EU products at 15% in return for a commitment by

the EU to apply 0% tariff on all US industrial goods.

There is also a joint US-EU commitment to “work

together to reduce or eliminate non-tariff barriers” and to

“enhance opportunities for technical cooperation” on

standards development.

Of particular significance to the forest products sector, the

US-EU framework agreement states with respect to the

EU Deforestation Regulation that the EU “commits to

work to address the concerns of US producers and

exporters… with a view to avoiding undue impact on US-

EU trade”.

Viet Nam and Indonesia drive rise in EU27 tropical

wooden furnitureimports this year

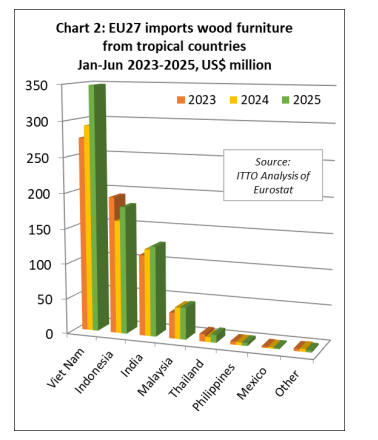

The EU27 imported 168,900 tonnes of wooden

furniturefrom tropical countries with a total value of

US$723 million in the first six months of 2025. Import

quantity and value were up 11% and 13% respectively

compared to the same period in 2024.

In the first six months of 2025, EU27 import value of

wooden furnitureincreased from all major supply countries

including Viet Nam (+19% to US$348.2 million),

Indonesia (+12% to US$180.9 million), India (+4% to

US$128.2 million), Malaysia (+2% to US$45.6 million),

Thailand (+58% to US$11.3 million), and Mexico (+7% to

US$1.8 million). EU27 wooden furnitureimports from the

Philippines were down 1% to US$4.3 million. EU27

wooden furnitureimports from all other tropical countries

were negligible during the quarter (Chart 2).

EU27 imports of tropical sawnwood just surpass last

year’s record low

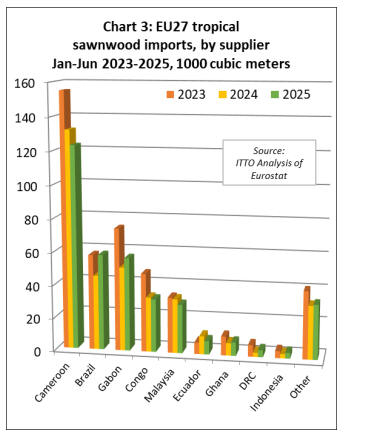

The EU27 imported 356,100 cu.m of tropical sawnwood

with a total value of US$327.2 million in the first six

months of 2025, respectively 2% and 1% more than the

same period in 2024. Tropical sawnwood imports were

down in the first six months of 2025 compared to the same

period last year from Cameroon (-7% to 123,100 cu.m),

the Republic of Congo (-3% to 32,100 cu.m), Malaysia (-

10% to 29,500 cu.m), and Ecuador (-26% to 8,200 cu.m).

However, these declines were offset by rising imports

from Brazil (+28% to 57,800 cu.m), Gabon (+11% to

56,500 cu.m), Ghana (+7% to 8,100 cu.m), the Democratic

Republic of Congo (+65% to 4,200 cu.m), and Indonesia

(+33% to 3,400 cu.m) (Chart 3).

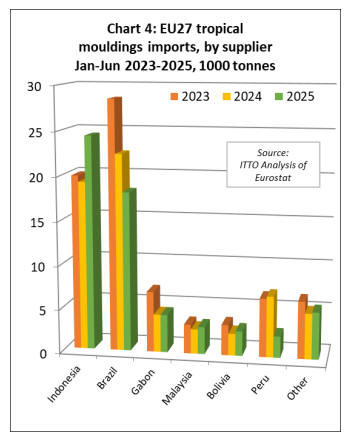

The EU27 imported 60,500 tonnes of tropical

mouldings/decking with a total value of US$103.7 million

in the first six months of 2025, respectively 4% and 6%

less than the same period last year. The decrease in

imports was mainly due to a steep decline from Brazil (-

19% to 18,100 tonnes), and Peru (-65% to 2,400 tonnes).

Imports increased from Indonesia (+27% to 24,400

tonnes), Malaysia (+11% to 3,100 tonnes), and Bolivia

(+13% to 2,800 tonnes). Imports from Gabon were

unchanged compared to last year at 4,300 tonnes (Chart 4).

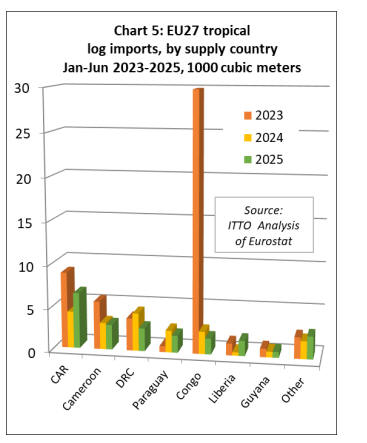

Second quarter rise in EU27 imports of tropical logs

from CAR and Liberia

The EU27 imported 20,900 cu.m of tropical logs with a

total value of US$11.7 million in the first six months of

2025, respectively 5% more and 3% less than the same

period in 2024. The rise in trade quantity was driven by

sharp percentage increases from the Central African

Republic (+52% to 6,500 cu.m) and Liberia (+348% to

1,800 cu.m), concentrated in the second quarter if the year.

Imports from other African countries continued to fall in

the first half of 2025, responding to tighter controls on log

exports. In the first six months of 2025, EU27 log imports

were down from Cameroon (-7% to 2,900 cu.m), the

Democratic Republic of Congo (-39% to 2,700 cu.m), and

the Republic of Congo (-29% to 1,800 cu.m). Logs

imports also fell from Paraguay, by 22% to 2,000 cu.m,

but were stable from Guyana at 700 cu.m (Chart 5).

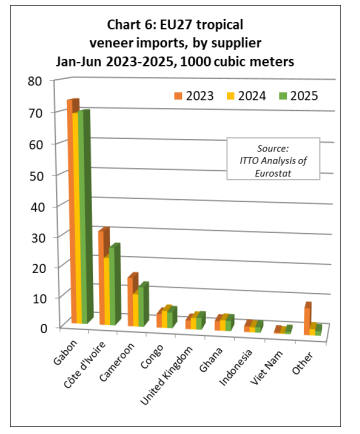

Signs of recovery in EU imports of tropical veneer and

plywood this year

The EU27 imported 125,900 cu.m of tropical veneer with

a total value of US$87.9 million in the first six months of

2025, respectively up 5% and 9% compared to the same

period last year. EU27 imports of tropical veneer increased

during the six month period from Gabon (+1% to 70,000

cu.m), Côte d'Ivoire (+15% to 26,000 cu.m), Cameroon

(+23% to 13,200 cu.m), the UK (+5% to 4,000 cu.m),

Indonesia (+10% to 1,800 cu.m), and Viet Nam (+347% to

800 cu.m).

However, imports of tropical veneer decreased from the

Republic of Congo (-7% to 5,300 cu.m) and Ghana (-3%

to 3,400 cu.m) during the period (Chart 6).

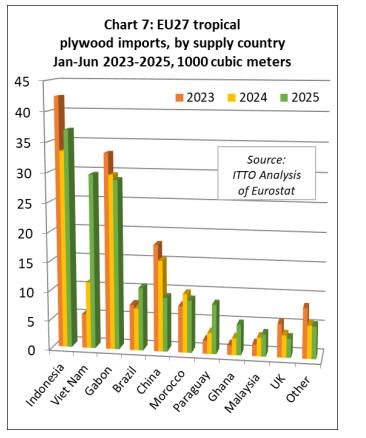

The EU27 imported 150,400 cu.m of tropical plywood

with a total value of US$103.6 million in the first six

months of 2025, up 19% and 13% respectively compared

to the same period in 2024. Imports increased during the

six-month period from Indonesia (+11% to 36,900 cu.m),

Viet Nam (+162% to 29,600 cu.m), Brazil (+49% to

10,700 cu.m), Paraguay (+137% to 8,400 cu.m), Ghana

(+81% to 5,200 cu.m), and Malaysia (+19% to 3,800

cu.m).

However, these gains were partly offset in the first six

months of 2025 by declining imports from Gabon (-3% to

28,800 cu.m), China (-40% to 9,200 cu.m), Morocco (-

10% to 9,000 cu.m), and the UK (-14% to 3,200 cu.m)

(Chart 7).

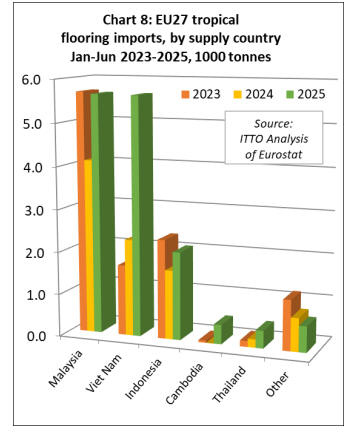

Rebound in EU imports of tropical joinery products

The EU27 imported 14,800 tonnes of tropical wood

flooring with a total value of US$37.5 million in the first

six months of 2025, up 65% and 62% respectively

compared to the same period in 2024. Imports of 5,600

tonnes from Viet Nam in the first six months this year

were nearly 150% more than the same period last year.

Imports also increased by 38% from Malaysia to 5,600

tonnes, recovering in the second quarter after a very slow

start to the year.

EU tropical wood flooring imports have also risen sharply

in percentage terms this year from Indonesia (+27% to

2,100 tonnes), and Thailand (+113% to 400 tonnes).

Imports of tropical wood flooring from Cambodia, near

zero in the first six months of last year, were 500 tonnes in

the same period this year (Chart 9).

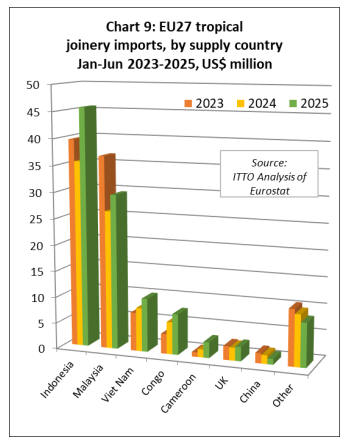

EU27 import value of other joinery products from tropical

countries - mainly laminated window scantlings, kitchen

tops and wood doors – was US$108.4 million in the first

six months of 2025, 18% more than the same period last

year. Import quantity was up 20% to 48,700 tonnes in the

same period. Import value increased from Indonesia

(+28% to US$45.7 million), Malaysia (+12% to US$29.5

million), Viet Nam (+23% to US$10.2 million), the

Republic of Congo (+27% to US$7.8 million), and

Cameroon (+98% to US$3.0 million).

However, EU27 import value of joinery products made

from tropical wood was down 11% to US$2.7 million

from the UK, and down 34% to US$1.1 million from

China (Chart 9).

EC proposal to delay EUDR for 12 months

With just over three months until EU Deforestation

Regulation (EUDR) compliance is scheduled to start on 30

December 2025 the European Commission announced it is

considering another one-year delay. On 23 September,

Jessika Roswall, Commissioner for Environment, Water

Resilience and a Competitive Circular Economy, sent

letters to the Parliament and Council indicating that the

Commission’s information system for transactions covered

by the EUDR currently is not expected to be able to

adequately handle all such transactions.

According to Commissioner Roswall’s letter “Based on

the available information, the Commission’s assessment is

that this will very likely lead to the system slowing down

to unacceptable levels or even to repeated and long-lasting

disruptions which would negatively impact companies and

their possibilities to comply with the EUDR.

Operators would be unable to register as economic

operators, introduce their Due Diligence Statements,

retrieve the necessary information from the IT system, or

provide the necessary information for Customs purposes

where relevant. This would severely impact the

achievement of the objectives of EUDR, but also

potentially affect trade flows in the areas covered by the

legislation.”

The letter goes on to suggest that “Despite efforts to

address the issues in time for the entry into application of

the EUDR, it is not possible to have sufficient guarantees

that the IT system will be able to sustain the level of the

expected load.”

The one-year postponement is intended to allow time to

remedy the identified risks. With EUDR compliance

looming the Commission is now expected to quickly

release a “stop the clock” proposal.

To secure quick approval by the Council and it is likely

that the proposal will be limited to timing and will not

seek to address other issues.

See: https://www.euractiv.com/news/eu-set-to-propose-new-

delay-to-anti-deforestation-rules/

|