US Dollar Exchange Rates of

25th

September

2025

China Yuan 7.10

Report from China

Viet Nam’s anti-dumping duties on Chinese fibreboard

had little impact

Recently, the Ministry of Industry and Trade in Viet Nam

issued Decision No. 2491/QD-BCT announcing the

imposition of provisional anti-dumping duties on certain

fibreboard products originating from China with the duty

rate range set at 2.59% to 39.88%.

The Vietnamese Ministry pointed out in its initial

investigation that fibreboard products from China were

being dumped and posed a significant and substantial

threat of damage to the domestic fibreboard industry in

Viet Nam. However, the anti-dumping duty had little

impact as import volumes in the first half of 2025

increased by more than 52% compared with the same

period a year earlier.

The Ministry of Industry and Trade of Viet Nam is

considering an additional rate increase to curb the rapid

increase of dumped fibreboard. The ministry emphasised

that the any increase will be temporary and it will continue

to communicate with all stakeholders to collect and verify

information before making a final decision.

See:https://www.wood365.cn/Industry/IndustryInfo_283019.html

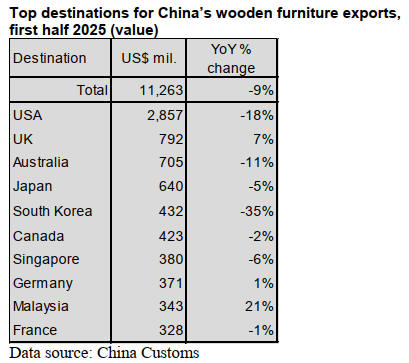

Decline in wooden furniture exports to US

The US was the largest market for China’s wooden

furniture exports in the first half of 2025. Around 25% of

China’s wooden furniture is exported to the US. In the first

half of 2025 the value of China’s wooden furniture exports

to the US fell 18% to US$2.857 billion year on year. This

was the main reason for the decrease in the total value of

China’s wooden furniture exports in the first half of 2025.

According to China Customs, the value of China’s wooden

furniture exports dropped 9% to US$11.263 billion in the

first half of 2025.

China’s wooden furniture is exported to over 200

countries. The proportion of China’s wooden furniture

exports to the top 10 destination countries was 65% in the

first half of 2025.

The value of China’s wooden furniture exports to

Australia and South Korea declined 11% and 35%

respectively in the first half of 2025. In contrast, in the

first half of 2025 China’s wooden furniture exports to the

UK and Malaysia rose 7% and 21% respectively over the

same period of 2024.

Decline in wooden furniture imports

According to China Customs, in the first half of 2025 the

value of China’s wooden furniture imports fell 8% to

US$295 million over the same period of 2024.

Italy and Germany were the main supppliers but the value

of China’s wooden furniture imports from the two

countries dropped 15% and 4% respectively and accounted

for 60% of the national total. The drop directly resulted in

the decrease of the national total.

In addition, China’s wooden furniture imports from Viet

Nam, France and Indonesia fell 32%, 10% and 13%

respectively in the first half of 2025.

In contrast, helped by the China-Europe Freight train

China’s wooden furniture imports from Poland, Thailand,

Slovakia and Romania grew 24%, 13%, 63%, 25%

respectively in the first half of 2025 .

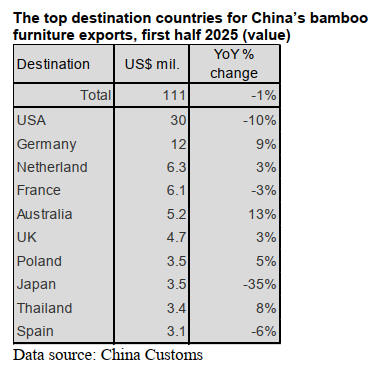

Drop in bamboo furniture exports to the US

According to China Customs, in the first half of 2025 the

value of China’s bamboo furniture exports to the US

dropped 10% to US$30 million over the same period of

2024. The US is the largest market for China’s bamboo

furniture exports with 27% of China’s bamboo furniture

being exported to the US. The total value of China’s

bamboo furniture exports fell 1% to US$111 million in the

first half of 2025.

The markets for China’s bamboo furniture export are

scattered and China’s bamboo furniture is exported to over

140 countries. The proportion of China’s bamboo furniture

exports to the top 10 destination countries was 70% in the

first half of 2025.

Germany was the second largest destination for China’s

bamboo furniture exports. 11% of China’s bamboo

furniture was exported to Germany. In the first half of

2025 the value of China’s bamboo furniture exports to

Germany rose 9% to US$11 million over the same period

of 2024. The value of China’s bamboo furniture exports to

Japan fell 35% in the first half of 2025. In the first half of

2025 China’s bamboo furniture exports to Australia and

Thailand rose 13% and 8% over the same period of 2024.

Decline in bamboo furniture imports

According to China Customs, in the first half of 2025 the

total value of China’s bamboo furniture imports dropped

30% to US$890 million over the same period of 2024.

Indonesia, Viet Nam and Italy are the top three suppliers

of China’s bamboo furniture imports and nearly 90% of

China’s bamboo furniture was imported from these three

countries in the first half of 2025.

China’s bamboo furniture imports from the top 2

suppliers, Indonesia and Viet Nam fell 5% and 50%

respectively but from Italy imports rose 1% over the same

period of 2024.

The main reason for the decrease in the total value of

China’s bamboo furniture imports is that domestic bamboo

furniture industry has developed rapidly in recent years

with the output of bamboo furniture constantly increasing

and the demand for imports gradually decreasing.

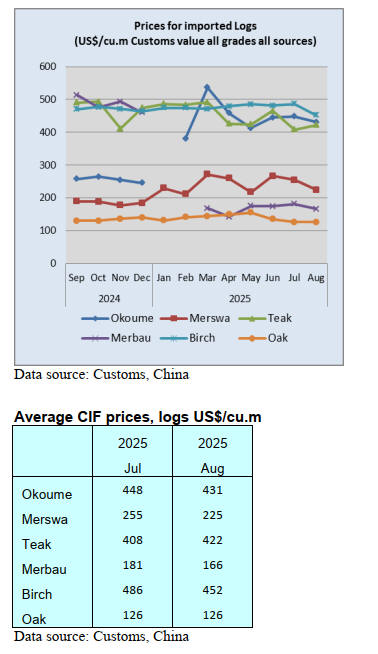

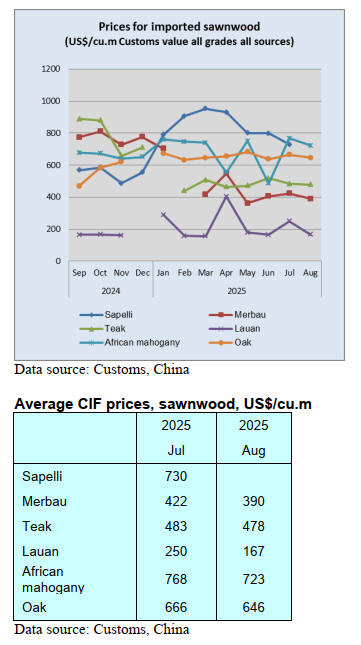

China Global Timber Index

Data from China’s General Administration of Customs

revealed that from January to July the country’s imports of

logs and sawnwood totaled 33.479 million cubic metres, a

decrease of 12% compared to the same period in 2024 and

the total import value reached 48.67 billion yuan, down

14.5%.

The China Furniture Industry Import & Export Report

released by the China National Furniture Association

showed that in the first half of this year the total export

value of China’s furniture industry stood at US$34.915

billion, a year-on-year decrease of 7%, although export

volume increased by 6%.

Influenced by tariff-related factors, the export value

declined noticeably in April and May reaching US$6.133

billion and US$5.983 billion respectively, representing

year-on-year drops of 7% and 9%.

On 29 August the People’s Bank of China, the National

Financial Regulatory Administration and the National

Forestry and Grassland Administration jointly issued a

‘Notice on Financial Support for High-Quality

Development of Forestry Industry’ outlining 15 specific

measures across five key areas:

+ enhancing financial services for the reform of the

collective forest tenure system

+ strengthening financial safeguards for major

forestry strategies

+ increasing financial input for high-quality

development of the forestry industry

+ establishing mechanisms for financial support to

realise the value of ecological products

+ improving supporting policies and safeguard

mechanisms.

In August 2025, the GTI-China index registered 51%, an

increase of 2 percentage points from the previous month

and above the critical value (50%) after one month,

indicating that the business prosperity of the timber

enterprises represented by the GTI-China index expanded

from the previous month.

Although the domestic market in China contracted during

this month both production volume and export orders

showed slight growth over the previous month.

As for the twelve sub-indices, nine (production, export

orders, existing orders, inventory of finished products,

purchase quantity, purchase price, inventory of main raw

materials, delivery time and market expectation) were

above the critical value of 50% while the remaining three

(new orders, import and employees) were below the

critical value.

See:

https://www.itto-ggsc.org/static/upload/file/20250918/1758161706789480.pdf

|