Japan

Wood Products Prices

Dollar Exchange Rates of 25th

September

2025

Japan Yen 149.51

Reports From Japan

BoJ policy rate unchanged

On 19 September the Bank of Japan (BoJ) policy board

voted unanimously to start selling a tranche of exchange-

traded funds (ETF) and Japan real estate investment trusts

causing a dip in the stock index and a strengthening of the

yen.

The BoJ started purchasing ETFs in 2010 as part of its

aggressive monetary easing programme to fight deflation.

The Bank decided in March 2023 to end new purchases

and has since been examining how to conduct the disposal.

In related news, the BoJ kept its key policy rate unchanged

at 0.5% amid uncertainty related to tariffs and domestic

politics.

Consumer inflation in August was 2.7%, down from 3.1%

in July and below expectations. Core consumer inflation

was also 2.7%, the first time below 3% in nine months but

still above the BoJ's 2% target. Inflation, excluding fresh

food and energy seen by the BoJ as better reflecting the

underlying inflation trends, was 3.3%.

See:

https://www.japantimes.co.jp/business/2025/09/19/economy/ban

k-of-japan-september-

rates/?utm_source=pianodnu&utm_medium=email&utm_campai

gn=72&tpcc=dnu&pnespid=8pkfj4el4qwxovi8oql2r.dn9b4o.taqh

qckak04veevywrezhcaiqakxkilxbbwiro_bq

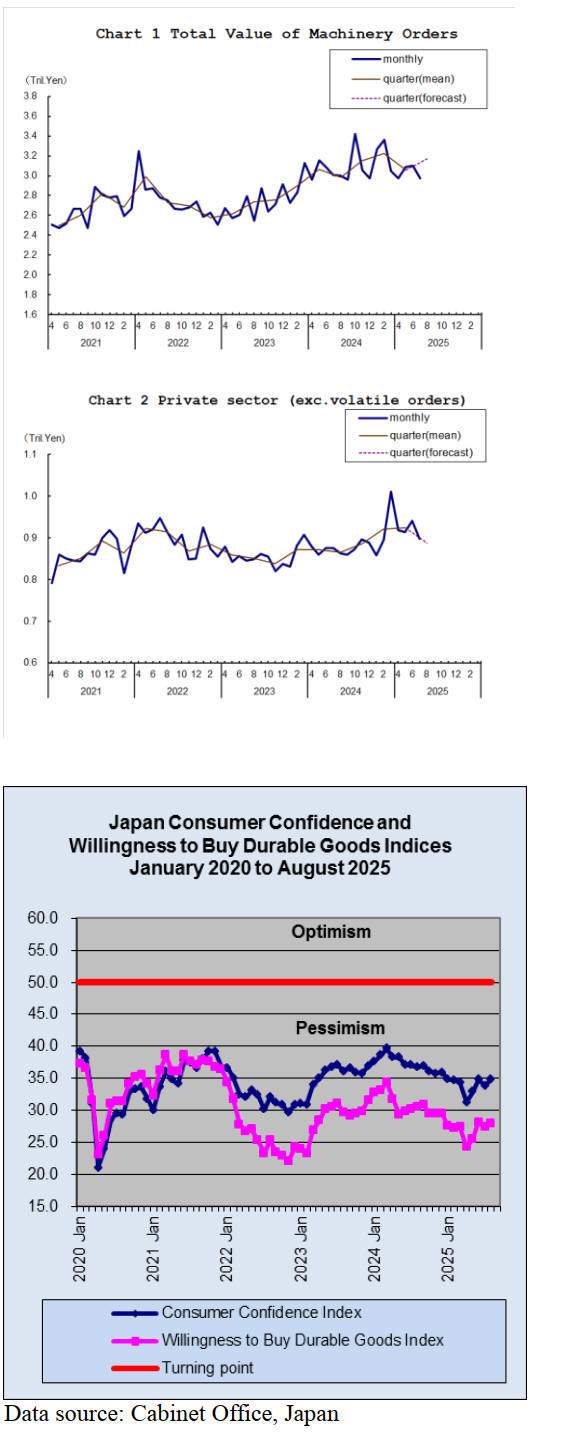

Machinery order sentiment indicator slides

The total value of machinery orders received by 280

manufacturers operating in Japan decreased by 4% in July

from the previous month on a seasonally adjusted basis

signaling these companies view on business prospects

dimmed.

Private-sector machinery orders, excluding volatile ones

for ships and those from electric power companies,

decreased a seasonally adjusted by almost 5% in July.

See: https://www.esri.cao.go.jp/en/stat/juchu/juchu-e.html

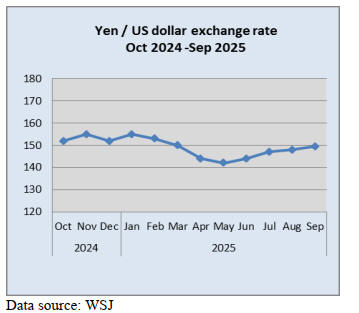

Yen dipped to 2-month low against dollar

The Japanese yen weakened against other major currencies

in late September following the release of lower than expected overall

inflation.

Data from the Ministry of Internal Affairs and

Communications showed that overall inflation (in the

Tokyo region, the inflation yardstick) was up 2.5% year on

year in September. That was below of expectations for an

annual increase of 2.6%. The BoJ basis for additional

interest rate increases has been made more difficult by the

fall in inflation.

See: https://asia.nikkei.com/business/markets/currencies/yen-

dips-to-2-month-low-against-dollar-as-investors-bet-on-longer-boj-pause

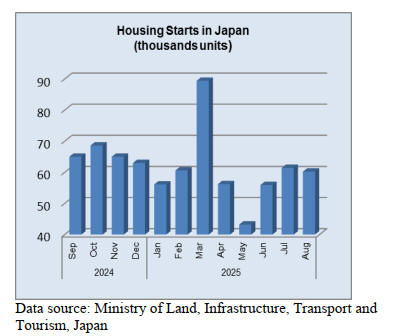

Home construction costs up 30% over past five years

House prices in Japan are soaring. The cost of constructing

homes is rising and the Ministry of Land, Infrastructure,

Transport and Tourism reported that, as of July, land

prices had risen for the fourth consecutive year which is

pushing up real estate prices.

A government survey has shown construction costs have

increased by about 30% over the past five years. Low-

interest rates and the weak yen have spurred real estate

transactions by affluent individuals and foreign investors

which has exacerbated the supply-demand balance. While

the population declines and vacant homes increase prices

of homes continue to rise.

See:

https://mainichi.jp/english/articles/20250922/p2a/00m/0op/007000c

Foreign trainee programme overhaul

The Japanese government has decided to replace the

controversial foreign trainee programme in 2027 with a

new system aimed at improving rights protections,

offering increased flexibility for job changes and

implementing tougher oversight.

Under the new legislation, foreign workers will be allowed

to change workplaces within the same industry under

certain conditions, marking a turnaround from the existing

programme that prohibited job transfers. Under the new

programme for training and securing labour Japan will

accept foreign workers in 17 industries, including

construction and farming which face severe labour

shortages.

See:

https://mainichi.jp/english/articles/20250926/p2g/00m/0na/047000c

Furniture import update

The furniture market in Japan was valued at around US$23

million in 2024 and is projected to reach US$26.32 million

by 2032. The Japanese furniture market is a mature and

sophisticated sector influenced by the country's unique

cultural heritage, urban living conditions and a strong

emphasis on quality and design.

Japan's aging population is a significant driver of furniture

market trends, particularly for products that cater to the

needs of older adults. Ergonomic and functional furniture

designed to support mobility and comfort is in high

demand. The high level of urbanisation in Japan has led to

an increase in smaller living spaces. This drives the

demand for space-saving, multifunctional and compact

furniture.

Home furniture accounts for the largest market share

driven by rising disposable incomes and focus on home

interiors. Office furniture demand is growing steadily due

to increasing demand for ergonomic and functional

workstations. Hospitality furniture is expected to expand

with the growing tourism industry.

See: https://www.datainsightsmarket.com/reports/japan-furniture-market-6703#summary

and https://www.renub.com/japan-furniture-market-p.php

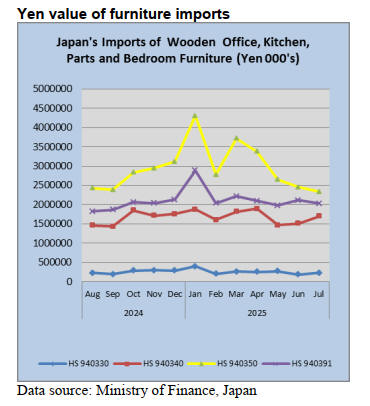

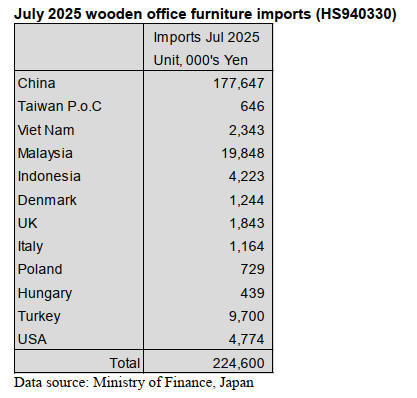

Wooden office furniture imports (HS940330)

Three shippers accounted for over 92% of July arrivals of

wooden office furniture (HS940330). The other main

source of wooden office furniture imports was EU

member countries along with Canada and the US.

In July, shippers in China accounted for 79% (90% in

June) of Japan’s imports of wooden office furniture the

other significant sources were Malaysia (9%) and Turkey

(4%). The value of July imports from Indonesia and the

US were significantly higher than in June and imports

from Italy in July were around the same level as in June

while the value of July imports from Viet Nam was at

around the same level as in June.

Year on year, the value of Japan’s imports of wooden

office furniture in July was around the same level but

compared to a month earlier the value of imports rose.

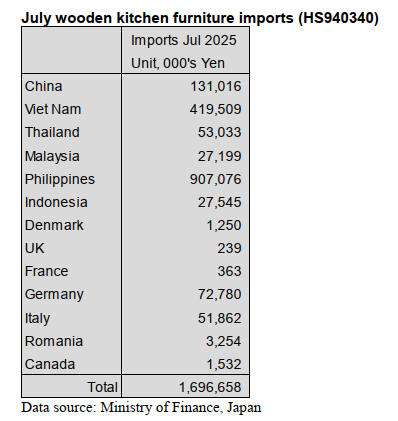

Wooden kitchen furniture imports (HS940340)

As in previous months July imports of wooden kitchen

furniture (HS940340) were dominated by shippers in the

Philippines (53% of HS940340 imports) and Viet Nam

(25% of HS940340 imports). July arrivals from the

Philippines and Viet Nam were up month on month. The

value of July arrivals from China was below the value

reported for June. There was a decline in imports from

Italy in July after the substantial June arrivals.

Year on year there was a 10% rise in the value of wooden

kitchen furniture and there was a significant rise in the

value of July imports compared to a month earlier.

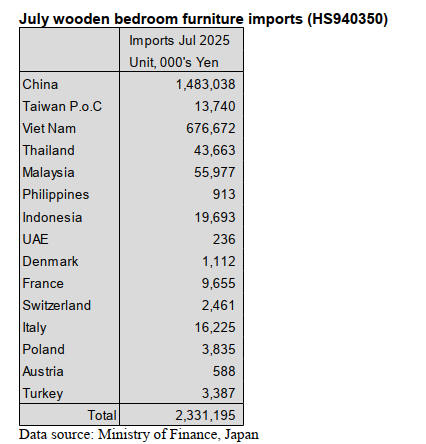

Wooden bedroom furniture imports (HS940350)

The downward trend in the value of wooden bedroom

furniture imports into Japan continued in July. The value

of July 2025 imports was 5% below that reported for June

and over 16% below the peak of imports in February.

The top two shippers of HS940350 to Japan in July were

China, 64% of the total but this was down month on

month and Viet Nam 29%, a slight increase month on

month. Malaysia maintained a share of imports at 2.5%

(down from 4% in June). The other main sources of July

imports were Indonesia, Italy and Poland.

Year on year there was an 18% decline in the value of

wooden bedroom furniture in July and compared to June

there was also a decline.

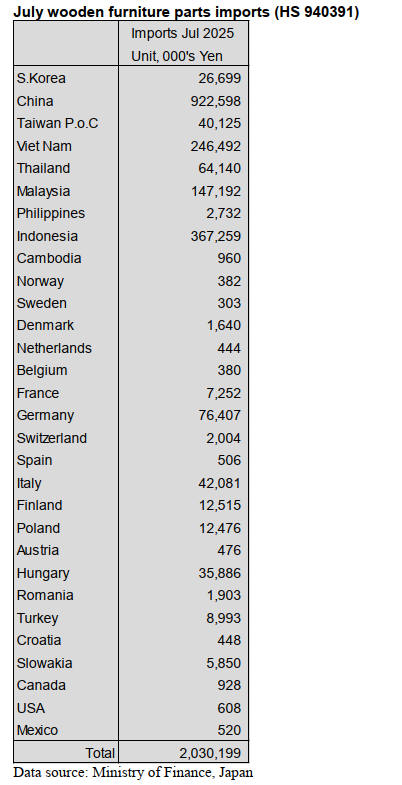

Wooden furniture parts imports (HS940391)

Apart from the spike in the value of wooden furniture

parts (HS940391) imports in January the monthly value of

imports remained steady during the first seven months of

2025.

The value of July 2025 imports was slightly lower (4%)

than reported in June and compared to July 2024 there was

a 12% decline in the value of imports. Shippers in China,

Indonesia and Viet Nam accounted for most (76%)

HS940391 imports in July 2025. The value of imports

from China rose month on month while import values

from Viet Nam dropped compared to June.

Of the total value of HS940391 imports, 46% was

delivered from China (41% in June) 18% from Indonesia

(19% in June), 12% from Viet Nam (11% in June).

Malaysia, which secured an 11% share of July imports,

was the forth ranked source in terms of the values. Imports

of HS940391 from Italy, Germany and Hungary rose in

July but for Taiwan P.o.C and South Korea there was a

decline in the value of imports.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see: https://jfpj.jp/japan_lumber_reports/

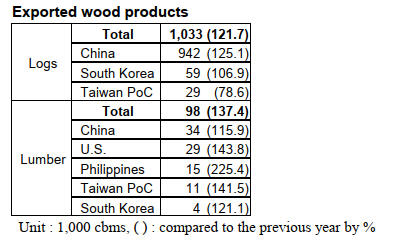

Wood exports during the first half of 2025

Volume of exported logs during January to June, 2025 is

1,033,781 cbms, 21.7 % more than January to June, 2024.

Volume of exporting lumber during January to June, 2025

is 98,179 cbms, 37.4 % more than the same period last

year. The increase has continued for three consecutive

years in logs, and for two consecutive years in lumber.

Despite the impact of the U.S. tariff policy against China

and tighter domestic supply and demand conditions, log

exports increased at a pace surpassing the previous year.

Log exports to China totaled 942,854 cbms, up 25.1%

from the same period last year. Exports to South Korea

reached 59,038 cbms, an increase of 6.9%, while exports

to Taiwan were 29,646 cbms, down 21.4% year-on-year.

Total volume of cedar is 930,962 cbms, 25.0 % increased

and of cypress is 92,625 cbms, 11.8 % increased from the

same period last year.

The total volume of lumber exported to China was 34,704

cbms, an increase of 15.9% compared to the same period

last year. Exports to the U.S. reached 29,172 cbms, up

43.8%. Shipments to the Philippines totaled 15,436 cbms,

a sharp rise of 125.4%. Exports to Taiwan were 11,692

cbms, up 41.5%, and to South Korea, 4,672 cbms, an

increase of 21.0%.

Japan’s log exports to China in June

Log export to China in June, 2025 is 177,413 cbms and

this is 20.0 % more than June, 2024.

However, when looking at individual ports, shipments

from Shibushi Port in Kagoshima Prefecture—which had

previously been a major export hub—have slowed down.

Exports of raw logs to China from the port dropped from

around 44,000 cbms in April and May, 2025 to 33,827

cbms in June, 2025, marking a decrease of approximately

10,000 cbms.

Due to the impact of US tariffs exports of cedar lumber

from China to the United States appear to have been

affected. This supports observations by raw log exporters

in Kyushu, who report a decline in inquiries from Chinese

manufacturers.

Although demand from Chinese manufacturers exporting

cedar lumber to the United States has weakened, inquiries

from domestic manufacturers supplying construction and

civil engineering materials within China remain steady.

Prices of Japanese cedar logs exported to China softened

at the beginning of the year due to concerns over Trump-

era tariffs, but have since remained stable. Domestic prices

for cedar logs intended for export have remained generally

stable. In Kyushu, where demand has stagnated, reduced

inquiries from China have enabled exporters to meet their

log requirements through direct shipments from forest

owners to ports.

Consequently, the need to procure supplementary volumes

from local log markets has declined, exerting downward

pressure on prices for lower-grade timber in the region.

Currently, the price of 4-meter cedar logs for export

remains slightly above ¥10,000 delivered to port, per cbm,

only ¥500 to ¥1,000 lower than this spring.

In regions such as Tohoku, port-delivered prices have

remained flat. Amid rising truck transportation costs, raw

material producers are increasingly prioritizing shipments

to nearby ports over deliveries to large, distant mills.

Japan to revise JAS labeling standards for wood products

The New Business and Food Industry Department of the

Minister's Secretariat at the Ministry of Agriculture,

Forestry and Fisheries will completely prohibit the use of

manually stamped JAS marks.

Triggered by last year's scandal involving unauthorised

use of the JAS mark, the labeling method will be revised

to a system that allows usage tracking through inkjet

printing or stickers. Stricter regulations on the application

of the JAS mark are scheduled to be discussed at this

summer’s JAS Standards Committee, with implementation

expected as early as around next summer.

For nine product categories—lumber, glued laminated

timber, CLT, LVL, structural panels, plywood, flooring,

2x4 lumber, and wood pellet fuel—the authorities have

called for clearer labeling of business operator information

on JAS-certified products, as well as harmonisation of

standards across different specifications. In cases where

the business entity displayed on a JAS-certified product is

not a certified operator, such as an importer, it will be

mandatory to include the certification number of the

relevant certified operator associated with the product.

The labeling of business operator information will be

revised, and the methods for indicating grades and other

specifications will also be clarified and standardised.

As part of this revision, the use of hand-stamped JAS

marks will be prohibited, and labeling methods will be

replaced with systems that allow usage tracking, such as

inkjet printing, laser marking, or stickers with quantity

control.

Under the revised labeling rules for forest products, all

items except raw materials such as plywood and lumber

will be subject to the changes. Since glued laminated

timber, plywood, and lumber have already adopted inkjet

printing, trackable roller stamps, or sticker-based labeling,

they are considered relatively well-prepared for the

transition.

At this stage, the items of concern include lumber not

classified under mechanical grading and single-layer

flooring, which are generally produced by small-scale

businesses. These operators often face difficulties in

securing funds for new equipment investments such as

inkjet labeling systems.

However, since last summer, the Ministry of Agriculture,

Forestry and Fisheries has been explaining the basic policy

for label revisions to domestic and international registered

certification bodies. It also appears to have provided

technical briefings during a liaison meeting held this

January. Between last December and this January, industry

associations related to JAS-certified products were also

briefed on the labeling revisions.

The Ministry considers that awareness of the changes has

been steadily progressing. According to the Ministry of

Agriculture, Forestry and Fisheries, it will formally

request that registered certification bodies either take

responsibility for collecting previously used hand-stamped

JAS marks or obtain a certificate of disposal.

U.S. tariffs

The Forestry Agency has released information regarding

the status of wood-related issues under U.S. tariff policy.

It was confirmed that the reciprocal tariffs implemented

from August 7 do not apply to certain items, including

wood products (such as logs, lumber and plywood),

pharmaceuticals, and semiconductors.

Japan's tariff rate has been set at 15%, but the list of

exempted items will generally follow the provisions of the

presidential order issued on April 2. In the case of wood-

related products, items such as logs, lumber, and plywood

are excluded from the tariffs.

On the other hand, new reciprocal tariffs will apply from

August 7 to items such as wooden fittings, other wood

products (including bamboo), and wooden tableware. In

2024, exports to the United States included ¥800 million

worth of “other fittings,” such as wooden fittings, ¥300

million of “other wood products” including bamboo items,

and ¥300 million of wooden tableware. These items,

which are relatively highly processed, are subject to tariffs

under the current policy.

It remains unclear at this point whether the 15% tariff will

be added on top of existing duties for items subject to

reciprocal tariffs, or whether it is included within the 15%.

Plywood

Domestic softwood plywood saw particularly sluggish

movement toward the end of August. Although

manufacturers continued to push for price increases in July

and August to improve profitability, actual demand

remained weak, resulting in flat price trends. Therefore,

the price of 12 mm 3 x 6 domestic structural softwood

plywood is 1,090 – 1,100 yen, delivered per sheet.

Meanwhile, major plywood manufacturers have

announced further price increases for September,

indicating that they are unwilling to sell below ¥1,100.

The movement of imported South Sea plywood has been

somewhat sluggish. Despite expectations of rising

domestic prices driven by higher source-country prices for

mainly 12mm thick products and the weaker yen buyers

continue to make purchases only as needed.

The price of 12 mm 3 x 6 coated formwork plywood is

1,800 – 1,850 yen, delivered per sheet. Standard formwork

plywood is around 1,550 yen, delivered per sheet.

Structural plywood is around 1,550 yen, delivered per

sheet. 2.5 mm plywood is around 780 yen, delivered per

sheet. 4 mm plywood is around 930 yen, delivered per

sheet. 5.5 mm plywood is 1,100 yen, delivered per sheet.

Price increases have been observed at the production

sources for 12mm thick plywood from Malaysia and

Falcata combination plywood from Indonesia. At the point

of origin, 12 mm 3 x 6 coated formwork plywood is

US$600 –610, C&F per cbm. Standard formwork plywood

is US$500 – 510, C&F per cbm. Structural plywood is

US$510 – 520, C&F per cbm.

In Indonesia, 2.4 mm 3 x 6 plywood is US$970, C&F per

cbm. 3.7 mm 3 x 6 plywood is US$880, C&F per cbm. 5.2

3 x 6 plywood is US$850, C&F per cbm.

Cedar logs for China

Export prices of Japanese cedar logs to China are on a

downward trend. The easing of domestic log supply and

demand in China is behind the trend.

Currently priced at US$102–103, C&F per cbm, the rate is

USD 13–15 lower than at the beginning of the year,

causing many exporters to face negative margins. The

cumulative volume of log exports to China—primarily

Japanese cedar— reached 942,854 cbms by the end of

June 2025, marking a 25.1% increase compared to the

same period last year and significantly surpassing the

previous record high. However, the export environment is

not necessarily favorable. Amid oversupply and sluggish

market conditions, the key question is how long the first-

half performance can be sustained.

Log prices of 8 cm and above are currently around

¥11,500, delivered per cbm, roughly ¥500 lower than at

the beginning of the year. Freight costs for small vessels

carrying approximately 3,000 cbms have dropped

significantly—from around US$60,000 per ship at the start

of the year to about US$ 40,000. However, the yen has

appreciated from ¥156 to the dollar in January to ¥144 in

June, resulting in negative margins of roughly US$ 10 per

shipment for exporters.

Following the confirmation of U.S. President Donald

Trump's election in November last year, there was a surge

in last-minute demand for log exports to China. However,

subsequent tariff disputes led to periods of stagnation in

purchasing activity.

Nevertheless, Japan's log exports did not decline; in fact,

the export volume in June reached 177,413 cbms, marking

a 20.2% increase compared to the same month the

previous year—the highest monthly figure since the

beginning of the year.

Due in part to the suspension of log imports from the

United States, China's total log imports in the first half of

the year declined by 10% compared to the same period last

year, potentially expanding the demand base for Japanese

cedar logs.

|