|

1.

CENTRAL AND WEST AFRICA

Regional update

Gabon

Power shortages remain a critical issue with daily

electricity cut now occurring twice a day. These

interruptions are disrupting industrial activity and creating

frustration among operators. On 15 September

construction work on the Owendo gas-fired thermal power

plant began. This constitutes the initial link in an

infrastructure project financed by the African Export-

Import Bank.

See: https://www.lenouveaugabon.com/fr/energies/1709-20614-afreximbank-injecte-130-milliards-fcfa-pour-trois-centrales-a-gaz-de-300-mw-au-gabon

Demand remains weak with European buyers being

cautious and Chinese interest being limited. The

competitive threat from Brazilian pine is a central concern

creating downward pressure on Okoume’s market share.

Okoume is facing growing competition from Brazilian

pine. News is circulating that a new, large-scale automated

sawmill in Brazil is offering sawn pine at Eur210–

220/cu.m CIF in Middle East makets. This is under-cutting

Okoume in one of its key export destinations and

contributing to sluggish sales and the build-up of stocks.

At the GSEZ Park in Nkok it is reported that Okoume

stocks have climbed to around 30,000 cu.m. This

accumulation reflects both weak demand and high

production levels during the dry period.

SETRAG is facing new criticism after a major fire at its

log stock park in Lastourville. The blaze, fuelled, it is said,

by sawdust and offcuts spread quickly and damaged some

Okoume stock. Those affected are demanding

compensation.

Regulatory developments

On 9 September the Gabon Forestry Ministry and the

Ministry of Economy and Finance hosted an Economic

Forest Forum. Operators were reminded that in 2023 the

forestry sector contributed 41.9 billion CFA in taxes,

equivalent to 3.2% of GDP, a level described by officials

as too low given Gabon’s forest coverage.

The government is seeking to increase revenue and

improve sector governance.

Several initiatives were presented under the new “Fonds

Bois Gabon 2030”, including:

+ reform of the forestry code (previous attempts failed)

+ stronger certification requirements

+ stricter enforcement of tax payments

+ an emphasis on downstream processing including furniture

+ geolocation for timber trucks using European style tachograph discs

It is said that currently 172 trucks in the GSEZ are

equipped with such a system but the country has a total of

450 trucks requiring installation.

Cameroon

The country is firmly in election mode ahead of the

October presidential polls. Political uncertainty is keeping

operations on hold with many companies scaling back

production until the elections are over. It is suggested that

trade missions and investment decisions are likely to

resume only in November.

Markets remain mixed across all regions. Demand in the

Middle East is reported as stable for redwood species

while Ayous is under pressure due to competition from

Brazilian pine.

The Philippines market remains very quiet while, in

contrast, Vietnam is showing strong demand. Europe

demand remains slow with no signs of significant recovery

in orders after the holiday period.

Recently Douala Port has been experiencing heavy

congestion with ships waiting more than a week to berth.

High charges at the port remain an issue with exporters

who point out that these cut margins and reduce

competitiveness when the costs are passed on. Containers

remain available but logistics inefficiencies are weighing

on operations.

Republic of Congo

No major disruptions have been reported but operators

focused on Okoume are struggling under the current

market conditions. Chinese demand has weakened sharply

and Okoume exporters are facing increasing competition

from Brazilian pine.

Despite this, price levels remain largely unchanged for

Europe. Interestingly, some Chinese buyers are showing

interest in Belli sawn timber although volumes remain

modest. Transport routes to Douala Port are said to be

functioning normally.

Demand sentiment is said to be ‘cautious’. Europe is

receiving more attention from producers as Chinese and

Philippine demand softens but sales are yet to pick up.

Demand in Viet Nam is providing some stability while the

Middle East markets are demonstrating a reduced appetite

for Okoume.

Overall, operators remain in a defensive mood, adjusting

production to avoid oversupply in weak markets.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

https://www.itto-ggsc.org/static/upload/file/20250918/1758161706789480.pdf

2.

GHANA

Participation in 5th World Teak Congress

Ghana participated in the 5th World Teak Congress

(WTC) which took place in Kochi, India, under the theme,

“Sustainable Development of the Global Teak Sector -

Adapting to Future Markets and Environments”.

The 4-day event was organised by TEAKNET, an

international network of institutions and individuals

interested in the teak value chain.

The mission of the Organisation is addressing the interests

of stakeholders which includes growers, traders,

researchers and other groups with an interest in teak. The

Conference brought together delegates from 40 countries.

Ghana was represented by a four-member delegation led

by the Chief Executive Officer (CEO) of the Ghana

Forestry Commission, Dr. Huge C. A. Brown, who is also

the Chairman of the Scientific Organising Committee and

Chairman of TEAKNET.

The Chairman of TEAKNET acknowledged the important

role the organisation has played in providing a platform

for all players in the teak sector to assemble at one place

for business and the exchange of ideas.

See: https://fcghana.org/5th-world-teak-congress-underway-in-kochi-india/

and

https://www.itto.int/top_stories/2025/09/24/5th_world_teak_conf

erence_experts_highlight_how_itto_project_is_advancing_sustainable_teak_production/

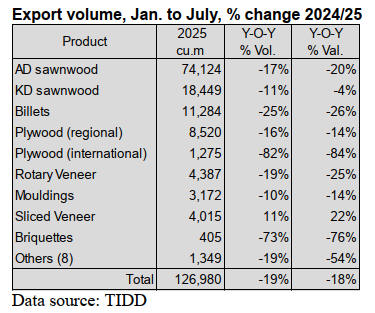

January to July exports

The total volume of wood products exported by Ghana

during the period January to July 2025 plummeted by 19%

to 126,980 cu.m. compared to the total volume of 157,518

cu.m. recorded for the same period in 2024 according to

data from the Timber Industry Development Division

(TIDD) of the Forestry Commission (FC).

These exports generated a revenue of Eur58.76 million an

18% decrease in value against the total receipts of

Eur71.27 million earned for the same period in 2024.

The top three products exported were air and kiln dried

sawnwood and billets accounting for 58%, 14% and 9%

respectively of the total export volume in 2025. The

dominance of air-dried sawnwood as against kiln-dried

sawnwood could be attributed to the high cost associated

with kiln-drying facilities.

The top destination for exports was the Asia which

accounted for 67% (84,951cu.m) of the country’s wood

products export for the period in January to July 2025,

compared to 65% (101,741 cu.m) of the total volume from

January to July 2024.

Revenue from wood products export to Asia accounted for

more than 50% of the total export receipts in 2024 (55%)

and in 2025 (55%), with the balances being from the

remaining five continental markets namely Europe,

America, Africa, Middle East and Oceania.

According to the data, air-dried sawnwood and billets

accounted for 99% of the total primary products exports

during the period January to July 2025.

Indian and Vietnamese companies were the major buyers

of the wood products with air-dried sawnwood (especially

wawa) and teak billets dominated exports to these two

countries.

Rivers and forests to be declared security zones

As part of renewed ongoing efforts to fight illegal mining

in the country, popularly known as galamsey, the Minister

for Lands and Natural Resources, Emmanuel Armah-Kofi

Buah, has announced government will soon declare all

rivers and forests in Ghana as security zones.

The move to designate rivers and forests as security zones

is expected to empower state security agencies to take

tougher action against illegal operations, which continue

to cause widespread destruction to water bodies and forest

reserves across the country.

Democracy Hub, the activist organisation behind Ghana’s

‘FixTheCountry’ movement, launched a major anti-

galamsey demonstration in the capital demanding

immediate government action against illegal mining

operations devastating the country’s water bodies and

forest reserves.

The demonstration represents the organisation’s latest

campaign following their successful mobilisation of

previous demonstrations aimed at convincing the

authorities to end the widespread environmental damage

and the socio-economic crisis caused by illegal mining

activities.

See: https://www.myjoyonline.com/rivers-forests-to-become-

security-zones-lands-minister-hints-in-intensified-galamsey-

fight/

Electricity tariff up by 1% more increases likely

The Public Utilities Regulatory Commission (PURC) has

announced a 1.14% upward adjustment in electricity

tariffs for all consumer categories effective 1 October

2025. Water tariffs remain unchanged.

In a statement signed by Acting PURC Executive

Secretary, Shafic Suleman, the Commission said the

decision follows its Quarterly Tariff Review Mechanism

which tracks key economic factors that affect the cost of

delivering utility services.

The Electricity Company of Ghana (ECG) is proposing a

more than doubling adjustment from the PURC in its

Distribution Service Charge (DSC1).

The company attributes the request to the depreciation of

the Ghana cedi effectively cutting ECG’s revenue in dollar

terms.

At a press conference the Director of Communications at

the IMF indicated that the IMF fully backs Ghana's efforts

aimed at reviewing utility tariffs in the country’s energy

and power sectors. The increase will also stimulate

investments to deal with the problems in the energy sector

See: https://ecg.com.gh/index.php/en/media-centre/public-notices/ecg-s-proposal-for-review-of-distribution-service-charge-1

Through the eyes of industry

The latest GTI report lists the challenges identified by the private sector

in Ghana.

https://www.itto-ggsc.org/static/upload/file/20250918/1758161706789480.pdf

3. MALAYSIA

International Workshop on Indigenous Forestry

The Sarawak Dayak Iban Association (Sadia), an NGO, in

collaboration with Forest Stewardship Council (FSC)

Malaysia and FSC Indigenous Foundation (FSC-IF) held

an ‘International Workshop on Indigenous Forestry and

FSC Certification in Sarawak’.

Themed ‘Rooted in Responsibility: Strengthening

Indigenous Forestry Management and FSC Compliance,

the three-day programme brought together 25 participants,

including representatives of indigenous communities,

NGOs and FSC. The workshop combined traditional

knowledge sharing and dialogue on indigenous forest

governance.

International speakers and participants from Panama, the

Philippines, Indonesia and India were present to share with

the participants their diverse experiences. The workshop’s

final day highlighted FSC certification standards through a

participatory gap analysis, allowing communities to

compare their practices with FSC requirements and

identify next steps toward certification readiness.

Sadia president, Sidi Munan, is reported as saying “This

seminar shows that indigenous peoples are not only

guardians of the forests but also key actors in shaping

global sustainability standards”.

See:https://www.theborneopost.com/2025/09/19/sadia-forest-

stewardship-council-collaborates-in-workshop-on-indigenous-forestry-

global-standards-compliance/

Ecosystem Restoration

WWF Malaysia has been awarded the Ecosystem

Restoration Field Verification Certificate in recognition of

habitat restoration efforts within the Mount Wullersdorf–

Ulu Kalumpang Forest Reserves, carried out in

collaboration with the Sabah Forestry Department.

Developed by Preferred by Nature, this globally-

recognised standard evaluates on-the-ground restoration

efforts, ensuring compliance with best practices in

sustainability and environmental recovery.

Through targeted restoration efforts the site within the

Mount Wullersdorf–Ulu Kalumpang Forest Reserves is

helping to reconnect fragmented forest areas to rebuild

ecological connectivity.

These natural linkages are critical for the movement and

survival of endangered wildlife such as orangutans and

banteng (a species of wild cattle), allowing them to access

food sources, breeding grounds and safe migration routes.

Strengthening connectivity also supports broader

ecosystem functions, contributing to biodiversity

conservation and long-term climate resilience.

See:https://theborneopost.pressreader.com/article/281715505764244

Biomass plant

Construction has begun on a RM31 million biomass steam

plant in the Gebeng Industrial Estate signaling a major

step in Malaysia’s renewable energy and de-carbonisation

agenda.

The plant will supply up to 30 tonnes per hour (TPH) of

biomass-generated steam to Kaneka Malaysia, replacing

natural gas-based systems. Kaneka Malaysia is targeting a

70% reduction in greenhouse gas emissions by 2030

aligned with its net zero 2050 goal.

Fuelled by palm-based biomass such as empty fruit

bunches, palm kernel shells and woodchips the facility

features high thermal efficiency systems automated ash

handling and stringent emissions controls.

The project supports the national Renewable Energy

Roadmap and National Energy Transition Roadmap by

promoting circular economy principles and converting

agricultural waste into clean energy.

See:https://theedgemalaysia.com/node/770192

Mangrove forest maintenance

Malaysia allocated over RM71 million for the planting and

maintenance of mangrove trees and suitable species

nationwide from 2006 to date. The Ministry for Natural

Resources and Environmental Sustainability said the

allocation covers research and development, monitoring

activities and public awareness programmes.

As of September this year, 3,820 hectares of coastal and

mangrove forest areas have been planted with over nine

million mangrove trees and other suitable species along

the country’s coastline. This work is supported by more

than 120 research studies that serve as key references,

along with the active involvement of 13 non-government

organisations and local communities.

This was revealed during the National Celebration of the

International Day for the Conservation of the Mangrove

Ecosystem and National Social Forestry Carnival 2025.

See: https://theborneopost.pressreader.com/article/281621016497736

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

https://www.itto-ggsc.org/static/upload/file/20250918/1758161706789480.pdf

4.

INDONESIA

Deregulation team to eliminate export and

investment barriers

According to Coordinating Minister for Economic Affairs,

Airlangga Hartarto, Indonesia's furniture industry is

gaining momentum as a potential key export driver

supported by the country’s rich natural resources and

strong creative design capabilities.

To further enhance its international presence the

government is pursuing strategic trade agreements,

including the upcoming Comprehensive Economic

Partnership Agreement (CEPA) with the European Union

which will grant zero-tariff access for up to 80% of

Indonesian products, including furniture.

Domestically, the government is implementing a range of

supportive policies aimed at boosting production and

workforce efficiency. These policies include subsidised

investment loans through the People’s Business Credit

(KUR) scheme, tax relief for low-income workers and

fully funded internship programmes for university

graduates.

Also, a cross-sector deregulation team will begin work in

October 2025 to eliminate export and investment barriers.

Through these integrated efforts, the government envisions

the furniture industry becoming a cornerstone of

Indonesia’s economic growth and a strong competitor in

global markets.

See: https://wartaekonomi.co.id/read583133/industri-furnitur-

berpotensi-jadi-penopang-utama-ekspor-ri

Showcasing eco-friendly wooden and rattan furniture

At the Korea International Furniture and Interior Fair

(KOFURN) 2025, Indonesian furniture businesses secured

potential transactions totaling US$3.07 million according

to Indonesia’s Ministry of Trade. Twelve Indonesian

exporters participated in the event showcasing eco-

friendly wooden and rattan furniture that blends traditional

craftsmanship with minimalist aesthetics.

The Ministry of Trade aims to further boost exports by

leveraging the Indonesia-Korea Comprehensive Economic

Partnership Agreement (CEPA) which offers zero tariffs

on furniture products. Officials see strong future potential

in the South Korean market due to its high purchasing

power and alignment with current design trends.

See: https://en.antaranews.com/news/379865/indonesias-

furniture-exports-to-south-korea-reach-usd307-mln

Creativity becoming engine of economic growth

The International Furniture and Craft Fair Indonesia

(IFFINA+) 2025, held at the Indonesia Convention

Exhibition BSD in Tangerang, showcased the country’s

growing recognition on the global stage for its creative

industries, particularly furniture and crafts.

With the theme “Story of Origin,” the exhibition

highlighted over 150 brands and 25 designers from across

Indonesia. It emphasised the nation's commitment to

offering unique designs featuring storytelling and

functionality that add value. The event acted as a strategic

bridge between local creators and international buyers,

aiming to expand Indonesia’s global presence in the

creative economy.

During the opening ceremony, Deputy Minister of

Creative Economy, Irene Umar, stressed the importance of

cross-sector collaboration in building a strong, sustainable

creative ecosystem. She underlined that, on a global scale,

creativity is becoming a new engine of economic growth

in both the national and international markets. IFFINA+

thus served as a symbol of Indonesia's bold steps towards

globalising its creative industry through innovation and

cultural identity.

See: https://rri.co.id/en/business/1841395/iffina-supports-

indonesia-s-furniture-going-global

Timber plantations for renewable energy

The Ministry of Forestry has announced its support for the

development of industrial timber plantations as a key

strategy to boost renewable energy production, restore

degraded ecosystems and strengthen the country’s climate

change mitigation efforts.

According to Tony Rianto, Head of the Sub-Directorate of

Forest Product Certification and Marketing, sustainably

managed timber plantations are seen as a vital solution for

rehabilitating critical lands, providing biomass energy and

achieving Indonesia’s 2030 Forestry and Other Land Use

(FOLU) Net Sink target, which aims to absorb more

carbon emissions than are released.

In addition to environmental goals, the government sees

plantation development as an opportunity to drive

economic benefits at the local level. These include job

creation, increased regional investment, diversification of

energy sources and enhanced global competitiveness

especially in the wood pellet export market.

Acknowledging concerns from civil society about the

biomass industry’s potential risks, the ministry has

implemented strict regulations and monitoring systems

such as mandatory sustainability certification (SVLK),

technology-based oversight and law enforcement to ensure

plantation development aligns with environmental and

social sustainability standards.

See:

https://money.kompas.com/read/2025/09/17/203049426/hutan-

tanaman-industri-untuk-biomassa-diklaim-dukung-energi-terbarukan?page=all#page2.

Indonesia to speed up recognition of indigenous forests

Indonesia is taking steps to accelerate the legal recognition

of indigenous forests with the government aiming to

formalise at least 70,000 hectares by the end of 2025. The

Minister of Forestry, Raja Juli Antoni, announced that a

newly formed Task Force for the Acceleration of

Customary Forest Designation has been created to tackle

bureaucratic delays that have hindered progress for years.

Since 2016, around 332,000 hectares have been recognised

as customary forests but at least 1.4 million hectares are

still awaiting legal status. The government hopes the Task

Force will identify obstacles and establish more efficient

processes to speed up recognition efforts moving forward.

The Task Force will adopt an inclusive and collaborative

approach, involving not only government officials but also

academics, environmental activists and civil society

organisations.

Experts from Gadjah Mada University, Bandung Institute

of Technology and Cenderawasih University are working

alongside advocacy groups such as the Indonesian Forum

for the Environment (Walhi) and the Indigenous Peoples'

Alliance of the Archipelago (AMAN). Minister Antoni

emphasised that this joint effort aims to create long-term

solutions and ensure that the rights of indigenous

communities over their ancestral lands are properly

acknowledged and protected.

See:https://en.antaranews.com/news/380809/indonesia-to-speed-up-recognition-of-indigenous-forests

and

https://www.liputan6.com/news/read/6159625/menhut-bentuk-

tim-percepatan-penetapan-hutan-adat-diisi-akademisi-hingga-lsm

Developing zoning map for mangrove rehabilitation

The Ministry of Environment is developing a detailed

zoning map to guide the rehabilitation of 600,000 hectares

of mangrove forests by 2029. The initiative aims to

strengthen coastal resilience and protect biodiversity by

targeting both forest and non-forest areas. This large-scale

effort involves collaboration between government

agencies, private sector stakeholders and local

communities to ensure the long-term sustainability of

mangrove ecosystems.

According to Sigit Reliantoro, Deputy for Environment

and Sustainable Natural Resources at the Ministry’s

Environmental Control Agency (BPLH), the zoning map

will categorise areas based on their environmental

suitability for mangrove planting.

See: https://rri.co.id/en/national/1843648/indonesia-develops-

zoning-map-for-mangrove-rehabilitation

In related news, Asia Pulp & Paper (APP) Group has

reportedly launched a new sustainability initiative called

Regenesis, pledging US$30 million annually for the next

decade to restore and conserve one million hectares of

Indonesia’s rainforests.

This commitment aims to go beyond traditional

conservation efforts by actively restoring ecosystems,

supporting local communities and driving innovation

across the company’s operations.

As part of the Regenesis initiative the APP Group also

introduced a new Forest Positive Policy which strengthens

its 2013 Forest Conservation Policy with a more structured

and ambitious sustainability framework.

The policy, says APP, is built on three core pillars: forests,

people and value chain. It focuses on achieving positive

ecological impact through integrated landscape

management, empowering communities through inclusive

development strategies and ensuring responsible sourcing

and supplier practices to create shared value.

See: https://www.businesstimes.com.sg/esg/app-group-pledges-

us30-million-year-restore-1-million-hectares-indonesias-

rainforests

IEU-CEPA opens trade cooperation opportunities

The Indonesia-European Union Comprehensive Economic

Partnership Agreement (IEU-CEPA), finalised after nine

years of negotiation, marks a major milestone in

Indonesia's economic diplomacy. According to the

Coordinating Ministry for Economic Affairs, this

agreement lays the groundwork for a more inclusive, fair

and sustainable trade relationship between Indonesia and

the EU.

The IEU-CEPA is expected to significantly improve

market access, boost foreign investment and strengthen the

competitiveness of key sectors in Indonesia. With the EU

being Indonesia’s fifth-largest trading partner the

partnership holds substantial economic potential. In 2024,

the trade volume between the two reached US$30.1 billion

with Indonesia enjoying a growing trade surplus rising

from US$2.5 billion in 2023 to US$4.5 billion in 2024.

The agreement is thus seen as a vital step toward

deepening economic ties and promoting long-term mutual

benefits.

Indonesia and the European Union officially signed the

substantial conclusion of the Indonesia-European Union

Comprehensive Economic Partnership Agreement (IEU-

CEPA) on September 23, 2025. The agreement, signed by

Indonesia’s Coordinating Minister for Economic Affairs

Airlangga Hartarto and European Commission’s

Commissioner for Trade and Economic Security Maroš

Šefčovič, marks a significant milestone after nearly a

decade of negotiations.

See: https://en.antaranews.com/news/381676/ieu-cepa-opens-up-fair-trade-cooperation-opportunities-ministry

and

https://www.cnbcindonesia.com/news/20250923104236-4-669334/sah-ri-uni-eropa-teken-dokumen-substansial-ieu-cepa

Through the eyes of industry

The latest GTI report lists the challenges identified by the private sector

in Indonesia.

https://www.itto-ggsc.org/static/upload/file/20250918/1758161706789480.pdf

5.

MYANMAR

Foreign investment declines sharply

Foreign direct investment (FDI) in Myanmar dropped

sharply in the first five months of the 2025–26 fiscal year

to just US$129 million compared with more than US$200

million in the same period last year.

The bulk of new inflows went into manufacturing (US$93

million), followed by oil and gas, energy and services.

Singapore remained the largest investor at US$36 million

with China at US$33 million and Thailand at about US$32

million.

China has become a key target for the Myanmar authority

and senior leaders recently met Chinese business

executives in Beijing pledging to protect investors and

proposing the creation of a Myanmar–China business

cooperation association.

See - https://burmese.dvb.no/post/724546

Addressing the energy crisis

Myanmar’s power sector is in crisis with demand

averaging 4,400 megawatts daily against production of

less than 2,000 megawatts. More than half the population

lacks reliable electricity while industries and major cities

face frequent blackouts. The World Bank has warned that

the challenges are structural and tied to conflict, political

instability and fragile infrastructure.

A World Bank study says Myanmar is endowed with

abundant primary energy resources. Its hydropower

potential is estimated at more than 100,000 megawatts

(MW) in its river systems including four basins of

Ayeyarwady, Chindwin, Thanlwin and Sittaung.

The installed hydropower capacity, however, is only 3,262

MW (2023), illustrating the huge potential to be harnessed

that could, in the long term, not only meet domestic

demand but also become a green energy source for the

region.

Myanmar is also a hydrocarbon-rich country; the potential

reserves of crude oil, natural gas, and coal are 15,220

million barrels, 93.698 trillion cubic feet, and 711 million

metric tons, respectively, according to the official

statistics.

Proven oil reserves are estimated at 50 million barrels,

and gas reserves at around 10 trillion cubic feet.

Conditions for renewable energy are favorable too.

Myanmar is in the “sunbelt” with the highest solar

potential reaching 6.6 kilowatt-hours per square meter

(kWh/m²) per day on a horizontal surface in the dry zone

(Mandalay, Sagaing, and Magway regions). Myanmar thus

has greater energy generation potential and more options

for meeting its needs than most countries in the region.

Myanmar is reportedly seeking to develop a nuclear

energy programme in partnership with Russia as it seeks to

address chronic electricity shortages.

Reports suggest Myanmar has signed an agreement with

the Russian state corporation for nuclear energy (Rosatom)

to build a small modular nuclear plant. No site or firm

timeline disclosed; financing structure also not disclosed.

See:

https://documents1.worldbank.org/curated/en/099062324221019

838/pdf/P500473-48b24a55-b69d-481b-9ce3-dee0cba378ed.pdf

and

https://www.bernama.com/en/world/news.php?id=2471748

ASEAN calls for easing border tensions

ASEAN has renewed its call for Myanmar to fully

implement the Five-Point Consensus and backed the

bloc’s Special Envoy to foster dialogue among

stakeholders but progress remains stalled as the country’s

political crisis deepens.

Tensions have sharpened ahead of a planned general

election later this year. A diplomatic mission by Foreign

Mnisters from Malaysia, Thailand, Indonesia and the

Philippines intended to assess the post-emergency

situation was postponed. ASEAN has urged that peace

and stability take precedence over elections.

See - https://www.scmp.com/week-

asia/politics/article/3326361/aseans-failure-meet-myanmar-junta-

over-election-shows-its-limited-leverage?utm_source=chatgpt.com

6.

INDIA

Sawnwood price index up, veneer index down

The annual rate of inflation based on the all India

Wholesale Price Index (WPI) was 0.52% in August. The

positive rate of inflation in August 2025 was primarily due

to increases in prices of food products, other

manufacturing, non-food articles, other non-metallic

mineral products and other transport equipment.

The index for manufacturing increased from 144.6 in July

to 144.9 in August. Out of the 22 NIC two-digit groups for

manufactured products 13 groups witnessed price

increases, 5 groups a decrease and 4 groups saw no

change.

Some of the groups that showed month on month price

increases were manufacture of food products, textiles,

electrical equipment, other transport equipment and

machinery and equipment. Some of the groups that saw a

decrease in price were manufacture of basic metals,

computers, electronic and optical products, wearing

apparel, products of wood and cork along with furniture.

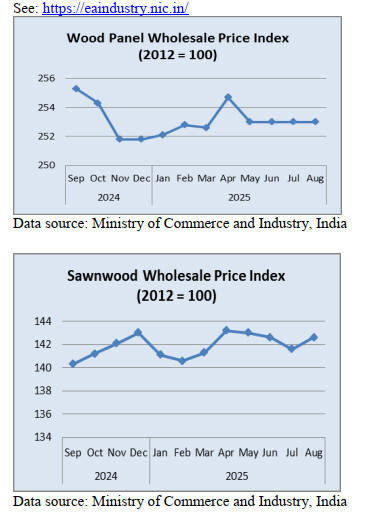

The price index for wood panels in August was unchanged

from July. The sawnwood price index recoverd in August

but there was a downward correction in the index for

veneers.

Lower GST will boost the economy

The new dual-slab goods and services tax (GST) structure

adopts a next-generation approach to dealing with indirect

taxation and will boost the economy significantly

according to Union Minister of Finance, Nirmala

Sitharaman. The new GST structure that takes effect

September 22 will have two rates 5% and 18%. Selected

luxury goods will be taxed at 40%.

She added the government is preparing a package for US

tariff-affected export sectors and a new wave of policy

changes is being worked on as the government realised the

need to diversify the economy in view of recent

challenges.

India’s economy grew by a better-than-expected, five-

quarter high of 7.8% in the June quarter but faces

headwinds from higher US tariffs.

See:

https://economictimes.indiatimes.com/news/economy/policy/low

er-gst-will-boost-indias-economy-higher-says-fm-nirmala-

sitharaman/articleshow/123728556.cms?from=mdr

Tripura can be leading plywood producer

As a result of infrastructure developments in Tripura,

backed by an Asian Development Bank, the Tripura

Industrial Development Corporation (TIDC) has initiated a

project to promote the plywood industry in the State.

Nabadal Banik, TIDC Chairman, said currently there are

two plywood plants in the State with another seven under

development.

The State has around 110,000 hectares of rubber plantation

of which approximately 10,000 hectares are ready for

replanting. If the plywood development initiative succeeds

Tripura will be one of the leading States in plywood

manufacturing, asserted Banik.

In addition to industrial development, the emphasis on

rubberwood plantations will also serve the State’s mission

to raise farmers’ income through agro-forestry.

See: https://www.newsonprojects.com/news/adb-approves-975-

crore-loan-to-boost-tripuras-industrial-infrastructure

7.

VIETNAM

Wood and Wood Product (W&WP) trade highlights

According to statistics from the Viet Nam Customs

Department W&WP exports in August 2025 reached

US$1.46 billion, down 0.5% compared to July 2025 and

down 3% compared to August 2024. Of the total WP

exports were valued at US$970 million, down 3.5%

compared to July 2025 and down 7% compared to August

2024.

In the first 8 months of 2025 W&WP exports totalled

US$11.1 billion, up 6.5% over the same period in 2024 of

which WP exports alone accounted for US$7.6 billion, up

6% over the same period in 2024.

W&WP exports to the EU market in August 2025 earned

US$51.5 million, up 52% compared to August 2024. In

the first 8 months of 2025 W&WP exports to the EU

amounted to US$400 million, up 15% over the same

period in 2024.

Office furniture exports in August 2025 contributed

US$33 million to total earnings, up 0.3% compared to

August 2024. In the first 8 months of 2025 exports of

office furniture brought in about US$252 million, up 31%

over the same period in 2024.

W&WP imports into Viet Nam in August 2025 reached

US$288.5 million, down 7% compared to July 2025, but

up 6% compared to August 2024. In the first 8 months of

2025 W&WP imports were valued at US$2.11 billion, up

17% over the same period in 2024.

Ash wood imports in August 2025 were estimated at

87,100 cu.m, worth US$23.8 million, down 8% in volume

and 7% in value compared to July 2025 but compared to

August 2024 imports were up 20% in volume and 37% in

value. In the first 8 months of 2025 ash wood imports

totalled 560,500 cu.m, worth US$147.7 million, up 48% in

volume and 51% in value over the same period in 2024.

Viet Nam’s imports of raw wood (logs and sawnwood)

from the US in July 2025 reached 158,390 cu.m, with a

value of US$67.13 million, down 8% in volume and 9% in

value compared to June 2025 but up 115% in volume and

118% in value over the same period in 2024. In the first 7

months of 2025 imports of raw wood from the US reached

749,250 cu.m with a value of US$311.49 million, up 90%

in volume and 85% in value over the same period in 2024.

Woodchip exports in August 2025 reached US$195

million, down 29% compared to August 2024. In the first

8 months of 2025 wood chip exports are estimated at

US$1.6 billion, down 11% over the same period in 2024.

Domestic market a strategic pillar for industry

Vu Ba Phu, Director of the Trade Promotion Agency,

Ministry of Industry and Trade, has said besides exports

the domestic market of more than 100 million people

needs to be considered a strategic pillar to ensure stable

and sustainable growth for the wood industry.

Viet Nam's wood industry has made great strides,

becoming a leading center for processing and supplying

wooden furniture and interiors. In 2024 exports of wood

and wood products reached US$16.28 billion, up 21%

over the previous year.

In the first 8 months of 2025 exports reached US$11.1

billion, up 6% over the same period last year and the

whole year is expected to reach US$18 billion.

These figures show strong resilience but also reflect a

large dependence on external markets.

Vu Ba Phu has repeatedly emphasised “The wood and

forestry industry has always been considered one of the

important industries in Viet Nam, not only contributing

greatly to exports but also affirming its position on the

global trade map. However, businesses need to pay special

attention to exploiting the potential of the domestic market

with more than 100 million people, where purchasing

power is increasing strongly”.

As expected, the domestic market is the fulcrum for the

wood industry to maintain its growth rate in the context of

many international fluctuations. The rapid increase in

housing demand, urbanisation and green consumption

trends have created a large development space for

domestic wooden furniture products. If exploited this will

be the driving force to help the industry reduce the risk of

depending on large markets such as the US or EU.

From an association perspective Ngo Sy Hoai, Vice

President and General Director of the Viet Nam Timber

and Forest Products Association, also pointed out “Viet

Nam's wood industry currently exports to more than 40

markets and imports raw materials from more than 100

markets. However, we cannot only focus on exports. With

the characteristics of wood products closely related to the

environment and forests the domestic market will be the

place to affirm the responsible and sustainable

development of the industry.”

Trade promotion - key to exploiting market potential

Trade promotion plays a central role in developing both

international and domestic markets. Major fairs such as

Hawa Expo, VIFA ASEAN or VIFA Expo are not only

places to display and promote Viet Namese wood products

to the world but also an opportunity for businesses to

reach domestic consumers.

Vu Ba Phu affirmed “Towards the target of wood and

wood products exports reaching over US$18 billion in

2025 the Ministry of Industry and Trade will continue to

closely coordinate with ministries, branches and localities

to implement many programmes to support businesses in

technology transformation, design improvement, brand

development and trade promotion. The domestic market

must also be placed at the center of this strategy.”

According to him, in addition to organising fairs the

industry needs to expand specialised trade promotion

services, researching domestic consumer tastes, organising

communication campaigns, training on design, e-

commerce and green transformation. This will not only

help increase exports but also effectively stimulate

domestic purchasing power.

Representing the wood industry business community, Ngo

Sy Hoai suggested that foreign and domestic media

channels support strong promotion of the wood industry's

achievements, spreading the message that Viet Nam is

determined to develop a responsible and sustainable wood

industry. Linking the Viet Namese wood brand with the

image of green, environmentally friendly production will

create a competitive advantage right at home.

In order for the domestic market to truly become a fulcrum

experts also recommend solutions that need to be

implemented synchronously. In particular, by researching

consumer tastes and trends businesses need to:

+ grasp changes in design needs, materials and

models especially with the young generation who

make up a large proportion of the population.

+ develop diverse distribution channels, combining

traditional stores, furniture supermarkets, and e-

commerce platforms.

+ apply virtual reality technology and online

shopping experiences.

+ strengthen domestic trade promotion, promote the

organisation of specialised fairs and exhibitions

in major cities such as Hanoi, Ho Chi Minh City,

Da Nang and expand to localities with high

demand for construction and urbanisation.

Viet Nam’s wood industry has risen fast thanks to the

strength of exports. But to maintain growth momentum

and minimise risks the domestic market needs to be seen

as a “second pillar” alongside the international one.

With more than 100 million people the domestic market is

not only a place for consumption but also a “laboratory”

for businesses to test designs, shape trends and build

sustainable brands.

As Vu Ba Phu emphasised, the sustainable development of

the wood industry cannot rely solely on exports but must

also rely on the growth of the domestic market. And as

Ngo Sy Hoai affirmed, Viet Namese wood must follow a

responsible path, associated with the environment to

thereby affirm its value domestically before reaching out

to the world.

See: https://www.Viet Nam.vn/en/mo-rong-thi-truong-trong-nuoc-cho-nganh-go-viet

Viet Nam and Germany outline next steps for sustainable timber trade

On September 11-12, the Viet Nam Forestry

Administration (VNFOREST) and the German

Development Agency (GIZ) hosted a forum titled

"Ensuring Timber Legality for Sustainable Forestry

Development in Viet Nam". The event served as a crucial

platform to strengthen joint efforts on timber traceability

and legality, review the country's progress towards

implementing the Voluntary Partnership Agreement on

Forest Law Enforcement, Governance and Trade (VPA

FLEGT), and promote gender equality within the forestry

sector.

At the opening of the forum, Director General Tran Quang

Bao remarked, “This forum provides an important

opportunity for government agencies, businesses, timber

associations, social organisations, local communities and

international partners to exchange views, share

experiences and propose solutions to ensure the legality of

timber in Viet Nam.

We especially appreciate the support of the German

people and government through the GIZ, in implementing

the VPA FLEGT, a strong example of multistakeholder

cooperation and our shared commitment to building a

timber industry that is legal, transparent, sustainabl, and

responsible.”

Jens Schmid-Kreye, the First Secretary at the German

Embassy said Germany is proud to support Viet Nam in

strengthening timber legality and sustainable forestry

through our joint technical cooperation to develop

enabling policy frameworks, capacity development and

knowledge transfer and the development of practical

digital tools.”

Meanwhile, the EU and Viet Nam share a strong,

cooperative relationship, particularly in trade, highlighted

by the free trade agreement that entered force in 2020.

See: https://vir.com.vn/Viet Nam-and-germany-outline-next-

steps-for-sustainable-timber-trade-136319.html

Wood chip exports declined in first 8 months 2025

It is estimated that the exports of woodchips in August

2025 reached US$195 million, down 29% compared to

August 2024. In the first 8 months of 2025, woodchip

exports earned US$1.6 billion, down 11% over the same

period in 2024.

The main market was China at US$891.4 million but

down 13% over the same period in 2024. This is a sharp

decline, reflecting the slowdown in demand for pulp and

paper materials in China.

Exports to Japan, as the next destination, reached

US$349.3 million, up 3% followed by Indonesia

(US$101.1 million, up 3%), South Korea (US$37.9

million, up 7%).

A decline in key markets such as China and South Korea

poses a challenge for Viet Namese wood chip enterprises

and the need to reassess their export strategies.

Of significance is the strengthened cooperation with forest

farms and plantations to ensure stable supply, consistent

quality and reduced logistics costs. Optimising production

processes associated with reducing carbon emissions to

meet increasing demand from the buyers, has been

emerging as a priority.

8. BRAZIL

Bahia State boosting the production Chain and

sustainability

The city of Salvador in the State of Bahia will host the 5th

“Sustainable Timber: The Future of the Market”, on 19

November 2025. The event is being organised by the

National Forum of Forest-Based Activities (FNBF) in

partnership with the Center of Timber Producing and

Exporting Industries of the State of Mato Grosso (Cipem)

with support from Sebrae Mato Grosso, Sebrae Bahia and

the Industrial Federations of Mato Grosso State (Fiemt)

and the Bahia State (Fieb).

The conference will bring together public sector

representatives, business leaders and experts to discuss

opportunities and challenges in the native timber

production chain with a focus on legality, sustainability

and innovation.

The conference in the Northeast region is strategic

considering the concentration of consumer hubs and the

increasing demand for sustainable solutions. The event

seeks to strengthen the perception of legally sourced

timber as a tool for decarbonising the civil construction

sector, generating jobs and income and fostering the socio-

economic development of forest regions. It seeks to

consolidate its position as a platform for business

development, sectoral integration and the promotion of the

Brazilian forest industry.

See: https://www.folhamax.com/mobile/economia/madeira-

sustentavel-chega-a-salvador/512056

Mato Grosso’s forest sector in crisis

The forest sector in the State of Mato Grosso is facing a

severe crisis as a result of tariffs imposed by the United

States on Brazilian wood products with the impact being

felt in the Ipe flooring and decking sector where the main

market is the US.

The tariffs have affected sales which led to reduced shifts,

production cuts and mass layoffs affecting companies that

had been operating exclusively in this niche market for

years. The inability of importers to pass on the costs of the

tariffs to consumers coupled with the difficulty of

directing production to other markets has led to high

stocks levels, falling prices and an erosion of the sector’s

competitiveness. Together, the tariffs are causing negative

economic effects throughout the entire regional supply

chain.

In response, associations and federations in the timber

sector requested the Federal Government to take strong

position in negotiations with the US government. At the

same time, companies are exploring mitigation strategies

such as diversifying timber species and identifying new

consumer markets with the aim of preserving economic

viability and minimising the impact on employment and

production.

See: https://nativanews.com.br/economia/setor-florestal-de-mato-

grosso-entra-em-crise-apos-tarifas-dos-eua-sobre-madeira-de-

ipe/

Export update

In August 2025 Brazilian exports of wood-based products

(except pulp and paper) decreased 18% in value compared

to August 2024, from US$268.4 million to US$220.5

million.

Pine sawnwood exports decreased 12% in value between

August 2024 (US$48.2 million) and August 2025

(US$42.6 million). In volume, exports decreased 7% over

the same period from 205,700 cu.m to 191,100 cu.m.

In contrast, tropical sawnwood exports in August 2025

increased 26% in volume, from 17,600 cu.m in August

2024 to 22,100 cu.m. In value, exports increased 34%

from US$6.5 million to US$8.7 million over the same

period.

Pine plywood exports decreased 27% in value in August

2025 compared to August 2024 from US$58.7 million to

US$42.8 million. In volume, exports decreased 21% over

the same period, from 173,600 cu.m to 136,700 cu.m.

As for tropical plywood, exports increased in volume by

87% and by 67% in value from 1,500 cu.m and US$0.9

million in August 2024 to 2,800 cu.m and US$1.5 million

in August 2025.

Wooden furniture exports decreased from US$48.4 million

in August 2024 to US$44.6 million in August 2025, a

decrease of 8%.

US tariff impacts the timber sector

The Brazilian Association of Mechanically Processed

Timber Industry (ABIMCI) has reported significant

impacts on the Brazilian timber sector from the 50% tariff

imposed by the United States.

A survey conducted with its member companies recorded

approximately 4,000 layoffs between July and September.

In addition 5,500 workers were placed on vacation and

1,100 under temporary layoff arrangements.

If the current tariff scenario remains unchanged it is

estimated that as many as 4,500 more jobs will be lost

over the next 60 days compromising socio-economic

sustainability.

The tariff increase caused an immediate downturn in the

market leading to contract cancellations, shipment

interruptions and a significant reduction of new business

deals. August export data indicates a decline of between

35% and 50% in the volume of wood products shipped to

the US.

ABIMCI has sought dialogue with the Ministry of

Development, Industry and Trade (MDIC), requesting the

initiation of diplomatic negotiations with the US

government based on technical and commercial grounds to

seek tariff readjustment.

The Association points out that the sector accounts for

about 50% of Brazil’s export-oriented production (in some

segments, with up to 100% dependency on the US market)

and emphasised that the timber sector generated US$1.6

billion in export revenues in 2024.

The Association warns that the continuation of the current

tariffs puts at risk around 180,000 formal jobs, disrupts

well-established production chains and threatens decades

of investments in technology, certification and compliance

with international market requirements.

ABIMCI considers the urgent need for the federal

government to take immediate action to re-establish

bilateral trade and mitigate the economic and social

impacts on the sector.

In related news, in early September ABIMCI participated

in a high-level business mission to Washington organised

by the National Confederation of Industry (CNI) with the

participation of sectoral associations and industry

federations. The initiative focused discussions with US

authorities and institutions on mitigating the impact of

tariffs imposed on Brazilian products and to safeguard the

competitiveness of bilateral trade.

The mission’s agenda included strategic meetings at the

Brazilian Embassy, dialogues with the US Chamber of

Commerce and legal consultancies specialised in

government relations seeking negotiated pathways for the

reversal of tariff barriers.

ABIMCI participated in a public hearing convened by the

United States Trade Representative (USTR) under Section

301 of the US Trade Act and presented a technical defense

of Brazil’s processed wood industry.

ABIMCI’s formal submission filed on 18 August

highlighted the sustainable origin of exported timber

products, strict compliance with Brazilian environmental

and labour legislation and the absence of forced labour

within the sector.

The document emphasised traceability systems, forest

certification and the sector’s commitment to combating

illegal deforestation and this was supported by letters of

endorsement from US importers.

This mission consolidated a coordinated, multisectoral

action to sustain trade flows and align diplomatic efforts,

prioritising technical approaches and defending the

international image of the Brazilian forestry sector.

See: https://bit.ly/PosicionamentoAbimciTaxaçãoEUA and

https://abimci.com.br/abimci-participa-de-missao-empresarial-a-washington/

and

https://abimci.com.br/abimci-estara-em-audiencia-publica-no-

istr-dia-3-09-sobre-a-investigacao-da-secao-301/

Through the eyes of industry

The latest GTI report lists the challenges identified by the private sector

in Brazil.

https://www.itto-ggsc.org/static/upload/file/20250918/1758161706789480.pdf

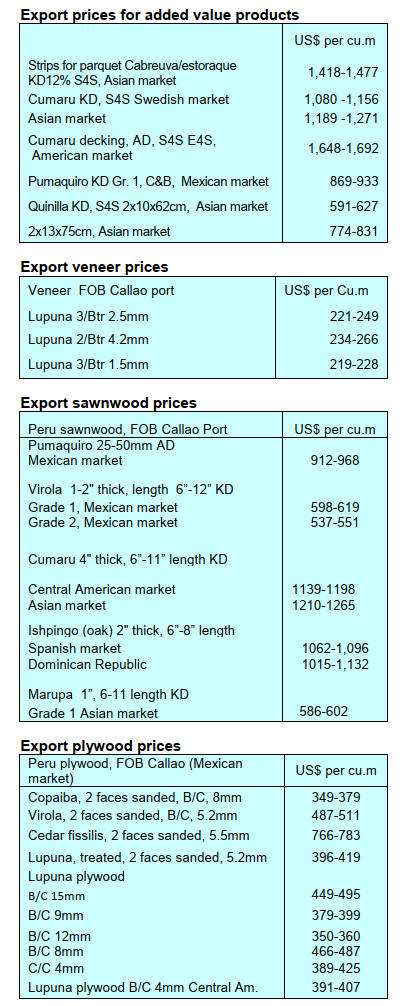

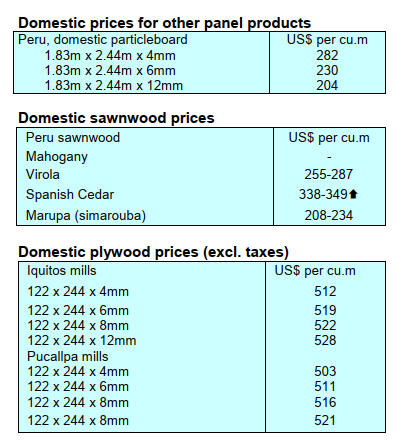

9. PERU

Export update - July

Shipments of wood products totalled US$37.4 million

during the first five months of 2025 representing a

decrease of 21% compared to the same month in 2024

(US$47.4 million) according to the Center for Global

Economy and Business Research of the CIEN-ADEX

Exporters Association.

According to figures from the ADEX Data Trade Trade

Intelligence System exports included sawnwood

(US$14.3 million), semi-manufactured products (US$11.7

million), firewood and charcoal (US$3.8 million),

furniture and parts (US$2.5 million) and construction

products (US$2.3 million).

The leading destination was the Dominican Republic with

shipments totalling US$7.3 million, an increase of 13%

compared to the previous year. The US followed with

US$5.6 million, a massive decline compared to 2024,

France with US$4.8 million, a decrease of 37%, Mexico

with US$3.8 million, a decrease of 27% and rounding out

the top 5 markets was Viet Nam with exports at US$3.7

million, an increase of 32%.

Veneer and plywood exports continue to grow

According to information provided by the Extractive

Industries and Services Department of the Association of

Exporters (ADEX) veneer and plywood shipments during

the January-July 2025 period reached an FOB export value

of US$1.5 million growing by 7%, a positive change

compared to the same period in 2024 (US$1.4 million),

The main market for exports in this subsector was Mexico

which represented a 47% share but this was much lower

than in the same period in 2024. Ecuador had a 32% share

and Colombia at an 11% share followed by the Dominican

Republic (6% share) and Costa Rica with a 3% share.

SERFOR and Germany alliance to promote SFM

The National Forestry and Wildlife Service (SERFOR)

and the German Development Bank (KfW) have

successfully completed a mission on the Sustainable

Productive Forests Programme (BPS). Following the visit

key agreements to further strengthen forest development,

sustainable management and the fight against

deforestation were made.

During the mission, conducted between September 2 and 9

in Lima and Madre de Dios, both institutions highlighted

the progress of the Sustainable Productive Forests

Programme (BPS) and agreed on new actions to accelerate

its implementation.

Among the main agreements reached was a decision to

expand access to financing to support investments in

plantations, natural forest management and forest planning

and to evaluate the expansion of the Forest Incentives

Programme.

See: https://www.gob.pe/institucion/serfor/noticias/1246936-

serfor-y-gobierno-aleman-fortalecen-alianza-para-impulsar-la-

gestion-forestal-sostenible-en-peru

|