|

Report from

North America

US hardwood plywood imports - trend remains

unpredictable

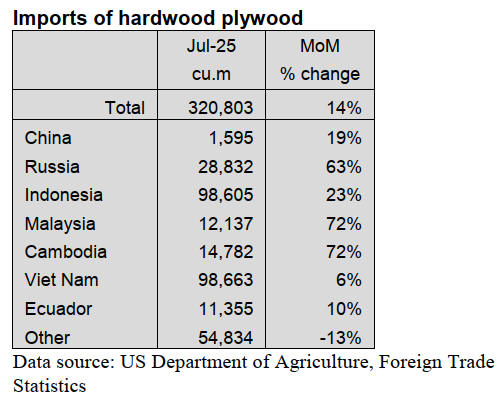

US imports of hardwood plywood rebounded soundly in

July, continuing the monthly up-and-down pattern of the

last few months. At 320,803 cubic metres, July imports

were up 14% from the previous month and a robust 47%

from July 2024.

Imports from Russia rose 63% in July while imports from

Malaysia and Cambodia both jumped 72%. Imports from

the largest suppliers showed more modest gains.

Imports from Indonesia increased by 23% while imports

from Vietnam edged up 6%. Through July, total import

volume of hardwood plywood into the US is up 24% over

last year.

Imports of sawn tropical hardwood also unpredictable

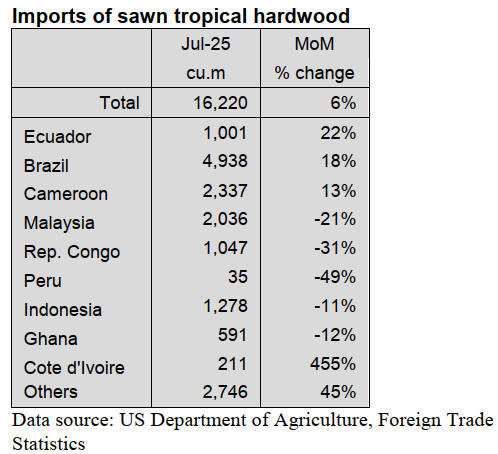

After plunging 21% in June, US imports of sawn tropical

hardwood rose 6% in July, as this market goes through the

same monthly gyrations as plywood imports. But unlike

hardwood plywood imports, the average for the year isn’t

outperforming last year.

At 16,220 cubic metres, import volume for July 2025 was

8% less than in July of last year. Rising imports from

Brazil (up 18%), Ecuador (up 22%) and Cameroon (up

13%) more than made up for declines in imports from

Malaysia, Ghana, Indonesia, Peru and Congo

(Brazzaville). Imports of Cedro, Jatoba, Mahogany and

Ipe all rebounded sharply after falling in June. Year to

date, total imports of sawn tropical hardwood are about the

same as last year, up less than 1% through July.

In Canada, imports of sawn tropical hardwood rose 3% in

July over the previous month but were 35% lower than the

previous July.

Imports from top-supplier Cameroon rebounded sharply in

July, rising 55% while imports from Congo (Brazzaville)

surged to their highest level in nearly six years.

Veneer imports bounce back sharply

US imports of tropical hardwood veneer rose 29% in July,

rebounding from a 20% drop in June. At US$3.1 million,

the monthly total was 8% higher than for July 2024.

A 51% increase in imports from top-supplier Cameroon

and an 80% jump in imports from Cote d’Ivoire fueled the

rise, despite declines from other major suppliers and the

continuing month-to-month volatility in imports from Italy

(down 95% in July).

Through July, total imports of tropical hardwood veneer

are up 5% from the previous year.

Moulding imports fall

US imports of hardwood mouldings fell 3% in July,

retreating for a second straight month after reaching a 3-

year high in May. At US$15.1 million, July imports were

7% higher than last July despite the dip.

An 18% rise in imports from China helped avoid a sharper

monthly decline as imports from top-supplier Canada fell

10% in July and imports from Malaysia dropped 25%.

For the year so far, total imports of hardwood mouldings

are up 19% over last year.

Hardwood flooring imports surged in July

US imports of hardwood flooring, which have lagged for

most of the year, jumped 71% in July as imports from

Malaysia surged. At US$7.3 million, July imports were

their highest in 14 months and 18% higher than in July

2024.

Imports from Malaysia more than tripled, rising to their

highest level of the past 10 years. Imports from Brazil,

which have been down sharply all year, rallied in July to

the level we are more used to seeing.

Despite the solid month, year-to-year imports from Brazil

are still down 42% versus last year and overall US imports

of hardwood flooring are down 11% through July.

US imports of assembled flooring also rose in July after

three months of declines. However, the rise was only 4%,

imports from top-supplying countries were all down, and

the monthly total remained well below that of the previous

year.

At US$20.4 million, July imports were 34% less than in

July 2024. A 159% gain in imports in China drove the

monthly rise as imports from top-traders Canada,

Indonesia, and Vietnam all fell. Total imports for the year,

which this spring were well ahead of last year, were up

only 5% over last year through July.

US wooden furniture imports rise

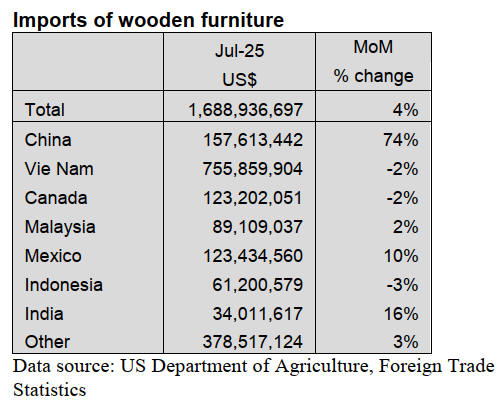

US imports of wooden furniture rose 4% in July, moving

upward for the second consecutive month. At US$1.69

billion, imports for the month were 8% below those of

July 2024. Imports from China rose 74%, rebounding after

a couple of very slow months, while imports from India

and Mexico both showed solid gains. Imports from

Canada and Malaysia both declined by 2%.

Through July, total imports of wooden furniture were

down 2% versus last year.

In June, the US furniture market trended downward,

according to the latest Furniture Insights published by

Smith Leonard. new orders for June were down 9%

compared with May but up 3% versus June 2024. For the

first half of the year, new furniture orders for 2025 were

down 2% from last year.

See: https://www.smith-leonard.com/2025/09/02/august-2025-

furniture-insights/

US Tariff Update

An appeals court ruled that most of the recent US tariffs

are illegal. The ruling from the US Court of Appeals for

the Federal Circuit focused on the "reciprocal" tariffs

imposed in April, as well as separate tariffs on China,

Canada and Mexico that the administration put in place

citing emergency powers granted under a 1970s-era law.

The court's decision does not impact other tariffs,

authorised under different authorities, such as taxes on

imported steel and aluminum.

The appeals court ruled that the president had overstepped

his authority in invoking the International Emergency

Economic Powers Act (IEEPA) to impose most of the

tariffs. The act from the 1970s gives the president the

power to respond to "unusual and extraordinary" threats at

times of national emergencies.

The divided appeals court, which split 7 to 4, said the

IEEPA does not give a president the power to impose such

sweeping tariffs. The court’s ruling keeps tariffs in place

until at least October 14, with analysts expecting the

Supreme Court to hear the administration’s appeal.

Barring an expedited hearing, a decision is unlikely before

November and possibly not until mid-2026. .

White House offers exemptions

On September 5, President Trump signed an executive

order offering some tariff exemptions to trading partners

who strike deals on industrial exports such as nickel, gold

and other metals, as well as pharmaceutical compounds

and chemicals and some wood products that don’t grow in

the US.

His latest order identifies more than 45 categories for zero

import tariffs from "aligned partners" who clinch

framework pacts to cut Trump's "reciprocal" tariffs and

duties imposed under the Section 232 national security

statute.

The order brings US tariffs in line with its commitments in

existing framework deals, including those with allies such

as Japan and the European Union. A White House official

said it also creates new carve outs for some agricultural

products, aircraft and parts, and non-patented articles for

use in pharmaceuticals.

In situations where a country has struck a "reciprocal"

trade deal with the United States, this will allow the US

Trade Representative, the Commerce Department and

customs to waive tariffs on covered imports without a new

executive order from Trump, the official said.

Steep tariffs on India take effect

Steep US tariffs on a range of products from India took

effect on August 27, threatening a serious blow to India’s

overseas trade in its largest export market.Trump had

initially announced a 25% tariff on Indian goods.

But in August he signed an executive order imposing an

additional 25% tariff due to India’s purchases of Russian

oil, bringing the combined tariffs imposed by the US on its

ally to 50%.

The Indian government estimates the tariffs will impact

US$48.2 billion worth of exports. Officials have warned

the new duties could make shipments to the US

commercially unviable, triggering job losses and slower

economic growth. The tariffs will not impact all sectors

uniformly, pharmaceuticals, energy products and

electronics remain exempt.

See: https://www.msn.com/en-us/money/markets/trumps-50-

tariffs-on-india-over-russian-oil-purchases-take-effect/ar-

AA1Li6e9?ocid=BingNewsVerp

and

https://www.msn.com/en-in/money/topstories/us-tariffs-on-india-

from-august-27-exports-worth-48-bn-to-be-hit-says-commerce-

ministry-here-s-a-list-of-affected-sectors/ar-

AA1LeZFG?ocid=BingNewsVerp

and

https://www.msn.com/en-us/money/news/trump-signs-order-

offering-some-tariff-exemptions-to-countries-with-us-trade-

deals/ar-AA1LZmrH?ocid=BingNewsVerp

and

https://www.whitehouse.gov/fact-sheets/2025/09/fact-sheet-

president-donald-j-trump-modifies-the-scope-of-reciprocal-

tariffs-and-establishes-procedures-for-implementing-trade-deals/

Interfor curtails production across all North American

regions

Interfor, a forest products company specialising in the

production and sale of various lumber and wood products

based in Canada, has announced a reduction in its North

American lumber production by approximately 145

million board feet between September and December of

2025, representing approximately 12% of its normal

operating capacity.

The temporary curtailments will be through a combination

of reduced operating hours, prolonged holiday breaks,

reconfigured shifting schedules and extended maintenance

shut-downs.

The curtailments are expected to impact all of Interfor’s

operating regions, with both the Canadian and U.S.

operations expected to reduce their production levels by

approximately 12% each.

The curtailments are in response to persistently weak

market conditions and ongoing economic uncertainty. The

company states it will continue to monitor market

conditions across all of its operations and adjust its

production plans accordingly.

See: https://www.woodworkingnetwork.com/news/canadian-

news/interfor-curtails-production-across-all-north-american-

regions

|