Japan

Wood Products Prices

Dollar Exchange Rates of 10th

September

2025

Japan Yen 147.52

Reports From Japan

Is timing for an interest rate hike approaching?

Japan’s economy expanded in the second quarter the

government confirmed in a revised report as data for

private consumption were revised higher. Gross domestic

product grew at an annualised pace of 2.2% the Cabinet

Office reported. The economy has now grown for five

consecutive quarters.

The consumption report confirms that consumer spending

gained momentum and capital investment remained

positive despite. Takeshi Minami, Chief Economist at the

Norinchukin Research Institute said "this outcome reflects

a positive cycle of wage increases and rising prices as the

Bank of Japan (BoJ) anticipated and I believe the timing

for an interest rate hike is approaching.”

Japan’s economy is struggling amid high inflation and a

global slowdown. The main drags to growth came from

the public sector and exports.

Wage growth announcements at this year’s shunto (wage

negotiations held in spring between employers and unions)

were quite strong and this fueled speculation that

consumer spending would strengthen, driving stronger

underlying inflation and higher wage growth. Despite the

announcements of such strong wage increases, total wage

growth in Japan remains relatively weak.

One of the most uncertain aspects of the Cabinet outlook

revolves around international trade. Evidence of a

slowdown in trade is already showing up in the data.

Japanese goods exports had surged in the first quarter of

2025 ahead of tariffs but had fallen by 1.7% in May on a

year on year basis. Unsurprisingly, goods exports to the

United States were notably weak, falling 11% over the

same period.

See:

https://www.japantimes.co.jp/business/2025/09/08/economy/gros

s-domestic-product-grew-22-last-quarter/

Japan business sentiment

Japan’s Business Survey Index (BSI) for large

manufacturing firms unexpectedly rose to 3.8% in the

third quarter of 2025, up from -4.8% in the previous

quarter, the lowest reading since early 2024.

The BSI, based on a survey of large Japanese

manufacturers, serves as a key gauge of economic health

in a country heavily reliant on industrial output.

Manufacturers remain optimistic about the months ahead,

projecting a further rise to 3.9% in final quarter of 2025

followed by a slight decline to 3.3% in the first quarter of

2026.

See: https://www.cao.go.jp/index.html

Retirement crisis facing workers of the ‘Lost Decades’

The term “employment ice age” has been coined to

describe the first decade of corporate retrenchment (mid-

1990s through early 2000s) following the collapse of

Japan’s 1980s asset-price bubble. Young people who

entered the work force during those years had a hard time

securing “regular” corporate jobs and those struggles have

had a lasting impact on their average income, savings and

cumulative pension contributions.

Now in their forties or early fifties, many members of the

“ice-age generation” (here, comprising all those who

completed their school education between 1993 and 2004)

are facing the prospect of a retirement crisis and

policymakers have begun searching for a solution. In June

a ministerial council dedicated to this issue submitted a

“basic framework for new programmes to support the

‘employment ice age’ generation and others.

See: https://www.nippon.com/en/in-depth/d01155/

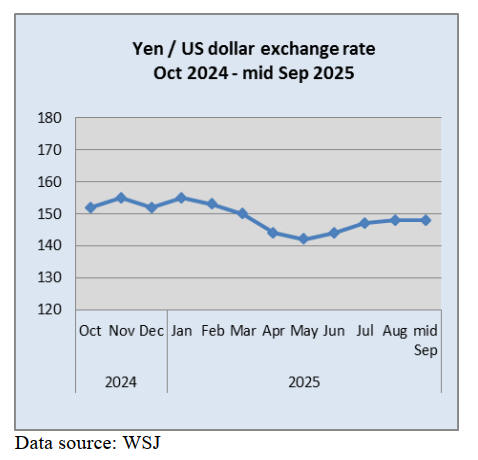

Yen exchange rate temporarily tilted by Prime

Minister’s comments

The yen has been weakening once again. The Japanese

currency traded at the 147 level against the dollar in early

September but at one point the yen fell below 149 against

the dollar. Expectations that the US Federal Reserve could

announce a major interest rate cut at its next meeting in

November have moderated and many are now anticipating

that US interest rates will continue to remain high for

some time.

Another reason cited for the short-term yen decline was

that the Prime Minister told reporters he personally thinks

Japan is not ready for an additional interest rates hike. The

market reacted sharply to his remarks.

See: https://www3.nhk.or.jp/nhkworld/en/news/backstories/3594/

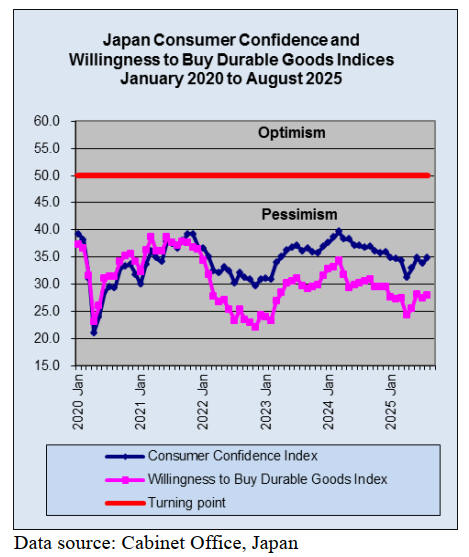

High rents dampening personal consumption

Tokyo rents have soared reaching their highest rate of

increase in 30 years and now account for over 30% of

household income which is squeezing family finances and

potentially dampening personal consumption.

This surge, driven by increased demand for urban centre

apartments and rising construction costs signifies the

inflation cycle impacting Japan's housing market and

could lead to further Bank of Japan interest rate hikes, says

a Nikkei Real Estate Market report.

See: https://asia.nikkei.com/business/markets/property/tokyo-

rents-soar-past-30-of-household-income-squeezing-families

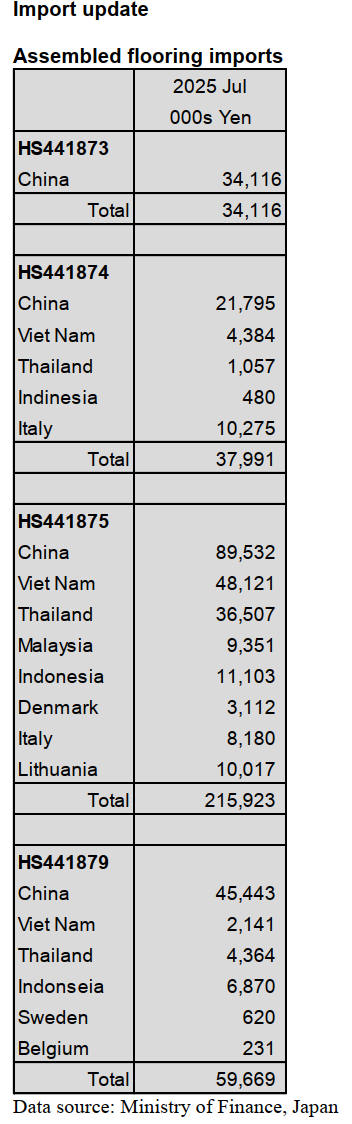

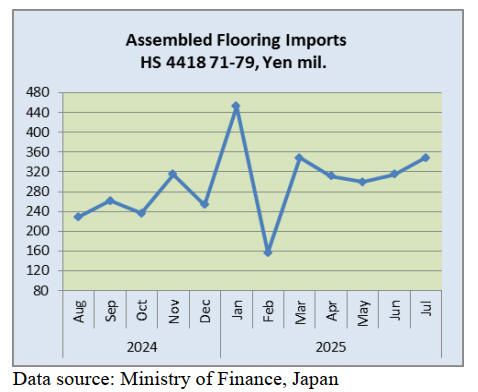

Assembled wooden flooring imports

In the first half of 2025 assembled flooring imports were

15% higher than in the same period in 2024. The main

category of assembled flooring imports in July 2025 was

HS441875, accounting for 62% (61% in June) of the total

value of assembled flooring imports. Of HS441875

imports, 80% was provided by shippers in China, Viet

Nam and Thailand. The other main sources of assembled

flooring (HS441875) in July were Indonesia and

Lithuania, a new supplier.

The second largest category in terms of value in July 2025

was HS441879, 75% of which was shipped from China. A

further 18% was shipped from Indonesia and Thailand.

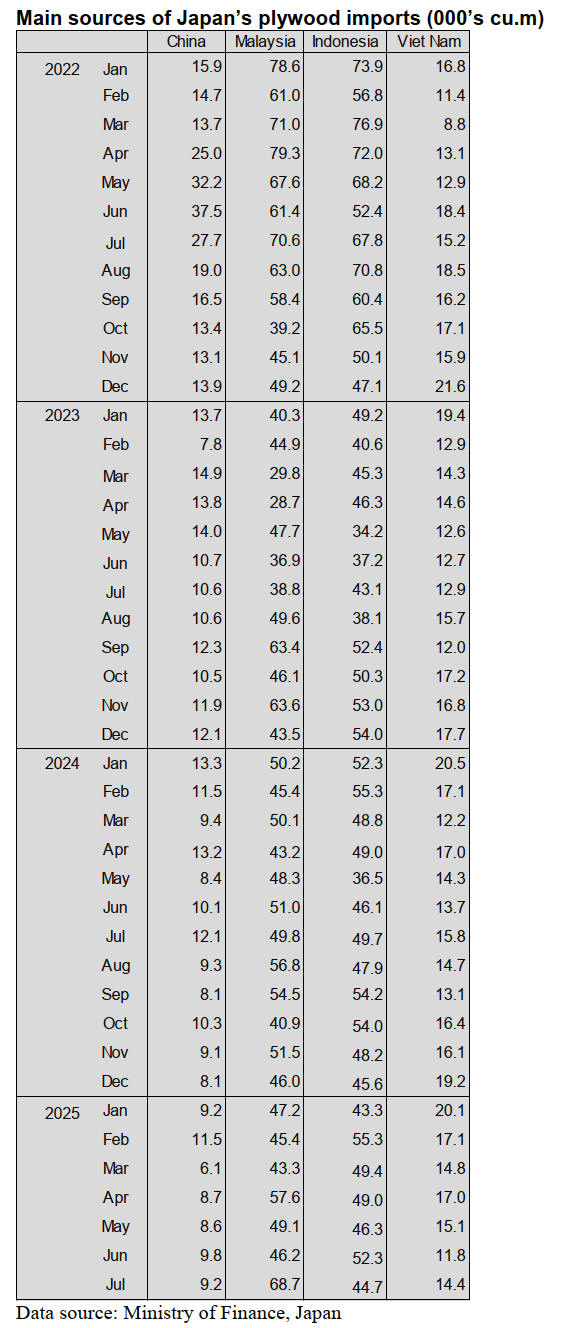

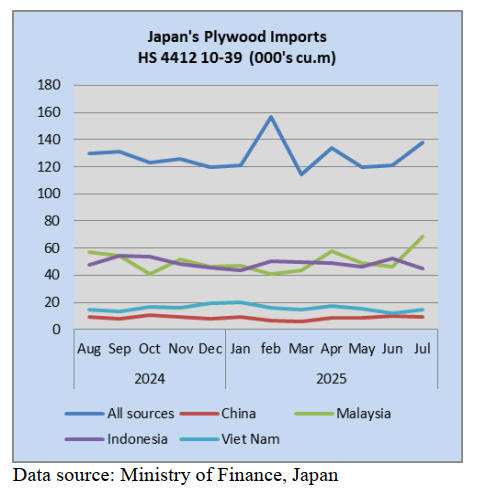

Plywood imports

In the first half of 2025 there was a modest 3% year on

year rise in the volume of plywood imports into Japan.

Shipments in the first half of 2025 from China dropped

25% year on year while import volumes from the other

three main shippers; Malaysia, Indonesia and Viet Nam

were at almost the same level and in the first half of 2024.

In July, Malaysia and Indonesia were the top suppliers of

plywood to Japan, as in previous months. The volume of

July 2025 imports from Malaysia was almost 50% above

the volume reported for July 2024 and year on year there

was a 37% increase. July imports from Indonesia were

down slightly month on month and little changed from the

volume reported for July 2024.

Imports of plywood from China in July were at around the

same level as in June but year on year there was a 25%

decline in arrivals.

In July 2025 arrivals of HS441210-39 were reported at

137,732 cu.m (121,000 cu.m in June) up 7% year on year

and up 14% compared to June.

As in previous months, of the various categories of

plywood imported in July 2025, HS441231 was the largest

followed by HS441233 and HS441234 (5%). The balance

was of HS441239.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

North American logs

Log demand in Japan remains sluggish due to a shift

toward domestic cedar and cypress, as well as weak

overall market activity. Production adjustments may be

necessary in the future. Prices for U.S. Douglas fir logs for

Japan, IS grade, FAS, MBM, Scribner scale, remain flat at

around US$1,020 compared to July shipments. Domestic

supply and demand levels are still low.

Canadian Douglas fir logs for plywood exports to Japan

are also stable at US$220–US$221, CIF per cbm,

following a July price increase. At an exchange rate of

¥147/USD, the landed cost is estimated at around ¥34,100.

KD Douglas fir lumber prices remain flat, ¥68,000–

¥71,000/m³ for 105×150–270mm beams, around

¥80,000/m³ for square beams, and ¥85,000–¥88,000/m³

for 60×45 mm small-cut lumber (delivered to precut

factories).

Weak demand and the lower cost of domestic wood make

price increases difficult. Precutting plants operating rates

have yet to recover, and August saw limited activity due to

extreme heat and fewer working days. A recovery in

demand is hoped for in the fall.

A recent fire at a major imported lumber manufacturer has

had no impact so far, and Douglas fir lumber remains

sufficiently supplied. Companies handling U.S. and

Canadian wood are closely monitoring potential supply

disruptions and network restructuring from September

onward.

Plywood

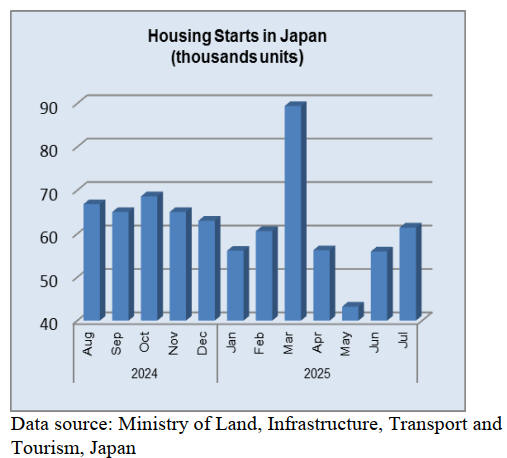

Demand for domestic softwood plywood remains weak,

largely due to sluggish new housing starts. However,

shipments improved from late July to early August as

buyers stocked up ahead of the Obon holiday. With

manufacturers maintaining a firm stance on price hikes,

some buyers moved to secure inventory, anticipating price

stability. As of late August, though, shipment activity has

slowed again.

Major plywood manufacturers aimed to raise prices in

August for 12 mm 3 x 6 domestic structural softwood

plywood to ¥1,150–¥1,200 per sheet, delivered. However,

due to weak demand, prices remained mostly flat, with

central Tokyo rates holding at ¥1,090–¥1,100.

Prices for imported tropical plywood from Indonesia and

Malaysia are trending firm, driven by reduced log supply

from inland areas and rising raw material costs. In

Sarawak, Malaysia, a major supplier raised prices by about

US$10, C&F per cbm, in July. As a result, prices for 12

mm coated formwork plywood are US$600–US$610 per

cbm, standard formwork plywood US$500–US$510 per

cbm, and structural plywood US$510–US$520 per cbm.

The Malaysian ringgit has strengthened against the dollar

since early April, keeping production costs

high.Indonesian standard plywood is priced at around

US$970 per cbm for 2.4 thickness, US$880 per cbm for

3.7 mm, and US$850 per cbm for 5.2 mm. Both natural

tropical wood plywood and falcata combo plywood face

rising production costs, prompting firm pricing from

suppliers.

Domestic prices are as follows: 12 mm 3 x 6 coated

formwork plywood for construction use is ¥1,800–¥1,850

per sheet, standard formwork and structural plywood are

around ¥1,550, and standard plywood is ¥780 for 2.5 mm,

¥930 for 4 mm, and ¥1,100 for 5.5 mm thickness

Domestic logs and lumber

Domestic softwood lumber showed mixed trends in July

and early August. Market activity remained sluggish, and

demand varied among trading companies supplying

builders.

Supply and demand eased slightly, causing modest price

drops for top-grade items like cedar posts and cypress

foundation timbers, especially in northern Kanto. Cedar

105 mm KD premium posts fell to ¥55,000– 58,000 per

cbm, and cypress equivalents to ¥75,000–78,000 per

cbm—both down about ¥3,000.

Unlike last year’s nationwide decline, cedar log prices

stayed high, especially in producing regions. In Kyushu, 3

m cedar logs in Miyazaki reached ¥16,000 per cbm and 4

m logs in Oita ¥14,500 per cbm—both up ¥2,000 year-on-

year. In northern Kanto, Tochigi logs rose to ¥15,500 per

cbm and Akita logs to ¥15,000 per cbm.

Cypress prices climbed in western Japan. In Shikoku, 3 m

and 4 m logs for posts and foundations rose to ¥25,000–

25,600 per cbm—up ¥ 2,000 from last month and over

¥5,000 year-on-year. In Okayama, logs fell ¥1,500 to

¥24,000 per cbm but remained up compared to last year.

Prices in Kyushu and northern Kanto also stayed high

relative to 2024 levels.

South Sea log and products

Shipments of Southeast Asian and Chinese wood products

remain slow. While commercial-use materials like decking

see steady orders, residential demand continues to

stagnate. Domestic distributors are buying only what's

needed for immediate projects, as housing starts stay

weak.

Despite low demand from Japan, Southeast Asian

producers are hesitant to cut prices due to inflation and

rising costs. With the yen still falling, import prices remain

high. Japanese buyers are limiting purchases to short-term

needs.

Some distributors report growing interest in alternative

materials for furniture and interior/exterior use, driven by

rising import costs and global trade uncertainty, including

U.S. tariffs. No Southeast Asian logs arrived in June, but

existing inventory has reached end users, and shortages are

not expected.

Plywood supply in first half of 2025

Total plywood supply during January to June, 2025 is

2,336,000 cbms, 3.1 % more than January to June 2024.

The reason is that production of domestic plywood

1,304,000 cbms, 6.2 % more than the same period last

year.

The new starts during January to June, 2025 is 7.5 % less

than the same period last year. Due to the price increases

by plywood manufacturers starting in January, demand-

side purchasing interest in softwood structural plywood

appears to have improved compared to last year’s

prolonged downturn. Imported plywood is 1,032,000

cbms, 0.6 % less than the same period last year.

Production of domestic structural softwood plywood in the

first half of this year is 6.7 % more than the same period

last year. Shipment is 8.9 % more than the same period

last year. Although market activity was sluggish in June,

the monthly performance was the lowest of the first half of

the year—yet still reached the 180,000 cbms range.

Considering that the monthly average in the first half of

last year was approximately 178,000 cbms, the overall

situation has recovered.

There was an increase in Indonesian plywood by 0.9 %

from the same period last year. Malaysian plywood is 1.6

% less than the same period last year. Due to

developments surrounding the Trump tariffs, exchange

rates remained volatile, and importers continued to focus

on procuring only the necessary designated sources.

In Malaysia’s Sarawak State, heavy rains and flooding

occurred in early February. As a result, delays in log

transportation and localized inundation caused a

slowdown in production at local plywood factories. As a

result, domestic inventory shortages were anticipated

around March to May. However, local manufacturers

continued production using work-in-progress stock, and

shipments arrived despite some delays, limiting the

shortage to certain items such as South Sea structural

plywood.

Chinese plywood during January to June, 2025 is 9.3 %

less than the same period last year. Vietnamese plywood is

11.0 % increased.

Solid-wood surface flooring hits Japanese market

Hokuyo Trading has begun domestic sales in Japan of

three-layer flooring with a solid wood surface,

manufactured by the German flooring company

PARADOR. It is rare for parquet flooring that meets

European standards to be compatible with low-profile

floor heating systems. Delivery is scheduled to begin in

October, with a target of selling 4,000 cbms in the first

year.

The product is designed to offer the same appearance and

texture as solid wood flooring, with a top layer made of

approximately 2.5 mm thick solid oak.

By combining a high-quality substrate layer,

approximately 9 mm thick and made of SPF wood,

beneath the surface, the flooring is designed to minimize

the natural tendencies of solid wood such as expansion,

warping, and cracking, thereby ensuring excellent

dimensional stability.

|