|

1.

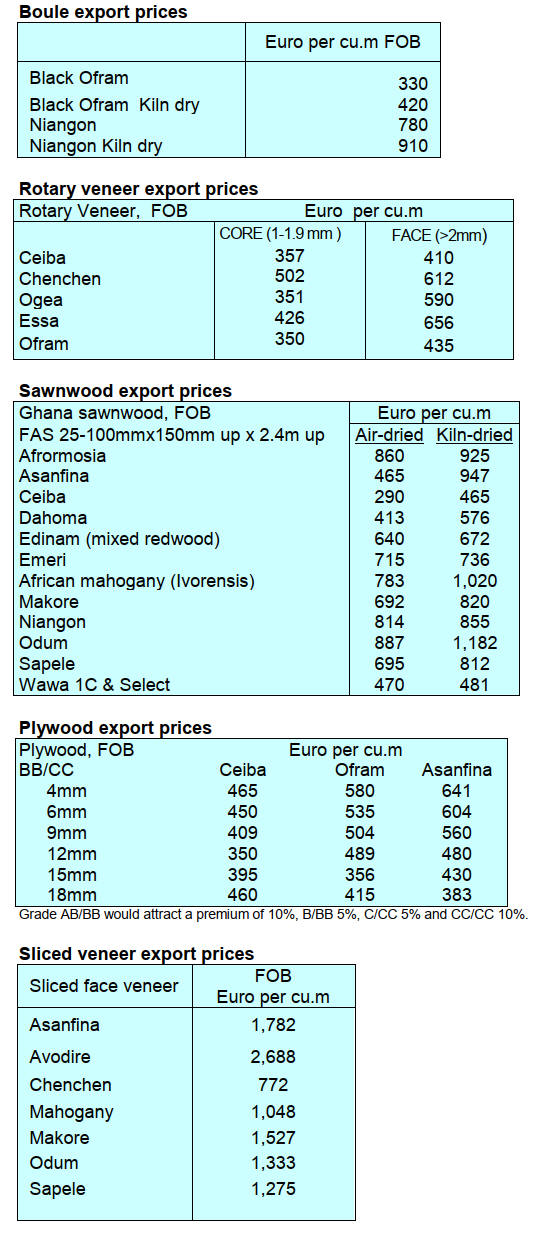

CENTRAL AND WEST AFRICA

Regional update

Gabon

Operations remain subdued with market demand still weak

and buyers largely absent. GPS-linked log traceability

remains strictly enforced in line with EUTR compliance.

All sawnwood bundles are being checked for compliance

before export.

European buyers have returned from summer holidays but

ordering remains slow as stocks in the main markets

remain high. Chinese demand is extremely weak while

European orders are mostly on a supply-on-demand basis.

It has been reported that demand for Okan has weakend in

both China and the Netherlands, said to be due to

oversupply and the recent focus of mills to cur Azobe. The

local market remains active for Okoume and Bilinga.

Okoume peelable logs are selling in the NKok zone at

80,000 CFA/pcbm, while CS-grade Okoume logs are at

85,000 CFA/pcbm.

Local sawn logs are trading at 60,000 CFA/pcbm and

prices for sawn Okoume are steady at 140,000 CFA/pcbm.

The GSEZ log park is said to hold about 10,000 cu.m of

mostly low-grade Okoume alongside Bosse, Sapelli,

Padouk and small volumes of Azobe and Okan.

The rain season has returned but thanks to ongoing work

roadtransport has improved on the main forest to port

routes, including Okonja–Makoukou–Lastourville–

Ovang–Lope–Ndjole to Bifoun. Deliveries to Libreville

are moving more steadily as road works progresses. The

government has launched a plan to repair 3,000 km of

roads over four years, with priority given to the most

critical sections.

Rail transport remains problematic. The Union des

Forestiers et Industriels du Bois du Gabon (UFIGA)

continues to pressure the government on the performance

of SETRAG. Recurrent derailments and poor maintenance

are frustrating travellers and delaying log transport. The

government has demanded that SETRAG overhaul its 40-

year-old network within a year with funding support from

the African Development Bank.

Milling continues to be disrupted by power cuts. The

government has pressed SEEG (the national electricity

company) to stabilise supply. Two Turkish floating power

units are already in place with a third ship expected to

raise output to 228,000 kWh. However, installation of this

new capacity is resulting in short term power cuts

Political activity is intensifying as Gabon heads to local

elections on 27 Septembe, the first real test for the

President’s new party, Les Bâtisseurs.

In what is said to be a surprise move the government has

also ordered that “low-level jobs” such as taxi services,

small shops and manual work be reserved for Gabonese

citizens. This directive has created pressure on Beninese

workers who currently work in the country. The Benin

government has requested negotiations on this issue.

Cameroon

Persistent heavy rains are causing delays in production and

driving down output volumes. By the end of September

most sawmills are expected to close temporarily due to the

upcoming presidential elections. More than half of the

Chinese-operated mills remain closed.

Many operators have left the country ahead of the October

presidential elections citing both political uncertainty and

weak market conditions. They are expected to return at the

end of October once the election period has passed.

Domestic sawmills are also slowing down, with new

contract demand delayed.

Operators had briefly increased production earlier in the

dry season by repairing roads but demand is now weak so

production has been scaled back. Chinese buyers, in

particular, are not showing very much interest and this

lack of demand is unsettling operators.

Transport to ports continues without major disruption and

container availability is sufficient, with no shortages of

empty boxes reported. Port operations remain steady and

shipments are dispatched as planned.

Middle Eastern markets are stable, particularly for species

such as Iroko, Sapelli, and other redwoods but the low

density species are not moving in the Middle East.

European orders are being placed and fulfilled quickly as

Cameroon can respond efficiently to smaller, short-term

contracts.

The looming EUDR is causing concern among operators

in both the timber and agricultural sectors as the EUDR

applies to many agricultural products. CITES requirements

are creating additional difficulties with operators

experiencing heavy delays document processing.

European importers are also reportedly under pressure as

CITES procedures complicate transactions.

The timber industry remains highly sensitive to the

political climate. With presidential elections scheduled for

12 October many mills are expected to suspend operations

at the end of Septembe ralthough some legal advisors

indicate closures will only be necessary during the

immediate election period of 10–14 October.

Republic of Congo

Demand in international markets remains relatively quiet.

Harvesting continues at normal levels though rains are

disturbing operations and creating some challenges on

laterite roads. Repair work is ongoing in certain areas so

trucking remains functional but slowed by weather.

Transport routes to Douala port are operational.

Demand pressures are being felt with Philippine interest in

Okoume declining and Middle Eastern demand also

weakening. This has left sawmills with few options

beyond small contracts to southern Europe, particularly

Portugal and Italy. Demand is stable but uneven across

markets. Purchases of Okoume sawn timber by the

Philippines is declining while Tali shipments to Vietnam

continue to support mill activity.

Port operations remain stable with shipments proceeding

normally. Container availability is not a present an issue.

While some weather-related delays exist, overall export

flows are functioning without serious disruption.

2.

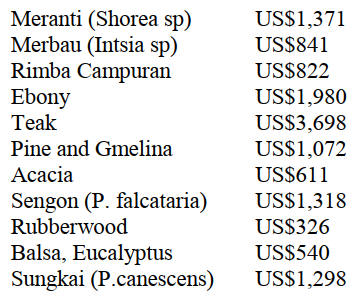

GHANA

Measures to end illegal mining in forest reserves

As part of measures to curtail the alarming rate of illegal

mining in Ghana’s forest reserves which has polluted and

destroyed some of the country’s water bodies, the

government has taken some steps to strengthen

environmental protection under the Environmental

Protection Agency (EPA).

The Acting Minister for Environment, Science and

Technology, Emmanuel Armah-Kofi Buah, has formally

written to the Office of the Attorney General for the

immediate revocation of Legislative Instrument (L.I.)

2462 and its amended version, L.I. 2501.

The L.I., passed in 2022 under Environmental Protection

(Mining in Forest Reserves) Regulation, allowed for

mining activities in forest reserves with some exceptions

and requirements for environmental management.

In a statement issued by the Director of Communications

for the Lands Ministry, Ama Mawusi Mawuenyefia, the

Minister assured the public that revoking the L.I. will not

create a regulatory vacuum. The statement expressed

confidence that the Environmental Protection Agency's

(EPA) existing framework will provide robust provisions

to govern all mining activities and ensure strict

compliance with environmental standards.

He added that this critical step is intended to unify and

strengthen the regulatory framework, creating a cohesive

front for all stakeholders in the national fight against

illegal mining.

In late 2024 government began the process of revoking

this law following calls from environmental groups and

civil society organisations. Forestry Commission statistics

indicate that the country loses about 120,000 hectares of

forest cover annually, much of which is linked to

agricultural expansion activities and the menace of illegal

mining.

See: https://www.myjoyonline.com/acting-environment-minister-

armah-kofi-buah-writes-to-attorney-general-for-immediate-

revocation-of-l-i-2462/

Wood product exports to African market slump while

ECOWAS sees growth

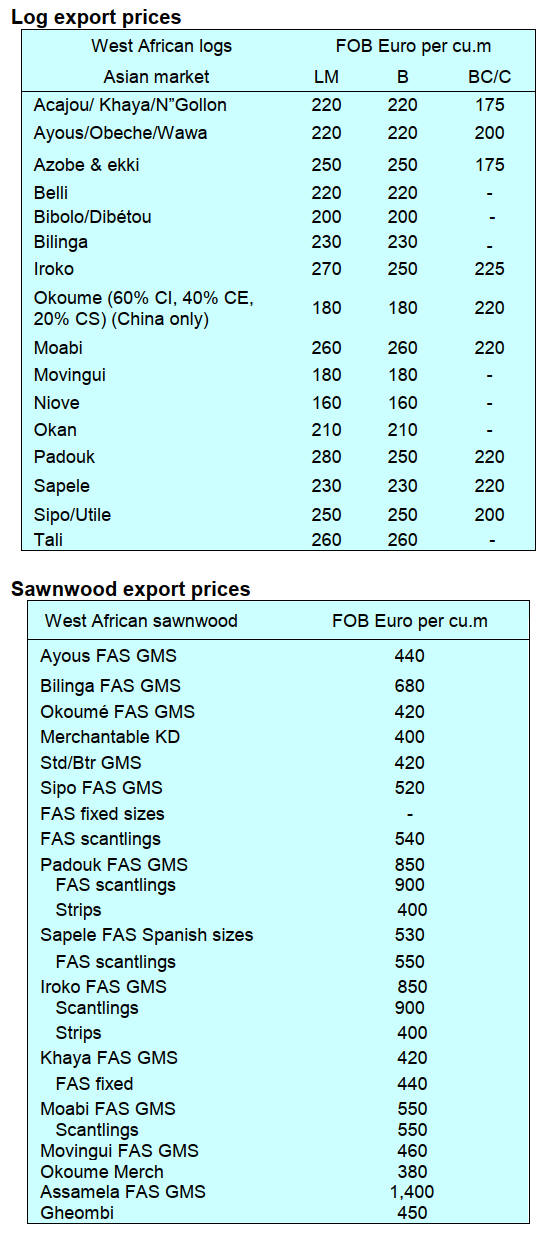

Cumulative timber and wood product exports in the first

six months of 2025 through Takoradi and Tema Ports as

well as overland stood at Eur51.63 million, representing a

15% decrease compared to the Eur60.58 million traded in

the same period of 2024 according to data source from the

Timber Industry Development Division (TIDD).

In the first half of the year Africa’s market share of

Ghana’s product exports dipped from 13,175cu.m. in 2024

to 10,186cu.m in 2025. These exports generated revenues

of Eur4.28 million for the period in 2025 compared to

Eur5.42 million, a decline of 21% in value.

The data revealed that overland exports to neighboring

ECOWAS countries accounted for Eur3.13 million from

8,069 cu.m of the total African wood products exported

from January-June 2025 as compared to Eur3.85 million

obtained from 10,277 cu.m during the same period of

2024.

Ghana’s wood products export to the regional market for

the period included plywood, kiln dried sawnwood, sliced

veneer and poles.

Plywood dominated exports accounting for 99% of the

regional export volumes for 2024 and 2025. The total

value of overland plywood exports during the half year

was Eur3.85 million in 2024 compared to Eur3.13million

in 2025.

The average unit price registered an increase of 3.5% from

Eur375 per cu.m. in January-June 2024 to Eur388 per

cu.m. in the same period of 2025.

Plywood exports by sea went to Gambia (35%), South

Africa (23%) and Senegal (22%) altogether accounted for

80% of total export volume for the period January to June

2025. The major species used in plywood production

included chenchen, ceiba, cedrela, eucalyptus and

gmelina.

The major markets for the African trade included Egypt,

Morocco and South Africa. While Togo, Burkina Faso,

Niger, Gambia, Mali, Benin, Cote D’Ivoire, Nigeria and

Senegal were the markets for the ECOWAS.

Strengthening forest governance

The Minister for Lands and Natural Resources, Emmanuel

Armah-Kofi Buah, has inaugurated a Timber Validation

Committee with a mandate to enhance transparency,

accountability and credibility in Ghana’s timber industry.

In his inaugural address, the Minister said the committee

would play a vital role in safeguarding Ghana’s forests

while ensuring that all timber products meet both domestic

and international standards. He hailed Ghana’s recent

milestone of issuing its first Forest Law Enforcement,

Governance and Trade (FLEGT) license for timber exports

to the European Union.

Mr. Armah-Kofi Buah described the step as the country’s

bold statement of commitment to legality, transparency

and sustainability in the global timber trade.

The Minister tasked the Committee with the need to work

hard to preserve the country’s forests as a national heritage

we owe to our children and grandchildren. He pledged

government’s full support to the committee to help it carry

out its work effectively.

The Committee Chairman, Fiifi Buckman, expressed

gratitude on behalf of members and assured stakeholders

of their professionalism and integrity.

See:https://www.myjoyonline.com/lands-minister-inaugurates-

timber-validation-committee-to-strengthen-forest-

governance/#google_vignette

VAT to be lowered to 20% in 2026

The final Value Added Tax (VAT) rate that will be paid

by businesses is expected to be reduced from 22% to 20 %

from 2026. This will be captured in the 2026 Budget,

which the Finance Minister Dr. Ato Forson, disclosed

could be presented to parliament in October 2025.

When meeting the press, Commissioner General of the

Ghana Revenue Authority (GRA), Anthony Sarpong,

noted that the government is committed to reducing the tax

burden on businesses. He said the new VAT bill should be

ready by September this year before the next budget

reading.

Meanwhile, in a bid to make the payment of VAT, taxes

and filing convenient the GRA has now moved towards a

more digitalised economy for taxpayers to file returns and

pay taxes online with ease.

The Association of Ghana Industries (AGI) among other

manufacturing companies have complained of the

complex and double VAT taxation system encouraging the

government to review, consolidate and to make payment

convenient for taxpayers.

See: https://www.vatupdate.com/2025/08/16/ghana-reduces-vat-

to-20-in-major-tax-reform-to-boost-compliance-and-ease-

business-burden/

Ghana’s economy grew 6.3% in the second quarter

According to the Ghana Statistical Service (GSS)

provisional data release, Ghana’s economy grew by 6.3%

in the second quarter of 2025. The data revealed that the

real Gross Domestics Product (GDP) increased by 1.4% in

second quarter of 2025, from 1.6% in the first quarter of

this year.

Meanwhile, according to IC Research a leading market

research firm, the Monetary Policy Committee of the Bank

of Ghana will likely announce a second successive interest

rate cut at the September 2025 meeting.

See:https://www.graphic.com.gh/business/business-news/ghana-

news-economy-grows-6-3-in-2nd-quarter-driven-by-services-

industry.html

3. MALAYSIA

Malaysia committed to 50% forest cover

Malaysia is currently maintaining 54.3% of its land area as

forests according to Johari Abdul Ghani who is currently

overseeing the Ministry of Natural Resources and

Environmental Sustainability.

He said the country remains committed to maintaining at

least 50% of its land mass under forest cover in line with

the pledge made to the United Nations in 1992.

He added that forest plantations established in forest

reserves (HSK) are not categorised as having resulted in

deforestation as this involve replanting rather than

permanent conversion of forest land to non-forest use.

"As of June 30 this year the total area of forest plantations

in Peninsula Malaysia stood at 259,654ha. of which

175,331ha. have been replanted. These plantations are

established to ensure a continuous supply of raw material"

he told the Malaysian Parliament.

Johari said harvesting within forest reserves is strictly

controlled. "States are allowed to harvest no more than 5%

of their HSK areas at any one time. After harvesting, the

area must be replanted, only then can a further 5% be

opened. This way, we ensure biodiversity is protected

while maintaining forest cover," he said.

See:

https://www.nst.com.my/news/nation/2025/08/1265761/malaysia

-affirms-50pct-forest-cover-pledge-amid-concerns-over-

timber?topicID=1&articleID=1265761

Minister - furniture industry must prioritise innovation,

sustainability and design

The Deputy Plantation and Commodities Minister, Chan

Foong Hin, has said Malaysia’s furniture industry must

prioritise innovation, sustainability and design to remain

globally competitive instead of relying solely on price. He

noted that Malaysia enjoys a slight tariff advantage over

Vietnam in the United States market, 19% compared with

Vietnam’s 20%. Vietnam is among Malaysia’s main

competitors in the global furniture market, with both

countries vying for market share particularly in the home

and office furniture segments.

“We have an advantage but in the long run, I don’t think

price will be the only factor, innovation is key. Malaysia

must move from only manufacturing in Malaysia to

manufacturing and designing by Malaysia,” he said at the

opening of the Malaysia Furniture Furnishings Market

2025 (MFFM).

Chan added that international buyers are increasingly

demanding eco-certified products with the Malaysian

Timber Certification Council (MTCC) encouraging local

manufacturers to obtain certification to strengthen their

credibility.

Despite global headwinds, Chan said the timber industry

remained resilient with exports rising 4.9% to RM22.9 bil

in 2024. Wooden furniture contributed RM9.9 bil, up

8.4% and now accounts for more than 40% of Malaysia’s

total wood product exports to more than 160 countries.

Chan attributed this success to strong craftsmanship,

design innovation and collaboration with agencies such as

the Malaysian Timber Industry Board (MTIB), MTC and

MTCC.

Over 370 companies are now certified under the

Malaysian Timber Certification Scheme, endorsed by the

Programme for the Endorsement of Forest Certification

(PEFC) giving Malaysia global recognition as a trusted

source of responsibly made furniture.

Looking ahead, Chan identified three megatrends that will

shape the industry, sustainability and ESG (environment,

social and governance), digital transformation and design

innovation. “Compliance with international standards is no

longer optional. Industry 4.0 technologies are reshaping

the way furniture is designed and manufactured and the

government is supporting SMEs with assessments and

matching grants,” he said.

See:

https://www.thestar.com.my/news/nation/2025/09/04/innovation-

the-key-to-malaysian-furniture-industry039s-future-says-deputy-

minister

Global conservation expertise comes to Sarawak

Sarawak Energy’s climate and biodiversity efforts reached

a new milestone with the official handover of the Dataran

Seping Carbon Study Permit (CSP) from the Forest

Department Sarawak and the signing of a Memorandum of

Understanding (MoU) with the International Union for

Conservation of Nature (IUCN) bringing global

conservation expertise to Sarawak.

Sarawak Energy is an electric power utility company. Both

initiatives, unveiled at the Sustainability & Renewable

Energy Forum (SAREF 4.0), strengthen Sarawak Energy’s

nature-based solutions projects and its pathway towards

net zero.

The Carbon Study Permit grants Sarawak Energy the legal

approval to commence feasibility studies for its NbS

projects within hydropower catchments. These projects are

projected to generate more than 250,000 carbon credit

units, which will offset emissions from hard-to-abate

generation sectors and support the company’s Net Zero

Action Plan.

The initiative, guided by the Hydropower Sustainability

Standard (HSS), leverages NbS to strengthen water

resource resilience, biodiversity protection and long-term

community benefits.

See: https://dayakdaily.com/sarawak-energy-secures-dataran-

seping-carbon-study-permit-partners-with-iucn-to-drive-nature-

based-climate-solutions/

Japanese company funding mangrove restoration

The Sabah Government, through the Sabah Forestry

Department (SFD), has renewed its commitment to

mangrove conservation by signing a Memorandum of

Understanding (MoU) with the International Society for

Mangrove Ecosystems (ISME). Launched in 2011, the

SFD–ISME Mangrove Rehabilitation Project has grown

into one of Sabah’s most significant conservation

initiatives.

Now entering its fourth phase (2024–2029), the project

will continue with the support of Tokio Marine & Nichido

Fire Insurance Co. Ltd., Japan, which is providing funds to

restore degraded mangroves across the State.

Since its inception, the project has successfully restored

556 hectares of mangrove forests, benefitting coastal

ecosystems and local communities. Beyond rehabilitation

the collaboration has also advanced scientific research on

mangrove ecosystems.

See: https://www.dailyexpress.com.my/news/265428/sabah-

renews-mangrove-rehab-deal/

3D LiDAR technology to measure forest structure

The Forest Department Sarawak (FDS) has signed a

Memorandum of Agreement (MoA) and a Memorandum

of Understanding (MoU) with Arbonaut Ltd, a leading

international company in forestry and geospatial

technology.

Arbonaut Ltd. has been appointed as the consultant for the

project ‘Quantifying Stand Structure Dynamics and

Productivity in Natural Forest and Planted Forest Stands

Using Airborne 3D Ranging Systems’.

According to FDS, the project will utilise 3D LiDAR

technology to measure forest structure, growth dynamics

and productivity in both natural forests and industrial tree

plantations. The technology is expected to improve the

accuracy of forest inventory parameters such as tree

height, volume, biomass, carbon stocks and forest fire risk

assessments.

In addition, FDS signed a five-year MoU with Arbonaut

Ltd. outlining collaboration in areas including forest

carbon assessment, carbon project development and

trading. The MoU also covers joint research in

biodiversity, forest products, fire management, soil science

and pathology, as well as technical information exchange,

knowledge transfer and the use of remote sensing in forest

inventory systems, sustainable forest management, forest

traceability and forest information systems.

See: https://www.theborneopost.com/2025/08/27/forest-dept-

sarawak-seals-moa-mou-with-finlands-arbonaut-ltd-to-boost-

forestry-tech-collaboration/

4.

INDONESIA

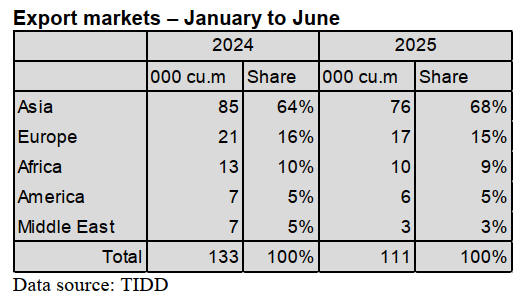

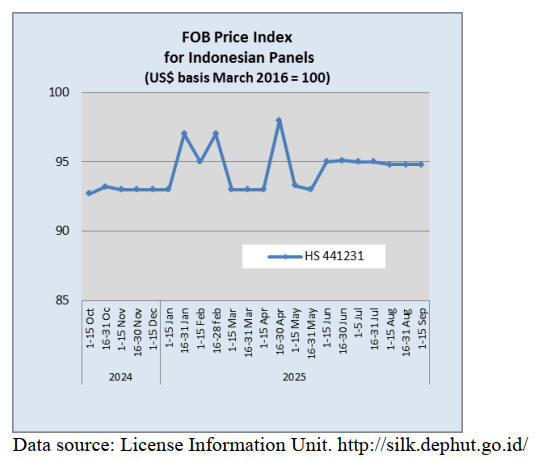

Export Benchmark Prices (HPE)

The following is a list of Wood HPE from 1 to 30

September 2025.

Processed wood (prices per cu.m)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are levelled on all four

sides so that the surface becomes even and smooth of

Merbau wood with the provisions of a cross-sectional area

of 4,000 sq.mm to 10,000 sq.mm (ex 4407.11.00 to ex

4407.99.90) = US$1,500/cu.m

See: https://jdih.kemendag.go.id/peraturan/keputusan-menteri-

perdagangan-republik-indonesia-nomor-1844-tahun-2025-

tentang-harga-patokan-ekspor-dan-harga-referensi-atas-produk-

pertanian-dan-kehutanan-yang-dikenakan-bea-keluar

Calls for a simplification of regulations

A number of forestry and economic experts are urging the

Indonesian government to simplify regulations to

revitalise the national timber industry and boost its

competitiveness. They argue that the current rules are

hindering investment, weakening production and reducing

the forestry sector's contribution to the economy.

Specifically, Bogor University IPB forestry specialist,

Sudarsono Sudomo, believes that the Timber Legality and

Sustainability Verification System (SVLK) creates more

costs than benefits and that many growers do not know

they have to obtain the required certificate. He also refutes

the claim that natural forest management is the main cause

of deforestation, stating that land conversion is a more

frequent cause.

The experts' call for action is supported by data showing a

sharp decline in the industry. From 1990 to 2023 the

number of active forestry businesses in natural forests has

fallen from about 600 to just 250. According to Sudarsono,

the industry also has a low capacity for job creation,

absorbing only about 1,500 workers for every Rp1 trillion

in investment.

Forestry analyst, Petrus Gunarso, highlighted that the issue

of timber traceability is often misunderstood, noting that

international NGOs often label the conversion of natural

forests to timber plantations as deforestation.

See:https://ekonomi.republika.co.id/berita/t2ax0b522/pemerintah

-didorong-permudah-regulasi-industri-kayu-nasional

and

https://investor.id/business/408872/regulasi-industri-kayu-perlu-

dipermudah#goog_rewarded

and

https://www.liputan6.com/bisnis/read/6154684/bebani-

pengusaha-pemerintah-diminta-permudah-regulasi-industri-kayu

SVLK verified wood pellets

The Indonesian Ministry of Forestry has confirmed that

Indonesian wood pellets exported with a V-Legal/FLEGT

License meet the Timber Legality and Sustainability

Verification System (SVLK). This provides a guarantee

that the products originate from legal and sustainable

sources that fully comply with Indonesian law.

This clarification was made during a meeting with

Japanese industry representatives and was a direct

response to accusations from several NGOs that the wood

pellet industry was causing deforestation.

According to Tony Rianto, Head of the Sub-Directorate of

Forest Product Certification and Marketing at the Ministry

of Forestry, the SVLK scheme is comprehensive, covering

not only legal aspects but also social, ecological and

business factors. Industries that utilise SVLK-certified raw

materials are therefore assured of both ecological and

economic sustainability. He stated that the SVLK system

is the government's way of protecting forests, preventing

deforestation and supporting the transition to clean energy

by ensuring the pellets come from legal and sustainable

sources.

See: https://industri.kontan.co.id/news/penuhi-svlk-produk-

wood-pellet-indonesia-dijamin-legalits-dan-kelestariannya

Indonesian furniture and craft at VIFA ASEAN

The Indonesian Furniture and Craft Industry Association

(HIMKI) is strengthening the presence of Indonesian

products in the global market by participating in the VIFA

ASEAN 2025 International Furniture and Home

Accessories Fair in Viet Nam. This is the second time

HIMKI has participated in the event.

According to Marthunus Fahrizal, HIMKI's Head of

International Institutional Relations, this exhibition was a

crucial opportunity to gain access to the global market,

particularly within the fast-growing Southeast Asian

region.

HIMKI attended the Fair with six member companies to

showcase the quality and diversity of Indonesian furniture

and craft products. This participation aimed to introduce

the products to international consumers, investors,

designers and other professionals. The Association's

involvement in the event was a key part of its commitment

to solidify Indonesia's position on the international

furniture and craft industry map.

See: https://investor.id/business/407677/industri-furnitur-

perkuat-penetrasi-di-pasar-asean

In related news, Indonesia participated in the Korea

International Furniture and Interior Fair (KOFURN) 2025

in Goyang City, South Korea held from August 28-31.

This event is South Korea's largest international furniture

and interior exhibition and twelve leading Indonesian

furniture companies took part.

The participation was a strategic initiative by Indonesia's

Ministry of Trade, the Indonesian Embassy in Seoul, the

Indonesian Trade Attaché in Seoul and Indonesia

Eximbank in order to promote high-quality Indonesian

furniture and strengthen its position in the South Korean

market.

The Indonesian Pavilion showcased a variety of products,

including wooden furniture, upholstered chairs, home

interior furnishings and innovative designs using eco-

friendly materials.

In addition to the exhibition, the participating companies

also engaged in business-matching sessions to connect

with potential buyers from South Korea and other Asian

countries. The Deputy Chief of Mission at the Indonesian

Embassy in Seoul, Ali Andika Wardhana, said this

participation will create more trade opportunities for the

Indonesian companies.

See: https://wartaekonomi.co.id/read580913/ri-perkenalkan-

desain-dan-kualitas-produk-furnitur-lokal-ke-korea-selatan

Impact of US tariffs on Indonesian furniture and

handicrafts

According to the Indonesian Furniture and Handicraft

Industry Association (HIMKI) the US accounts for 55-

60% of Indonesia's total global exports of furniture and

handicraft with a value of US$2.43 billion in 2024.

Although details of the US 232 investigation are still

unknown, the uncertainty has prompted Indonesian

businesses to begin preparations.

The HIMKI is undertaking several mitigation efforts

including forming a coalition with the American Home

Furnishings Alliance (AHFA) and seeking an exemption

in coordination with the Indonesian Embassy in

Washington. The Association plans to provide evidence

that additional tariffs would ultimately raise furniture

prices for American consumers.

For the medium term, HIMKI is considering more

significant strategic shifts. This includes the possibility of

relocating or establishing new production facilities in

countries that have existing free trade agreements (FTAs)

with the US such as Jordan. Additionally, the Association

is exploring alternative export markets to reduce its

dependence on the US including Western Europe, Japan,

Australia, the Middle East and ASEAN countries.

See: https://www.msn.com/id-id/politik/pemerintah/trump-mau-

pasang-tarif-impor-furnitur-bagaimana-nasib-mebel-dan-

kerajinan-indonesia/ar-AA1L6TVE?ocid=BingNewsVerp

and

https://www.msn.com/id-id/berita/other/as-bakal-terapkan-tarif-

tinggi-furnitur-produsen-berharap-prabowo-turun-tangan/ar-

AA1L6uBN?ocid=BingNewsVerp

Improving access to capital and financial services

The Financial Services Authority (OJK) and the Ministry

of Forestry have entered into a collaboration aimed at

increasing access to capital and financial services for

farmers managing social forestry areas. The partnership

establishes eight key areas of cooperation, with the

primary objective being to encourage banks to provide

loans to these forest farmers.

According to Forestry Minister, Raja Juli Antoni, this

initiative is crucial for helping communities make their

lands more productive, thereby improving their welfare

and contributing to economic growth.

The collaboration directly addresses a long-standing issue

where forest farmers struggled to obtain capital because

their social forestry management submissions were not

accepted by financial institutions.

By working with the OJK the government hopes to make

these farmers "more bankable," allowing them to secure

the financing needed to develop their land. This effort is

also expected to boost the economic literacy of the

communities involved and ensure that forests remain

sustainable.

See: https://en.antaranews.com/news/376817/ojk-govt-

collaborate-to-expand-access-to-capital-for-forest-farmers

https://rri.co.id/daerah/1802005/ojk-kemenhut-jalin-kerja-sama-

dorong-pembiayaan-perhutanan-sosial

https://jakartaglobe.id/special-updates/ojk-and-forestry-ministry-

strengthen-synergy-between-financial-services-and-forestry-

sectors#goog_rewarded

Ministry projects 2026 budget to boost investment

The Ministry of Forestry in Indonesia has projected a

proposed 2026 budget of Rp6.039 trillion (approximately

US$367.8 million). Key priorities include protecting

forests as the "lungs of the planet," regulating water

systems, and managing forest rehabilitation and wildfire

control. This budget is also projected to create over

400,000 jobs contribute to the national target of reducing

greenhouse gas emissions by 15 percent from the forestry

sector.

Furthermore, the Ministry is committed to equitable forest

governance by providing community access to forest

management and streamlining permit regulations. The

budget will also be used to support food and energy

security through the development of agroforestry, multi-

business forestry and the down-streaming of forest

products.

See:https://en.antaranews.com/news/378465/forestry-ministry-

projects-2026-budget-to-boost-investment

and

https://koran-jakarta.com/2025-09-07/anggaran-kemenhut-2026-

disiapkan-untuk-dorong-kebijakan-kehutanan-berkelanjutan

US$ 1.3 Billion for domestic industry revitalisation

The Indonesian government has allocated up to IDR20

trillion (approximately US$1.3 billion) to revitalise

domestic industries.

The goal of this initiative is to strengthen the industries'

global competitiveness and create more employment

opportunities.

The funding will be sourced from the government-backed

Kredit Usaha Rakyat (KUR), or People's Business Credit,

program, which offers a subsidized interest rate of 5%.

The programme will specifically target labor-intensive

sectors such as the textile and textile products industry,

food and beverage industry and furniture industry.

See: https://rri.co.id/en/business/1815639/indonesia-allocates-

usd-1-3-billion-for-domestic-industry-revitalization

5.

MYANMAR

Exports of veneer to India and China

Myanmar exports veneer sheets, sheets for plywood and

other wood products to India and China. In 2024 Myanmar

earned US$9.61 million from exports to India

and US$19.34 million from exports to China according to

the United Nations COMTRADE database on

international trade.

China remains a larger buyer of veneers for plywood

manufacture from Myanmar, roughly double what India

bought in 2024 (US$19.34 mil. vs. US$9.61 mil.) The

figures are relatively modest. It is to be noted that the trade

channel with India is almost all by sea while the trade with

China is believed mainly the informal cross-border trade.

See -

https://tradingeconomics.com/myanmar/exports/india/veneer-

sheets-sheets-plywood-

wood and https://tradingeconomics.com/myanmar/exports/china/

veneer-sheets-sheets-plywood-wood

Acting President Visits China

Acting President Min Aung Hlaing paid a visit to China,

attending the Shanghai Cooperation Organization (SCO)

Summit in Tianjin and holding a meeting with Chinese

President Xi Jinping.

The trip, which took place from 30 August to 1 September

2025 is being widely interpreted as a strategic move to

solidify ties with China amid ongoing internal conflict and

ahead of a planned general election in Myanmar.

In related news, Min Aung Hlaing stated that the Myitsone

Dam project, which has been suspended for more than a

decade, would be restarted. Decisions were made on the

need to expedite the implementation of several projects

between Myanmar and China, including the Kyaukphyu

project, the Myitsone project, the oil and gas pipeline

projects and the Mandalay-Muse railway project.

See:

https://www.fmprc.gov.cn/eng/xw/zyxw/202508/t20250830_116

98908.html?utm_source=chatgpt.com

and

https://www.irrawaddy.com/news/burma/myanmar-junta-chiefs-

china-visit-hailed-as-successful-and-fruitful-by-

regime.html?utm_source=chatgpt.com

Recovery loans for earthquake hit SMEs

The Central Bank has announced it will provide 700

billion kyats in recovery loans to businesses and people

affected by the powerful earthquake on March 28. The

funds will be used for a disaster recovery fund to rebuild

the areas damaged by the powerful Sagaing earthquake. Of

the initial 700 billion kyats, 500 billion will come from the

National Natural Disaster Management Fund and 200

billion will come from the Central Bank's Market

Stabilisation Fund.

The loans will have terms of three to five years and will

cover a variety of needs. These include loans for

rebuilding homes and buildings, working capital for small

and medium-sized enterprises (SMEs) and funds for

machinery, water, electricity and solar investments. Loans

will also be available for the repair and operation of large

factories, as well as short-term loans for construction

companies responsible for rebuilding state-owned

infrastructure.

The 7.7 magnitude Sagaing earthquake caused extensive

damage to homes, buildings and resulted in a high number

of casualties in regions including Naypyidaw, Mandalay,

Sagaing, Magway, Bago and northeastern Shan State.

See: https://burmese.dvb.no/post/722811

Kyat’s Stability

According to Myanmar Economic Monitors from The

World Bank, the Myanmar kyat (MMK) has appeared

stable over the past three months, with official figures

even suggesting a modest appreciation. Analysts caution,

however, that this stability reflects government controls

rather than underlying economic strength.

The Central Bank of Myanmar (CBM) continues to peg

its reference rate at MMK2,100 per US dollar while banks

and trade transactions operate closer to MMK3,600 per

dollar. In the informal market, rates remain higher

still around MMK4,300.

The World Bank’s latest Myanmar Economic

Monitor notes that parallel market volatility has eased

since late 2024, but stabilisation does not equal recovery.

Inflation remains high, headline inflation reached 34%

year on year to April 2025 and import costs continue to

squeeze businesses.

See-

https://documents1.worldbank.org/curated/en/099061125205014

652/pdf/P507203-cbcf81b5-0107-4517-8ad7-

82b588a6328f.pdf?utm_source=chatgpt.com, https://forex.cbm.g

ov.mm/index.php/fxrate?utm_source=chatgpt.com

and

https://www.vdb-loi.com/mm_publications/revisions-to-foreign-

exchange-rates-for-taxation-on-imports-and-or-exports-and-

personal-income-tax-payments-

currency/?utm_source=chatgpt.com

Impact of import-restriction appearing

The restrictions on imports and foreign sourced materials

are likely to harm small and medium-sized enterprises

(SMEs) in Myanmar. Economic analysts say these import

restrictions will significantly impact local SMEs. An

import-export expert noted that because Myanmar relies

heavily on foreign inputs, the ongoing restrictions could

particularly damage the vital garment and agriculture

sectors.

The restrictions could also lead to a rise in the black

market, forcing businesses to pay exorbitant prices for

goods. Myanmar's imports are typically sourced from a

variety of countries: consumer goods and food from

Thailand, raw materials from China and pharmaceuticals

from India. Controlling imports is part of the broader

effort to control the exchange rate.

See - https://burmese.dvb.no/post/723802

6.

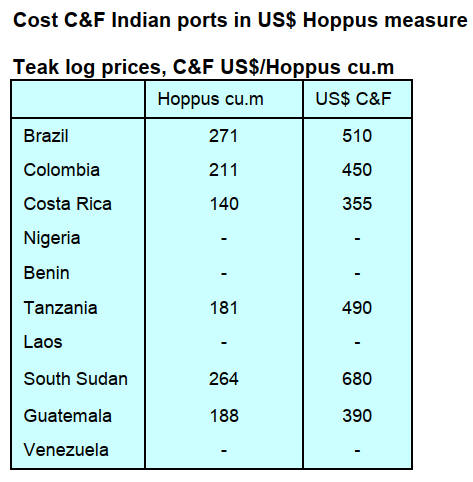

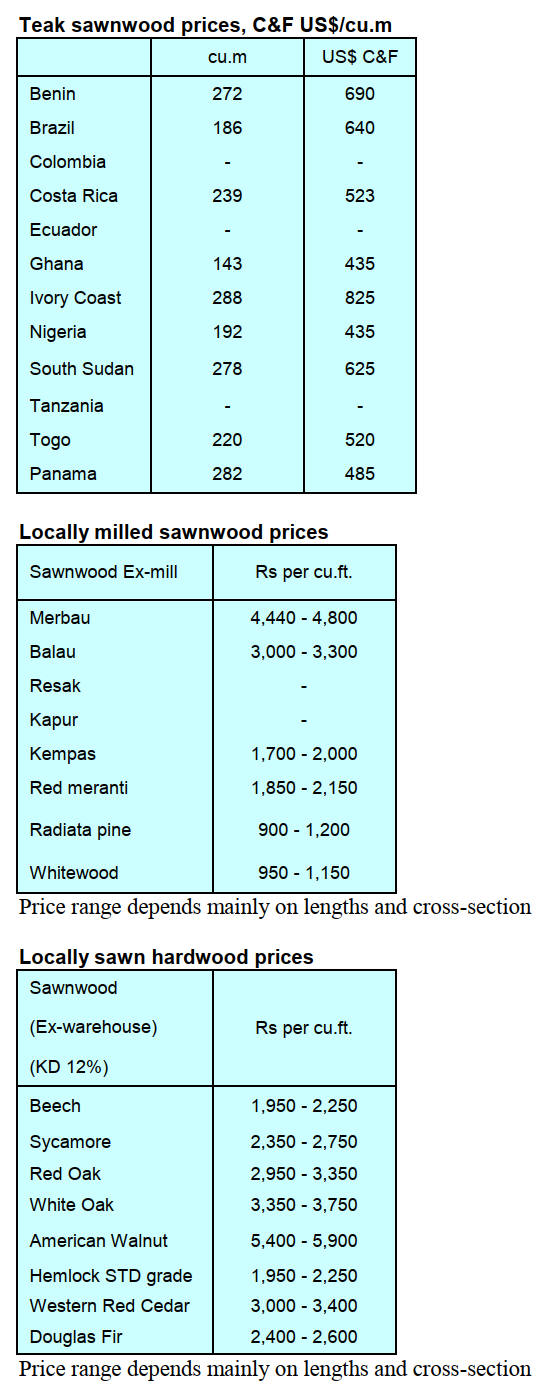

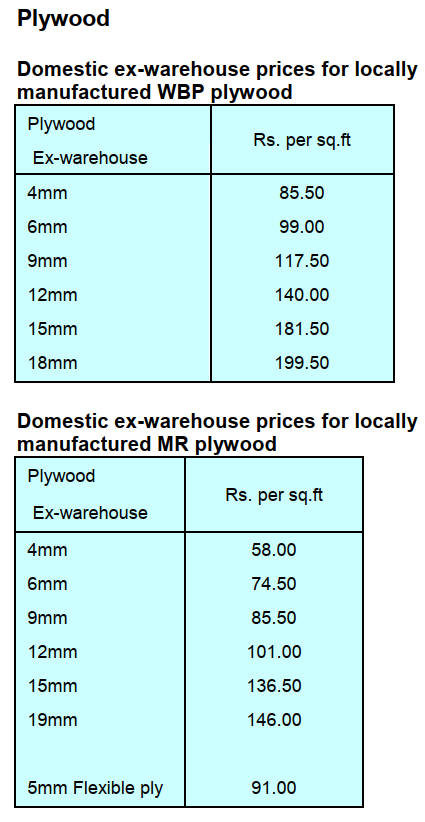

INDIA

Changes to the Goods and Services tax

A press release from the government of India has provided

details on changes to the Goods and Services tax. The

press release says the Goods and Services Tax (GST),

introduced on 1st July 2017, is India’s most significant

indirect tax reform since Independence.

By bringing together multiple central and state taxes into a

single, unified system, GST created a common national

market, reduced the cascading of taxes, simplified

compliance, and improved transparency. Over eight years,

GST has steadily evolved through rate rationalisation and

digitalisation, becoming the backbone of India’s indirect

tax framework.

The 56th meeting of the GST Council, chaired by Union

Finance Minister, Smt Nirmala Sitharaman, has now

approved Next-Gen GST reforms with focus on improving

people‘s lives and ensuring ease of doing business

including small traders and businessmen.

In his Independence Day address, Prime

Minister Narendra Modi had announced “The government

will bring Next-Generation GST reforms, which will bring

down tax burden on the common man”.

In line with the PM’s vision, the GST Council has

recommended a comprehensive reform package that

includes rate rationalisation with a simplified two-level

structure (5% and 18%) sweeping rate reductions across

sectors, with focus on common-man, labour intensive

industries, farmers and agriculture, health all key drivers

of the economy. These recommendations are based

on consensus among all members of the GST Council to

make GST simpler, fairer and more growth-oriented.

See:

https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=155151&

ModuleId=3

In related news, the government of India has formed a

high-level committee to examine the difficulties that

manufacturing plants encounter in terms of

taxes and export clearances.

The action is being taken at a time when exporters are

under pressure from high tariffs in foreign markets,

especially from the United States and increasing

competition that has been weighing on India's trade

performance.

The committee will be a forum where the prevailing tax

structures on exports, including customs duty and export

incentives and also clearance systems that contribute

significantly to the competitiveness of the

country's manufacturing industry will be evaluated, an

official said.

The committee consists of members from some of the

most important government and regulatory agencies such

as the Finance Ministry, Department for Promotion of

Industry and Internal Trade (DPIIT), Department of

Commerce, Directorate General of Foreign Trade (DGFT)

and the Reserve Bank of India.

Also, industry associations, export promotion councils and

consultancy agencies will also be included in the process

to ensure policymakers' and industry voices are heard

while making recommendations.

Together, this mix is likely to collate policymaking,

financial regulatory, trade facilitation and ground-level

industrial operations expertise. The main mandate of the

committee is to evaluate the challenges exporters are

facing in dealing with the existing tax and clearance

regimes.

See: https://www.siliconindia.com/finance/news/govt-sets-up-

committee-to-review-tax-and-export-issues-in-manufacturing-

sector-nid-237640.html#google_vignette

Challenges remain in integrating industry demands

with agroforestry production

Agroforestry in India is a significant, expanding practice,

covering 8.65% of the country's geography and playing a

vital role in wood production, employment and the wood-

based industry.

While government policies such as the 2014 National

Agroforestry Policy (NAP) promote its growth, with

recent initiatives like the National Transit Pass System

(NTPS) facilitating timber movement, challenges remain

in integrating industry demand with farmer production to

ensure market stability and growth.

Key aspects of this dynamic include increased farm-grown

timber, diversification of farming system and the creation

of extensive value chains. According to the Forest Survey

of India the top ten species by number of trees under

agroforestry are:

Mangifera indica (mango)

Azadirachta indica (neem)

Prospopis juliflora (mesquite)

Areca catechu (areca palm)

Eucalyptus spp. (safeda)

Tectona grandis (teak)

Cocos nucifera (coconut)

Butea monosperma (dhak)

Acacia nilotica (kikar)

Ziziphus mauritiana (ber)

The increased planting of eucalyptus and teak indicates

their rising importance as sources of industrial wood in

India.

See: https://plyinsight.com/dynamics-of-agroforestry-in-

india/#:~:text=Over%20the%20past%20decade%20(2013,fall%2

0below%20the%20national%20average.

7.

VIETNAM

According to statistics from the Vietnam

Customs

Department, Vietnam’s W&WP exports to the Dutch

market in July 2025 reached US$13.8 million, more than

double that in July 2024. In the first 7 months of 2025

W&WP exports to the Dutch market were recorded at

US$51.1 million, up 14% over the same period in 2024.

Vietnam’s W&WP exports to Spain in July 2025

amounted to US$4.9 million, down 13% compared to July

2024. In the first 7 months of 2025 W&WP exports to the

Spanish market totaled US$7.7 million, up 37% over the

same period in 2024.

Vietnam's oak imports in July 2025 amounted to

67,700 cu.m, worth US$36.6 million, up 4% in volume

and 5% in value compared to June 2025 and up 69% in

volume and 60% in value compared to July 2024. In the

first 7 months of 2025 imports of this wood reached

311,209 cu.m, worth US$175.7 million, up 49% in volume

and 46% in value over the same period in 2024.

Vietnam’s raw wood (logs and sawnwood)

imports

from China in July 2025 totalled 112,000 cu.m, worth

about US$40 million, up 33% in volume and 25% in value

over the same period in 2024. Over the first 7 months of

2025 the total import volume of raw wood from China

totalled 865,480 cu.m, worth US$268.44 million, up 71%

in volume and 34% in value over the same period in 2024.

Vietnam’s W&WP exports in August 2025 were

valued at US$1.52 billion, up 1% compared to August

2024. Of this, WP exports alone, amounted to US$969.2

million, down 6% compared to August 2024. In the first 8

months of 2025 W&WP exports were US$11.2 billion, up

7% over the same period in 2024 of which WP exports

recorded at US$7.6 billion, up 6% over the same period in

2024.

Imports of raw wood (log and sawnwood) in August

2025 amounted to 697,800 cu.m, worth US$223.3 million,

up 4% in volume and 5.0% in value compared to July

2025. Compared to August 2024, there was an increase of

20% in volume and 25% in value. In the first 8 months of

2025 raw wood imports stood at 4.62 million cu.m, worth

US$1.47 billion, up 28% in volume and 25% in value over

the same period in 2024.

Vietnam’s NTFP exports in August 2025 dropped for

the 3rd consecutive month, valued at US$65 million, down

1.5% compared to July 2025 and down 3% over the same

period in 2024. NTFP exports in the first 8 months of 2025

fetched US$572.95 million, up 5% over the same period in

2024.

Vietnam’s wood industry sees strong growth

Year on year Vietnam’s total trade rose 16% in the first

half of 2025, with the wood and wood products sector

standing out as a key driver with a 9% growth,

underscoring a strong recovery according to the Vietnam

Chamber of Commerce and Industry (VCCI).

The remarks were made at the opening ceremony of the

Vietnam-ASEAN International Furniture and Handicraft

Products Fair (VIFA ASEAN 2025. The VCCI noted that

the US remains the primary market for Vietnamese wood

products with exports to this market climbing 12% and

accounting for more than 55% of total xports in the first

half of the year.

However, the organisation cautioned against relying too

heavily on a single market, stressing the importance of

diversification.

Speaking at the event, Vu Ba Phu, Director of the

Trade

Promotion Agency under the Ministry of Industry and

Trade, said VIFA ASEAN 2025 marks an important step

toward building Ho Chi Minh (HCMC) into a regional

trade hub.

He added that the ministry will continue supporting the

wood industry through digital transformation initiatives,

green production practices, and efforts to strengthen

Vietnam’s national brand.

Echoing this vision, Nguyen Van Dung, Vice Chairman of

the HCMC People’s Committee, highlighted the

advantages of integrating Binh Duong province into

HCMC.

This move, he said, creates a seamless supply chain - from

production in Binh Duong’s industrial parks to export

through HCMC’s major seaports.

HCMC, Binh Duong and Ba Ria-Vung Tau, all industrial

hubs in southern Vietnam, were recently merged to form

the new HCMC.

“With this alignment between the government and

businesses, we expect to generate new momentum for

sustainable growth in Vietnam’s wood industry and

solidify HCMC’s position as an essential destination on

the global trade map,” Dung said.

See: https://theinvestor.vn/vietnams-wood-industry-sees-strong-

growth-d16803.html

Vietnam's export orders rebound despite tariffs

Among seven countries surveyed by S&P Global in July,

Vietnam led with a PMI of 52.4, well above the ASEAN

average of 50.1. New export orders rose for the fourth

straight month reaching their fastest pace since November

2024.

This positive and surprising sign comes amid continued

concerns over the reciprocal tariffs from the US, a key

export market.

Ngo Sy Hoai, Vice President and General Secretary of the

Vietnam Timber and Forest Product Association

(VIFORES), noted that despite heavy impacts of the US

reciprocal tariffs and trade defense measures, timber and

wood product exports had reached US$9.6 billion by the

end of July, up 8% year on year.

The sector is projected to earn over US$7 billion in the

final five months of 2025 bringing the year’s total to

around US$17 billion, he said.

See: https://en.vietnamplus.vn/vietnams-manufacturing-sector-

returned-to-growth-in-july-post323838.vnp

Boosting imports from US to balance trade

In response to US trade actions Vietnamese timber firms

have stepped up imports of American logs and sawnwood.

In 2024 Vietnam purchased US$320 million in US wood

products.

During the first seven months of this year, imports

had

already reached US$321 million surpassing the previous

year’s total.

This shows Vietnam’s goodwill in narrowing the trade

surplus and supporting American timber producers, said

Hoai. If export conditions remain stable, imports from the

US are expected to keep rising, He added.

He said Vietnamese furniture exporters remain hopeful of

a fair and suitable tariff framework that avoids market

disruption and protects American consumer access to

Vietnamese products.

See: https://en.vietnamplus.vn/vietnams-export-orders-rebound-

amid-reciprocal-tariffs-post323993.vnp

Industry faces mounting challenges amid US tariff

pressure

Vietnam’s wood industries face mounting export

challenges as US tariffs, rising logistics costs and slowing

global demand squeeze profits and cloud the outlook for

the rest of 2025.

According to the latest data from the Department of

Customs, wood and wood products ranked seventh among

Vietnam’s top ten export categories in the first seven

months of 2025.

The US remained Vietnam’s largest export market

accounting for 56% of the total, up 11% year on year.

Vietnam’s strong position in the US market, now among

the top three wood exporters, is due to its cost advantages,

including low labour costs and the use of 70% of

domestically sourced materials.

However, the US administration announcement in early

April of a potential 46% countervailing tariff on

Vietnamese goods immediately placed the wood sector

among those most at risk.

If implemented, this tariff would significantly erode the

price competitiveness of Vietnamese wood products,

pushing up costs significantly.

During the tariff negotiation phase with businesses hopeful

for a more moderate 20% rate many leading exporters

ramped up production to seize a ‘golden window’,

resulting in relatively strong short-term growth.

Yet, business results from the second quarter of 2025

suggest that the anticipated recovery did not fully

materialise.

Looking ahead to the second half of the year, export

prospects appear even more uncertain. Tran Quoc Manh,

vice chairman of Vietnam Handicraft Exporters

Association, noted that adverse impacts are becoming

visible as early as the third quarter, particularly in August

and September.

"Most businesses are still operating but largely in a

holding pattern," Manh said. "Selling prices are falling,

product ranges are narrowing and many customers, despite

having placed orders, are delaying delivery ahead of

market developments.

Even import partners are uncertain about the situation,

which is causing transaction timelines to stretch out."

He added that, while the US market is already facing

difficulties, the European market continues to shrink,

increasing the pressure on Vietnamese exporters. The

situation is expected to deteriorate as orders continue to

decline.

Dang Quoc Hung, chairman and CEO of Alliance

Handicraft and Wooden Fine Art Corporation, warned that

the export wood market will face even greater challenges

in the near future.

recent shipments to the US have already encountered tax-

related hurdles and this is expected to continue affecting

orders in the upcoming months.

As taxes increase companies are forced to raise prices

which reduces competitiveness and directly hits sales,"

Hung explained.

Hung also pointed out a shift in buyer expectations.

"Previously, exporters typically absorbed all import taxes

for shipments to the US but now there is a push for shared

cost responsibility. This forces business to raise prices,

impacting customers and partners directly, some of whom

have already raised concerns in recent weeks."

Despite growing instability the Vietnam Timber and

Forest Products Association remains optimistic that the

country can still achieve its 2025 wood and wood product

export target of US$18 billion. However, the industry’s

heavy dependence on the US market poses significant

risks.

Any fluctuation in American consumer demand can

immediately affect Vietnam’s export revenues. As a result,

regulatory bodies are encouraging firms to diversify their

markets and tap into new growth areas.

Echoing this sentiment, Manh from the Vietnam

Handicraft Exporters Association said "In reality, this is

incredibly difficult. No market can replace the US in the

short term.

See: https://en.vietstock.vn/2025/08/wood-industry-faces-

mounting-challenges-amid-us-tariff-pressure-974-619810.htm

8. BRAZIL

With AI forestry sector begins a new era

The wood industry is one of the pillars of the Brazilian

economy with projected investments exceeding BRL105

billion by 2028 according to the Brazilian Tree Industry

Association (IBÁ).

The sector generates 690,000 direct jobs and

approximately 2 million indirect jobs. Facing challenges

such as monitoring, wildfires, pests, logistics,

environmental compliance and climate impacts, digital

transformation is essential to ensure efficiency and

sustainability in forest management.

In this context, Generative Artificial Intelligence (GenAI)

tools are emerging as a strategic support for forestry

operations. Intelligent assistants streamline data analysis,

while AI agents integrate systems and autonomously

execute processes, enhancing operational efficiency and

accuracy.

Practical applications include automatic pest detection

through drones and sensors, continuous monitoring for

wildfire prevention and the use of imagery and historical

data to estimate growth, timber volume and forecast

harvests thereby reducing costs and replacing manual

surveys.

Among national initiatives, the Netflora methodology,

developed by Embrapa, stands out. It employs drones and

AI to identify species in the Amazon with up to 95%

accuracy, expanding forest mapping capacity from 10,000

to 1 million hectares per year thus supporting timber

volume estimates, carbon stock assessments and harvest

planning.

To achieve such progress in an efficient and secure

manner specialised GenAI platforms are required. These

platforms combine frameworks and enterprise services to

accelerate implementation, ensure data privacy, process

large data volumes and allow scalability and continuous

updates.

By adopting GenAI the Brazilian forestry sector can

strengthen competitiveness and consolidate sustainable

practices that are essential for its future, balancing

productivity, environmental protection and technological

innovation.

See: https://www.maisfloresta.com.br/inovacao-e-

sustentabilidade-a-industria-florestal-entra-numa-nova-era-com-

a-genia/

Paraná Association seeks support to mitigate impact

of US tariffs

The timber sector in Brazil has major concerns on the

impact of US tariffs. In August 2025, the Paraná

Association of Forest-Based Companies (APRE Florestas)

held a meeting with the State Secretariat of Finance of

Paraná (Sefa) to discuss the impacts of tariffs of up to 50%

imposed by the US on forest products.

Between January and June 2025, the State concentrated

almost all of its forestry sector exports to the US market

with the following products: moldings (98%, US$102

million), wooden doors (96%, US$34 million), pine

plywood (34%, US$100 million) and pine sawnwood

(33%, US$26 million).

According to the Federation of Industries of Paraná

(FIEP), the crisis threatens more than 38,000 jobs and

could affect 67% of the municipalities in the State.

APRE has requested measures such as a state-level public

procurement programmes for wood products, expedited

reimbursement of the ICMS tax at all stages of the export

process and an update of Paraná’s Forestry Law aimed at

ensuring legal certainty and the sustainability of the sector.

Furthermore, the sector still faces the risk of additional

trade barriers in the US due to ongoing investigations

under Section 232 of the Trade Expansion Act which will

evaluate whether certain imports pose a threat to US

national security and may justify the imposition of

additional tariffs, as well as Section 301 of the Trade Act,

which allows unilateral trade retaliation to pressure market

liberalisation.

Given this scenario, APRE is urging stronger coordination

from public authorities to defend Paraná’s forestry sector,

in order to ensure the continuity of operations, safeguard

employment and maintain Paraná’s relevance in

international trade.

See: https://www.maisfloresta.com.br/apre-e-secretaria-da-

fazenda-estudam-medidas-emergenciais-para-conter-crise-no-

setor-florestal-do-parana/

Amazonian countries approve creation of ‘Tropical

Forests Forever Facility’

The nine Amazonian countries in South America (Brazil,

Peru, Colombia, Bolivia, Ecuador, Venezuela, Guyana,

French Guiana and Suriname) members of the Amazon

Cooperation Treaty Organization (ACTO) have approved

the establishment of the Tropical Forests Forever Facility

(TFFF), a financial mechanism dedicated to the

conservation, restoration and sustainable use of tropical

forests, with a particular focus on the Amazon.

The TFFF will be officially launched in Belém during

COP 30 (United Nations Framework Convention on

Climate Change (UNFCCC) and will serve as a

complementary instrument to existing climate and

environmental financing initiatives. It will operate on a

results-based payment system, incentivising deforestation

reduction, forest cover expansion and the valuation of

ecosystem services.

The joint communiqué of the ACTO Member States

highlights key points, including the mobilisation of

predictable and long-term financial resources from

investor countries, multilateral organisations, development

banks, climate funds, international cooperation agencies,

philanthropy and the private sector with concrete

contributions to capitalise the TFFF and ensure its swift

operationalisation.

It also emphasises that the TFFF´s design incorporates, as

a fundamental principle, the recognition of the strategic

role of Indigenous Peoples and Local Communities in

forest conservation. This is reflected, among other

measures, in the appropriate allocation of resources to

reward their conservation and sustainable development

efforts while acknowledging each country´s specific

circumstances.

The TFFF is conceived as complementary to other

international initiatives, such as the Paris Agreement, the

Convention on Biological Diversity (Kunming-Montreal

Global Biodiversity Framework) and the 2030 Agenda for

Sustainable Development.

It also strengthens regional cooperation under the ACTO,

consolidating the leadership of Global South countries in

creating innovative financial solutions to mobilise

resources for the conservation, restoration and sustainable

management of tropical forests.

The TFFF is presented as a pragmatic, transformative and

shared-governance mechanism, designed to foster

sustainable development and the well-being of present and

future generations.

See: https://omundodiplomatico.com.br/2025/08/28/paises-

amazonicos-aprovam-criacao-de-fundo-florestas-tropicais-para-

sempre/

Brazil and Chile at business roundtable

The governments of Brazil and Chile have discussed a

business partnership at meetings that brought together

government officials and business leaders to strengthen

bilateral trade and review progress of the Bioceanic Route,

which will connect the state of Mato Grosso do Sul to

Chilean ports, thus reducing logistics costs and enhancing

regional integration among Chile, Argentina, Paraguay

and Brazil.

During the Brazil-Chile Business Panel and Roundtable

held in Campo Grande in Mato Grosso do Sul, the Chilean

pulp and wood panel company, Arauco, explained its

strategic position in Brazil.

The company highlighted the importance of the Sucuriú

Project, currently under development in the municipality

of Inocência in the state of Mato Grosso do Sul,

representing investment in the construction of its first pulp

mill in Brazil scheduled to begin operations in 2027. The

new facility will account for 40% of Arauco’s global

production currently split among Chile, Argentina and

Uruguay.

Arauco also emphasised Brazil as a strategic global

partner, highlighting the project’s socioeconomic

potential, including job creation, workforce training,

investment attraction and promotion of regional

development.

See: https://www.maisfloresta.com.br/arauco-reforca-integracao-

entre-brasil-e-chile-em-rodada-de-negocios/

9. PERU

Grants

for commercial plantations in six Peruvian

Departments

More than 3,000 hectares of forest plantations will be

established over the next two years in six regions of the

country thanks to a grant of more than US$2 million

awarded by the National Forest and Wildlife Service

(SERFOR) through its Sustainable Productive Forests

Programme (BPS).

With this disbursement, 28 rural and indigenous

communities, associations and MSMEs will be able to

implement Forestry Business Plans agreed under the

Forest Incentives Program (PIF). It is expected that this

will benefit more than 6,000 families in the regions of

Áncash, Cajamarca, Huánuco, the Central Pasco Forest,

Junín and San Martín.

See: https://www.gob.pe/institucion/serfor/noticias/1239195-

midagri-serfor-otorga-mas-de-7-millones-de-soles-para-

impulsar-plantaciones-forestales-comerciales-en-seis-

departamentos-del-peru

Veneer and plywood exports impressive

According to information provided by the Services and

Extractive Industries Department of the Association of

Exporters (ADEX), veneer and plywood shipments during

the January-June 2025 period reached an FOB export

value of US$1.47 million, a positive 50% plus change

compared to the same period in 2024 (US$955,000).

The main destinations for exports in this subsector in the

first half were Mexico, a 49% share and a year on year

growth of 7% followed by Ecuador with a 33% share. In

third place was Colombia with an 8% share. The

Dominican Republic ranked fourth (7% share) and Costa

Rica concluded the top five with a 3% share.

Preventing forest fires and restoring Amazon

ecosystems

SERFOR has reaffirmed its commitment to the

conservation of the country's forests and wildlife through

the signing of an inter-institutional cooperation agreement

with the regional government of Ucayali, as well as with

the Ministry of the Environment (MINAM) through the

National Service of Protected Natural Areas (SERNANP).

These agreements aim to prevent forest fires and promote

the restoration of affected areas through technical

assistance, monitoring, training and investment projects in

reforestation with native species.

Peru is making progress in the implementation of the

National Strategy for the Restoration of Degraded

Ecosystems and Forest Lands (ProREST) 2021-2030 and

is strengthening its collaborative work with regions and

local communities, promoting sustainable productive

alternatives and reducing the practice of burning that

endangers life and the environment.

See:https://www.gob.pe/institucion/serfor/noticias/1239561-

serfor-refuerza-acciones-para-prevenir-incendios-forestales-y-

recuperar-ecosistemas-afectados-en-la-amazonia

In related news, SERFOR and the Technological Institute

of Production (ITP CITE Network) of the Ministry of

Production signed an agreement to promote the

development of the forestry sector in seven Peruvian

departments.

The agreement will be implemented through the ITP-CITE

Forestry Wood Network which brings together specialised

agencies in Ucayali, Loreto, Madre de Dios and Lima.

The initiative covers timber and non-timber product

processing and marketing with the goal of promoting

sustainable management that provides greater benefits to

families living in forests.

A training programme on reduced-impact logging

operations in natural forests will be held. Additionally,

studies on the properties of wood are planned, as well as

the promotion of training programs in low-impact

techniques.

See: https://www.gob.pe/institucion/serfor/noticias/1239981-

serfor-e-itp-firman-convenio-para-fortalecer-sector-forestal-en-

siete-departamentos

Peru, Brazil and Colombia - cooperation to combat

illegal logging

Illegal logging and illicit timber trafficking know no

borders and is a risk in the forests and communities of the

border areas between Peru, Brazil and Colombia.

Faced with this challenge more than 60 authorities and

specialists from the three countries participated in the

Regional Operational Cooperation Forum: Cross-Border

Coordination in Forest Crime Cases organised by the

United Nations Office on Drugs and Crime (UNODC) in

coordination with the Forest and Wildlife Resources

Oversight Agency (OSINFOR) and the International

Criminal Police Organization (INTERPOL).

Police officers, prosecutors and representatives from

ministries, environmental agencies and international

organisations met in Iquitos to strengthen cross-border

cooperation aimed at preventing, detecting and

investigating forest crimes.

The forum became a historic event where key information

on illegal routes and modus operandi was shared, field

simulations were conducted using investigative techniques

and technological innovations such as the use of satellite

imagery and artificial intelligence-based selective logging

detection algorithms were presented.

The delegations identified areas where activities affecting

the Amazon, such as illegal mining, illicit cropping,

deforestation and illegal logging are occurring, as well as

cross-border passageways for these illegal activities.

They established a framework for cooperation based on

intelligence gathering and analysis, early detection through

new technologies and the planning of joint investigations

and coordinated operations in shared territory.

Communication channels between agencies were also

strengthened, with a commitment to streamline data

exchange and coordinate joint actions in the most critical

areas.

See:https://www.gob.pe/institucion/osinfor/noticias/1239173-

peru-brasil-y-colombia-refuerzan-la-cooperacion-para-enfrentar-

la-tala-ilegal-en-el-trapecio-amazonico

|