|

Report from

Europe

Anti-dumping investigation drove rise in European

plywood imports

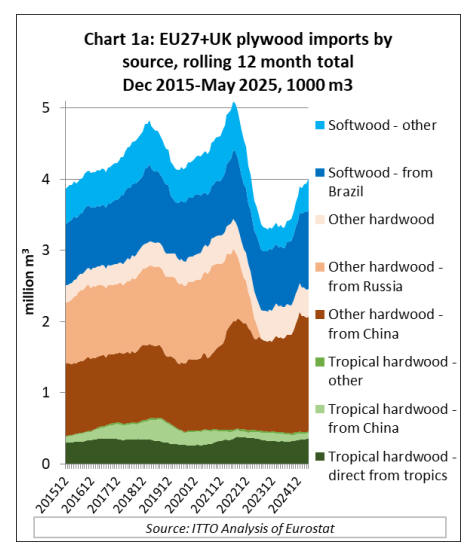

Total EU+UK imports of plywood from outside the region

in the first five months of 2025 were 1.83 million cu.m, up

15% compared to the same period in 2025. Import value

increased by 14% to US$829 mil. in the first five months

year-on-year. While the rebound is significant, import

quantity in the 12 months to May 2025, at around 4

million cu.m, is still some way below the annual average

import of 4.25 million cu.m in the years immediately

before the covid pandemic (Chart 1a).

European plywood imports in the first five months of this

year were likely boosted by on-going anti-dumping

investigations in the EU which may have encouraged

stock piling of the affected products in advance of

anticipated levy increases.

These include Chinese hardwood plywood for which the

EU introduced provisional duties of up to 62.4% from 11

June and Brazilian softwood plywood for which EU anti-

dumping investigations are still on-going.

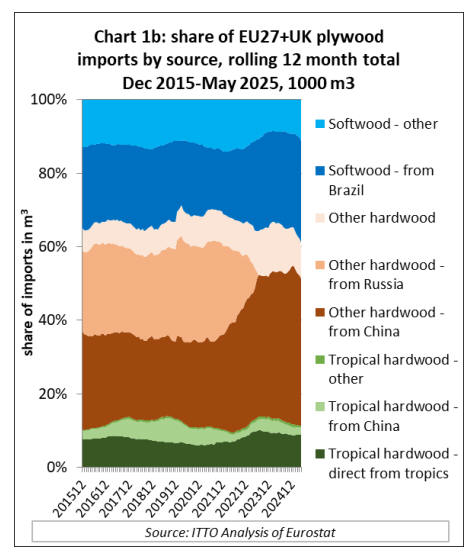

In terms of share of total plywood imports in the EU+UK

region, Brazilian softwood plywood has experienced the

biggest gain this year, accounting for 37% of imports in

the first five months compared to 33% in the same period

last year. The share of Chinese temperate hardwood

plywood in total plywood imports fell from 36% in the

first five months of 2024 to 31% in the same period this

year.

Nevertheless, Chinese hardwood plywood still retained a

large part of the gains in the European market made

following the imposition of EU and UK sanctions on

Russian plywood in 2022 (Chart 1b).

EU Commission determines dumping by Chinese

hardwood plywood manufacturers

EU domestic plywood manufacturers called for an anti-

dumping investigation of Chinese hardwood plywood

imports. The complaint against China was made last year

on behalf of the EU hardwood plywood manufacturing

sector by the Greenwood Consortium,which, according to

evidence collected by the Commission, was supported by

producers accounting for more than 25% of hardwood

plywood production in the EU.

Details of the EU Commission’s investigation which led to

the subsequent imposition of the preliminary duties on

hardwood plywood from China from 11 June this year are

contained in Implementing Regulation (EU) 2025/1139 of

6 June 2025.

The EU Commission investigation concluded that EU

production of hardwood plywood fell 11% from 1,872,902

cu.m in 2021 to 1,664,963 cu.m during the period 1 July

2023 to 30 June 2024. It determined that the “Union

industry was unable to benefit from the exclusion of

Russian and Belarusian hardwood plywood on the Union

market. To the contrary, it was forced to reduce its

production starting in the year 2022 because of the

increase of Chinese imports (+32% in 2022, +10% in 2023

and + 16% in the investigation period) sold at dumped

prices.”

The EU Commission investigation further concludes that

“[T]he development of [EU hardwood plywood]

production capacity, which increased by 2% during the

period considered following investments made by the

Union industry, bears witness to the efforts of the Union

industry to replace the Russian and Belarusian hardwood

plywood excluded by the sanctions from the Union

market.

Capacity utilisation at 75% was already low in 2021 when

COVID negatively affected demand. In 2022, the Union

industry managed to maintain this level, only to see it fall

by 10% in 2023 and 13% in the IP, when compared to the

2021 level”.

The EU Commission goes on to state that “Sales quantity

on the EU market by the Union industry followed a

downward trend between 2021 and 2023 before slightly

picking up in the investigation period. Throughout the

period considered, the total Union industry’s sales quantity

decreased significantly by 12%”.

The EU Commission’s report of the investigation refers to

numerous submissions by Chinese plywood industry and

EU plywood importing representatives, the latter led by

the Plywood Trade Interest Alliance (PTIA), arguing

against the call for antidumping duties. These focused on

the specific characteristics of Chinese hardwood plywood

sold in the EU which they implied satisfies a different

market segments from EU production.

The various arguments against duties were rejected by the

EU Commission mainly on grounds that both the Chinese

and EU plywood industries “can and do produce the full

range of hardwood plywood products present in the Union

market” and that the “purported differences between

Chinese and Union industry hardwood plywood are in

quality only; their basic physical, technical and chemical

characteristics remain the same”.

See: https://eur-lex.europa.eu/eli/reg_impl/2025/1139/oj/eng

Declining availability of supply and consumption of

plywood

The combined effects of EU and UK sanctions on Russian

plywood and EU anti-dumping duties on Chinese

hardwood plywood and potentially also Brazilian

softwood plywood, will impact plywood availability in the

EU market. This comes at a time when the level of

plywood consumption in Europe is facing significant

headwinds.

Construction industry buyers reported another decline in

construction activity in the Eurozone, with the pace

accelerating in July. The latest HCOB Eurozone

Construction Purchasing Managers’ Index (PMI) showed

the steepest decline in new orders since February.

The seasonally adjusted Total Activity Index dropped to

44.7, from 45.2 in June, marking the 39th consecutive

month below the 50.0 threshold separating growth from

contraction.

Housing remained the worst-performing segment,

although its rate of decline eased slightly, while civil

engineering and commercial work also contracted.

France recorded the sharpest fall in output among the

bloc’s three largest economies. By contrast, German

construction companies reported a rate of decline that,

while still sharp, was the weakest for two and a half years

and suggested signs of a recovery.

Italy posted its first decline in five months as weak

demand led to the fastest reduction in purchasing activity

since December 2024. Sentiment remained negative, with

only Italian firms forecasting growth. “The outlook for

European construction companies remains weak,” said

HCOB economist Norman Liebke.

Construction industry buyers in the UK recorded the

steepest fall in activity in more than five years in July,

with the latest S&P Global UK Construction Purchasing

Managers’ Index (PMI) showing sharp declines across all

main sectors.

The headline PMI dropped to 44.3, from 48.8 in June,

signaling a marked downturn driven by a fresh contraction

in residential building and a steep fall in civil engineering

activity. Commercial construction also fell, albeit at a

softer rate. New orders declined for a seventh consecutive

month, with firms citing fewer tender opportunities, site

delays and weaker customer confidence.

One of the few bright spots for the European plywood

trade is that freight rates are currently quite low and there

are indications that the recent volatility in the shipping

sector may be easing. According to the Drewry's World

Container Index, at this time last year rates on the

Shanghai to Rotterdam route for a 40-ft container stood at

over $8250 but these had fallen to US$4774 by the end of

last year and hit a new low of just above US$2000 in early

May this year.

Drewry expects spot rates to remain less volatile in

coming weeks. Drewry’s Container Forecaster expects the

supply-demand balance to weaken again in the second half

of this year, which will cause spot rates to contract.

However the volatility and timing of rate changes will

depend to some extent on future US tariffs and on capacity

changes related to the introduction of US penalties on

Chinese ships, which are uncertain.

See: https://www.drewry.co.uk/supply-chain-advisors/supply-

chain-expertise/world-container-index-assessed-by-drewry

Malaysia and Vie Nam increase share of European

hardwood plywood market

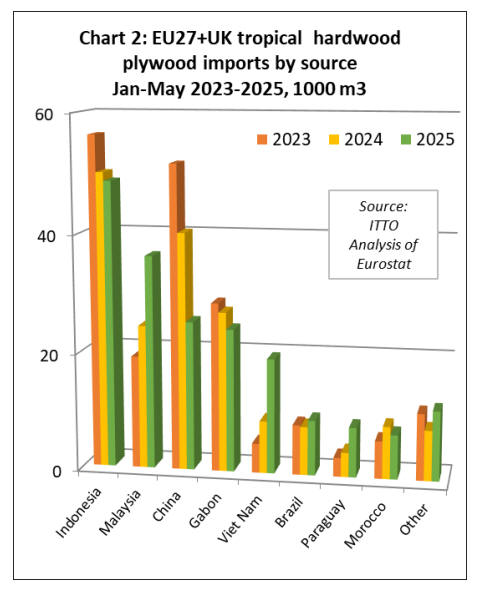

Imports of plywood faced with tropical hardwood into the

EU+UK region were 191,400 cu.m in the first five months

of 2025, 6% more than the same period in 2024. In value,

imports increased 5% to US$121m in 2024.

This year EU+UK imports of tropical hardwood plywood

direct from tropical countries are performing much better

than imports of tropical hardwood plywood from China

(Chart 2).

EU+UK imports of tropical hardwood faced plywood from

China, mainly destined for the UK, were 25,300 cu.m in

the first five months of this year, 37% less than the same

period last year. However, EU+UK plywood imports

direct from tropical countries in the first five months of

2025 were 157,300 cu.m, 22% more than the same period

last year.

There were particularly large year-on-year increases in

imports from Malaysia, up 49% to 36,300 cu.m, and Viet

Nam which rose 120% to 19,500 cu.m. Imports of

hardwood plywood also increased 14% year-on-year from

Brazil, to 9,300 cu.m, while eucalyptus plywood imports

from Paraguay increased 105% to 8,500 cu.m.

In contrast, imports from Indonesia were down 3% year-

on-year to 48,700 cu.m in the first five months of 2025,

while imports from Gabon were down 11% to 24,300

cu.m, and imports of okoume plywood from Morocco

were down 15% to 7,500 cu.m.

The share of imports of hardwood plywood direct from

tropical countries in total EU+UK imports of plywood in

the first five months of this year was 8.6%, up slightly

from 8.1% in the same period last year. A bigger rise was

not recorded only because of the surge in Brazilian

softwood plywood imports in the early months of this

year.

The opportunity for tropical counties to increase their

share of the European market in the future seems clear

given the sanctions on Russian product and anti-dumping

measures already targeting Chinese product and threatened

for Brazilian softwood plywood.

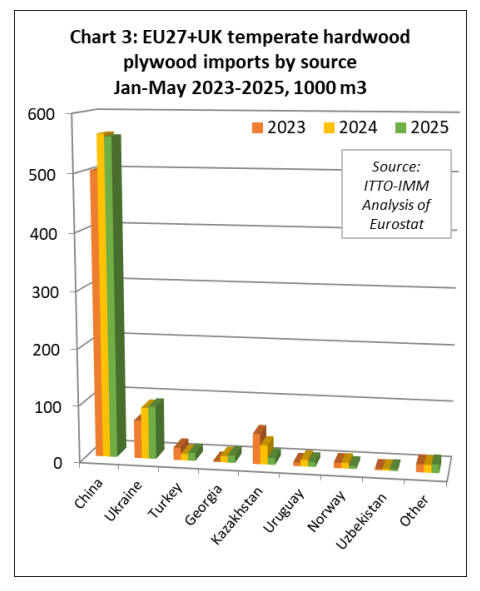

European imports of temperate hardwood plywood

declined

The quantity of EU+UK imports of temperate hardwood

plywood decreased 3% year-on-year to 724,600 cu.m in

the first five months of 2025. Import value fell 2% to

US$375. A big part of the decline was due to a 64% fall in

imports from Kazakhstan, a result of EU taking steps to

prevent circumvention of the sanctions on Russian

plywood by supplying through the country.

There were also large percentage falls in EU+UK imports

during the first five months of this year from Uruguay (-

24% to 8,700 cu.m), and Norway (-48% to 5,100 cu.m).

Imports of temperate hardwood plywood from China were

559,500 cu.m in the first five months of this year, 1% less

than the same period in 2024. These losses were partly

offset by rising year-on-year imports from Ukraine (+3%

to 93,600 cu.m), Turkey (+24% to 14,300 cu.m), and

Georgia (+16% to 12,900 cu.m) (Chart 3).

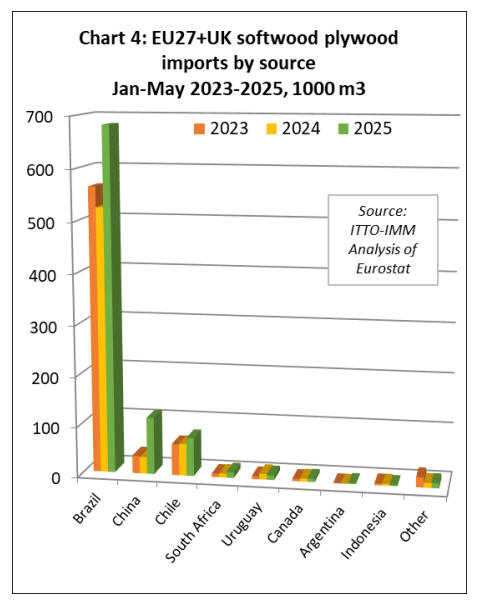

Rising pace of European softwood plywood imports

The EU+UK region imported 912,000 cu.m of softwood

plywood in the first five months of 2025, 38% more than

the same period in 2024. Imports were up 30% year-on-

year from Brazil at 681,900 cu.m, while imports from

China increased 241% to 112,800 cu.m.

Imports also increased 20% to 76,100 m3 from Chile and

47% to 11,300 cu.m from South Africa. Imports from

elsewhere were negligible.

The duty-free quota for coniferous plywood imports, set at

201,000 cu.m for the UK and 448,500 cu.m for the EU,

was used up very rapidly this year (Chart 4).

|