US Dollar Exchange Rates of

25th

August

2025

China Yuan 7.15

Report from China

Decline in first half 2025 sawnwood imports

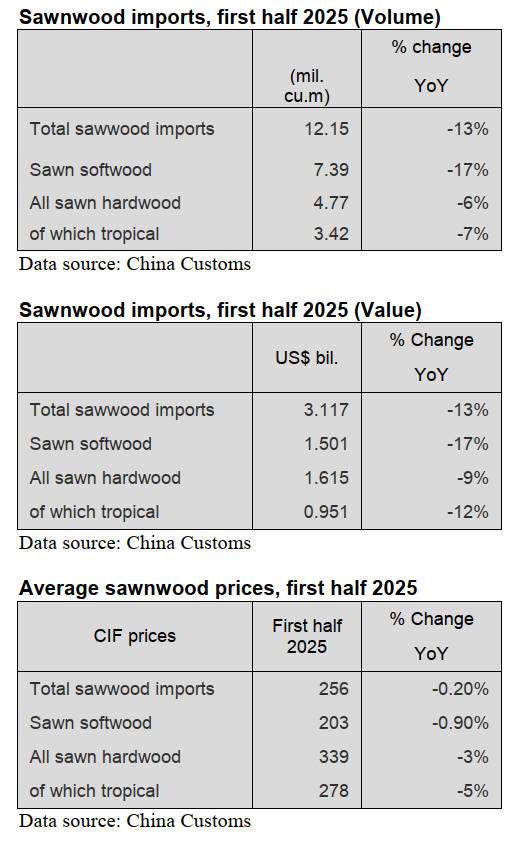

According to data from China Customs in the first half of

2025 sawnwood imports totalled 12.15 million cubic

metres valued at US$3.117 billion, down 13% in both

volume and value. The average CIF price for sawnwood

imports fell to US$256 per cubic metre over the same

period of 2024.

Of total sawnwood imports, sawn softwood imports fell

17% to 7.39 million cubic metres and accounted for 61%

of the national total, down 3 percentage points over the

same period of 2024. The average CIF prices for sawn

softwood imports dropped 0.9% year on year to US$203

per cubic metre over the same period of 2024.

Sawn hardwood imports declined 6% to 4.77 million cubic

metres in the first half of 2025. The average CIF price for

sawn hardwood imports dropped 3% to US$339 per cubic

metre over the same period of 2024.

Of total sawn hardwood imports, tropical sawnwood

imports were 3.42 million cubic metres valued at US$951

million, down 7% in volume and 12% in value and

accounted for about 28% of the national total. The average

CIF prices for tropical sawnwood fell 5% to US$278 per

cubic metre over the same period of 2024.

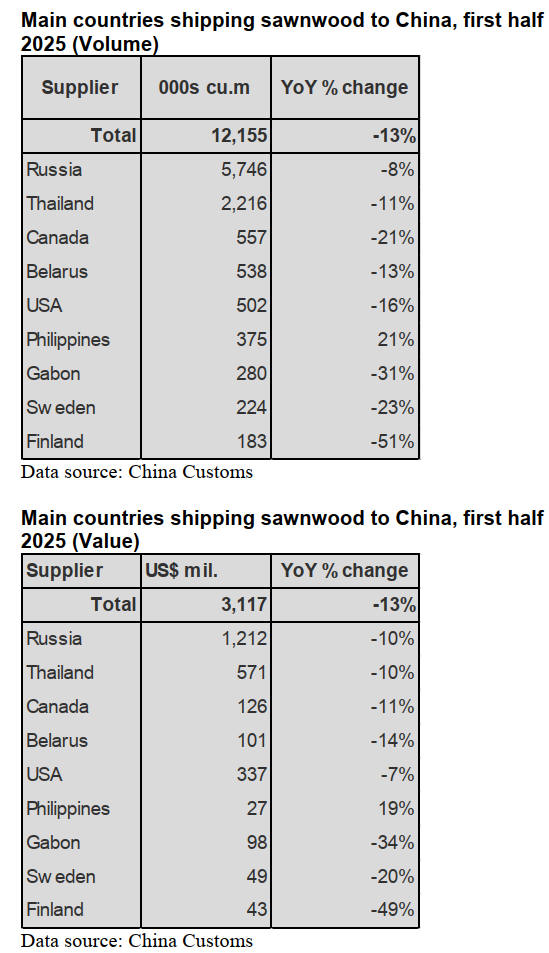

The decline in China’s sawnwood imports was attributed

mainly to the slump in activity in the real estate and

construction sectors. A seasonal slowdown caused by the

rain season in many provinces of China also slowed

overall demand for timber. China’s sawnwood imports

from most of top suppliers, especially from the largest

supplying country, Russia, fell in the first half of 2025.

Rise in sawnwood imports from the Philippines

China Customs has reported that in the first half of 2025

China’s sawnwood imports from the Philippines, alone

among the top suppliers, rose 21% over the same period of

2024.

Russia still was the largest supplier of sawnwood imports

in the first half of 2025 but the proportion of China’s

sawnwood imports from Russia declined to 47% in the

first half of 2025 from 65% in the first half of 2024.

Thailand was the second largest supplier of China’s

sawnwood imports in the first half of 2025 accounting for

18% of the national sawnwood imports total.

However, China’s sawnwood imports both from Russia

and Thailand fell 8% and 11% to 5.746 million cubic

metres and 2.216 million cubic metres respectively and it

was this downturn that impacted the overall decline in the

sawnwood imports.

China’s sawnwood imports from almost all of top

suppliers declined in the first half of 2025 as can be seen

in the table below.

Rise in sawn softwood imports from New Zealand

In the first half of 2025 China’s sawn softwood imports

from New Zealand, alone among the top suppliers, rose

41% over the same period of 2024. China’s sawn

softwood imports from almost all of top suppliers declined

year on year in the first half of 2025. (see below)

Decline in tropical sawnwood imports

China’s tropical sawnwood imports were 3.421 million

cubic metres valued at US$951 million, down 7% in

volume and 12% in value and accounted for about 28% of

the national total in the first half of 2025.

Thailand has been the largest supplier shipping tropical

sawnwood to China for many years. However, China’s

tropical sawnwood imports from Thailand in the first half

of 2025 dropped 11% to 2.216 million cubic metres valued

at US$571 million, down 10% over the same period of

2024 and accounted for 65% of the national total down 3

percentage points over the same period of 2024.

China’s tropical sawnwood imports from Gabon,

Myanmar, Malaysia, Cameroon and Indonesia fell 31%,

36%, 26%, 50% and 42% respectively in the first half of

2025.

In contrast, China’s tropical sawnwood imports from the

Philippines, Vietnam and the Republic of Congo rose

21%, 52% and 9% respectively in the first half of 2025.

It is worth noting that China’s tropical sawnwood imports

from PNG surged over 300% in the first half of 2025.

Global Timber Index – July 2025

Customs data showed that in the first half of this year

China's timber imports totalled US$5.811 billion, marking

a year-on-year decline of 14%. Breakdowns revealed that

log imports amounted to US$2.695 billion, down 18%

year-on-year, while sawnwood imports stood at US$3.117

billion, a drop of 13%. The sharp decline in timber imports

reflected, to some extent, the downturn in the real estate

market.

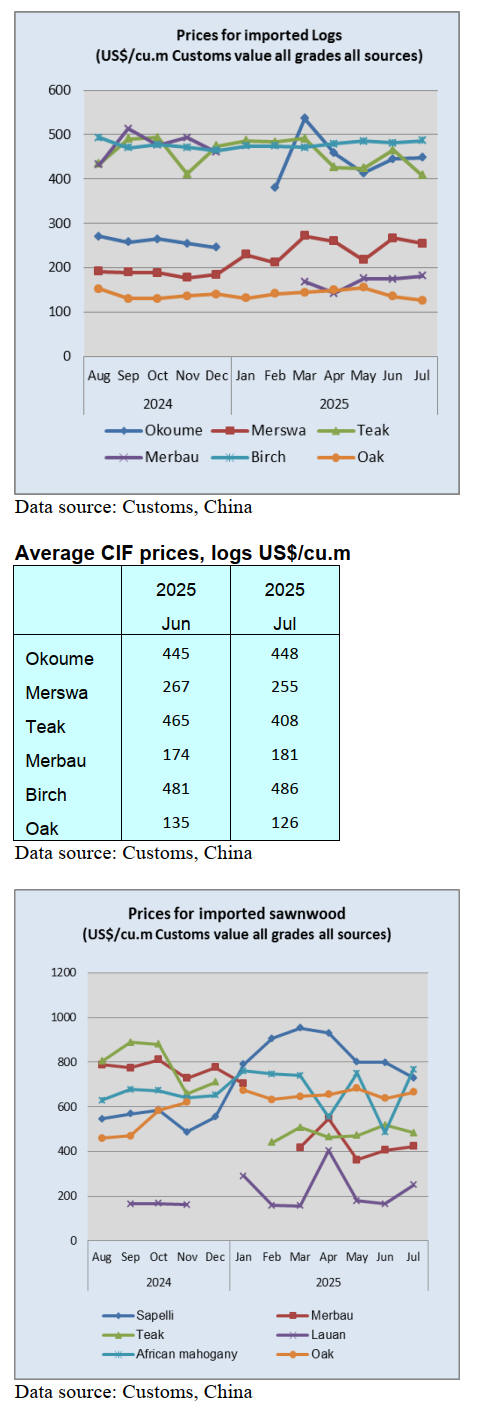

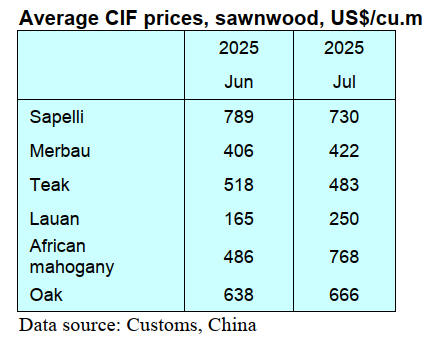

Currently, China's timber demand shows a mixed trend

with walnut and golden teak prices rising and that of some

other species remaining relatively stable. Since July timber

demand entered a period of adjustment due to high

temperatures and heavy rains. Construction activity

slowed and the output of furniture manufacturers also

declined compared to early this year.

Amidst the challenges the industry is hoping for a rebound

in demand during the traditional peak season of September

and October.

In July 2025 the GTI-China index registered 48.7%, a

decrease of 8.8 percentage point from the previous month

and fell below the critical value (50%) after 4 months

indicating that the business prosperity of the timber

enterprises represented by the GTI-China index shrank

from the previous month.

As for the twelve sub-indices, two (production and

purchase price) were above the critical value of 50%, one

index (market expectation) was at the critical value while

the remaining nine indices (new orders, export orders,

existing orders, inventory of finished products, purchase

quantity, import, inventory of main raw materials,

employees and delivery time) were all below the critical

value.

Compared to the previous month, the indices for

production, new orders, export orders, existing orders,

inventory of finished products, purchase quantity,

purchase price, import, inventory of main raw materials,

employees, delivery time and market expectation declined.

See: https://www.itto-

ggsc.org/static/upload/file/20250819/1755566095153001.pdf

|