Japan

Wood Products Prices

Dollar Exchange Rates of 25th

August

2025

Japan Yen 147.77

Reports From Japan

Prefectures go their own way on minimum wage

The Japan Times has reported most Japanese prefectures

that have prepared their minimum wage plans for this year

and are breaking with a Ministry of Labour panel on the

level of increase. Most are opting for larger increases as

inflation is causing a decline in real incomes. A minimum

wage recommendation (plus 6%) was established by a

ministry panel for implementation by each of Japan’s 47

prefectures in the autumn

As of August, 28 prefectures determined their minimum

wage increases for this year and of those, 21 went above

the target. Minimum wage increases are a major economic

agenda item for the government which stresses the

importance of higher wages to support household finances.

When the ministry released the 6% increase target, Ken

Kobayashi, Head of the Japan Chamber of Commerce and

Industry (JCCI) which represents small and midsize

companies, said reaching that target would be “extremely

difficult” for smaller enterprises.

According to a survey in March this year by the JCCI,

around 20% of small businesses said it would be

“impossible” to make the increases needed to achieve the

governments minimum wage target, while 55% said it

would be “difficult.”

See:

https://www.japantimes.co.jp/business/2025/08/25/economy/min

imum-wage-prefectures/

Inflation slows but still above BoJ target

Core consumer inflation (measured in Tokyo) slowed in

August but stayed above the Bank of Japan’s (BoJ) 2%

target which analysts forecast could trigger an interest rate

increase.

The Tokyo core consumer price index (CPI), which

excludes volatile fresh food but includes fuel costs, rose

2.5% in August from a year earlier. It slowed from a 2.9%

rise in July due largely to government fuel subsidies that

pushed down utility bills. While consumer inflation has

been above 2% for well over three years BoJ Governor,

Kazuo Ueda, has stressed the need to move cautiously

while assessing the impact to the economy from U.S.

tariffs.

See:

https://www.japantimes.co.jp/business/2025/08/29/economy/toky

o-cpi-august/

Tight labour market expected to drive wage growth

Speaking at an event in the US, BoJ Governor, Kazuo

Ueda, indicated that Japan's tight labour market is

expected to continue driving wage growth. Wage increases

are spreading from large corporations to small and

medium-sized enterprises, he said.

He added, Japan faces demographic challenges with a

declining population and an aging workforce. Foreign

workers, while only 3% of the labour force, accounted for

over half of the labour force growth.

Ueda’s remarks are likely to support growing market

speculation of another interest rate increas this year

although he didn’t directly discuss monetary policy at the

event.

See: https://scanx.trade/stock-market-news/global/boj-governor-

ueda-signals-persistent-wage-growth-amid-tight-labor-

market/17562481

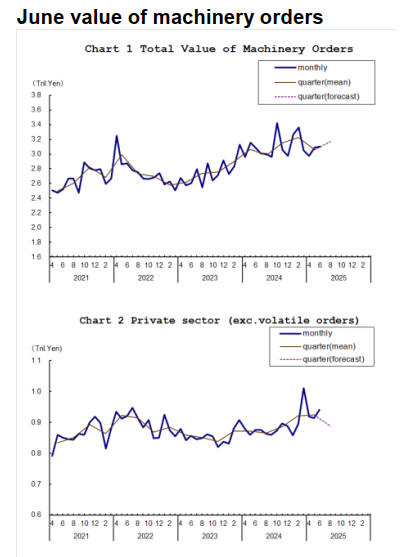

Rise in machinery orders a positive sign

In June the value of machinery orders received by a

sample 280 manufacturers operating in Japan increased by

0.3% from the previous month. In the April-June period

however, order values decreased by 5.3% compared with

the previous quarter. Private-sector machinery orders,

excluding volatile ones for ships and those from electric

power companies, increased by 3.0% in June and rose by

0.4% in April-June period.

In the July-September period the total value of machinery

orders is forecast to increase by 3.7% and private-sector

orders, excluding volatile ones, to decrease from the

previous quarter.

See: https://www.esri.cao.go.jp/en/stat/juchu/2025/2506juchu-

e.html

See: https://www.esri.cao.go.jp/en/stat/juchu/2025/2506juchu-

e.html

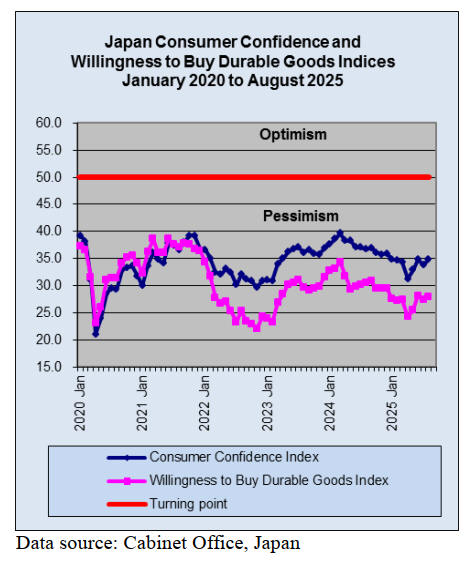

Consumer confidence ticks higher

Japan consumer confidence improved in August but

inflation expectations remain. The index for willingness to

purchase durable goods, which is included in the overall

index, also rose in August

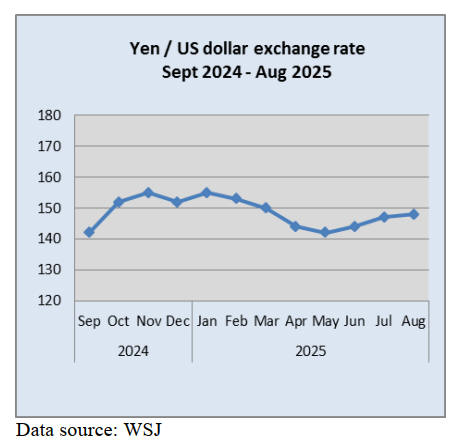

Struggling yen – weakness persists

At the end of August the Japanese yen was down against a

basket of major and minor currencies continuing its losses

for the past three months.

Foreigners investing heavily in real estate

CBRE Japan, a commercial real estate services and

investments company, has reported real estate purchases in

Japan by foreigners came to 1.14 trillion yen (US$7.76

billion) between January-June, the highest for a first half

year going back to 2005. Office buildings accounted for

more than 40%. The growth is due partly to the

expectation of higher rents and greater profitability than in

Europe and the US.

See: https://asia.nikkei.com/business/markets/property/japan-

real-estate-purchases-by-foreign-investors-hit-record-high

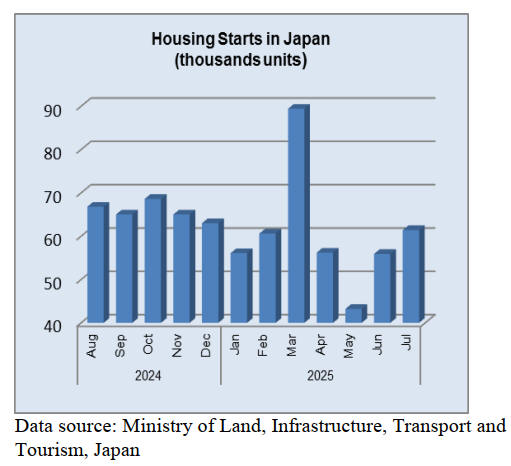

July housing starts

July housing starts were down 10% year on year but

compared to June there was a 10% rise in starts.

TICAD 9 - catalysing Japanese private sector

investment in Africa

The latest of the three-yearly gathering of Japanese and

African leaders (TICAD 9) was held in Yokohama in

August. African Business has reported the summit

produced few headlines instead, the summit featured a

greater focus on solutions involving the private sector.

Xu Haoliang, Acting Administrator of the UN

Development Programme, said TICAD 9 featured

discussions “more serious than in the past” around

catalysing Japanese private sector investment in Africa.

Ankit Khandelwal, Mitsubishi UFJ Financial Group’s

Head of Africa development and blended finance said the

two key themes of this year’s TICAD were “to support the

private sector to drive growth and to support regional

connectivity in support of trade.”

See: https://african.business/2025/08/trade-investment/ticad-9-

japan-shifts-from-aid-to-trade-as-private-sector-prioritised

and

https://www.mofa.go.jp/files/100893431.pdf

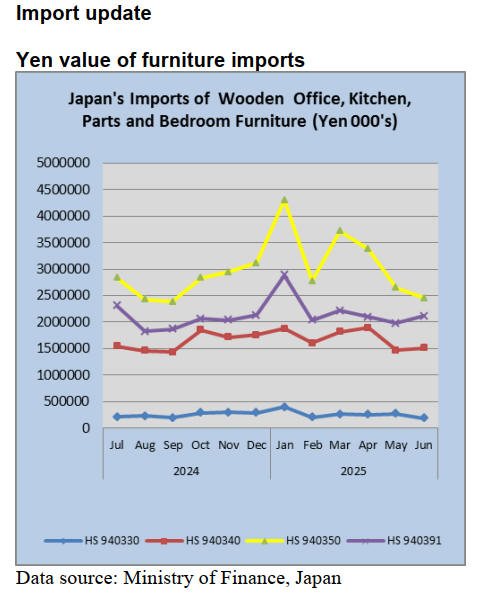

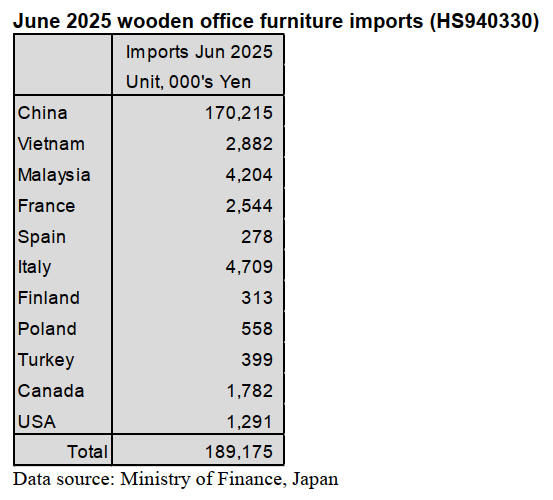

Wooden office furniture imports (HS940330)

Four shippers accounted for over 95% of June arrivals of

wooden office furniture (HS940330). The other main

source of wooden office furniture imports was EU

member countries.

In June shippers in China accounted for 90% (86% in

May) of Japan’s imports of wooden office furniture the

other significant sources were Italy (2.5%), Malaysia

(2.0%) and Vietnam (1.5%). The value of imports from

Italy in June was around the same level as in May while

the value of June imports from both Malaysia and Vietnam

was down compared to May.

Year on year, the value of Japan’s imports of wooden

office furniture in June declined 16% and compared to a

month earlier the value of imports was down 30%.

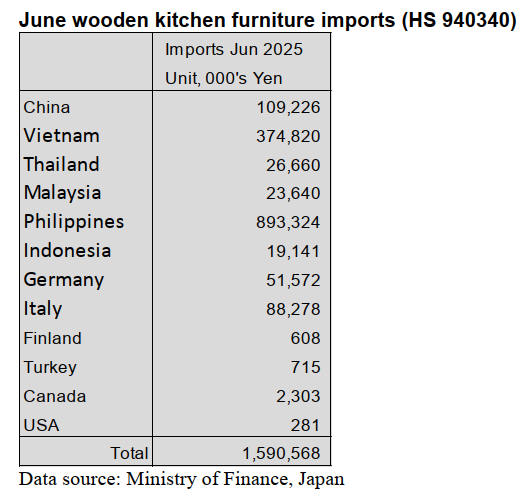

Wooden kitchen furniture imports (HS940340)

As in previous months imports of wooden kitchen

furniture (HS940340) were dominated by shippers in the

Philippines (56% of HS940340 imports) and Vietnam

(24% of HS940340 imports).

June arrivals from the Philippines were up month on

month while the value of imports from Viet Nam was

below May values. The value of June arrivals from China

was below the value reported for May. Of note was the

sharp rise in the value of wooden kitchen furniture from

Italy.

Year on year there was a further decline in wooden

furniture imports (9%) but compared to a month earlier

there was a 3% increase in the value of imports.

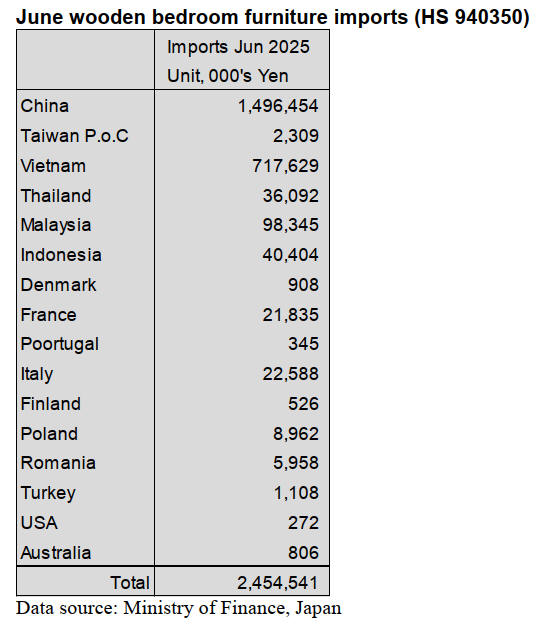

Wooden bedroom furniture imports (HS 940350)

June 2025 marked the fifth month on month decline in the

value of wooden bedroom furniture imports into Japan.

The value of June 2025 imports was over 40% below that

reported at the beginning of this year.

The top two shippers of HS 940350 to Japan in June were

China, 61% of the total but this was down month on

month and Viet Nam, 24%, also down month on month.

Malaysia maintained a share of imports at 4% with both

Thailand and Indonesia having a 2% share of the value of

June imports.

Year on year there was a13% decline in the value of

wooden bedroom furniture in June and compared to May

arrivals in June were down 7%.

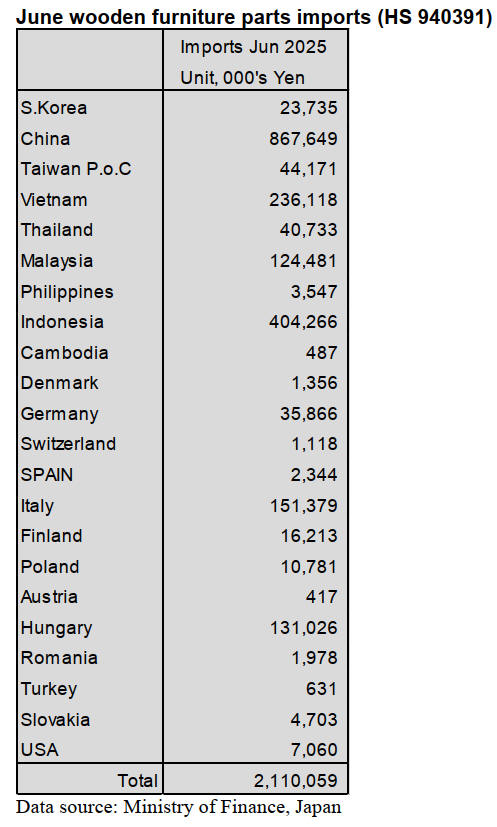

Wooden furniture parts imports (HS 940391)

Apart from the spike in the value of wooden furniture

parts (HS940391) imports in January, the monthly value of

imports remained steady during the first half of 2025.

The value of June 2025 imports was slightly higher

(7%)

than reported in May and compared to June 2024 there

was a 9% rise in the value of imports. Shippers in China,

Indonesia, Viet Nam and Malaysia accounted for most

(77%) HS940391 imports in June 2025. The value of

imports from the top two shippers, China and Viet Nam

was below that reported for May 2025.

Of the total value of HS940391 imports, 41% was

delivered from China (47% in May) 19% from Indonesia

(19% in May), 11% from Viet Nam (12% in May) and

Malaysia which secured a 6% share of June imports. The

value of imports of HS940391 from Italy and Germany

rose in June.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR) was not published in

mid-August as the country celebrated the Obon (Bon)

festival. Obon or Bon is the Japanese festival celebrated to

honour the dead and spirits of their ancestors.

See: https://www.jrailpass.com/blog/obon-festival-in-japan

|