|

1.

CENTRAL AND WEST AFRICA

Regional update

International demand remains muted

The timber sector across the region ended August with

prices remaining broadly stable, though international

demand is still muted. Political developments are shaping

the business climate with presidential elections taking

place in Cameroon and Congo and local elections will be

held in Gabon.

At the same time unpredictable weather patterns are

creating difficulties. Cameroon is experiencing widespread

flooding that is affecting communities and transport

networks while the Congo has experienced heavy flooding

in Brazzaville and across the river in Kinshasa.

Gabon

According to the First Quarter 2025 Sectoral Outlook

published by the Ministry of Economy and Finance at the

end of March the composite index for activities in the

timber sector increased by 15% compared to the previous

quarter. This increase, as stated in the Sectoral Outlook

publication, was driven mainly by demand from China.

See: https://www.gabonreview.com/industries-du-bois-une-

hausse-de-153-au-premier-trimestre-2025-sous-limpulsion-de-la-

chine/#respond

In-country producers report adequate supplies of Azobe

logs and sawnwood with European buyers, particularly in

the Netherlands which continues to prioritise Azobe for

dragline mats. However, demand for Okan has picked up

as it is now being used in combination with Azobe for the

same application. This has boosted Okan prices which

showed some firming towards the end of the month.

The Okoume market remains steady with continued

domestic sales from millers in the NKok zone. Milling for

the domestic market is continuing at a steady pace but

production for export proceeds slowly.

After the extended rainy season repairs to laterite roads are

underway across the south including the Okonja–

Makoukou road. August and September mark the middle

of the dry period with cooler temperatures and improved

transport conditions.

Rail transport remains a critical issue. Producers in the

south are requesting more wagons but SETRAG gives

priority to manganese shipments. Recent intervention at a

ministerial level slightly improved allocations for timber.

Public and government frustration with SETRAG remains

high following repeated delays and poor track

maintenance. Although SETRAG has received funds for

repairing tracks and bridges protests continue over its

performance.

Producers report the availability of containers is adequate

and port operations are running normally though some

report port charges for timber have increased.

Since January this year every bundle of sawn timber must

carry GPS data linked to the logs from which it was milled

and this is checked at Owendo Port before shipment.

Enforcement has been tightened under a Presidential

Directive.

By year-end, all concession holders must submit aerial

surveys of their areas carried out by government operators

using satellite imagery. Forestry officials are already

employing drones to monitor logging activities.

Cameroon

Cameroon has been significantly affected by flooding

which has disrupted timber movement and caused

difficulties for local communities. Despite this, export

activity has continued at modest levels.

Azobe supplies remain stable and readily available and

Ayous and Sapele are trading at normal volumes. Prices

for these species have not shown significant change since

early August.

Sawmill activity in Cameroon has reportedly slowed as

several Chinese operators have ceased operation. The

political uncertainty ahead of the October presidential

elections is weighing on sentiment in the sector. Overall,

sawmills are operating at reduced capacity and expansion

plans are on hold.

Azobe continues to show steady demand, particularly in

the Dutch market. However, forestry authorities are

imposing limits on available sizes which is said to

constrain supply. In contrast, demand for redwoods is

reportedly weakening. Operators had built log stock earlier

in the season and currently hold about two months of

reserves reducing the pressure to ramp up harvesting.

Transportation of timber to port is running normally and

container availability is not an issue. Port operations are

said to be stable with no significant disruptions reported.

Producers say order levels are stable to low depending on

the species. Azobe demand provides some support but

weakening interest in redwoods is slowing activity. In

general, the industry is now more focused on political

developments than on investment or expansion of

operations.

Republic of Congo

Heavy flooding around Brazzaville and on the opposite

side of the river in Kinshasa has strained infrastructure and

delayed timber transport. The presidential election is

adding to business uncertainty but producers say prices for

most species remain stable. Supply is adequate and

harvesting continues at moderate levels.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

See: https://www.itto-

ggsc.org/static/upload/file/20250819/1755566095153001.pdf

2.

GHANA

Sliced veneer exports record year-on-year growth

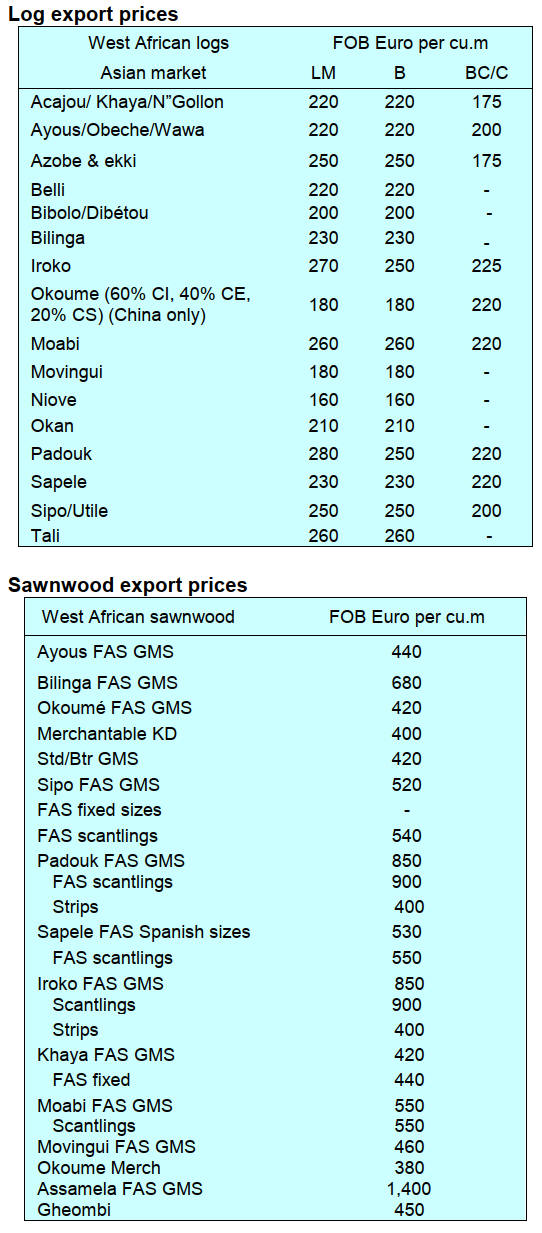

Available data on wood product exports provided by the

Timber Industry Development Division (TIDD) of

Ghana’s Forestry Commission (FC) for the period January

to June 2025 show that sliced veneer exports recorded a

20% rise in volume and 32% rise in value. This resulted

from increased demand in every major market.

For the first six months of 2025 the cumulative volume of

veneer shipments improved to 3,545 cu.m, from 2,965

cu.m for the same period in 2024.

The country’s export earnings also jumped from Eur 3.4

million in 2024 to Eur 4.5 million in 2025.

The TIDD data also revealed that sliced veneer accounted

for 2% and 3% of the total export volumes in 2024 and

2025 respectively. Veneer exports accounted for 6% in

2024 and 7% of 2025 of total export earnings.

Sliced veneer is categorised as a Secondary Wood

Products (SWP), a category which also includes kiln-dried

sawnwood, rotary veneer, plywood, briquettes and kiln-

dried boules. These together accounted for 39% of the

total export revenue for the first half of 2025, a marginal

increase of 1% over that for 2024 for the same period.

However, revenue from the Primary Products export

dipped from 57% in 2024 to 56% in 2025, while Tertiary

Products maintained 5% of the total export receipts in both

years

Species processed to sliced veneer included chenchen,

asanfina, koto, sapele, makore, edinam, yaya, ceiba and

candollei. The main markets included Morrocco, Italy, US,

Denmark, UAE, Spain, India and Belgium.

First shipments of FLEGT licensed timber

Ghana has begun the export of timber under the new

European Union (EU) framework, following the

successful validation processes of the Voluntary

Partnership Agreement (VPA) with the EU.

The Forestry Commission has issued the first six

certificates to five Ghanaian companies to export wood

products to the EU under the Forest Law Enforcement,

Governance and Trade (FLEGT) licensing regime.

The certificates from the Forestry Commission verify that

the wood products are derived from legally harvested logs

and processed in accordance with national laws. These

licenses mark a milestone for Ghana in sustainable forest

governance and the trade in legal timber. Dr. Hugh Brown,

Acting Chief Executive of the Forestry Commission

described the launch of Ghana’s FLEGT Licenses as a

historic milestone, marking 16 years of reform and

collaboration since the signing of the Voluntary

Partnership Agreement (VPA) with the EU in 2009.

He highlighted the development of the Timber Legality

Assurance System (TLAS) from forest to market. He

indicated this system has improved accountability, enabled

data-driven decision-making and promoted inclusive

governance involving all key stakeholders.

The Minister for Lands and Natural Resources, in a speech

read on his behalf, also described the FLEGT License as a

major step toward the sustainable management of Ghana’s

forest reserves.

The Deputy Head of the EU Delegation, Mr. Jonas Claes,

praised Ghana’s commitment and leadership. He stated

that the move reinforces Ghana’s role in the legal timber

trade, improved forest governance and the fight against

illegal logging.

See: https://fcghana.org/ghana-pioneers-flegt-licensing-in-africa/

and

https://www.myjoyonline.com/ghana-begins-legal-timber-export-

under-new-eu-legal-framework/

IFC to support Ghana boost agribusinesses

Ghana’s Millennium Development Authority (MiDA) is

set to collaborate with the International Finance

Corporation (IFC) to transform the country’s agricultural

sector through a major boost in agribusiness investment

and development.

This was disclosed during a working visit by Kyle

Kelhofer, IFC Senior Manager for Ghana, Liberia and

Sierra Leone, to the Chief Executive Officer of MiDA,

Mr. Alexander Kofi-Mensah Mould. The meeting was

centered on strategic partnerships aimed at unlocking the

potential of key agricultural enclaves across the country.

The partnership marks a significant step toward

transforming Ghana’s agricultural landscape and

positioning the country as a key player in regional food

production and agribusiness.

See: https://thebftonline.com/2025/07/14/mida-partners-with-

ifc-to-boost-agribusiness/

Ghana to review investment Act to attract investors

The President has announced his government will remove

the minimum capital requirements for foreign investors

under a revised Ghana Investment Promotion Centre

(GIPC) Act.

Speaking at the sidelines of the Ghana Presidential

Investment Forum on the Ninth Tokyo International

Conference on African Development (TICAD-9) in

Yokohama, Japan the President said the amendment is

aimed at making Ghana’s business landscape more

attractive to investors of varying sizes.

He mentioned small investors will be able to establish a

business in Ghana, this he said would ease entry barriers

and open the way for small and medium-scale investors to

operate in Ghana.

The announcement is intended to woo investors from the

Asia pacific region to strengthen trade and investment

links in industrialisation, agro-processing and exports with

Ghana.

Under the existing law, GIPC Act 2013 (Act 865) foreign

investors are required to meet a minimum equity

contribution ranging from US$200,000 to US$1,000,000

before setting up businesses.

Business and economic analysts have cautioned

government to advance cautiously, so as not to expose

local businesses and enterprises, especially small and

medium-scale businesses, to unfair competition.

See: https://www.graphic.com.gh/news/general-news/mahama-

scraps-foreign-investor-minimum-capital-requirement-under-

revised-gipc-act.html

and

https://gipc.gov.gh/minimum-equity-requirements/

Bank of Ghana policy rate now 25%, down from 28%

The Monetary Policy Committee (MPC) of the Bank of

Ghana (BoG) has reduced the policy rate to 25% from

28%. The Governor of the BoG, Dr. Johnson Asiama

made the announcement at a press briefing after majority

of the 7-member committee voted to reduce the policy

rate.

The year-on-year Inflation in Ghana for July 2025 slowed

down to 12% from the 14% recorded in July 2024. This is

the seventh consecutive decline this year and the lowest

since October 2021 according to data from the Ghana

Statistical Service.

In related news, at a meeting with chief executives of

banks the Governor indicated the gains made in stabilising

the banking system and urged commercial banks to

translate this into tangible benefits for the real economy.

See: https://www.graphic.com.gh/news/general-news/ghana-

news-bog-drops-policy-rate-to-25.html

and

https://www.myjoyonline.com/macroeconomic-stability-must-

translate-into-growth-bog-governor-tells-banks/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Ghana.

See: https://www.itto-

ggsc.org/static/upload/file/20250819/1755566095153001.pdf

3. MALAYSIA

Exports resilient despite tariffs and slowdown in global

demand

Malaysia’s timber exports continue to show resilience

achieving a total value of RM9.03 billion in the first five

months of this year despite tariffs, a slowdown in the

global economy and the challenge of preparing for the

EUDR.

Plantation and Commodities Deputy Minister, Chan Foong

Hin, acknowledged the industry’s concerns over the

EUDR which demands a high level of supply chain

transparency and verification. He said that the ministry is

working closely with relevant agencies to ensure full

compliance throughout the entire timber value chain with

a strong focus on traceability, transparency and legality.

Chan also addressed domestic concerns over the expanded

Sales and Service Tax (SST) and US trade tariffs which

have pushed up costs and eroded competitiveness.

The SST, he said, has increased operational expenses by

8–12% which has pushed up prices across the supply chain

and particularly affected small and medium enterprises.

Looking ahead, Chan said the domestic timber industry’s

future will be shaped by three major trends, sustainability,

digital transformation and evolving consumer lifestyles.

“Through the National Agri-commodity Policy 2021–

2030, we are addressing these challenges via five key

thrusts: sustainability, productivity, value creation, market

development and inclusivity.

See: https://thesun.my/business-news/malaysian-timber-exports-

resilient-in-face-of-global-headwinds-LF14661864

Malaysia's trade hit a record high in July 2025

Malaysia's international trade hit a record high in July

2025 but analysts cautioned that uncertainties from US

tariffs and a cloudy semiconductor outlook could weigh on

momentum in the months ahead.

According to the Ministry of Investment, Trade and

Industry (MITI), July trade rebounded by almost 4% year

on year to RM265.92 billion, the strongest monthly

performance on record. Exports rose 7% to RM140.45

billion, the highest since September 2022, while imports

rose 0.6% to RM125.47 billion.

The timber industry, especially the furniture sector, is

apprehensive of recent news that US President has

directed his administration to investigate imports of

furniture into Unites States that may lead to higher tariffs

by October.

See:

http://theborneopost.pressreader.com/article/282162182313008

Pioneer forest restoration project

Face the Future, in collaboration with the Sabah

Foundation, has been working on restoration and

protection of the degraded forest in Sabah since 1992.

Face the Future is a NGO based in the Netherland.

Through enrichment planting using indigenous species the

project aims to contribute to restoring the natural

biodiversity of Sabah’s rainforest. The primary species

selected for the project include indigenous dipterocarps

from the genera Shorea, Parashorea, Dipterocarpus,

Vatica, Hopea and Dryobalanops. These species are well-

suited as pioneers in open and severely degraded areas.

See:

https://theborneopost.pressreader.com/article/281629606361895

and

https://www.yayasansabahgroup.org.my/conservation_managem

ent.cfm

Black wooden pellet

It is reported that a major timber group based in Sarawak

has signed a letter of intent (LOI) with Japan’s Kobe Steel

to develop black wooden pellet biomass, a substitute for

coal in power generation and industrial heat production.

Under the LOI, a joint feasibility study will be conducted

for a plant capable of producing 300,000 tonnes per year

of black pellets.

Black pellets, created through thermal treatment

(torrefaction) of white pellets under specific conditions,

have the calorific value comparable to coal and are

expected to be a low-CO2 alternative with the potential to

be utilised as both a fuel for power generation and a raw

material for steelmaking.

See:

https://ceomorningbrief.theedgemalaysia.com/article/2025/1013/

Home/12/767531

MTCC invites comments

Since 1999 the Malaysian Timber Certification Council

(MTCC) has been advancing sustainable forest

management through the Malaysian Timber Certification

Scheme (MTCS). Following the scheme’s last re-

endorsement in 2021 by the Programme for the

Endorsement of Forest Certification (PEFC), MTCS

standards are undergoing a review for re-endorsement to

align with national and international requirements.

The public statement from MTCC says this is ongoing

commitment to strengthen sustainable forest management

practices to ensure long-term sustainable environmental,

social and economic benefits from our forests in

Malaysia.

To ensure a transparent and participatory process as

outlined in MTCS ST 1001:2021 – Standards Setting

Procedures for Forest Management Certifications, a multi-

stakeholder Standard Review Committee (SRC) will be

formed. This committee will be a key platform for

enhancing the credibility, inclusivity and transparency of

the MTCS.

The MTCS ST 1001:2021 document can be found at:

https://mtcc.com.my/wp-content/uploads/2021/10/MTCS-

ST-1001-2021-Standard-Setting-Procedures-for-FMC-

Standards-30-Sep-2021.pdf

For more information see:

https://mtcc.com.my/public-announcement-standard-review-

committee-src-endorsement-of-the-malaysian-timber-

certification-scheme/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

See: https://www.itto-

ggsc.org/static/upload/file/20250819/1755566095153001.pdf

4.

INDONESIA

Contribution of manufacturing to econmy

dips

The Indonesian Furniture and Handicraft Industry

Association (HIMKI) has raisied concerns about the

declining share of the manufacturing sector in the nation's

GDP, as it has fallen from 28% in 2010 to below 19%

currently.

The furniture and handicraft sectors, despite their

importance to the creative economy are particularly

affected by this downturn. The sector faces many

challenges, including high production and logistics costs,

dependence on imported raw materials, hurdles to access

financing and fierce international competition.

The Association emphasised the need for an integrated

approach, including developing industrial clusters,

prioritising design and utilising international trade fairs for

promotion.

Despite the challenges HIMKI sees several growth

opportunities, particularly over the next five years. The

global trend toward sustainability and eco-friendly

products presents a new market for furniture made from

materials like bamboo and rattan. Additionally, trade

agreements such as the Indonesia–European Union

Comprehensive Economic Partnership Agreement (IEU-

CEPA) could provide tariff benefits for Indonesian goods.

The Chairman of HIMKI has said a fundamental "mental

transformation" is necessary on the part of entrepreneurs.

He stressed that the industry's habit of copying designs

from buyers or other producers creates an image of ‘low-

cost factory’ rather than a hub of creativity leading to

businesses competing mainly on price.

Additionally, a focus on quantity over quality and a lack of

collaboration among businesses weaken the industry's

international position.

See: https://www.msn.com/id-id/berita/other/sektor-manufaktur-

ri-lesu-sektor-mebel-dan-kerajinan-ikut-tertekan/ar-

AA1KH6nF?ocid=BingNewsVerp

and

https://koran-jakarta.com/2025-08-21/indonesia-bisa-jadi-

pemimpin-industri-kerajinan-dunia-asal-ubah-mentalitas

To grow, furniture and woodworking industries need

the latest technologies

Erie Sasmito, the General Chairman of the Indonesia

Furniture & Craft Promotion Forum (IFPF) is urging

enterprises to adopt modern technology to expand business

and improve global competitiveness. He said “utilising the

latest technology can make the industry more efficient and

better equipped to handle tough global competition”.

The Secretary-General of the Indonesian Sawmill and

Woodworking Association (ISWA), Choiril Muchtar,

added that only an estimated 24% of the industry's

potential has been exploited.

He noted that new machinery and technology can help

reduce raw material costs which typically make up 40-

60% of total production costs while simultaneously

boosting productivity and product quality.

A key event for assessing technology is IFMAC

WOODMAC 2025, an exhibition that will take place from

September 24-27 at the Jakarta International Expo

(JIExpo) Kemayoran.

See: https://www.msn.com/id-id/berita/other/industri-furniture-

dan-perkayuan-indonesia-perlu-manfaatkan-teknologi-untuk-

perbesar-bisnis/ar-AA1KqDX5?ocid=BingNewsVerp

Indonesia welcomes foreign support for forest

rehabilitation

Indonesia's Forestry Minister, Raja Juli Antoni, announced

that the country is open to international collaboration and

funding for forest conservation and rehabilitation.

Speaking at the initial meeting for the REDD+ GCF Phase

II RBP, he stated that Indonesia is committed to protecting

its forests and supporting community welfare and

welcomes global involvement.

See: https://en.antaranews.com/news/372969/indonesia-opens-to-

foreign-support-for-forest-rehabilitation

In other news, Minister Raja Juli Antoni is promoting the

integration of the forestry sector into Indonesia's carbon

trading scheme as part of efforts to rehabilitate degraded

land and reduce deforestation.

He emphasised the urgency of revising Presidential

Regulation No. 98 of 2021 to facilitate the opening of a

voluntary carbon market thus enabling private sector

investment. With around 6.5 million hectares of degraded

land in need of rehabilitation, the Minister believes that

allowing private participation in carbon trading will not

only support environmental goals but also generate state

revenue through taxes and related mechanisms.

See: https://www.antaranews.com/berita/5031821/menhut-kejar-

implementasi-perdagangan-karbon-sektor-kehutanan

Promoting non-timber forest products, a forest

rehabilitation market

The Ministry of Forestry organised a Forest and Land

Rehabilitation (RHL) market to promote non-timber forest

products (NTFPs) from all over the country. This market

aims to help communities sell forest products that they

have planted to restore critical land. The Directorate

General of Watershed Management and Forest

Rehabilitation (Ditjen PDASRH) are leading the initiative.

According to Dyah Murtiningsih, the Director General of

Watershed Control and Forest Rehabilitation, the RHL

market is a practical example of how forest and land

rehabilitation can support food security in Indonesia. The

Ditjen PDASRH also plans to develop a comprehensive

program for natural resource management with a focus on

empowering communities.

See:

https://lestari.kompas.com/read/2025/08/20/152817386/dorong-

produk-hasil-hutan-bukan-kayu-kemenhut-gelar-pasar-

rehabilitasi-hutan.

and

https://www.jawapos.com/index.php/image/detail/18505/kemenh

ut-gelar-pasar-pasar-komoditas-rehabilitasi-hutan-dan-lahan

400,000 hectares designated as Customary Forests

The Ministry of Forestry has designated 400,000 hectares

of land as Customary Forests to recognise and protect the

rights of indigenous communities.

According to the Minister these actions are intended to

provide legal certainty and protection for indigenous

communities over their ancestral lands which have been

managed sustainably for generations. The Minister

emphasised that this achievement is a result of strong

synergy between national policy, various stakeholders and

indigenous communities.

See: https://esgnow.republika.co.id/berita/t0sama487/menhut-

raja-juli-klaim-hampir-400-ribu-hektare-hutan-adat-sudah-diakui

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Indonesia.

See: https://www.itto-

ggsc.org/static/upload/file/20250819/1755566095153001.pdf

5.

MYANMAR

Myanmar to hold first phase of general

election in

December

Myanmar government has announced the initial phase of a

general election will be held on 28 December, the first

national polls in nearly five years. The election

announcement outlines a phased voting process planned

for December and January. However, while 55 political

parties have registered for the upcoming polls, with nine

planning to compete nationwide, the election is expected

to be dominated by candidates backed by the military.

.

The interim administration has stated its intent to hold

voting in over 300 constituencies, including in areas

currently experiencing heavy fighting with armed

opposition groups.

See: https://www.channelnewsasia.com/asia/myanmar-junta-

new-election-details-5306766

And

https://www.straitstimes.com/asia/se-asia/myanmar-to-hold-first-

phase-of-general-election-on-dec-28-state-television-reports

Timber trade flows have shifted dramatically

According to a Forest Trends study, Myanmar’s timber

industry has experienced significant upheaval since 2021

due to sanctions, conflict and altered trade dynamics.

While timber exports have exceeded US$1.27 billion since

2021, the markets have shifted dramatically.

By 2024, China and India dominated imports at 88% and

about 20% respectively, while exports to Western

countries, which constituted 25% of trade in 2022, have

dropped to virtually zero. Since 2021, Myanmar has

ceased publishing trade data.

See: https://www.forest-trends.org/wp-

content/uploads/2025/02/myanmars-forest-sector-since-the-

coup_FINAL.pdf

New measures for currency control

The local and regional press has reported Myanmar's

government is undertaking a multi-pronged strategy to

exert control over its economy these measures include

enforcing strict capital controls on exporters, physically

seizing control of the border trade and establishing an

alternative financial channels.

Myanmar's Central Bank has mandated the swift

repatriation and settlement of all export earnings.

Companies must bring their foreign income back into the

country within strict deadlines: 30 days for exports to

Asian countries and 60 days for those to non-Asian

countries. Failure to comply will resultss in harsh

penalties,say the authorities.

Pivot away from the US dollar

To reduce its dependency on the US dollar, Myanmar has

partnered with Russia. The Russian Central Bank

announced it will accept the Myanmar Kyat for direct

exchange, allowing the two nations to trade using their

local currencies, the ruble and the kyat. This enables

Myanmar to pay for Russian imports without using scarce

US dollar reserves.

See -

https://burmese.dvb.no/post/719373, https://burmese.dvb.no/post

/721055

and

https://www.thestar.com.my/aseanplus/aseanplus-

news/2025/08/19/myanmar-border-closure-cripples-thai-exports-

worth-billions

6.

INDIA

Sawnwood and veneer price indices delined

in June

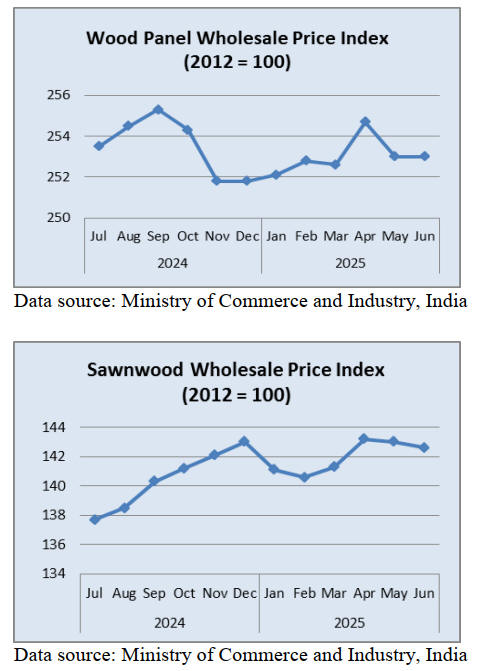

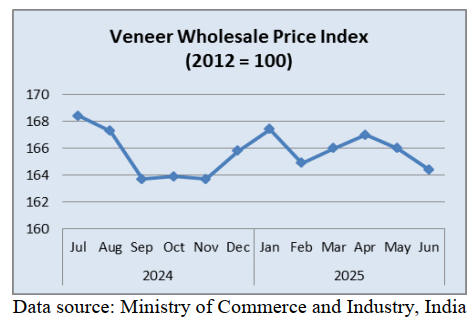

The annual rate of inflation based on the all India

Wholesale Price Index (WPI) was -0.13% in June. The

negative rate of inflation in June 2025 was primarily due

to decreases in the price of food articles, mineral oils,

manufacture of basic metals and crude petroleum and

natural gas.

The index for manufacturing declined by 0.07% to 144.8

in June 2025 from 144.9 for May 2025. Out of the 22 NIC

two-digit groups for manufactured products, 11 groups

witnessed an increase in prices, 6 groups a decrease and 5

groups witnessed no change in prices.

Some of the important groups that showed month on

month increased prices were other manufacturing,

machinery and equipment, other transport equipment,

pharmaceuticals, medicinal chemical and botanical

products, computes, electronic and optical products.

Some of the groups that witnessed a decrease in prices in

June were manufacture of basic metals, food products,

fabricated metal products (except machinery and

equipment), tobacco products, rubber and plastics

products.

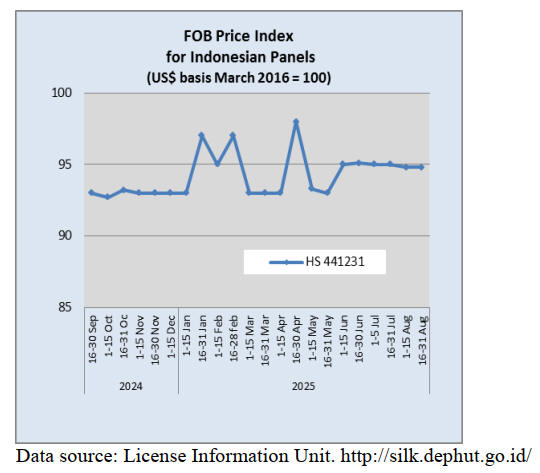

The price index for wood panels in June was unchanged

from May. The sawnwood price index in June was down

compared to a month earlier and there was also a decline

in the index for veneers.

See: https://eaindustry.nic.in/

CREDAI report - remarkable surge in residential real

estate market

In a press release, the Confederation of Real Estate

Developers’ Associations of India (CREDAI) announced

that, in collaboration with CRE Matrix, a report, ‘India

Housing Report July 2025’ has been published.

The press release says the report highlights significant

regional variations with the National Capital Region

(NCR) leading the market with a 26% revenue share,

fueled by a 21% increase in sales value and a 32% surge in

average prices.

The Mumbai Metropolitan Region (MMR) followed

closely with a 23% revenue share, recording a 9% growth

in sales value and 75,000 units sold, with a 16% increase

in average prices.

In the south, Chennai emerged as a standout performer

achieving a 23% increase in sales value with 11,000 units

sold and a 12% rise in average prices. New launches in

Chennai grew from 14,000 to 19,000 units, though the

market share of homes fell.

The decline in new launches across most cities signals a

cautious approach by developers amid rising costs says the

report. However, the robust growth in transaction values

highlights the sector’s resilience and the increasing

premiums in the market.

Commenting on the report, Shekhar Patel, president of

CREDAI, said “we are witnessing a decisive shift in

homebuyer preferences across India. The demand is

clearly moving towards larger, better-located and more

premium homes—reflecting rising aspirations and

improved purchasing power. A 21% growth in NCR’s

housing value, despite lower volumes, is a clear indicator

that quality and location are now more important than

quantity.

See: https://credai.org/media/view-details/?file_no=93

Indian furniture brands innovating to meet evolving

demands of domestic consumers

Furniture Design & technology (FDT), an Indian trade

magazine, has suggested India’s furniture industry is

poised to become a formidable player in the global market.

The sector is projected to be worth US$34 billion by 2028

as domestic consumers shift to organised retail outlets as

opposed to the traditional craft sector.

Indian brands are said to be innovating to meet the

evolving demands of consumers. The rise in demand for

customised furniture is another trend which, says FDT, is

fueled by factors such as urbanisation, increased

disposable incomes and a growing preference for quality

home furnishing.

See: https://furnituredesignindia.com/magazine/Current-Issue

7.

VIETNAM

Wood and Wood Product (W&WP) trade

highlights

According to the Vietnam Customs Department, in July

2025 W&WP exports reached US$1.47 billion, up 9%

compared to June 2025 and up 6% year-on-year. Of this,

WP exports alone fetched US$ billion, up 9% compared to

June 2025 and up 5% year-on-year.

In the first 7 months of 2025 W&WP exports amounted to

USUS$9.6 billion, up 8% over the same period in 2024

with WP exports contributing US$6.6 billion, up 8% over

the same period in 2024.

W&WP exports to Middle East markets in July 2025 were

recorded at USUS$9.8 million, up 19% compared to July

2024. In the first 7 months of 2025 W&WP exports to the

Middle East markets earned US$67.7 million, up 38%

over the same period in 2024.

In July 2025 bedroom furniture exports were valued at

US$182 million, down 6% compared to July 2024. In the

first 7 months of 2025 exports of bedroom furniture

brought in about US$1.2 billion, up 5% over the same

period in 2024.

In July 2025 W&WP imports to Vietnam were valued at

US$309.5 million, up 17% compared to July 2024. In the

first 7 months of 2025 W&WP imports were valued at

US$1.8 billion, up 19% over the same period in 2024.

Vietnam's poplar imports in July 2025 were 37,600 cu.m,

worth US$17.1 million, up 8% in volume and 9% in value

compared to June 2025. Compared to July 2024 the value

of imports decreased by 9% in volume but increased by

4% in value.

In the first 7 months of 2025 poplar imports were

estimated at 196,900 cu.m, worth US$84.9 million, down

10% in volume but up 2% in value year-on-year.

Vietnam's imports of raw wood (log and lumber) from the

ASEAN region in June 2025 dropped to 65,840 cu.m, with

a value of US$13.43 million, down 29% in volume and

39% in value compared to May 2025.

In the first 6 months of 2025, imports of raw wood from

ASEAN amounted to 441,390 cu.m, with a value of

US$114.72 million, down 5% in volume and 9% in value

over the same period in 2024.

Viet Nam timber enterprises eye US-based

manufacturing

In response to US reciprocal tariffs some Vietnamese

wood manufacturers are considering manufacturing in the

US, said Ngo Sy Hoai, Vice Chairman and General

Secretary of the Vietnam Timber and Forest Products

Association (Viforest).

The Ministry of Agriculture and Environment reported

that exports of agricultural, forestry and fishery products

in the first seven months of 2025 reached US$39.68

billion, up 15% year-on-year. Of this, wood and wood

products earned US$9.67 billion, an increase of 8% over

the same period.

In the period January to July agricultural-forestry-fisheries

earned a trade surplus of US$11.52 billion with wood and

wood products making the largest share at US$7.7 billion,

up 4% over the same period in 2024.

The US remains Vietnam’s largest market for wood and

wood products accounting for 56% of total exports in the

first seven months of 2025, followed by Japan and China,

with 12% and 11% respectively.

Viet Nam’s Decree on forest carbon credits

The Government is formulating a new Decree to provide a

legal basis for the commercialisation of forest carbon

credits. This move comes after Vietnam’s first successful

sale of 10.3 million forest carbon credits (equivalent to

10.3 million tonnes CO₂) at a price of US$5 per tonne,

earning about US$51.5 million through a World Bank-

supported transaction.

That pioneering deal demonstrated the economic potential

of forest carbon sequestration and underscored the urgent

need for a clear legal framework to scale up the market.

The draft Decree aims to mobilise new financial resources

for forest protection and development via a carbon market.

The draft Decree clearly defines core concepts and

establishes market mechanisms for forest

carbon absorption and storage services.

See: Vietnam's Decree on Forest Carbon Credits: Everything

You Want to Know - Thị trường Carbon

Manufacturers urged to offer more products to existing

markets

Vietnamese wood companies should introduce more

product lines and offer these to avoid “having all eggs in

one basket,” said Phung Quoc Man, chairman of the

Handicraft and Wood Industry Association of Ho Chi

Minh City (HAWA).

For example, exports to Japan should not be limited to

woodchips and pellets, Man added while speaking on

impacts and business responses to US tariffs.

He explained that the industry’s first reaction to the new

tariffs was “shock,” with orders declining however,

companies quickly adapted by advancing shipments

during the grace period.

Since the tariffs took effect supply chain stability has been

maintained by sharing the tax burden among producers,

importers and retailers. As a result, wood exports in the

first seven months still grew with shipments to the US up

around 12%, a sign of the industry’s strong resilience. In

the long run, solutions include diversifying markets,

improving management capacity and cutting costs.

To reduce risks, firms could expand their offerings to

existing destinations. He suggested Japan could import

more than just woodchips and pellets, South Korea more

than just engineered wood and Europe more than just

outdoor furniture.

Can Van Luc, a member of the Prime Minister’s

Economic Advisory Council and chief economist at state-

controlled BIDV Bank, pointed out that four out of 10

kitchen products in the US now come from Vietnam.

According to the import-export department under the

Ministry of Industry and Trade, steady growth in the US

market not only reflects a recovery in consumer demand

for furniture but also shows how Vietnamese companies

are proactively adapting to tariffs and increasingly strict

buyer requirements.

Wood industry has certain opportunities after tax

Vu Kim Hanh, chairwoman of the High-Quality

Vietnamese Goods Business Association, highlighted a

golden opportunity for Vietnam’s wood industry following

the US decision to impose a reciprocal tariff on

Vietnamese wood products.

In the US market, Vietnam has become the largest supplier

after China. But in the year to end-July 2025, Vietnam

overtook China to claim the No. 1 spot. Hanh emphasised

the importance of enhancing the reputation of Vietnam's

wood industry.

While tariffs have risen Vietnam’s top competitor has

been sidelined creating a natural advantage. “But this is

not a time to stand still,” Hanh warned. Chinese

companies anticipated the trade conflict long ago and have

already shifted their trade infrastructure, supply chains and

management including marketing and sales, to the US.

See: Vietnamese wood firms urged to offer more products to

existing markets amid tariff concern

8. BRAZIL

Forestry sector seeks support to mitigate

tariff impact

The Federation of Industries of Mato Grosso (FIEMT) in

partnership with the Center of Timber Producing and

Exporting Industries of Mato Grosso (CIPEM) has

assessed the impact of tariff increases imposed by the US

on Brazilian forest-based products.

The timber sector in Mato Grosso is highly dependent on

the US market which absorbs more than 26% of the

State’s native timber production. Among the products,

solid finished wood flooring stands out as it is exclusively

exported to the US with no viable market alternatives due

to technical specifications unique to US consumers.

The tariff increases are particularly critical for regions

such as Juína, Colniza and Aripuanã municipalities where

up to 80% of local jobsare in the timber industry at more

than 180 companies.

Currently, the forest sector in Mato Grosso has 1,359

establishments and employs 10,869 direct workers

primarily concentrated in sawmills (49% of the companies

and 60% of the workforce). Furniture manufacturing

accounts for 31% of establishments and 18% of jobs

followed by other activities suh as wood-based panel

production and the manufacturing of various wood

products which together sustain thousands of jobs across

the State.

Faced with the risk of economic losses, production line

shutdowns and rising unemployment, FIEMT proposed a

joint letter from industry representatives and workers. The

letter will be sent to State and Federal authorities

requesting support and mitigation measures. The alliance

among unions, associations and federations seeks to

safeguard competitiveness, preserve jobs and ensure the

continued economic contribution of the forest sector to

Mato Grosso State.

See: https://www.maisfloresta.com.br/fiemt-propoe-carta-

conjunta-para-amenizar-impactos-da-tarifa-dos-eua-no-setor-de-

base-florestal/

ABIMCI - without negotiations the timber industries

will remain in crisis

The Brazilian Association of Mechanically Processed

Timber Industry (ABIMCI) considers that the package of

measures announced by the Brazilian Federal government

to mitigate the impacts of the tariffs imposed by the

United States on Brazilian wood products needs to be

reviewed.

According to the Association the only effective solution

lies in direct negotiations aimed at reducing tariff rates and

which could restore timber sector competitiveness in the

U.S. market.

The tariff increase has already triggered production

shutdowns, contract cancellations, collective layoffs and

the imminent risk of plant/factory closures affecting

approximately 180,000 direct jobs.

Some Brazilian State governments have adopted support

measures such as tax incentives and expanded credit lines

but such actions, while helpful, cannot replace the urgent

need for Federal-level negotiations with the US

government says ABIMCI.

See: https://abimci.com.br/sem-negociacao-com-os-eua-medidas-

governamentais-nao-resolverao-a-crise-no-setor-madeireiro/

Advancing Atlantic forest restoration

Minas Gerais has achieved 74% of its target for Atlantic

Forest restoration with the planting of 5,1 million native

species seedlings out of the 7 million goal set to be planted

by December 2026.

This initiative is part of the Atlantic Forest Treaty signed

in 2023 by the South and Southeast Integration

Consortium (Cosud) which sets a collective goal of

planting 100 million seedlings and restore 90,000 hectares

by 2026 across states of Minas Gerais, Espírito Santo, São

Paulo, Rio de Janeiro, Paraná, Santa Catarina and Rio

Grande do Sul.

This progress is the result of integrated management led

by the State Secretariat for Environment and Sustainable

Development (Semad) which coordinates monitoring,

accounting and plannig with different governmental

agencies and partner institutions.

In addition to meeting legal and environmental

commitments the State’s efforts foster the creation of

ecological corridors which contribute to biodiversity

conservation, facilitate wildlife movement and strengthen

ecosystem services.

Minas Gerais State holds the largest area of Atlantic Forest

in Brazil consolidating its role as a national leader in

ecological restoration and climate change mitigation,

strengthening the alignment between sustainable

development and environmental conservation.

See: https://www.remade.com.br/noticias/20869/minas-avanca-

no-reflorestamento-e-ultrapassa-70-por-cento-da-meta-de-

restauracao-da-mata-atlantica

Export update

In July 2025 Brazilian exports of wood-based products

(except pulp and paper) increased 1.5% in value compared

to July 2024, from US$301.4 million to US$305.9 million.

Pine sawnwood exports increased 16% in value between

July 2024 (US$53.6 million) and July 2025 (US$62.3

million). In volume, exports increased 16% over the same

period, from 228,600 cu.m to 265,200 cu.m.

Tropical sawnwood exports increased 15% in volume,

from 25,000 cu.m in July 2024 to 28,800 cu.m in July

2025. In value, exports increased 2.6% from US$11.4

million to US$1.7 million over the same period.

Pine plywood exports increased 3.5% in value in July

2025 compared to July 2024, from US$59.2 million to

US$61.3 million. In volume, exports increased 14% over

the same period, from 170,800 cu.m to 194,700 cu.m.

As for tropical plywood, exports increased in volume 47%

and 64% in value, from 1,900 cu.m and US$1.1 million in

July 2024 to 2,800 cu.m and US$1.8 million in July 2025,

respectively.

The value of wooden furniture exports increased from

US48.6 million in July 2024 to US$54.2 million in July

2025 an increase of 11.5%.

Amazonian countries to protect the Amazon

Studies conducted by the Scientific Panel for the Amazon

(SPA), the Amazon Waters Alliance (AAA), the Northern

Amazon Alliance (ANA) and the Amazon Network of

Georeferenced Socio-Environmental Information (RAISG)

warn that the loss of biological connectivity threatens vital

functions of the biome, including moisture transport,

rainfall regulation, carbon storage and biodiversity. This

directly affects the health, food and water security,

livelihoods and traditional knowledge of more than 47

million inhabitants of the region.

According to ANA and RAISG data, by 2022 about 23%

of the Amazon biome (193 million hectares) had already

completely lost its ecological connectivity while 13% (108

million hectares) showed significant degradation.

The four socio-environmental networks delivered a

strategic document to the governments of Amazonian

countries and to the Amazon Cooperation Treaty

Organization (ACTO) with recommendations to protect

the ecological, hydroclimatic and sociocultural

connectivity of the Amazon.

The initiative is in the context of the Amazon Dialogues,

preparatory to the Amazon Presidents’ Summit and the

UNFCCC COP30, highlighting the importance of joint

action for conservation and climate mitigation.

The networks propose establishing a technical-scientific

working group to develop a methodology for monitoring

and implementing programmes to protect and restore

connectivity in the Amazon.

See: https://www.socioambiental.org/noticias-

socioambientais/governos-amazonicos-sao-convocados-liderar-

um-pacto-pela-conectividade-do

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See: https://www.itto-

ggsc.org/static/upload/file/20250819/1755566095153001.pdf

9. PERU

Wood

product exports weakened yet again

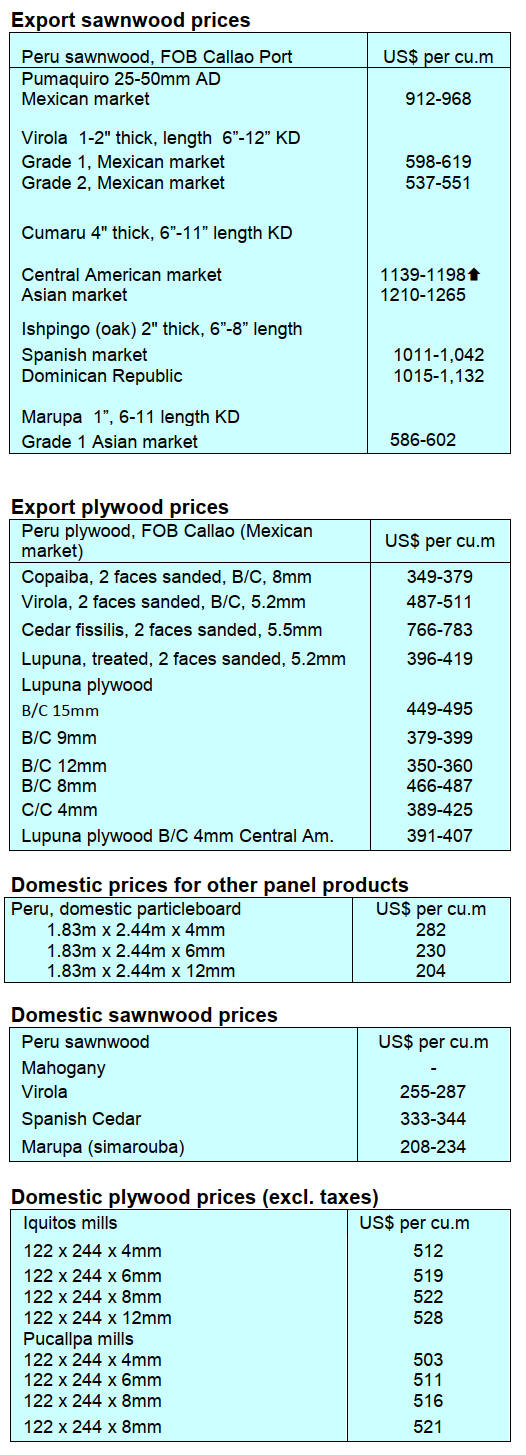

Shipments of wood products totalled US$32.48 million

during the first five months of 2025 representing a year on

year decrease of 20% according to the Center for Global

Economy and Business Research of the CIEN-ADEX

Exporters Association.

According to figures from the ADEX Trade Intelligence

System exports included sawnwood (US$12.7 million),

semi-manufactured products (US$9.5 million), firewood

and charcoal (US$3.5 million), furniture and parts

(US$2.3 million) and construction products (US$1.9

million).

The leading destination was the Dominican Republic with

shipments abroad totalling US$6.4 million a 20% increase

compared to the previous year. The United States followed

with US$4.8 million, a decrease of 25% compared to

2024, France with US$3.9 million, a decrease of 40%,

Mexico with US$3.6 million, a decrease of 16% and

rounding out the top 5 is Vietnam with sales of US$3.4

million, an increase of 52%.

Veneer and plywood exports continue to grow

According to information provided by the Services and

Extractive Industries Department of the Association of

Exporters (ADEX), veneer and plywood shipments during

the period January-June 2025 reached an FOB value of

US$1.5 million, a positive change (+56%) compared to the

same period in 2024.

The main market for this sub-sector was Mexico which

accounted for a 41% share and a positive change of 7%

compared to the same period in 2024, followed by

Ecuador with a 33% share. In third place was Colombia

with an 8% share then the Dominican Republic with a 7%

share and rounding out the Top Five was Costa Rica with

a 3% share.

SERFOR and ANIN agreement on restoration projects

The National Forestry and Wildlife Service (SERFOR)

and the National Infrastructure Authority (ANIN) signed

an inter-institutional cooperation agreement to implement

joint actions aimed at restoring degraded forest ecosystems

and promoting natural infrastructure interventions.

This agreement marks a milestone in disaster management

and the promotion of climate-smart investment

contributing to the implementation and sustainability of

projects, investment programmes and natural

infrastructure interventions led by ANIN helping to close

the gap in the area of degraded forest ecosystems.

The Executive Director of SERFOR is quoted as saying

“Conserving our ecosystems is not only an environmental

issue, but also an effective strategy to protect our

communities. Today we are talking about 14 viable

restoration projects in 17 watersheds exposed to the El

Niño phenomenon.

This represents more than 60,000 hectares of land under

restoration, which translates into local employment,

sustainable production chains, the use of native species

and, above all, more opportunities for investors,

companies and communities to work together to build a

more resilient country”.

Forest Management with participation of indigenous

groups

The Ucayali Regional Government, in coordination with

the National Forest and Wildlife Service (SERFOR), held

the first Forest Management (FM) awareness workshop in

the Amazonian Department with the participation of 12

leaders of indigenous organisations.

The president of the Ucayali Regional Organization of

Amazonian Nationalities (ORNAU) emphasised: "It is

important to understand the forest management process as

it will allow us to know when we can develop our forestry

activities and how to continue conserving our forests

within our territories."

Ucayali is the second department to begin establishing

Forest Management Units (FMUs), geographic areas that

serve as a basis for organising, planning and managing the

use of forests and wildlife. Each FMU clearly defines what

activities can be carried out in communal territories, such

as forest harvesting, conservation or the development of

forest plantations.

See: https://www.gob.pe/institucion/serfor/noticias/1231011-

ucayali-impulsa-el-ordenamiento-forestal-con-participacion-de-

organizaciones-indigenas

|