|

Report from

Europe

Rise in UK tropical wood and wooden furniture imports

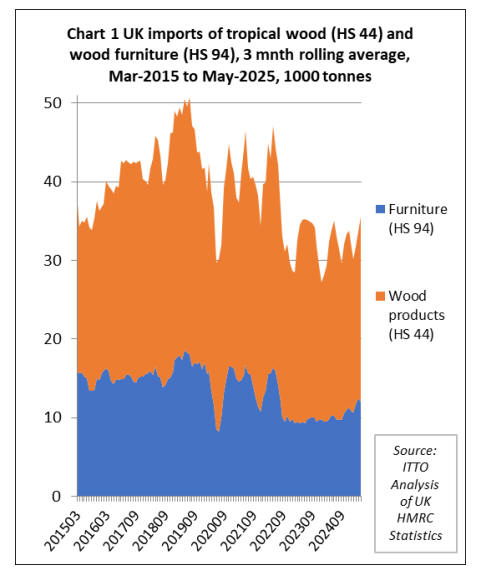

In the first five months of this year the UK imported

168,200 tonnes of tropical wood and wooden furniture

products, 5% more than same period in 2024.

Import value in the first five months this year was US$442

million, 8% more in nominal terms (not accounting for

inflation) than the same period in 2024. Although imports

were slow in the first quarter this year, down 6% in

quantity terms compared to the final quarter of 2024, they

strengthened in April and May (Chart 1).

The overall rise in imports of tropical wood products in

the first five months of this year has been driven mainly by

wooden furniture and joinery products. There were only

marginal gains in imports of tropical sawnwood and

mouldings/decking, while imports of tropical plywood

have weakened once more.

Underlying the import gains are some improving signals

from the UK economy. The first quarter saw a stronger-

than-expected start, with 0.7% growth.

The U.K. has also managed, so far, to steer clear of the

trade wars after deciding not to retaliate against the U.S.

tariffs and reaching an early trade agreement with the

Trump Administration.

Construction sector indices for the UK, while pointing to

only moderate growth, are also more favourable than other

large European economies. The ‘Summer 2025 UK

Construction Market View’ report published on 30 June

by Arcadis, a global design and consultancy firm for

natural and built assets, includes a cautiously optimistic

outlook, with several key sectors beginning to scale up,

and projections suggesting that the construction industry is

growing faster than the wider economy.

The Arcadis report observes that “while sticky inflation

may slow the rate of interest rate cuts, there are early,

tentative signs of recovery. Orders have regained some

lost momentum, and industry sentiment is improving”.

Less positive is the news on consumer confidence in the

UK which took a sharp downturn in Q2 2025, according to

Deloitte’s latest Consumer Tracker, falling by 2.6% to

10.4%, which is the lowest level recorded since early

2024. The drop marks the first significant dip in sentiment

since October 2022, when inflation hit a 40-year high.

According to Deloitte “This drop in confidence signals a

weakening of consumers’ resilience, as concerns of a

slowing labour market have left consumers worried about

job security and income growth prospects, while persistent

inflation and a high cost of living have negatively

impacted sentiment towards personal debt.”

See:

https://www.arcadis.com/en-gb/news/europe/united-

kingdom/2025/6/arcadis-releases-summer-2025-uk-construction-

market-view-report

and

https://www.deloitte.com/uk/en/Industries/consumer/research/co

nsumer-tracker.html

Rise in UK imports of wooden furniture from tropical

continues

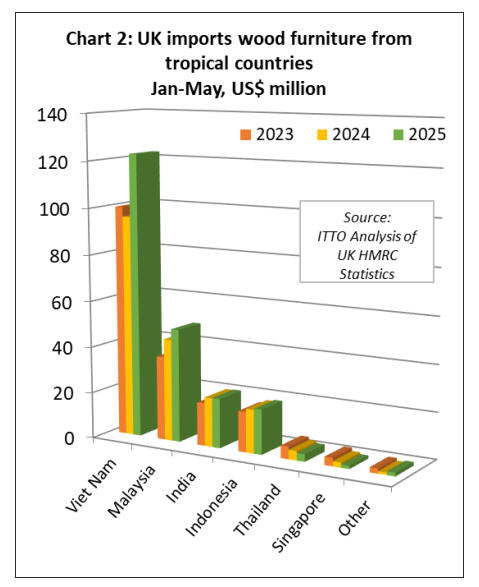

In the first five months of this year UK imports of wooden

furniture from tropical countries increased 17% to US$219

million while import quantity increased 16% to 57,900

tonnes. Tropical wooden furniture imports in the five-

month period increased particularly sharply from Vietnam

(+28% to US$123 million) and Malaysia (+11% to US$48

million), building on the momentum that built up in the

second half of last year. Imports increased at a slower pace

from India (+1% to US$21 million), and Indonesia (+3%

to US$19 million).

However, imports declined from Thailand (-20% to

US$3.2 million), and Singapore (-34% to US$1.4 million).

UK wooden furniture imports were negligible from all

other tropical countries during the first five months of this

year (Chart 2).

UK imports of tropical wood joinery products rise

sharply from Asia

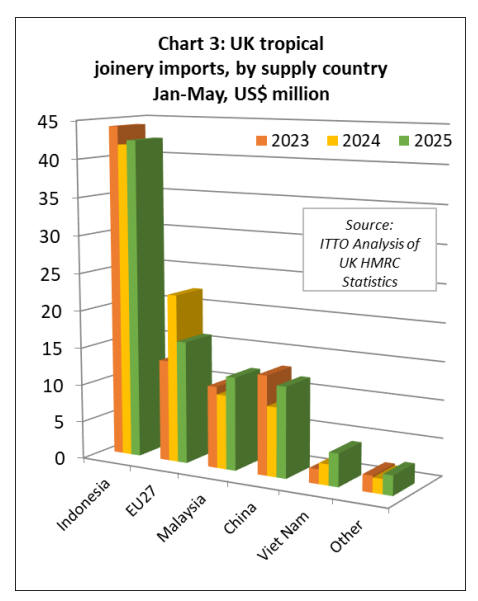

Total UK import value of tropical joinery products

increased 2% to US$90 million in the first five months of

2025 and import quantity increased 7% to 31,800 tonnes.

Following a big increase in 2024, imports of these

products from the EU fell 27% to US$16 million in the

first five months of this year.

However, this was compensated by rising imports from

Malaysia (+26% to US$26 million), China (+31% to

US$12 million) and Vietnam (+58% to US$4.4 million).

Imports from Indonesia were US$42 million during the

five-month period, the same level as last year (Chart 3).

Large increase in UK imports of plywood from

Malaysia

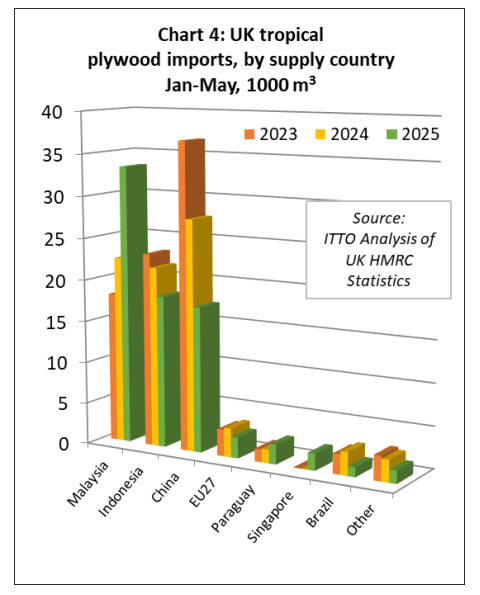

In the first five months of this year, the UK imported

78,600 cu.m of tropical hardwood plywood, 4% less than

the same period last year. Import value fell more sharply,

by 8% to US$45 million. However, this was mainly due to

a decline in imports from China and the EU.

Direct UK imports of hardwood plywood from tropical

countries increased 15% to 58,700 cu.m in the five-month

period. Imports were up 49% to 33,400 cu.m from

Malaysia and up 43% to 2,400 cu.m from Paraguay. They

also increased from zero to 2,000 cu.m from Singapore.

These gains offset declines of 16% to 18,200 cu.m from

Indonesia and of 58% to 1,200 cu.m from Brazil. The UK

imported 17,400 cu.m of plywood with an outer layer of

tropical hardwood from China in the first five months of

this year, 37% less than in the same period last year. UK

imports of tropical hardwood plywood from EU countries

were also down, by 27% to 2,500 cu.m during this period.

(Chart 4).

Republic of Congo takes larger share of UK tropical

sawnwood market

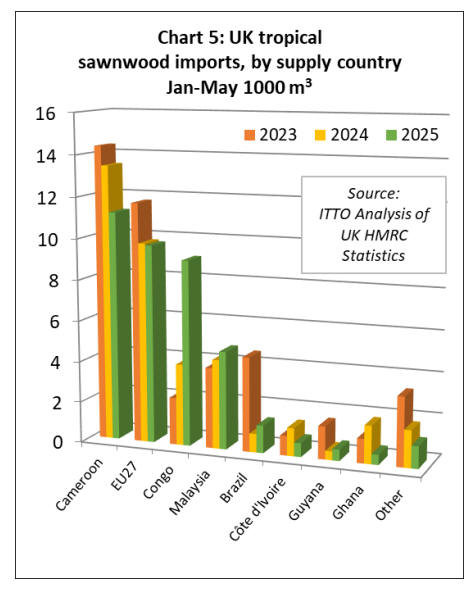

UK imports of tropical sawnwood were 38,800 cu.m in the

first five months of this year, 3% more than the same

period last year. Import value also increased by 3% to

US$48 million during the period. The most notable trend

this year has been a sharp rise in imports from the

Republic of Congo which increased 128% to 9,100 cu.m

in the first five months of this year.

Less dramatic increases were recorded in imports from

Malaysia (+10% to 4,800 cu.m), Brazil (+1% to 1,300

cu.m), and Guyana (+28% to 500 cu.m).

Meanwhile imports from Cameroon, still the largest

supplier to the UK but now only just ahead of the Republic

of Congo, were down 17% to 11,200 cu.m in the first five

months of this year. Indirect imports from the EU were

9,700 cu.m, 1% less than the same period last year.

(Chart5).

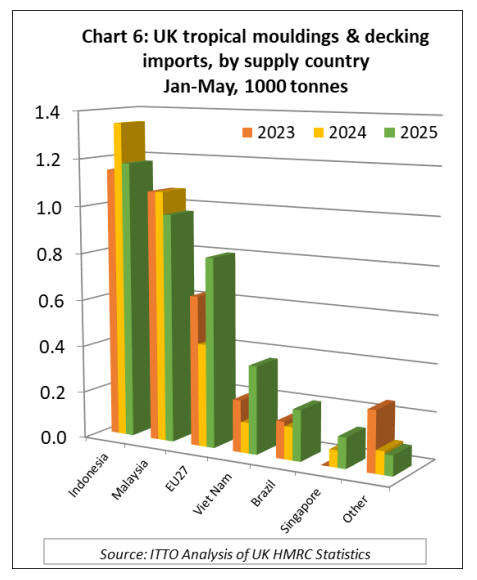

UK imports of tropical hardwood mouldings/decking

increased 7% to 3,800 tonnes in the first five months of

this year. Import value was up 6% to US$10.6 million.

Much of the gain was due to a rise in imports from EU

countries, up 83% to 800 tonnes, and from Vietnam which

gained 187% to 400 tonnes during the five-month period.

UK imports of this commodity from Indonesia fell by 13%

to 1,200 tonnes and were down 9% from Malaysia to

1,000 tonnes (Chart 6 above).

Marginal gain in tropical share of UK wood product

imports

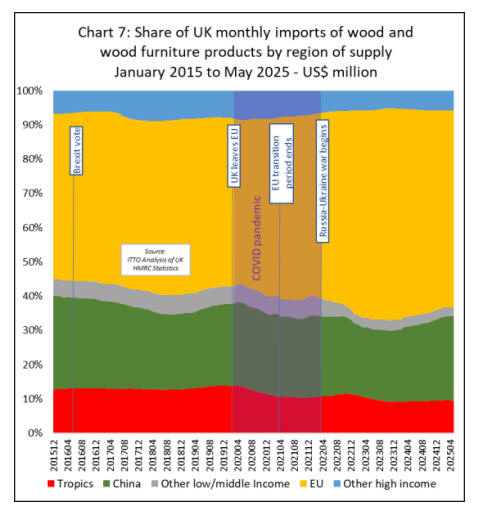

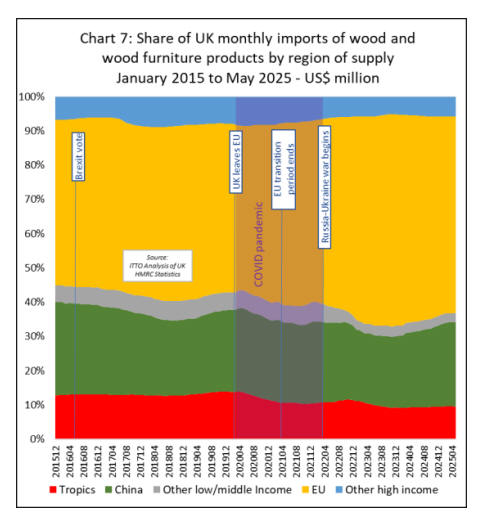

The UK market for tropical wood and wooden furniture

products in the first five months of this year performed

marginally better than the wider UK market for wood and

wooden furniture products.

In real terms (accounting for inflation), total UK import

value of these products increased 4% to US$4.57 billion in

the first five months of 2025, while the value of tropical

product imports increased by 5% to $442 million during

this period.

The share of tropical wood and wooden furniture products

in total UK imports increased slightly from 9.6% in the

first five months of 2024 to 9.7% during the same period

this year. However, it was still down on the 11.4% share

achieved in 2022 and the close to 14% share typical before

the COVID pandemic (Chart 7).

UK imports of this commodity from Indonesia fell by 13%

to 1,200 tonnes and were down 9% from Malaysia to

1,000 tonnes (Chart 6 above).

Marginal gain in tropical share of UK wood product

imports

The UK market for tropical wood and wooden furniture

products in the first five months of this year performed

marginally better than the wider UK market for wood and

wooden furniture products.

In real terms (accounting for inflation), total UK import

value of these products increased 4% to US$4.57 billion in

the first five months of 2025, while the value of tropical

product imports increased by 5% to $442 million during

this period.

The share of tropical wood and wooden furniture products

in total UK imports increased slightly from 9.6% in the

first five months of 2024 to 9.7% during the same period

this year. However, it was still down on the 11.4% share

achieved in 2022 and the close to 14% share typical before

the COVID pandemic (Chart 7).

|