US Dollar Exchange Rates of

25th

July

2025

China Yuan 7.17

Report from China

OSB consumption Guideline

An Oriented Strand Board (OSB) Consumption Guideline

has been released. This Guideline helps consumers

understand OSB through simple language and pictures.

The Guideline elaborates on OSB characteristics and

applications, key qualities and environmental protection

indicators. Also presented are inventories of major

manufacturing enterprises in terms of product

classification, quality identification, environmental

protection indicators and purchase information.

The release of the Guideline is of significance for

regulatingthe OSB market and guiding consumers to

consume rationally. It provides consumers with a scientific

and practical basis for selection which helps enhance their

self-protection and prevents them from being misled. At

the same time it also promotes the orderly development of

the OSB industry and creates a favorable market

environment.

It is believed that the OSB industry will embrace new

development opportunities. It is expected that consumers

will pay more attention to this type of board, enhance

market awareness and acceptance and thereby fully

unleash the value and application potential of OSB.

See:

https://ishare.ifeng.com/c/s/v002507vnqfpcG9ShdNR9NGbSFeQ

Gnm--X-_r-_ofNx4l3JyT4__

Wooden furniture via China-Europe freight trains

Buying globally and selling globally, in Nankang District,

Ganzhou City, Jiangxi Province, relying on the China-

Europe freight trains, a furniture industry with an output

value of over RMB280 billion is booming.

The Ganzhou International Land Port Station accepts

China-Europe freight trains with European spruce and fir.

Nankang was neither along the border nor by the sea. In

the past it took three months to transport timber from

Russia at a cost as high as RMB4,000 per cubic metre.

Today, relying on the China-Europe freight trains, the

transport time has been shortened to 14 days and the

overall logistics cost has been reduced by 18%.

Relying on the "port + bonded + cross-border" linkage

model of Ganzhou International Land Port, Nankang

furniture has appeared in international markets.

It has been exported to countries in Europe, America,

Southeast Asia, Central Asia and the Middle East with

overseas orders signed exceeding RMB5 billion in 2024.

Nankang has successfully established a complete

industrial supply chain integrating wood trading, design

and research and development, intelligent manufacturing

and logistics distribution. There are over 10,000 furniture

enterprises and more than 500,000 employees in Nankang.

In 2024 the Ganzhou International Land Port has operated

over 1,600 China-Europe (Asia) freight trains covering

more than 100 cities in five Central Asian countries and

over 20 European countries.

Wood-based panel industry in first half 2025

According to the Industrial Development Planning

Institute of the National Forestry and Grassland

Administration, China's plywood industry has declined in

terms of number of enterprises but there has been an

increase in total production capacity.

The fibreboard industry shows a trend of a decline in the

number of enterprises and a continued contraction in total

production capacity.

The particleboard industry has witnessed a slight decline

in the number of enterprises and a slowdown in the growth

of total production capacity in the first half of 2025.

By the end of June 2025, there were around 5,200

plywood product manufacturing enterprises in China

distributed across 26 provinces (municipalities and

autonomous regions), a decrease of approximately 800

enterprises compared to the end of 2024. The total

production capacity is approximately 248 million cubic

metres per year, representing a 12% increase compared to

the end of 2024.

In the first half of 2025 three fibreboard production lines

(including one continuous flat press line) was completed

and put into operation adding a production capacity of

520,000 cubic metres per year.

By the end of June 2025 228 fibreboard manufacturing

enterprises in China had 252 fibreboard production lines

and the factories were distributed across 21 provinces

(municipalities and autonomous regions) with a total

annual production capacity of 40.64 million cubic metres.

The net reduction in fibereboard production capacity was

1.19 million cubic metres representing a further decrease

of around 3% compared to the end of 2024.

Of the factories, there were 122 continuous flat pressure

lines with a combined production capacity of 27.42

million cubic metres per year.

The fibreboard industry showed a further downward trend

in the number of enterprises, production lines and total

production capacity. There are five fibreboard production

lines under construction across the country with a

combined annual production capacity of 1.18 million

cubic metres.

In the first half of 2025 9 particleboard production lines

(including 7 continuous flat pressing lines) were put into

operation adding production capacity of 3.27 million cubic

metres per year.

At the end of June this year 298 particleboard

manufacturing enterprises across the country had 323

particleboard production lines distributed in 22 provinces

(municipalities and autonomous regions)with a total

production capacity of 66.76 million cubic metres per

year, a net annual increase of 2.61 million cubic metres.

Among them, there were 149 continuous flat pressure lines

with a combined production capacity of 49.51 million

cubic metres per year and the proportion of total panel

production capacity rose to 74% over the same period of

2024. The particleboard industry shows a trend of a slight

decline in the number of enterprises and production lines

as well as a slowdown in the growth of total production

capacity.

There are 23 particleboard production lines under

construction across the country with a combined

production capacity of 7.05 million cubic metres per year.

The risk of overheated investment in the particleboard

industry still exists.

Strict Standard on formaldehyde emission limits

The State Administration for Market Regulation recently

issued a new national standard for wood-based panels, GB

18580-2025, "Formaldehyde Emission Limits for Indoor

Decoration and Renovation Materials – Wood-based Panel

and its Products". This comes into effect on 1 June 2026

and replaces GB 18580-2017.

The new Standard incorporates E0 and E1 grade standards

into regulatory requirements and further refines the

classification and testing methods for wood-based panel.

The formaldehyde limit indicators have become more

strict.

The new national Standard clearly defines wood-based

panels and products thereof for the first time. In addition

to classification, the new national Standard has also

changed the formaldehyde emission limit to a grading

requirement, uniformly using E0 and E1 grades as the

judgment criteria.

At the same time the testing methods were standardised

and a "small lab method" was added in the production

quality control process making the detection and

management more scientific and rigorous.

Surge in woodchips imports from South Africa

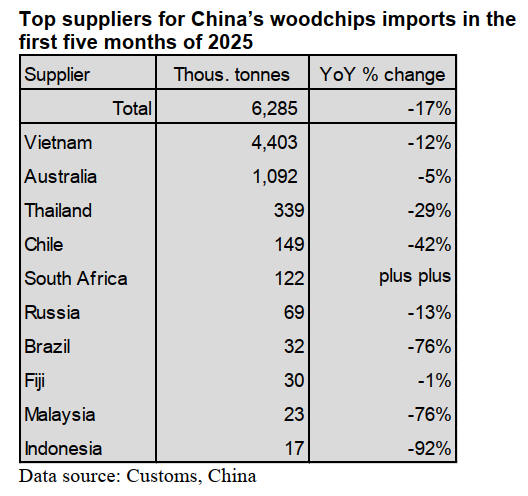

According to China Customs woodchips imports totalled

6.285 million tonnes in the first five months of 2025,

down 17% over the same period of 2024.

Vietnam and Australia are the largest and the second

largest suppliers of China’s woodchips imports,

accounting for 87% of the national total. However,

China’s woodchips imports from Vietnam and Australia

fell 12% and 5% respectively in the first five months of

2025.

China’s woodchips imports from the other top suppliers

except South Africa dropped at a fast pace in the first five

months of 2025. China’s woodchips imports from South

Africa surged in the first five months of 2025.

June Global Timber Indices for China

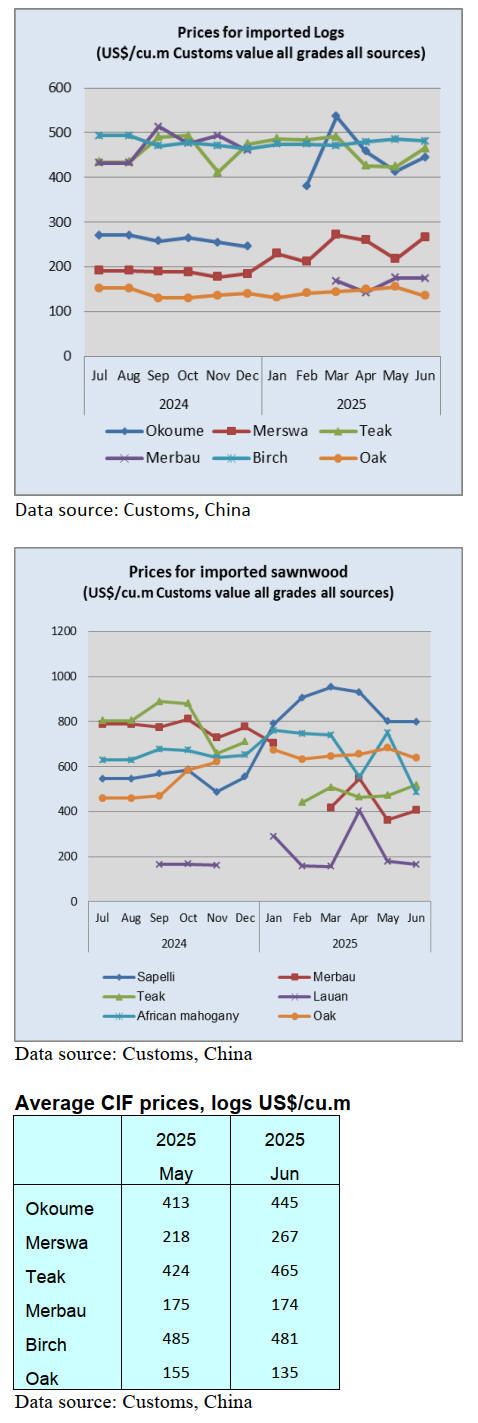

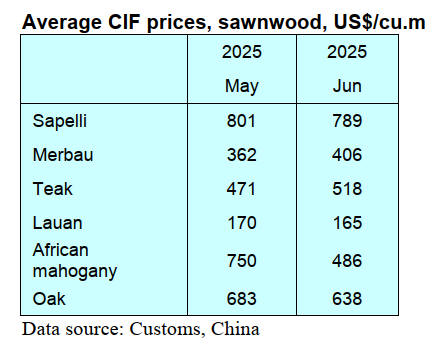

China Customs data shows that in May 2025 total wood

imports reached 4.966 million cubic metres, a 17%

decrease compared to the same period in 2024.

Specifically, log imports stood at 2.961 million cubic

metres, down 18.5% year-on-year, while sawnwood

imports reached 2.005 million cubic metres, down 15%.

It is worth noting that imports of African wood to China

continued to shrink in the first five months of 2025. The

total import volume was 813,700 cubic metres, a 31% year

on year decrease.

On 11 June, China announced that it would implement a

policy of granting 53 African countries having diplomatic

relations with China zero-tariff treatment for all tariff

lines, expanding the scope from 33 countries, with newly

added countries such as Gabon, the Republic of the

Congo, Ghana, Cameroon and Angola.

Wood products would also enjoy zero-tariff treatment

which is expected to boost the export of wood from

African countries to the Chinese market.

Recently, China's plywood industry faced significant

export challenges. On 12 June, the US Department of

Commerce announced the initiation of antidumping duty

and countervailing duty investigations on hardwood and

decorative plywood from China, Indonesia and Vietnam.T

he preliminary antidumping duty rate for Chinese products

was set at 504.07%, far exceeding the rates of 138.04% -

152.41% for Vietnamese products and 84.94% for

Indonesian products.

On 10 June the European Commission officially

announced a preliminary affirmative determination in the

antidumping duty investigation of hardwood plywood

from China. Except for an enterprise subject to a 25.1%

provisional antidumping duty, other Chinese companies

face a rate of 62.4%.

In June 2025 the GTI-China index registered 57.5%, a

decrease of 0.1 percentage point from the previous month

and has been above the critical value (50%) for 4

consecutive months indicating that the business prosperity

of the timber enterprises represented by the GTI-China

index expanded from the previous month. In June, China's

timber sector still saw an upward trend on both production

and consumption; however, the expansion was not so

obvious.

As for the sub-indexes, all the twelve indexes were above

the critical value of 50%. Compared to the previous month

the index for inventory of finished products increased by

0.2 percentage point while the indexes for production, new

orders, export orders, existing orders, purchase quantity,

purchase price, import, inventory of main raw materials,

employees, delivery time and market expectation declined

by 0.2-1.7 percentage point(s).

See: https://www.itto-

ggsc.org/static/upload/file/20250716/1752653872183995.pdf

|