Japan

Wood Products Prices

Dollar Exchange Rates of 25th

July

2025

Japan Yen 147.65

Reports From Japan

Ruling coalition looses its majority

At the recent election Japan's ruling coalition lost its

majority in the country's Upper House. Having already lost

its majority in Japan's more powerful lower house last

year, the defeat will undermine the coalition's influence.

The LDP/Komeito centre-right coalition has governed

Japan almost continuously for decades.

Obserevrs say the election result underscores highlights

voter frustration with the administration that has struggled

against economic headwinds, a cost-of-living crisis and

trade difficult negotiations with the United States.

.

See: https://www.bbc.com/news/articles/c8xvn90yr8go

An agreement in principle

Japan and the United States reached a trade deal with the

“reciprocal” tariff rate set at 15%. There is little

information on sector-specific tariffs.

The local media reported the overall tariff rate on

automobiles will be 15%. The US has claimed this deal

will create thousands of jobs in the US adding that Japan

will open their market to US cars and trucks, rice and

certain other agricultural products.

The Japanese Prime Minister said at a news conference

that he believes this will contribute to Japan and the

United States working together to create jobs and promote

high-quality manufacturing, thereby fulfilling various

roles on the global stage.

Tsutsui Yoshinobu, head of Japan's leading business

lobby, welcomed the trade agreement with the United

States but voiced concern over the current state of the

global economy.

Tsutsui Yoshinobu became the new chairman of the Japan

Business Federation, (Keidanren) in late May.

Tsutsui said that he highly evaluated the terms of the

bilateral deal. But he added it came at a time when the

world is at a major turning point with the Japanese

economy facing many challenges.

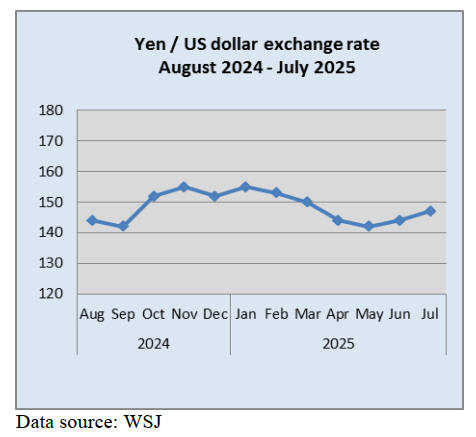

When the tariff agreement was announced Japan’s

benchmark Nikkei 225 stock index rose about 2% and the

yen strengthened.

Shinichiro Kobayashi, Principal Economist at Mitsubishi

UFJ Research and Consulting said the deal is positive as it

has removed uncertainty it provides only brief relief as

tariffs remain at higher levels than before threatening

recovery in Japan's inflation-plagued economy.

A senior economist at Daiwa Institute of Research says the

trade agreement between Japan and the US will hurt

Japan's economy and that the impact of tariffs on trade

with the US may reduce Japan's GDP by 1.1% in real

terms this year.

See:

https://www.japantimes.co.jp/business/2025/07/23/economy/us-

japan-trade-deal-trump/

and

https://mainichi.jp/english/articles/20250724/p2g/00m/0bu/0290

00c

EU and Japan to expand trade ties

The European Union and Japan have agreed a so-called

“competitiveness alliance” to expand bilateral trade ties,

promote business cooperation and explore ways to

diversify critical mineral supply chains. This comes as

both sides face increased economic pressure from the US.

The alliance, which will also include an “upgraded”

economic dialogue in a format similar to what are known

as two-plus-two talks involving senior officials, was

among a series of agreements reached.

The European Commission commented “Together, Europe

and Japan represent a fifth of global GDP and a market of

600 million people, so we have the scale to shape global

rules on trade and technology in line with our values of

fairness and openness”.

The alliance framework rests on three pillars: increasing

bilateral trade, strengthening economic security and

working together more closely on innovation as well as the

green and digital transitions.

The partners also agreed to step up coordination and

jointly lead international discussions, for example, by

steering trade-related talks at meetings of the World Trade

Organization (WTO) and through the expanded economic

dialogue, which will now include Stephane Sejourne, the

EU Commission’s Executive Vice President for Prosperity

and Industrial Strategy. The two sides will aim to identify

strategic goods and sectors, while addressing economic

coercion and nonmarket policies and practices.

Under their new alliance, Japan and the EUs also plan to

simplify and streamline rules to reduce administrative

burdens for Japanese and European businesses and citizens

while deepening industrial policy cooperation and

facilitating investment and business collaboration.

Other objectives of the new framework include promoting

and protecting critical and emerging technologies,

enhancing research security as well as the physical and

cybersecurity of critical infrastructure.

Finally, the EU's new ‘Competitiveness Compass’

positioned innovation, decarbonisation and dependency

reduction as growth pillars where Japan emerges as the

bloc’s “natural technological and values-based partner.

EU-Japan relations are based on a strategic partnership

agreement and a free-trade deal that has been in force

since 2019. EU firms already export nearly €70 billion

(US$81.8 billion) in goods and €28 billion (US$32.7

billion) in services to Japan every year.

See:

Ahttps://www.japantimes.co.jp/business/2025/07/23/economy/ja

pan-eu-economic-

cooperation/?utm_source=pianodnu&utm_medium=email&utm_

campaign=72&tpcc=dnu&pnespid=_ehpmdie_kfi_kayq0_27p4k

vq8msjfshwa4bvi6t0cvzvkziz5q9v6roxs8vohynddewq

Bank of Japan holds rates steady

The yen strengthened slightly after the Bank of Japan

(BoJ) maintained its stance on interest ratesat the end of

July however, the BoJ did raise its inflation forecast for

the current fiscal year. At the end of July the yen was at

between 145-149 against the US dollar.

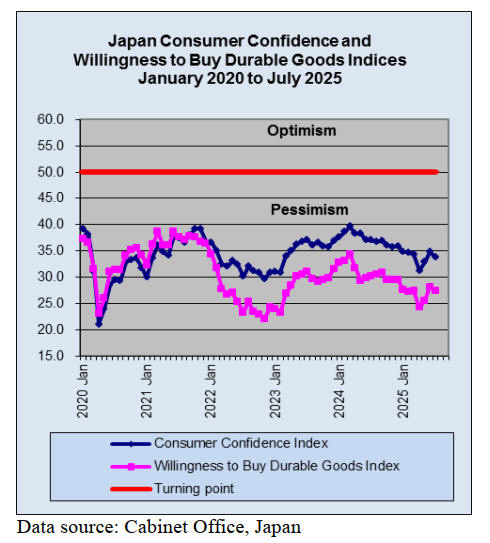

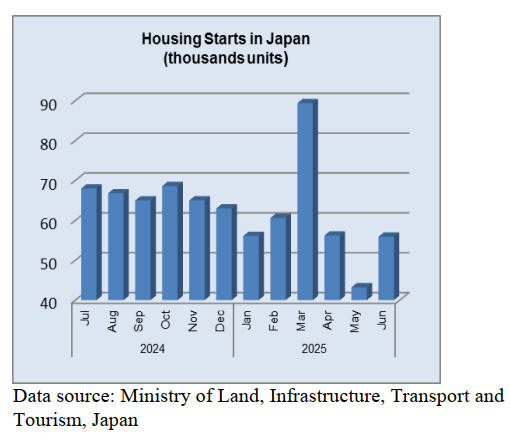

Volatility in the housing sector

In April 2025 housing starts plummeted to 56,188 units, a

37% drop from March's unusual surge and marked a 27%

year-on-year decline. This sharp reversal from March

underscores the fragility of a sector now caught between

cyclical volatility and an irreversible slowdown.

Japan's housing crisis is rooted in its shrinking population.

With 8 million abandoned homes (14% of total housing

stock) and projections of over 20 million vacant units by

2033. Even if immigration reforms attract 800,000 foreign

workers by 2029 this will barely offset annual population

losses.

Fewer households mean fewer buyers and it gets worse

overtime as construction costs continue to rise due to

labour shortages. Real estate prices, up almost 3% in early

2024 have stagnated after inflation adjustments. This

“price ceiling” traps developers in a low-margin, high-risk

situation, say analysts.

The AInvest website comments that “Japan's housing

market is entering a “new normal” of low starts, over-

supply and demographic decline”.

See: https://www.ainvest.com/news/japan-collapsing-housing-

market-navigating-structural-decline-cyclical-volatility-2505/

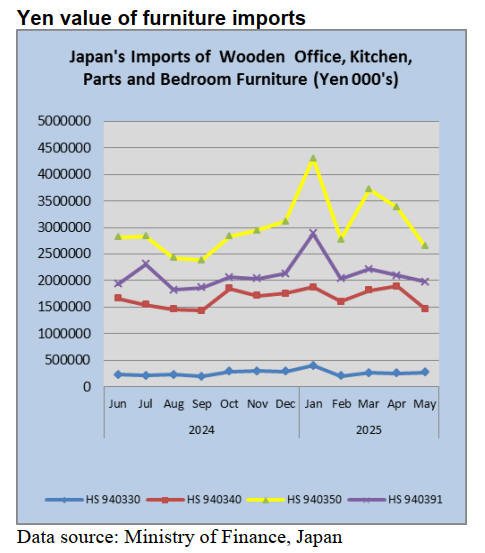

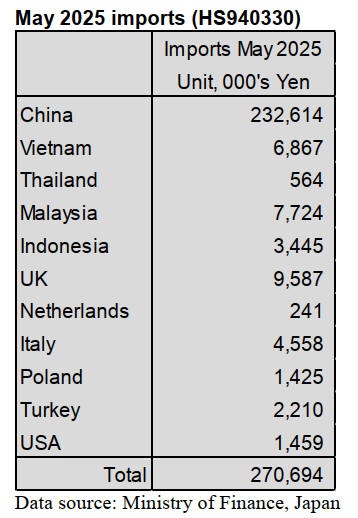

May wooden office furniture imports (HS940330)

In May shippers in China accounted for 86% of Japan’s

imports of wooden office furniture (HS940330) the other

significant sources were the UK (45%) and Malaysia

(3%). May shipments from suppliers in China were up

11% while those from shippers in Malaysia were down

around 6% month on month. Shippers in the UK were a

new addition to sources in May.

These three shippers accounted for over 90% of May

arrivals. The other source of wooden office furniture

imports was EU member countries (around 9%) with the

balance coming from Italy and Vietnam.

Year on year, the value of Japan’s imports of wooden

office furniture in May were down 9% but compared to

the value of April arrivals there was an 8% increase.

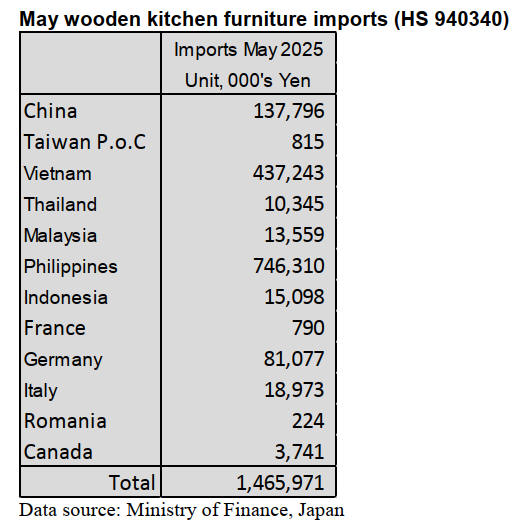

May wooden kitchen furniture imports (HS940340)

As in previous months imports of wooden kitchen

furniture (HS940340) were dominated by shippers in the

Philippines and Vietnam which together accounted for

over 80% of the value of May arrivals.

Shippers in the Philippines accounted for around 51% of

total arrivals in May, down 6% from a month earlier.

Imports from shippers in Viet Nam accounted for a further

30% also down sharply (20%) month on month.

May arrivals from China were at around the same level as

in April but arrivals from Germany, previously a

significant supplier of HS940340, drooped over 50%.

Year on year there was 10% decline in the value of

wooden kitchen furniture imports and compared to the

values of April arrivals there was a 22% decline.

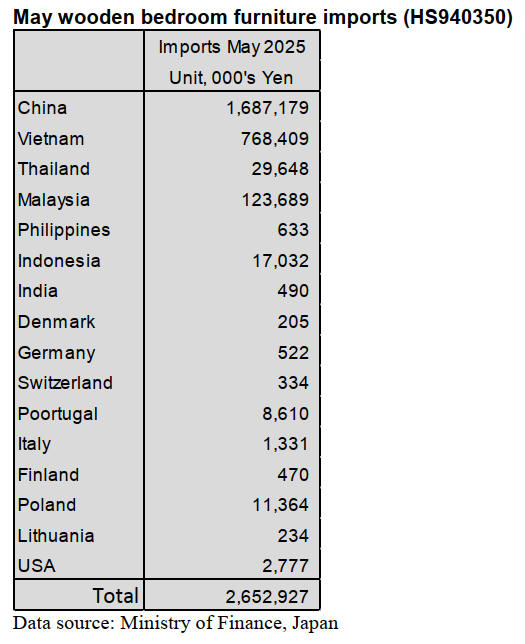

May wooden bedroom furniture imports (HS 940350)

May marked a steading of the value of imports of

HS940350 after a volatile start to the year.

The top two shippers of HS940350 to Japan in May were

China, 64% of the total but down 6% month on month and

Viet Nam, 29% but down 37% month on month. Malaysia

and Thaiand were the other shippers of note in May

together accounting for around 6% of the value of arrivals.

Year on year there was a 19% decline in the value of

wooden bedroom furniture in May and compared to April

arrivals in May were down 22%.

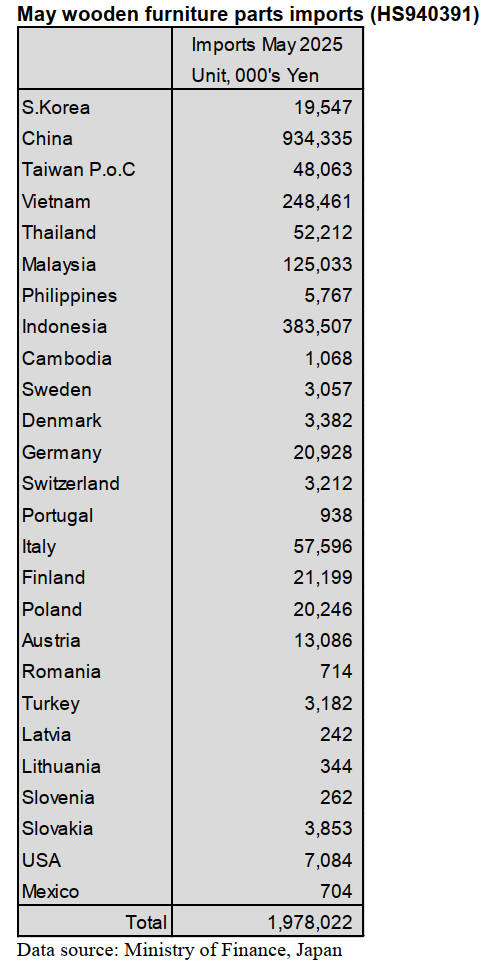

May wooden furniture parts imports (HS 940391)

In May there was a further decline in the value of wooden

furniture parts imports and this was the second monthly

decline. The value of May 2025 imports was almost the

same as in April 2024 and compared to May 2024 there

was little change.

Shippers in China, Indonesia, Viet Nam and Malaysia

accounted for most of Japan’s imports of wooden furniture

parts (HS940391) in May 2025. Of the total value of

HS940391 imports 47% was delivered from China (50%

in April) 19% from Indonesia (17% in April March), 12%

from Viet Nam (13% in April) and Malaysia which

secured a 5% share of May imports.

The value of imports of HS940391 from Italy and

Germany rose in May and there was a rise in the value of

imports from the US.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Russian lumber becomes the third major raw material

APT-Shinko Co., Ltd. in Toyama Prefecture, one of major

red pine lumber manufacturers in Japan, has announced its

plan to position Russian red pine lumber as a “third raw

material.” Alongside lumber sourced from semi-processed

boards, currently considered the second raw material, the

company aims to enhance customer satisfaction by

offering a broader range of Russian sawn timber products.

The company consumes 2,000 cbms of Russian semi-

processed boards monthly and imports 800 – 1,000 cbms

of Russian lumber monthly.

The company exclusively imports 3 or 4 metre, 30 x 40

KD taruki for the Japanese market from Vitim, a Russian

manufacturer and re-sorts the products according to its

own grading standards. At the same time, it has also begun

selling the lumber to other companies that handle general

Russian timber.

Radiata pine lumber from Chile

For the third shipment of Chilean radiata pine lumber

scheduled for July 2025, CMPC, which had previously

shared bulk shipping with Arauco, has shifted its Japan-

bound shipments from bulk vessels to container shipping.

As a result, Arauco became the sole operator of the

shipment.

The two companies had jointly operated shipping services

for over 20 years, but due to a slowdown in international

trade caused in part by the Trump tariffs, CMPC opted for

container shipping this time.

With demand for packaging-grade radiata pine lumber

remaining unclear, all eyes are on whether CMPC will

stick with container shipping. Nonetheless, suppliers plan

to ensure a steady supply.

Orders for house builders

The orders at many major housing companies and house

builders in May, 2025 do not exceed the orders in May,

2024. There is also a reactionary decline following the

increase in orders in March, 2025. However, companies

that put effort into sales promotion were able to attract

more visitors to their showrooms and increase their orders.

Major companies have not yet seen any significant impact

from the March revision of the Building Standards Act,

and it appears that most are proceeding smoothly with

building permit applications. However, there is skepticism

as to whether things will continue without impact going

forward.

While sales of detached houses remain steady in major

metropolitan areas, they have been sluggish in regional

cities. Order trends for multi-unit housing vary across

companies. For some companies, the order value for

multi-family housing has declined by more than 10%

compared to the same month of the previous year. Orders

for renovation projects remained steady. Notably, some

companies recorded around a 10% year-on-year increase

in order value for May.

Domestic lumber and logs

In the Kanto market, the sense of tight supply for green

domestic products is intensifying. 4 m x 90 mm cedar

square lumber is around 35,000 yen, delivered per cbm

and this is 3,000 - 5,000 yen higher than the past few

months. Sawmills are quoting prices in the range 38,000

yen to 40,000 yen, per cbm.

Supply of 3, 3.65, and 4-meter lengths × 13–18 × 45 or 90

mm furring strip has also declined, with central market

prices across the Kanto hovering around 45,000 yen per

cbm - an increase of approximately 3,000 yen over the

past few months.

A growing sense of shortage is also being felt for thin

board (12×150, 180, 225 × 1,820 mm boards).

The central market price has risen to 33,500 - 38,000 yen,

marking an increase of 3,000 - 5,000 yen.

As this is a season when log insect damage is more likely

to demand particularly for medium- diameter logs—has

weakened. Cedar log for post is 15,000 delivered per cbm

in Tochigi Prefecture and this is 1,400 yen more than last

month. In Okayama Prefecture, cypress log for post is

25,500 yen and this is 2,500 yen more than last month.

In Kyushu region, cedar log for post is 16,000 yen,

delivered per cbm. 15,000 – 16,000 yen, delivered per

cbm, in Akita Prefecture. Cypress log for sill is 24,000

yen, delivered per cbm, in Kyushu region and is 23,000

yen, delivered per cbm, in Tochigi Prefecture.

Cypress log for post is 23,800 yen, delivered per cbm,

Tochigi Prefecture and it is 22,400 yen, delivered per cbm,

in Shikoku area.

The price of a log for plywood in Tohoku Region is weak

but prices remain elevated in western Japan. Inquiries for

exporting logs in the southern part of Kyushu region are

sluggish.

|