|

1.

CENTRAL AND WEST AFRICA

Log shortage reported in Cameroon

The immediate challenge in the milling sector is an acute

log shortage say producers. Some major sawmills report

virtually empty log yards forcing reduced shifts or

complete shutdowns. It has been reported that at least

three sawmills in Douala have temporarily ceased

operations and relocated outside the city limits to free up

land for urgent housing construction. Overall industry

sentiment is one of frustration and uncertainty as raw

material supplies remain critically low.

Heavy rains across the country have stalled harvesting

operations, exacerbating an existing log shortage. The

onset of the rain season has brought widespread

downpours, creating impassable conditions on laterite

roads. Transport delays of up to two days from forest areas

to mills have reduced overall throughput.

Rail services continue without major disruption. Container

availability at Douala and Kribi ports remain adequate,

however, berthing issues can delay loading by up to a

week. Shipping lines report Cameroon now loading

roughly 75% of Gabon’s timber volumes, exhasterbating

port congestion.

With 28 presidential candidates now declared ahead of

October elections uncertainty is dampening investment

appetite. Ministerial departures to contest the vote

underscore the volatility. Operators have adopted a “keep

the mills running” stance, deferring serious capital

expansions until the post-election outlook stabilises.

Rain wreaking havoc on road repairs and log haulage

in Gabon

Despite it being the ‘official’ dry season, persistent daily

showers in Libreville and rain further north near the

Cameroon border are wreaking havoc on road repairs and

log haulage. Through late July, operations in the bush

remain constrained by lingering rains as mentioned above,

with many peeling and plywood plants in the Nkok special

economic zone running a single shift.

Persistent downpours continue to render laterite access

roads between Okondja, Makokou, Lastourville and Lope

virtually impassable causing trucks to abandon certain

routes altogether. Operators are pinning their hopes on the

‘true’ dry spell, expected in August, to rebuild log stocks

but anticipate that unhindered timber transport will not

resume until around September.

Despite quiet markets in India and China, demand for

Okoume logs continues with prices around CFA70,000 per

cubic metre delivered to Nkok rising to CFA80,000 for

top-grade logs.

The rail company SETRAG struggles to meet shippers’

needs despite a ministerial directive to prioritise timber. A

fresh infusion of Central African Development Bank funds

should accelerate track and bridge repairs and SETRAG

has already begun replacing wooden sleepers with

concrete.

The two Turkish power-ships have largely stabilised

Libreville’s electricity supply following government

intervention. Outages have fallen from daily multi-hour

cuts to perhaps one brief disruption each week, though

some night-time interruptions of two to three hours persist.

Mill operators report no significant shortages of spare

parts or other critical inputs but they remain wary of

contractual disputes with certain public agencies.

Owendo Port continues to handle timber dispatches

without container shortages though berthing delays of two

to three days recur when grain vessels and roll-on/roll-off

ships occupy quay space. Overall port charges and

customs duties remained unchanged through July.

Since January, every bundle of sawn timber must carry

GPS-verified origin data and as of July forestry inspectors

have begun rigorous cross-checks of both bundle tags and

truck loads in the bush. Any sawntimber truck longer than

13m or carrying logs under minimum diameters (e.g.

Okoume below 70 cm) is subject to immediate seizure. A

new weighbridge facility 150 km from Libreville is due to

become operational in August eliminating most remaining

avenues for non-compliant transport.

The traders in the Middle East report growing competition

from Brazilian pine which is exerting downward pressure

on Okoume prices but orders for Andoung and Iroko

remain healthy.

Heavy rain continues to disrupt road transport in

Republic of Congo

Producers report market activity is relatively quiet. In the

north of the Republic of Congo heavy rains continue to

disrupt overland shipments bound for Kribi and Douala

compounding already weakened production due to muted

Chinese demand. Meanwhile, the southern basin remains

dry but output levels have yet to recover as long‐term

contracts and slow markets keep sawmills operating well

below capacity.

No significant changes were reported in harvesting

volumes or log throughput this period. Road and rail links

to Pointe-Noire continue to operate with spare-part

availability for logging machinery remaining adequate.

Market demand for Congolese sawn timbers and veneers

remains steady but very subdued.

There have been no new forestry regulations, ministerial

decrees or policy announcements affecting timber

production or exports since the last update. With no

significant developments in the forestry and transport

sectors industry participants anticipate that conditions will

remain stable into early August.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

See: https://www.itto-

ggsc.org/static/upload/file/20250716/1752653872183995.pdf

2.

GHANA

Eurobond holders paid

Ghana has made significant progress in fulfilling its debt

service obligations with two debt payments totalling about

US$700 million paid to Eurobond holders in the first half

of 2025 according to the Minister of Finance, Dr. Cassiel

Ato Forson.

When delivering the 2025 Mid-Year Budget Review in

Parliament Dr. Forson affirmed the Government’s

commitment to restoring debt sustainability and

maintaining investor confidence.

The Minister further indicated that GH¢9.8 billion in

domestic coupon payments were also made to Domestic

Debt Exchange Programme (DDEP) bondholders in the

first half of 2025.

Ghana’s total public debt has declined significantly from

GH¢726.7 billion at the end of December 2024 to GH¢613

billion as of end of June 2025. The decline translates into a

negative 16% rate of debt accumulation, improving the

country’s debt-to-GDP ratio from 62% at the end of 2024

to 44% as of June 2025.

Meanwhile, the Monetary Policy Committee (MPC) of the

Bank of Ghana (BoG) has announced that the economy

has seen some significant improvements with a positive

outlook as all macro-economic indicators showed good

results.

President John Mahama, in advance of the recent Budget

Statement, revealed that Ghana’s international reserves

had increased to six months of import cover from the 4.7

months quoted by the Bank of Ghana in April this year..

See: https://www.graphic.com.gh/news/general-news/govt-pays-

700m-to-eurobond-holders-ghc9-8bn-to-domestic-investors.html

and

https://mofep.gov.gh/sites/default/files/budget-statements/2025-

Mid-Year-Fiscal-Policy-Review.pdf

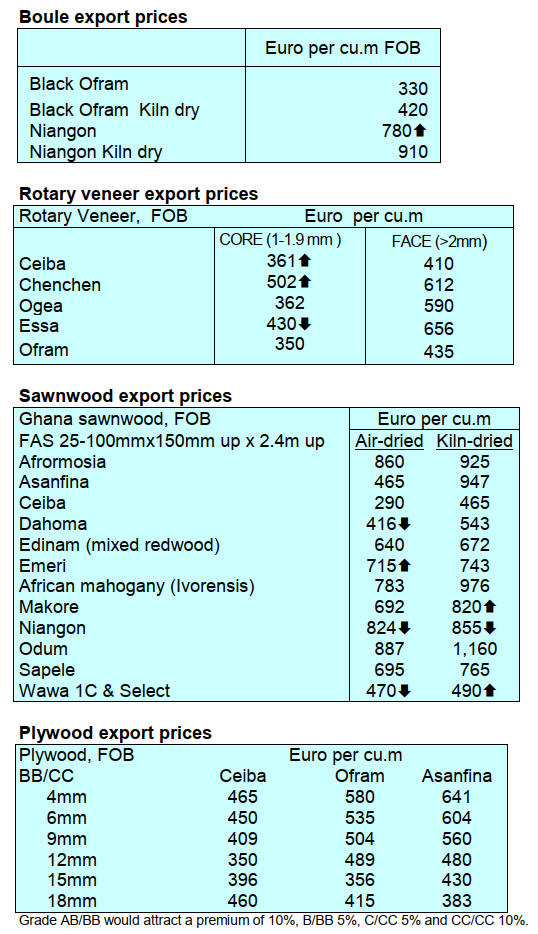

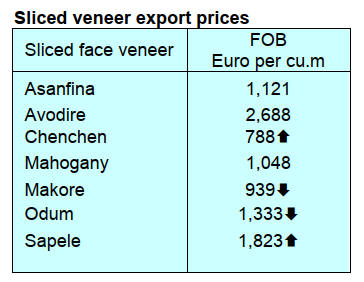

Teak accounted for 85% of sawnwood exports

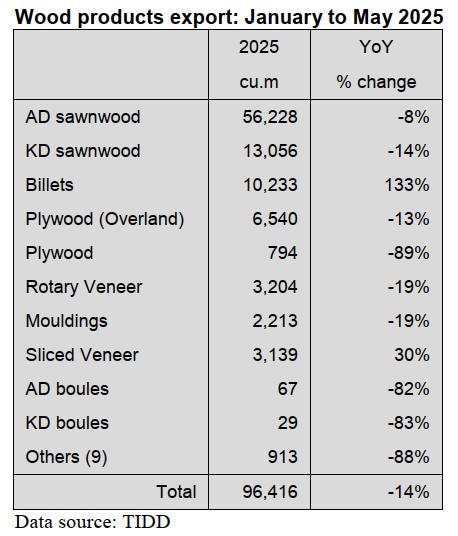

According to the Timber Industry Development Division

(TIDD) of the Forestry Commission, wood product

exports from Ghana during the first five months of 2025

totalled 96,416 cu.m valued at Euro44.84 million

compared to 111,999 cu.m and Euro51.44 million in the

same period in 2024.

This represents a decline of 14% and 13% in volume and

value respectively. During the period, exports of all timber

products declined except for billets and sliced veneer.

Air and kiln dried sawnwood together contributed 69,284

cu.m (72%) of the total export volume for the period

January to May 2025. While for the same period in 2024

these products contributed 76,242 cu.m (68%) of the total

export volume.

The data showed that sawnwood exports in 2025

accounted for 69% of the total value of wood exports for

the period January-May while the contribution of billets

and plywood to regional market exports were 7% and 6%

respectively, 15 other products contributed the balance of

the total exported value.

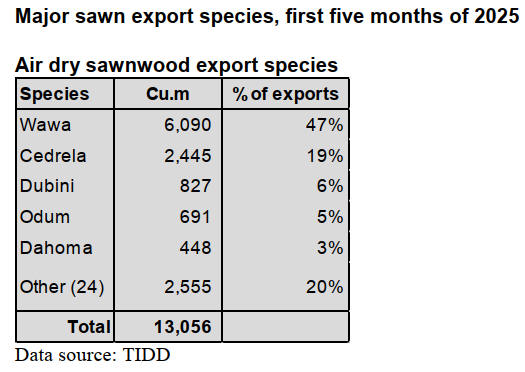

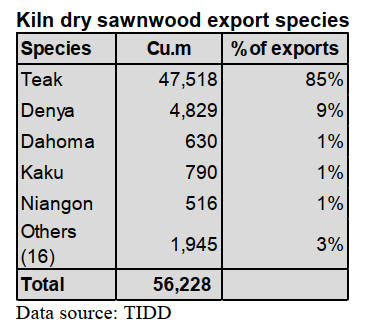

Of the total sawnwood exports, the kiln-dried sawnwood

volume was four times more than that of the air-dried

sawnwood during the period. There was a marked

difference in the range of species exported depending on

whether the timber was kiln or air dried.

Wawa dominated exports of air dried sawnwood for the

period but for kiln dried sawnwood teak accounted for

85% of the total.

A drop in export volumes of plywood (-88%), kiln dried

boules (-83%), air dried boules (-81%) and rotary veneer

(-19%) could be attributed to the inadequate domestic

supply of logs.

Parliament ratifies Timber Utilisation Contracts (TUCs)

Ghana’s Parliament has ratified Timber Utilisation

Contracts (TUCs) for some 131 companies for a

sustainable timber trade in the country in accordance with

article 268 of the 1992 Constitution.

The Ministry of Lands and Natural Resources convened a

high-level consultative meeting on the ratification of the

TUCs bringing together representatives from key

Ministries, Non-governmental organisations and

stakeholders in the timber industry.

The meeting discussed the status of the TUC ratification

process which was before Cabinet for approval and also

reviewed progress on the issuance of Forest Law

Enforcement, Governance and Trade (FLEGT) license.

In his remarks, Innocent Haligah, speaking on behalf of

the Sector Minister Hon. Emmanuel Armah-Kofi Buah,

welcomed participants and highlighted ongoing efforts by

the Ministry to meet critical deadlines for the issuance of

the FLEGT license.

The TUC ratification and FLEGT licensing processes are

seen as vital components of Ghana's commitment to

sustainable forest management and legal timber trade

under international agreements.

The consultative meeting provided the platform for

stakeholders to share insights, raise concerns and align

strategies toward achieving a transparent and accountable

forestry sector.

See:https://gna.org.gh/2025/07/parliament-ratifies-five-mining-

lease-agreements-timber-utilisation-contracts-for-131-

companies/

Company claims it faces collapse as illegal logging

depletes forest reserves

A major company in the newly-created Ahafo Region has

warned it faces collapse from illegal mining and logging

activities as encroachers are fast depleting the forest

reserve that feeds raw material to the company.

The General Manager of the company raised the alarm

over the devastating impact of illegal logging on the

company’s operations, during a working visit by the Ahafo

Regional Minister, Charity Gardiner.

In a related development, the University Teachers

Association of Ghana (UTAG), which is deeply concerned

about the continued destruction of Ghana’s environment

through illegal mining activities, has threatened a

nationwide strike if there is no action to address the

country’s ‘galamsey’ threats.

See: https://www.adomonline.com/ayum-timber-company-faces-

collapse-as-illegal-logging-depletes-forest-reserves/

and

https://www.myjoyonline.com/utag-gives-mahama-government-

3-month-ultimatum-to-end-galamsey-or-face-strike/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Ghana.

See: https://www.itto-

ggsc.org/static/upload/file/20250716/1752653872183995.pdf

3. MALAYSIA

Overall trade growth

The recorded cumulative trade value increase by 4.8% to

RM1.465 trillion in the first half of 2025 reflecting the

strength and resilience of Malaysia’s external trade

position.

The country’s trade surplus surged to RM8.59 billion in

June compared to RM759.9 million in May 2025 marking

the 62nd consecutive month of surplus since May of 2020.

The key factors driving exports in June included palm oil

and palm oil-based agricultural products which recorded

double-digit growth for 15 consecutive months.

See:

https://theborneopost.pressreader.com/article/282153592318217

Muar Furniture Association - outlook tough

The furniture sector is struggling under mounting

international and domestic pressures leading to some long-

standing manufacturers shutting down after decades of

operation. Muar Furniture Association (MFA) president,

Steve Ong, said some businesses had ceased operation

over the past two years, including several original

equipment manufacturers as they felt the future of the

industry was not promising.

“The situation has become increasingly tough for local

furniture makers who are already grappling with policies

that burden businesses. Aside from having to deal with the

expanded sales and service tax (SST), the US-imposed

tariffs on Malaysian exports are an added burden for those

focused on the American market,” he said.

Ong, who’s Association represents more than 800

members, pointed out that high electricity tariffs and

mandatory the Employees Provident Fund (a national

retirement fund) contributions for foreign workers are also

adding to the pressure on businesses.

He said MFA has continued to call for a temporary

suspension of the SST, electricity tariff hike and EPF

contribution for foreigners.

Ong also urged the government to provide financial

incentives or assistance to help companies transition

effectively.

He said that while the government is encouraging

automation many industry players are hesitant to make the

change. “If local furniture makers are forced to shut down

or relocate overseas it will not only affect jobs but the

entire supply chain will suffer,” he said.

The MFA held a dialogue session with industry recently to

listen to their concerns. Many participants, including a

furniture maker who has been in the business for over four

decades, lamented about the “policies that are not

business-friendly” which are hurting the economy.

Malaysian Furniture Council president, Desmond Tan,

who is also MFA executive adviser, said the council

received over 180 petitions from industry players about

the untimely policies. He added that the council had

submitted a petition to Plantation and Commodities

Ministry over the matter.

See:

https://www.thestar.com.my/news/nation/2025/07/24/furnitures-

tough-outlook#goog_rewarded

Value of timber trade

Malaysia’s total value of wood and wood products trade

(exports and imports) reached RM 9.95 billion in the first

four months of this year, said Sarawak Timber Industry

Development Corporation (STIDC) General Manager,

Zainal Abidin Abdullah. Last year, timber exports earned

RM22.9 billion, a solid almost 5% increase from the

previous year.

He said exports contributed RM7.183 billion, signifying

strong demand for Malaysian timber products while

imports stood at RM 2.767 billion, reflecting healthy

domestic use and a well-connected supply chain.

Wooden furniture took the lead in exports bringing in

RM3,083 million, followed by plywood (RM742.5

million), sawn timber (RM582.5 million) and fibreboard

(RM210 million). Zainal also pointed out material

shortages as ‘a significant hurdle’, with Malaysia

importing up to 60% of its raw materials such as timber,

hardware and fabrics.

Zainal continued saying that Sarawak’s timber export

earnings reached RM2.84 billion last year, a slight drop

from RM3.14 billion in 2023.

“Sarawak, despite its rich timber resources, exports raw

wood rather than finished products thus limiting value-

added opportunities. In addition, our industry relies

heavily on foreign workers which affect skills retention

and innovation. Locally, there is a shortage of skilled

craftsmen and designers, which slows productivity and the

adoption of new technologies”, he said.

On STIDC, Zainal said a comprehensive ‘Furniture

Industry Blueprint’ had been developed to map out a clear,

strategic pathway for the sector’s growth encompassing

product development, supply chain strengthening and

market expansion.

See:

https://mail.google.com/mail/u/0/?tab=rm&ogbl#inbox/WhctKL

bfNvkzcqDsfmkPmfhwKNZdfpQjnsLZwWDDVJlWjchjQvfXK

qGXVmJmQMmlxhDwFBb

Training future foresters

Nineteen postgraduate students from Universiti Malaysia

Sabah (UMS) completed a four day intensive training

workshop aimed at empowering the younger generation to

understand sustainable forest management and

biodiversity conservation.

The high-impact training, GIS & Statistical Analysis

Training Workshop was held through a special

collaboration between UMS and the Sabah Environmental

Trust (SET), a local non-governmental organisation.

Dr. Elia Godoong, a Senior Lecturer at the Faculty of

Tropical Forestry, UMS and one of the workshop trainer

on statistics said the participants were introduced to both

technical and practical skills essential for forest

management and biodiversity conservation.

The participants also learned to use advanced geospatial

technologies such as Geographic Information Systems

(GIS), as well as big data analytics and statistical

modeling approaches using R software.

See:

https://mail.google.com/mail/u/0/?tab=rm&ogbl#inbox/WhctKL

bfMvLSsWZhZPrPFdntqvwcmjDbgMdlVdkMjMLsHrqRLkHvp

zlJZGhcdldHMMTwKbB

Certification Standard review

The Malaysian Timber Certification Council (MTCC) is

conducting a scheduled review of two Standards under the

Malaysian Timber Certification Scheme (MTCS). This

review aims to ensure continued relevance, alignment with

international requirements and incorporation of national

and stakeholder interests. Feedback is invited to help

strengthen the MTCS by improving the standards’ clarity,

feasibility and effectiveness.

The review of the Malaysian Timber Certification Scheme

(MTCS) standards, particularly MTCS ST 1002:2021

Malaysian Criteria and Indicators for Sustainable Forest

Management and MTCS ST 1003:2021 Group Forest

Management Certification – Requirements, is a crucial

process to ensure their continued relevance, credibility,

and alignment with international best practices in

sustainable forest management and certification.

See: https://mtcc.com.my/mtcs-standard-review-initial-

feedback-on-existing-standards/

4.

INDONESIA

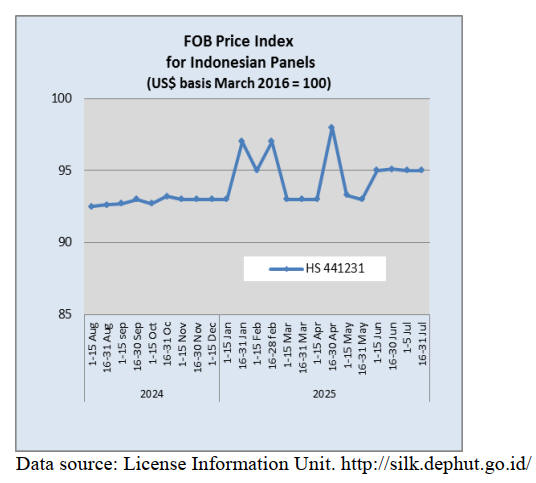

USITC found hardwood and decorative

plywood

imports have caused "material injury"

The US International Trade Commission (USITC) has

made a preliminary ruling favoring domestic hardwood

and decorative plywood (HWDP) producers. This decision

comes after an anti-dumping petition was filed against

HWDP exports from Indonesia, Vietnam and China.

The USITC found sufficient indications that these imports

have caused "material injury" to the US HWDP industry.

This initial ruling, made on 3 July, is expected to be

finalised later this year and follows a petition submitted by

the Coalition for Fair Trade in Hardwood Plywood.

See: https://agroindonesia.co.id/itc-plywood-indonesia-rugikan-

produsen-dalam-negeri-as/

Furniture exports face challenges despite IEU-CEPA

The Indonesian Furniture and Craft Industry Association

(Himki) sees significant potential in the European Union

(EU) furniture market valued at an annual US$58.4 billion

especially in light of the, soon to be finalised, Indonesia-

European Union Comprehensive Economic Partnership

Agreement (IEU-CEPA).

However, Himki Chairman Abdul Sobur said” this

potential cannot fill the gap in expected declines in exports

to the US due to tariffs”.

The EU market presents significant challenges due to strict

sustainability and due diligence standard and this requires

time for local producers to adapt, invest and reposition

their products focusing on high value-added items with

strong designs and non-price competitiveness.

Despite these hurdles, Sobur acknowledges the benefits of

the IEU-CEPA. These include zero tariffs for most

Indonesian furniture and craft products entering the EU

enabling more competitive market access.

The agreement also provides incentives for industrial

transformation towards environmentally friendly practices

and certification. Furthermore, it opens opportunities for

technical cooperation, joint ventures with European brands

and strengthens Indonesia's position as an alternative

supply chain for Europe.

The (IEU-CEPA) could increase furniture exports to the

EU by 15% to 25% within the first three years of its

implementation depending on the industry's preparedness,

said Sobur.

See: https://www.msn.com/id-id/berita/other/pengusaha-mebel-

sebut-pasar-eropa-menantang-meski-ada-ieu-cepa/ar-

AA1IFFV5?ocid=BingNewsVerp

and

https://www.msn.com/id-id/berita/other/ieu-cepa-berpotensi-

dongkrak-ekspor-mebel-ke-eropa-hingga-25/ar-

AA1IzA5l?ocid=BingNewsVerp

Tariffs a burden for SME manufacturers

Despite a new 19% reciprocal tariff imposed by US

President Donald Trump, the Indonesian Furniture and

Craft Industry Association (Himki) anticipates moderate

growth of 5-7% annually in furniture exports to the US.

Himki acknowledges that the 19% tariff remains a burden

for Indonesian manufacturers, particularly small and

medium enterprises.

Export growth is not expected to match pre-trade war

levels as US buyers are now more cost-conscious and

exploring alternative markets.

See:

https://ekonomi.bisnis.com/read/20250717/257/1893665/tarif-

trump-19-ekspor-furnitur-ri-ke-as-diproyeksi-tumbuh-moderat.

Agroforestry skills for forest communities

Indonesian Minister of Manpower, Yassierli, highlighted

the critical role of agroforestry skills in improving the

economic well-being of families in forest communities.

Speaking in Padang City at the opening of the "Human

Resources Empowerment in the Forestry Sector for

Agroforestry Farmers" training, Minister Yassierli stated

that the goal is for village communities near forest areas to

gain strong agroforestry skills. This will enable them to

contribute to their families' economies without resorting to

deforestation.

See: https://en.antaranews.com/news/365885/minister-promotes-

agroforestry-skills-for-forest-communities-growth

Indonesia taps social forestry to boost food security

Indonesia's Minister of Forestry, Raja Juli Antoni, has

highlighted the social forestry policy as a key strategy to

enhance national food security. He emphasised that this

effectively links environmental conservation with

grassroots economic development.

This initiative aims to boost the forestry sector's

contribution to food self-sufficiency and directly improve

the welfare of forest farmers.

The Minister expressed the government's openness to

collaborate with stakeholders to ensure sustainable

forestry practices while strengthening the sector's role in

food security and local livelihoods.

See: https://en.antaranews.com/news/365365/indonesia-taps-

social-forestry-to-boost-food-security

Addressing degraded forests

The Ministry of Forestry reports that Indonesia faces a

significant challenge with 12.7 million hectares of critical

or degraded forest land, out of 120.5 million hectares of

forest area.

Deputy Minister, Sulaiman Umar Siddiq, highlighted that

this degradation negatively impacts food security, water

quality, bio-diversity and exacerbates climate change.

To combat this, the Ministry is implementing the Forestry

and Other Land Uses (FOLU) Net Sink programme which

focuses on four key strategies: preventing deforestation,

promoting sustainable forest management and

conservation, protecting and restoring peatlands, and

enhancing carbon sequestration.

Furthermore, the Ministry has made strides in

rehabilitation and restoring 2 million hectares of forests

land between 2015 and 2024. This effort, coupled with

Integrated Forest Fire Management, has led to a notable

reduction in forest and land fires.

The government is utilising both domestic and

international funding for reforestation, fire prevention and

bolstering its Social Forestry Programme. The Ministry is

also providing free seedlings and encourages public

participation in a range of forest restoration activities,

including critical land rehabilitation, reforestation and

preventing forest degradation.

See:

https://lestari.kompas.com/read/2025/07/09/120643986/lahan-

kritis-capai-12-juta-hektare-kemenhut-beberkan-rencana-

mengatasinya.

https://forestinsights.id/indonesia-dorong-restorasi-lahan-

sebagai-kunci-pembangunan-kehutanan-inklusif/

US tariff cut eases impact on economy

Indonesia's National Economic Council (DEN) Chairman,

Luhut Binsar Pandjaitan, announced that a reduction in the

US tariff rate on Indonesian products from 32% to 19% is

expected to significantly boost Indonesia's economy.

Pandjaitan emphasised that this tariff arrangement is not a

one-sided concession but rather a strategy for mutual

benefit aiming to open investment opportunities, drive

technology transfer and increase the competitiveness of

Indonesian products.

Economic simulations conducted by DEN project that the

19% tariff rate could lead to a 0.5% growth in Indonesia's

GDP, largely due to an anticipated increase in investment

as global companies move manufacturing to Indonesia.

DEN views this tariff reduction as a crucial opportunity

for Indonesia to accelerate its deregulation agenda and

reduce domestic logistics and production costs.

See:https://en.antaranews.com/news/367009/us-tariff-cut-to-

boost-indonesias-economy-den

and

https://www.thejakartapost.com/world/2025/07/19/indonesia-not-

out-of-woods-despite-us-eu-deals.html

5.

MYANMAR

Myanmar prepares to negotiate tariffs

Major General Zaw Min Tun, spokesperson for the State

Administration Council, announced plans to negotiate with

the United States following the US announcement of a

40% tariff on Myanmar’s exports starting 1 August.

Speaking through state media, Zaw Min Tun expressed

optimism for “positive negotiations and mutually

beneficial outcomes.” The Military Council has indicated

readiness to send a high-level delegation to discuss tariff

adjustments.

The proposed visit to the US comes amid longstanding

tensions following the 2021 suspension of the Trade and

Investment Framework Agreement (TIFA) by the United

States. The agreement, signed in 2013, enabled structured

dialogue on trade and labour practices.

Under the TIFA Myanmar had committed to uphold core

labour rights aligned with International Labour

Organization (ILO) standards.

Myanmar is waiting for a response from the US on

whether talks will proceed with Myanmar facing both

economic and diplomatic pressure to protect its export

channels.

See - https://burmese.dvb.no/post/716131

and

https://burmese.dvb.no/post/713734

Currency stablisation efforts

The Myanmar government has moved to curb imports in a

bid to stabilise the country’s volatile exchange rate which

reached up to nearly 6,000 MMK to the US dollar in 2024.

Import restriction, especially those aimed at stabilising the

exchange rate, can have far-reaching

consequences including on the timber industry which has

facing challenges of market access.

The main impact will be on imports of machinery, spare

parts, chemicals and packaging materials since many

operations rely on imported items.

The strategy, aimed at preserving foreign currency

reserves comes amid mounting pressure on the Kyat and a

widening trade deficit. However, critics say that limiting

imports without a comprehensive assessment of

commodity pricing and inflation risks could exacerbate

economic fragility.

See - https://www.ogresearch.com/news/myanmar-a-unique-

system-of-multiple-parallel-exchange-rates, https://www.scm-

legal.com/post/cbm-allows-exporters-to-keep-more-foreign-

currency and https://www.iges.or.jp/en/pub/forests-timber-

sources-and-supply-chains-myammar-opportunities-and-

constraints-ensure-legal

Decline in FDI

Myanmar’s foreign direct investment (FDI) plummeted in

the first quarter of the 2025–26 fiscal year despite recent

government efforts to attract new investments. Official

figures show that Myanmar received only US$40.8

million in FDI between April and June, just one-third of

the US$147.9 million recorded during the same period the

previous year.

Data from the Directorate of Investment and Company

Administration (DICA) shows that investment was

concentrated in just three of the 12 permitted

sectors: manufacturing US$35.8 million, livestock and

fisheries US$2.5 million and services US$2.6 million.

China remained the largest foreign investor during the

period contributing US$13.5 million, followed

by Thailand (US$10.5 million), Hong Kong (US$10

million), and Singapore (US$4.7 million). Smaller

investments came from Japan, South Korea and Taiwan

P.o.C.

In a bid to boost economic activity, the Myanmar

Investment Commission (MIC) approved 35 new

investment projects during its latest meeting on July 17.

See: https://burmese.dvb.no/post/715215 and https://burmese.dv

b.no/post/714889

6.

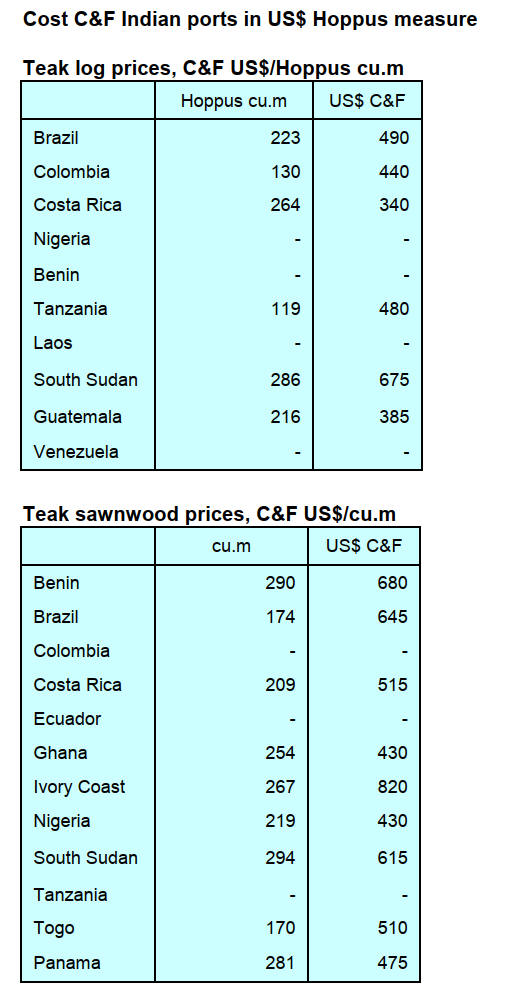

INDIA

Cost of raw materials

rising

The correspondent reports domestic demand is stable but

subdued and the cost of raw materials is rising but

companies are not able to increase prices due to slow

demand. Ocean Freight and the exchange rate is stable, he

reports.

India and the United States have concluded five rounds of

negotiations for the proposed Bilateral Trade Agreement,

negotiations continue.

The Indian Standards Institute (BIS) is restructuring the

quality standards for various panel products. When the

new Standards are released they will be reported.

The correspondent emphasised an article below on how

the plywood industry is experimenting with new timbers

for core veneer.

Kerala State earned US$162 million from teak

The Times of India has reported Kerala State harvested of

over 6.75 lakh (0.675 million) trees including teak,

rosewood and sandalwood from its forests since 2016. The

auction of teak alone generated more than Rs 1,393 crore

(US$162 million) in revenue for the State according to

information tabled in the assembly by the forests and

wildlife department.

The figures reflect only trees whose felling is regulated

and done with the Departments clearance including teak,

rosewood, ebony and sandalwood

Most revenue came from the auction of teak with

rosewood and sandalwood auctions also adding to the

revenue. While the state earned US$162 million from teak

timber alone it earned another US$9.30 million as tax,

including GST, forest development tax and income tax.

In effect, the teak timber sales alone fetched

approximately US$256 million for the State in a span of

nine years.

The forest department also auctions sandalwood

trees.Though the quantity is less than teak sandalwood is

in high demand, including from public sector companies

outside the State like Karnataka Soaps.

Clarifying rules for private landowners, Forest Department

data presented to the assembly also stated that under the

Kerala Promotion of Tree in Non-Forest Areas Act, 2005

the felling of trees such as teak and rosewood from non-

forest lands is still covered under the forest

department regulation, except in some land categories. The

2011 rules framed under this Act govern the approval

process.

However, even private landowners are prohibited from

felling sandalwood trees, even if standing on their land.

Only the Forest Department is allowed to cut sandalwood

trees and after auctions the proceeds are given to the

landowner after deducting costs be around 30% of the

proceeds.

See:

https://timesofindia.indiatimes.com/city/thiruvananthapuram/kera

la-govt-fells-6-75-lakh-trees-in-forests-in-9-yrs-teak-sale-alone-

fetches-rs-2200-

crore/articleshow/121343206.cms#:~:text=Bengaluru%20Heavy

%20Rainfall-

,Kerala%20govt%20fells%206.75%20lakh%20trees%20in%20fo

rests%20in%209,alone%20fetches%20Rs%202%2C200%20cror

e&text=T'puram%3A%20The%20state%20recorded,its%20fores

t%20ranges%20since%202016.

Pine logs a lifeline for plywood manufacturers

In one of its recent magazines Plyreporter identifies that

imported pine logs have become a lifeline for Indian

plywood manufacturers for core veneer. It has been

reported that plywood industries in Gujarat, Rajasthan,

Haryana and Punjab have been using substantial quantities

of pine logs and their dependency has been shifted to

almost 35% of their total log requirement.

Industry experts suggest that Australian pine logs are more

suitable than others for core veneer although there are

some complaints of bending in pine core veneer

production but that this can be resolved. Uruguay and New

Zealand sourced pine is preferred for block board and

flush doors.

Kandla Port has noted a 17% increase in pine imports.

Importers view that the stable pricing and availability of

logs from Australia, Uruguay, New Zealand, Brazil, South

Africa and other Latin American countries is one of the

reasons demand has risen.

See: https://www.plyreporter.com/article/154110/plywood-

sector-demand-push-up-timber-import-in-india

7.

VIETNAM

Value of wood product exports slipped in

May

According to statistics from the Vietnam Customs

Department, W&WP exports in June 2025 reached

US$1.35 billion, up 4% compared to May 2025 and up 6%

compared to June 2024. WP exports contributed US$923.3

million, down 7% compared to May 2025 but up 6%

compared to June 2024.

In the first half of 2025 W&WP exports totalled US$8.2

billion, up 8% compared to the same period in 2024; of

which, WP exports accounted for US$5.6 billion, up 9%.

Vietnam’s W&WP exports to the US in June 2025

amounted to US$778.3 million, down 9% compared to

May 2025 but up 9% compared to June 2024. In the first

six months of 2025 W&WP exports to the US were valued

at US$4.6 billion, up 12% year-on-year.

In June 2025 W&WP exports to Australia stood at

US$12.7 million, down 0.8% compared to June 2024. In

the first half of 2025 total W&WP exports to Australia

earned US$69.6 million, down 4% compared to the same

period in 2024.

Vietnam's W&WP imports in June 2025 amounted to

US$296.2 million, down 2% compared to May 2025

however, it was up 26% compared to June 2024.

In the first half of 2025 total W&WP imports reached

US$1.51 billion, up 20% year-on-year.

Vietnam’s imports of raw wood (log and sawnwood) from

the US in June 2025 continued to increase and reached a

record high of 180,000 cu.m, with a value of US$73.0

million, up 25% in volume and 25.0% in value compared

to May 2025 and up 173% in volume and 165 in value

compared to the same period in 2024.

In the first half of 2025 raw wood imports from the US

reached 598,780 cu.m, worth US$243.48 million, up 86%

in volume and 77% in value compared to the same period

in 2024.

Industry looks towards new horizons

While long considered a strong export sector, local

enterprises are now re-evaluating their strategies to not

only sustain growth but also reposition Vietnamese wood

products on the global trade map. Amid global economic

uncertainties and tightening trade policies, the wood

industry is navigating through significant headwinds.

According to Nguyễn Liêm, chairman of the Bình Dương

Furniture Association, major shifts in trade policies among

importing countries have been felt since early this year.

Although Vietnamese wood products have been sold to

over 160 countries and territories the US remains the

largest market, accounting for nearly 50% of the industry's

export earnings. As a result fluctuation in US regulations

create a ripple effect across the entire industry.

Recently, the US Department of Commerce (DOC)

initiated anti-dumping and countervailing investigations

into plywood imported from Viet Nam.

The action has placed more than 130 Vietnamese timber

processing and exporting companies under scrutiny,

casting uncertainty over one of Vietnam’s most valuable

export category. Despite this, the Ministry of Agriculture

and Environment (MAE) has set an ambitious export goal

for the wood sector in 2025 at US$18 billion.

In the first six months of the year the value of timber and

forest product exports was estimated at over US$8.2

billion, up 9% compared to the same period in 2024.

Yet, global geopolitical tensions and trade policy shifts

continue to threaten the feasibility of this target.

Besides the US, the European Union has also implemented

new technical and legal requirements. Regulations such as

the EU Deforestation Regulation (EUDR), the Carbon

Border Adjustment Mechanism (CBAM) and the

Corporate Sustainability Reporting Directive (CSRD) are

demanding more rigorous environmental and traceability

standards. In Japan, meanwhile, policy changes are

affecting wood pellet exports.

Requirements for transparent, certified sourcing and rising

costs are impacting export competitiveness. In addition to

trade barriers, the domestic wood industry is contending

with challenges in raw material supply.

Vietnam’s wood product exporters are in fierce

competition with major global players such as China,

Malaysia and Indonesia, countries that boast advanced

processing technologies, lower costs and well established

supply chains.

In response to the ongoing US investigations the Vietnam

Timber and Forest Product Association (VIFOREST) has

said it is preparing to participate in the US hearings. The

aim is to clarify that Vietnam’s plywood industry merely

complements, rather than harms, the US domestic sector.

Meanwhile, the MAE is actively coordinating with US

governmental bodies to resolve the issues through

dialogue and technical clarification. Experts have urged

Vietnamese wood businesses to expand into new markets

to reduce over-reliance on traditional buyers.

In particular, such regions as the Middle East, South Asia,

Africa, Latin America and Eastern Europe have emerged

because of their growing demand for furniture,

construction timber and value-added products.

Exploring new markets

Among these potential new markets the Middle East offers

promising opportunities. The United Arab Emirates (UAE)

and Qatar have demonstrated strong demand for luxury

interior and exterior wooden furniture, especially for high-

end hotels and resorts.

Vietnamese enterprises are encouraged to participate in

trade fairs such as Index Dubai, build partnerships with

regional distributors and obtain international certifications

including FSC and PEFC to enhance market credibility.

India, too, is becoming an attractive destination for

Vietnamese wood products. Rapid urbanisation, rising

incomes and a preference for compact, modern furniture

have made online platforms like Amazon India and

Flipkart particularly lucrative. Vietnamese exporters report

strong sales growth in lightweight, space-saving products

suitable for Indian apartments and offices.

The ongoing negotiations for a Free Trade Agreement

(FTA) between Vietnam and India are also expected to

reduce import tariffs from 10% to 5% further boosting

competitiveness. If signed the FTA could lay the

groundwork for deeper economic integration and longer-

term stability in bilateral trade.

Sustainability, technology upgrades

In the face of these pressures, the Vietnamese wood

industry is aiming to elevate its marketing strategy. A

central part of the strategy is ensuring that all wood used,

both domestically and for export, comes from legal,

verifiable sources.

There is a growing push to certify supply chains

with

international standards and improve environmental

transparency.

The MAE has also called for at least 80% of wood

processing and storage facilities nationwide to meet

advanced technological benchmarks. This transition would

allow Vietnamese firms to meet the increasingly complex

technical and environmental demands of foreign

customers.

At the same time, the global shift in supply chains,

including companies looking to diversify away from

Chinese sourcing, offers Vietnamese firms an opening. By

investing in compliance, certification and efficient

logistics, they can become a trusted alternative in the

global wood product market.

According to VIFOREST, with proper orientation and

coordinated efforts between the State and enterprises, the

wood industry can not only overcome current challenges

but also strengthen its global standing.

“We must move beyond survival strategies and enter a

phase of strategic transformation,” the Association said.

With global demand patterns changing and traditional

markets becoming more unpredictable, diversification is

no longer optional, it is vital.

Whether through entering emerging markets, upgrading

processing technology or enhancing legal compliance,

Vietnam’s wood industry is laying the groundwork for a

more resilient and competitive future.

As one of the country’s top export earners, the industry’s

ability to adapt will determine not only its own trajectory

but also Vietnam’s broader reputation in sustainable and

value-added manufacturing.

See: https://vietnamnews.vn/economy/1721573/viet-nam-s-

wood-industry-faces-market-shifts-looks-towards-new-

horizons.html

Wood and wood product exports continued to grow

amid tariff uncertainty

According to the Ministry of Agriculture and Environment

W&WP export values in the first six months of 2025

reached US$8.21 billion, representing an increase of 8.9

per cent compared to the same period in 2024.

The US remained Vietnam’s largest export market,

accounting for 56% of the total exports. Japan and China

followed with market shares of 13% and 10% respectively.

Despite the persistent pressure of tariffs in its key market,

the sector continued to demonstrate its strength, remaining

among the top five agricultural groups with the largest

trade surplus.

First half export performance exceeded expectations

Phùng Quốc Mẫn, Chairman of the Members’ Council of

Bảo Hưng Co., Ltd. and President of the Handicraft and

Wood Industry Association of HCM City, said that

although the US market was affected by new minimum

and countervailing tax regimes, Vietnam’s export

performance in the first half of 2025 exceeded

expectations.

Exports to the US still managed to grow by roughly 6%,

partly due to clients boosting inventory levels ahead of

expected tax enforcement.

Phùng Quốc Mẫn noted that the countervailing tax policy

imposed by the US, though unexpected, was applied

broadly to many exporting nations, not exclusively

Vietnam. As a result, even though the cost of goods

increased, US importers were compelled to continue

placing orders to maintain their supply chains and meet

demand.

Many Vietnamese exporters collaborated closely with

their clients to temporarily share increased costs, ensuring

continuity across the supply chain and maintaining

mutually beneficial relationships.

To mitigate the impact of tariffs, several businesses have

shifted towards market diversification and e-commerce.

Trần Lam Sơn, Deputy General Director of Thiên Minh

Co., shared that e-commerce provides the shortest path

from producer to consumer. While traditional Business-to-

Business (B2B) transactions are significantly affected by

cumulative cost increases due to tariffs, direct-to-

consumer sales via online platforms remain less price

sensitive.

Interior furniture products sold online typically carry

lower value and post-tax price differences that remain

within acceptable levels for end-users. This has resulted in

a growing and stable stream of online orders.

Vietnam completes legal framework for forest carbon

market

The draft decree on forest carbon sequestration and

storage services marks the first attempt to establish a

domestic standard for forest carbon while aligning with

international carbon credit systems. It clearly defines

eligible service providers and buyers, allowing both public

and private entities to supply or purchase credits through

contracts or a national carbon exchange.

Vietnam is pushing forward with efforts to establish a

legal framework for the forest carbon market, aiming to

mobilise new financial resources for sustainable forestry

and climate goals. At a seminar held in Hanoi on 15 July

co-hosted by the Vietnam Forest Owners Association and

Forest Trends, stakeholders discussed a draft decree on

forest carbon sequestration and storage services, which is

currently under review by the Ministry of Agriculture and

Environment.

Speaking at the event, the Director the Department of

Forestry and Forest Protection, Tran Quang Bao, said the

draft is designed to ease administrative procedures and

facilitate forest owners’ participation in carbon trading. He

noted that once adopted, the decree would give carbon

credit holders more autonomy in domestic and

international transactions.

According to Bao, the draft also aims to attract private-

sector involvement to boost forest reserves, which is key

to achieving sustainable forest development and realising

Vietnam’s commitment to emissions reduction.

To Xuan Phuc, a senior expert from Forest Trends, said

the decree is expected to draw financial flows from both

international and domestic private sources via carbon

trading. He noted that planted forests owned by

households should be considered private assets and

relevant regulations and decrees should be expanded to

give them full rights to form joint ventures and

partnerships and participate in the carbon market.

He also recommended that for state-owned forest lands,

once national contribution calculations are completed,

policies should allow cooperation from businesses and

projects to generate carbon credits for trading at home and

abroad. He underlined the importance of transparency in

carbon transactions after Vietnam fulfils its nationally

determined contributions (NDCs).

Nghiem Phuong Thuy of the Department of Forestry and

Forest Protection described the decree as a step toward

translating Vietnam’s net-zero pledge by 2050 into

actionable policies in the forestry sector. It includes

provisions on carbon credit certification, revenue

management, and carbon exchange mechanisms.

She added that the decree clearly defines eligible service

providers and buyers, allowing both public and private

entities to supply or purchase credits through contracts or a

national carbon exchange.

Thuy concluded that the legal framework is essential not

only to meet international transparency requirements but

also to unlock additional funding for forest protection and

development in Vietnam.

See: https://en.vietnamplus.vn/vietnam-completes-legal-

framework-for-forest-carbon-market-post322767.vnp

8. BRAZIL

Timber sector facing severe consequences

from US

tariffs

The Brazilian Association of Mechanically Processed

Timber Industry (Abimci) has expressed deep concern

over the impact of the US government decision to impose

a 50% tariff on Brazilian timber products.

Abimci says this measure severely undermines the

competitiveness of Brazil’s national production chain

which directly employs approximately 180,000 people.

Production is largely concentrated in the three southern

states with about 90% of installed capacity being in the

region, says the Associaition.

Wood product exports to the US reached around US$1.6

billion in 2024 highlighting the importance of the

American market which accounted for an average 50% of

Brazil’s national production. The sector is gripped by

uncertainty.

The industry is already facing serious consequences such

as contract cancellations, suspension of shipments and

partial or total shutdown of production facilities.

Currently, approximately 1,400 containers are enroute to

the US and around 1,100 containers are stuck at Brazilian

ports awaiting shipment, worsening logistical problems

andresulting in commercial losses.

Some companies have already been forced to implement

mandatory worker leave to buy time and preserve jobs

while others are preparing for layoffs. Production is being

reduced across virtually the entire sector and in many

cases it has come to a complete halt.

Considering this critical situation, Abimci has urged the

Federal government to take immediate and coordinated

actions to mitigate the effects of the tariffs.

These include a formal request to extend the

implementation deadline of the tariffs; a recommendation

not to apply reciprocal tariffs that could be interpreted as

retaliation by the US government and the intensification of

diplomatic dialogue with the United States.

Abimci emphasises that this crisis demands high-priority

treatment and the urgent mobilisation of foreign policy

and international trade instruments to safeguard industrial

activity, protect jobs and maintain Brazil’s presence in the

US market.

See: https://abimci.com.br/wp-

content/uploads/2025/07/Nota_Abimci_Taxacao_EUA.pdf

The bio-economy and forest restoration

According to the ‘New Economy for the Brazilian

Amazon’ study coordinated by WRI Brazil, integrating the

bio-economy with forest restoration has the potential to

add up to BRL45 billion to Brazil’s GDP and generate

approximately 830,000 jobs by 2050.

Products such as açaí, Brazil nuts, cupuaçu, camu-camu,

andiroba oil, copaiba oil and honey from native bees

already support value chains rooted in biodiversity-based

economic development, traditional knowledge and the

empowerment of local communities.

The Pan-Amazonian Bio-economy Network, a multi-

sectoral alliance bringing together indigenous

communities, local producers, investors, research centers,

financial institutions and civil society organisations leads

efforts to strengthen the sector.

In mid-July 2025, the Network held the Pan-Amazonian

Action Forum for the Bioeconomy in Leticia, Colombia,

bringing together stakeholders from civil society, the

private sector, governments, indigenous organisations,

international organisations and investors to build alliances

and develop a shared agenda.

Despite the progress of such initiatives, the bioeconomy

remains an underfunded sector in the region. Key barriers

to its expansion include the lack of integrated public

policies, limited access to financing, and insufficient

coordination among stakeholders.

See: https://www.maisfloresta.com.br/bioeconomia-e-

restauracao-florestal-podem-gerar-r-45-bilhoes-no-pib-brasileiro/

Environmental leadership and pressure on Brazil

Brazil began 2025 by taking a strategic role in global

environmental governance, particularly as it prepares to

host the 30th United Nations Climate Change Conference

(COP30) in Belém, Pará, in November. The event will

take place amid a growing climate urgency which is

intensifying demands for tangible progress in multilateral

negotiations.

During the 17th BRICS Summit held on 6 July in Rio de

Janeiro the eleven member countries reaffirmed their

commitment to international instruments such as the Paris

Agreement and the United Nations Framework

Convention on Climate Change (UNFCCC) emphasising

the importance of cooperation among nations in

addressing environmental challenges.

The BRICS group expressed strong support for the agenda

proposed by the Brazilian government endorsing the

creation of the Tropical Forest Forever Facility (TFFF),

scheduled to be launched at COP30. This innovative

mechanism aims to mobilise long-term, results-based

climate finance for the conservation of tropical forests.

See:

https://www.correiobraziliense.com.br/opiniao/2025/07/7199502

-lideranca-ambiental-e-a-pressao-sobre-o-

brasil.html#google_vignette

Export update

In June 2025 Brazilian exports of wood-based products

(except pulp and paper) decreased 2.4% in value compared

to June 2024, from US$331.3 million to US$305.7

million.

Pine sawnwood exports decreased 5% in value between

June 2024 (US$59.6 million) and June 2025 (US$56.5

million). In volume, exports decreased 4% over the same

period, from 250,900 cu.m to 240,400 cu.m.

Tropical sawnwood exports increased 14% in volume,

from 27,200 cu.m in June 2024 to 31,000 cu.m in June

2025. In value, exports increased 11% from US$11.2

million to US$12.4 million over the same period.

Pine plywood exports decreased 19% in value in June

2025 compared to June 2024, from US$79.2 million to

US$ 64.2 million. In volume, exports decreased 10% over

the same period, from 224,900 cu.m to 202,500 cu.m.

As for tropical plywood, exports increased in volume 3%

and decreased in value by 11%, from 2,900 cu.m and

US$1.9 million in June 2024 to 3,000 cu.m and US$1.7

million in June 2025 respectively.

The value of wooden furniture export increased from

US$44.6 million in June 2024 to US$51.7 million in June

2025, an increase of 16%.

Southern Region leads wood and furniture exports

The State of Santa Catarina in southern Brazil, has

established itself as the national leader in timber and

furniture exports, generating over US$800 million in

revenue during the first half of 2025.

According to the Ministry of Development, Industry,

Trade and Services (MDIC), these two sectors accounted

for approximately 15% of Santa Catarina’s total exports

between January and June 2025, contributing to an overall

6.6% increase in the State’s export portfolio. The products

were shipped to over 100 international destinations.

In the timber sector, Santa Catarina exported 1.3 million

tonnes of timber and cork products, generating US$668

million in revenue, equivalent to 37% of the Brazil´s total

timber exports and 11% of the state’s total exports. Paraná

ranked second (US$641.2 million), followed by the state

of Rio Grande do Sul.

This strong performance is attributed to industrial

excellence and incentive programmes such as Prodec

(Program from Development of Companies in Santa

Catarina) and Pro Employment Program (Pró-Emprego)

which have delivered tangible results to the sector.

In the furniture sector, the Santa Catarina State also led

national furniture exports with revenue totalling US$141

million, representing 32% of Brazil’s total. The top

exporting municipalities included São Bento do Sul,

Caçador, Campo Alegre, Rio Negrinho and Fraiburgo. The

growth in revenue is driving job creation, boosting the

State economy and strengthening the entire production

chain.

See: https://clicrdc.com.br/economia/santa-catarina-lidera-

exportacoes-de-madeira-e-moveis-no-brasil-em-2025/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See: https://www.itto-

ggsc.org/static/upload/file/20250716/1752653872183995.pdf

9. PERU

Buyer trade mission to

Pucallpa

A recent business breakfast between buyers and exporters,

the main event of a timber buyers' mission to Pucallpa,

was a success. It brought together key players in regional,

national and international trade.

The event, which took place at the facilities of the Ucayali

Chamber of Commerce, Industry and Tourism (CCITU) in

the first half of June of this year, brought together more

than a dozen prominent value-added timber exporters from

the Ucayali region and buyers from Belgium, France,

Mexico, South Korea and Portugal.

"This business breakfast was a valuable platform for our

exporters to showcase their products and connect with

potential buyers in a business-friendly environment” said

the president of the Ucayali Chamber of Commerce,

Industry and Tourism.

Ucayali Chamber of Commerce and SERFOR awarded

lumber project

With the goal of contributing to quality education and at

the same time promoting the sustainable use of forest

resources, the Ucayali Chamber of Commerce, Industry

and Tourism led a project, with the technical support of

the National Forestry and Wildlife Service (SERFOR) and

the coordination of various stakeholders in the forestry

sector, to promote the project "Design and Construction of

a Modular Wooden Classroom Prototype at a School in the

Yarinacocha District, Coronel Portillo Province, Ucayali.

The project was approved by the Programa Nacional de

Desarrollo Tecnológico e Innovación (ProInnóvate) Board

of Directors with the Chamber of Commerce, Industry and

Tourism of Ucayali as the implementor along with the

National University of Ucayali, the Pucallpa Forestry

CITE and three Ucayali-based timber companies.

The classroom design incorporates criteria of efficiency,

sustainability and adaptation to climate change while also

promoting the use of new forest species for construction.

ADETOP algorithm to detect illegal logging

Peru is taking a technological leap forward in the defense

of its forests. On 15 July the Forest and Wildlife

Resources Oversight Agency (OSINFOR) presented

ADETOP v2, a new artificial intelligence algorithm for

detecting logging from space. Developed in conjunction

with the Universities of Sheffield and Cambridge, this

model represents a strategic innovation to strengthen forest

oversight and the fight against illegal logging in the

country.

The technical challenge was to develop an algorithm

capable of learning from forest information and adapting

to its social and ecological complexity. As an artificial

intelligence algorithm, ADETOP v2 uses the Random

Forest machine learning method. Therefore, it was fed

with information from Peruvian Amazonian forests,

collected by high-resolution drones used by OSINFOR

during monitoring work providing a real, validated and

reliable database.

Additionally, the system uses images from the Sentinel-2

satellite which offer a spatial resolution of ten metres and

captures the same point of interest every four days

allowing for frequent and detailed monitoring of the forest.

The combination of these elements is said to make

ADETOP v2 accurate in detecting selective logging in

Peru.

See: https://www.gob.pe/institucion/osinfor/noticias/1208816-

osinfor-lanza-adetop-v2-el-algoritmo-que-detecta-tala-ilegal-

desde-el-espacio

Strengthening forest management capacities of

regional governments

In order to promote the use of the "Gestiona Forestal" web

platform the National Forest and Wildlife Service (Serfor)

is strengthening the capacities of Amazonian regional

governments and forest agents who are responsible for

overseeing management plans to ensure timber traceability

and promote the sector's competitiveness.

Training sessions consisted of a theoretical and practical

component. Sessions included a simulation of Gestiona

Forestal (Forest Management Plan) for the proper

application of the process of formulating, evaluating and

approval of Forest Management Plans as well as their

various modalities for timber concessions, native and rural

communities and private properties.

The Director of Forest and Wildlife Asset Management

Control at Serfor reported that training sessions have been

held in Junín, Pasco and Huánuco. "It is crucial to advance

the process of strengthening the capacities of those

involved in the use of Gestiona Forestal (Forest

Management Plan).

One of the most advanced Departments in this practice is

Ucayali, whose authorities, as well as users and agents,

have successfully implemented this forestry tool”, the

Director emphasised.

See: https://www.gob.pe/institucion/serfor/noticias/1209382-

serfor-fortalece-las-capacidades-de-los-gore-y-regentes-para-uso-

de-la-plataforma-gestiona-forestal

|