|

Report from

North America

Imports of sawn tropical hardwood soar to a 21-month

high

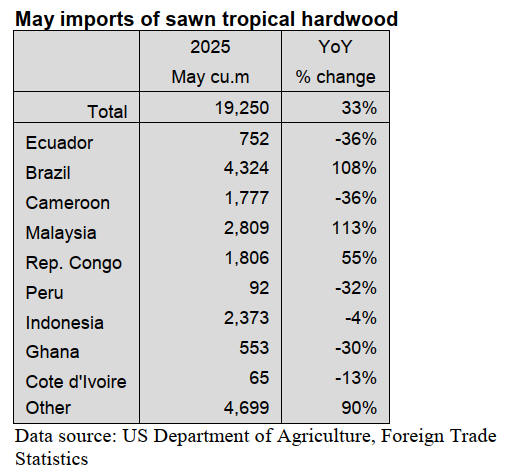

US imports of sawn tropical hardwood jumped 33% in

May to their highest level since August 2023. Import

volume reached 19,250 cubic meters, which was 42%

higher than May of last year. Imports from Brazil and

Malaysia both more than doubled while imports from

Congo (Brazzaville) rose by 55%.

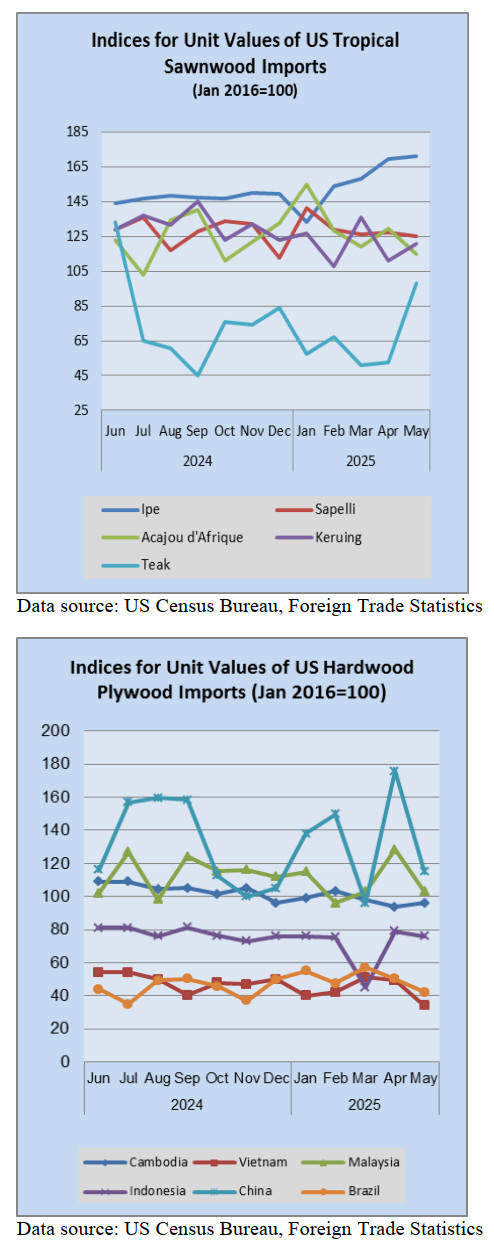

Imports from Ecuador, Cameroon, Peru and Ghana all fell

by about one third. Imports of Mahogany, Sapelli,

Keruing, Ipe and Iroko all rose sharply. With the surge,

2025 total imports now lead last year’s pace for the first

time this year, up 2% from 2024 through the first five

months of the year.

Canadian imports of sawn tropical hardwood continue to

bounce back, rising for a second consecutive month in

May. Despite the 17% gain from the previous month,

imports were down 2% from the May 2024 level. Total

imports are up 9% over last year through May.

Hardwood plywood imports rebound

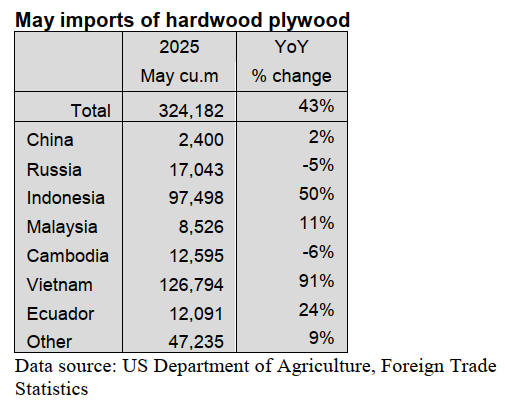

US imports of hardwood plywood rebounded sharply in

May, surging 43% over the previous month as fears of

tariffs eased.

At 324,182 cubic metres, May imports were 34% higher

than in May 2024. For the year so far, imports of

hardwood plywood are up 17% over 2024 with imports

from Indonesia up 65% and imports from Vietnam ahead

by 27%.

Veneer imports steady

After climbing more than 50% in April, US imports of

tropical hardwood veneer stayed fairly level in May,

falling 4% from the previous month. At just over US$3

million, imports for May were 6% lower than in May

2024.

While imports from most top trading partners showed

solid increases and imports from Cote d’Ivoire more than

tripled, a steep decline in imports from Italy more than

offset those gains. While remaining erratic from month to

month, year-to-date imports from Italy are up 240% over

last year. Total US imports of tropical hardwood veneer

are up 6% compared with 2024 over the first five months

of the year.

Moulding imports stay strong

US imports of hardwood moulding rose 12% in May,

reaching their highest level in nearly three years. At

US$16.7 million, the May total outpaced the previous May

by 20% as imports from top-supplier Canada rebounded

from April’s decline. However, imports from other top

trading nations, Malaysia, China and Brazil all retreated in

May. Year to date, total US imports of hardwood

moulding are up 26% this year over 2024.

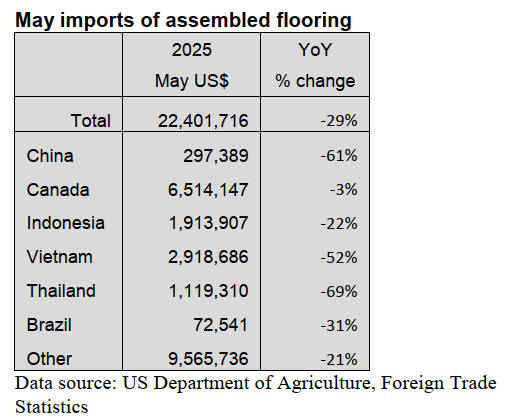

Imports of assembled flooring panels fall to 20-month

low

US imports of assembled flooring panels fell 29% in May,

continuing their retreat from the all-time high set in

March. At US$22.4 million, May imports were at their

lowest since September 2023 and were 18% below the

May 2024 total.

Imports fell by more than 60% from Brazil and Thailand

while imports from top-supplier Canada fell a more

modest 3%. Despite the weak month, total imports for the

year are up 23% through May versus 2024 due in most

part to the blockbuster March total.

Comparatively, US imports of hardwood flooring held

stable, rising 1% in May. However, May is usually a

strong month for flooring imports, so the slight 1% gain

left the May total at 32% lower than what was reached in

May 2024.

Imports from nearly all top trading partners fell by more

than 10% from the previous month, hinting at further

weakness. Year to date, total imports of hardwood flooring

are down 11% versus last year through May.

Wooden furniture imports drop by 6%

US imports of wooden furniture fell 6% in May to their

lowest level in more than a year. At US$1.6 billion,

imports for the month were down 11% from the previous

May.

Imports from China and Indonesia both slid more than

30% while imports from Malaysia fell by 19%. A rise of

5% in imports from Canada eased overall losses. Despite

the setback, total imports of wooden furniture remain

ahead of last year, up 1% through the first five months of

the year.

Furniture industry faces headwinds

Contract and residential furniture manufactures

experienced an overall drop in sales in 2024, according to

a recently released annual report. The “FDMC 300”

reported that combined 2024 sales for the 98 FDMC 300

companies in the contract and residential manufacturing

segment were roughly US$32.8 billion, ($17.2 billion

commercial and $15.6 billion residential) compared with

US$34.5 billion in 2023.

The FDMC 300 is an annual report published in April that

tracks North America’s largest wood products

manufacturers and ranks them by sales.

According to the report, the residential furniture sector

was hit by the slowdown in the housing market, elevated

interest rates, and inflation, all of which have led to

consumers spending less.

Meanwhile, the contract furniture industry continues to

grapple with economic uncertainty and evolving

workspace models, although the increasing trend of

employees returning to the office either full-time or part-

time may alleviate some of these negative impacts in the

future. Ongoing supply chain issues have also had an

impact on the overall industry, particularly the large

manufacturers in the FDMC 300.

More currently, April saw declines in new furniture

orders, shipments, backlogs and receivables, according to

the June issue of Furniture Insights. New orders were

down 9% in April 2025 compared to April 2024.

New orders were also down 7% compared to the prior

month of March 2025.

Accordingly, year to date through April 2025, new orders

are now down 4% compared to 2024. Shipments were

down 2% in April 2025 compared to April 2024.

Shipments were also down 4% compared to the prior

month of March 2025.

However, year to date through April 2025, shipments

remain flat compared to 2024. April 2025 backlogs were

down 10% compared to April 2024, and down 2% from

March 2025. Receivable levels were down 4% from

March 2025, and down 1% from April 2024.

Inventories and employee/payroll levels are again

materially in line with recent months and the prior year,

however, with the gradual decline in employees, it does

appear companies are allowing some normal attrition to

occur without rushing to find replacements.

US announces tariff deal with Vietnam

The United States will place a lower-than-promised 20%

tariff on many Vietnamese exports, President Donald

Trump said July 2, cooling tensions with its tenth-biggest

trading partner days before the US president could raise

levies on most imports.

Vietnamese goods would face a 20% tariff and trans-

shipments from third countries through Vietnam will face

a 40% levy, he said. Vietnam could import U.S. products

with a zero percent tariff, he added.

Trump's announcement came just days before a July 9

deadline to ramp up tariffs on most imports, one of the

Republican's signature economic policies. Under that plan,

announced in April, US importers of Vietnamese goods

would have had to pay a 46% tariff.

Details were scant. It was not clear which products

Trump's 20% tariff would apply to, or whether some

would qualify for lower or higher total duties.

Also left to later discussion was how the new trans-

shipment provision, aimed at products largely made in

China and then labeled "Made in Vietnam," would be

implemented and enforced. The Vietnamese government

did not confirm the specific tariff levels in a statement

celebrating what it described as an agreement on a joint

statement about a trade framework.

Vietnam would commit to "providing preferential market

access for U.S. goods, including large-engine cars," the

government in Hanoi said. The US is Vietnam's largest

export market and the two countries' growing economic,

diplomatic and military ties are a hedge against

Washington's biggest strategic rival, China. Vietnam has

worked to retain close relations with both superpowers.

Mann, Armistead & Epperson, in its Second Quarter 2024

Furnishings Digest newsletter, reported that Vietnam was

the world’s largest exporter of wood furniture to the

United States, and the second largest exporter of overall

furniture, including wood furniture, upholstery, metal

furniture and bedding to the US last year.

See:

https://www.woodworkingnetwork.com/news/woodworking-

industry-news/trump-announces-tariff-deal-vietnam

|