US Dollar Exchange Rates of

15th

July

2025

China Yuan 7.17

Report from China

National standard on harmful substances in furniture

The national mandatory standard GB 18584-2024 Limits

of Hazardous Substances in Furniture, approved by the

State Administration for Market Regulation

(Standardization Administration of the People's Republic

of China) was released on 25 June 2024 and came into

effect on 1 July 2025.

The new standard replaces GB 18584-2001 Limits of

Hazardous Substances in Wooden Furniture for Interior

Decoration and Renovation Materials and GB 28481-2012

Limits of Hazardous Substances in Plastic Furniture and

has a wider range of applicability. Its scope of application

covers all kinds of furniture products including imported

furniture and raw materials.

First ‘free on truck’ log futures completed

Recently, the first Free on Truck (FOT) log futures was

successfully completed at Shandong Port providing an

important practical example for the Dalian Commodity

Exchange (DCE) log futures to serve the real economy and

marking a crucial step forward in the integration of China's

wood industry and the futures market. This innovative

FOT model has addressed some critical issues in the

industry. The integration of futures and spot markets has

facilitated industrial upgrading allowing the industry to

have a more intuitive understanding of delivery rules.

The delivery mode of log FOT is closer to spot trading

which helps to enhance the convenience of wood

processing and trading enterprises in using futures tools

for risk management and effectively reduces the delivery

costs of enterprises.

See: http://www.stcn.com/article/detail/2419889.html

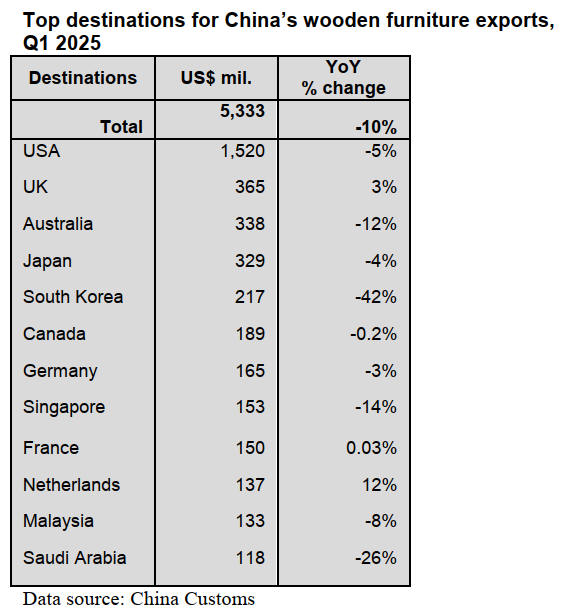

Decline in wooden furniture exports to the US

According to China Customs the value of China’s wooden

furniture exports to the US dropped 5% in the first quarter

of 2025. The US is still the largest market for China’s

wooden furniture exports. Nearly 30% of China’s wooden

furniture was exported to US in the first quarter of 2025.

The reduction in the value of wooden furniture exports to

the US has directly led to a decline in the total value of

China’s wooden furniture exports, with exports in the first

quarter of 2025 falling 10% to US$5.3 billion compared to

the same period in 2024.

China’s wooden furniture exports to Australia, South

Korea, Singapore and Saudi Arabia also fell 12%, 42%,

14% and 26% respectively in the first quarter of 2025.

China’s wooden furniture is exported to more than 200

countries and furniture destination are scattered. The value

of China’s furniture exports to the top 5 countries; US,

UK, Australia, Japan and South Korea accounted for only

52% of the national total furniture exports in the first

quarter of 2025.

In contrast, China’s wooden furniture exports to UK and

Netherlands in the first quarter of 2025 rose 3% and 12%

respectively.

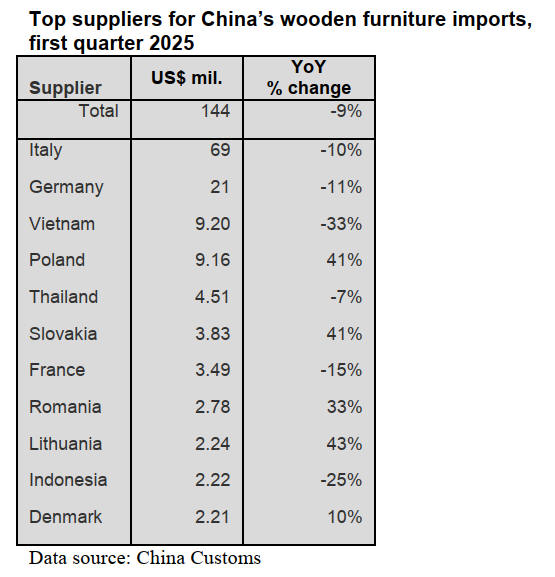

Decline in wooden furniture imports

According to China Customs, the total value of China’s

wooden furniture imports in the first quarter of 2025 fell

9% to US$144 million over the same period of 2024.

Italy and Germany are the top 2 suppliers of wooden

furniture imports. Over 60% of China’s wooden furniture

was imported from the two countries but import values fell

10% and 11% respectively in the first quarter of 2025.

This was the main reason for the decline in the total value

of China’s wooden furniture imports in the first quarter of

2025.

The main reason for the large decline was that domestic

demand for furniture has fallen sharply due to the

downturn in China's real estate sector.

The value of China’s wooden furniture imports from Italy,

Germany and Vietnam, the top shippers, dropped 10%,

11% and 33% respectively in the first quarter of 2025.

In contrast, the value of China’s wooden furniture imports

from Poland, Slovakia, Romania, Lithuania and Denmark

rose 41%, 41%, 33%, 43% and 10% respectively in the

first quarter of 2025. This is because the rapid

development of the China-Europe Railway Express has

driven wooden furniture trade between China and

European countries.

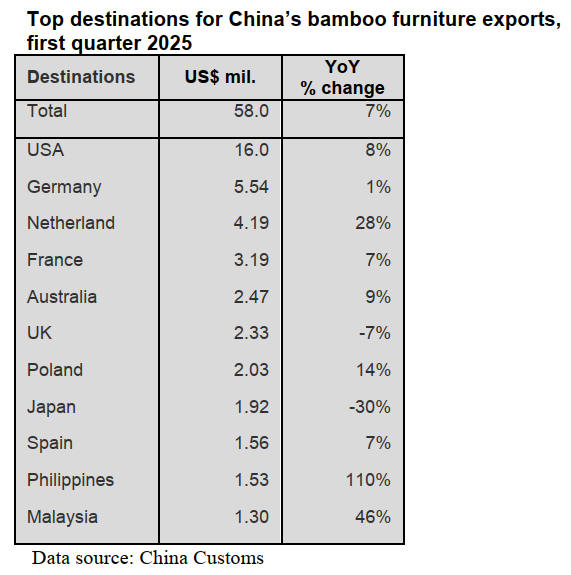

Rise in Bamboo furniture exports

According to China Customs, bamboo exports rose 7% to

US$58 million in the first quarter of 2025. China's policy

of "replacing plastic with bamboo" has been extensively

promoted driving the rapid development of the domestic

bamboo industry in recent years.

China’s bamboo furniture exports to the top three

destination countries, USA, Germany and the Netherlands

in the first quarter of 2025 grew 8%, 1% and 28%

respectively over the same period of 2024.

In contrast, bamboo furniture exports to the UK and Japan

in the first quarter of 2025 fell 7% and 30% over the same

period in 2024.

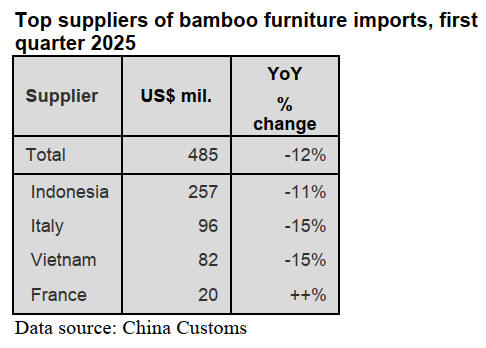

Rise in bamboo furniture imports from France

According to China Customs, China’s bamboo furniture

imports from France in the first quarter of 2025 rose

sharply over the same period of 2024. This trade benefited

from the rapid development of the China-Europe freight

train service.

Indonesia was the largest supplier of China’s bamboo

furniture imports in the first quarter of 2025 but imports

from Indonesia in the first quarter of 2025 fell 11% over

the same period of 2024. This directly resulted in large

decrease (-12%) in the total value of China’s bamboo

furniture imports in the first quarter of 2025.

In addition, China’s bamboo furniture imports both from

Italy and Vietnam dropped in the first quarter of 2025.

|