Japan

Wood Products Prices

Dollar Exchange Rates of 15th

July

2025

Japan Yen 147.40

Reports From Japan

Election becoming referendum on consumption

tax cut

The election in Japan is becoming a referendum on

whether the country should cut its consumption tax as

households continue to struggle with a cost-of-living

crisis. A clear dividing line has emerged between the

ruling coalition of the Liberal Democratic Party and

Komeito, which is advocating a one-time cash handout

and opposition parties are calling for varying degrees of

cuts to the consumption tax, a form of value-added tax on

purchases of all goods and services.

Economy back on track

Japan's economy grew at an annualised pace of 0.9% in

May led by private-sector capital expenditure according to

an estimate released by the Japan Center for Economic

Research (JCER). This marked a reversal from the

previous month when a Nikkei-affiliated think tank

estimated that the economy contracted an annualised

0.7%.

Tariff negotiations with US back to the beginning

Japan's hopes of securing a trade deal with the US was

shattered when the US described Japan, a close ally as

"spoiled" and the recent declaration on the US tariff level

for Japan seemed to shatters Japan's hopes for a special

deal on tariffs. In recent negotiations Japan has

emphasised its huge investments in the US and the

strategic alliance.

Japan’s Prime Minister expressed confidence that Japan

would be treated differently as "Japan is the world's largest

investor in the US and creates the largest number of jobs".

Lizzi Lee, a fellow at the Asia Society Policy Institute's

Center for China Analysis, told Nikkei Asia "Japan is

holding on to a set of assumptions about alliances, cost-

benefit calculations and grand strategy that no longer fully

apply. For decades, Japan's strategic posture was built on

the idea that its role as America's most reliable ally in

Asia, along with its massive foreign-direct-investment

footprint in the US and its stance on the China-Taiwan

P.o.C issue would provide an opportunity for special

treatment."

See: https://asia.nikkei.com/Economy/Trade-war/Trump-

tariffs/Trump-s-tariff-letter-shatters-Japan-s-hopes-for-a-special-

relationship

Tariffs could reduce GDP by almost 1%

The 25% reciprocal tariff on imports from Japan, if

imposed, is projected to reduce GDP by at least 0.8% in

2025 according to a private-sector estimate. Over the

longer term through to 2029, the newly set tariff that takes

effect on 1 August is estimated to cut Japan's GDP by

1.9% according to the Daiwa Institute of Research.

Along with other tariffs imposed, including the 27.5%

duty on automobiles, the US trade policy could result in a

marked economic downturn.

See: https://japantoday.com/category/politics/trump's-25-tariff-

to-reduce-japan's-gdp-by-0.8-in-2025-think-tank

Dividends on track for record despite tariff turmoil

The domestic media has reported Japanese companies are

expected to raise their dividends for a fifth record high for

this fiscal year even with trade tensions expected to erode

earnings. This could translate into a boost wages and

consumer spending. Annual dividends for 2,300

companies that closed their books in March 2025

expanded around 3%.

Summer heat returns

The oppressive summer heat in Japan brings broad risks to

the economy, potentially leaving consumers with less

money to spend as work hours shrink and energy costs

rise, as well as less desire to spend.

June Japan's hottest month since in records dating back to

1898 began with temperatures averaging 2 degrees C

above normal according to the Japan Meteorological

Agency.

In parts of Japan, mainly in the west, the rainy season

ended two or three weeks earlier than usual and

temperatures have topped 35 degrees C on some days.

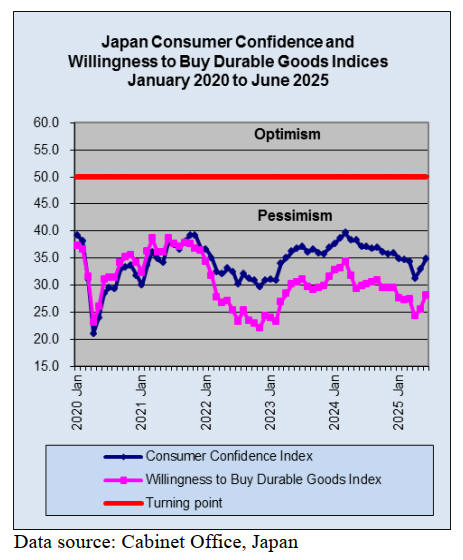

Cost-of-living pressures undermining consumer

sentiment

An Australian government website has commented that

Japan’s economy has long-faced flat or falling prices that

prompted traditionally conservative consumers to save

rather than spend making it difficult to spur economic

growth. Inflation is now increasing; the headline consumer

price index remained above 2% year-over-year for the

third straight month in June. Meanwhile, the yen recently

hit yen147 against the US dollar, its lowest in more than

two decades.

These forces may be more negative than positive for the

world’s third last economy because the rise in consumer

prices is being driven by rising food and energy costs

rather than sustained increases in wages and economic

activity. This is contributing to cost-of-living pressures,

undermining consumer sentiment and eroding household

purchasing power.

See: https://www.exportfinance.gov.au/resources/world-risk-

developments/2022/august/japan-weaker-yen-and-higher-

inflation-hit-consumers-and-businesses/

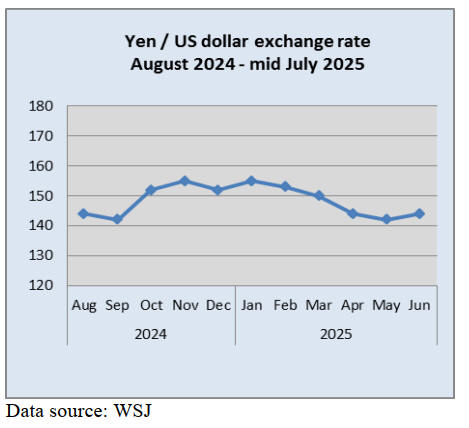

Yen dropped to 147 to the US dollar

The US dollar briefly rose to the lower 147 yen range in

early July as US long-term interest rates climbed amid

waning expectations for a Federal Reserve rate cut

because of higher US inflation from tariffs seen as a key

factor.

Currency analysts have suggested the 25% tariff on

Japanese goods may undermine the Bank of Japan plans to

normalise interest rates which could extend the yen

weakness against the dollar.

Real Estate Information website a hit

The Ministry of land in Japan has expressed surprise that

its Real Estate Information website attracted more than 10

million hits in a six month period.

The Real Estate Information Library released by the

Ministry can overlay data necessary for property

transactions on a single map and has been proving

popular. It allows users to see information on real estate

transaction prices, school districts, hazard maps and more,

in addition to the standard land prices. It also offers an

English language option.

See:

https://mainichi.jp/english/articles/20241015/p2a/00m/0na/00500

0c

and

https://www.reinfolib.mlit.go.jp/

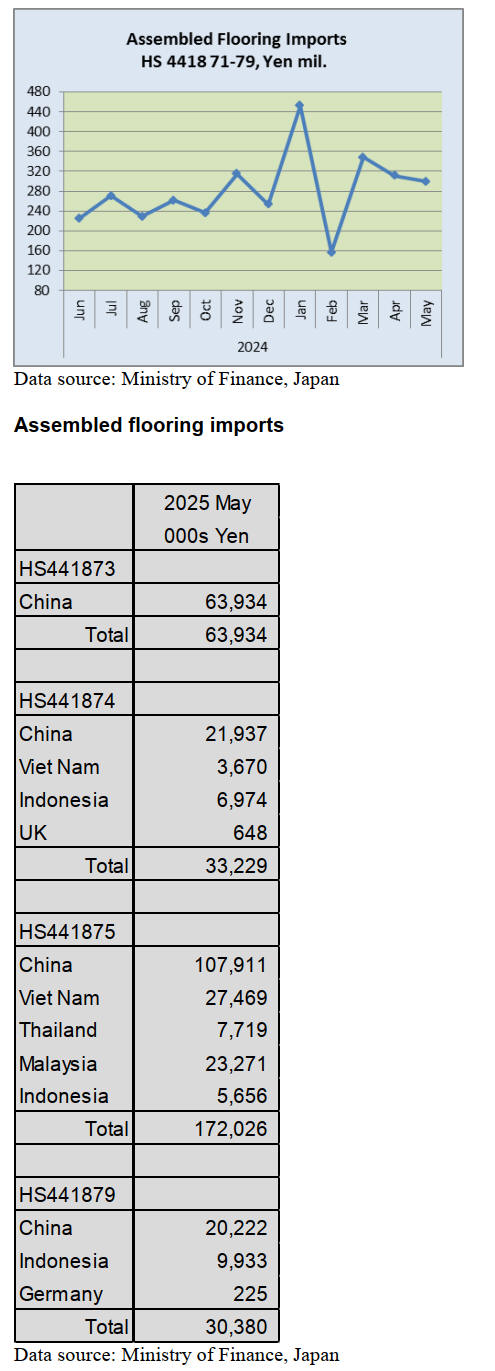

Import update

Assembled wooden flooring imports

The main category of assembled flooring imports in May

2025 was HS441875, accounting for 58% (75% in April)

of the total value of assembled flooring imports compared.

Of HS441875 imports, 67% was provided by shippers in

China, 16% by shippers in Viet Nam and 13% by shippers

in Malaysia. The other main source of assembled flooring

(HS441875) in May was Thailand.

The second largest category in terms of value in May

2025

was HS441873 (21% of the total in May) all of which was

shipped from China. The third and fourth largest

categories in value terms were HS441879 (10%) and

HS441874 (11%).

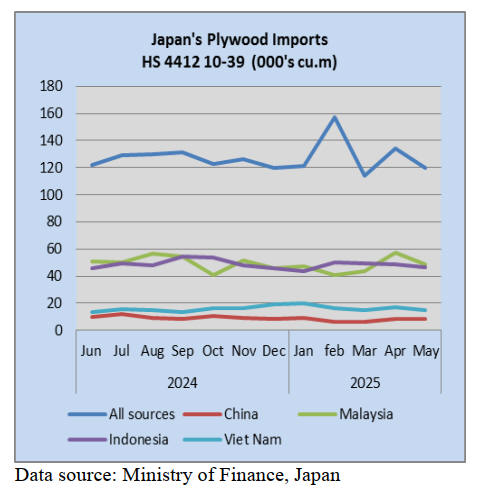

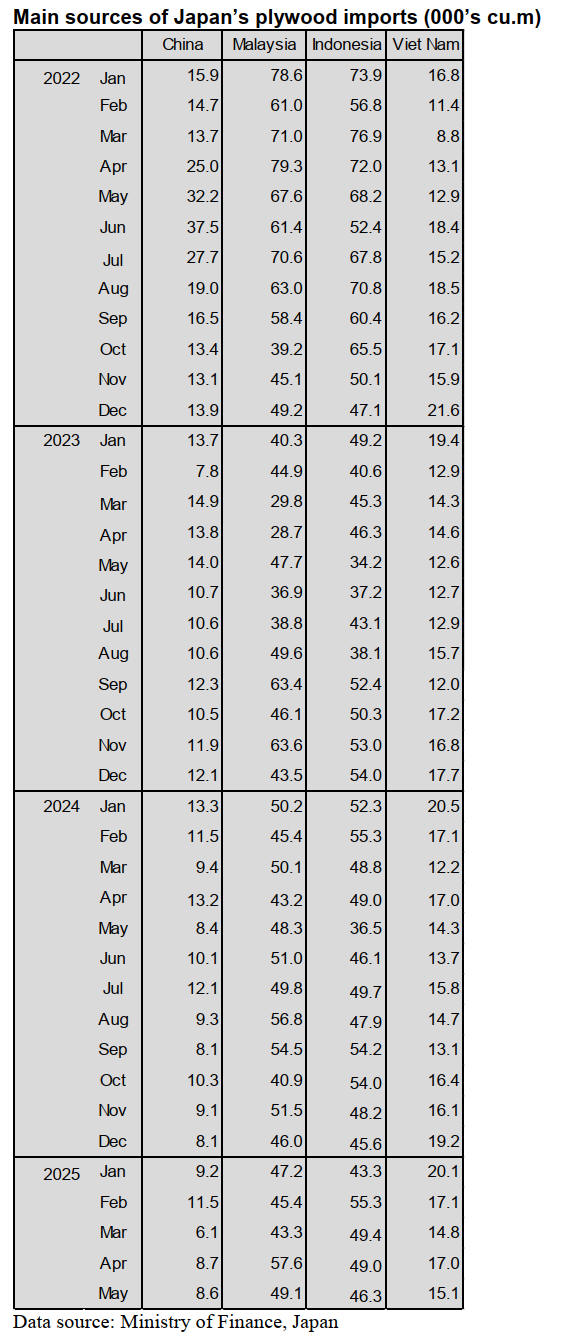

Plywood imports

Activity in the building and construction collapsed in May

mainly as the result of the long ‘golden week’ holiday and

this resulted in very slow domestic sales of plywood. In

May 2025 arrivals of HS441210-39 were down 4% month

on month but were sharply up (36%) compared to May

2024.

Malaysia and Indonesia were the top suppliers in May as

in previous months. The volume of May imports from

Malaysia was slightly down compared to April as were

arrivals from Indonesia and Vietnam. Arrivals from China

in May were at around the same level as in April.

As in previous months, of the various categories of

plywood imported in May 2025, HS441231 was the

largest (87% of total imports) followed by HS441233

(6%) and HS441234 (5%). The balance was of HS441239.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

US to expand supplying lumber

On May 30, 2025, the U.S. Forest Service announced its

goal to increase the annual supply of lumber by at least 25

% over the next four to five years. It also aims to supply 4

billion BF (approximately 9.44 million cbms) of lumber

annually by fiscal year 2028.

The strategy is said to align with Executive Order 14225,

issued by President Trump in March 2025, which calls for

the immediate expansion of American timber production.

On May 29, the U.S. Secretary of Agriculture announced a

$200 million investment to implement the strategy, aiming

to expand timber production, strengthen rural economies,

and stabilize American industry.

Expansion of locally sourced and domestic hardwood

utilisation in Japan

Niigata Gouhan Shinko Co., Ltd. in Niigata Prefecture has

announced plans to install veneer drying and strength

grading equipment by mid-October, 2025, with the goal of

restoring its monthly plywood production volume to 4,000

cbms.

The total investment for this series of equipment upgrades

is expected to reach 2 billion yen.

In January 2024, the company experienced a fire involving

a softwood veneer dryer at its third plant. With support

from repairs, restoration efforts, and veneer supply

assistance from peer companies, the company resumed

plywood production in August 2024 at a monthly volume

of 2,500 cubic meters representing a 28.6% to 37.5%

decrease compared to pre-fire levels.

The company currently uses 37,100 cbms of domestic

timber annually, of which 29,600 cbms are sourced from

Niigata Prefecture. Starting from the fiscal year ending

March 2027, it aims to expand this volume to 55,000 cbms

by the fifth year (fiscal year ending March 2031)

representing a 1.9-fold increase.

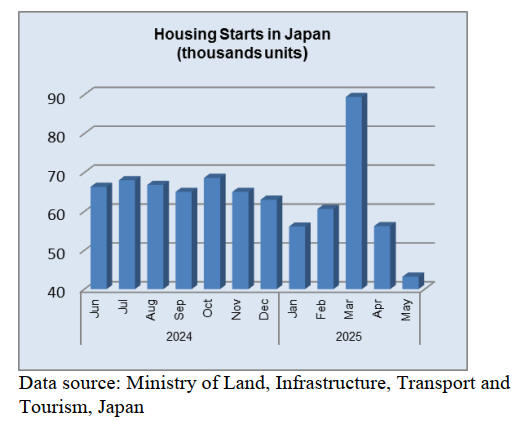

North American logs

Demand for lumber products within Japan is balanced,

albeit at a low level. While there has been some demand

due to a shortage of Douglas fir lumber in the market,

there hasn't been a significant surge, as the slump in

detached housing construction and the rise in single-story

homes have kept growth in check.

Construction starts at building sites in May and June, 2025

lost momentum as they were delayed due to setbacks in

approval-related procedures stemming from regulatory

changes implemented in April,

2025.

As a result the movement of goods and operating levels at

precutting plants varied significantly, with some

experiencing a rush in activity ahead of the changes and

others facing a lull afterward. However, there is strong

sentiment that the situation will recover to levels

comparable to the previous year by summer.

The price of KD Douglas fir beam is 68,000 – 71,000 yen,

delivered per cbm. KD Doulgas fir square costs around

80,000 yen, delivered per cbm. KD Douglas fir small

lumber is around 85,000 yen

South Sea logs and lumber

The movement of hardwood products has shown

fluctuations due to exchange rate changes, but overall, it

remains lackluster as end-user demand continues to be

weak. In early May, when the yen shifted from

appreciation to depreciation, some buyers moved to secure

supplies early in anticipation of further weakening.

However, as the yen began to strengthen again, that wave

of demand subsided.

In producing regions the impact of China’s suspension of

U.S. hardwood log imports continues to be felt. In

Indonesia as well, furniture manufacturers targeting the

U.S. market have seen a slowdown in orders. Producers of

laminated free boards are also experiencing a decline in

business, reflecting the indirect impact of U.S. tariff

policies.

However, in the producing regions, there are concerns that

the decline in demand for logs bound for China could lead

selected for Japan. With remaining uncertain, it is also

difficult to predict trends in the supply regions of imported

hardwood.

|