|

1.

CENTRAL AND WEST AFRICA

Challenging market for Azobé

The Azobé sector is facing mounting pressure and

producers report okan exports to China have almost halted.

In the Netherlands market, dragliner-sheet producers are

bracing for competition from mills which are now

manufacturing the same 20×20 cm and 15×20 cm

dimensions in European beech sourced from Germany,

Romania and the Czech Republic and selling at a much

lower price than Azobé. While the durability may be lower

the cost advantage is significant, say some endusers.

In the Netherlands, one of the country’s largest Azobé

processor has reportedly reduced Azobé production and

halted okan altogether. In Gabon, Chinese owned sawmills

are only willing to sell Azobé if buyers also take Okan to

reduce their stockpiles.

In Cameroon heavy rains have returned delaying log

deliveries and road repairs. Forestry authorities are

maintaining strict controls. In the Republic of the Congo,

where the trade in Okan is small producers are

experiencing the same demand headwinds.

The trend in the Middle East to favour Brazilian Pine as an

alternative to okoumé is driving down prices in the

domestic markets. In the Philippines, okoumé remains in

demand but the arrival of large Brazilian pine shipments

could also impact this market.

Regional round-up

Gabon

Despite being in the traditional dry season heavy rains

persist hampering operations and keeping activity at low

levels. The main species being harvested remain okoumé,

azobé, okan and various redwoods but demand is slow.

Road transport continues at a slow pace in central Gabon

where all-weather laterite routes are under repair in

Lastourville, Lopé and Makokou. The journey from these

regions to Owendo Port can take two to three days by

truck.

Gabon has secured a CFA140 billion loan from the

African Development Bank to fund road and bridge

repairs as well as to bolster rail connectivity. However, rail

services still lack sufficient wagons in southern corridors

even after the recent increased allocation.

Following repeated blackouts earlier in the year power

disruptions have all but ceased since the government

ordered SEEG’s board to address shortcomings. Although

two brief outages occurred in early July Libreville’s

electricity supply has remained reliable providing much-

needed stability to sawmills and port operations.

Owendo Port is functioning normally, with no significant

delays in dispatch. Container availability remains

adequate, say shippers, however, congestion still affects

larger Roll-on/Roll-off vessels, though these delays are

less severe than earlier in the year.

Exporters say CITES constraints on Padouk, Khaya and

Doussié continue to choke exports and the situation is

made worse as European administrations are slow to

process the required documentation.

The Forest Authority has launched land‐tax enforcement

after the 25 March deadline and operators who missed

payments risk heavy penalties.

It has been reported that aerial surveys of all concessions

will soon be mandatory, conducted by a

government‐appointed satellite imagery provider based in

Nkok. In other news, SNBG (Société Nationale des Bois

du Gabon) under joint Chinese/Gabonese management,

remains solvent thanks to a recent capital injection.

Public-Private Partnership for added value production

Gabonreview has reported on a Public-Private Partnership

to create a processing unit covering three levels of wood

processing: primary, secondary and tertiary processing.

The government has said this new industrial infrastructure

will help strengthen the local value chain in the sector,

reduce dependence on raw timber exports and stimulate

domestic economic spinoffs.

Under the partnership the government “will ensure a

regular supply of logs and provide the partner company

with a forest area of around 50,000 hectares. This land

allocation will allow the company to secure its raw

material needs while respecting the sustainability

principles required by national and international

standards” according to Gabonreview.

See: https://www.gabonreview.com/industrialisation-du-bois-un-

nouveau-ppp-pour-dynamiser-la-transformation-locale-au-gabon/

Cameroon

The dry season has ended and heavy rains have returned

across Cameroon forcing a sharp reduction in harvesting

activity. Although operators stockpiled logs and repaired

roads during the dry weather, the renewed downpours

have stalled logging once again.

Douala and Kribi ports continue to handle cargo under

normal conditions but Douala now reports significant

delays with ships waiting more than one week to berth due

to congestion and heavy traffic. Cameroon’s ports are said

to be currently loading about 75% of the timber volumes

seen in Gabon.

While demand in Europe remains subdued Cameroon

sawmills have an advantage of being able to respond

rapidly to specific European orders. Shippers in Cameroon

say demand in the Middle East is stable for Iroko, Sapelli

and redwoods.

Republic of Congo

Demand for Sapelli and Sipo is said to be stable while

interest in Iroko has become more positive reflecting niche

demand in Europe and the Middle East.

Electricity supply in Brazzaville has normalised after

recent disruptions eliminating production delays at veneer

and sawmilling facilities.

2.

GHANA

IMF disbursement after fourth review

On 7 July 2025 the International Monetary Fund (IMF)

Executive Board concluded its fourth review of Ghana’s

ongoing 18th IMF programme which began in May 2023.

Completion of the review unlocked a new disbursement of

US$370 million bringing the total support under the

programme to US$2.3 billion. This is a positive

development for the Ghanaian cedi.

The injection of the IMF funds into the economy will

boost foreign exchange reserves and support the local

currency. The IMF is, however, urging the Bank of Ghana

to reduce its interventions in the foreign exchange market.

The successful review of the Extended Credit Facility

(ECF) is seen as a positive indicator of progress of the

country’s macro-economic reforms and fiscal discipline.

See: https://www.imf.org/en/News/Articles/2025/07/07/pr-

25242-ghana-imf-completes-the-4th-review-under-the-ecf-

arrange

and

https://www.graphic.com.gh/business/business-news/imf-

executive-board-approves-370-million-disbursement-for-

ghana.html

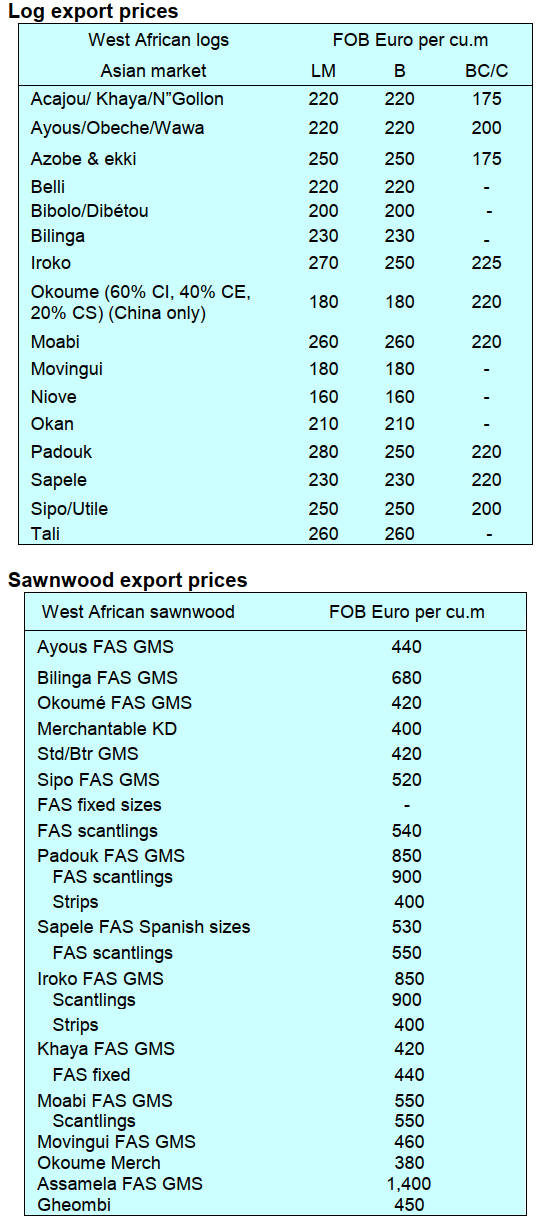

Primary products account for 70% of wood exports

Wood products export for the period January to April 2025

totalled 77,492 cu.m valued at Eur36.48 million against

that recorded for the same period in 2024 which was

86,755 cu.m valued at Eur39.29 million according to data

source from the Timber Industry Development Division

(TIDD) of the Forestry Commission. These figures

registered decreases of 11% and 7% in volume and value

respectively year-on-year.

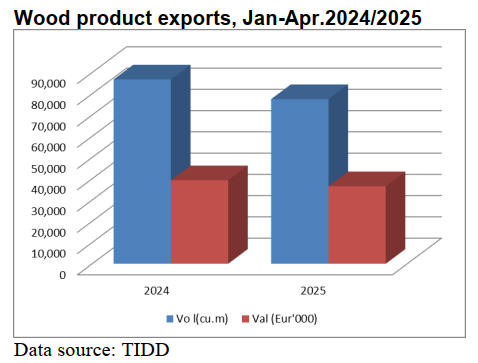

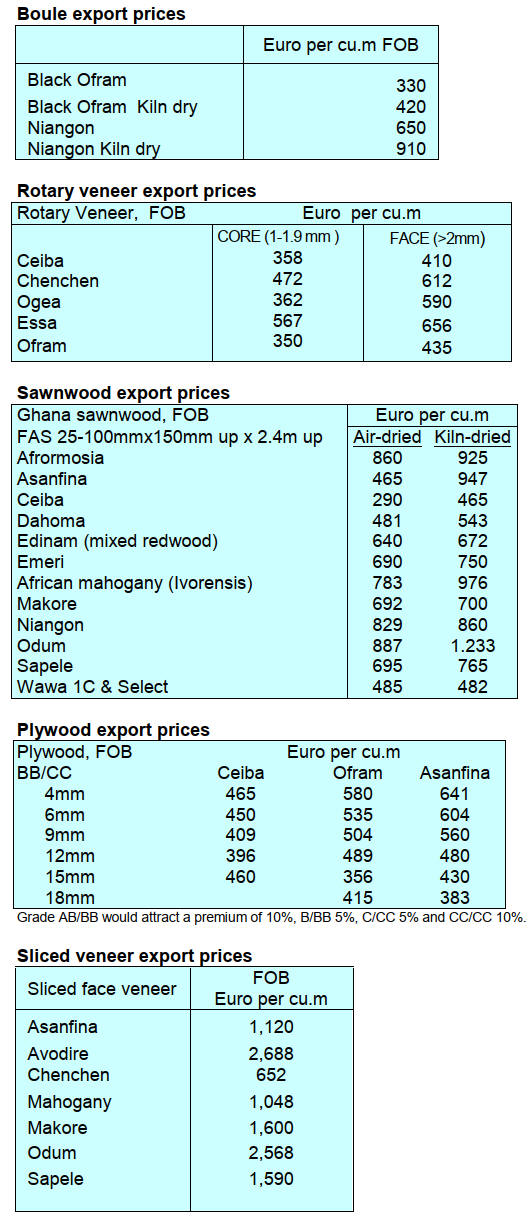

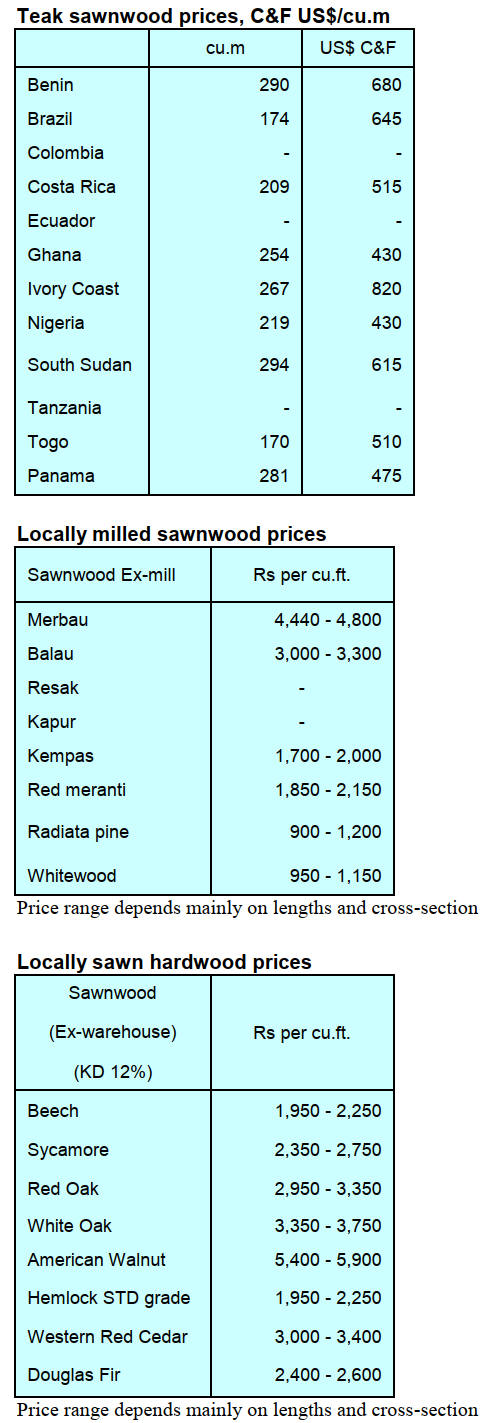

The country’s export statistics classified these products as

Primary, Secondary and Tertiary as shown in graph below.

Primary products such as air-dried sawnwood, boules,

billets, teak logs, kindling, poles and rollboard accounted

for 70% (54,576 cu.m) of the total export volume in the

first four months of 2025 (77,492 cu.m).

For the same period in 2024 these products accounted for

65% (56,104 cu.m) of the total export volume (86,755

cu.m).

Secondary wood products comprising kiln-dried

sawnwood and boules, veneers, plywood and briquettes

accounted for 33% and 27% respectively of the total

export volumes in 2024 and 2025. The corresponding

revenue from the secondary wood product exports were

Eur15.17 million for 2024 and Eur13.79 million for 2025.

Tertiary Wood Products (TWPs) which were mainly

mouldings and dowels accounted for 2,117 cu.m in 2024

(1,729 cu.m in 2025). These products accounted for 2%

each of the total export volume for the respective years.

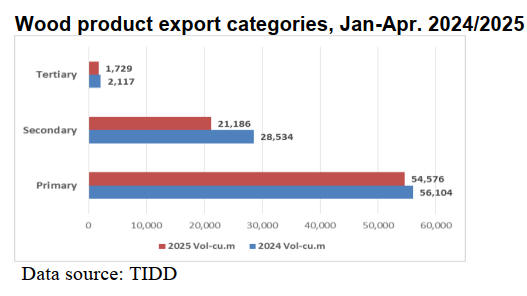

Ghana’s export of secondary and tertiary wood products

recorded gains in their average unit prices for 2025

compared to 2024. However, the AUP of primary product

dipped by 2.4%.

Tertiary wood products recorded the highest AUP of

Eur943/cu.m, followed by the secondary wood product at

Eur651/cu.m and primary products also at Eur386/cu.m

during the period January to April 2025.

The overall average unit price( AUP) saw a slight increase

of 4.0% from Eur453/cu.m in January-April 2024 to

Eur471/cu.m over the same period of 2025. The leading

export species during the period were teak, wawa, ceiba,

denya and cedrela.

Business and investor confidence improving

The Chief Executive Officer of the Association of Ghana

Industries (AGI), Seth Twum-Akwaboah, has stated that

business and investor confidence in Ghana has seen

significant improvement over the past six months.

Mr. Twum-Akwaboah attributed this improvement to

enhanced engagement between the public and private

sectors as well as favourable macroeconomic environment

in recent times which are beginning to yield positive

results and restoring optimism within the business

community.

The CEO added that while the signs are encouraging

there’s still work to be done. He therefore urged

policymakers to maintain the momentum by addressing

structural challenges such as high production costs, access

to credit and bureaucratic delays which continue to affect

many local businesses.

He also called for more directed policies to support

manufacturing, innovation and value addition to

strengthen Ghana’s industrial base, necessary if Ghana

seeks to accelerate economic growth and attract foreign

investment.

PriceWaterhouse Coopers (PwC) report on the 28th

Annual CEO Survey has indicated that 64% of CEOs in

Ghana are optimistic firms will thrive beyond the next

decade if they stick to their current business models or

plans. This percentage is considerably higher than their

peers in Africa (52%) and globally (55%) who share

similar convictions.

The Bank of Ghana’s May 2025 Summary of Economic

and Financial Data has also revealed that the country’s

Business Confidence Index increased to 102.2% in April

2025 when compared to 92.6% for the same period in

2024 and 90.9% in December 2023.

Meanwhile according to the Ghana Statistical Service

(GSS), Ghana’s year-on-year inflation rate for June 2025

fell to 13.7%.

See: https://www.myjoyonline.com/business-and-investor-

confidence-improving-agi/

and

https://www.myjoyonline.com/64-of-ceos-in-ghana-optimistic-

firms-will-thrive-beyond-next-decade-if-pwc-report/

and

https://www.pwc.com/gh/en/assets/pdf/ceo-survey-ghana-

2025.pdf

BoG policy rate likely to drop to 25%

According to IC Research Institute the Monetary Policy

Committee (MPC) of the Bank of Ghana may cut the

policy rate by 300 basis points to 25% which it attributed

to a sharp fall in inflation in June 2025 which was 13.7%.

The MPC of the Bank of Ghana maintained the policy rate

at 28% in May 2025 citing the need to consolidate gains

made in controlling inflation and supporting currency

stability.

According to the Governor, Dr. Johnson Asiama, the

decision was driven by the central bank’s latest forecast

which indicated a continued easing of inflationary

pressures, supported by a tight monetary policy stance,

relative exchange rate stability and ongoing fiscal

consolidation.

See: https://www.myjoyonline.com/bog-to-cut-policy-rate-by-

300-basis-points-to-25-ic-research/

and

https://www.myjoyonline.com/ghanas-international-reserves-hit-

6-months-of-import-cover-mahama/

3. MALAYSIA

Looming demand shock from the US tariffs

Economists recommend Malaysia should urgently rethink

its strategy to secure a trade deal with the US to avoid a

long-term economic fallout. They warn of a looming

demand shock from the US tariffs and urge policymakers

to reassess their approach, including boosting imports

from the United States and addressing non-tariff barriers.

The US tariff on imports from Malaysia was increased to

25%, up from 24%, effective 1 August. This is more

favourable than tariffs for Thailand (36%) and Indonesia

(32%) but higher than that for Vietnam.

Sunway University economics professor and government

adviser, Yeah Kim Leng, said Malaysian exporters,

particularly in US-exposed sectors, could see reduced

orders as American buyers cut back purchases. “The key

question now is whether market share will shift due to

relative price changes stemming from the varying tariff

levels with countries with lower tariffs potentially gaining

a competitive edge” said Yeah.

Malaysian Furniture Council president, Desmond Tan,

said Vietnam, Malaysia’s closest competitor in the global

furniture market, produces a similar range of products and

targets the same export destinations, especially the US.

Tan said the industry is also being squeezed by rising costs

on the domestic front. “These include the expanded Sales

and Service Tax (SST), which now imposes a 5% tax on

raw materials and directly drives up production costs. We

also face higher labour expenses with the new minimum

wage” he added.

See: https://www.thestar.com.my/business/business-

news/2025/07/09/tariff-strategy-shift-crucial#goog_rewarded

and

https://www.thestar.com.my/news/nation/2025/07/10/govt-

urged-to-intervene-as-new-us-tariff-brings-jitters-for-businesses

Green furniture certification

The Forest Research Institute Malaysia (FRIM) is guiding

furniture makers to obtain Green Furniture Certification,

aiming to give them a competitive edge in the global

market that increasingly favours sustainable and eco-

friendly products.

Green Furniture refers to pieces crafted from sustainable

materials through environmentally responsible, recyclable

processes with minimal impact on nature. The certification

assures consumers of quality and safety and would

position Malaysian furniture alongside international eco-

friendly products.

By offering designs that are both appealing and ‘healthy’

for people and the environment, Malaysian furniture

producers stand to compete effectively in the global

market, a representative from FRIM said.

He noted that green certification aligns with national goals

to promote a green economy and support the United

Nations Sustainable Development Goals (SDGs).

He said Malaysia’s rich natural resources such as timber,

bamboo, rattan and other natural fibres present significant

potential for the green furniture sector. The first stage of

the FRIM Green Furniture certification process covers raw

material verification and safety testing while the second

stage adds performance evaluations for health and safety

standards.

See:

http://theborneopost.pressreader.com/article/282235196673084

Sabah’s net carbon sink a valuable asset

Sabah's status as a net carbon sink is a rare and valuable

asset that must be protected, said State Assistant Minister,

Abidin Madingkir. "Put simply, we absorb more carbon

than we emit. We are among the few jurisdictions in the

world with this status," he said when tabling the Sabah

Climate and Carbon Governance Enactment 2025 in the

State Assembly.

Abidin said Sabah accounted for about 36% of Malaysia's

total carbon sequestration giving it a strategic edge in a

carbon-constrained global economy. Sabah completed its

first comprehensive Greenhouse Gas Inventory in 2024

and is already aligned with Malaysia's 2050 net zero target

under the Paris Agreement.

The bill was passed and includes establishment of a Sabah

Climate Change Action Council, a Climate Registry,

Inventory Centre and the Sabah Climate Fund.

See:

https://www.nst.com.my/news/nation/2025/07/1241899/sabah-

tables-climate-bill-protect-carbon-sink-status

FRIM support for reforestation efforts in Saudi Arabia

Forest Research Institute Malaysia Incorporated (FRIM

Inc.) has signed a memorandum of understanding with

DMELL Global to supply tree planting material in support

of Saudi Arabia’s green initiative. The partnership is

meant to supply high-quality forest tree planting material

to bolster large scale reforestation efforts in Saudi Arabia.

Under the agreement, FRIM Inc. would supply up to eight

million trees annually.

FRIM sees this as the foundation for a broader partnership,

including technical consultancy, knowledge sharing,

capacity building and joint environmental planning.

Beyond providing planting materials, FRIM is equipped to

deliver end-to-end support, from technical consultancy to

on-the ground location guidance.

See:

http://theborneopost.pressreader.com/article/281968908691739

4.

INDONESIA

Export Benchmark Price (HPE) April 2025

The following is the list of Wood HPE from 1 July to 31

July, 2025.

Processed wood (prices per cu.m)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are levelled on all four

sides so that the surface becomes even and smooth of

Merbau wood with the provisions of a cross-sectional area

of 4000 sq. mm to 10,000 sq.mm (ex 4407.11.00 to ex

4407.99.90) = US$1,500/cu.m

See: https://jdih.kemendag.go.id/peraturan/keputusan-menteri-

perdagangan-republik-indonesia-nomor-1552-tahun-2025-

tentang-harga-patokan-ekspor-dan-harga-referensi-atas-produk-

pertanian-dan-kehutanan-yang-dikenakan-bea-keluar

Import rules for forest products relaxed

The Indonesian government is highlighting the benefits of

its new import deregulation policy particularly for forest

products. On 2 July 2025 the Minister of Forestry, Raja

Juli Antoni, stated that this policy aims to provide legal

certainty, facilitate investment and create jobs.

The policy, a collaborative effort between the Forestry,

Trade and Finance Ministries, is the first phase of

Indonesia's strategy to boost global competitiveness. It

relaxes import rules for 10 commodities with forest

products being the largest group, encompassing 441 HS

code forest products.

The Minister of Trade, Budi Santoso, emphasised that

most imported forest products such as logs, plywood and

wooden crates serve as raw materials for industry making

this deregulation crucial.

While imported forest products no longer require Import

Approval (PI) from the Ministry of Forestry importers still

need to submit an import declaration.

The Minister of Trade, Budi Santoso, explained that the

deregulation was necessary to support industrial demand

while reducing pressure on domestic forests. By lifting

restrictions and prohibitions the government aims to

facilitate imports of raw materials while ensuring that

legal traceability of the wood is maintained through

declarations verified by the Ministry of Forestry.

See: https://en.antaranews.com/news/363405/ri-govt-highlights-

benefits-of-import-deregulation

and

https://finance.detik.com/berita-ekonomi-bisnis/d-

7988601/mendag-ungkap-alasan-longgarkan-impor-441-

produk-kehutanan.

SVLK relaxation not under review

The deregulation of forest product imports has sparked

renewed discussion about relaxing the Timber Legality

and Sustainability Assurance Program (SVLK) for

exports. However, the Minister of Trade clarified on 30

June that the SVLK, which pertains to exports, is distinct

from the recently announced import deregulation and is

not currently under review. He also confirmed there has

been no harmonisation between the two policies.

The Indonesian Furniture and Craft Industry Association

(HIMKI) has actively advocated for SVLK review

especially for small, labour intensive businesses in the

downstream sector. HIMKI asserts that the industry

supports the local economy and does not contribute to

deforestation. With furniture exports valued at US$2.5

billion in 2024, HIMKI aims to reach US$5 billion.

See: https://www.cnbcindonesia.com/news/20250630163310-4-

645007/sempat-muncul-wacana-relaksasi-svlk-ekspor-produk-

kayu-ini-updatenya

Government urged to secure preferential tariffs for

exports to the US

The Indonesian Furniture and Craft Industry Association

(HIMKI) called for strategic collaboration with the

Indonesian government to advocate for preferential tariffs

on furniture and craft exports to the United States.

HIMKI Chairman, Abdul Sobur, highlighted the urgent

need for a review of tariffs. He stressed that favorable

tariff policies could attract global investment, create

millions of jobs and significantly boost Indonesia's

furniture and craft exports.

To support the government's efforts HIMKI proposed five

key initiatives: Export Tariff Diplomacy, Market

Diversification, Export Ecosystem Reform, Fiscal

Incentives for Exporters and Domestic Market Protection.

These proposals aim to improve trade relations, simplify

export processes and safeguard the domestic industry.

Sobur reiterated that tariff policies are not merely financial

figures but impact the livelihoods of millions and the

future of Indonesia's strategic industries.

See: https://www.msn.com/id-id/berita/other/himki-dorong-

pemerintah-perjuangkan-tarif-preferensial-ekspor-mebel-

kerajinan-ke-as/ar-AA1HJdkS?ocid=BingNewsVerp

and

https://www.tribunnews.com/bisnis/2025/06/30/himki-dukung-

pemerintah-perjuangkan-tarif-preferensial-ekspor-mebel-dan-

kerajinan-ke-as

Concerns raised on impact of EUDR on smallholders

Indonesia is currently waiting for a formal response from

the European Union (EU) regarding its concerns over

the EUDR. Dida Gardera from Indonesia’s Coordinating

Ministry for Economic Affairs confirmed that Indonesia

submitted written questions to the EU after a bilateral

dialogue in Brussels on 4 June.

Key areas of concern include the legal basis and

methodology for the EUDR's risk classification,

the recognition of Indonesia's national legality system and

potential conflicts with World Trade Organization (WTO)

rules.

Indonesia has also highlighted the

significant administrative burdens the regulation could

place on smallholders particularly concerning digital

traceability and geolocation requirements.

Gardera stressed that over 90% of Indonesia's coffee and

cocoa producers are smallholders. He is reported as saying

the EUDR's demand for separating production from forests

might be incompatible with Indonesia’s sustainable

agroforestry practices, especially in coffee and cocoa

cultivation. Gardera cited examples, such as Perhutani's

coffee plantations in Java which apply sustainable

agroforestry that does not harm forest ecosystems, arguing

that a blanket application of the EUDR might not be

feasible for all crops.

See: https://en.antaranews.com/news/363805/indonesia-awaits-

eu-reply-on-deforestation-rule-concerns

Updating the nation's forestry regulations

On 29 June 2025 Indonesia's Parliamentary Commission

IV initiated discussions to update the nation's forestry

regulations as the current Law, No. 41 of 1999, is

considered insufficient for modern forest management

challenges.

During a Public Hearing on 25 June lawmakers, experts

and academics highlighted how overlapping provisions

with other sectoral policies, particularly involving

the Ministry of Agrarian Affairs and Spatial

Planning/National Land Agency (BPN) complicate

effective governance.

Sturman Panjaitan, a Commission IV member, emphasised

that the existing law, stemming from the reform era no

longer meets contemporary needs due to conflicting

regulations that could hinder sustainable forest

management.

He argued that a new legal framework is vital to provide

clarity, boost forest utilisation and ensure long-term

benefits for the population. Fellow Commission IV

member, I Nyoman Adi Wiryatama, agreed advocating for

a complete overhaul rather than mere revision.

Parliament is now gathering input from various

stakeholders, including civil society, forestry businesses

and indigenous communities. The goal is to draft a new

forestry law that better addresses Indonesia's current and

future ecological and economic challenges. This lengthy

process is deemed crucial for creating a more responsive

and effective regulatory system for forest management.

See: https://forestinsights.id/uu-kehutanan-dinilai-tidak-lagi-

relevan-dpr-ri-dorong-penyusunan-regulasi-baru/

In related news, Difa Shafira, from the Indonesian Centre

for Environmental Law (ICEL), stated that the current

classification of forests under Indonesia's Forestry Law

No. 41 of 1999 into conservation, protection and

production zones is outdated and ineffective.

She argues this system undermines forests' role as life-

support systems and fails to align with national emission

reduction targets in the Forestry and Other Land Use

(FOLU) sector. Beyond reform Shafira called for clearer

and more inclusive zoning criteria that considers the

ecological, cultural and social contexts of each region.

She emphasised integrating the needs of local

communities, indigenous peoples and regional

governments into forest management policies.

Environmental resilience and the land's capacity to support

human activity without degradation must be central to

zoning decisions. Shafira warned against generalising

forest management across Indonesia's diverse islands

urging more attention to the unique and fragile ecosystems

of smaller islands often overlooked in national policy.

See:

https://lestari.kompas.com/read/2025/06/26/211645686/pembagi

an-fungsi-hutan-dalam-revisi-uu-kehutanan-dinilai-sudah-tak-

relevan.

and

https://www.tempo.co/lingkungan/-pengaturan-hutan-adat-

dalam-ruu-kehutanan-1925180

Indonesia and UK strategic partnership set to be

concluded in September

Indonesia and the United Kingdom are set to finalise a

new strategic partnership agreement in September

according to the British Ambassador, Dominic Jermey.

This partnership aims to strengthen ties between the two

nations amidst global geopolitical shifts, emphasising

shared democracy and human rights issues.

The agreement will focus on human resource

development (especially in education and health),

economic growth, sustainable development (including

green energy and forest conservation). It is planned the

partnership will be formally launched during a meeting

between Indonesian President, Prabowo Subianto and UK

Prime Minister Keir Starmer.

See: https://en.antaranews.com/news/362029/new-indonesia-uk-

strategic-partnership-agreement-coming-september-2025

Indonesia’s planned trade pact with US partners

upended

Indonesia was set to sign a US$34 billion pact with

American business partners ahead of the 9 July US tariff

deadline. This aimed to boost imports from the United

States and was part of Jakarta's strategy to avoid the

threatened 32% tariff on Indonesian exports to the U.S.

But this initiative was overtaken by decisions from the US

government. The Indonesia government expressed surprise

and disappointment after learning the 32% tariff on

Indonesian exports to the US will stand.

The government had proposed significant measures to

address the US trade deficit including a pledge to increase

imports from the US by US$34 billion across sectors like

agriculture, energy and aviation.

The US decision contrasts sharply with plans to lower

tariffs on Vietnam (from 46% to 20%) and Cambodia

(from 49% to 36%). Indonesia now remains burdened by

both the 32% tariff hike and a 10% global baseline tariff.

Former WTO Ambassador, Iman Pambagyo, criticised the

US approach suggesting Indonesia should focus

on building resilience rather than trying to further appease

Washington.

Lili Yan Ing, Secretary General of the International

Economic Association, advised that ASEAN nations,

including Indonesia, should bypass direct engagement

with the US government and instead leverage the

influence of US corporations with strong interests in the

region to safeguard their interests. The 32% tariff is set to

take effect on 1 August 2025.

See: https://jakartaglobe.id/business/indonesia-offers-34-billion-

in-us-imports-to-secure-tariff-relief

and

https://jakartaglobe.id/business/indonesia-stunned-by-us-tariff-

decision-despite-34b-trade-offer

5.

MYANMAR

Myanmar dismisses World Bank economic forecast

Myanmar Prime Minister, Min Aung Hlaing, has publicly

challenged the World Bank's recent forecast of a

significant economic contraction for the country,

dismissing the forecast as based on "inaccurate and

incomplete data." His remarks were made during a

National Economic Development Coordination meeting,

as reported by state media.

The World Bank projected that Myanmar's economy

would shrink by 2.5% in the 2025/26 financial year. This

downturn was largely attributed to the devastating

magnitude 7.7 earthquake in March which inflicted an

estimated US$11 billion worth of damage, equivalent to

14% of Myanmar's GDP.

In contrast to the World Bank's assessment Min Aung

Hlaing claimed Myanmar's GDP was US$76.4 billion in

2024-25 and has a target of US$81.6 billion for 2025-26,

representing a US$5.2 billion increase.

"Regardless of external forecasts if the people remain

committed and hardworking we can defy these

expectations and achieve real GDP growth," he stated.

On the ground, Myanmar faces a multifaceted crisis,

including ongoing civil war, natural disasters, inflation,

job scarcity, currency devaluation and severe power

outages with millions grappling with post-earthquake

challenges.

See https://www.irrawaddy.com/business/economy/myanmar-

regime-leader-rejects-world-bank-economic-forecast-as-

inaccurate.html

ILO - Unprecedented action against Myanmar

In a landmark decision the 113th International Labour

Conference (ILC) adopted, by consensus, the resolution

invoking Article 33 of the International Labour

Organization (ILO) Constitution concerning Myanmar.

Invoking ILO Article 33 of its Constitution against

Myanmar is the strongest measure available to the

organisation. This unprecedented step, only the third in the

ILO's century-long history (previously used for Myanmar

in 2000 and Belarus in 2023) underscores the perceived

severe and persistent violations of workers' and human

rights in the country since the February 2021.

Myanmar has rejected the resolution, labeling it

"politically motivated" and claiming it will have "no

effect" on the country's labour landscape. The

administration maintains it is working with the ILO.

US tariffs and existing ILO measures against Myanmar

have created a challenging economic environment for its

export sectors. Recent reports indicate that the US has

imposed a 40% tariff on goods from Myanmar, effective 1

August 2025. This is a substantial increase as US tariffs on

Myanmar garment imports averaged around 20%.

Myanmar's garment industry is a major employer,

providing livelihoods for nearly 800,000 workers and

generating around US$5 billion in exports annually.

See: https://www.ilo.org/sites/default/files/2025-06/ILC113-

Record-2A-%5BSECTOR-250602-001%5D-Web-EN.pdf

and

https://www.scoop.co.nz/stories/WO2506/S00169/ilo-member-

states-implement-resolution-on-myanmar-junta.htm

and

https://www.thestar.com.my/aseanplus/aseanplus-

news/2025/06/12/earthquake-worsens-myanmar039s-economic-

decline-world-bank-says

6.

INDIA

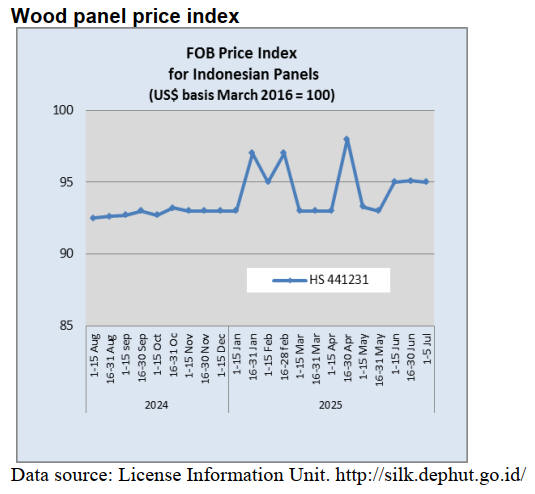

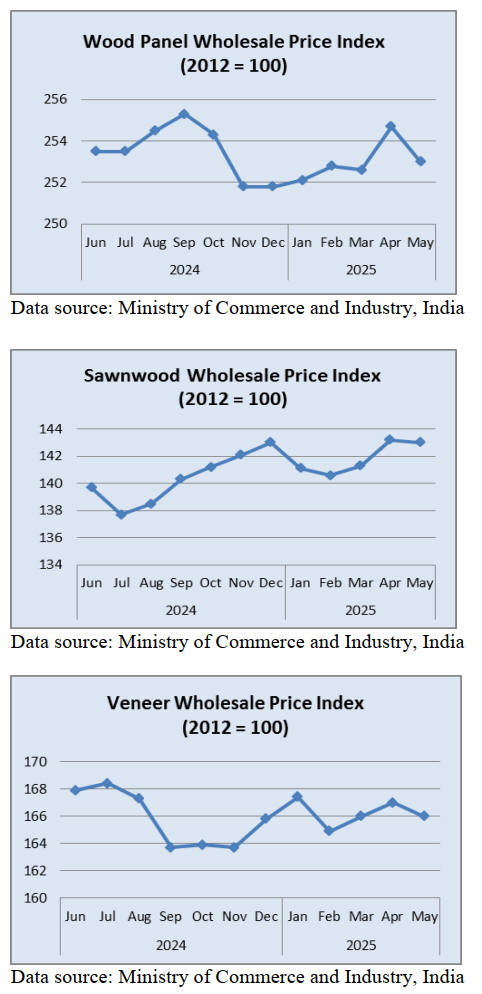

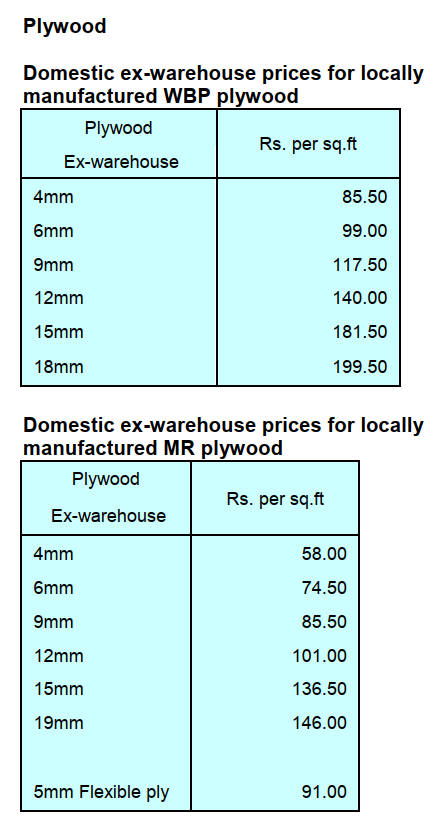

Wood panel index declined

after 3 monthly increases

The annual rate of inflation based on the all India

Wholesale Price Index (WPI) was 0.39% in May. The

positive rate of inflation in May was primarily due to

increased prices for manufactured food products,

electricity, other manufacturing, chemicals and chemical

products, manufacture of other transport equipment and

non-food articles.

The index for Manufacturing remained unchanged at

144.9 in May 2025. Out of the 22 NIC two-digit groups

for manufactured products, 10 groups witnessed an

increase in prices, 9 groups witnessed a decrease in prices

and 3 groups saw no change in prices.

Some of the important groups that showed month on

month price increases were other manufacturing,

manufacture of other non-metallic mineral products,

computers, electronic and optical products,

pharmaceuticals, medicinal chemical and botanical

products and textiles.

Some of the groups that saw a decrease in prices were

manufacture of food products, basic metals; rubber and

plastics products, chemical and chemical products and

electrical equipment.

The price index for wood panels declined in May

after 3

months of increase. The sawnwood price index was little

changed from a month earlier but there was a decline in

the index for veneers.

See: https://eaindustry.nic.in/

Veneer sector faces challenge in securing base ply

The correspondent wtites “Overall the markets are

improving. The decorative veneered plywood market is

facing lots of issues in India as factories and importers are

not able to import the base plywood for overlaying which

is the main raw material for manufacturing veneered

plywood/fancy plywood.

Earlier the BIS (Bureau of Indian Standards) office had

said that plywood less than 4 mm will be permitted as raw

material for fancy plywood manufacturers but the new

regulation which came in May has also restricted these

imports. So far the BIS has not granted any licence for

Plywood/MDF/Particle Board manufacturers in Vietnam,

Indonesia, China and Russia.

Ocean freight charges ares high but stable. The good news

is that the monsoon is progressing satisfactorily and

forecasts of India's growth have been positive”.

National Bamboo Mission (NBM) 2025

In a major effort for India’s bamboo industry the central

government launched a National Bamboo Mission (NBM)

2025 aimed at expanding bamboo cultivation,

strengthening industry linkages and reducing import

dependence.

The initiative focuses on increasing bamboo plantations on

non-forest lands, including farms, homesteads, community

lands and along irrigation canals. By raising farm incomes,

promoting climate resilience and ensuring a resilience and

ensuring a steady supply of raw material for industries,

NBM seeks to establish bamboo as a key economic driver.

A major aspect of NBM 2025 is improving post-harvest

management by setting up primary processing units,

treatment and seasoning plants and market infrastructure

near production clusters. The mission also places strong

emphasis on research, product innovation and skill

development to align with market demands.

To ensure sustainability, farmers producer organisations

(FPOs), self-help groups and entrepreneurs will be

actively involved facilitating better access to financial and

market support.

Ashish Kaswa, a Nagpur-based entrepreneur and bamboo

industry expert, praised Maharashtra’s investment, calling

it a major step toward unlocking the sectors potential.

“Maharashtra is leading in private bamboo plantations and

with the right policies it can become a hub for bamboo-

based industries” he said.

See: https://timesofindia.indiatimes.com/city/nagpur/rs-4300-

crore-maha-plan-to-boost-bamboo-

sector/articleshow/119881552.cms

7.

VIETNAM

Wood and Wood Product (W&WP) trade

highlights

According to the Viet Nam Customs Department W&WP

According to Vietnam General Department of Customs

W&WP exports in June 2025 reached US$1.3 billion, an

increase of 4% compared to June 2024 of which, WP

exports contributed US$884 million, up 4% compared to

June 2024.

In the first six months of 2025 exports of wood and wood

products are estimated to have earned US$8.1 billion, an

increase of 8% compared to the same period in 2024 of

which WP exports accounted for US$5.55 billion, up 9%

compared to the same period in 2024.

Raw wood (log and sawnwood) imports in June 2025

reached 694,700 cu.m, valued at US$222.3 million, an

increase of 3% in volume and 5% in value compared to

May 2025. Compared to June 2024 there was an increase

of 51% in volume and 46% in value.

In the first six months of 2025 raw wood imports were

3.32 million cu.m valued at US$1.04 billion, an increase

of 34% in volume and 27% in value compared to the same

period in 2024.

NTFP exports in June 2025 reached US$75 million, down

6% compared to May 2025 bringing total exports of this

product group in the first half of 2025 to US$443.21

million, up 9% compared to the same period in 2024.

W&WP exports to the EU market in June 2025 amounted

to US$42 million, up 21% compared to June 2024. In the

first six months of 2025 exports to the EU earned about

US$302 million, up 9% compared to the same period in

2024.

Vietnam’s woodchip exports in June 2025 reached

US$170 million, down 6% compared to May 2025 and

down 13% compared to June 2024.

In the first half of 2025 woodchip exports were estimated

at US$1.19 billion, down 9% compared to the same period

in 2024.

Poplar wood imports into Vietnam in June 2025 totalled

26,600 cu.m valued at US$11.8 million, down 0.4% in

volume but up 0.3% in value compared to May 2025.

Compared to June 2024 imports were down 25% in

volume and 13% in value. In the first six months of 2025

imports of this item are estimated at 150,600 cu.m, valued

at US$64.0 million, down 15% in volume and 5% in value

compared to the same period in 2024.

Vietnam ‘low risk’ under EUDR

Vietnam has been classified as a “low-risk” country under

the EUDR. The classification means that Vietnamese

exports to the EU will be subject to simplified due

diligence requirements, easing the compliance burden on

businesses.

According to Tran Van Cong, Vietnam’s Agricultural

Counsellor to Belgium and the EC, the low-risk

classification is a positive outcome of sustained

cooperation between the two sides, including Vietnam’s

engagement in the Voluntary Partnership Agreement on

Forest Law Enforcement, Governance and Trade

(VPA/FLEGT) as well as efforts in environmental

protection and sustainable development.

See: https://bizhub.vietnamnews.vn/vn-classified-as-low-risk-

under-eu-anti-deforestation-regulation-post375983.html

Advancing legal framework for forest carbon market

The Government is in the process of finalising a draft

decree on forest carbon sequestration and storage services

which includes provisions on the transfer of forest carbon

credits.

Designed based on the principles of transparency,

accountability and balance of interests among the State,

forest owners and relevant stakeholders the draft, now

under public consultation, is expected to establish the

necessary legal foundation for the trading, payment and

management of forest carbon credits in both domestic and

international markets.

Key provisions in the draft Decree

Under the draft decree a forest carbon credit is defined as

the volume of CO₂ absorbed through sustainable forestry

practices which is measured, verified and certified by

domestic or international authorities and may be traded in

both national and global markets.

Notably, the draft decree clearly specifies parties to the

carbon market. Specifically, service providers include

forest owners; commune-level People’s Committees and

other organisations assigned forest management

responsibilities in accordance with law; foreign

organisations and individuals meeting certain conditions

(as specified in Decree 06/2022/ND-CP and Decree

119/2025/ND-CP) and domestic organisations and

individuals not regulated but wishing to use the results of

emission reductions or forest carbon credits to voluntarily

offset greenhouse gas emissions.

Under the draft, transactions would be conducted in two

forms: bilateral contract between relevant parties or via the

domestic carbon exchange. In either case, transactions

may only be conducted after the volume of emission

reductions and carbon credits has been verified and

approved by competent state authorities.

Payment methods include direct and indirect forms. In

direct payment, the service user pays the service provider

directly under a contract or according to the operational

mechanism of the domestic carbon exchange.

In indirect payment, the service user makes payment to the

service provider via entrustment through the Forest

Protection and Development Fund, based on a contract

with a state agency acting as the representative of the

service provider.

The draft decree also stipulates the payment rate. The

payment rate is the price for the exchange or transfer of

one ton of CO₂ or one forest carbon credit, calculated in

Vietnamese dong or another foreign currency.

Specifically, the determination of the price for the

exchange and transfer of forest carbon sequestration and

storage services with respect to forests under all-people

ownership would go through a three-step process:

First, the Ministry of Agriculture and Environment would

prescribe the method of pricing forest carbon sequestration

and storage services.

Second, provincial-level People’s Committees would,

based on the guidance of the Ministry of Agriculture and

Environment, issue a price list for forest carbon

sequestration and storage services applicable to forests

under local management.

Third, relevant parties would determine the starting price

or reserve price of forest carbon sequestration and storage

services on the domestic carbon exchange or in auctions

based on the price stated in the above-mentioned price list.

For the exchange or transfer of emission reductions or

carbon credits involving two or more provinces/cities, the

starting price/reserve price would be the highest among

the price lists issued by the relevant provincial-level

People’s Committees. In case neither the pricing method

nor the price list has been issued, the Ministry of

Agriculture and Environment will conduct negotiations

and report the case to the Prime Minister for the latter to

decide on a specific price.

The draft decree is expected to serve as a supplement to

Vietnam’s current legal framework governing the carbon

market.

On December 28, 2022, the Government promulgated

Decree 107/2022/ND-CP, on the pilot transfer of emission

reductions and financial management under the Emission

Reductions Payment Agreement (ERPA) for the North

Central region. The pilot program, which has been

implemented since the issuance of the Decree, will remain

in effect until the end of 2026.

Since the effective date of Decree 107, Vietnam has

successfully transferred over 10 million tonnes of CO₂ to

the World Bank’s Forest Carbon Partnership Facility at a

price of US$5 per tonne yielding over US$50 million.

Vietnam is the first among 15 ERPA signatory nations to

deliver all contracted carbon credits in the initial reporting

period.

See: https://vietnamlawmagazine.vn/vietnam-advances-legal-

framework-for-forest-carbon-market-74589.html

8. BRAZIL

Decree on forest replacement and

environmental

credits

The Government of Pará State has Published Decree No.

4.740/2025 which establishes a new regulatory framework

for forest replacement procedures and the granting of

forest compensation credits in the State. The goal is to

align with the current Brazilian Forest Code and replace

rules based on the former 1965 Forest Code.

The decree defines the technical, administrative and

operational criteria for obtaining, granting, transferring

and overseeing forest replacement credits. This measure

modernises the environmental compensation policy by

seeking to align rural production/farming with

environmental conservation, promoting sustainable

practices and the reforestation of native timber species.

The decree establishes that all individuals or legal entities

that use forest raw materials derived from the suppression

of native vegetation which, even if legally authorised,

should carry out forest replacement. This can be done

through four ways: direct planting with own resources;

participation in reforestation projects through associations

or cooperatives; Acquisition of existing credits or a

compensatory payment to the State Forest Development

Fund.

All operations involving the generation, transfer and use of

forest credits should be registered in the Pará State System

for Commercialisation and Transport of Forest Products

(Sisflora) and the Registry of Forest Product Exploiters

and Consumers (Ceprof).

The Pará Institute for Forest and Biodiversity

Development (Ideflor-Bio) and the State Secretariat for

Environment and Sustainability (Semas) are the agencies

responsible for monitoring and issuing certificates.

See: https://forestnews.com.br/para-regulamenta-por-decreto-

reposicao-florestal-e-concessao-de-creditos-ambientais/

Plan to boost investments in the Amazon

A plan to attract investments in the conservation,

restoration and sustainable development of the Amazon

was presented to the 30th United Nations Climate Change

Conference (COP30) presidency by seven civil society

organisations that have been active in the Amazon region

for over 30 years.

The plan entitled “Scaling Finance for Nature-Based

Solutions to Protect the Amazon: A Roadmap for Action”

not only proposes a framework to create climate finance

flows for the Amazon but also aims to consolidate actions

that enable the development of a green economy in the

region and strengthen the capacity to implement

sustainable initiatives in the biome.

According to Conservation International (CI), the plan

highlights that, although the Amazon generates around

US$317 billion annually, investments directed toward its

conservation totalled just US$5.81 billion between 2013

and 2022, a figure below the World Bank´s estimate of

US$7 billion per year needed to prevent the tipping point,

a scenario in which parts of the Amazon would turn into

savannah, altering rainfall patterns and causing

biodiversity loss.

CI points out that the World Bank data shows that only 3%

of these investments were allocated to nature-based

solutions for mitigating climate change and 11% were

used to adapt local infrastructure.

The roadmap proposes actions such as redirecting

subsidies from high-emission production chains to a green

economy, improving supply chain traceability through

satellite imagery and other technologies, payment for

environmental services and combating the illegal

economic activities in the region.

One of the main instruments to implement these actions is

the Tropical Forests Forever Fund (TFFF) which aims to

raise US$5 billion annually, with US$2 billion allocated

specifically to the Amazon, four times the average

investment made over the past decade.

The proposal also calls for drafting a Global Declaration

for the Amazon, encouraging countries under the Climate

Convention to commit to ensuring that the biome

continues to play a crucial role in addressing climate

change.

See: https://agenciabrasil.ebc.com.br/meio-

ambiente/noticia/2025-07/organizacoes-sociais-propoem-plano-

para-investimentos-na-amazonia

Exports

Furniture sector strategies to expand export markets

The furniture industry in Santa Catarina State is evaluating

strategies to mitigate impacts and address challenges

arising from the economic policies of the US, the main

external market for wooden furniture which accounted for

48% of State exports in 2024.

According to the Federation of Industries of Santa

Catarina State (FIESC), key concerns include a possible

tariff resulting from the US investigation into the impact

of wood and wood product imports on national security as

well as the risk of an economic slowdown in the US driven

by high inflation and persistently elevated interest rates.

Despite a heavy reliance on the US market, the sector

shows potential for diversifying its international markets.

FIESC’s analysis highlights a strong local production

chain in the furniture sector with 65% of inputs sourced

within the state and 43% of output directed to the domestic

market. The study also notes that R$100 million in orders

generate R$318 million in production value with the

potential to create approximately 2,800 jobs.

Despite the sector’s dynamism, attracting and training

skilled professionals remains a challenge. To strengthen

the sector’s image the furniture cluster in Planalto Norte

has launched AMPLIA, an initiative aimed at developing

strategies that promote the furniture industry’s recognition

and sustainable growth through professional skills

development, improved quality of life and technological

advancement in the region.

See: https://www.moveisdevalor.com.br/portal/setor-moveleiro-

debate-estrategias-para-ampliar-mercados-de-exportacao

EUDR drives traceability requirements for exports to

Europe

In 2023, the European Union (EU) established the

regulation on Deforestation-free products (EUDR), aiming

to combat global deforestation and the degradation of

forest ecosystems.

The EUDR mandates that companies exporting products

such as timber, cocoa, rubber, cattle, palm oil, coffee,

soybeansand their derivatives to the European market shall

demonstrate that their products do not originate from

deforested areas, ensuring traceability and transparency

throughout the entire supply chain.

In the forestry sector the regulation requires that, prior to

placing products on the EU market, exporters of timber

and forest products shall carry out due diligence to ensure

compliance with the regulation’s requirement.

To help meet the EUDR’s complex requirements a

Brazilian company has launched a digital platform to

support exporting companies in adapting to the regulation.

The platform also offers services such as geolocation,

legal assessments, preparation of the Due Diligence

Statement (DDS) and comprehensive support in regulatory

compliance management.

See: https://industriasa.com.br/uniao-europeia-exigira-

comprovacao-de-origem-sustentavel-em-produtos-

importados/?utm_campaign=marketingstcpcombr&utm_medium

=email&utm_source=RD+Station

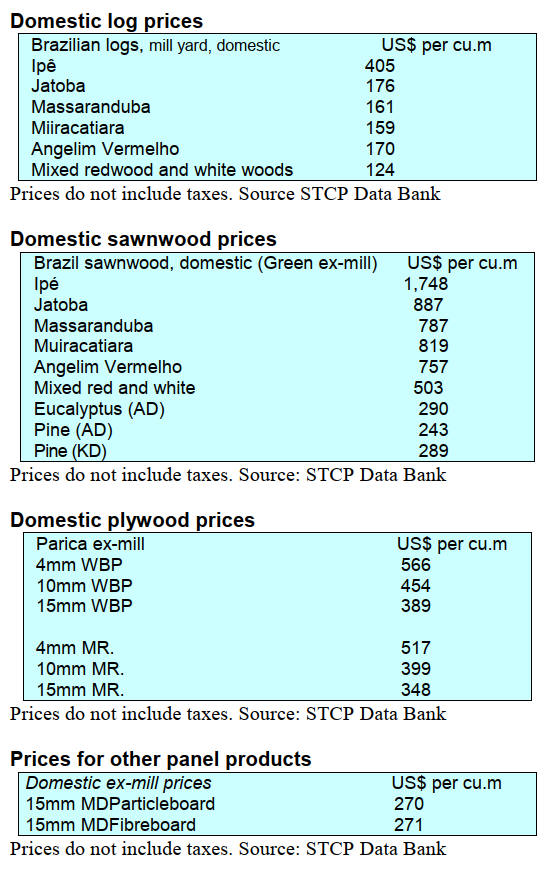

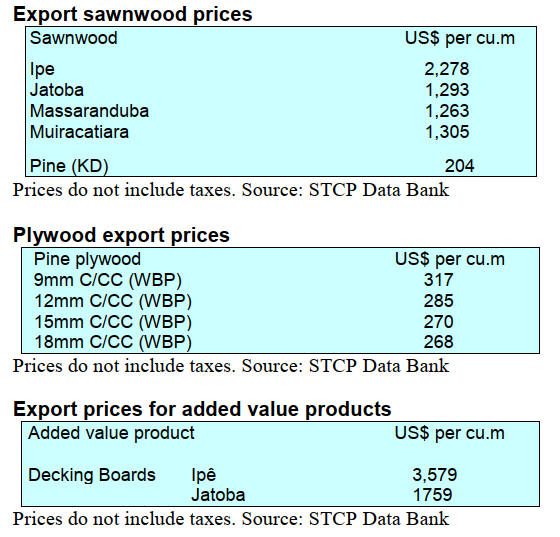

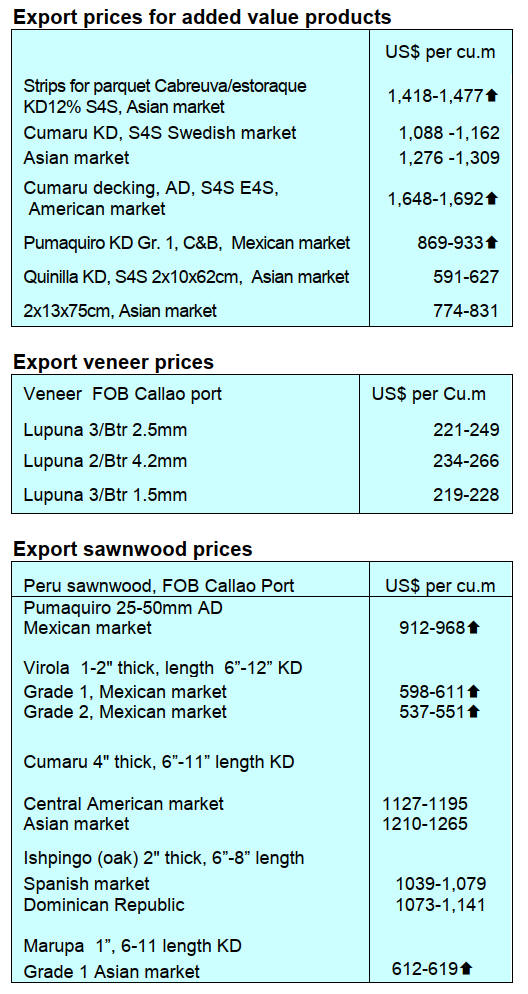

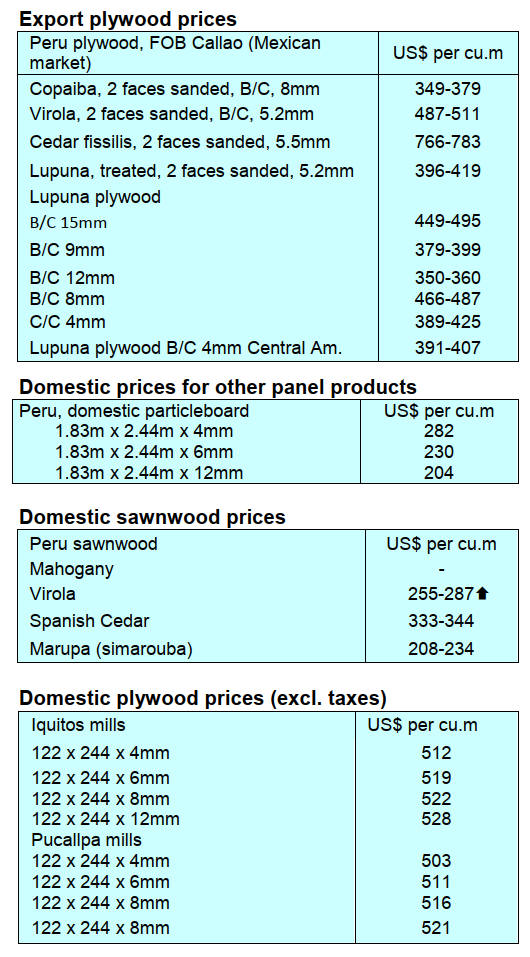

Export prices

Average FOB prices Belém/PA, Paranaguá/PR,

Navegantes/SC and Itajaí/SC Ports.

9. PERU

Veneer and plywood

export success

According to information provided by the Services and

Extractive Industries Department of the Association of

Exporters (ADEX), veneer and plywood shipments during

the January-April 2025 period reached an FOB export

value of US$914,000, growing by 148% compared to the

same period in 2024 (US$369,000).

The main export market for these products was Mexico

with a 52% share of exports and a positive increase year

on year of 64%, followed by Ecuador with a 29% share.

The Dominican Republic was in third place with an 8

share. Rounding out the top five were Colombia and Costa

Rica.

Forest regents strengthen technical role for

sustainable forest management

More than 50 forest regents gained experience in

technological tools used in forest oversight and in the

monitoring and follow-up procedures carried out by the

Forest and Wildlife Resources Oversight Agency

(OSINFOR). This was achieved through a workshop held

to ensure the efficient and sustainable management of

forest products in Peru, starting with the planning and

implementation of management plans.

Forest regents are professionals certified by the National

Forest and Wildlife Service (SERFOR) to provide

technical advice to forest users in the development and

implementation of management plans that ensure

responsible use of forest resources. Their work has a direct

impact on the results of the oversight carried out by

OSINFOR in the areas where the forest owners receive

their support.

During the event, the OSINFOR technical team explained

the use of satellite imagery and selective logging detection

algorithms as tools to strengthen the work of field

supervisors. They also discussed how the use of drones

(RPAs) has allowed for expanded monitoring coverage,

encompassing larger areas of forest.

See: https://www.gob.pe/institucion/osinfor/noticias/1203055-

regentes-forestales-fortalecen-su-rol-tecnico-para-una-gestion-

sostenible-del-bosque

Sawmillers participated in LIGNA 2025 Fair

A delegation of sawmill entrepreneurs from the Ucayali

and Madre de Dios regions participated in the 50th edition

of the LIGNA International Fair considered an important

global technology and innovation fair for the forestry and

wood products industry.

LIGNA proved to be a valuable platform for Amazonian

entrepreneurs who have been promoting modernisation

and value-added processes in their production lines. The

search for technologies to manufacture products such as

decking, deck tiles and finger jointing was one of the main

objectives of this participation.

During the Fair, the entrepreneurs not only established

direct contact with manufacturers of machinery and

cutting-edge technology but were also able to update their

knowledge, learn about new international market trends

and strengthen their networks with key players in the

sector.

In recent years demand for products made from tropical

wood such as decking, deck tiles and structural beams has

grown steadily in markets such as Europe and the United

States. This represents an opportunity for Peruvian

producers who need to invest in specialised machinery to

guarantee international standards of quality and

competitiveness such as those presented at LIGNA.

Participation in this Fair is part of the Amazonian private

sector's efforts to promote a sustainable, modern and

export-oriented timber industry.

Over one million hectares of FSC-certified forests

According to information provided by FSC Peru, the

country has 1,069,165.14 hectares of FSC-certified forests

of which 88 are private initiatives in the timber and paper

sectors.

The regions with the largest certified areas are: Madre de

Dios, with 578,793 hectares and a 54% share, followed by

Loreto with 358,186 hectares and a 34% share and finally

Ucayali with 132,186 hectares and a 12% share.

Peru assumes presidency of the Amazon Network of

Forest Authorities

After four days of dialogue among the forest authorities of

the eight countries in the Amazon basin Peru was elected

to preside over the Amazon Network of Forest Authorities

(RAFO) for the 2025-2027 term.

The country will host the Second Regional Meeting of this

Network which brings together the member countries of

the Amazon Cooperation Treaty Organization (ACTO).

Peru's election to the presidency of the forum constitutes a

significant milestone in forest governance in the Amazon

basin and reaffirms Peru’s commitment to a resilient,

sustainable, and humane Amazon.

The RAFO is comprised of forest authorities and

representatives from the Ministries of Foreign Affairs of

the eight ACTO member countries, Bolivia, Brazil,

Ecuador, Colombia, Guyana, Peru, Suriname and

Venezuela.

See: https://www.gob.pe/institucion/serfor/noticias/1207910-

midagri-peru-asume-la-presidencia-de-la-red-amazonica-de-

autoridades-forestales-rafo-2025-2027

|