|

Report from

Europe

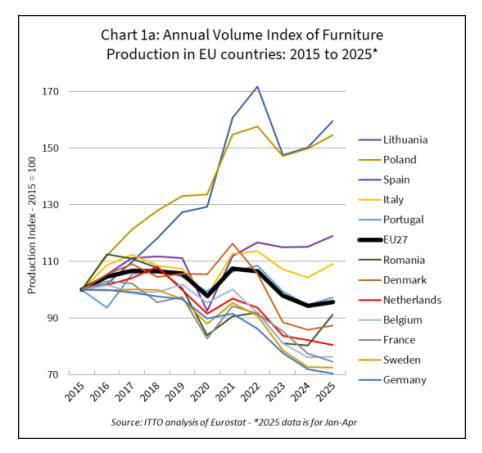

Slow recovery in European furniture production

After a two-year period when the value of furniture

production in the EU27 fell by over 10%, in 2024 sinking

to a level lower even than in 2020 at the height of the

pandemic, production was showing some signs of

recovery in the opening months of this year.

Eurostat data indicates that seasonally adjusted furniture

production in the EU27 during the first four months of

2025 was up by around 1.5% compared to the previous

year.

Furniture production was rising in several EU countries in

the first four months of this year, notably Lithuania,

Poland, Spain, and Italy. Production in all four of these

countries, which has been outpacing that in nearly all other

EU countries in recent years, is now above the pre-

pandemic level.

Production also recovered ground in Portugal, Romania,

and Denmark in the opening months of 2025, although in

each of these countries production is still well down on the

pre-pandemic level. Production in Germany, Sweden,

France, Belgium, and the Netherlands continued to

stagnate in the first four months of this year (Chart 1a).

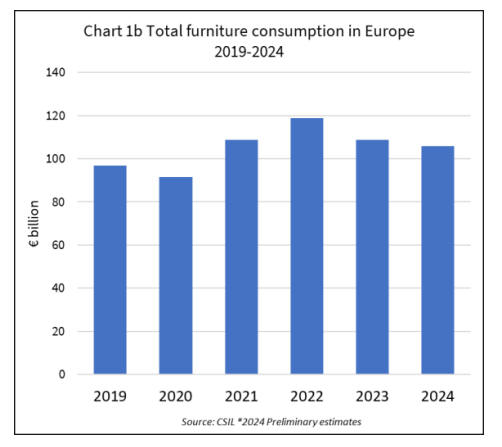

In the latest issue of their in-house journal, World

Furniture Online (www.worldfurnitureonline.com), the

Italy-based market research organisation CSIL reports that

total furniture consumption in Europe fell by 3% to €106

billion in 2024. This followed an 8% decline the previous

year (Chart 1b).

On market prospects, CSIL observes that in Europe

“furniture demand is forecasted to remain almost stagnant

in 2025 and slightly improve in the medium term. Some

positive factors that could support a recovery include a

slight improvement in macroeconomic indicators, an

expected easing of inflation and interest rates, and

potential wage growth. These factors could boost

consumer confidence and encourage spending on

furniture”.

CSIL acknowledges that their forecast of European

furniture market prospects is “subject to a higher-than-

usual degree of uncertainty” and that the “overall

economic and geopolitical environment remains volatile,

with potential downside risks”. But CSIL also highlight

the underlying resilience of the European furniture sector,

despite recent global market volatility, underpinned “by

major retail chains and manufacturers operating on a

European scale” which benefit “from strong internal

cohesion and a well-established trade network”.

CSIL note that “this structural strength not only underpins

its stability but also drives the substantial concentration of

export and import flows within the region”.

The resilience of this sector was evident at the Interzum

show for suppliers to the furniture industry in Cologne

during May. A total of 1,616 exhibiting companies from

57 countries on a gross exhibition space of 176,000 square

metres and around 60,000 trade visitors from 157

countries took part in the show. Despite the sluggish

market, these figures were only marginally down on the

previous show in 2023.

European furniture exports remain flat while imports

rise rapidly

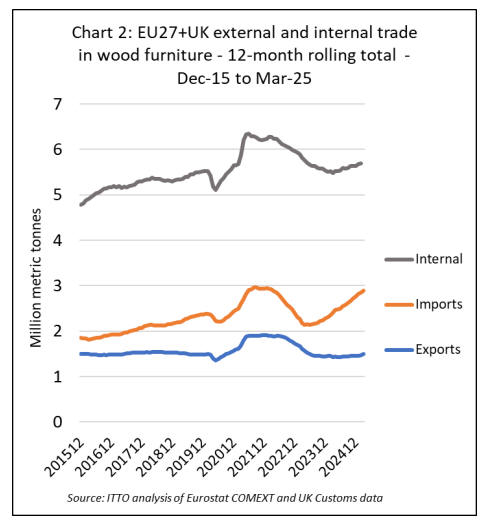

The latest Eurostat and UK trade data (Chart 2) shows that

European exports of wood furniture to countries outside

the region, after rising and then falling rapidly between

2021 and 2022, have remained stable since then at

annualised level of just below 1.5 million tonnes.

In contrast, European imports of wood furniture from

other parts of the world began to increase in the second

half of 2023, a trend maintained throughout 2024 and in

the opening months of 2025. Imports from outside the

region in the 12 months ending March 2025, at 2.9 million

tonnes, were close to those at the height of the boom in

2021 and 2022.

Internal European trade in wood furniture, which was

slowing in 2023 and the opening months of 2024, has also

been rising since the middle of last year.

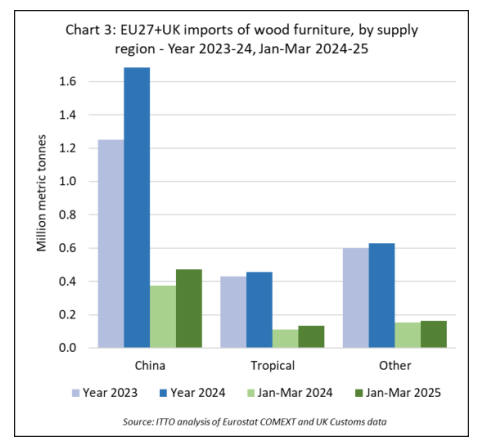

China drives rise in European furniture imports

Close analysis of Eurostat data reveals that the recent

growth in wood furniture imports into the EU27+UK has

been driven almost entirely by China. Imports into Europe

from China, after rising 5% in 2023, increased by more

35% to 1.68 million tonnes in 2024 and were up 27% to

470,000 tonnes in the first quarter of this year (Chart 3).

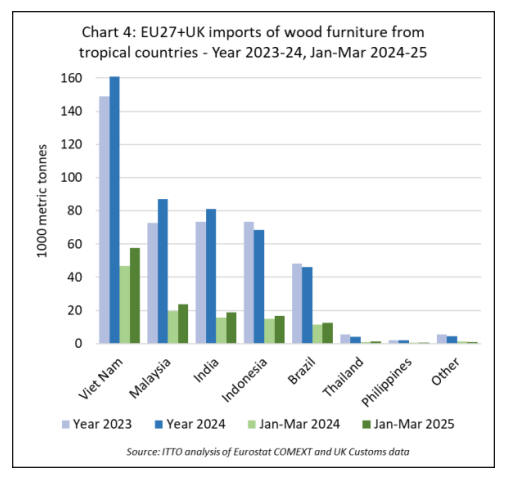

EU27+UK wood furniture imports from tropical countries,

after falling by 23% in 2023, were up 6% to 454,000

tonnes in 2024. Imports from all other countries (mainly

non-EU European countries and Turkey), after decreasing

8% to 590,000 tonnes in 2023, rebounded by 5% to

630,000 tonnes in 2024 and by another 6% to 160,000

tonnes in the first three months of 2025.

Wood furniture imports from China have increased both

into the UK, the largest single wood furniture importing

country in Europe, and into the EU. UK imports from

China increased 13% to 417,000 tonnes in 2023 and were

up another 17% to 488,000 tonnes in 2024. In the first

quarter of this year, they were 147,000 tonnes, up 26%

compared to the same period in 2024.

EU imports of wood furniture from China were up only

3% in 2023 to 833,000 tonnes but increased 44% to

1,196,000 tonnes in 2024. In the first quarter of this year,

EU imports of wood furniture from China were 147,000

tonnes, 27% more than the same period in 2024. Imports

of wood furniture from China have been rising rapidly into

all EU countries, but the gains have been particularly

dramatic in the Netherlands and Spain where they

increased by more than 50% in 2024 and have gained a

further 50% in the first quarter of this year.

The rise in Chinese wood furniture imports into European

countries in 2023 and 2024 is partly explained by the fact

that it followed a big decline in 2022 when Chinese

exports were seriously impacted by rigorous lockdowns

during the pandemic. And while high production costs are

impeding the international competitiveness of European

furniture products the competitiveness of Chinese products

is benefiting from continual improvements in technical

performance, manufacturing efficiency and from

increasing investment in advertising and marketing.

On-going trade tensions between China and the US, which

remains the largest export market for Chinese wood

furniture products, is now providing a strong incentive for

Chinese manufacturers to diversify their export sales in

other parts of the world, with Europe being a natural

target.

The accelerating pace of imports from China during 2024

and the first quarter of 2025, at a time when underlying

growth in European consumption is stagnant, may also be

related to EUDR. European importers may be building

stock in advance of that law being enforced, originally

scheduled for 30 December 2024 but delayed until 30

December 2025. The full impact of EUDR on EU imports

of composite products like furniture remains to be seen but

is likely to be very significant given the challenges of

meeting the far-reaching traceability requirements.

European imports of tropical wooden furniture recover

lost ground

Following a steep decline in 2023, European imports of

wood furniture from the three largest tropical supplying

countries – Viet Nam, Malaysia, and India - recovered

some lost ground in 2024, a trend which continued in the

first quarter of 2025 (Chart 4).

EU27+UK imports of wood furniture from Viet Nam

increased 8% to 161,000 tonnes in 2024 and were up 23%

to 58,000 tonnes in the first quarter of this year. Imports

from Malaysia increased 20% to 87,000 tonnes in 2024

and were up 22% to 24,000 tonnes in the first quarter of

this year. Imports from India increased 10% to 81,000

tonnes in 2024 and were up 19% to 19,000 tonnes in the

first quarter of this year.

EU27+UK imports of wood furniture from both Indonesia

and Brazil declined last year, respectively by 7% to 68,000

tonnes and by 5% to 46,000 tonnes. However, imports

from both countries started this year more strongly.

Imports of 17,000 tonnes from Indonesia in the first

quarter of 2025 were 11% more than the same period last

year. Imports from Brazil of 13,000 tonnes were 13%

more than the same period last year.

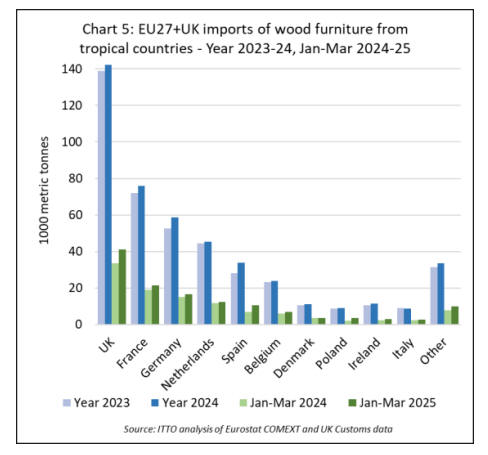

After most European destinations for tropical wood

furniture recorded a large downturn in 2023, there was

slow recovery in all the main markets in 2024, a trend

which continued in the first quarter of 2025 (Chart 5).

During the first three months of this year, imports of

tropical wood furniture increased in the UK (+23% to

41,200 tonnes), France (+13% to 21,300 tonnes), Germany

(+11% to 16,800 tonnes), Netherlands (+5% to 12,400

tonnes), Spain (+48% to 10,400 tonnes), Belgium (+13%

to 6,800 tonnes), Poland (+59% to 3,500 tonnes), Ireland

(+28% to 3,000 tonnes), and Italy (+22% to 2,800 tonnes).

Imports in Denmark were stable at 3,600 tonnes.

Slowdown in internal EU furniture market dampens

global trade

Despite recent challenging market conditions, Europe

continues to hold a crucial position in the global furniture

industry, acting as a pivotal hub for production,

consumption and world trade. Valued at nearly US$ 125

billion in 2024, the European market accounts for more

than one-quarter of the global world furniture market.

A key feature of the European furniture sector is that it is

characterised by an exceptionally high level of business-

to-business trade concentration and integration. Unlike in

the U.S. where a large share of furniture production has

been relocated to China, Southeast Asia and Mexico, 80%

of current demand in Europe continues to be met by

European manufacturers.

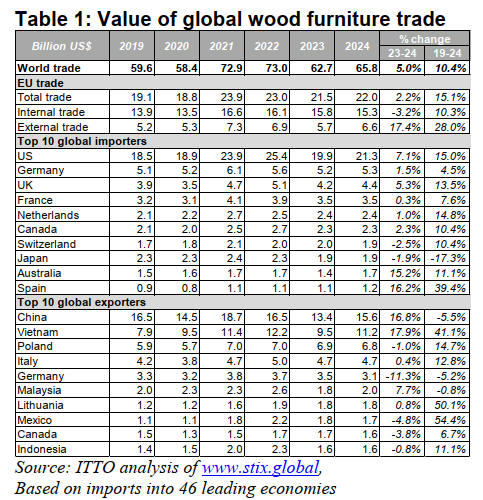

Considering just wood furniture, around 33% (US$ 22.0

billion) of the total value of world trade in 2024 (US$ 65.8

billion) involved EU countries where there is a robust

intra-regional trade network.

Analysis of wood furniture trade data shows that the

sluggish pace of EU internal trade in 2024 had a

dampening effect on global trade. The total value of world

trade in wood furniture increased 5% from US$ 62.7

billion in 2023 to 65.8 billion in 2024. However, if internal

EU trade is excluded, the rise in the total value of global

trade was closer to 8% last year.

The value of wood furniture imports into the EU from

outside the region increased by 17% to US$ 6.64 billion in

2024. Imports of wood furniture products into four other

major global markets also rebounded last year: the U.S.

(+7% to US$ 21.3 billion), the UK (+5% to US$ 4.4

billion), Australia (+15% to US$ 1.7 billion), and Canada

(+2% to US$ 2.3 billion).

These positive trends were partly offset by a 3.2% fall in

the value of the EU internal wood furniture trade to US$

15.3 billion, alongside a 2% fall in Japan’s imports to US$

1.9 billion, and a 3% fall in Swiss imports to US$ 1.9

billion.

China and Viet Nam, and to a lesser extent Malaysia, were

the principal beneficiaries of the overall recovery in global

wood furniture trade in 2024. The value of China’s exports

increased by nearly 17% to US$ 15.6 billion, while

exports from Viet Nam increased by nearly 18% to US$

11.2 billion. Exports from Malaysia increased by nearly

8% to US$ 2.0 billion during the period.

Considering longer term trends, the clear winner in the

global wood furniture trade is Viet Nam for which the

value of exports increased by over 40% between 2019 and

2024. This gain was largely at the expense of China for

which the value of wood furniture exports declined 6%

during the same period.

Nevertheless, last year China was still the world’s leading

exporter of wood furniture by a significant margin.Overall,

the data implies that the widely anticipated trend towards

“reshoring” of production back to historic production

centres such as the US, Europe, and Japan, has yet to gain

any real momentum, at least in the wood furniture

manufacturing sector.

This trend is expected to be driven by the closing gap

between Chinese and US/European production costs, the

reduction of labour intensity due to the progressive advent

of technology, the development of regional value chains,

and increasing demand for product customization and

shorter time to market favouring proximity of

manufacturers to clients.

It should be said though that in Europe the furniture

manufacturing industry never really left. For Europe, the

massive shift to lower-cost manufacturing locations that

characterised the global industry between 2000 and 2020

mainly took place inside the continent – from western to

Eastern Europe - rather than involving any large-scale

move further afield.

Furthermore, the rapidly changing geopolitical

environment this year, particularly the US administration’s

enthusiasm for tariffs to boost domestic manufacturing and

the EU’s imposition of tougher traceability requirements

through EUDR - which create particular challenges for

SMEs and for products based on composite panels and

wood from small plantations or that is imported from third

countries - could yet add impetus to the reshoring trend in

the wood furniture sector in the next few years.

EU imposes anti-dumping duties on Chinese

hardwood plywood

The EU Commission has announced it is imposing

provisional duties of up to 62.4% on hardwood plywood

imports from China, as part of its Anti-Dumping

investigation on hardwood-faced Plywood.

The investigation began following a complaint by the

Greenwood Consortium, which represents the EU’s

hardwood plywood industry. The Consortium’s complaint

alleged that Chinese plywood was being ‘dumped’ onto

the EU market and sold below market value.

While the investigation is ongoing, and due to be

completed within six months, the EU has taken the

following actions entering into force on 11 June, 2025:

Interim levels of additional duty of 62.4% for all

hardwood plywood from China except products

from a single identified Chinese manufacturer for

which a 25.1% rate will apply.

A new requirement for customs authorities in

each EU member state to keep records of

coniferous-faced Chinese Plywood arriving at EU

borders. This action is designed to help prevent

circumvention of the new anti-dumping duties

through modification of the Chinese plywood

products.

Definitive duties are expected to be published in

December.

Full details of the EU anti-dumping measures are available at:

https://eur-lex.europa.eu/legal-

content/EN/TXT/PDF/?uri=OJ:L_202501139

|